Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 3: Stock Valuation Methods and Efficient Market Hypothesis

Caricato da

Pablo EkskobaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 3: Stock Valuation Methods and Efficient Market Hypothesis

Caricato da

Pablo EkskobaCopyright:

Formati disponibili

CHAPTER 3: STOCK VALUATION METHODS AND EFFICIENT

MARKET HYPOTHESIS

NEEDS FOR VALUATION OF SHARES

To fix an issue price for an unquoted company to be listed.

Takeover bid and the offer price for the purpose of merger and acquisition activities.

For the purposes of taxation and as collateral for a loan made by a company.

When a group holding company is negotiating the sale of its subsidiary to a management

buyout team or to an external buyer.

When a shareholder wishes to dispose of his holding especially if a large or controlling

interest is being sold..

When a company is being broken up in a liquidation situation or the company needs to

obtain additional finance or refinance current debt.

STOCK VALUATION METHODS

1. The asset-based valuation method

Determines a companys ordinary share value by analyzing the value of the

companys assets.

The difficulty in an asset valuation method is establishing the asset values to use.

Bases of asset-based valuation method:

a) Historic cost basis/book value

Based on figure stated on balance sheet which is on historic costs

b) Replacement basis

Provide a measure of the maximum price that a purchaser should

pay for the company if assets are to be use don an on-going basis

c) Realizable basis/break-up value

In a situation when a company ceases to be a going concern due to

financial difficulties or;

When a company is purchased to be broken up and assets are sold

separately for their realizable value

Normally represents minimum price which should be accepted for

sale of business as a going concern

USEFULNESS

As a measure of the security in the

share value for comparison with other

valuation approaches.

As a measure of comparison in a

scheme of merger asset backing

valuation.

As a floor value for a business that is

up for sale or to set a minimum price

in a takeover bid

WEAKNESSES

Assumes that investors normally buy

a company for its balance sheet

assets.

Ignores non-balance sheet intangible

assets which may include a strong

and experienced management team

and highly skilled workers

2. The income-based valuation method

One of the most common methods for valuing share price.

Apply the price-to-earnings ratio (P/E) which is based on historic ratios and statistics

P/E ratio = Market price per share/Earnings per share.

By selecting a suitable P/E ratio and multiplying this by the EPS, the market price per

share or the the total value of a company can be computed.

The market price per share = EPS x P/E ratio.

3. The cash flow-based valuation method

May include dividend valuation model, dividend growth and discounted cash flow

basis

4. The dividend valuation method

The equilibrium price for any security depends on the future expected stream of

income from the security discounted using an appropriate cost of capital or a

required rate of return.

Williams (1938) stated that the price of a stock should reflect the present value of

the shares future dividends. In equation form, this is the statement of the DVM:

The general model can be formulated if the companys dividends are expected to

follow these basic patterns:

a) Zero growth

Same amount of dividend paid every year

b) Constant growth

Amount of dividend grows at a constant rate every year

c) Differential growth

Amount of dividend grows at a various rate

FACTORS AFFECTING SHARE PRICES

Earnings announcements

Industry performance

Dividend

Stock splits

Share buy-back

Product innovation

Takeover or merger

Major contracts

Insider trading

Analyst upgrade/downgrade

STOCK RISK

Risk can be defined as the uncertainty that actual returns will not match expected returns.

Standard deviation is a statistical measure of the degree to which actual returns are spread

(disperse) around the mean actual return.

A higher standard deviation means higher risk

The diversification of risk variabilities of returns of the individual assets in the portfolio

offset one another and as more securities are added, the risk of the portfolio is reduced.

2

SOURCES OF INVESTMENT RISK

Systematic risk risk attributed to relatively uncontrollable external factors.

1. Exchange rate risk: The risk that an investments value will be impacted by changes

in the foreign currency market.

2. Interest rate risk: The risk attributed to the loss in market value due to an increase in

the general level of interest rates.

3. Market risk: The risk attributed to the loss in market value due to declining

movement of the entire market portfolio.

4. Purchasing power risk: The risk attributed to inflation and how it erodes the real

value of an investment over time.

Unsystematic risk risk attributed to the underlying investment.

1. Business risk: The risk attributed to a companys operations, particularly those

involving sales and income.

2. Financial risk: The risk attributed to a companys financial stability and structure,

namely the companys use of debt to leverage earnings.

3. Industry risk: The risk attributed to a group of companies within a particular

industry. Investments of companies tend to rise and fall based on what their peers in

the industry are doing.

4. Liquidity risk: The risk that an investment cannot be purchased or sold at a price at

or near market prices.

5. Call risk: The risk attributed to an event where an investment may be called prior to

maturity.

6. Regulation risk: The risk that new laws and regulations will negatively impact the

market value of an investment.

Total risk is equal to the sum of systematic and unsystematic risk.

BETA

The risk of a single stock can be defined in terms of the contribution it makes to the risk

(standard deviation) of the market portfolio. This risk measure is called beta.

Beta is the ratio of the standard deviation of the stock to the standard deviation of the

market portfolio, multiplied by the correlation coefficient between the stock and the market

portfolio.

The formula of beta of a stock A can be presented as follows:

Beta (A) = Relative risk of Stock A

= (Total risk of Stock A)/(Total risk of market portfolio)

Reasons in difference beta estimates:

1. Some sources use daily returns while others use monthly returns

2. Different market proxies

3. Some sources adjust the historic beta values for their expectations of future

STOCK PERFORMANCE MEASUREMENTS

1. Treynor Index

This index therefore relates excess return over the risk-free rate to the additional

risk taken.

The focus of risk is on systematic risk instead of total risk.

This performance measure should really only be used by investors who hold

diversified portfolios.

The higher the Treynor Index, the higher the return relative to the risk-free rate, per

unit of risk.

The formula is as follows:

2.

Sharpe Index

The Sharpe ratio is almost similar to the Treynor measure, except that the risk

measure used is the standard deviation of the portfolio instead of considering only

the systematic risk, as represented by beta.

The higher the portfolios mean return relative to the mean risk-free rate and the

lower the standard deviation p, the higher the Sharpe Index will be.

The formula can be expressed as follows:

Sharpe Index

3.

Rp R f

Jensen Index

This measure is also known as alpha.

The Jensen Index measures how much of the portfolio's rate of return is attributable

to the manager's ability to deliver above-average returns, adjusted for market risk.

A portfolio with a consistently positive excess return will have a positive alpha, while

a portfolio with a consistently negative excess return will have a negative alpha.

The higher the ratio, the better are the risk-adjusted returns

The formula is as follows:

All the three measures combine risk and return performance into a single value. This makes it easier

to compare the performance of competing portfolios.

EFFICIENT MARKET HYPOTHESIS (EMH)

A theory that tries to explain the movement of share prices.

It hypothesizes that at any given time, share prices fully reflect all available information and

the stock market reacts immediately to all the information that is available.

FORMS OF FINANCIAL MARKET EFFICIENCY

1. Weak form efficiency

asserts that all past market prices and data are fully reflected in share prices

since new information arrives unexpectedly, changes in share prices should

occur in a random fashion

2. Semi-strong form efficiency

asserts that all publicly available information as well as information about

past price movements are fully reflected in securities prices

if semi-strong form efficiency holds, weak form efficiency holds as well

3. Strong form efficiency

asserts that all information, whether publicly available or private or insider

information, if fully reflected in securities prices

ROLES OF PORTFOLIO MANAGERS

If markets are efficient, the primary role of a portfolio manager consists of analyzing and

investing appropriately based on an investor's tax considerations and risk profile.

Optimal portfolios will vary according to factors such as age, tax bracket, risk aversion and

employment.

The role of the portfolio manager in an efficient market is to tailor a portfolio to those

needs, rather than to beat the market.

Investors will be best served by constructing broadly-diversified portfolios that correspond

to the level of systematic risk they are willing to bear, and adopting a buy-and-hold strategy.

Potrebbero piacerti anche

- Research Methodology of Portfolio ManagementDocumento6 pagineResearch Methodology of Portfolio ManagementZalak Shah100% (1)

- Zeus Asset Management Case Week 5Documento8 pagineZeus Asset Management Case Week 5Johanlee1992Nessuna valutazione finora

- Reading 24 - Equity Valuation - Applications and ProcessesDocumento5 pagineReading 24 - Equity Valuation - Applications and ProcessesJuan MatiasNessuna valutazione finora

- RELATIVE VALUATION Theory PDFDocumento5 pagineRELATIVE VALUATION Theory PDFPrateek SidharNessuna valutazione finora

- CDMDocumento2 pagineCDMi am tadaeiNessuna valutazione finora

- 25 SAP CRM Interview Questions and AnswersDocumento5 pagine25 SAP CRM Interview Questions and AnswersHunny BhatiaNessuna valutazione finora

- Financial Reporting and AnalysisDocumento34 pagineFinancial Reporting and AnalysisNatasha AzzariennaNessuna valutazione finora

- Cfa Prepare Part 4Documento12 pagineCfa Prepare Part 4Роберт МкртчянNessuna valutazione finora

- Chapter 6Documento24 pagineChapter 6sdfklmjsdlklskfjd100% (2)

- Investment Valuatio1Documento9 pagineInvestment Valuatio1Nguyen Thi HangNessuna valutazione finora

- Task 1Documento5 pagineTask 1my youtube advisorNessuna valutazione finora

- FM QP KeyDocumento19 pagineFM QP KeyporseenaNessuna valutazione finora

- CH 16Documento9 pagineCH 16NMBGolfer100% (1)

- Company Analysis & Stock Val.Documento7 pagineCompany Analysis & Stock Val.Ezyquel QuintoNessuna valutazione finora

- Securities Analysis & Portfolio Management IntroDocumento50 pagineSecurities Analysis & Portfolio Management IntrogirishNessuna valutazione finora

- Synopsis On A Comparative Study of Equity Linked Savings Schemes Floated by Domestic Mutual Fund PlayersDocumento8 pagineSynopsis On A Comparative Study of Equity Linked Savings Schemes Floated by Domestic Mutual Fund PlayersPraveen Sehgal100% (1)

- Stock and Stock Valuation Garcia Cheska Kate HDocumento4 pagineStock and Stock Valuation Garcia Cheska Kate HJosua PranataNessuna valutazione finora

- Unit - Iv Valuation of Shares and Goodwill What Is Share Valuation?Documento56 pagineUnit - Iv Valuation of Shares and Goodwill What Is Share Valuation?Rizwan AkhtarNessuna valutazione finora

- Corporate ValuationDocumento23 pagineCorporate ValuationRakesh GuptaNessuna valutazione finora

- Uk Cmsa - Nur Eka Ayu Dana - 20180420159 - Ipacc 2018Documento3 pagineUk Cmsa - Nur Eka Ayu Dana - 20180420159 - Ipacc 2018nur eka ayu danaNessuna valutazione finora

- Acca F9 Business ValuationsDocumento6 pagineAcca F9 Business ValuationsHaseeb SethyNessuna valutazione finora

- 8524 UniqueDocumento20 pagine8524 UniqueMs AimaNessuna valutazione finora

- Unconfirmed 205358.crdownloadDocumento13 pagineUnconfirmed 205358.crdownloadKavita PawarNessuna valutazione finora

- DocumentDocumento24 pagineDocumentKavita PawarNessuna valutazione finora

- Equity AnalysisDocumento6 pagineEquity AnalysisVarsha Sukhramani100% (1)

- Stock Market Efficiency & Stock ValuationDocumento23 pagineStock Market Efficiency & Stock ValuationKaila SalemNessuna valutazione finora

- Moduel 4Documento4 pagineModuel 4sarojkumardasbsetNessuna valutazione finora

- Fsa 12NDocumento4 pagineFsa 12Npriyanshu.goel1710Nessuna valutazione finora

- FIN 404 Final AssessmentDocumento16 pagineFIN 404 Final AssessmentHOSSAIN MOHAMMAD YEASINNessuna valutazione finora

- Lesson 1 - OVERVIEW OF VALUATION CONCEPTS AND METHODSDocumento14 pagineLesson 1 - OVERVIEW OF VALUATION CONCEPTS AND METHODSGevilyn M. GomezNessuna valutazione finora

- CAPMDocumento8 pagineCAPMshadehdavNessuna valutazione finora

- SHARPE SINGLE INDEX MODEL - HarryDocumento12 pagineSHARPE SINGLE INDEX MODEL - HarryEguanuku Harry EfeNessuna valutazione finora

- Project Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Documento20 pagineProject Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Arun OusephNessuna valutazione finora

- Risk and Return: Week 3 - Financial MarketDocumento25 pagineRisk and Return: Week 3 - Financial MarketToni MarquezNessuna valutazione finora

- Business 2 2023Documento10 pagineBusiness 2 2023group0840Nessuna valutazione finora

- Merger & Acquisition: Defences Against Unwelcome TakeoversDocumento22 pagineMerger & Acquisition: Defences Against Unwelcome TakeoversViraj GawandeNessuna valutazione finora

- Equity Securities MarketDocumento40 pagineEquity Securities MarketBea Bianca MadlaNessuna valutazione finora

- INV (8 Questions)Documento2 pagineINV (8 Questions)leizelNessuna valutazione finora

- Project On Impact of Dividends Policy 1Documento43 pagineProject On Impact of Dividends Policy 1Soma BanikNessuna valutazione finora

- Chapter 7Documento11 pagineChapter 7Seid KassawNessuna valutazione finora

- Task 3 - Investment AppraisalDocumento12 pagineTask 3 - Investment AppraisalYashmi BhanderiNessuna valutazione finora

- Part 1 & 2Documento12 paginePart 1 & 2Monoarul Islam JawadNessuna valutazione finora

- Is Your Stock Worth Its Market PriceDocumento14 pagineIs Your Stock Worth Its Market PriceHuicai MaiNessuna valutazione finora

- Securities Analysis & Portfolio ManagementDocumento52 pagineSecurities Analysis & Portfolio ManagementruchisinghnovNessuna valutazione finora

- F9 Note (Business Valuation 1)Documento12 pagineF9 Note (Business Valuation 1)CHIAMAKA EGBUKOLENessuna valutazione finora

- Differentiate Profit Maximization From Wealth MaximizationDocumento8 pagineDifferentiate Profit Maximization From Wealth MaximizationRobi MatiNessuna valutazione finora

- Factors Affecting Valuation of SharesDocumento6 pagineFactors Affecting Valuation of SharesSneha ChavanNessuna valutazione finora

- Portfolio Management NotesDocumento25 paginePortfolio Management NotesRigved DarekarNessuna valutazione finora

- Equity Shares 3Documento4 pagineEquity Shares 3Sci UpscNessuna valutazione finora

- Equity HY NotesDocumento30 pagineEquity HY NotesshalinNessuna valutazione finora

- Security Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Documento17 pagineSecurity Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Sukanya ShridharNessuna valutazione finora

- Topic 2 - Equity 1 AnsDocumento6 pagineTopic 2 - Equity 1 AnsGaba RieleNessuna valutazione finora

- UNit 4 Introduction of Portfolio MGT - SDocumento43 pagineUNit 4 Introduction of Portfolio MGT - SKeyur KevadiyaNessuna valutazione finora

- Definition of 'Dividend Discount Model - DDM'Documento2 pagineDefinition of 'Dividend Discount Model - DDM'Siddhesh PatwaNessuna valutazione finora

- Module Iv Capital Structure÷nd DecisionsDocumento37 pagineModule Iv Capital Structure÷nd DecisionsMidhun George VargheseNessuna valutazione finora

- FMF T8 DoneDocumento10 pagineFMF T8 DoneThongkit ThoNessuna valutazione finora

- Research Proposal For Portfolio Management in Banking, IT and Pharmaceutical SectorDocumento6 pagineResearch Proposal For Portfolio Management in Banking, IT and Pharmaceutical Sectorzalaks67% (3)

- Equity Portfolio Management Strategies and Evaluation of Portfolio PerformanceDocumento10 pagineEquity Portfolio Management Strategies and Evaluation of Portfolio PerformanceChinmayee ChoudhuryNessuna valutazione finora

- Investment & Risk ManagementDocumento5 pagineInvestment & Risk ManagementE-sabat RizviNessuna valutazione finora

- SIM - ACC 212 - Week 8-9 - ULOb CAPMDocumento16 pagineSIM - ACC 212 - Week 8-9 - ULOb CAPMDaisy GuiralNessuna valutazione finora

- TOPIC 7 & 8 - Portfolio MGTDocumento15 pagineTOPIC 7 & 8 - Portfolio MGTDaniel DakaNessuna valutazione finora

- Chapter 1Documento23 pagineChapter 1Pablo EkskobaNessuna valutazione finora

- MAF 680 Chapter 7 - Futures Derivatives (New)Documento89 pagineMAF 680 Chapter 7 - Futures Derivatives (New)Pablo EkskobaNessuna valutazione finora

- Maf 630 Chapter 11Documento6 pagineMaf 630 Chapter 11Pablo EkskobaNessuna valutazione finora

- Maf 630 Chapter 6Documento5 pagineMaf 630 Chapter 6Pablo EkskobaNessuna valutazione finora

- Maf 630 CHAPTER 7Documento3 pagineMaf 630 CHAPTER 7Pablo EkskobaNessuna valutazione finora

- Maf 630 Chapter 4Documento2 pagineMaf 630 Chapter 4Pablo EkskobaNessuna valutazione finora

- Maf 630 Chapter 8Documento4 pagineMaf 630 Chapter 8Pablo EkskobaNessuna valutazione finora

- Chapter 5: Malaysian Bond MarketDocumento4 pagineChapter 5: Malaysian Bond MarketPablo EkskobaNessuna valutazione finora

- Maf 630 Chapter 1Documento3 pagineMaf 630 Chapter 1Pablo EkskobaNessuna valutazione finora

- Solution Far450 - Jun 2014Documento7 pagineSolution Far450 - Jun 2014Pablo EkskobaNessuna valutazione finora

- Far450 A April 2011Documento8 pagineFar450 A April 2011Pablo EkskobaNessuna valutazione finora

- Far450 A April 2011Documento8 pagineFar450 A April 2011Pablo EkskobaNessuna valutazione finora

- Suggested Solution FAR450 - JUNE 2012 Solution 1ADocumento8 pagineSuggested Solution FAR450 - JUNE 2012 Solution 1APablo EkskobaNessuna valutazione finora

- Share BuybackDocumento3 pagineShare Buybackurcrazy_mateNessuna valutazione finora

- NCA Held For Sale and Disc Operation-DiscussionDocumento3 pagineNCA Held For Sale and Disc Operation-DiscussionJennifer ArcadioNessuna valutazione finora

- Professional Development Portfolio GuidanceDocumento10 pagineProfessional Development Portfolio GuidancehoheinheimNessuna valutazione finora

- Lean - Total Productive MaintenanceDocumento9 pagineLean - Total Productive MaintenanceBalaji SNessuna valutazione finora

- GeM Bidding 4885013Documento4 pagineGeM Bidding 4885013MaheshNessuna valutazione finora

- Cost and Benefit Analysis of Outsourcing From The Perspective of Datapath LTDDocumento59 pagineCost and Benefit Analysis of Outsourcing From The Perspective of Datapath LTDranzlorenzoo100% (1)

- Ef1c HDT Sharemarket PCB3Documento37 pagineEf1c HDT Sharemarket PCB3PRATIK PRAKASHNessuna valutazione finora

- Government ProcurementDocumento4 pagineGovernment ProcurementPauline Vistan GarciaNessuna valutazione finora

- Algorithmic Trading Directory 2010Documento100 pagineAlgorithmic Trading Directory 201017524100% (4)

- Operations Management-Chapter FiveDocumento64 pagineOperations Management-Chapter FiveAGNessuna valutazione finora

- Enron ScandalDocumento9 pagineEnron ScandalRohith MohanNessuna valutazione finora

- EU Transition Timeline Whitepaper PDFDocumento10 pagineEU Transition Timeline Whitepaper PDFWFreeNessuna valutazione finora

- Applying Value Stream Mapping Technique in Apparel IndustryDocumento9 pagineApplying Value Stream Mapping Technique in Apparel IndustryAbhinav Ashish100% (1)

- Work Life Balance TechniquesDocumento2 pagineWork Life Balance TechniquestusharNessuna valutazione finora

- International Banking and Future of Banking and FinancialDocumento12 pagineInternational Banking and Future of Banking and FinancialAmit Mishra0% (1)

- The Importance of Independence.: Q:-Who Is Subject To Independence Restrictions?Documento5 pagineThe Importance of Independence.: Q:-Who Is Subject To Independence Restrictions?anon-583391Nessuna valutazione finora

- Innovation: Innovated by Professor Vijay Govindarajan, Tuck School of Business, Dartmouth CollegeDocumento13 pagineInnovation: Innovated by Professor Vijay Govindarajan, Tuck School of Business, Dartmouth CollegeManikandan SuriyanarayananNessuna valutazione finora

- CFMB AS CS3 v3Documento6 pagineCFMB AS CS3 v3lawless.d90Nessuna valutazione finora

- 1844 RulesDocumento20 pagine1844 RulestobymaoNessuna valutazione finora

- Chapter 8 Entry Strategies in Global BusinessDocumento3 pagineChapter 8 Entry Strategies in Global BusinessMariah Dion GalizaNessuna valutazione finora

- 2020 Walmart Annual ReportDocumento88 pagine2020 Walmart Annual ReportPruthviraj DhinganiNessuna valutazione finora

- Centre For Innovation, Incubation and Entrepreneurship (CIIE)Documento13 pagineCentre For Innovation, Incubation and Entrepreneurship (CIIE)Manish Singh RathorNessuna valutazione finora

- Comparative Analysis of Mutual Funds With Special Reference To Bajaj CapitalDocumento13 pagineComparative Analysis of Mutual Funds With Special Reference To Bajaj Capitalpankajbhatt1993Nessuna valutazione finora

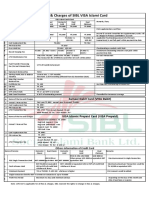

- Fees and Charges of SIBL Islami CardDocumento1 paginaFees and Charges of SIBL Islami CardMd YusufNessuna valutazione finora

- PDF 2Documento8 paginePDF 2ronnelNessuna valutazione finora

- BFIN300 Full Hands OutDocumento46 pagineBFIN300 Full Hands OutGauray LionNessuna valutazione finora