Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hoyle

Caricato da

Jose MataloDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hoyle

Caricato da

Jose MataloCopyright:

Formati disponibili

Source: ADVANCED ACCOUNTING 10th edition (Joe B. Hoyle, Thomas F.

Schaefer,

Timothy S. Doupnik)

(Estimated Time: 30 to 40 Minutes) For the past several years, the Andrews, Caso,

Quinn, and Sheridan

partnership has operated a local department store. Based on the provisions of the

original articles of partnership,

all profits and losses have been allocated on a 4:3:2:1 ratio, respectively. Recently,

both Caso

and Quinn have undergone personal financial problems and, as a result, are now

insolvent. Casos creditors

have filed a $20,000 claim against the partnerships assets, and $22,000 is being

sought to repay

Quinns personal debts. To satisfy these legal obligations, the partnership property

must liquidate. The

partners estimate that they will incur $12,000 in expenses to dispose of all noncash

assets.

At the time that active operations cease and the liquidation begins, the following

partnership balance

sheet is produced. All measurement accounts have been closed out to arrive at the

current capital

balances.

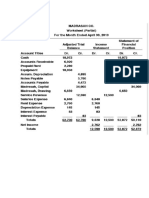

Cash . . . . . . . . . . . . . . . . . . . . $ 20,000 Liabilities . . . . . . . . . . . . . . . . . . . $140,000

Noncash assets . . . . . . . . . . . . 280,000 Caso, loan . . . . . . . . . . . . . . . . . . 10,000

Andrews, capital (40%) . . . . . . . . 76,000

Caso, capital (30%) . . . . . . . . . . . 14,000

Quinn, capital (20%) . . . . . . . . . . 51,000

Sheridan, capital (10%) . . . . . . . . 9,000

Total assets . . . . . . . . . . . . . $300,000 Total liabilities and capital . . . . . $300,000

During the lengthy liquidation process, the following transactions take place:

Sale of noncash assets with a book value of $190,000 for $140,000 cash.

Payment of $14,000 liquidation expenses. No further expenses are expected.

Distribution of safe capital balances to the partners.

Payment of all business liabilities.

Sale of the remaining noncash assets for $10,000.

Determination of deficit capital balances for any insolvent partners as

uncollectible.

Receipt of appropriate cash contributions from any solvent partner who is

reporting a negative capital

balance.

Distribution of final cash.

Required

a. Using the information available prior to the start of the liquidation process,

develop a predistribution

plan for this partnership.

b. Prepare journal entries to record the actual liquidation transactions

Caso, Loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000

Caso, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000

To record offset of loan against capital balance in anticipation

of liquidation.

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140,000

Andrews, Capital (40% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000

Caso, Capital (30% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,000

Quinn, Capital (20% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000

Sheridan, Capital (10% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,000

Noncash Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 190,000

To record sale of noncash assets and allocation of $50,000 loss.

Andrews, Capital (40%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,600

Caso, Capital (30%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,200

Quinn, Capital (20%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,800

Sheridan, Capital (10%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,400

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,000

To record payment of liquidation expenses

Quinn, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,000

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,000

To record distribution of available cash based on safe capital balance.

Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140,000

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140,000

To record extinguishment of all partnership debts.

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000

Andrews, Capital (40% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32,000

Caso, Capital (30% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,000

Quinn, Capital (20% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,000

Sheridan, Capital (10% of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,000

Noncash Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90,000

To record sale of remaining noncash assets and allocation

Andrews, Capital (47 of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,971

Quinn, Capital (27 of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,486

Sheridan, Capital (17 of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,743

Caso, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,200

To record write-off of deficit capital balance of insolvent partner.

Quinn, Capital (27 of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,486

Sheridan, Capital (17 of loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,743

Caso, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,200

To record write-off of deficit capital balance of insolvent partner.

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,143

Sheridan, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,143

To record contribution made to eliminate deficit capital balance.

Andrews, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,429

Quinn, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,714

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,143

To record distribution of remaining cash according to final capital

balances.

Potrebbero piacerti anche

- Assignment AdvDocumento4 pagineAssignment AdvTilahun GirmaNessuna valutazione finora

- Presented Here Is The Total Column of The Governmental FundsDocumento1 paginaPresented Here Is The Total Column of The Governmental Fundstrilocksp SinghNessuna valutazione finora

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandDa EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNessuna valutazione finora

- Solutiondone 2-455Documento1 paginaSolutiondone 2-455trilocksp SinghNessuna valutazione finora

- Reforming Severance Pay: An International PerspectiveDa EverandReforming Severance Pay: An International PerspectiveNessuna valutazione finora

- Solutions To Exercises - Chap 3Documento27 pagineSolutions To Exercises - Chap 3InciaNessuna valutazione finora

- Assignment 1 - SolutionDocumento10 pagineAssignment 1 - SolutionKhem Raj GyawaliNessuna valutazione finora

- Cash FlowsDocumento6 pagineCash FlowsZaheer AhmadNessuna valutazione finora

- Case 2-3: Lone Pine Cafe (A) : Assets Current AssetsDocumento5 pagineCase 2-3: Lone Pine Cafe (A) : Assets Current AssetsyashasviNessuna valutazione finora

- Advance AssigmentDocumento3 pagineAdvance AssigmentAdugna MegenasaNessuna valutazione finora

- AnswersDocumento41 pagineAnswersAnonymous PlR6s9ELcqNessuna valutazione finora

- Mid-Term - Financial Accounting For Managers July 2010...Documento4 pagineMid-Term - Financial Accounting For Managers July 2010...ApoorvNessuna valutazione finora

- Cost of Capital - Berkshire Instruments CaseDocumento3 pagineCost of Capital - Berkshire Instruments CaseAleksandar AndjelkovićNessuna valutazione finora

- CHAPTER 1 - Partnership - Basic Considerations and FormationDocumento11 pagineCHAPTER 1 - Partnership - Basic Considerations and FormationRominna Dela Rueda0% (1)

- Key Chapter 2Documento11 pagineKey Chapter 2JinAe NaNessuna valutazione finora

- Assets Liabilities and Owner's Equity: Stafford Press Condensed Balance Sheet (Revised To Reflect Move)Documento1 paginaAssets Liabilities and Owner's Equity: Stafford Press Condensed Balance Sheet (Revised To Reflect Move)Vivek DasguptaNessuna valutazione finora

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocumento1 paginaThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNessuna valutazione finora

- FIN 220, Ch3, Selected Problems 2Documento3 pagineFIN 220, Ch3, Selected Problems 23ooobd1234Nessuna valutazione finora

- Chapter 18Documento10 pagineChapter 18Ali Abu Al Saud100% (2)

- Buscom - Module 3Documento10 pagineBuscom - Module 3naddieNessuna valutazione finora

- Chapter 1 TutorialDocumento5 pagineChapter 1 TutorialAnisaNessuna valutazione finora

- Balance Sheet and Statement of Cash FlowsDocumento8 pagineBalance Sheet and Statement of Cash FlowsAntonios FahedNessuna valutazione finora

- Cash Flow 1Documento3 pagineCash Flow 1Percy JacksonNessuna valutazione finora

- 1.5.1) Marshaling of Assets Doctrine and Liquidation of A PartnershipDocumento5 pagine1.5.1) Marshaling of Assets Doctrine and Liquidation of A PartnershiptemedebereNessuna valutazione finora

- ACC 642 - CH 01 SolutionsDocumento17 pagineACC 642 - CH 01 SolutionstboneuncwNessuna valutazione finora

- Assignment 3 Lump-Sump LiquidationDocumento1 paginaAssignment 3 Lump-Sump LiquidationchxrlttxNessuna valutazione finora

- Problem 1-1Documento3 pagineProblem 1-1wivadaNessuna valutazione finora

- Case 1and2Documento7 pagineCase 1and2Lema RevillameNessuna valutazione finora

- Accounting For Merchandize OperationDocumento7 pagineAccounting For Merchandize OperationMUHAMMAD ARIF BASHIRNessuna valutazione finora

- BADM 1050 Assignment # 1 - CLDocumento4 pagineBADM 1050 Assignment # 1 - CLemilynelson1429Nessuna valutazione finora

- Annual Report 123121Documento61 pagineAnnual Report 123121nickNessuna valutazione finora

- Buscom 7Documento9 pagineBuscom 7dmangiginNessuna valutazione finora

- Accounting ExerciseDocumento6 pagineAccounting Exercisenourhan hegazyNessuna valutazione finora

- Solve 6Documento2 pagineSolve 6lalalalaNessuna valutazione finora

- Module III. Business Combination - Subsequent To Date of AcquisitionDocumento5 pagineModule III. Business Combination - Subsequent To Date of AcquisitionAldrin Zolina0% (4)

- gr12 Chapter 5 SolutionsDocumento14 paginegr12 Chapter 5 SolutionsMrinmoy SahaNessuna valutazione finora

- Practice Exercise - Pas 7Documento4 paginePractice Exercise - Pas 7Martha Nicole MaristelaNessuna valutazione finora

- 2010 06 24 - 172141 - P3 3aDocumento4 pagine2010 06 24 - 172141 - P3 3aVivian0% (1)

- NKLT - PR1-3B-GR8Documento1 paginaNKLT - PR1-3B-GR8kimphuc3819Nessuna valutazione finora

- Chapter 3 - Adv Acc 1Documento17 pagineChapter 3 - Adv Acc 1Maurice AgbayaniNessuna valutazione finora

- Acct 3101 Chapter 05Documento13 pagineAcct 3101 Chapter 05Arief RachmanNessuna valutazione finora

- Ordinary Level (J03)Documento16 pagineOrdinary Level (J03)MahmozNessuna valutazione finora

- Key Chapter 8Documento6 pagineKey Chapter 8JinAe NaNessuna valutazione finora

- Current Assets: Asofjunei As of June 30Documento3 pagineCurrent Assets: Asofjunei As of June 30Stranger SinhaNessuna valutazione finora

- Maynard A SolutionDocumento3 pagineMaynard A SolutionStranger SinhaNessuna valutazione finora

- Tutorial 8 SolutionsDocumento5 pagineTutorial 8 SolutionsKenNessuna valutazione finora

- Sources of CapitalDocumento17 pagineSources of Capitaliniwan.sa.ere0Nessuna valutazione finora

- App DDocumento15 pagineApp DTino HartonoNessuna valutazione finora

- Advanced Financial AccountingDocumento4 pagineAdvanced Financial AccountingchuaxinniNessuna valutazione finora

- Cebu Cpar Practical Accounting 1 Cash Flow - UmDocumento9 pagineCebu Cpar Practical Accounting 1 Cash Flow - UmJomarNessuna valutazione finora

- HW - 11Documento7 pagineHW - 11aslatorNessuna valutazione finora

- Warren SM ch.09 FinalDocumento46 pagineWarren SM ch.09 FinalLidya Silvia RahmaNessuna valutazione finora

- Ch10 ExercisesDocumento15 pagineCh10 Exercisesjamiahamdard001Nessuna valutazione finora

- CH 1 & 14Documento13 pagineCH 1 & 14Rabie HarounNessuna valutazione finora

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocumento2 pagineFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNessuna valutazione finora

- anthonyIM 01Documento15 pagineanthonyIM 01Julz JuliaNessuna valutazione finora

- AKM 1 Bab 3Documento5 pagineAKM 1 Bab 3alesha nindyaNessuna valutazione finora

- TellshDocumento1 paginaTellshJose MataloNessuna valutazione finora

- AZLyric 1 NDocumento4 pagineAZLyric 1 NJose MataloNessuna valutazione finora

- Az LyricsDocumento4 pagineAz LyricsJose MataloNessuna valutazione finora

- Cash Distribution PlanDocumento2 pagineCash Distribution PlanJose MataloNessuna valutazione finora

- Solution Manual - Partnership & Corporation, 2014-2015 PDFDocumento77 pagineSolution Manual - Partnership & Corporation, 2014-2015 PDFRomerJoieUgmadCultura78% (88)

- Solution Manual - Partnership & Corporation, 2014-2015 PDFDocumento77 pagineSolution Manual - Partnership & Corporation, 2014-2015 PDFRomerJoieUgmadCultura78% (88)

- Par Tern Ship Liquidation CH 16Documento31 paginePar Tern Ship Liquidation CH 16Jasmine Desiree WashingtonNessuna valutazione finora

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocumento19 pagineMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNessuna valutazione finora

- CMD Tips & Tricks: 1. Personalize Your Command Prompt (CMD)Documento7 pagineCMD Tips & Tricks: 1. Personalize Your Command Prompt (CMD)Jose MataloNessuna valutazione finora

- ACC 407 Week 1 Assignment Partnership ProblemsDocumento1 paginaACC 407 Week 1 Assignment Partnership ProblemsJose MataloNessuna valutazione finora

- Chapter 15 Advanced TutorialDocumento32 pagineChapter 15 Advanced TutorialAmandaNessuna valutazione finora

- Partnership LiquidationDocumento32 paginePartnership LiquidationA Muneeb QNessuna valutazione finora

- Chapter 16 Solution ManualDocumento54 pagineChapter 16 Solution ManualJose Matalo67% (3)

- ACC 407 Week 1 Assignment Partnership ProblemsDocumento1 paginaACC 407 Week 1 Assignment Partnership ProblemsJose MataloNessuna valutazione finora

- Partnership Termination and LiquidationDocumento29 paginePartnership Termination and LiquidationTrinidad Cris Gerard67% (3)

- Accounting For Partnerships A. Formation 1. AccountingDocumento23 pagineAccounting For Partnerships A. Formation 1. AccountingJames_Flores_1718Nessuna valutazione finora

- Lupisan BaysaDocumento206 pagineLupisan BaysaJoselle Jan Blanco Claudio77% (52)

- LS220 Assignment 4Documento4 pagineLS220 Assignment 4jamesbondzambia899Nessuna valutazione finora

- Parerga y Paralipómena - Vol. II PDFDocumento690 pagineParerga y Paralipómena - Vol. II PDFmaurisio2100% (3)

- Chapter Three: Dissolution and Winding UpDocumento2 pagineChapter Three: Dissolution and Winding UpJoshua DaarolNessuna valutazione finora

- INS 21 Chapter9-Insurance PoliciesDocumento27 pagineINS 21 Chapter9-Insurance Policiesvenki_hinfotechNessuna valutazione finora

- Indian Partnership Act, 1932Documento13 pagineIndian Partnership Act, 1932Divya GuptaNessuna valutazione finora

- University San Agustin - DoneDocumento2 pagineUniversity San Agustin - DoneMini U. SorianoNessuna valutazione finora

- Organisation Commerce Notes of H.S.C.Documento176 pagineOrganisation Commerce Notes of H.S.C.Rajan Anthony Parayar78% (9)

- Matrix Anesthesia, P.S. From Overlake Hospital Bellevue, WA and EvergreenHealth Kirkland, WA SuedDocumento14 pagineMatrix Anesthesia, P.S. From Overlake Hospital Bellevue, WA and EvergreenHealth Kirkland, WA SuedpamNessuna valutazione finora

- Business Law Assignment 2Documento4 pagineBusiness Law Assignment 2suratwalanishith22Nessuna valutazione finora

- Warranty Certificate: Panel Name: - Sr. No.: - 20in 1out Acjb Panel 2439/001Documento6 pagineWarranty Certificate: Panel Name: - Sr. No.: - 20in 1out Acjb Panel 2439/001imaad quadriNessuna valutazione finora

- Shri Nishant S/o Shri Kamal Roy KhandelwalDocumento3 pagineShri Nishant S/o Shri Kamal Roy KhandelwalDIVYANSHU CHATURVEDINessuna valutazione finora

- Technology Start Ups Jun 15 FinalDocumento86 pagineTechnology Start Ups Jun 15 FinalAlberto LoddoNessuna valutazione finora

- Shakespeare. Life and Work - John Munro Fred - James FurnivallDocumento1 paginaShakespeare. Life and Work - John Munro Fred - James FurnivallAlexandre FunciaNessuna valutazione finora

- IPru Elite Wealth II Leaflet 26 DecDocumento8 pagineIPru Elite Wealth II Leaflet 26 DecTushar DasguptaNessuna valutazione finora

- Immediate Resignation Letter TemplateDocumento1 paginaImmediate Resignation Letter TemplateDeejay FarioNessuna valutazione finora

- Business Law - All SlidesDocumento478 pagineBusiness Law - All Slidesshreyansh120Nessuna valutazione finora

- CASE No. 74 DBP vs. Family Foods Manufacturing Co. Ltd. and Spouses Julianco and Catalina CentenoDocumento2 pagineCASE No. 74 DBP vs. Family Foods Manufacturing Co. Ltd. and Spouses Julianco and Catalina CentenoJonel L. SembranaNessuna valutazione finora

- Chapter - 7 Motor PolicyDocumento65 pagineChapter - 7 Motor PolicyYASHASVI SHARMANessuna valutazione finora

- Pre TestDocumento5 paginePre TestDiana Faye CaduadaNessuna valutazione finora

- Legal Notice 5813803 20003320000064 30012024175840Documento2 pagineLegal Notice 5813803 20003320000064 30012024175840jhaprintingpressdelhiNessuna valutazione finora

- Your Offer Letter,,,,.Documento2 pagineYour Offer Letter,,,,.Süñîl Åñîl PäťïlNessuna valutazione finora

- Distributor Agreement SampleDocumento7 pagineDistributor Agreement SampleZairus Effendi SuhaimiNessuna valutazione finora

- Illegal Contract What Is A Contract?Documento7 pagineIllegal Contract What Is A Contract?Pooja KVNessuna valutazione finora

- BAR QnA BankingDocumento4 pagineBAR QnA BankingCzarina BantayNessuna valutazione finora

- 11 Company InsolvencyDocumento18 pagine11 Company InsolvencyLuckmore Chivandire100% (1)

- Santosh Sharma PPT IBCDocumento15 pagineSantosh Sharma PPT IBCmoney honeyNessuna valutazione finora

- 10 EDUARDO V. LITONJUA, JR. v. ETERNIT CORPORATIONDocumento2 pagine10 EDUARDO V. LITONJUA, JR. v. ETERNIT CORPORATIONTriciaNessuna valutazione finora

- Aftercare Advice Is Important For A Number of Reasons.: GNS&S - Guide To FranchisingDocumento5 pagineAftercare Advice Is Important For A Number of Reasons.: GNS&S - Guide To Franchisingoxens skillsNessuna valutazione finora

- Corporate Business RiskDocumento30 pagineCorporate Business RiskCinthyaNessuna valutazione finora

- Vehicle Lease Agreement TEMPLATEDocumento4 pagineVehicle Lease Agreement TEMPLATENjau JosephNessuna valutazione finora

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetDa EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetValutazione: 5 su 5 stelle5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsDa EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsValutazione: 5 su 5 stelle5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDa EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistValutazione: 4 su 5 stelle4/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)