Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Discharge of Debtor - Fleury Chapter 7 Bankruptcy

Caricato da

arsmith718100%(1)Il 100% ha trovato utile questo documento (1 voto)

120 visualizzazioni2 pagineA notice to debtor of courts actions granting a discharge of debt.

Titolo originale

Discharge of Debtor -Fleury Chapter 7 Bankruptcy

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoA notice to debtor of courts actions granting a discharge of debt.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

120 visualizzazioni2 pagineDischarge of Debtor - Fleury Chapter 7 Bankruptcy

Caricato da

arsmith718A notice to debtor of courts actions granting a discharge of debt.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

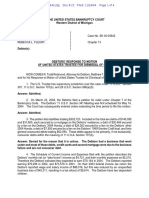

Case:04-03642-jdg

Doc #:24 Filed: 06/02/05

Page 1 of 2

Form B18 (Official Form 18)(9/97)

United States Bankruptcy Court

Western District of Michigan

299 Federal Building

110 Michigan, NW

PO Box 3310

Grand Rapids, MI 49501

IN RE:

Matthew T. Fleury

6336 Eagle Ridge Dr

Kalamazoo, MI 49004

SSN: xxxxx1746

Rebecca L. Fleury

6336 Eagle Ridge Dr

Kalamazoo, MI 49004

SSN: xxxxx1166

Case Number 0403642jdg

Chapter 7

Honorable James D. Gregg

Debtor(s)

DISCHARGE OF DEBTOR

It appearing that the debtor is entitled to a discharge,

IT IS ORDERED :

The debtor is granted a discharge under section 727 of title 11, United States Code, (the Bankruptcy Code).

BY THE COURT

Dated: 6/2/05

James D. Gregg

United States Bankruptcy Judge

SEE THE BACK OF THIS ORDER FOR IMPORTANT INFORMATION.

Case:04-03642-jdg

Doc #:24 Filed: 06/02/05

Page 2 of 2

FORM B18 continued (7/97)

EXPLANATION OF BANKRUPTCY DISCHARGE

IN A CHAPTER 7 CASE

This court order grants a discharge to the person named as the debtor. It is not a dismissal of the case

and it does not determine how much money, if any, the trustee will pay to creditors.

Collection of Discharged Debts Prohibited

The discharge prohibits any attempt to collect from the debtor a debt that has been discharged. For

example, a creditor is not permitted to contact a debtor by mail, phone, or otherwise, to file or continue a lawsuit, to

attach wages or other property, or to take any other action to collect a discharged debt from the debtor. [In a case

involving community property:] [There are also special rules that protect certain community property owned by the

debtor's spouse, even if that spouse did not file a bankruptcy case.] A creditor who violates this order can be required

to pay damages and attorney's fees to the debtor.

However, a creditor may have the right to enforce a valid lien, such as a mortgage or security interest,

against the debtor's property after the bankruptcy, if that lien was not avoided or eliminated in the bankruptcy case.

Also, a debtor may voluntarily pay any debt that has been discharged.

Debts That are Discharged

The chapter 7 discharge order eliminates a debtor's legal obligation to pay a debt that is discharged.

Most, but not all, types of debts are discharged if the debt existed on the date the bankruptcy case was filed. (If this

case was begun under a different chapter of the Bankruptcy Code and converted to chapter 7, the discharge applies to

debts owed when the bankruptcy case was converted.)

Debts that are Not Discharged.

Some of the common types of debts which are not discharged in a chapter 7 bankruptcy case are:

a. Debts for most taxes;

b. Debts that are in the nature of alimony, maintenance, or support;

c. Debts for most student loans;

d. Debts for most fines, penalties, forfeitures, or criminal restitution obligations;

e. Debts for personal injuries or death caused by the debtor's operation of a motor vehicle while intoxicated;

f. Some debts which were not properly listed by the debtor;

g. Debts that the bankruptcy court specifically has decided or will decide in this bankruptcy case are not

discharged;

h. Debts for which the debtor has given up the discharge protections by signing a reaffirmation agreement in

compliance with the Bankruptcy Code requirements for reaffirmation of debts.

This information is only a general summary of the bankruptcy discharge. There are exceptions

to these general rules. Because the law is complicated, you may want to consult an attorney to determine the

exact effect of the discharge in this case.

Potrebbero piacerti anche

- Chapter 13 Bankruptcy in the Western District of TennesseeDa EverandChapter 13 Bankruptcy in the Western District of TennesseeNessuna valutazione finora

- United States Trustees Complaint Objecting Discharge To Charles R Lance's Chapter 7 Bankruptcy DischargeDocumento20 pagineUnited States Trustees Complaint Objecting Discharge To Charles R Lance's Chapter 7 Bankruptcy DischargeDGWBCSNessuna valutazione finora

- Bankruptcy Court Objection To Discharge Marc Randazza Debtor, Crystal Cox CreditorDocumento5 pagineBankruptcy Court Objection To Discharge Marc Randazza Debtor, Crystal Cox CreditorCrystal CoxNessuna valutazione finora

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryDa EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNessuna valutazione finora

- Mers Bailee LetterDocumento3 pagineMers Bailee LetterHelpin HandNessuna valutazione finora

- Tom Lawler Tries and Fails Again FCUSADocumento10 pagineTom Lawler Tries and Fails Again FCUSAMike FarellNessuna valutazione finora

- State Court Ruling Deals Blow To Bank Mortgage SystemDocumento2 pagineState Court Ruling Deals Blow To Bank Mortgage SystemTeodoro Cabo San LucasNessuna valutazione finora

- Court Order Remanding Case Back To State CourtDocumento10 pagineCourt Order Remanding Case Back To State CourtMartin AndelmanNessuna valutazione finora

- Nominee? No Power No Authority: Lane Houk CommentsDocumento3 pagineNominee? No Power No Authority: Lane Houk CommentsdcsshitNessuna valutazione finora

- US Internal Revenue Service: F1099a - 1998Documento6 pagineUS Internal Revenue Service: F1099a - 1998IRSNessuna valutazione finora

- Teva Whistleblower (SEC Response)Documento38 pagineTeva Whistleblower (SEC Response)Mike KoehlerNessuna valutazione finora

- Official Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineDocumento3 pagineOfficial Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineCarloe Perez100% (1)

- Schneider Sent First American A RESPA Qualified Written Request, Complaint, and Dispute of Debt and Validation of Debt LetterDocumento9 pagineSchneider Sent First American A RESPA Qualified Written Request, Complaint, and Dispute of Debt and Validation of Debt Letterlarry-612445Nessuna valutazione finora

- Chapter 8: Hold or Fold - BankruptcyDocumento28 pagineChapter 8: Hold or Fold - BankruptcyJafari SelemaniNessuna valutazione finora

- Banking and The Duty of ConfidentialityDocumento4 pagineBanking and The Duty of ConfidentialityMohamed YosryNessuna valutazione finora

- ROWLAND Et Al v. OCWEN LOAN SERVICING, LLC. Et Al Notice of RemovalDocumento6 pagineROWLAND Et Al v. OCWEN LOAN SERVICING, LLC. Et Al Notice of RemovalACELitigationWatchNessuna valutazione finora

- 3 Blank Notice of DefaultDocumento3 pagine3 Blank Notice of DefaultKristin Cantley SnellNessuna valutazione finora

- Management of TrustsDocumento4 pagineManagement of Trustsnikhil jkcNessuna valutazione finora

- Negotiable Instrument: Private International LawDocumento20 pagineNegotiable Instrument: Private International LawAnkita SinhaNessuna valutazione finora

- The Declaration of Independence: A Play for Many ReadersDa EverandThe Declaration of Independence: A Play for Many ReadersNessuna valutazione finora

- A Little Bit of LachesDocumento21 pagineA Little Bit of LachesJoe RealNessuna valutazione finora

- Federal Habeas Corpus Petition 28 U S C 2254Documento19 pagineFederal Habeas Corpus Petition 28 U S C 2254Janeth Mejia Bautista AlvarezNessuna valutazione finora

- PrintableDocumento2 paginePrintableapi-309082881Nessuna valutazione finora

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithDa EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNessuna valutazione finora

- Chapter 12 - Settlement of Claims-Unliquidated and Liquidated DebtsDocumento3 pagineChapter 12 - Settlement of Claims-Unliquidated and Liquidated Debtstong ZhouNessuna valutazione finora

- Bob Motion To DismissDocumento4 pagineBob Motion To DismissRobert MillerNessuna valutazione finora

- Morgan V Ocwen, MERSDocumento15 pagineMorgan V Ocwen, MERSForeclosure Fraud100% (2)

- Quiet Title Virginia Greg BrylDocumento2 pagineQuiet Title Virginia Greg BrylRK Corbes100% (1)

- Credit Bureau WarningDocumento1 paginaCredit Bureau WarningStephanie VincentNessuna valutazione finora

- Affidavit of Walker Todd Signed Copy With Decision Text 2023 - 09 - 27 19 - 01 - 41 UTCDocumento16 pagineAffidavit of Walker Todd Signed Copy With Decision Text 2023 - 09 - 27 19 - 01 - 41 UTCbrendonNessuna valutazione finora

- United States Bankruptcy Court: Southern District of West VirginiaDocumento54 pagineUnited States Bankruptcy Court: Southern District of West VirginiaWVGOP Research100% (1)

- Instruments Law ReviewerDocumento11 pagineInstruments Law ReviewerSam MaligatNessuna valutazione finora

- A Clog On The Equity of RedemptDocumento27 pagineA Clog On The Equity of Redemptamit dipankarNessuna valutazione finora

- Downes vs. BidwellDocumento4 pagineDownes vs. BidwelljeiromeNessuna valutazione finora

- A Lawyer Shall Uphold The Constitution, Obey The Laws of The Land and Promote Respect For Law and Legal ProcessesDocumento20 pagineA Lawyer Shall Uphold The Constitution, Obey The Laws of The Land and Promote Respect For Law and Legal ProcessesSheila Mae Embabuena100% (1)

- Mortgage Concurrent Resolution 11-3-11Documento6 pagineMortgage Concurrent Resolution 11-3-11Foreclosure FraudNessuna valutazione finora

- United States Court of Appeals, First CircuitDocumento8 pagineUnited States Court of Appeals, First CircuitScribd Government DocsNessuna valutazione finora

- Clouded Title Permanent Injunction To Foreclose Appeal 1987 TEXASDocumento15 pagineClouded Title Permanent Injunction To Foreclose Appeal 1987 TEXASJohn ReedNessuna valutazione finora

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Documento2 pagineBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNessuna valutazione finora

- Dispute Transaction Notification FormDocumento3 pagineDispute Transaction Notification FormNicholas SullivanNessuna valutazione finora

- Uber Fair Credit Class ActionDocumento20 pagineUber Fair Credit Class Actionjeff_roberts881Nessuna valutazione finora

- Ferrel L. Agard,: DebtorDocumento20 pagineFerrel L. Agard,: DebtorJfresearch06100% (1)

- Mortgage Not Duly ExecutedDocumento5 pagineMortgage Not Duly Executedbob doleNessuna valutazione finora

- LVNV Funding, L.L.C. v. ColvellDocumento4 pagineLVNV Funding, L.L.C. v. ColvellSamuelNessuna valutazione finora

- The Nature of Credit Instruments - A Credit InstrumentDocumento2 pagineThe Nature of Credit Instruments - A Credit Instrumentjoshua aguirreNessuna valutazione finora

- Dirty Dough Motion To FileDocumento7 pagineDirty Dough Motion To FileKUTV 2NewsNessuna valutazione finora

- Stroman ComplaintDocumento79 pagineStroman ComplaintFrank JeanNessuna valutazione finora

- Billingsley ComplaintDocumento12 pagineBillingsley ComplaintJimmy ElliottNessuna valutazione finora

- State of Ohio V GMAC, ALLY, Jeffrey StephanDocumento175 pagineState of Ohio V GMAC, ALLY, Jeffrey StephanForeclosure Fraud100% (1)

- Social Security Packet (2023)Documento12 pagineSocial Security Packet (2023)Shay K. SkuceNessuna valutazione finora

- SUDDENLY APPEARING ENDORSEMENTS USED BY BANK-TRUSTEES IN FORECLOSURES - Housing JusticeDocumento27 pagineSUDDENLY APPEARING ENDORSEMENTS USED BY BANK-TRUSTEES IN FORECLOSURES - Housing JusticecloudedtitlesNessuna valutazione finora

- Motion To Default Bradley Arant Boult Cummings LLP For Indirect Criminal ContemptDocumento146 pagineMotion To Default Bradley Arant Boult Cummings LLP For Indirect Criminal ContemptChristopher Stoller EDNessuna valutazione finora

- Transcript SEC Fundamentals Part 1Documento10 pagineTranscript SEC Fundamentals Part 1archanaanuNessuna valutazione finora

- Little Miller ActDocumento2 pagineLittle Miller ActLincoln Reserve Group Inc.Nessuna valutazione finora

- Securities and Exchange Commission (SEC) - Sec1661Documento4 pagineSecurities and Exchange Commission (SEC) - Sec1661highfinanceNessuna valutazione finora

- Final Decree-Fleury Chapter 7 BankruptcyDocumento1 paginaFinal Decree-Fleury Chapter 7 Bankruptcyarsmith718Nessuna valutazione finora

- Notice of Stay-Fleury Chapter 7 BankruptcyDocumento2 pagineNotice of Stay-Fleury Chapter 7 Bankruptcyarsmith718Nessuna valutazione finora

- Debtors (Rebecca Fleury's) Response To Motion To Dismiss-Fleury Chapter 7 BankruptcyDocumento4 pagineDebtors (Rebecca Fleury's) Response To Motion To Dismiss-Fleury Chapter 7 Bankruptcyarsmith718Nessuna valutazione finora

- Motion To Dismiss-Fleury Chapter 7 BankruptcyDocumento5 pagineMotion To Dismiss-Fleury Chapter 7 Bankruptcyarsmith718Nessuna valutazione finora

- Notice of Chapter 7 Bankruptcy Case, Meeting of Creditors, & DeadlinesDocumento2 pagineNotice of Chapter 7 Bankruptcy Case, Meeting of Creditors, & Deadlinesarsmith718100% (1)

- Statement of Financial Affairs-Fleury Chapter 7 BankruptcyDocumento7 pagineStatement of Financial Affairs-Fleury Chapter 7 Bankruptcyarsmith718Nessuna valutazione finora

- Grievance Redressal PolicyDocumento7 pagineGrievance Redressal PolicyDeepakKashyapNessuna valutazione finora

- Mrunal PDFDocumento819 pagineMrunal PDFMayur MeenaNessuna valutazione finora

- 33 KVDocumento258 pagine33 KVAMOL HIRULKARNessuna valutazione finora

- Amsterdam Ghid Parcari P+RDocumento4 pagineAmsterdam Ghid Parcari P+RIrina MihaelaNessuna valutazione finora

- Chapter 3Documento39 pagineChapter 3Low JoeyNessuna valutazione finora

- E - Banking Project Report by SUDARSHANDocumento41 pagineE - Banking Project Report by SUDARSHANSudarshan Tomar74% (61)

- Credit Risk ModellingDocumento28 pagineCredit Risk ModellingAnjali VermaNessuna valutazione finora

- Final Project 2017-18Documento3 pagineFinal Project 2017-18Monali rautNessuna valutazione finora

- Applicant InformationDocumento1.326 pagineApplicant Informationmunaff0% (1)

- American Home VS TantucoDocumento1 paginaAmerican Home VS Tantucoiamnumber_fourNessuna valutazione finora

- COC - SUbcontract FormDocumento32 pagineCOC - SUbcontract Formsham2000Nessuna valutazione finora

- Bloomberg Businessweek - 14 April 2014Documento80 pagineBloomberg Businessweek - 14 April 2014hellowodNessuna valutazione finora

- Auditor Independence and Audit Quality PDFDocumento22 pagineAuditor Independence and Audit Quality PDFadamNessuna valutazione finora

- FPG PI Proposal Form 11.16Documento7 pagineFPG PI Proposal Form 11.16Liza BuetaNessuna valutazione finora

- Cute Exam Paper Set 4Documento12 pagineCute Exam Paper Set 4Raja PeriasamyNessuna valutazione finora

- Chase Bank StatementDocumento4 pagineChase Bank StatementJoe SFNessuna valutazione finora

- Monte Carlo Fashions Limited - RHP - 21 November 2014Documento336 pagineMonte Carlo Fashions Limited - RHP - 21 November 2014Biswa Jyoti GuptaNessuna valutazione finora

- PDFDocumento10 paginePDFManasa M JNessuna valutazione finora

- 60 Car Loans Audit Report FINALDocumento14 pagine60 Car Loans Audit Report FINALEmil Victor Medina MasaNessuna valutazione finora

- Sr. No. Bic Code Institution Name Branch Information CityDocumento3 pagineSr. No. Bic Code Institution Name Branch Information Cityran4monuNessuna valutazione finora

- Money Banking Generic Elective Third Sem. 5.5 PDFDocumento3 pagineMoney Banking Generic Elective Third Sem. 5.5 PDFAkistaaNessuna valutazione finora

- Mt103 One Way Doa Beaufort .Documento18 pagineMt103 One Way Doa Beaufort .Yadav Arun100% (1)

- Self-Registers Bank Account @cashout - KingdomDocumento16 pagineSelf-Registers Bank Account @cashout - Kingdomradohi6352100% (1)

- Invoice - Seasky International Business Travel Gde0902Documento1 paginaInvoice - Seasky International Business Travel Gde0902Hank ZhouNessuna valutazione finora

- Fixed Deposits Interest - Fixed Deposit Interest Rates - ICICI BankDocumento5 pagineFixed Deposits Interest - Fixed Deposit Interest Rates - ICICI BankShikhar MahajanNessuna valutazione finora

- ALLANDALE SPORTSLINE INC. v. THE GOOD DEVELOPMENT CORP CONSIGNATIONDocumento4 pagineALLANDALE SPORTSLINE INC. v. THE GOOD DEVELOPMENT CORP CONSIGNATIONCML100% (1)

- DIAC Application Checklist PAKISTANDocumento4 pagineDIAC Application Checklist PAKISTANVishal KrzNessuna valutazione finora

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocumento4 pagineInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNessuna valutazione finora

- Final 1111Documento106 pagineFinal 1111Kalpesh PatilNessuna valutazione finora

- Unified Payments Interface UPI Explained in PDFDocumento5 pagineUnified Payments Interface UPI Explained in PDFnizam petaNessuna valutazione finora