Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Duffy v. Central R. Co. of NJ, 268 U.S. 55 (1925)

Caricato da

Scribd Government DocsDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Duffy v. Central R. Co. of NJ, 268 U.S. 55 (1925)

Caricato da

Scribd Government DocsCopyright:

Formati disponibili

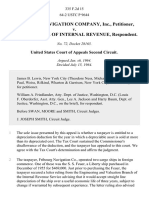

268 U.S.

55

45 S.Ct. 429

69 L.Ed. 846

DUFFY, Collector of Internal Revenue,

v.

CENTRAL R. CO. OF NEW JERSEY.

No. 129.

Argued March 13-16, 1925.

Decided April 13, 1925.

The Attorney General and Mr. Alfred A. Wheat. of New York City, for

petitioner.

[Argument of Counsel from pages 56-57 intentionally omitted]

Mr. C. E. Miller, of New York City, for respondent.

[Argument of Counsel from pages 58-60 intentionally omitted]

Mr. Justice SUTHERLAND delivered the opinion of the Court.

During the year 1916, respondent, as lessee, was in possession of and operating

certian railroads and branches in New Jersey and Pennsylvania. The leases were

for terms of 999 years and bound respondent to maintain and keep the leased

property in good order and repair and fit for efficient use. Each provided that in

the event of a default in that respect the lease might be terminated by the lessor.

At the same time, respondent had leases of certain piers from the city of New

York for various terms with the privilege of renewal, not to exceed in any case

30 years in all. One such lease required respondent to acquire and pay for the

interest of private owners in an old pier and to construct a new one in its place.

It provided that, if the cost should be less than $2,750,000, respondent was to

pay in addition to rent 5 1/2 per cent. on the difference between that amount and

the actual cost; but, if the cost should be more than $2,750,000, respondent was

to be credited on its annual rental with 5 1/2 per cent. on such difference for 39

years, in which event the term was to be extended under a formula not

necessary to be repeated. Respondent agreed to maintain the premises and

structures thereon, or to be erected thereon, in good and efficient repair. The

city was authorized to terminate the lease at any time after 10 years, but in such

case agreed to pay to respondent such reasonable sum as might be fixed by

arbitration. Other leases required respondent to do such dredging as the

commissioner of docks considered necessary, and still others to build

extensions to the leased piers. All the leases provided that the city could

terminate them if respondent failed to pay rent or failed otherwise to observe

the covenants or agreements.

2

In the year 1916, respondent expended, under the railroad leases, for additions

and betterments and, under the pier leases, for the several purposes therein set

forth, the aggregate sum of $1,659,924.33, of which $1,525,308.72 was for the

acquisition of the private rights in the old pier and the construction of the new

one.

In submitting its income tax return for that year, respondent sought to deduct

these various expenditures from its gross income under section 12(a) of the

Revenue Act of 1916 (39 Stat. 756, 767-769, c. 463 [Comp. St. 6336l]),

which provides, in the case of a corporation, that annual net income shall be

ascertained by deducting from the gross amount thereof, among other things:

'First. All the ordinary and necessary expenses paid within the year in the

maintenance and operation of its business and properties, including rentals or

other payments required to be made as a condition to the continued use or

possession of property to which the corporation has not taken or is not taking

title, or in which it has no equity.' The collector refused to allow the deductions,

and respondent, under protest, paid the amount of the increased assessment due

to such refusal, and brought this action to recover it. Its contention is that the

expenditures were 'rentals or other payments' within the meaning of the

provision above quoted, and that the whole amount constitutes an allowable

deduction for the year 1916. On the other hand, the government contends that

the disbursements were capital expenditures and that the only permissible

deduction is an annual allowance under section 12(a), subd. Second, 39 Stat.

768,1 for 'depreciation'; but, if the expenditures are to be regarded as additional

rentals or other payments within the meaning of section 12(a), subd. First, the

amount must be prorated, under a regulation of the Treasury Department, over

the life of the improvements or the life of the lease, whichever is the shorter.

The federal district court gave judgment for respondent, which was affirmed by

the Circuit Court of Appeals (289 F. 354), and the case is here on certiorari

(263 U. S. 693, 44 S. Ct. 34, 68 L. Ed. 510).

Clearly the expenditures were not 'expenses paid within the year in the

maintenance and operation of its [respondent's] business and properties';2 but

were for additions and betterments of a permanent character, such as would, if

made by an owner, come within the proviso in subdivision Second, 'that no

deduction shall be allowed for any amount paid out for new buildings,

permanent improvements, or betterments made to increase the value of any

property,' etc. They were made, not to keep the properties going, but to create

additions to them. They constituted, not upkeep, but investment; not

maintenance or operating expenses, deductible under subdivision First, 12(a),

but capital, subject to annual allowances for exhaustion or depreciation under

subdivision Second.

Nevertheless, do such expenditures come within the words 'rentals or other

payments required to be made as a condition to the continued use or possession

of property'? We think not. The statement of the court below that it was

conceded by both parties that the expenditures were 'additional rentals' is

challenged by the government and does not seem to have support in the record.

The term 'rentals,' since there is nothing to indicate the contrary, must be taken

in its usual and ordinary sense, that is, as implying a fixed sum, or property

amounting to a fixed sum, to be paid at stated times for the use of property.

Dodge v. Hogan, 19 R. I. 4, 11, 31 A. 268, 1059; 2 Washburn, Real Property

(6th Ed.) 1187; and in that sense it does not include payments, uncertain both

as to amount and time, made for the cost of improvements or even for taxes.

Guild v. Sampson, 232 Mass. 509, 513, 122 N. E. 712; Garner v. Hannah, 13

N. Y. Super. Ct. 262, 266, 267; Bien v. Bixby, 18 Misc. Rep. 415, 41 N. Y. S.

433, 435; Simonelli v. Di Ericco, 59 Misc. Rep. 485, 110 N. Y. S. 1044, 1045.

Expenditures, therefore, like those here involved, made for betterments and

additions to leased premises, cannot be deducted under the term 'rentals,' in the

absence of circumstances fairly importing an exceptional meaning; and these

we do not find in respect of the statute under review. Nor do such expenditures

come within the phrase 'or other payments,' which was evidently meant to bring

in payments ejusdem generis with 'rentals,' such as taxes, insurance, interest on

mortgages, and the like, constituting liabilities of the lessor on account of the

leased premises which the lessee has covenanted to pay.

In respect of the 999-year leases, the additions and betterments will all be

consumed in their use by the lessee within a fraction of the term, and, as to

them, allowances for annual depreciation will suffice to meet the requirements

of the statute. In the case of the pier leases, the improvements may and

probably will outlast the term, and, as to them, deductions may more properly

take the form of proportionate annual allowances for exhaustion.

The judgment below cannot be sustained except for $37,781.54, the amount of

a conceded overpayment, with interest thereon as allowed by the trial court.

Judgment reversed, and cause remanded, with instructions to modify the

judgment in conformity with this opinion.

Second. All losses actually sustained and charged off within the year and not

compensated by insurance or otherwise, including a reasonable allowance for

the exhaustion, wear and tear of property arising out of its use or employment in

the business: * * * Provided, that no deduction shall be allowed for any amount

paid out for new buildings, permanent improvements, or betterments made to

increase the value of any property or estate, and no deduction shall be made for

any amount of expense of restoring property or making good the exhaustion

thereof for which an allowance is or has been made. * * *

Perhaps a critical analysis of the detailed statement found in the record might

reveal items of minor importance which are of this character, or which might be

classed as 'rentals or other payments'; but since no point appears to be made in

respect of such a differentiation we do not consider it.

Potrebbero piacerti anche

- Pledger v. Russell, 10th Cir. (2017)Documento5 paginePledger v. Russell, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Payment AgreementDocumento4 paginePayment AgreementIvy PazNessuna valutazione finora

- United States v. Garcia-Damian, 10th Cir. (2017)Documento9 pagineUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Documento22 pagineConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Sample Demand For Full Satisfaction of Judgment in CaliforniaDocumento3 pagineSample Demand For Full Satisfaction of Judgment in CaliforniaStan Burman100% (3)

- In The Matter To Declare in Contempt of Court Hon. Simeon A. DatumanongDocumento2 pagineIn The Matter To Declare in Contempt of Court Hon. Simeon A. DatumanongElyn ApiadoNessuna valutazione finora

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Documento21 pagineCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento10 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsDa EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsValutazione: 3 su 5 stelle3/5 (1)

- Tagaytay Realty Co. V GatucanDocumento3 pagineTagaytay Realty Co. V GatucanJustineNessuna valutazione finora

- Rudi Schwab: The Forgotten Letters by Daniel SchwabDocumento138 pagineRudi Schwab: The Forgotten Letters by Daniel SchwabDaniel SchwabNessuna valutazione finora

- Helvering v. Bruun, 309 U.S. 461 (1940)Documento6 pagineHelvering v. Bruun, 309 U.S. 461 (1940)Scribd Government DocsNessuna valutazione finora

- PDF Loose ThreadsDocumento241 paginePDF Loose Threadsikkiik509 EndNessuna valutazione finora

- Edgar Cokaliong Vs UCPB - Sealand Service Inc. Vs IACDocumento2 pagineEdgar Cokaliong Vs UCPB - Sealand Service Inc. Vs IAC001nooneNessuna valutazione finora

- Labour Law ProjectDocumento26 pagineLabour Law Projecthargun100% (1)

- Allen Vs AlbayDocumento2 pagineAllen Vs AlbayJan Re Espina CadeleñaNessuna valutazione finora

- History of Fort Bonifacio TaguigDocumento4 pagineHistory of Fort Bonifacio TaguigCyra EstacioNessuna valutazione finora

- Roy Padilla, Et Al V. Court of AppealsDocumento1 paginaRoy Padilla, Et Al V. Court of AppealsJill BagaoisanNessuna valutazione finora

- Palmer v. Connecticut Railway & Lighting Co., 311 U.S. 544 (1941)Documento14 paginePalmer v. Connecticut Railway & Lighting Co., 311 U.S. 544 (1941)Scribd Government DocsNessuna valutazione finora

- David Dab and Rose Dab v. Commissioner of Internal Revenue, 255 F.2d 788, 2d Cir. (1958)Documento3 pagineDavid Dab and Rose Dab v. Commissioner of Internal Revenue, 255 F.2d 788, 2d Cir. (1958)Scribd Government DocsNessuna valutazione finora

- Helvering v. F. & R. Lazarus & Co., 308 U.S. 252 (1939)Documento4 pagineHelvering v. F. & R. Lazarus & Co., 308 U.S. 252 (1939)Scribd Government DocsNessuna valutazione finora

- Tax1-Helvering Vs BruunDocumento6 pagineTax1-Helvering Vs BruunSuiNessuna valutazione finora

- Lynchburg Nat. Bank & Trust Co. v. Commissioner of Internal Revenue, 208 F.2d 757, 4th Cir. (1953)Documento3 pagineLynchburg Nat. Bank & Trust Co. v. Commissioner of Internal Revenue, 208 F.2d 757, 4th Cir. (1953)Scribd Government DocsNessuna valutazione finora

- Millinery Center Building Corp. v. Commissioner, 350 U.S. 456 (1956)Documento4 pagineMillinery Center Building Corp. v. Commissioner, 350 U.S. 456 (1956)Scribd Government DocsNessuna valutazione finora

- Hotel Kingkade v. Commissioner of Internal Revenue, 180 F.2d 310, 10th Cir. (1950)Documento5 pagineHotel Kingkade v. Commissioner of Internal Revenue, 180 F.2d 310, 10th Cir. (1950)Scribd Government DocsNessuna valutazione finora

- Fribourg Nav. Co. v. Commissioner, 383 U.S. 272 (1966)Documento21 pagineFribourg Nav. Co. v. Commissioner, 383 U.S. 272 (1966)Scribd Government DocsNessuna valutazione finora

- Fall River Gas Appliance Company, Inc. v. Commissioner of Internal Revenue, 349 F.2d 515, 1st Cir. (1965)Documento4 pagineFall River Gas Appliance Company, Inc. v. Commissioner of Internal Revenue, 349 F.2d 515, 1st Cir. (1965)Scribd Government DocsNessuna valutazione finora

- Millinery Center Building Corporation v. Commissioner of Internal Revenue, 221 F.2d 322, 2d Cir. (1955)Documento4 pagineMillinery Center Building Corporation v. Commissioner of Internal Revenue, 221 F.2d 322, 2d Cir. (1955)Scribd Government DocsNessuna valutazione finora

- HELVERINGDocumento3 pagineHELVERINGRavenFoxNessuna valutazione finora

- 20 - Helvering v. Bruun (1940)Documento9 pagine20 - Helvering v. Bruun (1940)KristianNessuna valutazione finora

- Board of Commrs. v. NY Tel. Co., 271 U.S. 23 (1926)Documento7 pagineBoard of Commrs. v. NY Tel. Co., 271 U.S. 23 (1926)Scribd Government DocsNessuna valutazione finora

- Whipple v. Commissioner, 373 U.S. 193 (1963)Documento9 pagineWhipple v. Commissioner, 373 U.S. 193 (1963)Scribd Government DocsNessuna valutazione finora

- Joseph A. Zwetchkenbaum v. Commissioner of Internal Revenue, 326 F.2d 477, 1st Cir. (1964)Documento6 pagineJoseph A. Zwetchkenbaum v. Commissioner of Internal Revenue, 326 F.2d 477, 1st Cir. (1964)Scribd Government DocsNessuna valutazione finora

- Almota Farmers Elevator & Whse. Co. v. United States, 409 U.S. 470 (1973)Documento13 pagineAlmota Farmers Elevator & Whse. Co. v. United States, 409 U.S. 470 (1973)Scribd Government DocsNessuna valutazione finora

- In Re Airlift International, Inc., Debtor, Gatx Leasing Corp. v. Airlift International, Inc., 761 F.2d 1503, 11th Cir. (1985)Documento14 pagineIn Re Airlift International, Inc., Debtor, Gatx Leasing Corp. v. Airlift International, Inc., 761 F.2d 1503, 11th Cir. (1985)Scribd Government DocsNessuna valutazione finora

- Credtrans Cases 1-6Documento23 pagineCredtrans Cases 1-6FJ Valerio - LumioNessuna valutazione finora

- Hofferbert, Collector of Internal Revenue v. Briggs, 178 F.2d 743, 4th Cir. (1949)Documento4 pagineHofferbert, Collector of Internal Revenue v. Briggs, 178 F.2d 743, 4th Cir. (1949)Scribd Government DocsNessuna valutazione finora

- Higgins v. Commissioner, 312 U.S. 212 (1941)Documento5 pagineHiggins v. Commissioner, 312 U.S. 212 (1941)Scribd Government DocsNessuna valutazione finora

- Burnet v. Sanford & Brooks Co., 282 U.S. 359 (1931)Documento5 pagineBurnet v. Sanford & Brooks Co., 282 U.S. 359 (1931)Scribd Government DocsNessuna valutazione finora

- Commissioner v. Gillette Motor Transport, Inc., 364 U.S. 130 (1960)Documento5 pagineCommissioner v. Gillette Motor Transport, Inc., 364 U.S. 130 (1960)Scribd Government DocsNessuna valutazione finora

- Carolina, Clinchfield and Ohio Railway Company v. Commissioner of Internal Revenue, 823 F.2d 33, 2d Cir. (1987)Documento3 pagineCarolina, Clinchfield and Ohio Railway Company v. Commissioner of Internal Revenue, 823 F.2d 33, 2d Cir. (1987)Scribd Government DocsNessuna valutazione finora

- Commissioner of Internal Revenue v. Oxford Paper Co, 194 F.2d 190, 2d Cir. (1952)Documento3 pagineCommissioner of Internal Revenue v. Oxford Paper Co, 194 F.2d 190, 2d Cir. (1952)Scribd Government DocsNessuna valutazione finora

- Jordan Marsh Company v. Commissioner of Internal Revenue, 269 F.2d 453, 2d Cir. (1959)Documento8 pagineJordan Marsh Company v. Commissioner of Internal Revenue, 269 F.2d 453, 2d Cir. (1959)Scribd Government DocsNessuna valutazione finora

- Grant, Collector v. Hartford and New Haven Railroad Company, 93 U.S. 225 (1876)Documento4 pagineGrant, Collector v. Hartford and New Haven Railroad Company, 93 U.S. 225 (1876)Scribd Government DocsNessuna valutazione finora

- Jesse Johnson and Virginia D. Johnson v. Commissioner of Internal Revenue, 233 F.2d 752, 4th Cir. (1956)Documento5 pagineJesse Johnson and Virginia D. Johnson v. Commissioner of Internal Revenue, 233 F.2d 752, 4th Cir. (1956)Scribd Government DocsNessuna valutazione finora

- Helvering v. New York Trust Co., 292 U.S. 455 (1934)Documento11 pagineHelvering v. New York Trust Co., 292 U.S. 455 (1934)Scribd Government DocsNessuna valutazione finora

- Clarence K. Howe and Margaret C. Howe v. Commissioner of Internal Revenue, 814 F.2d 98, 2d Cir. (1987)Documento7 pagineClarence K. Howe and Margaret C. Howe v. Commissioner of Internal Revenue, 814 F.2d 98, 2d Cir. (1987)Scribd Government DocsNessuna valutazione finora

- McCoach v. Minehill & Schuylkill Haven R. Co., 228 U.S. 295 (1913)Documento12 pagineMcCoach v. Minehill & Schuylkill Haven R. Co., 228 U.S. 295 (1913)Scribd Government DocsNessuna valutazione finora

- Mills Estate, Inc. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Mills Estate, Inc, 206 F.2d 244, 2d Cir. (1953)Documento4 pagineMills Estate, Inc. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Mills Estate, Inc, 206 F.2d 244, 2d Cir. (1953)Scribd Government DocsNessuna valutazione finora

- Commissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Documento4 pagineCommissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Scribd Government DocsNessuna valutazione finora

- New York Life Ins. Co. v. Edwards, 271 U.S. 109 (1926)Documento6 pagineNew York Life Ins. Co. v. Edwards, 271 U.S. 109 (1926)Scribd Government DocsNessuna valutazione finora

- Lincoln Gas & Elec. Light Co. v. City of Lincoln, 223 U.S. 349 (1912)Documento7 pagineLincoln Gas & Elec. Light Co. v. City of Lincoln, 223 U.S. 349 (1912)Scribd Government DocsNessuna valutazione finora

- TRANSLINERDocumento2 pagineTRANSLINERMARRYROSE LASHERASNessuna valutazione finora

- Objection Deadline: December 21, 2008 at 4:00 P.M.: Extended To December 22, 2008 at 4:00 P.MDocumento21 pagineObjection Deadline: December 21, 2008 at 4:00 P.M.: Extended To December 22, 2008 at 4:00 P.MChapter 11 DocketsNessuna valutazione finora

- V. Loewers Gambrinus Brewery Co. v. Anderson, 282 U.S. 638 (1931)Documento6 pagineV. Loewers Gambrinus Brewery Co. v. Anderson, 282 U.S. 638 (1931)Scribd Government DocsNessuna valutazione finora

- New Colonial Ice Co. v. Helvering, 292 U.S. 435 (1934)Documento6 pagineNew Colonial Ice Co. v. Helvering, 292 U.S. 435 (1934)Scribd Government DocsNessuna valutazione finora

- Pacific Gas & Elec. Co. v. City and County of San Francisco, 265 U.S. 403 (1924)Documento15 paginePacific Gas & Elec. Co. v. City and County of San Francisco, 265 U.S. 403 (1924)Scribd Government DocsNessuna valutazione finora

- Midler Court Realty, Inc. v. Commissioner of Internal Revenue, 521 F.2d 767, 3rd Cir. (1975)Documento7 pagineMidler Court Realty, Inc. v. Commissioner of Internal Revenue, 521 F.2d 767, 3rd Cir. (1975)Scribd Government DocsNessuna valutazione finora

- M. Dematteo Construction Co. v. United States, 433 F.2d 1263, 1st Cir. (1970)Documento4 pagineM. Dematteo Construction Co. v. United States, 433 F.2d 1263, 1st Cir. (1970)Scribd Government DocsNessuna valutazione finora

- Case NoteDocumento5 pagineCase NoteNadibNessuna valutazione finora

- Yoke, Collector of Internal Revenue v. Mazzello, 202 F.2d 508, 4th Cir. (1953)Documento5 pagineYoke, Collector of Internal Revenue v. Mazzello, 202 F.2d 508, 4th Cir. (1953)Scribd Government DocsNessuna valutazione finora

- Manufacturers Hanover Trust Co., Robert P. Payne and Charles C. Parlin, As Trustees U/i 6/4/32 by Anne D. Dillon, As Grantor v. Commissioner of Internal Revenue, 431 F.2d 664, 2d Cir. (1970)Documento6 pagineManufacturers Hanover Trust Co., Robert P. Payne and Charles C. Parlin, As Trustees U/i 6/4/32 by Anne D. Dillon, As Grantor v. Commissioner of Internal Revenue, 431 F.2d 664, 2d Cir. (1970)Scribd Government DocsNessuna valutazione finora

- The Smoot Sand & Gravel Corporation v. Commissioner of Internal Revenue, 241 F.2d 197, 4th Cir. (1957)Documento14 pagineThe Smoot Sand & Gravel Corporation v. Commissioner of Internal Revenue, 241 F.2d 197, 4th Cir. (1957)Scribd Government DocsNessuna valutazione finora

- First Nat. Bank of Kansas City v. Nee, 190 F.2d 61, 1st Cir. (1951)Documento19 pagineFirst Nat. Bank of Kansas City v. Nee, 190 F.2d 61, 1st Cir. (1951)Scribd Government DocsNessuna valutazione finora

- Leslie Co. v. Commissioner of Internal Revenue, 539 F.2d 943, 3rd Cir. (1976)Documento11 pagineLeslie Co. v. Commissioner of Internal Revenue, 539 F.2d 943, 3rd Cir. (1976)Scribd Government DocsNessuna valutazione finora

- Fribourg Navigation Company, Inc. v. Commissioner of Internal Revenue, 335 F.2d 15, 2d Cir. (1964)Documento12 pagineFribourg Navigation Company, Inc. v. Commissioner of Internal Revenue, 335 F.2d 15, 2d Cir. (1964)Scribd Government DocsNessuna valutazione finora

- Burnet v. Niagara Falls Brewing Co., 282 U.S. 648 (1931)Documento5 pagineBurnet v. Niagara Falls Brewing Co., 282 U.S. 648 (1931)Scribd Government DocsNessuna valutazione finora

- 13th Meeting DigestsDocumento9 pagine13th Meeting DigestsChristin Jireh NabataNessuna valutazione finora

- Thomas McCaffrey Jr. v. Commissioner of Internal Revenue, 275 F.2d 27, 3rd Cir. (1960)Documento9 pagineThomas McCaffrey Jr. v. Commissioner of Internal Revenue, 275 F.2d 27, 3rd Cir. (1960)Scribd Government DocsNessuna valutazione finora

- Kalima vs. Hawaii 2009-11-03 Decision Re Liablity and Legal Causation-OCRDocumento18 pagineKalima vs. Hawaii 2009-11-03 Decision Re Liablity and Legal Causation-OCRscribd.hi.lgns8853Nessuna valutazione finora

- Harry Rosen and Rose Rosen v. United States, 288 F.2d 658, 3rd Cir. (1961)Documento6 pagineHarry Rosen and Rose Rosen v. United States, 288 F.2d 658, 3rd Cir. (1961)Scribd Government DocsNessuna valutazione finora

- Sun Oil Company, Transferee, Sunray DX Oil Company and Subsidiaries, Transferor v. Commissioner of Internal Revenue, 562 F.2d 258, 3rd Cir. (1977)Documento17 pagineSun Oil Company, Transferee, Sunray DX Oil Company and Subsidiaries, Transferor v. Commissioner of Internal Revenue, 562 F.2d 258, 3rd Cir. (1977)Scribd Government DocsNessuna valutazione finora

- Ellis Campbell, JR., Director of Internal Revenue For The Second Collection District of Texas v. Great National Life Insurance Company, 219 F.2d 693, 2d Cir. (1955)Documento9 pagineEllis Campbell, JR., Director of Internal Revenue For The Second Collection District of Texas v. Great National Life Insurance Company, 219 F.2d 693, 2d Cir. (1955)Scribd Government DocsNessuna valutazione finora

- Liant Record, Inc., William I. Alpert and Paula G. Alpert, Abraham Alpert and Sarah Alpert, Jack L. Alpert v. Commissioner of Internal Revenue, 303 F.2d 326, 2d Cir. (1962)Documento6 pagineLiant Record, Inc., William I. Alpert and Paula G. Alpert, Abraham Alpert and Sarah Alpert, Jack L. Alpert v. Commissioner of Internal Revenue, 303 F.2d 326, 2d Cir. (1962)Scribd Government DocsNessuna valutazione finora

- PROPERTYDocumento9 paginePROPERTYAbdullah Jawad MalikNessuna valutazione finora

- Coyle v. Jackson, 10th Cir. (2017)Documento7 pagineCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Documento20 pagineUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Olden, 10th Cir. (2017)Documento4 pagineUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Pecha v. Lake, 10th Cir. (2017)Documento25 paginePecha v. Lake, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Apodaca v. Raemisch, 10th Cir. (2017)Documento15 pagineApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Muhtorov, 10th Cir. (2017)Documento15 pagineUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Documento100 pagineHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Roberson, 10th Cir. (2017)Documento50 pagineUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento24 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- United States v. Voog, 10th Cir. (2017)Documento5 pagineUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento14 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Documento25 pagineUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Kearn, 10th Cir. (2017)Documento25 pagineUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Henderson, 10th Cir. (2017)Documento2 pagineUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Magnan, 10th Cir. (2017)Documento4 pagineUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Documento9 pagineNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Robles v. United States, 10th Cir. (2017)Documento5 pagineRobles v. United States, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Chevron Mining v. United States, 10th Cir. (2017)Documento42 pagineChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento17 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- United States v. Magnan, 10th Cir. (2017)Documento27 pagineUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Kundo, 10th Cir. (2017)Documento7 pagineUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Jimenez v. Allbaugh, 10th Cir. (2017)Documento5 pagineJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Coburn v. Wilkinson, 10th Cir. (2017)Documento9 pagineCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Northern New Mexicans v. United States, 10th Cir. (2017)Documento10 pagineNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Purify, 10th Cir. (2017)Documento4 pagineUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- AbortionDocumento2 pagineAbortionJosselle KilitoyNessuna valutazione finora

- Notice Walmart and MCSO Violation Americans With Disabilities Act (ADA)Documento2 pagineNotice Walmart and MCSO Violation Americans With Disabilities Act (ADA)Neil GillespieNessuna valutazione finora

- Prisoner of Zenda - Elements of The NovelDocumento16 paginePrisoner of Zenda - Elements of The NovelNor Azizah Bachok100% (5)

- EE319 Lab 2Documento3 pagineEE319 Lab 2Fathan NaufalNessuna valutazione finora

- Da Pam 600-3-31 Branch Code 31 Military PoliceDocumento18 pagineDa Pam 600-3-31 Branch Code 31 Military PoliceMark CheneyNessuna valutazione finora

- Sports BettingDocumento7 pagineSports BettingarnavbishnoiNessuna valutazione finora

- The Dark Side of Anwar Sadat WASHINGTON POSTDocumento2 pagineThe Dark Side of Anwar Sadat WASHINGTON POSTKarim MerabetNessuna valutazione finora

- Hollywood Reloaded PDFDocumento16 pagineHollywood Reloaded PDFΚώσταςΣταματόπουλοςNessuna valutazione finora

- 16-1 January IssueDocumento16 pagine16-1 January Issuedisaacson1Nessuna valutazione finora

- United States v. Anthony Frank Gaggi, Henry Borelli, Peter Lafroscia, Ronald Ustica, Edward Rendini and Ronald Turekian, 811 F.2d 47, 2d Cir. (1987)Documento23 pagineUnited States v. Anthony Frank Gaggi, Henry Borelli, Peter Lafroscia, Ronald Ustica, Edward Rendini and Ronald Turekian, 811 F.2d 47, 2d Cir. (1987)Scribd Government DocsNessuna valutazione finora

- Airfreight 2100, Inc.Documento2 pagineAirfreight 2100, Inc.ben carlo ramos srNessuna valutazione finora

- Laporan KKI Ke POSI 2021Documento5 pagineLaporan KKI Ke POSI 2021dheoakuNessuna valutazione finora

- (CD) Aguilar vs. CA - G.R. No. 76351 - October 29, 1993 - AZapantaDocumento1 pagina(CD) Aguilar vs. CA - G.R. No. 76351 - October 29, 1993 - AZapantaAmiel Gian Mario ZapantaNessuna valutazione finora

- JQC Complaint No. No 12385 Judge Claudia Rickert IsomDocumento165 pagineJQC Complaint No. No 12385 Judge Claudia Rickert IsomNeil GillespieNessuna valutazione finora

- San Mateo Daily Journal 02-09-19 EditionDocumento32 pagineSan Mateo Daily Journal 02-09-19 EditionSan Mateo Daily JournalNessuna valutazione finora

- Torres-Madrid Brokerage, Inc. v. Feb Mitsui Marine Ins. Co., Inc.Documento8 pagineTorres-Madrid Brokerage, Inc. v. Feb Mitsui Marine Ins. Co., Inc.hijo depotaNessuna valutazione finora

- Four of The Most Basic Leadership Styles AreDocumento8 pagineFour of The Most Basic Leadership Styles AreMc SuanNessuna valutazione finora

- Article JSTOR - Roman Army Pay Scales (Michael A. Speidel)Documento22 pagineArticle JSTOR - Roman Army Pay Scales (Michael A. Speidel)Dada MamusaNessuna valutazione finora

- Mulugeta AbrhaDocumento104 pagineMulugeta Abrhafraol alemuNessuna valutazione finora

- Answers 6.3.2021Documento9 pagineAnswers 6.3.2021rubby deanNessuna valutazione finora