Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PAS38 Theories

Caricato da

AngelicaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PAS38 Theories

Caricato da

AngelicaCopyright:

Formati disponibili

1.

An intangible asset is regarded as having an indefinite useful life when

a. There is a foreseeable limit to the period over which the asset is expected

to generate net cash inflows to the entity.

b. There is no foreseeable limit to the period over which the asset is

expected to generate net cash inflows to the entity.

c. The useful life of the intangible asset arises from legal right.

d. The useful life of the intangible asset arises from contractual right.

2. Which of the following statements is incorrect in relation to trademark?

a. A trademark is an identifiable intangible asset.

b. A trademark can be regarded as an intangible asset with an indefinite

useful life considering the almost automatic renewal of the legal life.

c. A trademark with indefinite life is not amortized but tested for impairment

at least annually and whenever there is an indication of impairment.

d. A trademark with indefinite useful life is amortized and tested for

impairment whenever there is an indication of impairment at the end of the

reporting period.

3. Which of the following statements is true in relation to internally generated

intangible asset?

a. Internally generated goodwill shall not be recognized as an intangible

asset.

b. Internally generated brand, masthead, publishing title, and customer list

shall not be recognized as an intangible asset.

c. The cost of internally generated intangible asset comprises all directly

attributable costs necessary to create, produce and prepare the asset for

the intended use.

d. All of these statements are true.

4. Which of the following statements is true in relation to acquisition of an

intangible asset as part of a business combination?

I. Intangible assets acquired in a business combination shall only be recognized

if the assets have already been recognized by the acquiree.

II. Intangible assets acquired in a business combination shall be recognized

separately from goodwill.

a. I only

b. II only

c. Both I and II

d. Neither I nor II

5. Which intangible asset should be reported as a separate line item in the

statement of financial position?

a.

b.

c.

d.

Franchise

Trademark

Patent

Goodwill

6. The residual value of an intangible asset with a finite useful life shall be

assumed zero, except

a. When there is a commitment by a third party to purchase the asset at the

end of its useful life.

b. When there is an active market for the asset and it is probable that such

market will exist at the end of useful life.

c. When there is a commitment by a third party to purchase the asset at the

end of its useful life or there is an active market for the asset and it is

probable that such market will exist at the end of useful life.

d. There are no exceptions.

7. An entity that acquires an intangible asset may use the revaluation model for

subsequent measurement only when

a.

b.

c.

d.

The cost of the intangible asset can be measure reliably.

An active market exists for the intangible asset.

The intangible asset is a monetary asset.

The useful life of the intangible asset can be reliably determined.

8. Which of the following is true in relation to control by the entity of the

intangible asset?

a. The skill of employees arising out of the benefits of training costs cannot

be recognized as intangible asset.

b. Market share and customer loyalty cannot normally be recognized as

intangible asset because an entity cannot control the action of customers.

c. The capacity of the entity to control the economic benefits from an

intangible asset would normally stem from legal rights that are enforceable

in a court of law.

d. All of these statements are true.

9. Which of the following is a criterion that must be met in order for an intangible

asset to be recognized other than goodwill?

a. The asset is identifiable and lacks physical substance.

b. The asset is expected to be used in the production or supply of goods or

services.

c. The asset is part of the activities aimed at gaining new scientific or

technical knowledge.

d. The fair value can be measure reliably.

10. Which of the following represents the maximum amortization period

mandated for intangible assets with finite useful life?

a.

b.

c.

d.

10 years

20 years

40 years

No arbitrary cap on the useful life has been established.

ANSWER

1. b

2. d

3. d

4. b

5. d

6. c.

7. b

8. d

9. d

10. d

Potrebbero piacerti anche

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Documento7 pagineRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNessuna valutazione finora

- K12 Philippines Whereabouts PDFDocumento37 pagineK12 Philippines Whereabouts PDFsichhahaNessuna valutazione finora

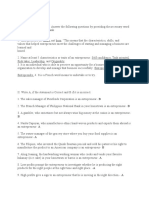

- ACCOUNTING 3A HomeworkDocumento12 pagineACCOUNTING 3A HomeworkDarynn Linggon0% (1)

- Jose A. Espiritu For Appellant. Cohn, Fisher and Dewitt For AppelleeDocumento16 pagineJose A. Espiritu For Appellant. Cohn, Fisher and Dewitt For AppelleeFebbie MarianoNessuna valutazione finora

- Skill BuildingDocumento2 pagineSkill BuildingMay Flor Abrasado100% (1)

- Noncurrent LiabsDocumento4 pagineNoncurrent Liabsrara elizalde100% (1)

- Exploration For and Evaluation of Mineral Resources: Ifrs 6Documento26 pagineExploration For and Evaluation of Mineral Resources: Ifrs 6Danna Claire100% (1)

- Switches Can Be Purchased For $8 Per Switch ($200,000) : Baron Co. Incurs The Following Costs To Make 25,000 SwitchesDocumento16 pagineSwitches Can Be Purchased For $8 Per Switch ($200,000) : Baron Co. Incurs The Following Costs To Make 25,000 SwitchesALI HAMEEDNessuna valutazione finora

- To What Extent Has The Pursuit of Wealth Become The Modern GoalDocumento1 paginaTo What Extent Has The Pursuit of Wealth Become The Modern GoalAshwin Joseph100% (1)

- Local Media271226407970108268Documento17 pagineLocal Media271226407970108268Jana Rose PaladaNessuna valutazione finora

- Finman FinalsDocumento38 pagineFinman Finalsem fabiNessuna valutazione finora

- Standard Costs and Variance Analysis ERDocumento19 pagineStandard Costs and Variance Analysis ERElyana SulayNessuna valutazione finora

- Module 1 - Problems and Exercises 1Documento11 pagineModule 1 - Problems and Exercises 1christine peredoNessuna valutazione finora

- Cup 3 Questions Answer KeyDocumento34 pagineCup 3 Questions Answer KeyDenmarc John AragosNessuna valutazione finora

- Cost Accounting 1-9 FinalDocumento14 pagineCost Accounting 1-9 FinalKristienalyn De AsisNessuna valutazione finora

- ReporttDocumento7 pagineReporttaryan nicoleNessuna valutazione finora

- MGMT 134 CA KeyDocumento4 pagineMGMT 134 CA KeyAnand KL100% (1)

- Garfield Cost Accounting Chapter 2Documento18 pagineGarfield Cost Accounting Chapter 2ViancaPearlAmores100% (1)

- Multiple ChoiceDocumento4 pagineMultiple ChoiceCarlo ParasNessuna valutazione finora

- Ppe Bio AssetDocumento2 paginePpe Bio AssetEvita Faith LeongNessuna valutazione finora

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocumento10 pagineMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad Estoque0% (1)

- Framework of AccountingDocumento11 pagineFramework of AccountingAngelica ManaoisNessuna valutazione finora

- AC78.6.2 Final Examinations Questions and Answers 1Documento15 pagineAC78.6.2 Final Examinations Questions and Answers 1rheaNessuna valutazione finora

- Iac 11 Current Liabilities PDFDocumento9 pagineIac 11 Current Liabilities PDFClarisse Pelayo0% (1)

- Premiums and WarrantyDocumento2 paginePremiums and WarrantyAJ Gaspar100% (1)

- Ch18 Raiborn SMDocumento23 pagineCh18 Raiborn SMMendelle Murry100% (1)

- Just-in-Time and Backflushing 1Documento6 pagineJust-in-Time and Backflushing 1Claudette ClementeNessuna valutazione finora

- Acctg201 PCLossesLectureNotesDocumento17 pagineAcctg201 PCLossesLectureNotesSophia Marie Eredia FerolinoNessuna valutazione finora

- Pre-Test 5Documento3 paginePre-Test 5BLACKPINKLisaRoseJisooJennieNessuna valutazione finora

- Problem 3 LessorDocumento7 pagineProblem 3 LessorGelo Owss33% (9)

- 09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingDocumento8 pagine09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingAnnaNessuna valutazione finora

- The Modified Distribution (MODI) : Example 1Documento15 pagineThe Modified Distribution (MODI) : Example 1Ramainne RonquilloNessuna valutazione finora

- Exercise - Part 2Documento5 pagineExercise - Part 2lois martinNessuna valutazione finora

- Absorption and AbcDocumento36 pagineAbsorption and AbcTricia Mae FernandezNessuna valutazione finora

- QUIZ REVIEW Homework Tutorial Chapter 5Documento5 pagineQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoNessuna valutazione finora

- Chapter 03Documento30 pagineChapter 03ajbalcitaNessuna valutazione finora

- Equity YyyDocumento33 pagineEquity YyyJude SantosNessuna valutazione finora

- Zakaria Ch4Documento15 pagineZakaria Ch4Zakaria Hasaneen0% (2)

- Ae16 Interm AccDocumento15 pagineAe16 Interm Accana rosemarie enaoNessuna valutazione finora

- FAR - RQ - Investment in AssociatesDocumento2 pagineFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Chapter 5-Accounting For Manufacturing OverheadDocumento31 pagineChapter 5-Accounting For Manufacturing OverheadDecery BardenasNessuna valutazione finora

- Practice 2 SolDocumento9 paginePractice 2 SolAhmer ChaudhryNessuna valutazione finora

- La Consolacion College - Manila Auditing Problem Final Quiz # 1Documento6 pagineLa Consolacion College - Manila Auditing Problem Final Quiz # 1NJ SyNessuna valutazione finora

- Quiz - M1 M2Documento12 pagineQuiz - M1 M2Jenz Crisha PazNessuna valutazione finora

- Accounting For Joint Products/By-Products: Multiple ChoiceDocumento10 pagineAccounting For Joint Products/By-Products: Multiple ChoiceAldrin CabangbangNessuna valutazione finora

- SCM Finals - Extra CreditDocumento16 pagineSCM Finals - Extra CreditEnola HolmesNessuna valutazione finora

- P 1Documento3 pagineP 1Thea Kimberly Oamil0% (1)

- Janet Wooster Owns A Retail Store That Sells New andDocumento2 pagineJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNessuna valutazione finora

- Joint Product & By-Product ExamplesDocumento15 pagineJoint Product & By-Product ExamplesMuhammad azeemNessuna valutazione finora

- Slack - Be Less Busy: 1. Do You Consider Slack A Form of Disruptive or Sustaining Technology? Why or Why Not?Documento1 paginaSlack - Be Less Busy: 1. Do You Consider Slack A Form of Disruptive or Sustaining Technology? Why or Why Not?Ryll BedasNessuna valutazione finora

- Audit of Shareholders' Equity Practice Problems IDocumento5 pagineAudit of Shareholders' Equity Practice Problems IAngel VenableNessuna valutazione finora

- ACCRETION and EVAPORATION LOSSDocumento17 pagineACCRETION and EVAPORATION LOSSVon Andrei MedinaNessuna valutazione finora

- C3 - Warranty LiabilityDocumento12 pagineC3 - Warranty LiabilityRiza Kristine DaytoNessuna valutazione finora

- Activity Based Costing ReviewerDocumento1 paginaActivity Based Costing ReviewerJonna LynneNessuna valutazione finora

- Chapter 4 Investments in Debt Securities and Other Long-Term InvestmentDocumento11 pagineChapter 4 Investments in Debt Securities and Other Long-Term Investmentpapajesus papaNessuna valutazione finora

- Contemporary WorldDocumento39 pagineContemporary WorldMARIA33% (3)

- Intangible AssetDocumento21 pagineIntangible AssetKenn Adam Johan Gajudo100% (4)

- CFASDocumento15 pagineCFASMary Rose NonesNessuna valutazione finora

- PRACTICE EXERCISES INTANGIBLES Students 2021Documento3 paginePRACTICE EXERCISES INTANGIBLES Students 2021Nicole Anne Santiago SibuloNessuna valutazione finora

- Chapter 31 - Multiple ChoiceDocumento4 pagineChapter 31 - Multiple ChoiceLorraineMartin100% (2)

- Final Paper 8Documento64 pagineFinal Paper 8AngelicaNessuna valutazione finora

- GSIS Case StudyDocumento10 pagineGSIS Case StudyAngelica0% (1)

- Finmanacase 4Documento5 pagineFinmanacase 4AngelicaNessuna valutazione finora

- Secretary's ReportDocumento2 pagineSecretary's ReportAngelicaNessuna valutazione finora

- Table of Contnts - SSHDocumento4 pagineTable of Contnts - SSHAngelicaNessuna valutazione finora

- Risk ReturnDocumento1 paginaRisk ReturnAngelicaNessuna valutazione finora

- PAS38 ProbsDocumento3 paginePAS38 ProbsAngelicaNessuna valutazione finora

- Pas 11Documento2 paginePas 11AngelicaNessuna valutazione finora

- IAS SourcesDocumento1 paginaIAS SourcesAngelicaNessuna valutazione finora

- PAS37 ProbsDocumento4 paginePAS37 ProbsAngelicaNessuna valutazione finora

- Final CompileDocumento37 pagineFinal CompileAngelicaNessuna valutazione finora

- PAS37 TheoriesDocumento7 paginePAS37 TheoriesAngelicaNessuna valutazione finora

- Pas 17Documento6 paginePas 17AngelicaNessuna valutazione finora

- Research Paper TemplateDocumento2 pagineResearch Paper TemplateAngelicaNessuna valutazione finora

- Papalvisit Reflecti0nDocumento1 paginaPapalvisit Reflecti0nAngelicaNessuna valutazione finora

- Pas 38Documento8 paginePas 38AngelicaNessuna valutazione finora

- Pas 37Documento5 paginePas 37Angelica100% (2)

- Competitor's ProfileDocumento3 pagineCompetitor's ProfileAngelica50% (2)

- Financial Budget 2. Marketing Strategies (Logo, Tagline, Layout)Documento1 paginaFinancial Budget 2. Marketing Strategies (Logo, Tagline, Layout)AngelicaNessuna valutazione finora

- IS ExpDocumento1 paginaIS ExpAngelicaNessuna valutazione finora

- Sweets Singer Haus: Meeting Agenda Objectives: General: SpecificDocumento1 paginaSweets Singer Haus: Meeting Agenda Objectives: General: SpecificAngelicaNessuna valutazione finora

- Measuring and Recording Manufacturing Overhead CostDocumento2 pagineMeasuring and Recording Manufacturing Overhead CostAngelicaNessuna valutazione finora

- LECTURE - 4 CHAPTER 4 Managing in A Global EnvironmentDocumento33 pagineLECTURE - 4 CHAPTER 4 Managing in A Global EnvironmentAngelica100% (1)

- FinalDocumento28 pagineFinalAngelicaNessuna valutazione finora

- Singing Sweets Haus Business PlanDocumento66 pagineSinging Sweets Haus Business PlanAngelica100% (1)

- Types of Information SystemsDocumento1 paginaTypes of Information SystemsAngelicaNessuna valutazione finora

- A Project Proposal: Manila Doctors Hospital Leave Management SystemDocumento13 pagineA Project Proposal: Manila Doctors Hospital Leave Management SystemAngelicaNessuna valutazione finora

- Final 2Documento36 pagineFinal 2AngelicaNessuna valutazione finora

- Executive SummaryDocumento3 pagineExecutive SummaryAngelicaNessuna valutazione finora

- RMC No 46-2014 Financial LeaseDocumento3 pagineRMC No 46-2014 Financial LeaseArnold ApduaNessuna valutazione finora

- Problems - Partnership LiquidationDocumento8 pagineProblems - Partnership LiquidationBrunxAlabastro56% (9)

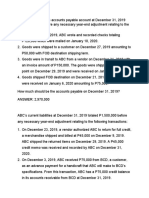

- CH 3 Answers Vol 1 - ReceivablesDocumento15 pagineCH 3 Answers Vol 1 - Receivablesadorableperez50% (2)

- Module 3 Copy of MBA 620 Company B FinancialsDocumento9 pagineModule 3 Copy of MBA 620 Company B FinancialsBenedict OnyangoNessuna valutazione finora

- Handout AP 2301Documento13 pagineHandout AP 2301Dyosa MeNessuna valutazione finora

- Assignment 6Documento2 pagineAssignment 6KarecelVillaseBetenioNessuna valutazione finora

- MFRS 116 PPE - Part 2 NotesDocumento39 pagineMFRS 116 PPE - Part 2 NotesWAN AMIRUL MUHAIMIN WAN ZUKAMALNessuna valutazione finora

- Asian Paints ProjectDocumento3 pagineAsian Paints ProjectRahul SinghNessuna valutazione finora

- Chapter 6 - Far - Adjusting EntriesDocumento14 pagineChapter 6 - Far - Adjusting EntriesDianna Lynn MolinaNessuna valutazione finora

- Study Material Accountancy 2023-24 - 2Documento129 pagineStudy Material Accountancy 2023-24 - 2amrita100% (1)

- Chapter 15Documento12 pagineChapter 15Nikki GarciaNessuna valutazione finora

- Lecture 8Documento48 pagineLecture 8Zixin GuNessuna valutazione finora

- Class Exercise Session 5 and 6Documento8 pagineClass Exercise Session 5 and 6Sumeet KumarNessuna valutazione finora

- Istrate - Luminita GabrielaDocumento5 pagineIstrate - Luminita GabrielaGabriela Luminita IstrateNessuna valutazione finora

- BusCom Prob 6 8 1Documento6 pagineBusCom Prob 6 8 1Jrllsy100% (1)

- Similarity and Difference Between Accounting Concept and ConventionDocumento23 pagineSimilarity and Difference Between Accounting Concept and ConventionravisankarNessuna valutazione finora

- Abdul Wasay Roll No 53. Sec ADocumento51 pagineAbdul Wasay Roll No 53. Sec AMuhammad Hammad RajputNessuna valutazione finora

- Plant AssetsDocumento17 paginePlant AssetsGizaw Belay100% (1)

- Making Investment Decisions With The Net Present Value RuleDocumento60 pagineMaking Investment Decisions With The Net Present Value Rulecynthiaaa sNessuna valutazione finora

- 2018 Working Capital Management: Test Code: R38 WCAM Q-BankDocumento9 pagine2018 Working Capital Management: Test Code: R38 WCAM Q-BankMarwa Abd-ElmeguidNessuna valutazione finora

- Actg 100Documento4 pagineActg 100Klaverine ClarenceNessuna valutazione finora

- Final Accounts of CompaniesDocumento30 pagineFinal Accounts of CompaniesAkanksha GanveerNessuna valutazione finora

- Verka Milk Plant Mohali: A Financial Analysis: Roope7606@cumail - inDocumento7 pagineVerka Milk Plant Mohali: A Financial Analysis: Roope7606@cumail - insharmaanita7761Nessuna valutazione finora

- Quiz Midterm - Answer KeyDocumento11 pagineQuiz Midterm - Answer KeyGloria BeltranNessuna valutazione finora

- Cap. 4 The Balance SheetDocumento45 pagineCap. 4 The Balance SheetJose Rafael Roman-NievesNessuna valutazione finora

- AFST Practice Set 04 Corporate LiquidationDocumento4 pagineAFST Practice Set 04 Corporate LiquidationAlain CopperNessuna valutazione finora

- 14 - SHE SBP BPSquestDocumento16 pagine14 - SHE SBP BPSquestbrentdumangeng01Nessuna valutazione finora

- CH # 2: Introduction To Financial Statements and Other Financial Reporting TopicsDocumento14 pagineCH # 2: Introduction To Financial Statements and Other Financial Reporting TopicsgazmeerNessuna valutazione finora

- Annual Report Analysis - Oct-14-EDEL PDFDocumento259 pagineAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNessuna valutazione finora

- Mortgage Loan BasicsDocumento11 pagineMortgage Loan BasicsBittu DesignsNessuna valutazione finora