Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

4.QT1 ASGMT 2016.01 Final

Caricato da

Joanne WongTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

4.QT1 ASGMT 2016.01 Final

Caricato da

Joanne WongCopyright:

Formati disponibili

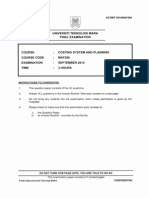

UBEQ 1013/ UKEQ 1013 QUANTITATIVE TECHNIQUES I ASSIGNMENT

Instruction:

1) Use Microsoft Excel ONLY to solve the following problems.

2) Answers must be type-written nicely. ALL input and output printouts shall be submitted

together with the answers.

3) Please provide cover page which includes ALL NAMES and ID of the group members.

One group consists of maximum 6 or 7members only.

4) The submission date is on WEEK 8 (11/03/2016)before 5pm. Late submission 10 marks

will be deducted.

4) You must submit at respective tutors room.

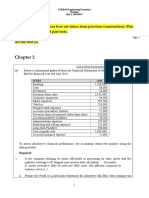

Problem 1 : API Capital Investment Valuation

API Capital Sdn Bhd is evaluating three mutually exclusive business projects in which it intends

to invest in Cambodia. The initial investment capital and after-tax cash flows associated with

these projects are shown in the following table.

Cash Flow

Year 0 (Initial investment)

Year 1

Year 2

Year 3

Year 4

Year 5

Project 1 :

Cocoa Plantation

(RM60,000)

20,000

20,000

20,000

20,000

20,000

Project 2 :

Bird Nest

(RM100,000)

31,500

31,500

31,500

31,500

31,500

(i) Determine the payback period for each project.

(ii)

Project 3 :

Aquaculture

(RM110,000)

32,500

32,500

32,500

32,500

32,500

(3 marks)

Determine the net present value (NPV) for the three projects. Assuming that APIs cost of

capital equal to 13%.

(6 marks)

(iii) Determine the internal rate of return (IRR) for each project.

(6 marks)

(iv) Which project should be adopted?

(2 marks)

(v)

Critically evaluate the IRR and NPV approaches in investment/project valuation and

explain the reasons why NPV generally outperformed the IRR approach.

(8 marks)

1

UBEQ 1013/ UKEQ 1013 QUANTITATIVE TECHNIQUES I ASSIGNMENT

[Total 25 Marks]

Problem 2 : ART Furniture Production Mix

ART Furniture Sdn Bhd produces six products from six inputs. Each product requires different

combinations and amounts of inputs. The following table shows the profit and raw materials

requirements for each product. The last column shows the total amounts of raw materials

available.

Products

Profits

60

70

48

5

2

48

60

400

2.

5

1.

5

-

1.

5

4

580

890

0.

5

1.

5

0.

5

0.

5

0.

5

0.

5

1

2.5

525

650

1.

5

620

Inputs required:

Aluminum

0.

5

Steel

2

Plastic

Rubber

1.

5

1.

5

0.

5

Glass

Chrome

2

2

1

2

Total

Amounts

of inputs

(a)

Formulate the appropriate linear programming model.

(5 marks)

(b)

Find the companys most profitable production plan using a Linear

Programming, computer programme and determine the profit maximization

value.

(5 marks)

[Total 10 Marks]

UBEQ 1013/ UKEQ 1013 QUANTITATIVE TECHNIQUES I ASSIGNMENT

Problem 3: Project Optimization of SabakPerdanaHousing Development

Sabak Perdana Development Sdn Bhd acquired a piece of 35 acres land in Sabak Bernam in

2015. The company is planning to use the land for new housing development. The initial plan of

the project was proposed by the architect of the company which consists of 3 types of houses,

namely double story terrace houses (24x80), semi-detached houses (40x80) and bungalows

(80x120). The 3 types of houses to be built are based on a demand response survey done by a

market survey consultant engaged by the company.

After setting aside the land requirements for infrastructure and recreation parks, the total buildable

area is reduced to 30 acres only. To construct a terrace house, it is estimated that a total of 30,300

labour hours are required and, similarly, 37,800 and 50,400 labour hours are needed to build one

unit of semi-d and bungalow, respectively. Meanwhile, the building and financing costs for each

unit of terrace house, semi-d and bungalow is estimated at RM170,000, RM215,000 and

RM320,000. In addition, it is estimated that a unit of terrace house, semi-d and bungalow will

utilise 0.05, 0.08 and 0.22 acre of the buildable lands respectively. Besides, the company has

allocated a total of RM100,000,000 working capital for this project and it is estimated the

construction of all houses has to be completed in 15 months, thus, the total labour hours available

is calculated at 15,120,000 hours.

The selling price of one unit of terrace house is set at RM245,000 while semi-d and bungalow is

selling at RM308,000 and RM438,000 each. At these selling prices, Sabak Perdana is projecting

to make a net profit of RM52,000, RM68,000 and RM92,000 for the 3 types of houses.

During the planning stage, the management already received a total of 15 pre-launch bookings of

its bungalow units which some came from the directors and top management of the company.

You are required to set up the linear programming model in line with the profit maximization

objective of Sabak Perdana and solve the following problems.

Note:

X = Link Houses, Y = Semi-D and Z = Bungalow. You will be required to model this problem

approximately using continuous variables and round off the answer to the nearest discrete value

after solution.

UBEQ 1013/ UKEQ 1013 QUANTITATIVE TECHNIQUES I ASSIGNMENT

(i)

Build the Liner Programming model for Sabak Perdana. How many of each house type

should be built in order to achieve a maximum profit for the company?

(8 marks)

(ii)

What is the estimated profit shall Sabak Perdana adopted the optimal solution generated

by the LP Model?

(3 marks)

(iii)

Are there any resources left over when the maximum profit is achieved? If so, list all

resources left over and the quantities of each. What should you proposed for to manage

the left over resources?

(4 marks)

(iv)

Use the sensitivity report to figure out the maximum increase that is allowable of the

profits of terrace houses and Semi-D houses that will not change the optimum solution.

(2 marks)

(v)

If the number of labor hours increased by 60,000, predict the maximum profit by using

shadow variables. (Show how you calculate this answer).

(3marks)

(vi)

What is the shadow price for the bungalows constraint? How do you interpret it?

(2 marks)

(vii)

If the selling price and costs of building bungalows remained the same, determine

whether should Sabak Perdana build more of bungalows for the project? If Sabak

Perdana would to build 16 units of bungalows, what is the implication to the profits of

the company? Explain your answers.

(3 marks)

[Total 25 Marks]

UBEQ 1013/ UKEQ 1013 QUANTITATIVE TECHNIQUES I ASSIGNMENT

Potrebbero piacerti anche

- The Chinese Overseas Students An Overview of The Flows ChangeDocumento26 pagineThe Chinese Overseas Students An Overview of The Flows Changepetrusantonius5707Nessuna valutazione finora

- D 6544 - 00 Rdy1ndqDocumento4 pagineD 6544 - 00 Rdy1ndqJuanNessuna valutazione finora

- Iso 18184 2020 en PDFDocumento11 pagineIso 18184 2020 en PDFRicardo AlvesNessuna valutazione finora

- GMI Practical ReportDocumento45 pagineGMI Practical ReportLukshman Rao Rao86% (7)

- Methodist KL 2013 M3 (Q)Documento3 pagineMethodist KL 2013 M3 (Q)STPMmaths100% (1)

- Math M P3 2013 QuestionDocumento6 pagineMath M P3 2013 QuestionMasnah HussenNessuna valutazione finora

- Exercises On ILP FormulationsDocumento7 pagineExercises On ILP FormulationsSahil MakkarNessuna valutazione finora

- St. Mary Sabah 2013 M3 (Q) PDFDocumento2 pagineSt. Mary Sabah 2013 M3 (Q) PDFSTPMmathsNessuna valutazione finora

- Tutorial 3Documento3 pagineTutorial 3veen jhana sekaranNessuna valutazione finora

- Tutorial 10Documento4 pagineTutorial 10Robert OoNessuna valutazione finora

- Engineering Economics RevisionDocumento43 pagineEngineering Economics RevisionDanial IzzatNessuna valutazione finora

- Horley Methodist 2013 M3 (Q)Documento2 pagineHorley Methodist 2013 M3 (Q)STPMmathsNessuna valutazione finora

- COEB442 - Sem - 2 - 2015-2016 RevisionDocumento37 pagineCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraNessuna valutazione finora

- This Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARADocumento7 pagineThis Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARAFaiz Mohamad0% (1)

- Q and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Documento95 pagineQ and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Samuel Dwumfour100% (1)

- Management PricipalDocumento7 pagineManagement PricipalmdivyalakshmiNessuna valutazione finora

- Final Exam April 2011Documento5 pagineFinal Exam April 2011dluvjkpopNessuna valutazione finora

- Performance Management: Friday 6 June 2003Documento8 paginePerformance Management: Friday 6 June 2003chimbanguraNessuna valutazione finora

- KNS4343 Final Take Home ExamDocumento6 pagineKNS4343 Final Take Home ExamAyish CehcterNessuna valutazione finora

- DIT 0205 Elementary Mathematics and Decision Making - PrintreaDocumento3 pagineDIT 0205 Elementary Mathematics and Decision Making - Printreakipkoecharonz korirNessuna valutazione finora

- POM Model Question PaperDocumento3 paginePOM Model Question PaperKailas Sree ChandranNessuna valutazione finora

- 16 Af 601 Sma - 3Documento4 pagine16 Af 601 Sma - 3umargee123Nessuna valutazione finora

- Tutorial 4Documento6 pagineTutorial 4FEI FEINessuna valutazione finora

- A) Manual Solution (Handwritten)Documento2 pagineA) Manual Solution (Handwritten)Mon LuffyNessuna valutazione finora

- A) Manual Solution (Handwritten)Documento2 pagineA) Manual Solution (Handwritten)Mon LuffyNessuna valutazione finora

- Matrices and Determinants - QB 2 (2023-2024)Documento4 pagineMatrices and Determinants - QB 2 (2023-2024)muskanthavnani7Nessuna valutazione finora

- mkt243 2011 S1Documento6 paginemkt243 2011 S1rxzlajuNessuna valutazione finora

- Production Operations Management ExamDocumento17 pagineProduction Operations Management ExamBi11y 1eeNessuna valutazione finora

- Past YearDocumento28 paginePast YearFirdaus LasnangNessuna valutazione finora

- Bukit Mertajam 2013 M3 (Q&a)Documento5 pagineBukit Mertajam 2013 M3 (Q&a)STPMmathsNessuna valutazione finora

- Test+Full+O R +++ABC+++Service+SectorDocumento4 pagineTest+Full+O R +++ABC+++Service+SectorSameer AhmedNessuna valutazione finora

- Assignment or BCADocumento5 pagineAssignment or BCAkuku288Nessuna valutazione finora

- Chapter 4 (Linear Programming: Formulation and Applications)Documento30 pagineChapter 4 (Linear Programming: Formulation and Applications)ripeNessuna valutazione finora

- BTHM Tourism & Hospitality ExamsDocumento6 pagineBTHM Tourism & Hospitality ExamsSanjay VaryaniNessuna valutazione finora

- B.E. Production Engineering V Semester PR 331 - Quantitative Techniques in Management exam paperDocumento3 pagineB.E. Production Engineering V Semester PR 331 - Quantitative Techniques in Management exam paperShathish GunasekaranNessuna valutazione finora

- Invest Choice, Profit Function, Linear Programming, Network Diagram, Inventory CostDocumento4 pagineInvest Choice, Profit Function, Linear Programming, Network Diagram, Inventory CostZAii ARiessNessuna valutazione finora

- Sacred Heart Sibu 2013 M3 (Q)Documento2 pagineSacred Heart Sibu 2013 M3 (Q)STPMmaths0% (1)

- Organizational ResearchDocumento31 pagineOrganizational ResearchsiddharthsharmazNessuna valutazione finora

- Sample Final Exam Accounting (Aug 2012 ISB 2.1 and 2.2)Documento5 pagineSample Final Exam Accounting (Aug 2012 ISB 2.1 and 2.2)Michael DavisNessuna valutazione finora

- (2015 Onwards) : M.Sc. Software Systems Degree Examin Tions, April 2018Documento6 pagine(2015 Onwards) : M.Sc. Software Systems Degree Examin Tions, April 2018Aravind KumarNessuna valutazione finora

- Management Science FinalDocumento8 pagineManagement Science FinalAAUMCLNessuna valutazione finora

- Optimal Cereal Production Using Linear ProgrammingDocumento5 pagineOptimal Cereal Production Using Linear ProgrammingTan KhuaiNessuna valutazione finora

- ECON1202 2004 S2 PaperDocumento8 pagineECON1202 2004 S2 Paper1234x3Nessuna valutazione finora

- Universiti Teknologi Mara Final Examination: Confidential EM/APR 2010/MEM575/KJP585/450Documento8 pagineUniversiti Teknologi Mara Final Examination: Confidential EM/APR 2010/MEM575/KJP585/450Pierce EpoiNessuna valutazione finora

- Acc3204 - Jan2018Documento5 pagineAcc3204 - Jan2018natlyhNessuna valutazione finora

- 32OR Set2Documento4 pagine32OR Set2Niraj BhansaliNessuna valutazione finora

- Management Science and Infrotmation Management - Homework 2Documento3 pagineManagement Science and Infrotmation Management - Homework 2Nitzan SchwarzNessuna valutazione finora

- MGMT6019 - Group AssignmentDocumento7 pagineMGMT6019 - Group AssignmentJieHyunNessuna valutazione finora

- Tutorial 1Documento3 pagineTutorial 1RusNessuna valutazione finora

- KABARAK UNIVERSITY ACCT 520 EXAMDocumento5 pagineKABARAK UNIVERSITY ACCT 520 EXAMMutai JoseahNessuna valutazione finora

- Comprehensive Assignment FourDocumento9 pagineComprehensive Assignment FourJasiz Philipe Ombugu100% (1)

- Wef2012 Pilot MAFDocumento9 pagineWef2012 Pilot MAFdileepank14Nessuna valutazione finora

- Universiti Teknologi Mara Final Examination: FacultyDocumento8 pagineUniversiti Teknologi Mara Final Examination: Facultymunirahzainal100% (1)

- Maximizing Profits and Coverage with Integer Programming FormulationsDocumento7 pagineMaximizing Profits and Coverage with Integer Programming Formulationssaheb167Nessuna valutazione finora

- OM1-Mid-Term Exam-2011-12 PDFDocumento4 pagineOM1-Mid-Term Exam-2011-12 PDFSri RamNessuna valutazione finora

- Instructions: Question Number Q1 Q2 Q3 Q4 Q5 Total 75Documento15 pagineInstructions: Question Number Q1 Q2 Q3 Q4 Q5 Total 75Chinmay Gokhale100% (1)

- Mathematics Worksheet for Management DecisionsDocumento3 pagineMathematics Worksheet for Management Decisionsabel shimeles100% (1)

- Mba026 Corporate Finance - 895727188Documento2 pagineMba026 Corporate Finance - 895727188Bhupendra SoniNessuna valutazione finora

- August 2022 R: Page 1 of 7Documento6 pagineAugust 2022 R: Page 1 of 7Salai SivagnanamNessuna valutazione finora

- Advanced Management Accounting For CA Final-Parag GuptaDocumento236 pagineAdvanced Management Accounting For CA Final-Parag GuptaPrasenjit Dey100% (1)

- Chia Ruo Qian Matthew Josephine Chiong Wei Leong Fong Siong Long Debra Huang Ing Ling Kok Cheng Hoo Din FoongDocumento1 paginaChia Ruo Qian Matthew Josephine Chiong Wei Leong Fong Siong Long Debra Huang Ing Ling Kok Cheng Hoo Din FoongJoanne WongNessuna valutazione finora

- 97em MasterDocumento15 pagine97em MasterJoey MclaughlinNessuna valutazione finora

- Essential Science Concepts ExplainedDocumento11 pagineEssential Science Concepts ExplainedJoanne Wong0% (1)

- Essay pt3Documento1 paginaEssay pt3Joanne WongNessuna valutazione finora

- Template MerahDocumento92 pagineTemplate MerahJoanne WongNessuna valutazione finora

- English Year 2 Final ExamDocumento5 pagineEnglish Year 2 Final ExamJoanne WongNessuna valutazione finora

- Notes Chapter 5Documento10 pagineNotes Chapter 5Princess AarthiNessuna valutazione finora

- Brosur Staclim Extended 2016Documento2 pagineBrosur Staclim Extended 2016Joanne WongNessuna valutazione finora

- UPM Guideline To Thesis PreparationDocumento74 pagineUPM Guideline To Thesis Preparationarahman1986Nessuna valutazione finora

- Navishasre (2) Chater 2 ScienceDocumento13 pagineNavishasre (2) Chater 2 SciencenavishasreNessuna valutazione finora

- English L1Documento5 pagineEnglish L1Joanne WongNessuna valutazione finora

- Vocabulary and grammar practiceDocumento4 pagineVocabulary and grammar practiceJoanne WongNessuna valutazione finora

- Soalan Peperiksaan Matematik Tingkatan 1 Kertas 2 - (SKEMA JAWAPAN)Documento8 pagineSoalan Peperiksaan Matematik Tingkatan 1 Kertas 2 - (SKEMA JAWAPAN)syukrie353% (15)

- 2000 Rep (Single Outlier) N 30Documento1.396 pagine2000 Rep (Single Outlier) N 30Joanne WongNessuna valutazione finora

- English Remove Class Final Year Exam QuestionDocumento7 pagineEnglish Remove Class Final Year Exam QuestionJoanne WongNessuna valutazione finora

- 1Documento5 pagine1Joanne WongNessuna valutazione finora

- Sss 3Documento21 pagineSss 3Joanne WongNessuna valutazione finora

- Witnessed Snatch TheftDocumento9 pagineWitnessed Snatch TheftJoanne Wong100% (1)

- Skewness GOFDocumento14 pagineSkewness GOFJoanne WongNessuna valutazione finora

- Sss 1Documento3 pagineSss 1Joanne WongNessuna valutazione finora

- Sss 1Documento3 pagineSss 1Joanne WongNessuna valutazione finora

- Hat Is An Outlier Istory of Utliers Mportance of Etecting Utliers Auses of UtliersDocumento3 pagineHat Is An Outlier Istory of Utliers Mportance of Etecting Utliers Auses of UtliersJoanne WongNessuna valutazione finora

- Gini Mean DifferenceDocumento32 pagineGini Mean DifferenceJoanne WongNessuna valutazione finora

- Skew NessDocumento8 pagineSkew NessJoanne WongNessuna valutazione finora

- Outlier and EstimationDocumento11 pagineOutlier and EstimationJoanne WongNessuna valutazione finora

- Robust Estimation Methods and Outlier Detection in Mediation ModelDocumento25 pagineRobust Estimation Methods and Outlier Detection in Mediation ModelJoanne WongNessuna valutazione finora

- TestingDocumento7 pagineTestingJoanne WongNessuna valutazione finora

- Peralihan Pintar - Paper 2 - FinalDocumento7 paginePeralihan Pintar - Paper 2 - Finalcitiecutie100% (1)

- Sample DataDocumento1 paginaSample DataJoanne WongNessuna valutazione finora

- Advertisement in RecessionDocumento5 pagineAdvertisement in RecessionqamarulislamNessuna valutazione finora

- Intellectual Property Rights and Hostile TakeoverDocumento8 pagineIntellectual Property Rights and Hostile TakeoverDanNessuna valutazione finora

- Role of UTI in mobilizing savings and assisting corporate sectorDocumento2 pagineRole of UTI in mobilizing savings and assisting corporate sectorsnehachandan9167% (3)

- Treasury and Risk Management: IntroductionDocumento7 pagineTreasury and Risk Management: Introductionmaster of finance and controlNessuna valutazione finora

- Infosys Vs Wipro AnalysesDocumento66 pagineInfosys Vs Wipro AnalysesNITESH100% (1)

- Currency Future & Option For StudentsDocumento8 pagineCurrency Future & Option For StudentsAmit SinhaNessuna valutazione finora

- Introduction To Finance: Stock ValuationDocumento20 pagineIntroduction To Finance: Stock ValuationZenedel De JesusNessuna valutazione finora

- 9708 Economics: MARK SCHEME For The October/November 2013 SeriesDocumento6 pagine9708 Economics: MARK SCHEME For The October/November 2013 SeriesRavi ChaudharyNessuna valutazione finora

- Risk & InsuranceDocumento8 pagineRisk & InsuranceAlan100% (2)

- LPMDocumento15 pagineLPMsteve hillNessuna valutazione finora

- The Multiplier Model ExplainedDocumento35 pagineThe Multiplier Model ExplainedannsaralondeNessuna valutazione finora

- PROJECT REPORT On "Listing of Securities"Documento63 paginePROJECT REPORT On "Listing of Securities"murlidharne88% (8)

- BBCS101D-Airport Customer Service PDFDocumento262 pagineBBCS101D-Airport Customer Service PDFrajmercuryNessuna valutazione finora

- Housing & Community PlanningDocumento29 pagineHousing & Community PlanningRaj SekharNessuna valutazione finora

- SweStep GFF FundingDocumento4 pagineSweStep GFF FundingkasperNessuna valutazione finora

- 426 Chap Suggested AnswersDocumento16 pagine426 Chap Suggested AnswersMohommed AyazNessuna valutazione finora

- Literature Review OriginalDocumento7 pagineLiterature Review OriginalJagjeet Singh82% (11)

- Final ReportDocumento43 pagineFinal ReportBhargavNessuna valutazione finora

- Z Gadhiya ResumeDocumento4 pagineZ Gadhiya ResumeRidhima VashisthNessuna valutazione finora

- Financial Performance of Indian Pharmaceutical Industry - A Case StudyDocumento25 pagineFinancial Performance of Indian Pharmaceutical Industry - A Case Studyanon_544393415Nessuna valutazione finora

- Barco Case AnalysisDocumento2 pagineBarco Case Analysiscoolavi0127100% (1)

- Rich Dad, Poor DadDocumento14 pagineRich Dad, Poor DadKeah Q. LacuestaNessuna valutazione finora

- A Business Model For Insurance in IndiaDocumento6 pagineA Business Model For Insurance in IndiaIRJAESNessuna valutazione finora

- Overview of IFSDocumento21 pagineOverview of IFSMaiyakabetaNessuna valutazione finora

- Mozal Finance EXCEL Group 15dec2013Documento15 pagineMozal Finance EXCEL Group 15dec2013Abhijit TailangNessuna valutazione finora

- Final Project Report - Gourav SharmaDocumento77 pagineFinal Project Report - Gourav SharmaGourav Sharma100% (1)

- Market TablesDocumento18 pagineMarket TablesallegreNessuna valutazione finora

- Historical Background of World BankDocumento19 pagineHistorical Background of World Bankasifshah4557022Nessuna valutazione finora

- Chap 11Documento45 pagineChap 11SEATQMNessuna valutazione finora

- Final Exam Review Principles of MacroeconomicsDocumento3 pagineFinal Exam Review Principles of MacroeconomicsKazım100% (1)