Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Handout Cash Flows

Caricato da

Anonymous XqMs1jFTjCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Handout Cash Flows

Caricato da

Anonymous XqMs1jFTjCopyright:

Formati disponibili

ACC111:

Resource

Management

Kristin

A.

Militante

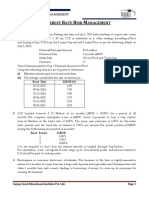

Statement of Cash Flows (Indirect Method)

Cash Flows from Operating Activities

Net income

Adjustments for noncash items:

+ Depreciation Expense

xxx

+ Bad Debts Expense

xxx

+ Losses on sale of assets

xxx

- Gains on sale of assets

(xxx)

Adjustments for changes in the current operating

accounts (except cash)

- increase in Current Assets

(xxx)

+ decrease in Current Assets

xxx

+ increase in Current Liabilities

xxx

- decrease in Current Liabilities

(xxx)

Net cash provided by (used in) Operating Activities

Cash Flows from Investing Activities

+ Receipts from sale of non-current assets

xx

- Payments for purchase of fixed assets

(xx)

+ Receipts from debtors for the principal amount of loan xx

- Payments to debtors for the principal amount of loan (xx)

Net cash provided by (used in) Investing Activities

Cash Flows from Financing Activities

+ Investment of owner to the business

xx

- Cash withdrawal of owner

(xx)

+ Receipts from creditors for principal amount of loans xx

- Payment to creditors for the principal amount of loans (xx)

Net cash provided by (used in) Financing Activities

Increase in cash

Cash, beginning

Cash balance, December 31, 20XX

XXX

XXX

XXX

XXX

XXX

P

XXX

XXX

P

XXX

ACC111: Resource Management

Kristin A. Militante

Adjustments Made to Net Income (Operating Activities)

Adjustments are made to net income so that we can arrive at the actual cash-out and

cash-in under operating activities.

Refer to the income statement below for letters A-F.

Happy Clinic

Income Statement

For the period ending Dec. 31, 2015

P 750,500

Service

Revenue

Depreciation Expense

35,000

Bad Debts Expense

1,000

Utilities Expense

12,000

Wages Expense

16,000

Rent Expense

36,000 -100,000

Other

Revenues and Expenses

Gain on Sale of Furniture

Loss on Sale of Motor Vehicle

Income

Net

P 800,500

200,000

-50,000

A. Adding

back

depreciation

and

bad

debts

expense

to

net

income

In

making

the

cash

flow

statement,

we

are

concerned

with

transactions

involving

cash.

Note

that

before

we

arrived

at

net

income,

we

considered

the

revenues

and

expenses

of

the

business.

Net

income

is

not

always

equal

to

cash.

Some

expenses

do

not

involve

an

actual

cash-out.

Lets

take

depreciation

expense,

for

example.

The

journal

entry

to

recognize

depreciation

would

be:

Depreciation

Expense

35,000

Accumulated

Depreciation

Equipment

35,000

Was

there

an

actual

cash-out?

No.

As

seen

in

the

journal

entry,

we

did

not

credit

cash

(therefore,

no

decrease

in

cash).

Another

example

would

be

bad

debts

expense.

To

recognize

allotment

for

uncollectible

accounts

during

the

year,

the

journal

entry

would

be:

Bad

Debts

Expense

Allowance

for

Bad

Debts

1,000

1,000

2

ACC111: Resource Management

Kristin A. Militante

Again,

there

was

no

actual

cash-out.

As

such,

we

need

add

these

two

accounts

back

to

net

income

to

recognize

the

reality

that

no

cash

was

used

when

these

expenses

were

incurred/recorded.

B. Adding

back

losses

/

subtracting

gains

on

sale

of

fixed

asset

to

net

income

Transactions

that

involve

selling

of

non-current

assets

would

fall

under

investing

activities.

At

this

point,

what

we

want

to

get

from

net

income

would

be

transactions

that

would

fall

under

operating

activities.

As

such,

we

add

back

the

loss

on

sale

on

fixed

asset

(since

it

was

previously

subtracted

from

revenue),

and

subtract

gains

on

sale

of

fixed

asset

(since

it

was

previously

added

to

revenue).

The

effect

on

the

sale

of

the

fixed

assets

would

be

taken

into

consideration

later

when

computing

for

the

net

cash

provided

by

(used

in)

investing

activities.

C. Subtracting

the

increase

in

current

assets

from

net

income

Consider

the

increase

in

accounts

receivable

in

the

table

below:

January

1,

2015

December

31,

2015

Accounts

Receivable

P

10,000

P

30,000

Accounts

receivable

increases

when

service

revenue

is

rendered

on

account.

The

journal

entry

for

this

transaction

is

as

follows:

Accounts

Receivable

20,000

Service

Revenue

20,000

Was

there

cash

received?

No.

However,

revenue

was

earned

because

the

service

was

already

rendered.

Because

of

this,

the

P20,000

contributed

to

net

income.

Remember

that

we

only

want

to

get

actual

cash

transactions

from

net

income.

Since

in

this

scenario

no

actual

cash

was

received,

we

subtract

the

increase

in

accounts

receivable

to

get

rid

of

the

portion

of

service

revenue

that

represents

service

rendered

on

account.

D. Adding

the

decrease

in

current

assets

to

net

income

Consider

the

increase

in

accounts

receivable

in

the

table

below:

January

1,

2015

December

31,

2015

Accounts

Receivable

P

15,000

P

10,000

ACC111: Resource Management

Kristin A. Militante

Accounts

receivable

goes

down

when

the

business

collects

cash

from

the

customer.

To

illustrate,

the

journal

entry

is

as

follows:

Cash

5,000

Accounts

Receivable

5,000

Was

there

an

actual

increase

in

cash?

Yes.

Was

this

considered

in

the

income

statement

(reflected

in

the

net

income)?

No.

As

such,

we

need

to

add

the

decrease

in

accounts

receivable

to

net

income

to

take

into

consideration

the

transactions

that

fall

under

operating

activities.

E. Adding

back

the

increase

in

current

liabilities

to

net

income

January

1,

2015

December

31,

2015

Utilities

payable

P

0

P

12,000

For

the

utilities

payable

to

be

recorded,

there

must

be

at

least

one

account

that

was

debited.

In

this

case,

the

account

partnered

with

utilities

payable

is

utilities

expense.

Journal

entry

as

follows:

Utilities

Expense

12,000

Utilities

Payable

12,000

Utilities

expense

was

recorded

because

utilities

were

already

used

or

consumed

by

the

company

during

the

period.

However,

they

have

not

paid

actual

cash

yet

to

the

utility

companies.

For

this

reason,

a

liability

is

recorded

in

the

form

of

utilities

payable.

Was

there

an

inflow

or

an

outflow

of

cash

in

this

scenario?

No.

However,

utilities

expense

was

subtracted

from

revenues

when

the

net

income

of

P800,500

was

recorded.

Since

we

want

to

only

get

actual

cash

transactions

from

net

income,

we

add

back

the

increase

in

utilities

payable

amounting

to

P12,000

to

add

back

the

amount

previously

deducted

from

service

revenue

in

the

form

of

utilities

expense.

F. Subtracting

the

decrease

in

current

liabilities

from

net

income

January

1,

2015

December

31,

2015

Accounts

payable

P

5,800

P

0

Payables

decrease

when

we

pay

the

parties

we

owe

money

to.

These

could

be

the

suppliers,

utility

companies,

our

employees

or

financial

institutions.

In

this

case,

noticeably,

our

accounts

payable

decreased

by

P5,800.

Journal

entry

for

this

is

as

follows:

ACC111: Resource Management

Kristin A. Militante

Accounts

Payable

5,800

Cash

5,800

Was

there

an

actual

cash-out?

Yes.

Was

this

considered

in

the

net

income?

No.

As

such,

we

need

to

add

the

decrease

in

the

accounts

payable

to

net

income

in

order

to

obtain

actual

cash

transactions

falling

under

operating

activities.

SOMETHING TO TICKLE YOUR MIND

Given:

Net Income

P 800,500

Increase in office supplies

6,000

Increase in accounts payable

6,000

If these are the only transactions that are to be considered to compute for the net

cash provided by operating activities, what amount will you get? Is it correct to say

that the net income in this scenario already reflects cash transactions categorized

under operating activities?

Potrebbero piacerti anche

- December 9 Complete LectureDocumento15 pagineDecember 9 Complete LectureToni100% (2)

- Chapter 13Documento9 pagineChapter 13RBNessuna valutazione finora

- Statement of Cash FlowDocumento24 pagineStatement of Cash FlowUgly Duckling0% (1)

- Statement of Cash Flows & Notes To Financial StatementsDocumento17 pagineStatement of Cash Flows & Notes To Financial StatementsMiriee Joy SshiNessuna valutazione finora

- NSCC Fee Guide 2014Documento26 pagineNSCC Fee Guide 2014theoriqueNessuna valutazione finora

- (IV) Statement of Cash-FlowsDocumento38 pagine(IV) Statement of Cash-FlowsmusthaqhassanNessuna valutazione finora

- Cash Flow StatementDocumento55 pagineCash Flow StatementGovind GovindNessuna valutazione finora

- Cash Flow StatementDocumento55 pagineCash Flow StatementPanktiNessuna valutazione finora

- Cash Flow StatementDocumento55 pagineCash Flow StatementSapna MalikNessuna valutazione finora

- Cash Flow StatementDocumento36 pagineCash Flow StatementMohd Zubair KhanNessuna valutazione finora

- Accounting Chapter 13 Summary Statement of Cash FlowsDocumento5 pagineAccounting Chapter 13 Summary Statement of Cash FlowsAndrew PhilipsNessuna valutazione finora

- Indirect MethodDocumento34 pagineIndirect MethodHacker SKNessuna valutazione finora

- Preparing The Statement of Cash Flows-Indirect MethodDocumento11 paginePreparing The Statement of Cash Flows-Indirect MethodMelvin ZefanyaNessuna valutazione finora

- Chapter 23 HomeworkDocumento10 pagineChapter 23 HomeworkTracy LeeNessuna valutazione finora

- ACCT 101 Chapter 12 HandoutDocumento5 pagineACCT 101 Chapter 12 Handoutpaul ndhlovuNessuna valutazione finora

- Cash Flow Statement - Lecture 6-8Documento41 pagineCash Flow Statement - Lecture 6-8SHIVA THAVANI100% (1)

- Ac1 Reviewer FinalsDocumento5 pagineAc1 Reviewer FinalsMark Christian BrlNessuna valutazione finora

- Working Backward To Cash Receipts and DisbursementsDocumento8 pagineWorking Backward To Cash Receipts and DisbursementsHarsha ThejaNessuna valutazione finora

- Cash Flow StatementDocumento22 pagineCash Flow StatementThe ONE GUYNessuna valutazione finora

- Acct 2301 FinaDocumento42 pagineAcct 2301 FinaFabian NonesNessuna valutazione finora

- Module 4 Statement of Cash Flows 1Documento9 pagineModule 4 Statement of Cash Flows 1Kimberly BalontongNessuna valutazione finora

- Cash Flow Statement: Manac IDocumento37 pagineCash Flow Statement: Manac IPraveen NNessuna valutazione finora

- Managerial Accounting1Documento33 pagineManagerial Accounting1MM-Tansiongco, Keino R.Nessuna valutazione finora

- Cash and AccrualDocumento3 pagineCash and Accrual夜晨曦Nessuna valutazione finora

- Financial Accounting & Analysis AssignmentDocumento4 pagineFinancial Accounting & Analysis AssignmentDhanshree Thorat AmbavleNessuna valutazione finora

- Cash Flow FADocumento10 pagineCash Flow FAWafa SehbaiNessuna valutazione finora

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Documento3 pagineQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923Nessuna valutazione finora

- Practice Questions - Cash FlowDocumento13 paginePractice Questions - Cash FlowMariamNessuna valutazione finora

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Documento12 pagineFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNessuna valutazione finora

- Cash Flow StatementDocumento5 pagineCash Flow StatementAngel Dianne NuñezNessuna valutazione finora

- VALUCON - SCF & ManAccDocumento21 pagineVALUCON - SCF & ManAccDanna VargasNessuna valutazione finora

- AK2-Chapter 14Documento43 pagineAK2-Chapter 14nitzi lailiNessuna valutazione finora

- Quarter 2 Lesson 1Documento11 pagineQuarter 2 Lesson 1Gilbert NarvasNessuna valutazione finora

- Self-Learning Kit: Region I Schools Division of Ilocos Sur Bantay, Ilocos SurDocumento13 pagineSelf-Learning Kit: Region I Schools Division of Ilocos Sur Bantay, Ilocos SurLiam Aleccis Obrero CabanitNessuna valutazione finora

- FABM2 1stqtr UploadDocumento4 pagineFABM2 1stqtr Uploadjay reamonNessuna valutazione finora

- "How Well Am I Doing?" Statement of Cash Flows: Solutions To QuestionsDocumento51 pagine"How Well Am I Doing?" Statement of Cash Flows: Solutions To Questionskhurram. khurshidNessuna valutazione finora

- Chapter 2 - Statement of Cash FlowsDocumento23 pagineChapter 2 - Statement of Cash FlowsCholophrex SamilinNessuna valutazione finora

- Chapter FourDocumento37 pagineChapter FourbiyaNessuna valutazione finora

- The Direct MethodDocumento15 pagineThe Direct MethodHacker SKNessuna valutazione finora

- Solutions Chapter 23Documento11 pagineSolutions Chapter 23Avi SeligNessuna valutazione finora

- Intermediate AccountingDocumento35 pagineIntermediate AccountingWisnu LaksonoNessuna valutazione finora

- Statement of Cash FlowsDocumento38 pagineStatement of Cash FlowsspringzingNessuna valutazione finora

- Statement of Cash Flows: Like An Income StatementDocumento27 pagineStatement of Cash Flows: Like An Income StatementbecalmNessuna valutazione finora

- Statement of Cash FlowsDocumento3 pagineStatement of Cash FlowsEricka DelgadoNessuna valutazione finora

- Statement of Cash FlowDocumento19 pagineStatement of Cash FlowSHARMAINE JOY FULGARNessuna valutazione finora

- Adjusting Entries IllustrationsDocumento3 pagineAdjusting Entries IllustrationsHeeseung LeeNessuna valutazione finora

- Quiz 3Documento5 pagineQuiz 3Iryna VerbovaNessuna valutazione finora

- Financial Statement Project 1 1Documento38 pagineFinancial Statement Project 1 1ABHISHEK SHARMANessuna valutazione finora

- Solution 3G To Accounting Principles Hermanson (CH 19)Documento28 pagineSolution 3G To Accounting Principles Hermanson (CH 19)Ahmed IstehadNessuna valutazione finora

- Cash FlowsDocumento15 pagineCash FlowsAkshat DwivediNessuna valutazione finora

- Cash Flow Statement: A Tool Kit Analysis: Prepared byDocumento17 pagineCash Flow Statement: A Tool Kit Analysis: Prepared byKrishna PrajapatiNessuna valutazione finora

- Finance Assi FinalDocumento8 pagineFinance Assi FinalVagdevi YadavNessuna valutazione finora

- Cash Flow StatementDocumento4 pagineCash Flow StatementRathore NitinNessuna valutazione finora

- Impairment of AssetsDocumento19 pagineImpairment of AssetsTareq SojolNessuna valutazione finora

- Case 5-6Documento2 pagineCase 5-6Arlene Samantha PlacidoNessuna valutazione finora

- İntermediate AccountingDocumento15 pagineİntermediate AccountingOzan TalayNessuna valutazione finora

- Hock CMA P1 2019 (Sections A, B & C) AnswersDocumento17 pagineHock CMA P1 2019 (Sections A, B & C) AnswersNathan DrakeNessuna valutazione finora

- Chapter 15Documento51 pagineChapter 15castluci0% (1)

- Chapter 12 ReviewDocumento14 pagineChapter 12 ReviewDonna Mae HernandezNessuna valutazione finora

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Pupun01206130000493015 2023Documento2 paginePupun01206130000493015 2023abhishekkumarasr847687Nessuna valutazione finora

- 2023 Outlook Asian CurrenciesDocumento13 pagine2023 Outlook Asian CurrenciesMaria Pia Rivas LozadaNessuna valutazione finora

- Bond Price and YieldDocumento13 pagineBond Price and YieldHarsh RajNessuna valutazione finora

- About Ripple: How Ripple Revolutionizes Cross-Border Payments and RemittancesDocumento5 pagineAbout Ripple: How Ripple Revolutionizes Cross-Border Payments and RemittancesDaniel keith LucasNessuna valutazione finora

- Rich Dad Poor DadDocumento26 pagineRich Dad Poor DadKhalid Iqbal100% (1)

- No Dues Certificate - 19 - 47 - 18Documento2 pagineNo Dues Certificate - 19 - 47 - 18chenchu kuppaswamyNessuna valutazione finora

- BES2-Real World Financial TransactionsDocumento18 pagineBES2-Real World Financial TransactionsJane Erestain BuenaobraNessuna valutazione finora

- Indian Financial SystemDocumento38 pagineIndian Financial SystemNikita DakiNessuna valutazione finora

- R15 Understanding Business CyclesDocumento33 pagineR15 Understanding Business CyclesUmar FarooqNessuna valutazione finora

- Chapter 2 Capital MarketsDocumento9 pagineChapter 2 Capital MarketsFarah Nader Gooda100% (1)

- Print ChallanDocumento1 paginaPrint ChallanSameer AsifNessuna valutazione finora

- Cash Flow StatementDocumento19 pagineCash Flow Statementasherjoe67% (3)

- MEcon - Presentation - MihailDocumento13 pagineMEcon - Presentation - MihailMisho IlievNessuna valutazione finora

- Import of Services. Interest, Profit and Dividends PaidDocumento10 pagineImport of Services. Interest, Profit and Dividends PaidDishaNessuna valutazione finora

- Monthly Statement: This Month's SummaryDocumento4 pagineMonthly Statement: This Month's SummaryRavi WaghmareNessuna valutazione finora

- ECB & Fed A Comparison A Comparison: International Summer ProgramDocumento40 pagineECB & Fed A Comparison A Comparison: International Summer Programsabiha12Nessuna valutazione finora

- Cottrell Sunningdale SeptDec2023Documento3 pagineCottrell Sunningdale SeptDec2023Adilah AzamNessuna valutazione finora

- Interest Rate Risk Management PDFDocumento2 pagineInterest Rate Risk Management PDFHARSHALRAVALNessuna valutazione finora

- Perpetual Help: Calculate Future Value and Present Value of Money andDocumento8 paginePerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoNessuna valutazione finora

- Financial Supervisory System in Korea: RYU, Min Hae HWANG, Jae HakDocumento43 pagineFinancial Supervisory System in Korea: RYU, Min Hae HWANG, Jae HakstaimoukNessuna valutazione finora

- Econ 100.1 Exercise Set No. 3Documento2 pagineEcon 100.1 Exercise Set No. 3Mara RamosNessuna valutazione finora

- AccesstoCapital VentureCapitalFirmsinSoCalDocumento4 pagineAccesstoCapital VentureCapitalFirmsinSoCalCarlos JesenaNessuna valutazione finora

- Fundamentals of Accountancy, Business and Management 1: Learning Activity SheetDocumento11 pagineFundamentals of Accountancy, Business and Management 1: Learning Activity SheetMarlyn LotivioNessuna valutazione finora

- Chapter 23Documento24 pagineChapter 23Nguyên BảoNessuna valutazione finora

- Mitc RupifiDocumento13 pagineMitc RupifiKARTHIKEYAN K.DNessuna valutazione finora

- Tax Invoice: Madimack Pty LTD 19 Tarra Cres Dee Why NSW 2099Documento1 paginaTax Invoice: Madimack Pty LTD 19 Tarra Cres Dee Why NSW 2099Mildred PagsNessuna valutazione finora

- Chapter 1-3 Notes & ExercisesDocumento10 pagineChapter 1-3 Notes & ExercisesHafizah Mat Nawi50% (2)

- Bridge Course in EconomicsDocumento17 pagineBridge Course in EconomicsProfessor Tarun DasNessuna valutazione finora

- FX Markets Weekly: The Upcoming Presidential Election in France (Raphael Brun-Aguerre)Documento44 pagineFX Markets Weekly: The Upcoming Presidential Election in France (Raphael Brun-Aguerre)nosternosterNessuna valutazione finora