Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Public Economics-Course Syllabus

Caricato da

shuvamTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Public Economics-Course Syllabus

Caricato da

shuvamCopyright:

Formati disponibili

HS 549

PUBLIC ECONOMICS

Course Co-ordinator: Dr. Mantu Kumar Mahalik

3 credits [3-0-0]

Modules:

Unit-1: Role of Government in Economy, Theory of Social goods, and Theory of Public

Choice

Unit-2: Public Expenditure: Growth and structure of Public Expenditure, Public

expenditure management, cost benefit analysis of public expenditure, evaluation of public

expenditure-principle and problems, subsidies

Unit-3: Public Revenue: Issues in individual income taxation, corporate taxation, income

tax integration, principle of taxation, indirect taxation-principle and issues, value added tax

(VAT)-principle and issues, and Non-tax revenue

Unit-4: Federal Finance: Principle of federal finance, centre-state relationship.

Course Outcomes: Public economics is the study of government policy in the basic provision of

social goods and services. In making government intervention more effective in the intervention of

social sector, the better management of government investment and expenditure should be necessary.

To check whether the effective allocation of government spending towards economic activities, public

policy as part of public economics plays a vital role in this aspect. The main objective of public policy

is to create employment opportunities, reduce poverty and income inequality, and also to achieve

sustainable economic growth and development. In order to have sustainable growth and development,

financing fiscal spending should be accommodated by the revenues generated from various fiscal

direct and indirect taxes. Since the developing countries are often characterized by the presence of

resources and (financial, human, social and physical capitals), it is useful for the underdeveloped

economy to prefer some sort of changes and shifting transformation from planned economy to market

oriented economy. Such liberal policy will enable fiscal government of developing countries to

support their consumption and investment expenditures by attracting more private players as we

believe that private players are operationally efficient. In this regard, microeconomic theory is utilized

to assess whether the private players likely to provide efficient outcomes in the absence of

governmental interference. Inherently, this study involves the analysis of government taxation and

expenditures. This subject encompasses a host of topics including market failures, externalities, and

the creation and implementation of government policy. Public economics builds on the theory of

welfare economics and is ultimately being used as a tool to improve social welfare.

Essential Readings

1. Harvey, Rosen, Public Finance (Second Edition), IRWIN, Homewood, 1988.

2. Atkinson, A. B. and Stiglitz, J.E., Lecturer in Public Economics, McGraw-Hill, New York

1980.

3. Myles, Garesth D, Public Economics, Cambridge University Press, 1995.

Supplementary Readings

1. Boadway Robin W Wildasin David E., Public Sector Economics, (2nd Edition), Little Brown,

Boston, 1984.

2. Musgrave, Richard A & Shoup, Carl S (ed), Classics of the Theory of Public Finance,

Macmillan, 1962.

3. Musgrave Richard A, Fiscal System, Yale University Press, New Haven and London, 1969.

Potrebbero piacerti anche

- Economics Lessons for the Tea Party, Most Conservatives and Some EconomistsDa EverandEconomics Lessons for the Tea Party, Most Conservatives and Some EconomistsNessuna valutazione finora

- 02 Ch2 Public Finance - Practice SheetDocumento17 pagine02 Ch2 Public Finance - Practice SheetDhruvi VachhaniNessuna valutazione finora

- Role of Social Marketing in Social Enterprises: The Case of GawleDa EverandRole of Social Marketing in Social Enterprises: The Case of GawleNessuna valutazione finora

- SEC 332/BEC 432 Lecturer: M.C. MulengaDocumento26 pagineSEC 332/BEC 432 Lecturer: M.C. MulengaMiyanda Hakauba HayombweNessuna valutazione finora

- A U-Turn on the Road to Serfdom: Prospects for Reducing the Size of the StateDa EverandA U-Turn on the Road to Serfdom: Prospects for Reducing the Size of the StateNessuna valutazione finora

- Public Finance Principles OverviewDocumento12 paginePublic Finance Principles OverviewShie RontaloNessuna valutazione finora

- Unit-1-Introduction To Public FinanceDocumento20 pagineUnit-1-Introduction To Public FinanceLavanya TanwarNessuna valutazione finora

- (Peco 201) 5Documento15 pagine(Peco 201) 5sriram pvNessuna valutazione finora

- (Peco 201) 3Documento14 pagine(Peco 201) 3sriram pvNessuna valutazione finora

- Public FinanceDocumento5 paginePublic FinanceANAM RAUF (GCUF)100% (1)

- (Peco 201) 6Documento14 pagine(Peco 201) 6sriram pvNessuna valutazione finora

- Ass YmentDocumento5 pagineAss YmentJacksonNessuna valutazione finora

- Article On Effects of Public ExpenditureDocumento11 pagineArticle On Effects of Public Expendituretanmoydebnath474Nessuna valutazione finora

- Eae 313 Public Finance Topic One Sept 2022Documento11 pagineEae 313 Public Finance Topic One Sept 2022Nereah DebrahNessuna valutazione finora

- Role of Government in The Economy MBS First YearDocumento27 pagineRole of Government in The Economy MBS First YearStore Sansar100% (1)

- EAE 313 AEC 307 PUBLIC FINANCE fINAL (2) - 1-1-2Documento150 pagineEAE 313 AEC 307 PUBLIC FINANCE fINAL (2) - 1-1-2Teddy jeremyNessuna valutazione finora

- Musgrave Et Al 1Documento24 pagineMusgrave Et Al 1regiscribNessuna valutazione finora

- Theory of Public ExpenditureDocumento16 pagineTheory of Public ExpenditureAkilesh AkNessuna valutazione finora

- ECO 3729 - Public EconomicsDocumento3 pagineECO 3729 - Public EconomicsSuditi TandonNessuna valutazione finora

- Public Finance II Year PDFDocumento18 paginePublic Finance II Year PDFerekNessuna valutazione finora

- h1 Public EconomicsDocumento9 pagineh1 Public EconomicsRajiv VyasNessuna valutazione finora

- Pahs 053 - Public FinanceDocumento69 paginePahs 053 - Public Financerichardanakwa1xNessuna valutazione finora

- 126 - Shrey Ladani - Literature Review 1Documento3 pagine126 - Shrey Ladani - Literature Review 1Pushkar OakNessuna valutazione finora

- Public Finance - Basic Concepts, Ties and Aspects: Aim of This ChapterDocumento75 paginePublic Finance - Basic Concepts, Ties and Aspects: Aim of This Chapterdiy with OshinixNessuna valutazione finora

- About The CourseDocumento3 pagineAbout The CourseFarook ShaikhNessuna valutazione finora

- PFT HandOutDocumento14 paginePFT HandOutyechale tafereNessuna valutazione finora

- Unit-II-Business Environment Notes: Role 1. Government: Regulator of BusinessDocumento13 pagineUnit-II-Business Environment Notes: Role 1. Government: Regulator of BusinessJaspreet BhatiaNessuna valutazione finora

- Public Finance - Basic Concepts, Ties and Aspect S: Aim of This ChapterDocumento78 paginePublic Finance - Basic Concepts, Ties and Aspect S: Aim of This Chapterphilip resuelloNessuna valutazione finora

- Public Finance Week 2Documento30 paginePublic Finance Week 2Letsah BrightNessuna valutazione finora

- Assignment CP-203Documento28 pagineAssignment CP-203Arman khanNessuna valutazione finora

- Chapter 1Documento6 pagineChapter 1zelalem wegayehuNessuna valutazione finora

- M1 Introduction To Public Finance-1Documento14 pagineM1 Introduction To Public Finance-1chachagiNessuna valutazione finora

- MDS 529 - Handout 1Documento7 pagineMDS 529 - Handout 1faruque.ddsNessuna valutazione finora

- Public Finance CH1 - PrintDocumento6 paginePublic Finance CH1 - PrintWegene Benti UmaNessuna valutazione finora

- Bba 103 AssignmentDocumento7 pagineBba 103 AssignmentjasonNessuna valutazione finora

- Meaning of Public FinanceDocumento7 pagineMeaning of Public Financemahammadshaheer603Nessuna valutazione finora

- 11 Advanced Taxation Aau MaterialDocumento129 pagine11 Advanced Taxation Aau MaterialErmi ManNessuna valutazione finora

- Teju's Public Finance Hand Out PDFDocumento136 pagineTeju's Public Finance Hand Out PDFሳቢያን-nationNessuna valutazione finora

- Module 3Documento21 pagineModule 3April MaeNessuna valutazione finora

- UntitledDocumento9 pagineUntitledAbebaw DebieNessuna valutazione finora

- Paper:: 11, Managerial Economics 35, Fiscal PolicyDocumento13 paginePaper:: 11, Managerial Economics 35, Fiscal PolicyShelly SinghNessuna valutazione finora

- Reading Material - Unit-1 and 2Documento33 pagineReading Material - Unit-1 and 2Nokia PokiaNessuna valutazione finora

- Positive vs Normative EconomicsDocumento4 paginePositive vs Normative Economicssachin tendulkarNessuna valutazione finora

- Sample Notes For Public AdministrationDocumento20 pagineSample Notes For Public AdministrationHarsimran Kaur100% (1)

- Benefit Cost Analysis and Public Sector EconomicsDocumento52 pagineBenefit Cost Analysis and Public Sector EconomicsHaery SihombingNessuna valutazione finora

- Local Media6494062741669407634Documento5 pagineLocal Media6494062741669407634Lovely CabuangNessuna valutazione finora

- Course Outline For Public FinanceDocumento6 pagineCourse Outline For Public Financerami assefaNessuna valutazione finora

- International Institute of Planning and Management AhmedabadDocumento17 pagineInternational Institute of Planning and Management AhmedabadRahul Singh100% (1)

- Unit 1Documento15 pagineUnit 1Devender SinghNessuna valutazione finora

- Public Finance Lecture NotesDocumento40 paginePublic Finance Lecture NotesSenelwa Anaya100% (2)

- Public SectorDocumento3 paginePublic SectorAdebowaleIsmailGaniyuNessuna valutazione finora

- CIA15 - Study Guide1 - Public FinanceDocumento4 pagineCIA15 - Study Guide1 - Public FinanceLovely Cabuang100% (1)

- Lecture On Public Finance Econ 301: Overview of The Course What Is Public Finance ? ExpenditureDocumento10 pagineLecture On Public Finance Econ 301: Overview of The Course What Is Public Finance ? Expendituresaad aliNessuna valutazione finora

- 74670bos60481-fnd-p4-cp7-u1Documento22 pagine74670bos60481-fnd-p4-cp7-u1Sailesh GoenkkaNessuna valutazione finora

- Economics Assingment HiteshDocumento20 pagineEconomics Assingment Hiteshhitesh kashyapNessuna valutazione finora

- Module 3 - IMDocumento41 pagineModule 3 - IMDHWANI DEDHIANessuna valutazione finora

- Fiscal Policy V UNIT-1Documento10 pagineFiscal Policy V UNIT-1madhumithaNessuna valutazione finora

- Chapter One TaxationDocumento10 pagineChapter One TaxationEmebet TesemaNessuna valutazione finora

- Public FinanceDocumento163 paginePublic FinancerodyaromanoNessuna valutazione finora

- (Peco 201) 7Documento17 pagine(Peco 201) 7sriram pvNessuna valutazione finora

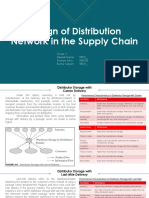

- Design of Distribution Network in The Supply ChainDocumento4 pagineDesign of Distribution Network in The Supply ChainshuvamNessuna valutazione finora

- Operation Management TasksDocumento3 pagineOperation Management TasksshuvamNessuna valutazione finora

- Waiting Lines or Queuing TheoryDocumento13 pagineWaiting Lines or Queuing TheoryshuvamNessuna valutazione finora

- Warehouse SolutionsDocumento16 pagineWarehouse SolutionsshuvamNessuna valutazione finora

- Mechanical EngineeringDocumento2 pagineMechanical EngineeringNitya SinghNessuna valutazione finora

- Power and Politics in An OrganisationDocumento16 paginePower and Politics in An Organisationshuvam100% (1)

- Marketing Solution To Select A Weeding DressDocumento9 pagineMarketing Solution To Select A Weeding DressshuvamNessuna valutazione finora

- GATE 2013 Test Series - 1Documento21 pagineGATE 2013 Test Series - 1Rupak KumarNessuna valutazione finora

- Mechanical-Engineering Gate2016.InfoDocumento3 pagineMechanical-Engineering Gate2016.InfoHenryNessuna valutazione finora

- Brazil Car Rental MarketDocumento6 pagineBrazil Car Rental Marketgiorgiogarrido6Nessuna valutazione finora

- Tobin - The Interest Elasticity of Transactions Demand For CashDocumento8 pagineTobin - The Interest Elasticity of Transactions Demand For CashWalter ArceNessuna valutazione finora

- Converged Systems Sales PlaybookDocumento12 pagineConverged Systems Sales PlaybookPeter Stone100% (3)

- Bajaj Allianz General Insurance Company LTD.: Declaration by The InsuredDocumento1 paginaBajaj Allianz General Insurance Company LTD.: Declaration by The InsuredArtiNessuna valutazione finora

- Regional CSHP report for NCR projects in September 2017Documento53 pagineRegional CSHP report for NCR projects in September 2017JohnmoiNessuna valutazione finora

- Deal ContractDocumento4 pagineDeal ContractRocketLawyerNessuna valutazione finora

- Disini StartUpGuide InteractiveDocumento19 pagineDisini StartUpGuide InteractiveDammy VegaNessuna valutazione finora

- Computer Simulation With Crystal Ball Solution To Solved ProblemsDocumento3 pagineComputer Simulation With Crystal Ball Solution To Solved Problemsprashantgargindia_93Nessuna valutazione finora

- Startup Summit Agenda - Chennai 2016Documento8 pagineStartup Summit Agenda - Chennai 2016Srinivas YakkalaNessuna valutazione finora

- Chapter 7 Problem 7.3 Nathali, Jeffrey, TasyaDocumento6 pagineChapter 7 Problem 7.3 Nathali, Jeffrey, Tasyavtech netNessuna valutazione finora

- Uttara BankDocumento67 pagineUttara Bankenamahmed50Nessuna valutazione finora

- Banks rely on branches to drive future growthDocumento6 pagineBanks rely on branches to drive future growthHien Bui100% (1)

- Why Accounting Research Skills Matter for Career SuccessDocumento18 pagineWhy Accounting Research Skills Matter for Career SuccessRudy0% (1)

- Indian Family Managed BusinessDocumento17 pagineIndian Family Managed BusinessAnuranjanSinha100% (6)

- 2012 National BudgetDocumento236 pagine2012 National BudgetPrince ZhouNessuna valutazione finora

- The Future of Export-Led Growth: A General AssessmentDocumento24 pagineThe Future of Export-Led Growth: A General AssessmentSiddharth SharmaNessuna valutazione finora

- RBI ECB GuidelinesDocumento19 pagineRBI ECB GuidelinesnareshkapoorsNessuna valutazione finora

- Blueprint For Restoring Safety and Soundness To The GSEs November 2018Documento32 pagineBlueprint For Restoring Safety and Soundness To The GSEs November 2018GSE Safety and SoundnessNessuna valutazione finora

- General StrategyDocumento5 pagineGeneral StrategyBenjamin DavidsonNessuna valutazione finora

- Pre Qualifying ExamDocumento14 paginePre Qualifying ExamGelyn CruzNessuna valutazione finora

- Pfizer, Inc: Company ValuationDocumento15 paginePfizer, Inc: Company ValuationPriyanka Jayanth DubeNessuna valutazione finora

- Indiafirst Smartsaveplan Onepager 19122013Documento2 pagineIndiafirst Smartsaveplan Onepager 19122013N-1397-10 KANISHKA Y HARDASANINessuna valutazione finora

- Growth Through Acquisition (Anslinger Copeland)Documento15 pagineGrowth Through Acquisition (Anslinger Copeland)Andre Bigo100% (1)

- Understanding Monetary Policy Series No 49Documento38 pagineUnderstanding Monetary Policy Series No 49Rodrigo CaldasNessuna valutazione finora

- Comparative Financial Analysis of Three Banks of India PDFDocumento86 pagineComparative Financial Analysis of Three Banks of India PDFSamiksha Gawas100% (1)

- Mr. Butler's Loan Requirements for Lumber Company ExpansionDocumento6 pagineMr. Butler's Loan Requirements for Lumber Company ExpansionamanNessuna valutazione finora

- Mindtree ValuationDocumento74 pagineMindtree ValuationAmit RanderNessuna valutazione finora

- Acctg 11-1 Gbs For Week 11Documento5 pagineAcctg 11-1 Gbs For Week 11Ynna Gesite0% (1)

- Homework 6Documento6 pagineHomework 6LiamNessuna valutazione finora

- Internal Control Systems at IFIC BankDocumento35 pagineInternal Control Systems at IFIC BankNishatNessuna valutazione finora

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetDa EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNessuna valutazione finora

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDa EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNessuna valutazione finora

- How an Economy Grows and Why It Crashes: Collector's EditionDa EverandHow an Economy Grows and Why It Crashes: Collector's EditionValutazione: 4.5 su 5 stelle4.5/5 (102)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaDa EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNessuna valutazione finora

- Look Again: The Power of Noticing What Was Always ThereDa EverandLook Again: The Power of Noticing What Was Always ThereValutazione: 5 su 5 stelle5/5 (3)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDa EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingValutazione: 4.5 su 5 stelle4.5/5 (97)

- Second Class: How the Elites Betrayed America's Working Men and WomenDa EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNessuna valutazione finora

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesDa EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesValutazione: 4.5 su 5 stelle4.5/5 (8)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsDa EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsValutazione: 4.5 su 5 stelle4.5/5 (94)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyDa EverandChip War: The Quest to Dominate the World's Most Critical TechnologyValutazione: 4.5 su 5 stelle4.5/5 (227)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldDa EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldValutazione: 4 su 5 stelle4/5 (16)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineDa EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineValutazione: 4.5 su 5 stelle4.5/5 (36)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentDa EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentValutazione: 4.5 su 5 stelle4.5/5 (92)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDa EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNessuna valutazione finora

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsDa EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsValutazione: 5 su 5 stelle5/5 (2)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationDa EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationValutazione: 4.5 su 5 stelle4.5/5 (46)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomDa EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNessuna valutazione finora

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailDa EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailValutazione: 4.5 su 5 stelle4.5/5 (237)

- Against the Gods: The Remarkable Story of RiskDa EverandAgainst the Gods: The Remarkable Story of RiskValutazione: 4 su 5 stelle4/5 (352)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyDa EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyValutazione: 4.5 su 5 stelle4.5/5 (69)

- The Ascent of Money: A Financial History of the WorldDa EverandThe Ascent of Money: A Financial History of the WorldValutazione: 4.5 su 5 stelle4.5/5 (132)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyDa EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyValutazione: 4.5 su 5 stelle4.5/5 (263)