Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Answers Introductory Finance

Caricato da

nira_110Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Answers Introductory Finance

Caricato da

nira_110Copyright:

Formati disponibili

ANSWERS

Answers

TOPIC 1: INTRODUCTION TO FINANCIAL

MANAGEMENT

SELF-CHECK 1.1

Essay Question

1.

(a) Maximising the managers utilities

(b) Implementing social responsibilities

(c)

(d) Uplifting the standards and welfare of workers

Continuous existence

SELF-CHECK 1.2

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

SELF-CHECK 1.3

Fill in the Blanks

1.

Maximising the firms wealth

2.

Unlimited, limited

3.

Financial manager

4.

Difficult to set up/double taxation

5.

Technology, globalisation

151

152

ANSWERS

TOPIC 2: FINANCIAL ENVIRONMENT

SELF-CHECK 2.1

Match the Correct Answers

1.

Commercial paper

2.

Negotiable Certificates of Deposit

3.

Treasury Bills

4.

Money Market

SELF-CHECK 2.2

Multiple Choice Questions

1.

2.

3.

4.

5.

TOPIC 3: FINANCIAL STATEMENT AND

FINANCIAL RATIOS ANALYSIS

SELF-CHECK 3.1

1.

Working capital

(2010)

= 24,300 6,600

= 17,700

Working capital

(2011)

= 30,000 9,300

= 20,700

SELF-CHECK 3.2

Essay Question

2011: = 15,154 3,525

= 11,629

2010: = 14,390 3,660

= 10,730

ANSWERS

153

SELF-CHECK 3.3

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

SELF-CHECK 3.4

Essay Question

Current ratio of Emas Limited Company for the year 2010 was 1.80 times, which was

higher compared to the year 2011 which had a current ratio of only 1.24 times. This

means that the firms liquidity for the year 2010 was better than for the year 2011. In the

year 2010, for each ringgit of current liabilities the company had a cash of RM1.80 and it

also had assets which were easily convertible into cash which could be used to pay-off its

short term debts quickly. This indicates that the firm was in a better condition in the year

2010 than in the year 2011.

SELF-CHECK 3.5

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

TOPIC 4: FINANCIAL MATHEMATICS

SELF-CHECK 4.1

1.

FV

= RM500(1 + 0.05)2

= RM500 (1.1025)

= RM551.25

2.

FV

= RM2,000(1 + 0.08)5

= RM2,000(1.4693)

= RM2,938.66

154

ANSWERS

SELF-CHECK 4.2

1.

Compounding: future value; discounting; present value.

2.

RM1,500

(a) PV =

2

(1 + 0.05)

= RM1,500

1.1025

= RM1,360.54

RM10,000

(b) PV =

4

(1 + 0.08)

RM10,000

=

1.3605

= RM7,350.24

SELF-CHECK 4.3

Higher, decrease.

SELF-CHECK 4.4

1.

RM500

0.08

= RM6,250

2.

RM500 (5.8666)

= RM2,933.30

3.

RM500 (5.8666) (1+ 0.08) = RM500 (6.3359)

= RM3,167. 95

SELF-CHECK 4.5

1.

RM500(1.2597) + RM800 (1.1664) + RM1,000(1.08) + RM1,200

= RM3,842.97

2.

RM5,000(0.9259) + RM7,000(0.8573) + RM5,000(0.7938) + RM3,000(0.7350)

= RM16,804.60

ANSWERS

155

SELF-CHECK 4.6

1.

n = 5 years 12 = 60 months

i = 9% = 0.75%

12

PVA = B(PVIFA i = 0.75%, n = 60)

200 000 = B (48.1734)

B = RM4,151.67

B = monthly installment

SELF-CHECK 4.7

1.

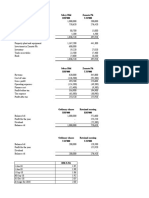

(a)

(1)

Period

(2)

Balance

brought

forward (RM)

(3)

Payment

(RM)

(4) = 1%x(2)

Interest (1%)

(5)=(3)-(4)

Principal loan

reduction

(6)=(2)-(5)

Last

Balance

2,726.96

100

27.27

72.73

2,654.23

2,654.23

100

26.54

73.46

2,580.77

2,580.77

100

25.81

74.19

2,506.58

2,506.58

100

25.07

74.93

2,431.65

(b) If the period of payment increases, the interest decreases while the

principal loan reduction increases even if the installment is fixed at

RM100.

SELF-CHECK 4.8

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

5.

156

ANSWERS

TOPIC 5: CAPITAL BUDGETING AND CASH FLOW

ProJECTION

SELF-CHECK 5.1

TRUE (T) or FALSE (F) Statements

(a) Payback period = 100,000

30,000

= 3 1/3 years

= 3 years 4 months

(b) No because the payback period exceeds 3 years.

SELF-CHECK 5.2

1.

100 000 = 30 000 (PVIFA i = ?, n = 4)

2.

Based on the PVIFA table for a period of 3 years, it shows that PVIFA at an

interest rate of 7% is 3.3782 and at an interest rate of 8% is 3.3121. Therefore,

the internal rate of return is between 7% and 8%.

SELF-CHECK 5.3

Fill in the Blanks

1. bigger, higher

2.

high, low

TOPIC 6: COST of capital AND Capital

STRUCTURE

SELF-CHECK 6.1

1.

Weighted debt

: 150,000

500,000

Preferences shares : 80,000

500,000

Ordinary shares

: 270,000

500,000

ANSWERS

SELF-CHECK 6.2

Debt cost after tax = 7% (1 0.30)

= 4.9%

SELF-CHECK 6.3

8 100 = 8.25%

Cost of preferences shares =

100 3

SELF-CHECK 6.4

D1

+ g

(a) Common equity =

H0

= 0.20 + 0.05

3.00

= 11.67%

(b) Common equity cost = D1 + g

H0(1 A)

= 0.20

+ 0.06

3(1 0.20)

= 13.33%

SELF CHECK 6.5

TRUE (T) or FALSE (F) Statements

1. T

Capital components

Weight

Capital cost

Debts

0.3

0.3 x 7% = 2.1%

Preferences shares

0.16

0.16 x 8% = 1.28%

Ordinary shares

0.54

0.54 x 12% = 6.48%

TOTAL

1.00

9.86%

2. F

3. F

4. T

5. T

157

158

ANSWERS

SELF CHECK 6.6

TRUE (T) or FALSE (F) Statements

1. F

2. F

3. T

4. F

5. T

TOPIC 7: WORKING CAPITAL MANAGEMENT

SELF-CHECK 7.1

For year 2010 Net working capital is RM30,000 and its current ratio 1.25.

For year 2011 Net working capital is RM15,000 and its current ratio 1.09.

For the year 2011, increase in current liabilities is higher than increase in current

assets (liabilities) leading to decrease in the firms liquidity position.

SELF-CHECK 7.2

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

5.

ANSWERS

159

TOPIC 8: CASH MANAGEMENT AND

MARKETABLE SECURITIES

SELF-CHECK 8.1

Fill in the Blanks

1. Differences between the balance in the firms cheques book and its account

in the bank.

2. (a) Payment

(b) Net

(c) Collection

SELF-CHECK 8.2

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

5.

TOPIC 9: ACCOUNTS RECEIVABLE

MANAGEMENT

SELF-CHECK 9.1

120,000 60

Accounts receivable management =

360

= RM20,000

SELF-CHECK 9.2

TRUE (T) or FALSE (F) Statements

1.

2.

160

3.

4.

5.

ANSWERS

TOPIC 10: INVENTORY MANAGEMENT

SELF-CHECK 10.1

(a) EOQ

= 439 components

(b) Reorder point

= 800 components

(c) Annual total cost = RM5,477.24

SELF-CHECK 10.2

TRUE (T) or FALSE (F) Statements

1.

2.

3.

4.

5.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Waqf Business ModelDocumento13 pagineWaqf Business Modelnira_110Nessuna valutazione finora

- Lietz 2010Documento6 pagineLietz 2010nira_110Nessuna valutazione finora

- The Need of An Effective Business Model For Waqf Land Development in MalaysiaDocumento12 pagineThe Need of An Effective Business Model For Waqf Land Development in Malaysianira_110Nessuna valutazione finora

- Capital Budgeting and Cash Flow ProjectionDocumento21 pagineCapital Budgeting and Cash Flow Projectionnira_110Nessuna valutazione finora

- Theories of Financial IntermediationDocumento38 pagineTheories of Financial Intermediationnira_1100% (1)

- Topi C 7: Corporate RestructuringDocumento28 pagineTopi C 7: Corporate Restructuringnira_110Nessuna valutazione finora

- Problem Review Set Dividend Policy With SolutionsDocumento6 pagineProblem Review Set Dividend Policy With SolutionsAujian ArenasNessuna valutazione finora

- Stiglitz IrrelevanceDocumento2 pagineStiglitz Irrelevancenira_110Nessuna valutazione finora

- Financial Environment PDFDocumento11 pagineFinancial Environment PDFnira_110100% (3)

- May2015 AssignDocumento7 pagineMay2015 Assignnira_110Nessuna valutazione finora

- Contoh Asgn FMDocumento21 pagineContoh Asgn FMnira_110Nessuna valutazione finora

- Binder (1998) - RQFA - 11 111-137Documento27 pagineBinder (1998) - RQFA - 11 111-137nira_110Nessuna valutazione finora

- MBA711 - Chapter11 - Answers To All Homework ProblemsDocumento17 pagineMBA711 - Chapter11 - Answers To All Homework ProblemsGENIUS1507Nessuna valutazione finora

- Mckenzie SolutionDocumento5 pagineMckenzie Solutionnira_110Nessuna valutazione finora

- Finance SourcesDocumento53 pagineFinance Sourcesnira_110100% (2)

- ProfitabilityDocumento25 pagineProfitabilitynira_11050% (2)

- Financial SourcesDocumento8 pagineFinancial Sourcesnira_110Nessuna valutazione finora

- Expected Return With and Without ExpansionDocumento2 pagineExpected Return With and Without Expansionnira_110100% (1)

- Exercise Annual Report 2012Documento1 paginaExercise Annual Report 2012nira_110Nessuna valutazione finora

- Philosophy of Science and Management Science 12 March 2012Documento2 paginePhilosophy of Science and Management Science 12 March 2012nira_110Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 1.4 Basic Research QuestionsDocumento3 pagine1.4 Basic Research QuestionsYidnekachewNessuna valutazione finora

- Manufacturers, Suppliers, Exporters & Importers From The World's Largest Online B2BDocumento1 paginaManufacturers, Suppliers, Exporters & Importers From The World's Largest Online B2BVeysel Gökhan YARARNessuna valutazione finora

- Swing Trading Strategies Quick GuideDocumento9 pagineSwing Trading Strategies Quick GuideAdam ChoNessuna valutazione finora

- Mutual FundsDocumento8 pagineMutual FundsNarendraVukkaNessuna valutazione finora

- Derivatives Test 3 SolnDocumento12 pagineDerivatives Test 3 SolnHetviNessuna valutazione finora

- Pressures For Global IntegrationDocumento16 paginePressures For Global IntegrationMahpuja JulangNessuna valutazione finora

- Subscription Incentive For Partners FAQ - Partner Version1Documento4 pagineSubscription Incentive For Partners FAQ - Partner Version1Manuel SosaNessuna valutazione finora

- Investment and Portfolio ManagementDocumento16 pagineInvestment and Portfolio ManagementmudeyNessuna valutazione finora

- Ias 33 EpsDocumento4 pagineIas 33 EpsMd. Mamunur RashidNessuna valutazione finora

- Digital Marketing Is The Promotion of ProductsDocumento8 pagineDigital Marketing Is The Promotion of ProductsAkshat AgarwalNessuna valutazione finora

- P.G.Apte International Financial Management 1Documento15 pagineP.G.Apte International Financial Management 1Alissa BarnesNessuna valutazione finora

- Karakteristik Perjanjian Jual Beli Medium Term Notes: Universitas AirlanggaDocumento20 pagineKarakteristik Perjanjian Jual Beli Medium Term Notes: Universitas AirlanggaMuhammad Rexel Abdi ZulfikarNessuna valutazione finora

- The Free and Open People's MarketDocumento28 pagineThe Free and Open People's MarketthunderdomeNessuna valutazione finora

- 79 TH AGMNotice-Bajaj Hindusthan LTDDocumento8 pagine79 TH AGMNotice-Bajaj Hindusthan LTDBadrinath ChavanNessuna valutazione finora

- Long Term Financing1 - MainDocumento35 pagineLong Term Financing1 - MainnwahidaNessuna valutazione finora

- Assignment-1 (IKEA)Documento2 pagineAssignment-1 (IKEA)Roselin ScallyNessuna valutazione finora

- Nivea 13 FullDocumento4 pagineNivea 13 FullNikhil AlvaNessuna valutazione finora

- EBAY Outlook and Research ReportDocumento8 pagineEBAY Outlook and Research ReporttradespoonNessuna valutazione finora

- Case Study - Venicia Business Strategy For Sustainable BusinessDocumento4 pagineCase Study - Venicia Business Strategy For Sustainable BusinessTegenu kedirNessuna valutazione finora

- Group Project 2 Sabry Zamato SolutionDocumento5 pagineGroup Project 2 Sabry Zamato SolutionSyafahani SafieNessuna valutazione finora

- CR Analysis PDFDocumento5 pagineCR Analysis PDFMd. Mostafizur RahmanNessuna valutazione finora

- Cost Sheet M3M - Antalya HillsDocumento9 pagineCost Sheet M3M - Antalya Hillssonu saxenaNessuna valutazione finora

- Product Life Cycle of Lux SoapDocumento23 pagineProduct Life Cycle of Lux SoapSugandha KumariNessuna valutazione finora

- Marketing Sales: Seminars inDocumento6 pagineMarketing Sales: Seminars insboaduappiahNessuna valutazione finora

- Odisha HandicraftPolicy 2019Documento20 pagineOdisha HandicraftPolicy 2019Sdrc IndiaNessuna valutazione finora

- Vision and Pricing StrategyDocumento32 pagineVision and Pricing Strategymary jessanie jameraNessuna valutazione finora

- Job Order CostingDocumento12 pagineJob Order CostingDahlia BloomsNessuna valutazione finora

- Final Paper - Application Analysis of Escrow System On Payment Transaction in An Online ShopDocumento18 pagineFinal Paper - Application Analysis of Escrow System On Payment Transaction in An Online ShopSaid Muhamad FarosNessuna valutazione finora

- Consumer Behaviour Analysis of Product ADocumento21 pagineConsumer Behaviour Analysis of Product AMuhammad Imran AwanNessuna valutazione finora

- Chapter 2 - Financial Markets: Learning OutcomesDocumento9 pagineChapter 2 - Financial Markets: Learning OutcomesIanna Kyla BatomalaqueNessuna valutazione finora