Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cocoa Market Update As of 3.20.2012

Caricato da

bambangijoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cocoa Market Update As of 3.20.2012

Caricato da

bambangijoCopyright:

Formati disponibili

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

Cocoa Market Update

KEY COCOA FACTS

World Producers of Cocoa

Cacao trees generally grow in regions located within

20 latitude of the Equator

Ideal climate conditions are hot, rainy tropical areas

with lush vegetation to provide adequate shading for

the trees

A typical pod contains 20 to 50 beans and

approximately 400 dried beans are required to make

one pound of chocolate

INTRODUCTION TO COCOA MARKET

Cocoa serves as an important crop around the world: a cash

crop for growing countries and a key import for processing and

consuming countries. Cocoa travels along a global supply

chain crossing countries and continents. The complex

production process involves numerous parties including, farmers,

buyers, shipping organizations, processors, chocolatiers, and

distributers. Cultivation of cocoa at the farm level is a delicate

process as crops are susceptible to various conditions including

weather patterns, diseases, and insects. Unlike larger,

industrialized agribusinesses, the vast majority of cocoa still

comes from small, family-run farms, who often confront outdated

farming practices and limited organizational leverage. A steady

demand from worldwide consumers draws numerous global

efforts and funds committed to support and improve cocoa

farm sustainability.

Cocoa trades on two world exchanges: London (LIFFE - Pound)

and New York (ICE - USD). In 2011, trading volume of cocoa

futures on the Intercontinental Exchange (ICE) was 4.95 million

metric tonnes, outpacing production by 750,000 tonnes.

Conversely, ICE traded 3.8 million tonnes in 2010, 390,000 tonnes

less than total production. Comparatively, ICE traded 5.2 million

metric tonnes of coffee futures in 2011 and 5.5 million metric

tonnes in 2010. 1

1

Major Producing Countries

Africa: Cote dIvoire (40%

global), Ghana, Nigeria,

Cameroon

Asia and Oceania: Indonesia,

Malaysia, Papua New Guinea

Americas: Brazil, Ecuador,

Colombia

Small cocoa farms

provide more than 90% of

world cocoa production

In Africa and Asia,

a typical farm covers 2 to

5 hectares (4.9 -12.3

acres)

5-6 million cocoa farmers

exist worldwide

40-50 million people

depend on cocoa for

ICE Market Data: https://www.theice.com/marketdata/reports/ReportCenter.shtml

their livelihood

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

In November 2011, global sales of chocolate confectionery crossed $100 billion for the first

time, with consumer demand for chocolate anticipated to continue increasing and likely

outpacing supply (Bloomberg).

SUPPLY: PRODUCTION

Numerous cocoa market experts and analysts provide reports based on historical, current,

and projected levels. Cocoa bean production is closely monitored as trade balances,

pricing, and futures contracts depend largely on supply side factors.

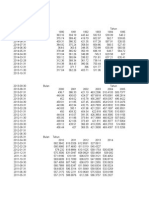

As depicted below, total production has increased in absolute terms from 3.66 million metric

tonnes in 2007-2008 to 3.98 million metric tonnes in 2011-2012. Change in production has not

been linear, however, and has fluctuated in various patterns among the different regions.

Africa has been and is projected to remain the principal cocoa producer with 73% market

share last year.

2007-2008

Total

3,667

7.2%

2008-2009

Total

3,507

-4.4%

2009-2010

Total

3,569

1.8%

2010-2011

Total

4,197

17.6%

Total Africa

% Change

Cameroon

Cote d'Ivoire

Ghana

Nigeria

Other Africa

2,603

9.5%

188

1,431

730

200

55

2,451

-5.8%

210

1,234

730

210

67

2,428

-0.9%

205

1,184

740

230

69

3,076

26.7%

230

1,668

860

240

78

2,801

-8.9%

220

1,400

870

230

81

Total Asia & Oceania

% Change

Indonesia

Malaysia

Other Asia

614

-3.3%

500

32

82

596

-2.9%

490

25

81

642

7.7%

530

20

92

563

-12.3%

450

18

95

623

10.7%

500

18

105

Total Am ericas

% Change

Brazil

Ecuador

Other Latin America

450

10.7%

170

115

165

459

2.1%

155

130

174

499

8.5%

159

150

189

558

12.0%

197

160

201

563

0.8%

185

170

208

Total Production (000 tonnes)

% Change

2011-2012 07/08 to 11/12

Total % Change

3,987

8.73%

-5.0%

7.61%

17.02%

-2.17%

19.18%

15.00%

47.27%

1.47%

0.00%

-43.75%

28.05%

25.11%

8.82%

47.83%

26.06%

Source: ICCO, USDA, Reuters, LMC Report February 2012

Dry weather patterns across West Africa early in the 2011/12 season caused forecasts of

production shortfalls. However, increased rains through March 2012 have changed these

projections. Production for the 2011/12 season is expected to approximately match

demand. 2

2 http://www.bloomberg.com/news/2012-03-15/cocoa-rally-fading-as-african-rains-erase-shortagecommodities.html

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

DEMAND: GRINDINGS

Once cocoa beans have been harvested, fermented, dried, and transported, cocoa

processing is the next key step in preparation for commercial consumption. From supply of

beans to demand by processors, it is important to analyze the import market for indications

of cocoa trade balance. In general, grindings from cocoa beans serve as the key focus for

market analysts for an overall view of anticipated demand relative to supply.

While processors of cocoa beans are located throughout the world, the highest percentage

is based in Europe, followed by Asia & Oceania, the Americas, and then Africa.

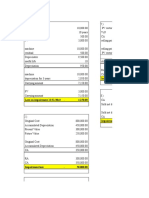

Grindings of cocoa beans (000 tonnes)

2009-2010

2010-2011

Europe

2011-2012

1,492

1,595

1,554

361

500

631

439

525

631

421

490

643

41.2%

41.7%

39.1%

Americas

801

839

865

Brazil

United States

Others

Share of Total

223

380

198

236

390

213

243

400

222

22.1%

22.0%

21.8%

Asia & Oceania

689

770

897

Indonesia

Malaysia

Others

Share of Total

120

298

271

170

305

295

270

312

315

19.0%

20.1%

22.6%

Germany

Netherlands

Others

Share of Total

Africa

642

618

657

Cote d'Ivoire

Ghana

Others

Share of Total

390

200

52

340

220

58

380

222

55

17.7%

16.2%

16.5%

World Total

3,624

3,822

3,973

Origin Grindings

1,423

1,472

World Grindings of

Cocoa Beans

(LMC as of February 2012)

1,621

Note: Totals may differ from sum of constituents due to rounding.

Source: LMC as of February 2012

In terms of cocoa beans, market analysts provide ongoing tracking of grindings to compare

and analyze against production estimates. Providing a breakdown of grindings per region

for a three year time frame, ICCO shows a relatively constant market share for the Americas

(~22%) and Africa (~17%) while Europe (~39%) has slightly declined and Asia & Oceania

(~22%) have increased. Origin grindings have slightly increased to 41% out of total grindings

over the time frame.

It is worthwhile to note the ranking of cocoa importing countries depends on the

composition of the goods imported: trade is not only tracked by cocoa beans but also by

semi-finished products of cocoa.

3

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

As an example of different metrics of interest, Global Trade Atlas tracks the following cocoa

import data among others such as cocoa shells and cocoa paste. The Netherlands, as one

of the main ports into Europe, leads in imports of beans; the US, with significant production of

cocoa complementary food products, leads in imports of powder; and France, one of the

biggest chocolate consumption per capita markets, leads in chocolate preparations.

2009 Imports ($USD Value)

Cocoa Beans

Cocoa Powder and Cake

Chocolate Preparations

Netherlands

2,075,860,000

United States

337,074,000

France

1,597,530,000

United States

1,228,060,000

Germany

110,855,000

Germany

1,465,840,000

United Kingdom

1,420,300,000

1,407,960,000

Germany

976,677,000

France

100,286,000

Malaysia

768,199,000

Japan

75,873,000

United States

France

493,246,000

Russia

73,286,000

Netherlands

762,134,000

Belgium

462,689,000

Spain

70,486,000

Canada

683,774,000

United Kingdom

426,156,000

Netherlands

67,114,000

Spain

535,130,000

Spain

244,124,000

Italy

61,799,000

Belgium

531,020,000

Singapore

208,586,000

Australia

59,417,000

Italy

480,966,000

Italy

206,966,000

China

47,147,000

Japan

479,535,000

Source: FAOSTAT as of March 2012

According to ICCO projections, stock levels are set to increase in the next year, with

stocks/grindings ratio of 43% in 2013. 3 ICCO projections are based on both macro- and

microeconomic assumptions and are subject to change over time, as updated economic

indicator information is received.

PRICE OF COCOA

As mentioned, cocoa futures contracts are traded in London and New York with prices

quoted in Great Britain Pounds / Metric Tonne and US Dollars / Metric Tonne. Cocoa is

unique among soft commodities in its link to two currencies; the GBP-USD exchange rate

assures the relationship between these two exchanges and offers an active arbitrage market

to traders. According to the New York market (ICE), the GBP leads the price of cocoa by

three calendar quarters, on average.

Information on cocoa prices:

https://globalderivatives.nyx.com/commodities/nyse-liffe

http://www.liffe-commodities.com/

https://www.theice.com/homepage.jhtml

https://www.theice.com/publicdocs/ICE_Cocoa_Brochure.pdf

http://www.icco.org/statistics/daily_prices.aspx

ICCO: http://www.icco.org ; ICCO provides up to date publications on production and grindings statistics.

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

Cocoa prices are affected by various factors including stock/grind ratios, expectations for

future production/demand, global food prices, and consolidation/fragmentation in cocoa

trade and processing industries. These components generally set the tone for long-term

trends in cocoa prices while trading by investment funds tend to drive movement in the

short-term. Over the past five years, the price of cocoa overall has increased, but it has

been prone to volatility from 2008 through 2011, spiking to a 30-year high of $3,625/tonne in

January 2010 and dropping back to $2,200/tonne in December 2011.

Source: IndexMundi

Price increases may be attributed to, among other factors, delayed transport of cocoa to

ports, limited producer selling, lower stockpiles, extreme weather conditions such as intense

rainy or dry periods, and/or political instability in producing countries.

Price decreases may be attributed to, among other factors, favorable weather conditions,

subsidized distribution of fertilizers and insecticides to farmers, expectations of a large crop or

higher stockpiles, and/or decreased demand expectations among processors.

Price movement is also highly influenced by hedge fund managers and speculators with

long and short positions in cocoa. This activity serves as a driving force behind short-term

volatility. Speculative buying (long position) results in a price increase and selling (short

position) results in a price decrease. Arbitrage between the two currency markets is an

additional consideration. A weaker pound relative to the dollar puts downward pressure on

cocoa as the attractiveness of supplies traded in New York decreases. A stronger pound

relative to the dollar leads to price increases due to the appeal of cheaper commodities in

New York.

As demonstrated below, soft commodities saw dramatic overall price increases, following

the global recessionary climate, which intensified in 2008. From a macroeconomic

perspective, input cost inflation along with higher crude oil prices applied significant pressure

to supply chain costs for commodities worldwide. Furthermore, the sharp decline in global

equity markets in 2008 led funds to increase portfolio positions in commodities in subsequent

years, driving prices to 5-year highs and increasing volatility in commodity prices between

2008 and 2012.

5

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

2007-2012 Monthly Price Levels

The fall in commodity prices from June of 2008 reflects, among other factors, lower input

costs, falling oil prices, and deepening recessionary concerns of decreased consumer

consumption among industrialized and developing countries. In addition, there has been

significant pressure on prices as investment funds settle cash positions to bolster liquidity in

light of global tightening of credit. The 2009 spike in cocoa prices has been attributed to

growing fears of a weaker Ivorian crop for 09/10 season combined with recovering demand

on the consumer side. The most recent price spike reflects significant political turmoil in Cte

dIvoire during the first half of 2011, as sanctions on the countrys cocoa exports decreased

supply levels.

Due to a bumper crop in the 2010-2011 season, supply outpaced demand towards the

beginning of the 2011-2012 season, causing prices to drop between October and

December 2011. 4 Prices began to rebound in January and early February 2012, as a lack of

rain led to forecasts of a supply shortage later in the season.

4 Bloomberg: http://www.bloomberg.com/news/2012-01-17/cocoa-falls-as-industry-is-well-stocked-barrycallebaut-says.html

COMPILED BY THE WORLD COCOA FOUNDATION FROM PUBLISHED REPORTS AND RESOURCES

MAR 2012

As referenced on page 2, Cte dIvoire produced 40% of the global cocoa supply in

2010/11; therefore the uncertainty around a new forward auction system for cocoa in

February 2012 caused a further drop in global cocoa futures prices, as most exporters are

expected to increasingly participate in the government-sponsored forward sales. 5

Additionally, increased rains through mid-March led analysts to cut their shortage forecasts. 6

This combination of factors may lead to further price drops as the 2011-2012 season

continues.

As evidenced above, numerous economic and non-economic factors, on a macro and

micro level, influence cocoa price movement. For further information on the cocoa market,

please refer to sources referenced herein or www.worldcocoa.org.

Bloomberg: http://www.bloomberg.com/news/2012-02-09/oil-natural-gas-gold-rise-cocoa-falls-commoditiesat-close.html

6 Bloomberg: http://www.bloomberg.com/news/2012-03-15/cocoa-rally-fading-as-african-rains-erase-shortagecommodities.html

5

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Daily FFB 30092022Documento2 pagineDaily FFB 30092022daidi andriasNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- A Review of Key Sustainability Issues in Malaysian Palm Oil IndustryDocumento13 pagineA Review of Key Sustainability Issues in Malaysian Palm Oil IndustrybambangijoNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Faktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiaDocumento150 pagineFaktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiabambangijoNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Faktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiaDocumento20 pagineFaktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiabambangijoNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- 1a - Total ProductionDocumento10 pagine1a - Total ProductionbambangijoNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Gula PasirDocumento5 pagineGula PasirbambangijoNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Faktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiaDocumento150 pagineFaktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiabambangijoNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Faktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiaDocumento150 pagineFaktor-Faktor Yang Mempengaruhi Produksi Produk Turunan Minyak Sawit Di IndonesiabambangijoNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Bussiness Opportunity On Palm Oil Industri PerbaikanDocumento4 pagineBussiness Opportunity On Palm Oil Industri PerbaikanbambangijoNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- EC-4-2 Cocoa Market Situation - English-WDocumento14 pagineEC-4-2 Cocoa Market Situation - English-WPusha PMNessuna valutazione finora

- ArcView Print JobDocumento1 paginaArcView Print JobbambangijoNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Peluang Bisnis Industri Kalapa Sawit Dan Produk Turunannya 2016 - 2020Documento9 paginePeluang Bisnis Industri Kalapa Sawit Dan Produk Turunannya 2016 - 2020bambangijoNessuna valutazione finora

- Studi of Palm Oil Industri and Its Derivatives in Indonesia 2016 - 2020Documento12 pagineStudi of Palm Oil Industri and Its Derivatives in Indonesia 2016 - 2020bambangijoNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Model Distribusi Gula Kelapa Yang Optimal Nikmatul Khoiryah (Unisam) Masyhuri (Unisma) 'Amul Jadidah (UIN)Documento20 pagineModel Distribusi Gula Kelapa Yang Optimal Nikmatul Khoiryah (Unisam) Masyhuri (Unisma) 'Amul Jadidah (UIN)aliyah99Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Say No and Yes CigareteDocumento1 paginaSay No and Yes CigaretebambangijoNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Cocoa DemandDocumento37 pagineCocoa DemandbambangijoNessuna valutazione finora

- Мировые цены на сахарDocumento1 paginaМировые цены на сахарOlya MikhoNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Presentation Title: My Name My Position, Contact Information or Project DescriptionDocumento5 paginePresentation Title: My Name My Position, Contact Information or Project DescriptionbambangijoNessuna valutazione finora

- Worldbank-Wld Sugar WLDDocumento13 pagineWorldbank-Wld Sugar WLDbambangijoNessuna valutazione finora

- Worldbank-Wld Sugar WLDDocumento12 pagineWorldbank-Wld Sugar WLDbambangijoNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Say No and Yes PizzaDocumento1 paginaSay No and Yes PizzabambangijoNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Say No and Yes (Compatibility Mode)Documento1 paginaSay No and Yes (Compatibility Mode)bambangijoNessuna valutazione finora

- Say No and Yes CigarDocumento1 paginaSay No and Yes CigarbambangijoNessuna valutazione finora

- Worldbank WLD PlywoodDocumento12 pagineWorldbank WLD PlywoodbambangijoNessuna valutazione finora

- Equipmnt KarateDocumento2 pagineEquipmnt KaratebambangijoNessuna valutazione finora

- The Karate 2Documento2 pagineThe Karate 2bambangijoNessuna valutazione finora

- Table 03 BDocumento2 pagineTable 03 BbambangijoNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Karikatur Self Defence (Compatibility Mode)Documento1 paginaKarikatur Self Defence (Compatibility Mode)bambangijoNessuna valutazione finora

- The Karate 2Documento2 pagineThe Karate 2bambangijoNessuna valutazione finora

- Seferiadis 2018 PDFDocumento88 pagineSeferiadis 2018 PDFOleksandrNessuna valutazione finora

- Atc Battery Catalogue VerDocumento8 pagineAtc Battery Catalogue Verrohan2212Nessuna valutazione finora

- Turning Great Strategy Into Great PerformanceDocumento22 pagineTurning Great Strategy Into Great PerformanceCathy Jeny Jeny Catherine100% (2)

- Lifting - Equipment - Matrix1 (Under Constrution)Documento1 paginaLifting - Equipment - Matrix1 (Under Constrution)PradeepNessuna valutazione finora

- Troop Registration FormDocumento1 paginaTroop Registration FormRODELIE EGBUSNessuna valutazione finora

- Dependency Theory and The Latin American ExperienceDocumento2 pagineDependency Theory and The Latin American ExperienceKate Angellou Jawood100% (1)

- Standard Moisture Regain and Moisture Content of FibersDocumento3 pagineStandard Moisture Regain and Moisture Content of Fibersff fixNessuna valutazione finora

- Chapter 23 IaDocumento4 pagineChapter 23 IaKiminosunoo LelNessuna valutazione finora

- UntitledDocumento3 pagineUntitledPutri Ayuningtyas KusumawatiNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Precast Accessories Catalog 2022Documento218 paginePrecast Accessories Catalog 2022crvishnuramNessuna valutazione finora

- Genealogical Sketch of William SimondsDocumento39 pagineGenealogical Sketch of William SimondsseanredmondNessuna valutazione finora

- Module 4 - DepreciationDocumento70 pagineModule 4 - DepreciationGaurav ShekharNessuna valutazione finora

- Payable Confirmation LetterDocumento2 paginePayable Confirmation LetterGeralyn BulanNessuna valutazione finora

- Fundamental Financial Accounting Concepts 10th Edition Edmonds Test BankDocumento44 pagineFundamental Financial Accounting Concepts 10th Edition Edmonds Test Bankpropelomnifi.cw3100% (25)

- Mid Examintation Research Methodology: "The Impact of US and China Trade War Tariff in Global Economic Growth 2018-2020"Documento8 pagineMid Examintation Research Methodology: "The Impact of US and China Trade War Tariff in Global Economic Growth 2018-2020"Syafa AzizahNessuna valutazione finora

- PS Review Chapter 4Documento8 paginePS Review Chapter 4Thai Quoc Toan (K15 HCM)Nessuna valutazione finora

- Circular 22-012 Increase of 2022 Association DuesDocumento1 paginaCircular 22-012 Increase of 2022 Association DuesJohn WickNessuna valutazione finora

- Course I - Section I - DR - Kanyarat NimtrakoolDocumento58 pagineCourse I - Section I - DR - Kanyarat NimtrakoolJO JENG CHINNessuna valutazione finora

- Floor HardenerDocumento2 pagineFloor Hardenerhks1209Nessuna valutazione finora

- Fa1 1Documento2 pagineFa1 1RyanNessuna valutazione finora

- Dongyang 1926 Parts Catalog Watermark 150625104921 Lva1 App 6891Documento10 pagineDongyang 1926 Parts Catalog Watermark 150625104921 Lva1 App 6891shirley100% (46)

- List of HRERA Agents 692017Documento10 pagineList of HRERA Agents 692017sharad159Nessuna valutazione finora

- Ga Sheravest RP EnglischDocumento2 pagineGa Sheravest RP EnglischOlariu FaneNessuna valutazione finora

- Appsc Group 1 em Prelims Test Series Schedule-Aks IasDocumento147 pagineAppsc Group 1 em Prelims Test Series Schedule-Aks IasBNREDDY PSNessuna valutazione finora

- Department of Education: Republic of The PhilippinesDocumento5 pagineDepartment of Education: Republic of The PhilippinesJoelmarMondonedo100% (7)

- Watco TechnicalDocumento111 pagineWatco TechnicalSushant Kumar SarangiNessuna valutazione finora

- أساسيات الاقتصاد القياسي باستخدام ايفيوز د خالد السواعي موقع المكتبةDocumento290 pagineأساسيات الاقتصاد القياسي باستخدام ايفيوز د خالد السواعي موقع المكتبةtouaf zinebNessuna valutazione finora

- Restaurant Presentation 1Documento17 pagineRestaurant Presentation 1alburo.jk.bsmtNessuna valutazione finora

- Invoice AmazonDocumento1 paginaInvoice AmazonBunny Patel100% (2)

- الطاقة المتجددة كخيار استراتيجي لتحقيق التنمية المستدامةDocumento14 pagineالطاقة المتجددة كخيار استراتيجي لتحقيق التنمية المستدامةُElhadj arabaNessuna valutazione finora

- $100M Leads: How to Get Strangers to Want to Buy Your StuffDa Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffValutazione: 5 su 5 stelle5/5 (18)

- Summary of Noah Kagan's Million Dollar WeekendDa EverandSummary of Noah Kagan's Million Dollar WeekendValutazione: 5 su 5 stelle5/5 (1)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverDa EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverValutazione: 4.5 su 5 stelle4.5/5 (186)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoDa Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoValutazione: 5 su 5 stelle5/5 (21)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDa EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeValutazione: 4.5 su 5 stelle4.5/5 (88)