Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reserve Bank of India

Caricato da

Prathik_Shetty_204Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Reserve Bank of India

Caricato da

Prathik_Shetty_204Copyright:

Formati disponibili

Module 7

Reserve Bank of India

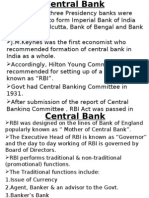

The need for the formation of a central Bank for the country was felt long before. Several attempts were

made from time to time to establish, but unfortunately those attempts failed to bear fruits.

The question of establishment of a full fledge Central Bank assumed importance once again in 1933, The

Central Bank enquiry Committee recommended the establishment of Reserve Bank of India for the

purpose of developing banking facilities and bringing about rapid economic development in the country.

The Reserve Bank of India was established on 1st April 1935 after passing the Reserve Bank of India Act

1934.

Ownership and control of RBI:

Initially RBI was set up as a shareholders bank, later Government of India acquired all the shares held by

private individuals by paying compensation. Today RBI functions as a state owned and state controlled

institution.

Capital of RBI:

RBI was started with a capital of 5 crores divided into 5 lakhs shares of Rs 100 each fully paid.

Management of RBI:

The general superintendence and the direction of affairs of the RBI are vested in the Central Board of

Directors and this board consists of 20 members.

1. One Governor and 4 deputy Governors appointed by the Central Government.

2. Four Directors nominated by the central government one each from each of the four local boards.

3. Ten other directors nominated by the Central Government.

4. One Government official nominated by the Central Government.

Offices of RBI:

Head Office: Mumbai.

Branches: Bombay, New Delhi, Bangalore, Kolkata, Chennai, Kanpur, Hyderabad, Patna, Nagpur,

Jaipur, Trivandrum, Gauhati, Indore.

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 1

Abroad: London.

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 2

Functions of Reserve Bank of India

RBI performs all the functions of a full fledged Central Bank besides it also performs certain

development functions.

1. Issue of Currency notes: RBI is given the monopoly of note issue in the India. Notes of different

denominations are issued. Eg Rupee 10, 20, 50, 100, 500, 1000 etc. Currently minimum reserve system is

followed.

2. Banker to the Government: RBI acts as the banker, financial agent and advisor to the State and

Central Government.

As a Banker

It holds the cash balances Of Central and state government

It collects the taxes and makes the payment on behalf of the state and central government

It grants temporary advances to the state and central government

It provides foreign exchange to the central and state government

It advices the government on all Banking and financial matters.

It represents the government of India in the International monetary institutions like IMF and

IBRD. Etc

3. Acting as a Bankers Bank: The RBI acts as a banker to the other banks by performing following

functions

It holds the portion of the cash reserve of the commercial bank

It provides the advances to commercial banks either by rediscounting the bills or by granting

loans against approved securities.

Acts as a clearing house to settle inter bank debt

It advices the banks on their lending policies

Acts as a Lender of the last resort

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 3

4. Controls Credit: RBI controls credit with a view to check the price level and to direct the flow of

credit to essential activities for this purpose it uses Qualitative and Quantitative techniques/ weapons.

Quantitative methods:

✔ Bank Rate Policy

✔ Open market operations

✔ Variable cash reserve ratio

Qualitative or Selective control methods:

✔ Issuing of direction

✔ Regulation of marginal requirements

✔ Differential rate of Interest

✔ Moral suasion

Bank Rate Policy: It is the minimum rate at which the Central bank provides loans to commercial

banks.

By Manipulating (raising or lowering) RBI can control the credit and level of economic activities.

By Increasing the bank rates it can make the credit costlier and thereby cause contraction of credit in

fall in economic activities and vice versa.

Open Market Operations: It means sale and purchase of securities by the RBI with a view to control the

credit. The main objective of this weapon is to control credit and influence the economic activity in the

country.

Variable Cash Reserve Ratio: RBI is empowered to vary the cash reserve percentage which the

commercial banks are required to keep with it.

Qualitative methods/ Selective methods

Issue of Directions: Under this method RBI has the power to issue instructions to the commercial banks

in regards to the purpose for which advances are to be granted, maximum amount of advances that can be

given, and rate of interest to be charged on advances. This method has been used by the RBI a number of

times.

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 4

Regulating marginal requirements: Under this method advances against certain commodities such as,

cotton, cotton yarn, oil seeds, vanaspathi, sugar etc are controlled by regulating the margins for advances

against these securities.

Deferential rate of Interest: RBI controls the credit by prescribing different rates of interest on the basis

of purpose for which the advances are given.

Moral Suasion: RBI persuades the commercial banks to follow a particular line of action while

advancing money. This method is used by RBI in India several times and has become very successful in

its implementation.

5. Developmental Functions: RBI apart from the performing the Central Banking functions, it extends

certain developmental functions indirectly.

• Provision Of agricultural finance.

• Provision of Industrial finance.

Banking Structure in India or Banking system in India:

Important constituents of banking structure in India includes:

Reserve Bank of India

State Bank of India and its subsidiaries

Nationalized and Private sector Indian commercial Banks

Regional Rural Banks or (RRB)

Foreign Banks

State Bank of India and its subsidiaries : SBI came into existence on nationalization of

“Imperial Bank of India” in 1955 on the recommendation by the Rural credit survey committee,

today SBI is the biggest (Having around 15000 branches) and most important commercial bank in

India.

Apart from Commercial Banking functions has access to capital market and also SBI acts as a agent to the

RBI and performs following functions in the areas where there are no RBI branches:

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 5

✔ Acts as a Bankers Bank

✔ Acts as a Banker to State and central Governments.

Public Sector Banks/ Nationalized Banks/ Commercial Banks: The second category of Public

sector banks is of 19 commercial banks of which 14 were nationalized in 1969 and 6 more in

1980. There are around 34355 branches as on June 2006.

Objectives for nationalization:

✔ To enable RBI to have greater control over commercial banks

✔ To channelize bank credit to priority sectors like Agriculture, Industries and Exports.

✔ To extend banking facilities to rural areas.

✔ To provide Better service and safety to the customers.

Regional Rural Banks or (RRB): RRB’s are sponsored by commercial Banks mostly public

sector banks engaged in granting of direct loans and advances to farmers, rural artisans, landless

labourers and other weaker section in the rural areas.

Objectives:

✔ To provide cheap credit to farmers, artisans, small entrepreneurs.

✔ To contribute for the development of rural economy.

✔ To provide employment opportunities for the rural folks.

✔ To inculcate banking habit and mobilize savings and accelerate the economic growth.

Private sector Banks: Private Sector commercial banks refers to banks owned and controlled by

Indian entrepreneurs. There are around 5794 branches which are operating in India.

There branches and business are relatively marginal compared to Nationalized and foreign banks.

In 2005-06 total Pvt Sector banks accounted for 15.1 per cent of total baking assets.

Eg: HDFC Bank Ltd, ICICI banking corporation Ltd, Axis Bank Ltd, IDBI Bank Ltd.

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 6

Foreign Banks: Foreign Banks refers to any bank incorporated outside India but having a place

of business in India.

These banks carry on all commercial banks functions besides their specialized functions of financing

exports, imports and foreign exchange.

On June 2006 there were around 262 branches located mostly in big cities.

Though there were many complaints about these banks most of it have been overcome by Banking

Regulation Act of 1949.

Eg: Citibank, Deutsche Bank, HSBC

Banking Sector Reforms:

1.Nationalization: 14 Commercial banks with deposit of 50 Crores or more nationalized or taken

over by Government of India on 19th July 1969, under the Banking Companies (Acquisition and

Transfer of Undertaking) Act 1970.

6 more Banks with demand and time liabilities exceeding 200 crores as on 31st March 1980 was

nationalized.

Objectives for nationalization:

To enable RBI to have greater control over commercial banks

To channelize bank credit to priority sectors like Agriculture, Industries and Exports.

To extend banking facilities to rural areas.

To provide Better service and safety to the customers.

To give professional bent to Banking management.

To provide security to the depositors

To raise employment levels

To provide better terms of service to the bank staff

2. Branch Expansion: The progress in branch expansion has been spectacular since

nationalization of banks in terms of number of branches coverage of rural and unbanked areas.

Progress in Bank expansion:

• Numerical increase in bank branches

• Branch opening in rural and unbaked areas

• Attempt to correct regional imbalances

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 7

3. Deposit Mobilization: These banks have been able to step up deposits mobilization. Time

deposits amounted to Rs 21, 79,172 crores while demand deposits were only Rs 4, 29,137 crores as on

March 30, 2007.

4. Bank lending: Advances granted by Commercial banks have been increased considerably, Total

advances of all the scheduled commercial banks in India amounted to Rs 1733679 crores as on December

22, 2006.

5. Finances to neglected Sector: Banks have taken a lead in extending credit to all the neglected

sectors of the society like artisans, craftsmen, self employed persons, taxi and auto rickshaw drivers,

small vegetable vendors.

6. Finance to Public Sector undertakings: The nationalized Banks have participated in the

provision of finance to public sector undertakings. They have given more fiancés to public sector

agencies engaged in food procurement. They have invested a good portion of their funds in Government

securities and thereby made more finance available to the public sector undertakings.

E Banking and recent trends in Banking Technology:

E banking is an abbreviation for electronic banking. E banking allows you to conduct bank transactions

online, instead of finding a bank and interacting with a teller.

which includes :

○ Account management

○ Bill payment

○ New account opening

○ loan applications, approval transfers

○ Investment/Brokerage services

○ Loan application and approval

Advantages Of e Banking are:

✔ Anywhere Banking

✔ Easy and hassle free ways of Banking

✔ It is easy to view recent transactions and monitor your account

✔ Provides many facilities.

Disadvantages

✔ If the bank's server is down, you can't use it

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 8

✔ Some Banks will charge you for online access

✔ There's always the possibility of Internet Crime (Phishing, Hacking)

ATM- Automated Teller Machines or Any time money

A customer using a Debit/ATM card can withdraw, deposit, transfer money from his account, also check

the balance, request for cheque book, statements at his convenience i.e. day or night,24/7.

Advantages

✔ ATM Services available to the customer round the clock.

✔ Bank staff can be downsized or engage the existing staff in other banking operations as ATM

reduces the work load at branches.

✔ The cost of operation is cheaper in case of ATM.

Disadvantages

✔ Card can be misplaced or misused.

✔ Illiterate customers may find it difficult to operate.

✔ Limits the cash withdrawals

Credit card allows the card holder to purchase goods, travel, dine in a hotel etc without making a

immediate payments. The card holder can get credit up to 45 days.

Thus a credit card is a passport to safety, convenience and credit.

Advantages

✔ Meets emergency Expenditures

✔ Allows making payment in phased fashion

✔ Gives a credit period of 45/60 days

✔ Customers enjoy rewards, n loyalty points

Disadvantages:

✔ Card can be misplaced or misused.

✔ Customer may lavishly purchase due to excess credit limits.

Debit card is a card which enables the account holder to transact his account using ATM’s.

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 9

Card can also be uses at card at point of sale terminals where money gets debited from his account by

swiping his card.

Advantages

✔ Debit cards can be used round the clock for cash withdrawals

✔ Allows making payment in phased fashion

✔ Hassel free way of purchasing

✔ Reduces the burden of carrying cash

Disadvantages

✔ Card can be misplaced or misused.

✔ Illiterate customers may find it difficult to operate.

✔ Limits the cash withdrawals

Electronic Funds Transfer (EFT) is a system of transferring money from one bank account directly

to another without any paper money changing hands.

EFT refers to any transfer of funds initiated through an electronic terminal, including credit card,

ATM, and point-of-sale (POS) transactions.

Advantages

✔ Reduces the transaction time

✔ Easy and Hassel free method

✔ Can be used 24/7

Disadvantages

✔ If the bank's server is down, you can't use it

✔ Some Banks will charge you for online access

✔ There's always the possibility of Internet Crime (Phishing, Hacking)

Department Of Management and Research centre, RNSIT- Ms Prema Latha Page 10

Potrebbero piacerti anche

- Functions of RBIDocumento4 pagineFunctions of RBIaditi aditiNessuna valutazione finora

- Traditional Functions of RBIDocumento3 pagineTraditional Functions of RBIomkarmbaNessuna valutazione finora

- RBI Functions List: Traditional, Developmental, SupervisoryDocumento25 pagineRBI Functions List: Traditional, Developmental, Supervisorygeethark12100% (1)

- Functions of RBIDocumento3 pagineFunctions of RBITarun BhatejaNessuna valutazione finora

- RBI's Main Activities to Sustain Economic GrowthDocumento9 pagineRBI's Main Activities to Sustain Economic GrowthPrateek GuptaNessuna valutazione finora

- Functions of RBIDocumento8 pagineFunctions of RBIdchauhan21Nessuna valutazione finora

- Geetika BankingDocumento9 pagineGeetika BankingGeetika GuptaNessuna valutazione finora

- Functions of RbiDocumento4 pagineFunctions of RbiMunish PathaniaNessuna valutazione finora

- Roles & Functions of RBIDocumento24 pagineRoles & Functions of RBIAvanishNessuna valutazione finora

- Reserve Bank of IndiaDocumento6 pagineReserve Bank of IndiaKhushboo HedaNessuna valutazione finora

- History 2Documento5 pagineHistory 2bickyboom96Nessuna valutazione finora

- Unit - 1Documento93 pagineUnit - 1Suji MbaNessuna valutazione finora

- Role of RBI Under Banking Regulation Act, 1949Documento11 pagineRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Money and Banking System MBADocumento29 pagineMoney and Banking System MBABabasab Patil (Karrisatte)100% (1)

- Functions of RBI (The India's Central Bank)Documento3 pagineFunctions of RBI (The India's Central Bank)dadapeer h mNessuna valutazione finora

- Reserve Bank of IndiaDocumento28 pagineReserve Bank of Indiazara_naveed92Nessuna valutazione finora

- Banking LawDocumento11 pagineBanking LawVasundhara GopaNessuna valutazione finora

- Roles & Functions of Reserve Bank of India: Useful LinksDocumento7 pagineRoles & Functions of Reserve Bank of India: Useful LinksJaldeep MangawaNessuna valutazione finora

- Functions of RbiDocumento14 pagineFunctions of RbiSheetal SainiNessuna valutazione finora

- Indian Banking System: Evolution, RBI Role and FunctionsDocumento47 pagineIndian Banking System: Evolution, RBI Role and FunctionsDhrumi PatelNessuna valutazione finora

- Classification of Banking System Final 52Documento7 pagineClassification of Banking System Final 52sonam1991Nessuna valutazione finora

- Banking Unit 2Documento10 pagineBanking Unit 2queenboss lifestyleNessuna valutazione finora

- History and Functions of the Reserve Bank of IndiaDocumento5 pagineHistory and Functions of the Reserve Bank of IndiaJay Ram100% (1)

- Banking: Prof. Rahul Mailcontractor Assistant Professor, Jain College of MCA and MBA, BelgaumDocumento69 pagineBanking: Prof. Rahul Mailcontractor Assistant Professor, Jain College of MCA and MBA, BelgaumhakecNessuna valutazione finora

- Principles and Practices of Banking: RBI - Functions and PoliciesDocumento7 paginePrinciples and Practices of Banking: RBI - Functions and Policiespassion481Nessuna valutazione finora

- CONCLUSIONDocumento12 pagineCONCLUSIONAniket ShigwanNessuna valutazione finora

- RBI Rules and RegulationDocumento30 pagineRBI Rules and Regulationsyed imranNessuna valutazione finora

- RBI's Role in India's Economic & Social ProgressDocumento14 pagineRBI's Role in India's Economic & Social ProgressAniket ShigwanNessuna valutazione finora

- Indian Banking SystemDocumento57 pagineIndian Banking Systemsamadhandamdhar6109100% (1)

- Types of Banks in India & Role of RBIDocumento32 pagineTypes of Banks in India & Role of RBINIYATI BAGWENessuna valutazione finora

- RBI Departments GuideDocumento55 pagineRBI Departments GuideSharath Unnikrishnan Jyothi NairNessuna valutazione finora

- Role of RbiDocumento4 pagineRole of RbiTanya ChaudharyNessuna valutazione finora

- Banking Law Unit 2Documento17 pagineBanking Law Unit 2D. BharadwajNessuna valutazione finora

- Monetary PolicyDocumento5 pagineMonetary PolicyKuthubudeen T MNessuna valutazione finora

- Central BankDocumento24 pagineCentral BankShailesh RathodNessuna valutazione finora

- Special Entities Accounting and Innovation Accounting: Project ConceptDocumento21 pagineSpecial Entities Accounting and Innovation Accounting: Project ConceptSanket AgarwalNessuna valutazione finora

- Agricultural Finance and Project Management: Reserve Bank of IndiaDocumento41 pagineAgricultural Finance and Project Management: Reserve Bank of IndiaPràßhánTh Aɭoŋɘ ɭovɘʀNessuna valutazione finora

- Good MorningDocumento24 pagineGood MorningManoj KumarNessuna valutazione finora

- RBI Finance PDF 1 - Regulators and Financial InstitutionsDocumento29 pagineRBI Finance PDF 1 - Regulators and Financial InstitutionsbiswashswayambhuNessuna valutazione finora

- Central Bank of India & Its Functions (RBIDocumento7 pagineCentral Bank of India & Its Functions (RBIPriyam PrakashNessuna valutazione finora

- INDIAN BANKING SYSTEM: KEY CONSTITUENTSDocumento25 pagineINDIAN BANKING SYSTEM: KEY CONSTITUENTSTajinder JassalNessuna valutazione finora

- Abstract - Role of Commercial Banks in IndiaDocumento8 pagineAbstract - Role of Commercial Banks in Indiasalman.wajidNessuna valutazione finora

- Reserve Bank of IndiaDocumento2 pagineReserve Bank of IndiasoujnyNessuna valutazione finora

- RBI & NABARD Functions Rural FinanceDocumento10 pagineRBI & NABARD Functions Rural FinanceNEERAJA UNNINessuna valutazione finora

- TEAM 3 - Assg 3 - Functions of RBIDocumento11 pagineTEAM 3 - Assg 3 - Functions of RBIVISHAL MNessuna valutazione finora

- Financial Institutions & MarketsDocumento62 pagineFinancial Institutions & MarketsSaurav UchilNessuna valutazione finora

- RBI PROJECTDocumento11 pagineRBI PROJECTShalini SonkarNessuna valutazione finora

- Reserve Bank of IndiaDocumento16 pagineReserve Bank of IndiaAlpa GhoshNessuna valutazione finora

- Indian Banking StructureDocumento20 pagineIndian Banking Structureneha16septNessuna valutazione finora

- Banking NotesDocumento12 pagineBanking NotesChiranjive Ravindra JagadalNessuna valutazione finora

- RBI FCDocumento15 pagineRBI FCARVIND YADAVNessuna valutazione finora

- Main Functions: Monetary AuthorityDocumento3 pagineMain Functions: Monetary AuthorityvaishnaviNessuna valutazione finora

- Study MaterialDocumento42 pagineStudy MaterialLion Naresh PradhanNessuna valutazione finora

- Commercial - Banks - in - India (Just For Reading)Documento18 pagineCommercial - Banks - in - India (Just For Reading)Nitya GuptaNessuna valutazione finora

- Introduction of Reserve Bank of IndiaDocumento9 pagineIntroduction of Reserve Bank of IndiaAbeer Mansingh MahapatraNessuna valutazione finora

- Banking Structure in IndiaDocumento13 pagineBanking Structure in IndiaharshNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Banking India: Accepting Deposits for the Purpose of LendingDa EverandBanking India: Accepting Deposits for the Purpose of LendingNessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- ConfigDocumento1 paginaConfigPrathik_Shetty_204Nessuna valutazione finora

- ConfigDocumento1 paginaConfigPrathik_Shetty_204Nessuna valutazione finora

- Exam 2010Documento1 paginaExam 2010Prathik_Shetty_204Nessuna valutazione finora

- IBE Module 6Documento29 pagineIBE Module 6Prathik_Shetty_204Nessuna valutazione finora

- Rate of Change: Example 1 Determine All The Points Where The Following Function Is Not ChangingDocumento5 pagineRate of Change: Example 1 Determine All The Points Where The Following Function Is Not ChangingKishamarie C. TabadaNessuna valutazione finora

- Environment Health: European Research OnDocumento73 pagineEnvironment Health: European Research OnDaiuk.DakNessuna valutazione finora

- Underground Water Tanks Cleaning ScopeDocumento2 pagineUnderground Water Tanks Cleaning ScopeOsama AhmedNessuna valutazione finora

- J S S 1 Maths 1st Term E-Note 2017Documento39 pagineJ S S 1 Maths 1st Term E-Note 2017preciousNessuna valutazione finora

- Chapter 4-Market EquilibriumDocumento24 pagineChapter 4-Market EquilibriumAiman Daniel100% (2)

- Lecture Notes On Revaluation and Impairment PDFDocumento6 pagineLecture Notes On Revaluation and Impairment PDFjudel ArielNessuna valutazione finora

- Knife Gate ValveDocumento67 pagineKnife Gate Valvekrishna100% (1)

- ELEC-E8714 Homework 3 - Life Cycle Assessment of LED Lamps - Manufacturing and UseDocumento2 pagineELEC-E8714 Homework 3 - Life Cycle Assessment of LED Lamps - Manufacturing and UseŞamil NifteliyevNessuna valutazione finora

- Quick Healthcare Stencil: SketchDocumento2 pagineQuick Healthcare Stencil: SketchNafiz Hannan NabilNessuna valutazione finora

- RMAN Backup and Recovery Strategies with Oracle DatabaseDocumento26 pagineRMAN Backup and Recovery Strategies with Oracle DatabaseCristiano Vasconcelos BarbosaNessuna valutazione finora

- March 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Documento459 pagineMarch 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Stan J. CaterboneNessuna valutazione finora

- SC WD 1 WashHandsFlyerFormatted JacobHahn Report 1Documento3 pagineSC WD 1 WashHandsFlyerFormatted JacobHahn Report 1jackson leeNessuna valutazione finora

- Boosting BARMM Infrastructure for Socio-Economic GrowthDocumento46 pagineBoosting BARMM Infrastructure for Socio-Economic GrowthEduardo LongakitNessuna valutazione finora

- I-Plan Marketing List On Installments 11-Aug-23Documento10 pagineI-Plan Marketing List On Installments 11-Aug-23HuxaifaNessuna valutazione finora

- Xbox - RGH E Ltu: Jogo 3.0 4.0 HD NºDocumento11 pagineXbox - RGH E Ltu: Jogo 3.0 4.0 HD NºGabriel DinhaNessuna valutazione finora

- Biomechanics of Knee Joint - 20 Questions-2Documento5 pagineBiomechanics of Knee Joint - 20 Questions-2rehab aymanNessuna valutazione finora

- Ceramic Tiles Industry Research ProjectDocumento147 pagineCeramic Tiles Industry Research Projectsrp188Nessuna valutazione finora

- Msme'S Premium Product Catalogue Book 2020: Craft CategoryDocumento50 pagineMsme'S Premium Product Catalogue Book 2020: Craft CategoryTomikoVanNessuna valutazione finora

- 9Documento2 pagine9هلال العمديNessuna valutazione finora

- The Barber of SevilleDocumento1 paginaThe Barber of SevilleAine MulveyNessuna valutazione finora

- Attaei PDFDocumento83 pagineAttaei PDFHandsomē KumarNessuna valutazione finora

- Summary of Relief Scenarios: Contingency DataDocumento3 pagineSummary of Relief Scenarios: Contingency Dataimtinan mohsinNessuna valutazione finora

- Data Structure & Algorithms (TIU-UCS-T201) : Presented by Suvendu Chattaraj (Department of CSE, TIU, WB)Documento23 pagineData Structure & Algorithms (TIU-UCS-T201) : Presented by Suvendu Chattaraj (Department of CSE, TIU, WB)Adhara MukherjeeNessuna valutazione finora

- Hydraulic Cylinders Series CD210 CG210Documento72 pagineHydraulic Cylinders Series CD210 CG210Le Van TamNessuna valutazione finora

- rfg040208 PDFDocumento2.372 paginerfg040208 PDFMr DungNessuna valutazione finora

- Gen-6000-0mh0/0mhe Gen-6000-0mk0 Gen-6000-0ms0/0mse Gen-7500-0mh0/0mhe Gen-8000-0mk0/0mke Gen-8000-0ms0/0mseDocumento26 pagineGen-6000-0mh0/0mhe Gen-6000-0mk0 Gen-6000-0ms0/0mse Gen-7500-0mh0/0mhe Gen-8000-0mk0/0mke Gen-8000-0ms0/0mseAhmed Khodja KarimNessuna valutazione finora

- Dermatitis Venenata Donald UDocumento5 pagineDermatitis Venenata Donald UIndahPertiwiNessuna valutazione finora

- The Muscle and Strength Training Pyramid v2.0 Training by Eric Helms-9Documento31 pagineThe Muscle and Strength Training Pyramid v2.0 Training by Eric Helms-9Hamada MansourNessuna valutazione finora

- Aegon Life Insurance Marketing Strategy AnalysisDocumento22 pagineAegon Life Insurance Marketing Strategy AnalysissalmanNessuna valutazione finora

- Currency Exchnage FormatDocumento1 paginaCurrency Exchnage FormatSarvjeet SinghNessuna valutazione finora