Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GARP Code of Conduct

Caricato da

Dhaval KondhiyaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

GARP Code of Conduct

Caricato da

Dhaval KondhiyaCopyright:

Formati disponibili

Printable Quizzes

1 of 3

http://www.schweser.com/online_program/test_engine/printable_answers...

Kaplan Schweser Printable Quizzes - GARP Code of Conduct

Quiz ID#: 11319121

Question 1 - #146825

When an analyst makes an investment recommendation, which of the following statements must be disclosed to

clients?

A) All of these statements must be disclosed to clients.

B) The firm is a market maker in the stock of the recommended company.

C) An employee of the firm holds a directorship with the recommended company.

D) The analyst's father-in-law has a material ownership in the security.

Your answer: A was correct!

GARP Members must make full and fair disclosure of all matters that could reasonably be expected to impair

independence and objectivity or interfere with respective duties to their employer, clients, and prospective clients.

This question tested from Topic Area 1, Topic 9, AIM 1

Question 2 - #117297

Preservation of confidentiality applies to the information that an analyst learns from:

A) current clients and prospects only.

B) former clients and prospects only.

C) current clients and former clients only.

D) current clients, former clients, and prospects.

Your answer: B was incorrect. The correct answer was D) current clients, former clients, and prospects.

According to Standard 3.1 and 3.2, confidentiality, a GARP Member shall not make use of confidential information for

inappropriate purposes and unless having received prior consent shall maintain the confidentiality of their work, their

employer, or client.

This question tested from Topic Area 1, Topic 9, AIM 1

Question 3 - #146791

Which of the following statements is incorrect regarding GARP Code of Conduct violations?

A) If the Code of Conduct and certain laws conflict, then the GARP Code of Conduct will take priority.

B) Violations of the Code of Conduct may result in temporary suspension from GARP membership.

C) Violations of the Code of Conduct could lead to a revocation of the right to use the FRM designation.

D) Violations of the Code of Conduct may result in permanent removal from GARP membership.

Your answer: C was incorrect. The correct answer was A) If the Code of Conduct and certain laws conflict, then the

GARP Code of Conduct will take priority.

All GARP Members are expected to act in accordance with the GARP Code of Conduct as well as any local laws

and regulations that pertain to the risk management profession. If the Code and certain laws conflict, then laws and

regulations will take priority.

3/15/2013 7:38 PM

Printable Quizzes

2 of 3

http://www.schweser.com/online_program/test_engine/printable_answers...

This question tested from Topic Area 1, Topic 9, AIM 2

Question 4 - #117298

Sue Johnson, FRM, has an elderly client with a very large asset base. The client intends to start divesting her fortune

to various charities. Johnson is on the Board of a local charitable foundation. Johnson most appropriately:

A)

must not discuss anything regarding her client and her client's intentions with the charitable foundation

without permission.

B)

can make this known to the charitable foundation so that they can solicit the client, since it is the client's

wish to divest assets to charities in the future.

C) should solicit the client herself, along with other Board members, to obtain a larger contribution.

D)

can discuss her client's situation with the charitable foundation as long as she informs other local charities

of her client's intentions.

Your answer: C was incorrect. The correct answer was A) must not discuss anything regarding her client and her

client's intentions with the charitable foundation without permission.

To comply with Standard 3.1, Johnson must not discuss with her charitable foundation anything regarding her client

and her client's intentions. It does not matter that her client intends to give money to charities in the near future.

This question tested from Topic Area 1, Topic 9, AIM 1

Question 5 - #117301

Charmaine Townsend, FRM, has been managing a growth portfolio for her clients using a screening process that

identifies companies that have high earnings growth rates. Townsend has decided that, because she thinks the

economy might turn volatile, she is going to adopt a value strategy using a screening process that identifies

companies that have low price-earnings multiples. Townsend will violate the GARP Code of Conduct if she makes this

change in her investment process without:

A) notifying her supervisor before she makes the change.

B) getting written permission from her clients in advance of the change.

C) promptly notifying her clients of the change.

D)

getting prompt written acknowledgment of the change from her clients within a reasonable time after the

change was made.

Your answer: C was correct!

GARP Members shall make full and fair disclosure of all matters that could reasonably be expected to impair

independence and objectivity or interfere with respective duties to their employer, clients, and prospective clients.

This question tested from Topic Area 1, Topic 9, AIM 1

Question 6 - #117296

Will Lambert, FRM, is a financial risk analyst for Offshore Investments. He is preparing a purchase recommendation

on Burch Corporation. According to the GARP Code of Conduct, which of the following statements about disclosure

of conflicts is most correct? Lambert would have to disclose that:

A) his wife owns 2,000 shares of Burch Corporation.

B) Offshore is an OTC market maker for Burch Corporations stock.

C) All of these choices require disclosure.

D) he has a material beneficial ownership of Burch Corporation through a family trust.

Your answer: B was incorrect. The correct answer was C) All of these choices require disclosure.

Related Searches: Earn Your Degree Online | GMAT Exam | Online Programs |

Degree Online

3/15/2013 7:38 PM

Printable Quizzes

3 of 3

http://www.schweser.com/online_program/test_engine/printable_answers...

According to Standard 2.2, GARP Members shall make full and fair disclosure of all matters that could reasonably be

expected to impair independence and objectivity or interfere with respective duties to their employer, clients, and

prospective clients.

This question tested from Topic Area 1, Topic 9, AIM 1

Question 7 - #117295

The Investment Banking Department of MLB&J often receives material nonpublic information that could have

considerable value to MLB&J's brokerage clients. To comply with the GARP Code of Conduct, MLB&J should most

appropriately:

A)

ensure that material nonpublic information is not disseminated beyond the firm's investment banking,

brokerage, and research departments.

B)

contact the firms involved and request that they make this information available to the public before

MLB&J allows its clients to trade in these securities.

C)

restrict proprietary trading in the securities of companies about which the Investment Banking Department

has access to material nonpublic information.

D)

prohibit MLB&J analysts from making buy or sell recommendations on this information until ten business

days after the receipt of this information.

Your answer: C was correct!

According to Standard 1.3, GARP members must take reasonable precautions to ensure that Member's services are

not used for improper, fraudulent or illegal purposes.

This question tested from Topic Area 1, Topic 9, AIM 1

2013 Kaplan Schweser

Related Searches: Earn Your Degree Online | GMAT Exam | Online Programs |

Degree Online

3/15/2013 7:38 PM

Potrebbero piacerti anche

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsDa EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNessuna valutazione finora

- Credit Risk and Bad Debt in TelecommunicationsDocumento3 pagineCredit Risk and Bad Debt in Telecommunicationsice_cream14111Nessuna valutazione finora

- Credit Risk and Bad Debt in TelecommunicationsDocumento3 pagineCredit Risk and Bad Debt in TelecommunicationsAssuringBusiness100% (3)

- PubCo ValuationDocumento12 paginePubCo ValuationAlan Zhu100% (1)

- Major Project ReportDocumento48 pagineMajor Project Reportinderpreet kaurNessuna valutazione finora

- FRM Part I - VAR & Risk ModelsDocumento17 pagineFRM Part I - VAR & Risk Modelspradeep johnNessuna valutazione finora

- IIIrd Sem 2012 All Questionpapers in This Word FileDocumento16 pagineIIIrd Sem 2012 All Questionpapers in This Word FileAkhil RupaniNessuna valutazione finora

- Level I of CFA Program 1 Mock Exam December 2019 Revision 1Documento76 pagineLevel I of CFA Program 1 Mock Exam December 2019 Revision 1millytan_Nessuna valutazione finora

- Islamic Derivatives 2Documento19 pagineIslamic Derivatives 2syedtahaaliNessuna valutazione finora

- FinQuiz Level1Mock2018Version2JuneAMSolutions PDFDocumento79 pagineFinQuiz Level1Mock2018Version2JuneAMSolutions PDFNitinNessuna valutazione finora

- CFA Level II Mock Exam 5 - Solutions (AM)Documento60 pagineCFA Level II Mock Exam 5 - Solutions (AM)Sardonna FongNessuna valutazione finora

- Solutions Paper - TVMDocumento4 pagineSolutions Paper - TVMsanchita mukherjeeNessuna valutazione finora

- Module 2Documento12 pagineModule 2zoyaNessuna valutazione finora

- Section A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Documento24 pagineSection A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Kenny HoNessuna valutazione finora

- Capital Structure: Theory and PolicyDocumento31 pagineCapital Structure: Theory and PolicySuraj ShelarNessuna valutazione finora

- Jun18l1pma-C02 QaDocumento4 pagineJun18l1pma-C02 Qarafav10Nessuna valutazione finora

- Level I Volume 5 2019 IFT NotesDocumento258 pagineLevel I Volume 5 2019 IFT NotesNoor QamarNessuna valutazione finora

- MPX x.100 Quarter 1Documento1 paginaMPX x.100 Quarter 1srinuvoodiNessuna valutazione finora

- Question 3Documento1 paginaQuestion 3Bhavish RamroopNessuna valutazione finora

- CRM in Investment Banking & Financial Market (PDF) - Finance - + - Found - at PDFDocumento16 pagineCRM in Investment Banking & Financial Market (PDF) - Finance - + - Found - at PDFsarferazul_haqueNessuna valutazione finora

- Guide To ACF PACF PlotsDocumento6 pagineGuide To ACF PACF Plotsajax_telamonioNessuna valutazione finora

- Presentation On Credit Appraisal in Banking SectorDocumento31 paginePresentation On Credit Appraisal in Banking Sectorchintan05ecNessuna valutazione finora

- ENG 111 Final SolutionsDocumento12 pagineENG 111 Final SolutionsDerek EstrellaNessuna valutazione finora

- 1.2 Doc-20180120-Wa0002Documento23 pagine1.2 Doc-20180120-Wa0002Prachet KulkarniNessuna valutazione finora

- Questions Risk Management and Investment ManagementDocumento159 pagineQuestions Risk Management and Investment ManagementBlack MambaNessuna valutazione finora

- Nism Mutual Fund VaDocumento24 pagineNism Mutual Fund VaKanikaa B KaliyaNessuna valutazione finora

- Term Paper On Acme LabsDocumento37 pagineTerm Paper On Acme LabsSyed Shahnawaz MohsinNessuna valutazione finora

- Total ChaptersDocumento67 pagineTotal ChaptersNaivee MeeNessuna valutazione finora

- Basel II AccordDocumento5 pagineBasel II Accordmhossain98Nessuna valutazione finora

- R21 Capital Budgeting Q Bank PDFDocumento10 pagineR21 Capital Budgeting Q Bank PDFZidane KhanNessuna valutazione finora

- Class V III ProspectusDocumento209 pagineClass V III ProspectusCarrieonicNessuna valutazione finora

- Reading 31 Slides - Private Company ValuationDocumento57 pagineReading 31 Slides - Private Company ValuationtamannaakterNessuna valutazione finora

- Ion - Why Is It Necessary - How It WorksDocumento7 pagineIon - Why Is It Necessary - How It WorksPankaj D. DaniNessuna valutazione finora

- BFF3351 S1 2020 FinalDocumento11 pagineBFF3351 S1 2020 Finalsardar hussainNessuna valutazione finora

- 2014 Mock Exam - AM - QuestionDocumento30 pagine2014 Mock Exam - AM - Question12jdNessuna valutazione finora

- Datar MathewsDocumento12 pagineDatar MathewsLukito Adi NugrohoNessuna valutazione finora

- Ubs FinalDocumento7 pagineUbs FinalJoshua CabreraNessuna valutazione finora

- Capital Market AnalysisDocumento86 pagineCapital Market AnalysisalenagroupNessuna valutazione finora

- Chapter 9: The Capital Asset Pricing ModelDocumento6 pagineChapter 9: The Capital Asset Pricing ModelJohn FrandoligNessuna valutazione finora

- Literature ReviewDocumento7 pagineLiterature ReviewadjoeadNessuna valutazione finora

- SS 01 Quiz 2 PDFDocumento60 pagineSS 01 Quiz 2 PDFYellow CarterNessuna valutazione finora

- CFA Exercise With Solution - Chap 15Documento5 pagineCFA Exercise With Solution - Chap 15Fagbola Oluwatobi OmolajaNessuna valutazione finora

- The Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquesDocumento26 pagineThe Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquessaminbdNessuna valutazione finora

- IslamicDerivatives & StructredProductDocumento75 pagineIslamicDerivatives & StructredProductSaid BouarfaouiNessuna valutazione finora

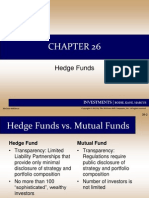

- Chap 026sddDocumento33 pagineChap 026sddsatishiitrNessuna valutazione finora

- Case Scenarios For Taxation Exams ACCT 3050 by RC (2020)Documento5 pagineCase Scenarios For Taxation Exams ACCT 3050 by RC (2020)TashaNessuna valutazione finora

- Chapter Five Investment PolicyDocumento14 pagineChapter Five Investment PolicyfergiemcNessuna valutazione finora

- The Effect of Portfolio DiversDocumento12 pagineThe Effect of Portfolio Diversfareha riazNessuna valutazione finora

- 3 Review SP14 Chapters 6 and 7 WITH Solutions PDFDocumento6 pagine3 Review SP14 Chapters 6 and 7 WITH Solutions PDFJeff CagleNessuna valutazione finora

- Introduction To Accounting and Business: Instructor Le Ngoc Anh KhoaDocumento66 pagineIntroduction To Accounting and Business: Instructor Le Ngoc Anh KhoaThien TranNessuna valutazione finora

- 1164914469ls 1Documento112 pagine1164914469ls 1krishnan bhuvaneswariNessuna valutazione finora

- Risk, Cost of Capital, and Valuation: Multiple Choice QuestionsDocumento34 pagineRisk, Cost of Capital, and Valuation: Multiple Choice QuestionsDũng Hữu0% (1)

- What Is Ratio AnalysisDocumento19 pagineWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- Empire Motors Pvt. Ltd. NavsariDocumento63 pagineEmpire Motors Pvt. Ltd. NavsariLaxmikant Pawar100% (1)

- How To Clear FRM Part 2 ExamDocumento9 pagineHow To Clear FRM Part 2 ExamNgo TungNessuna valutazione finora

- An Overview On BFIU Circulars and AML & CFT Acts: William ChowdhuryDocumento34 pagineAn Overview On BFIU Circulars and AML & CFT Acts: William ChowdhuryShuvonath100% (1)

- Combinepdf PDFDocumento65 pagineCombinepdf PDFCam SpaNessuna valutazione finora

- BodieDocumento7 pagineBodiepinoNessuna valutazione finora

- CApm DerivationDocumento27 pagineCApm Derivationpaolo_nogueraNessuna valutazione finora

- High-Performance Vanadium Redox Flow Batteries With Graphite Felt ElectrodesDocumento17 pagineHigh-Performance Vanadium Redox Flow Batteries With Graphite Felt ElectrodesDhaval KondhiyaNessuna valutazione finora

- Vitiligo and Other Hypomelanoses of Hair and Skin (PDF) (UnitedVRG)Documento693 pagineVitiligo and Other Hypomelanoses of Hair and Skin (PDF) (UnitedVRG)Dhaval Kondhiya100% (1)

- FRM EXAM PART I Admission Ticket: November 16, 2013Documento1 paginaFRM EXAM PART I Admission Ticket: November 16, 2013Dhaval KondhiyaNessuna valutazione finora

- L&T Interview PaperDocumento47 pagineL&T Interview PaperDhaval Kondhiya100% (1)

- NDT of Composite MaterialsDocumento50 pagineNDT of Composite MaterialsDhaval KondhiyaNessuna valutazione finora

- Department of Mechanical Engineering: Class: Be Mech A Semester: ODD Year: 2013-2014Documento1 paginaDepartment of Mechanical Engineering: Class: Be Mech A Semester: ODD Year: 2013-2014Dhaval KondhiyaNessuna valutazione finora

- Inflexion Foundation Annual Review 2022Documento9 pagineInflexion Foundation Annual Review 2022Glori ortuNessuna valutazione finora

- CSR Proposal TemplateDocumento7 pagineCSR Proposal TemplateIrnadi Zen80% (5)

- Hindu Religious and Charitable EndowmentDocumento23 pagineHindu Religious and Charitable EndowmentArunaML75% (12)

- South Africa's King III A Commercial Governance Code Determining Standards of Conduct For Civil Society OrganizationsDocumento109 pagineSouth Africa's King III A Commercial Governance Code Determining Standards of Conduct For Civil Society OrganizationsyemucNessuna valutazione finora

- A Historical View of The Development of Philanthropy in Albania - Partners - Albania, Center For Change and Conflict ManagementDocumento124 pagineA Historical View of The Development of Philanthropy in Albania - Partners - Albania, Center For Change and Conflict ManagementlibrariNessuna valutazione finora

- My 4/12/11 Letter To IL AG Requesting Investigation of Ronald McDonald House CharitiesDocumento2 pagineMy 4/12/11 Letter To IL AG Requesting Investigation of Ronald McDonald House CharitiesPeter M. HeimlichNessuna valutazione finora

- ++accountability and Not For Profit Organisations Implications For Developing International Financial Reporting StandardsDocumento25 pagine++accountability and Not For Profit Organisations Implications For Developing International Financial Reporting StandardsTareq Yousef AbualajeenNessuna valutazione finora

- (And How They Try To Get It) Anthony J. Nownes-Total Lobbying - What Lobbyists Want (And How They Try To Get It) - Cambridge University Press (2006)Documento279 pagine(And How They Try To Get It) Anthony J. Nownes-Total Lobbying - What Lobbyists Want (And How They Try To Get It) - Cambridge University Press (2006)Noel MartinNessuna valutazione finora

- Tax Exemption of Non Stock Non Profit Educational InstitutionsDocumento57 pagineTax Exemption of Non Stock Non Profit Educational InstitutionsIxhanie Cawal-oNessuna valutazione finora

- 5 Aptis Writing Example - 2 NovemberDocumento7 pagine5 Aptis Writing Example - 2 NovemberSyarifah SalmiahNessuna valutazione finora

- AFP Ready Ref Develop Fund Policies 0119 - 1Documento64 pagineAFP Ready Ref Develop Fund Policies 0119 - 1labsoneducationNessuna valutazione finora

- Topic 1: Types of Companies: Siti Aisyah Binti Safren Company Law (Law3033)Documento23 pagineTopic 1: Types of Companies: Siti Aisyah Binti Safren Company Law (Law3033)Nursyazriena YainNessuna valutazione finora

- Charity and Serving SocietyDocumento3 pagineCharity and Serving Societyk v3Nessuna valutazione finora

- Tax Answers at A Glance 2015 - 16 - H M Williams Chartered AccountaDocumento265 pagineTax Answers at A Glance 2015 - 16 - H M Williams Chartered AccountaAnonymous IZJqiRv0oKNessuna valutazione finora

- In The Matter of The Estate of Eldon FooteDocumento3 pagineIn The Matter of The Estate of Eldon FooteryanfloresNessuna valutazione finora

- Constitution of A Charitable Incorporated Organisation With Voting Members Other Than Its Charity TrusteesDocumento21 pagineConstitution of A Charitable Incorporated Organisation With Voting Members Other Than Its Charity TrusteesAnonymous W3SZota100% (1)

- CLINTON FOUNDATION - Charles Ortel Audit - Third - Followup - LetterDocumento10 pagineCLINTON FOUNDATION - Charles Ortel Audit - Third - Followup - LetterBigMamaTEANessuna valutazione finora

- 2011 Verizon Foundation Tax Package PDFDocumento302 pagine2011 Verizon Foundation Tax Package PDFArlanda JacksonNessuna valutazione finora

- Taxation 1 ReviewerDocumento10 pagineTaxation 1 ReviewerRey ObnimagaNessuna valutazione finora

- Business - Ethics - Governance - and - Risk - Assignment April 2022Documento7 pagineBusiness - Ethics - Governance - and - Risk - Assignment April 2022Rohit MotsraNessuna valutazione finora

- Through The Political Lens of The Philippine Social Realities and Social WelfareDocumento9 pagineThrough The Political Lens of The Philippine Social Realities and Social WelfareTawny Claire100% (1)

- 23rd Business Presentation For NACSTACCSDocumento16 pagine23rd Business Presentation For NACSTACCSDavid MythNessuna valutazione finora

- OISC Code of Standards and Commissioners RulesDocumento37 pagineOISC Code of Standards and Commissioners RulesAmir FarooquiNessuna valutazione finora

- CanadianbusinessleaderDocumento7 pagineCanadianbusinessleaderapi-3366473980% (1)

- Eligibility and Limitations For Acquiring Agricultural Land in KarnatakaDocumento40 pagineEligibility and Limitations For Acquiring Agricultural Land in KarnatakaSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (6)

- Acceptable Source of Funds For BorrowerDocumento27 pagineAcceptable Source of Funds For Borrowerapi-196037134Nessuna valutazione finora

- Shipping Goods To Malawi:: A Guide To Best PracticeDocumento16 pagineShipping Goods To Malawi:: A Guide To Best Practicepresentation555Nessuna valutazione finora

- Business Unit 1 NotesDocumento19 pagineBusiness Unit 1 Notesamir dargahiNessuna valutazione finora

- Professional Fundraising Charitable Solicitation ReportDocumento80 pagineProfessional Fundraising Charitable Solicitation ReportKyle SparksNessuna valutazione finora

- Robert Brockman - Biggest U.S. Tax Fraud Case Ever Filed - WSJDocumento12 pagineRobert Brockman - Biggest U.S. Tax Fraud Case Ever Filed - WSJKirk HartleyNessuna valutazione finora