Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

May 2016 Financial Status Connecticut

Caricato da

Helen BennettCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

May 2016 Financial Status Connecticut

Caricato da

Helen BennettCopyright:

Formati disponibili

FOR IMMEDIATE RELEASE

MONDAY, MAY 2, 2016

Contact: Tara Downes

860-702-3308

Tara.Downes@ct.gov

COMPTROLLER LEMBO, FOLLOWING UPDATED CONSENSUS

REVENUE ESTIMATES, PROJECTS $259.1-MILLION DEFICIT

FOR FISCAL YEAR 2016

Comptroller Kevin Lembo today, following the recently updated consensus revenue

estimate, reported that the state is on track to end the current fiscal year with a $259.1million deficit.

The updated consensus revenue estimates by the Office of Policy and Management (OPM)

and the Office of Fiscal Analysis (OFA) reflect underperforming income tax receipts, as

Lembo similarly projected in recent months.

In a letter to Gov. Dannel P. Malloy, Lembo said total income tax receipts are expected to

fall $559.4 million, or 5.7 percent short of the initial budget plan. That revenue shortfall,

combined with other revenue adjustments, result in projected General Fund revenue that is

$430 million short of the budget plan.

The major reason for the continued deterioration in the fiscal position of the General Fund

is the underperformance of income tax receipts, Lembo said. The payroll-driven

withholding portion of the income tax has posted positive year-to-date growth of 3 percent

compared to last fiscal year. However, the more volatile estimated and final payments

portion of the income tax, which is highly dependent on capital gains and bonus payments,

is down by 2 percent from last fiscal year.

Lembo reported that the revenue shortfall for Fiscal year 2016 is partially offset by spending

that is $170.1 million below the budget plan.

Meanwhile, Lembo said Connecticuts economy continues to experience moderate growth.

Lembo pointed to some of the latest economic indicators from federal and state

Departments of Labor and other sources that show:

Through April, year-to-date income tax withholding receipts were running 3 percent

above the same period last fiscal year. New tax rate tables incorporating the higher

rate structure, as adopted in PA 15-244, were required to be implemented by the end

of August. Therefore, beginning in September 2015 receipts have incorporated the

higher tax rates.

Withholding receipts are the largest single source of state tax revenue, accounting for

61 percent of the total income tax receipts in Fiscal Year 2015 and almost 40 percent

of total General Fund tax receipts in that year. With the exception of tax increase

spikes in Fiscal Years 2011 and 2012, the current cycle of economic recovery has

posted below normal withholding gains.

The Department of Labor reported preliminary payroll job numbers for March that

showed a gain of 300 positions. This brought the seasonally adjusted job total to

1,685,600. The original release of a 4,200 job gain for February 2016 was slightly

lowered to 4,100. For the 12-month period ending in March, the state has added

15,000 jobs.

Connecticut has now recovered 91,400 positions, or 76.7 percent of the 119,100

seasonally adjusted total nonfarm jobs that were lost in the state during the March

2008 - February 2010 employment recession. The state needs to reach the 1,713,300

seasonally-adjusted job mark to enter a clear nonfarm employment expansion. This

will require an additional 27,700 nonfarm jobs. Connecticuts nonfarm jobs recovery

is now 73 months old and is averaging about 1,252 jobs per month since February

2010.

As the states employment recovery has progressed, an increasing number of job

sectors have posted sustained employment gains. As this trend continues, improved

wage growth and withholding receipts should occur.

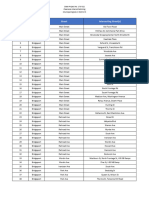

Sector

Construction

Manufacturing

Transp. & Public Utilities

Information

Financial

Prof . & Business Svc.

Education & Health Svc.

Leisure & Hospitality

Other Services

Government

3/16

57.0

159.7

299.8

33.7

130.8

216.9

329.2

155.5

64.7

237.8

3/15

57

158.9

295.9

32.3

129.9

216.1

326

150.9

63.8

239.2

Gain/Loss

0

0.8

3.9

1.4

0.9

0.8

3.2

4.6

0.9

-1.4

% Chng.

0.0%

0.5%

1.3%

4.3%

0.7%

0.4%

1.0%

3.0%

1.4%

-0.6%

U.S. employment has been advancing at a rate of 2 percent over the 12-month

period ending in March; Connecticuts employment growth was 0.9 percent for the

same period.

Connecticuts unemployment rate was 5.7 percent in March; the national

unemployment rate was 5.0 percent. Connecticuts unemployment rate has continued

to decline from a high of 9.5 percent in October 2010.

There were 107,600 unemployed job seekers in Connecticut in March. A low of

36,500 unemployed workers was recorded in October of 2000. The number of

unemployed workers hit a recessionary high of 177,200 in December of 2010.

The Department of Labor reported that average hourly earnings at $30.06, not

seasonally adjusted, were up $1.02, or 3.5 percent, from the March 2015 hourly

earnings estimate. The resultant average Private Sector weekly pay was calculated at

$997.99, up $22.25, or 2.3 percent higher than a year ago.

The Consumer Price Index for All Urban Consumers (CPI-U, U.S. City Average, not

seasonally adjusted) in March 2016 was 0.9 percent.

The graph below shows the monthly percent change from the prior year in

Connecticut private sector weekly earnings. Since the start of Fiscal Year 2015,

Connecticut has experienced positive growth in wages, although still below the prerecession growth levels.

Connecticut ranked 39th nationally in income growth for the 2015 calendar year

based on personal income statistics released by the Bureau of Economic Analysis on

March 24. Personal income grew by 3.1 percent in the state during 2015. Connecticut

ranked number one in per capita personal income at $66,972.

The chart below shows the trend in Connecticut personal income, which has yet to

attain its past expansionary strength. Data for the 1st quarter of 2016 will be released

on June 22.

In 2015, Connecticut ranked number two in the nation in the number of households

per capita with investable assets of over $1 million. According to Phoenix Global

Wealth Monitor, 100,996 or 7.3 percent of households in the state were millionaires.

The state also held this ranking in 2014.

According to an April 4 release by the Warren Group, single family home sales in

Connecticut grew by 29.9 percent in February from the same month last year.

Connecticut recorded 1,788 single-family home sales in February 2016, the most

sales in the month of February since 2007. Condominium sales were also strong,

growing 18.2 percent from last February.

Single-family home prices in Connecticut dropped 1 percent in February to a median

price of $222,750. Condominium prices fell 2 percent to a median of $150,000.

Prices have dropped or remained flat in Connecticut over the past 26 consecutive

months.

The table below shows sales activity in February 2016 by county as compared to last

January.

County

Fairfield

Hartford

Litchfield

Middlesex

New Haven

New

London

Tolland

Windham

2016 Home Sales and Median

Price by County Through Feb.

2015

2016

% Change

Median Price

360

328

90

74

322

96

413

438

111

105

422

145

14.7%

33.5%

23.3%

41.89

31.1%

51.1%

$391,000

$193,895

$205,000

$245,000

$185,000

$200,000

58

48

74

80

27.6%

66.7%

$205,000

$160,450

Change from

Jan 2015

-7.0%

2.1%

14.05%

2.1%

2.8%

-1.0%

-7.8%

11.8%

New housing permits in the state rose in February after a January decline. Overall

permits have been on an upward path since the end of the recession, although not

reaching the pace of prior post-recession activity. The shaded areas on the graph

below represent recessions.

Nationally, U.S. existing home sales rose 5.1 percent in March following a drop of

7.1 percent in February. Sales were positive throughout the four regions of the

country. Prices increased by 5.7 percent to a median price of $222,700.

Consumers

The Commerce Department reported that retail sales fell 0.3 percent between

February and March. The March drop marked the third straight month of

disappointing results sales contracted 0.4 percent in January and were virtually

unchanged in February. Excluding motor vehicle sales, retail sales climbed 0.2

percent over the month and were up 1.8 percent over the year. But this month's

weakness appeared to have little to do with the energy sector. Cheap energy prices

have tempered domestic retail growth for months, but recent upticks in gasoline

prices appear to have contributed to a slight increase in gas station sales.

Retail sales aren't the only determinant of overall consumer spending in the U.S. The

Commerce Departments separate selective services report documents consumer

spending on utilities, transportation, education, administrative support and

professional services, among other expenditures that aren't captured in the retail sales

report. This is a quarterly rather than a monthly report. The 4th quarter of 2015

posted solid consumer spending numbers. Growth of 1.5 percent was reported in

that quarter. Results for the 1st quarter of 2016 will not be available until June 8.

The Conference Board reported that its consumer confidence index fell 1.9 points to

a reading of 94.2 in April. Consumers were more pessimistic on the economy's shortterm prospects, implying they did not expect a pick-up in activity. Slightly fewer

people said they planned to take a vacation or buy a car, home or major household

appliance within the next six months.

The Federal Reserves April report on consumer borrowing showed a February

growth in credit of 5.8 percent. The use of revolving credit, mostly credit cards, rose

just 3.7 percent after slipping in January. Non-revolving credit, which includes

student loans, increased 6.6 percent.

This graph shows the general upward trend in consumer borrowing.

This graph shows the movement in personal savings.

Business and Economic Growth

According to the April 28 advance estimate, GDP in the 1st quarter of 2016 grew 0.5

percent. In the 4th quarter GDP expanded by 1.4 percent. This low level of economic

activity had been expected based on other economic indicators. The deceleration in

real GDP in the 1st quarter reflected a larger decrease in nonresidential fixed

investment, a deceleration in personal consumption, a downturn in federal

government spending, an upturn in imports, and larger decreases in private inventory

investment and in exports that were partly offset by an upturn in state and local

government spending and an acceleration in residential fixed investment.

Orders for long-lasting U.S. manufactured goods rebounded far less than expected in

March as demand for automobiles, computers and electrical goods slumped,

suggesting the downturn in the factory sector was not over. The Commerce

Department reported that orders for durable goods, items ranging from toasters to

aircraft meant to last three years or more, increased 0.8 percent last month after

declining 3.1 percent in February.

April data pointed to only a modest rebound in business activity across the U.S.

service economy according to the Markit U.S. Services Purchasing Managers Index

(PMI).

Matrix reported that growth momentum remained much weaker than that seen on

average since the survey began in late-2009. Survey respondents suggested that

subdued client demand and less favorable underlying economic conditions had

weighed on business activity at their units in April. Reflecting this, latest data signaled

only a marginal rebound in new business growth from the survey-record low

recorded in March.

A relatively weak upturn in new work contributed to slower job creation across the

service economy in April. The service sector is the biggest part of the U.S. economy.

In Connecticut, the business trends tracked by the Department of Labor-- which

include housing permits, exports, gaming slots, visits to major attractions, air

passenger count, CT manufacturing production index, and weekly hours-- had been

on an upward trend as 2015 ended.

Stock Market

Estimated and final income tax payments account for approximately 40 percent of

total state income tax receipts. These payments show a correlation to activity in

equity markets relating to capital gains.

At the end of April, year-to-date estimated and final income tax payments for Fiscal

Year 2016 were 2 percent or $62.5 million below the same period last fiscal year.

Stock market adjustments that impacted Fiscal Year 2016 receipts were a

contributing factor in the decline.

The graphs below show the year-to-date movement in the DOW and the S&P

respectively.

***END***

Potrebbero piacerti anche

- 17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Documento22 pagine17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Helen BennettNessuna valutazione finora

- TBL ltr March 5Documento26 pagineTBL ltr March 5Helen BennettNessuna valutazione finora

- 75 Center Street Summary Suspension SignedDocumento3 pagine75 Center Street Summary Suspension SignedHelen BennettNessuna valutazione finora

- Finn Dixon Herling Report On CSPDocumento16 pagineFinn Dixon Herling Report On CSPRich KirbyNessuna valutazione finora

- West Hartford Proposed budget 2024-2025Documento472 pagineWest Hartford Proposed budget 2024-2025Helen BennettNessuna valutazione finora

- National Weather Service 01122024 - Am - PublicDocumento17 pagineNational Weather Service 01122024 - Am - PublicHelen BennettNessuna valutazione finora

- Hunting, Fishing, And Trapping Fees 2024-R-0042Documento4 pagineHunting, Fishing, And Trapping Fees 2024-R-0042Helen BennettNessuna valutazione finora

- TBL Ltr ReprimandDocumento5 pagineTBL Ltr ReprimandHelen BennettNessuna valutazione finora

- PURA 2023 Annual ReportDocumento129 paginePURA 2023 Annual ReportHelen BennettNessuna valutazione finora

- Analysis of Impacts of Hospital Consolidation in Ct 032624Documento41 pagineAnalysis of Impacts of Hospital Consolidation in Ct 032624Helen BennettNessuna valutazione finora

- Pura Decision 230132re01-022124Documento12 paginePura Decision 230132re01-022124Helen BennettNessuna valutazione finora

- 20240325143451Documento2 pagine20240325143451Helen BennettNessuna valutazione finora

- South WindsorDocumento24 pagineSouth WindsorHelen BennettNessuna valutazione finora

- Commission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Documento4 pagineCommission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Helen BennettNessuna valutazione finora

- Be Jar Whistleblower DocumentsDocumento292 pagineBe Jar Whistleblower DocumentsHelen BennettNessuna valutazione finora

- 2024 Budget 12.5.23Documento1 pagina2024 Budget 12.5.23Helen BennettNessuna valutazione finora

- Hartford CT Muni 110723Documento2 pagineHartford CT Muni 110723Helen BennettNessuna valutazione finora

- CT State of Thebirds 2023Documento13 pagineCT State of Thebirds 2023Helen Bennett100% (1)

- Crime in Connecticut Annual Report 2022Documento109 pagineCrime in Connecticut Annual Report 2022Helen BennettNessuna valutazione finora

- District 4 0174 0453 Project Locations FINALDocumento6 pagineDistrict 4 0174 0453 Project Locations FINALHelen BennettNessuna valutazione finora

- District 3 0173 0522 Project Locations FINALDocumento17 pagineDistrict 3 0173 0522 Project Locations FINALHelen BennettNessuna valutazione finora

- District 1 0171 0474 Project Locations FINALDocumento7 pagineDistrict 1 0171 0474 Project Locations FINALHelen BennettNessuna valutazione finora

- Final West Haven Tier IV Report To GovernorDocumento75 pagineFinal West Haven Tier IV Report To GovernorHelen BennettNessuna valutazione finora

- District 3 0173 0522 Project Locations FINALDocumento17 pagineDistrict 3 0173 0522 Project Locations FINALHelen BennettNessuna valutazione finora

- Voices For Children Report 2023 FinalDocumento29 pagineVoices For Children Report 2023 FinalHelen BennettNessuna valutazione finora

- Hurley Employment Agreement - Final ExecutionDocumento22 pagineHurley Employment Agreement - Final ExecutionHelen BennettNessuna valutazione finora

- District 1 0171 0474 Project Locations FINALDocumento7 pagineDistrict 1 0171 0474 Project Locations FINALHelen BennettNessuna valutazione finora

- University of Connecticut Audit: 20230815 - FY2019,2020,2021Documento50 pagineUniversity of Connecticut Audit: 20230815 - FY2019,2020,2021Helen BennettNessuna valutazione finora

- PEZZOLO Melissa Govt Sentencing MemoDocumento15 paginePEZZOLO Melissa Govt Sentencing MemoHelen BennettNessuna valutazione finora

- PEZZOLO Melissa Sentencing MemoDocumento12 paginePEZZOLO Melissa Sentencing MemoHelen BennettNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Healthcare in Myanmar: Review ArticleDocumento12 pagineHealthcare in Myanmar: Review ArticleMin Chan Moon100% (1)

- Community Enterprise Full Report 98Documento75 pagineCommunity Enterprise Full Report 98Ananthanarayana SharmaNessuna valutazione finora

- Main ProjectDocumento42 pagineMain Projectsrm13_serinNessuna valutazione finora

- Employee EngagementDocumento87 pagineEmployee EngagementMonish Maitra100% (1)

- A Study On Employee Job Satisfaction With Referrence To Sivasakthi Ginning Factory at ThedavoorDocumento7 pagineA Study On Employee Job Satisfaction With Referrence To Sivasakthi Ginning Factory at ThedavoorRaghul RamasamyNessuna valutazione finora

- #2 The History of ManagementDocumento44 pagine#2 The History of ManagementJoanna Garcia0% (1)

- Labor Relations Azucena Vol II PDFDocumento164 pagineLabor Relations Azucena Vol II PDFKareen Moncada100% (1)

- Sandra Johnson - Updated ResumeDocumento2 pagineSandra Johnson - Updated ResumeSandra Orlick JohnsonNessuna valutazione finora

- Accounting Fraud at Worldcom Corporate Governance AssignmentDocumento4 pagineAccounting Fraud at Worldcom Corporate Governance AssignmentTarun BansalNessuna valutazione finora

- Nouf Fahad Binjubair: HR Business PartnerDocumento4 pagineNouf Fahad Binjubair: HR Business PartnerMohannad MoheisenNessuna valutazione finora

- Case Study 2 - Repairing Jobs That Fail To SatisfyDocumento7 pagineCase Study 2 - Repairing Jobs That Fail To SatisfyDhananjay Shrivastav100% (1)

- Mydin's Transformation Through Visionary LeadershipDocumento25 pagineMydin's Transformation Through Visionary LeadershipAini Arifah67% (3)

- Court upholds dismissal of compensation claim for death of casual laborerDocumento3 pagineCourt upholds dismissal of compensation claim for death of casual laborerandrea ibanezNessuna valutazione finora

- OSH Accident Investigation Study Case on Kubota Tractor AccidentDocumento23 pagineOSH Accident Investigation Study Case on Kubota Tractor AccidentMinho OnionsNessuna valutazione finora

- Research ProposalDocumento17 pagineResearch Proposalselina_kollsNessuna valutazione finora

- Alberta Venture February 2011Documento88 pagineAlberta Venture February 2011Venture PublishingNessuna valutazione finora

- Ill MTDocumento149 pagineIll MTsubham kumar dalaraNessuna valutazione finora

- Types Early Childhood ProgramsDocumento11 pagineTypes Early Childhood ProgramsRoxan Gonzales DelimaNessuna valutazione finora

- Hillsborough County Fire Rescue Employee SurveyDocumento57 pagineHillsborough County Fire Rescue Employee SurveyAnonymous YhHeJs100% (1)

- REQ-Mumbai MC1-11860967-5002214Documento1 paginaREQ-Mumbai MC1-11860967-5002214shreya arunNessuna valutazione finora

- Human Resource Management Chapter 5Documento13 pagineHuman Resource Management Chapter 5Abdul HadiNessuna valutazione finora

- Kisiiki SofiaDocumento152 pagineKisiiki SofiaMp ZNessuna valutazione finora

- Lowe's CompaniesDocumento14 pagineLowe's CompaniesNazish Sohail100% (1)

- Business Plan ExplainedDocumento22 pagineBusiness Plan ExplainedAshil JeelallNessuna valutazione finora

- Allied Free Worker's Union Vs Maritima - 19 SCRA 258Documento24 pagineAllied Free Worker's Union Vs Maritima - 19 SCRA 258Justin HarrisNessuna valutazione finora

- HONG KONG Expat Tax Guide - Mar10Documento4 pagineHONG KONG Expat Tax Guide - Mar10etechodNessuna valutazione finora

- 8 Steps For Organizational Development InterventionsDocumento10 pagine8 Steps For Organizational Development InterventionspavaniNessuna valutazione finora

- Case Study - 7HR001Documento9 pagineCase Study - 7HR001Jehan Jacob FernandoNessuna valutazione finora

- 16 Potential Key Performance Indicators For HospitalsDocumento3 pagine16 Potential Key Performance Indicators For HospitalsSyed Murtuza BakshiNessuna valutazione finora

- Mock Bar Civ 1st YearDocumento4 pagineMock Bar Civ 1st YearPending_nameNessuna valutazione finora