Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hershey Startegy

Caricato da

Akbar BhattiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hershey Startegy

Caricato da

Akbar BhattiCopyright:

Formati disponibili

CASE

SYNOPSIS: HERSHEYS

BACKGROUND IN BRIEF

The Hershey Company (Hersheys) was found by a candy-manufacturer, Milton Hershey in 1894.

It was first located in Lancaster, Pennsylvania. The early slogan for Hershey was A palatable confection

and a most nourishing food. The firm history can be divided into four main categories: getting started

(1894-1916), expanding and innovating (1917-1938), going to war (1939-1948) and growing globally

(1949-present). The following timeline (Table 1) is going to illustrate the important events at Hershey.

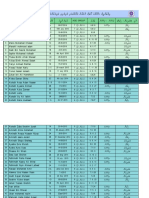

Table1: Timeline of Hershey

Year Event

<1894 Milton Hershey owns Lancaster Caramel Company. The Hershey Chocolate Company was a

wholly owned subsidiary to produce sweet chocolate as a coating for the caramels.

1894

Hersheys was set up and powdered cocoa had manufactured.

1895

Hersheys was manufacturing 114 kinds of chocolate in different sizes and shapes.

1896

A milk-processing plant was built on family farm to have onshore production.

1899

Formula to produced milk chocolate had developed.

1900

Mass production is used to maintain low unit cost.

1907

Product line expands.

Hersheys KISSES chocolates were produced.

1921

Machine wrapping was introduced.

1963

Hersheys acquired the H.B. Reese Candy Company.

1970

First consumer advertisement appears in 114 newspapers.

2002

The Milton Hershey Trust School plans to sell Hershey, but withdraws offer.

CURRENT SITUATION

Hersheys is now focusing on introducing new products frequently and taking advantage of

growth opportunities through acquisitions of different companies. This can expand its market with

diversified products. The international division of Hershey exports their products and maintains licensing

agreements with partners all over the world. It offers more than 80 brand names of confectionery products.

Hersheys acts as a leader in quality chocolate and non-chocolate confectionery and chocolate

related grocery products in North American manufacturer. It is also a leader in the gum and mint category

with good reputation.

The company currently has stores over 70 countries worldwide. There are 14,000 employees and

the net sales have over $6.6 billion. China and Mexico are Hersheys key international markets and it will

focus the competitive advantage in US and Canada.

CASE SYNOPSIS: HERSHEYS

MISSION, GOALS & STAKEHOLDERS

MISSION:

Hersheys stated mission is: Bringing sweet moments of Hershey happiness to the world every day.

GOALS and OBJECTIVES:

To spread awareness and increase sales of product

To promote the health benefits of Hershey Chocolate

To produce different chocolate flavours with best price for target markets

Hersheys has four main values to support its goals and objectives. First, it is open to possibilities.

STAKEHOLDERS:

Hersheys operations and decisions will affect different group of people and the following table

(Table 2) is going to introduce how stakeholders will be influenced.

TABLE 2: Organizational

Stakeholder Group

Product Market

Farmers

Customers

Communities

Capital Market

Investors

Business

partners

Organizational

Employees

Managers

Stakeholders

Group Demands / Attributes

Farmers of the cocoa are the main suppliers for Hershey. Cocoa is the

main source to make chocolate and the sales of Hershey will affect the

supply of cocoa. The price of the products will influence the amount of

chocolate purchased by customers and communities.

The profit and revenue of Hershey will affect stakeholders in the capital

market. Investors and business partners concern about the profit earned by

Hershey since this is directly affect their own return. The more revenue

Hershey made, the more return the stakeholders can get.

The decision made by Hershey will directly influence the stakeholders in

the organizational market. Employees and managers will need to follow

the decisions made by the company and work aligns with companys goals

and objectives.

EXTERNAL ANALYSIS

GENERAL ENVIRONMENT:

Demographic

Ethnic Mix: Switzerland is the top chocolate lovers which consumes 22.36 pounds per year while

North America ranks 11th with 11.64 pounds per year. In the top 20 chocolate consumption

countries, 16 are from Europe. This shows that Europe is a big market for Hersheys.

CASE SYNOPSIS: HERSHEYS

Geographic distribution: The geographic distribution is huge as there are more than 90 Hersheys

worldwide. It issues licensing to other countries so as to expand its market. Each market has

unique products to supply own country so that local responsiveness can be achieved.

Economical

The net sales of Hershey have increasing these years. The 5-year compound growth rate is

6.1% and the earnings per share of 2011 had increased 5.5% compared with 2011. Also, there is

an increase demand in dark chocolate, which require more cocoa to produce, due to the health

benefits. It would drive up the price of cocoa because of the deficit.

Political

Currently, there is no regulation concerning price control and no support for cocoa

production by the government. Since the chocolate prices are soaring, it is expected that there will

be government price control on raw materials of chocolate and price support for cocoa production.

Concerning sugar production, it is expected that the US federal government will spend $300

million on purchasing excess sugar as by law, the government has to buy excess sugar if the price

drops below a certain level.

Socio-cultural

People show higher preference in chocolate in festival periods, especially in Valentines

and Christmas period. The demand of chocolate in developed countries like Europe and North

America is expected to be improved in these festivals. About the forecast of chocolate demand, it

is expected that there will be a rise in grindings in North America as chocolate consumption gets

back on track after poor performance in chocolate market in 2012.

Technology

Concerning knowledge resources, lower sugar price in the States drives Canadian

manufacturers out of the country and manufacture in the States. This makes local chocolate

retailers a higher chance to import chocolate instead of purchasing local ones. On one hand, this

benefits chocolate manufacturers with lower input cost in the States; On the other hand, this

makes lives of American sugar producers more difficult as price of sugar is too low.

CASE SYNOPSIS: HERSHEYS

Global

The price of cocoa butter, which is one-fourth of ingredient cost of chocolate, have

increased 80% recently due to poor weather in the Ivory Coast and Ghana, which produce almost

half of the worlds cocoa beans. This leads to shortage of cocoa beans and, thus, drives up the

selling price of chocolate. Besides, West Africa, which produces 70% of cocoa beans, is expected

to suffer from dry weather and this affects the harvest of cocoa beans.

INDUSTRY ENVIRONMENT:

Porters Five Forces

Bargaining power of suppliers: High

The bargaining power of suppliers is high because the resources are differentiated. There

are only few substitutes of these raw materials with limited suppliers. They rely on suppliers to

deliver high quality cocoa that meet food regulations and consumer taste test. Cocoa beans are

grown in areas with tropical climate. These areas often at risk for natural disasters, such as

hurricanes, that can reduce the number of suppliers quickly and dramatically at any time.

Bargaining power of buyers: Low to Moderate

It is because the chocolate and cocoa products are differentiated. The chocolate industry

has several large players, such as Hersheys, Purdy, Mars and Nestle; they have strong brand

identification and customer loyalty, which increase buyers switching cost. Also, buyers do not

have complete information about the products and the market. Customers do not have strong

capital investment and hence there would not be a credible threat of backward integration.

Threat of new entrants: Low

Consumers have strong brand loyalty for Hersheys products. Therefore, switching to

different products may be costly. Also, large capital is required in the industry. Production

equipment, labor, raw materials, research and development, advertising and marketing lead to

high cost. High switching cost creates additional testing and research for new entrants to ensure

right quality, safety and taste. Lastly, there are many government regulations for food products.

CASE SYNOPSIS: HERSHEYS

New players need to go through the scrutiny of government regulations and inspections, which is

costly. These barriers will decrease the number of competitors to enter into the chocolate industry.

Threat of substitute products and services: Moderate to High

Flavourings are one of the substitutes. Customers can use flavourings for industrial and

cooking use instead of using chocolate and cocoa products. Moreover, buyers can consume

alternate snacks. The confectionary industry faces intense substitutes such as non-chocolate

snacks, candies, potato chips, ice cream and fruits. Since many consumers see chocolate as

unhealthy, many customers will switch to consume substitute products.

Intensity of rivalry among competitors in an industry: High

The chocolate industry has multiple industry leaders, which lead to intense rivalry. With

multiple industry leaders that are equally balanced competitors with similar size and products

offering, many of them create new product lines and actively participate in advertising wars.

The chocolate industry has high fixed cost and storage costs. Equipments are required to

produce chocolate and raw material such as milk and chocolate must be kept at a proper

temperature and humidity, which lead to high fixed and storage costs.

COMPETITOR ANALYSIS:

The three competitors of Hersheys are Purdys, a local Canadian chocolate company, Meiji, a

Japanese food company, and Nestle, a Switzerland-based chocolate company (see Table 3).

TABLE 3: Competitor Analysis

Purdys

Future

Objectives

Current

Strategy

Each and every employee

plays an integral role in the

Purdys operation and is

equally committed to

creating quality product

Partner with local

Canadian companies to

source supplies throughout

the cocoa harvest supply

chain

Meiji

It will continue working to

widen the world of Tastiness,

Enjoyment, Health and

Reassurance and endeavour to

always be there to brighten its

customers daily lives

By integrating technologies,

knowledge, and ideas from these

fields, new value that is useful

for customers of all ages is

created

Nestle

To be recognized as the world

leader in Nutrition, Health and

Wellness, trusted by all its

stakeholders, and to be the

reference for financial

performance in its industry.

Create alignment for people

behind a cohesive set of

strategic priorities that will

accelerate the achievement of

our objectives

CASE SYNOPSIS: HERSHEYS

Assumptions

Reputation as a quality

chocolatier

Capabilities

Manufacturing,

designing, marketing,

distributing and

merchandising capabilities

Environmentally

friendly: reduce solid

waste emissions by 47.2%,

i.e. 112.3 tones of carbon

dioxide in 2011

General

Notes

Leading Chocolatier in

Canada, with 63 stores in

British Columbia, Alberta

and Ontario.

Utilize network in Japan and

overseas

Long-term thinking

Wide range of products catering

different age groups needs

Confectionery business unit

Dairy business unit

Healthcare and nutritional

business unit

International business unit

A combination of hard-tocopy advantages throughout

the value chain, built up over

decades.

Inherent links between great

products and strong R&D, the

broadest geographical

presence and an

entrepreneurial spirit, as well

as great people and strong

value

It is the member of the Meiji

Group in charge of the food

business.

The worlds leading nutrition,

health and wellness company

STRATEGY

BUSINESS LEVEL STRATEGY:

Hersheys successfully uses the integrated cost leadership and differentiation strategy, allowing

Hersheys to adapt quickly and recognize the opportunities provided by the latest technology while

competing against its rivals in the industry. To reduce costs of production, Hersheys builds

manufacturing sites in countries with cheaper labours such as India, China, Brazil and Mexico. The recent

upgrades of distribution and administrative facilities in Hersheys, PA, make Hershey's supply chain more

efficient and cost-effective. To improve differentiation, it aggressively invests R&D department in the

emerging and current markets. Hersheys has a portfolio of representative brands to satisfy customers in

different market segments.

CORPORATE LEVEL STRATEGY:

Hersheys uses the related constrained diversification strategy in their confectionery industry.

There are five core brands globally, which results in their most profit such as Kisses, Reese's Hershey's,

Jolly Rancher and Ice Breakers. This strategy focuses its resources on manufacturing, marketing and

reducing duplicate expenditure. In the unrelated diversification strategy, Hersheys acquired small

independent pasta companies since the mid-1960s such as Ronzoni and America Beauty. This increases

CASE SYNOPSIS: HERSHEYS

market share and strategic investment in other high-return industry. Hersheys acquired the Mauna Loa

brand in 2004, which was the world's largest processor of macadamia seeds. This backward integration

allows the company gain its input at the lowest cost consistent with their integrated cost leadership or

differentiation strategy. On the other hand, Hersheys is considering the idea of Hershey's store in forward

integration. In April 2010, Hershey's announced plans to open six stores in Singapore within three years.

INTERNATIONAL STRATEGY:

Hersheys is using the transnational strategy to achieve local responsiveness and global efficiency.

In order to stay competitive, Hersheys is expanding its business internationally with focus on China,

Mexico, Brazil, and Canada market. By developing its international market share, its goal is to increase

revenue by 50 percents to $10 billion by 2017. For market similar to US, such as Canada market,

Hersheys uses standardized strategy to produce products with consistent quality. Products and services

offered in these markets are manufactured centrally at few locations. For other markets, Hersheys

strategy is to expand through partnership, acquisition, and joint ventures with foreign companies. This

strategy allows Hersheys to better understand the local market and helps it to localize and provide

products that cater to the domestic tastes. In order to adapt the local market in China, Hersheys not only

signed agreement with Lotte Company but also opened a new R&D facility to redesign its products and

aid promotion and distribution. In addition to the North American markets, Hersheys now owns

operations in over 90 countries. It develops strategic alliance with Barry Callebaut, Lotte, and Godrej

Beverages and Foods that helps it to improve its global presence.

COOPERATIVE STRATEGY:

Hersheys invests intensively in community programs in West Africa that aim to reinforce cocoa

sustainability. Hersheys, along with its private and public partners, invested heavily in agriculture

practices that can double the yield of the cocoa farm. CocoaLink, a farmer outreach programs, is used to

reach the farmers with valuable information through mobile phones on improving farming practices, farm

safety, child labor, health, crop disease prevention, post-harvest production and crop marketing. In

addition, Hershey Learn To Grow Farm Program provides local farms in Ghana with important

CASE SYNOPSIS: HERSHEYS

information on sustainable cocoa farming. This program is developed with Source Trust, a non-profit

organization, to improve farmers living standards as well as assisting government of Ghana to eliminate

child labor issue. The launch of these programs help Hersheys to not only improve farmers living

condition but also ensure long-term cocoa sustainability.

STRATEGIC CHALLENGES

LOSS OF CENTRALIZED CONTROL:

Hersheys is using licensing and acquisition to expand internationally. These enhance global

efficiency and expand internationally; however, decisions will become decentralized in each country.

Hersheys loses control over product quality, marketing and distribution even this is the easiest way to

expand worldwide. Hersheys may need to consider other entry mode in order to maintain centralized

control with local responsiveness.

HEALTH ISSUE:

Nowadays, people are getting more concerned about their health. People will consume organic

products to maintain a healthy lifestyle. However, chocolates are considered as junk food as it will

possibly cause obesity. This may reduce consumption of chocolate and, hence, affect Hersheys sales.

Although some researches show that dark chocolate is beneficial to peoples health, some of them will

still have preconception and consider chocolate as unhealthy. Hersheys may need to further advertise in

order to reduce publics prejudice towards chocolate.

CASE SYNOPSIS: HERSHEYS

10

REFERENCE

Hersheys

http://www.hersheys.com/

Hersheys Canada.

https://www.hersheycanada.com/en/home

Purdys

http://www.2010commercecentre.gov.bc.ca/BusinessPlanning/SuccessStories/Purdys.aspx

https://climatesmartbusiness.com/case-studies/purdys-chocolates/

http://www.purdys.com/About-Purdys.aspx

Meiji

http://www.meiji.co.jp/english/

Nestle

http://www.nestle.com/aboutus/

Analysis

http://www.scribd.com/doc/42983333/case-study-of-The-Hershey-Company

http://prezi.com/72lb8bhhf4fa/copy-of-hersheys-2/

http://www.ukessays.com/essays/marketing/the-hershey-company-is-the-largest-chocolate-producermarketing-essay.php

http://prezi.com/izcyn_-brf9n/hersheys/

http://www.slideshare.net/LelloPacella/hershey-financial-analyst-report

http://jmfrrell.blogspot.ca/2011/06/chapter-4-industry-analysisporters-five.html

http://www.huffingtonpost.com/doug-bandow/the-world-is-entering-a-d_b_4189608.html

http://www.confectionerynews.com/Commodities/Chocolate-bar-prices-climb-25-in-past-year-as-cocoadeficit-deepens-Mintec

http://www.nytimes.com/2013/10/31/us/american-candy-makers-pinched-by-inflated-sugar-prices-lookabroad.html?_r=0

http://www.confectionerynews.com/Commodities/Europe-s-chocolate-industry-plays-catch-as-Q3-cocoagrind-climbs-5

Potrebbero piacerti anche

- Cadbury Marketing PlanDocumento27 pagineCadbury Marketing PlanAjaz AhmedNessuna valutazione finora

- Case Study Hershey Food Corporation 120903220803 Phpapp01Documento9 pagineCase Study Hershey Food Corporation 120903220803 Phpapp01ace3aceNessuna valutazione finora

- Case Study Hershey Food CorporationDocumento8 pagineCase Study Hershey Food CorporationNimra JawaidNessuna valutazione finora

- Hershey's PresentationDocumento22 pagineHershey's PresentationTabish Mujahid100% (1)

- Hershey Company Swot AnalysisDocumento2 pagineHershey Company Swot AnalysisSamantha Dianne CalanaoNessuna valutazione finora

- Hersheys India PVT LTDDocumento33 pagineHersheys India PVT LTDAravind V GurramNessuna valutazione finora

- FinalDocumento29 pagineFinalCarlo M MedenillaNessuna valutazione finora

- Hershey Case StudyDocumento16 pagineHershey Case StudyJad FakhryNessuna valutazione finora

- The Hershey CompanyDocumento31 pagineThe Hershey Companyjudith matienzo67% (3)

- Indian Chocolate IndustryDocumento76 pagineIndian Chocolate IndustryPrateek Kr Verma50% (2)

- Case Study Hershey Food CorporationDocumento9 pagineCase Study Hershey Food CorporationHomework PingNessuna valutazione finora

- Case HersheyDocumento16 pagineCase Hersheynoor74900Nessuna valutazione finora

- 37 - Assignment Sample - A Good SampleDocumento18 pagine37 - Assignment Sample - A Good SampleThư Trần100% (1)

- Cadbury Report FinalDocumento21 pagineCadbury Report FinalAmila BuddikaNessuna valutazione finora

- Haighs Chocolates E-Marketing PlanDocumento16 pagineHaighs Chocolates E-Marketing PlanYusef ShaqeelNessuna valutazione finora

- 1 Hershey-Company PDFDocumento23 pagine1 Hershey-Company PDF98rainNessuna valutazione finora

- Porter's Five Forces "Cadbury"Documento3 paginePorter's Five Forces "Cadbury"Cristian MazurNessuna valutazione finora

- NestleDocumento18 pagineNestleNishantha FernandoNessuna valutazione finora

- Swot in Estee Lauder Inc 2011Documento2 pagineSwot in Estee Lauder Inc 2011Noor Syamila HashimNessuna valutazione finora

- Top Nestle Competitors Across The WorldDocumento19 pagineTop Nestle Competitors Across The WorldsajjadNessuna valutazione finora

- CASE STUDY - Hershey FoodsDocumento5 pagineCASE STUDY - Hershey FoodsKaustubh Tiwary50% (2)

- A Project Report On Chocolate Industry: Sonali Dhimmar Batch (2015-18) Enrolment No.022015099Documento27 pagineA Project Report On Chocolate Industry: Sonali Dhimmar Batch (2015-18) Enrolment No.022015099sonaliNessuna valutazione finora

- Hersheys FinalDocumento87 pagineHersheys FinalAnkush SharmaNessuna valutazione finora

- Saudi Arabia I. Basic Facts About The Country (Search For World Fact Book For Your Reference) GeographyDocumento9 pagineSaudi Arabia I. Basic Facts About The Country (Search For World Fact Book For Your Reference) GeographyÀlbert Francisco RiveraNessuna valutazione finora

- Highlighting Key Strategic Marketing Issues of DELVE DESSERTSDocumento31 pagineHighlighting Key Strategic Marketing Issues of DELVE DESSERTSTalha Iftikhar100% (2)

- Q1. How Structurally Attractive Is The Russian Ice Cream Market? Discuss How Its Industry Structure Can Be Made More Attractive? (663 Words)Documento5 pagineQ1. How Structurally Attractive Is The Russian Ice Cream Market? Discuss How Its Industry Structure Can Be Made More Attractive? (663 Words)Hongbo HaNessuna valutazione finora

- Levis PresenceDocumento26 pagineLevis Presencesangram96100% (1)

- Haier HBS Case StudyDocumento5 pagineHaier HBS Case StudyFederico DonatiNessuna valutazione finora

- HaldiramDocumento18 pagineHaldiramStany D'melloNessuna valutazione finora

- SWOT HersheyDocumento4 pagineSWOT HersheylionalleeNessuna valutazione finora

- J&J Chandrashekhar - DocxqeDocumento74 pagineJ&J Chandrashekhar - DocxqeManova Kumar100% (1)

- Power Point Notes Dyna 2015Documento13 paginePower Point Notes Dyna 2015Alice Lin100% (1)

- SIC - Sunpharma Ranbaxy M&ADocumento16 pagineSIC - Sunpharma Ranbaxy M&AAmitrojitNessuna valutazione finora

- Ferrero RocherDocumento19 pagineFerrero RocherAvni Dodia Rathod75% (4)

- Hershey'S QSPM Matrix: Strategies 1 Key Internal Factors Weights AS StrengthsDocumento7 pagineHershey'S QSPM Matrix: Strategies 1 Key Internal Factors Weights AS StrengthsSofiaNessuna valutazione finora

- IPPTChap 008Documento81 pagineIPPTChap 008Nia ニア MulyaningsihNessuna valutazione finora

- Coca Cola International Business Study For GlobalizationDocumento31 pagineCoca Cola International Business Study For GlobalizationSaima TasnimNessuna valutazione finora

- Pernod RicardDocumento18 paginePernod RicardSarsal6067Nessuna valutazione finora

- Market Entry Strategies of StarbucksDocumento14 pagineMarket Entry Strategies of StarbucksImraan Malik50% (2)

- Planning Process of Nestle PLC As A Tool PDFDocumento27 paginePlanning Process of Nestle PLC As A Tool PDFJahangir KhanNessuna valutazione finora

- Strategic Marketing: Absolut Vodka - Creating Advertising HistoryDocumento6 pagineStrategic Marketing: Absolut Vodka - Creating Advertising HistorybharathNessuna valutazione finora

- The Mechanism of InternationalisationDocumento13 pagineThe Mechanism of Internationalisationnazmuahsan1333Nessuna valutazione finora

- Launching Krispy Natural: Cracking The Product Management CodeDocumento48 pagineLaunching Krispy Natural: Cracking The Product Management Codemuhammad fadliNessuna valutazione finora

- Hershey India Private LimitedDocumento9 pagineHershey India Private LimitedBharath Raj SNessuna valutazione finora

- MKT 503Documento24 pagineMKT 503Prateek SehgalNessuna valutazione finora

- Principles of Marketing, Final ProjectDocumento15 paginePrinciples of Marketing, Final ProjectUswah Zar100% (1)

- Strategic Brand Management, Group Project.Documento18 pagineStrategic Brand Management, Group Project.Sanil YadavNessuna valutazione finora

- Tushar Bhargav ReportDocumento16 pagineTushar Bhargav ReportRishi BiggheNessuna valutazione finora

- Market SegmentationDocumento23 pagineMarket SegmentationRahul AroraNessuna valutazione finora

- Business Strategy of Cadbury India Limite1Documento4 pagineBusiness Strategy of Cadbury India Limite1Shivam yadavNessuna valutazione finora

- Global SourcingDocumento26 pagineGlobal SourcingOwais BhattNessuna valutazione finora

- Hershey's (Choclate Company)Documento12 pagineHershey's (Choclate Company)MUHAMMAD UMAIRNessuna valutazione finora

- Holland & Barrett-HashaniDocumento17 pagineHolland & Barrett-HashaniManasa SelamuthuNessuna valutazione finora

- Marketing ProjectDocumento9 pagineMarketing ProjectkherasiddharthNessuna valutazione finora

- Estee Lauder Chapter 2Documento16 pagineEstee Lauder Chapter 2Berry ChocoNessuna valutazione finora

- Red Bull in IndiaDocumento20 pagineRed Bull in IndiaKshitij GopalNessuna valutazione finora

- Strategic Management in Global ContextDocumento17 pagineStrategic Management in Global Contextsaifuddin ahammedfoysalNessuna valutazione finora

- Cadbury IndiaDocumento16 pagineCadbury Indiaakashbarnala0% (1)

- Case Study Hershey Food CorporationDocumento9 pagineCase Study Hershey Food CorporationMarvinLuisMontillaNessuna valutazione finora

- Choco DayDocumento26 pagineChoco DayAditya ChauhanNessuna valutazione finora

- The Power of Decisions: M. Akbar BhattiDocumento21 pagineThe Power of Decisions: M. Akbar BhattiAkbar BhattiNessuna valutazione finora

- Nature of International MarketingDocumento13 pagineNature of International MarketingAkbar BhattiNessuna valutazione finora

- Strategy Audit M/S Empire Tube Mills Lahore Sample Interview QuestionsDocumento2 pagineStrategy Audit M/S Empire Tube Mills Lahore Sample Interview QuestionsAkbar BhattiNessuna valutazione finora

- Quality (Misc)Documento4 pagineQuality (Misc)Akbar BhattiNessuna valutazione finora

- HRDDocumento40 pagineHRDAkbar BhattiNessuna valutazione finora

- Final Draft RTS On SADocumento84 pagineFinal Draft RTS On SAjose pazNessuna valutazione finora

- History and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFDocumento1.124 pagineHistory and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFOmkar sinhaNessuna valutazione finora

- Lipura Ts Module5EappDocumento7 pagineLipura Ts Module5EappGeniza Fatima LipuraNessuna valutazione finora

- Elaine Makes Delicious Cupcakes That She Mails To Customers AcrossDocumento1 paginaElaine Makes Delicious Cupcakes That She Mails To Customers Acrosstrilocksp SinghNessuna valutazione finora

- NPS Completed ProjectDocumento53 pagineNPS Completed ProjectAkshitha KulalNessuna valutazione finora

- NIST SP 800-53ar5-1Documento5 pagineNIST SP 800-53ar5-1Guillermo Valdès100% (1)

- 2015 3d Secure WhitepaperDocumento7 pagine2015 3d Secure WhitepapersafsdfNessuna valutazione finora

- 6 Chase Nat'l Bank of New York V BattatDocumento2 pagine6 Chase Nat'l Bank of New York V BattatrNessuna valutazione finora

- Surahduha MiracleDreamTafseer NoumanAliKhanDocumento20 pagineSurahduha MiracleDreamTafseer NoumanAliKhanspeed2kxNessuna valutazione finora

- Abrigo Vs Flores DigestDocumento4 pagineAbrigo Vs Flores DigestKatrina GraceNessuna valutazione finora

- Political Conditions in ArabiaDocumento11 paginePolitical Conditions in ArabiaAsad Malik100% (2)

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDocumento3 pagineFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliNessuna valutazione finora

- Hunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchiveDocumento21 pagineHunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchivePrince KatheweraNessuna valutazione finora

- Dividend Discount ModelDocumento54 pagineDividend Discount ModelVaidyanathan Ravichandran100% (1)

- Adobe Scan 03-May-2021Documento22 pagineAdobe Scan 03-May-2021Mohit RanaNessuna valutazione finora

- TDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Documento9 pagineTDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Sumukh TemkarNessuna valutazione finora

- Sailpoint Training Understanding ReportDocumento2 pagineSailpoint Training Understanding ReportKunalGuptaNessuna valutazione finora

- (MX) Public Figures, Private LivesDocumento3 pagine(MX) Public Figures, Private LivesbestatemanNessuna valutazione finora

- Beowulf Essay 1Documento6 pagineBeowulf Essay 1api-496952332Nessuna valutazione finora

- Notice - Carte Pci - Msi - Pc54g-Bt - 2Documento46 pagineNotice - Carte Pci - Msi - Pc54g-Bt - 2Lionnel de MarquayNessuna valutazione finora

- Internship Report Mca Audit Report InternshipDocumento33 pagineInternship Report Mca Audit Report InternshipJohnNessuna valutazione finora

- JournalofHS Vol11Documento136 pagineJournalofHS Vol11AleynaNessuna valutazione finora

- Philippine ConstitutionDocumento17 paginePhilippine ConstitutionLovelyn B. OliverosNessuna valutazione finora

- Open Quruan 2023 ListDocumento6 pagineOpen Quruan 2023 ListMohamed LaamirNessuna valutazione finora

- DLF New Town Gurgaon Soicety Handbook RulesDocumento38 pagineDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaNessuna valutazione finora

- Shop Decjuba White DressDocumento1 paginaShop Decjuba White DresslovelyNessuna valutazione finora

- 1-Introduction - Defender (ISFJ) Personality - 16personalitiesDocumento6 pagine1-Introduction - Defender (ISFJ) Personality - 16personalitiesTiamat Nurvin100% (1)

- Correctional Case StudyDocumento36 pagineCorrectional Case StudyRaachel Anne CastroNessuna valutazione finora

- MC Script For StorytellingDocumento1 paginaMC Script For StorytellingPPD LUBOK ANTU-CM15 KPMNessuna valutazione finora

- Crime and Punishment Vocabulary 93092Documento2 pagineCrime and Punishment Vocabulary 93092Rebeca Alfonso Alabarta50% (4)

- The United States of Beer: A Freewheeling History of the All-American DrinkDa EverandThe United States of Beer: A Freewheeling History of the All-American DrinkValutazione: 4 su 5 stelle4/5 (7)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterDa EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterValutazione: 3.5 su 5 stelle3.5/5 (487)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesDa EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesValutazione: 4.5 su 5 stelle4.5/5 (9)

- AI Superpowers: China, Silicon Valley, and the New World OrderDa EverandAI Superpowers: China, Silicon Valley, and the New World OrderValutazione: 4.5 su 5 stelle4.5/5 (399)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeDa EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeValutazione: 4 su 5 stelle4/5 (88)

- All You Need to Know About the Music Business: 11th EditionDa EverandAll You Need to Know About the Music Business: 11th EditionNessuna valutazione finora

- All The Beauty in the World: The Metropolitan Museum of Art and MeDa EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeValutazione: 4.5 su 5 stelle4.5/5 (83)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedDa EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedValutazione: 2.5 su 5 stelle2.5/5 (5)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerDa EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerValutazione: 4 su 5 stelle4/5 (121)

- System Error: Where Big Tech Went Wrong and How We Can RebootDa EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootNessuna valutazione finora

- What Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessDa EverandWhat Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessValutazione: 5 su 5 stelle5/5 (1)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyDa EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNessuna valutazione finora

- All You Need to Know About the Music Business: Eleventh EditionDa EverandAll You Need to Know About the Music Business: Eleventh EditionNessuna valutazione finora

- Lean Six Sigma: The Ultimate Guide to Lean Six Sigma, Lean Enterprise, and Lean Manufacturing, with Tools Included for Increased Efficiency and Higher Customer SatisfactionDa EverandLean Six Sigma: The Ultimate Guide to Lean Six Sigma, Lean Enterprise, and Lean Manufacturing, with Tools Included for Increased Efficiency and Higher Customer SatisfactionValutazione: 5 su 5 stelle5/5 (2)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumDa EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumValutazione: 3 su 5 stelle3/5 (12)

- Real Life: Construction Management Guide from A-ZDa EverandReal Life: Construction Management Guide from A-ZValutazione: 4.5 su 5 stelle4.5/5 (4)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomDa EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNessuna valutazione finora

- Women's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesDa EverandWomen's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesValutazione: 4.5 su 5 stelle4.5/5 (191)

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportDa EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportValutazione: 4 su 5 stelle4/5 (1)

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsDa EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsValutazione: 4.5 su 5 stelle4.5/5 (10)

- SkyTest® Airline Interview - The Exercise Book: Interview questions and tasks from real life selection procedures for pilots and ATCOsDa EverandSkyTest® Airline Interview - The Exercise Book: Interview questions and tasks from real life selection procedures for pilots and ATCOsValutazione: 4 su 5 stelle4/5 (12)