Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Advanced Accounting

Caricato da

galaxystarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Advanced Accounting

Caricato da

galaxystarCopyright:

Formati disponibili

Final Examinations

Module E

4 June 2015

3 hours 100 marks

Additional reading time 15 minutes

The Institute of

Chartered Accountants

of Pakistan

Advanced Accounting and Financial Reporting

Q.1

Consolidated financial statements of Malik Group of Companies (MGC) for the year ended

31 December 2014 are presented below:

Consolidated statement of financial position as on 31 December 2014

Equity

Ordinary shares (Rs.10 each)

Retained earnings

Other reserves *

Non-controlling interest

Non-current liabilities

Loans from banks

Deferred tax

Current liabilities

Trade and other payables

Income tax

Accrued interest

2014

2013

Rs. in million

15,000

15,000

17,550

10,850

7,500

5,250

40,050

31,100

3,100

3,200

5,000

1,500

3,000

1,050

8,000

3,875

125

61,650

7,250

3,525

75

49,200

Non-current assets

Goodwill

Property, plant and equipment

Investment in associate

Current assets

Inventories

Trade and other receivables

Cash and bank

2014

2013

Rs. in million

19,300

18,500

25,450

16,250

6,200

5,400

50,950

40,150

4,700

3,900

2,100

4,350

3,300

1,400

61,650

49,200

* include revaluation reserve

Consolidated statement of comprehensive income for the year ended 31 December 2014

Revenue

Operating expenses

Profit from operations

Gain on disposal of subsidiary

Finance cost

Income from associates

Profit before taxation

Income tax expense

Profit for the year

Other comprehensive income for the year

Re-measurement of post-employment benefits

Other comprehensive income from associates

Total comprehensive income

Profit attributable to:

Parent shareholders

Non-controlling interest

Total comprehensive income attributable to:

Parent shareholders

Non-controlling interest

Rs. in million

20,900

(11,550)

9,350

1,000

(350)

1,150

11,150

(2,250)

8,900

2,000

500

11,400

7,950

950

8,900

10,200

1,200

11,400

Advanced Accounting and Financial Reporting

Page 2 of 5

Additional information:

(i)

During the year, MGC acquired 80% holding in Gomel Limited (GL) against a cash

consideration of Rs. 15,000 million. On the date of acquisition, the non-controlling

interests holding was measured at its fair value of Rs. 3,400 million. The fair value of

net assets of GL at acquisition comprised of the following:

Property, plant and equipment

Inventory

Trade and other receivables

Cash and bank

Loans from banks

Trade and other payables

Income tax

(ii)

Rs. in million

12,800

1,500

2,400

800

(400)

(1,800)

(400)

14,900

During the year, MGC also disposed of its 60% shareholdings in Stone Limited (SL)

and realised cash proceeds of Rs. 8,500 million. This subsidiary had been acquired

several years ago for Rs. 6,000 million. At acquisition, the fair value of SLs net assets

and non-controlling interest was Rs. 7,300 million and Rs. 3,200 million respectively.

On the date of disposal, the net assets of SL had a carrying value in the consolidated

statement of financial position as follows:

Property, plant and equipment

Inventory

Trade and other receivables

Cash and bank

Loans from banks

Trade and other payables

Rs. in million

7,250

1,650

1,500

500

(300)

(800)

9,800

(iii)

Property, plant and equipment:

Depreciation charge for the year is Rs. 3,850 million.

A plant having carrying value of Rs. 2,500 million was sold for

Rs. 2,750 million. Gain on disposal has been credited to operating expenses.

On the basis of a professional valuation report, increase of Rs. 2,000 million has

been recognized in the value of property, plant and equipment.

(iv)

During the year, Rs. 1,250 million was paid as final dividend to ordinary

shareholders.

Required:

Prepare consolidated statement of cash flow of MGC for the year ended 31 December 2014,

using the indirect method.

Q.2

(22)

The financial statements of Integrity Steel Limited (ISL) for the year ended 31 March 2015

are in the final stage of their preparation and the following matters are under consideration:

(a)

On 1 April 2014, ISL entered into a contract with Invest Bank. Under the contract, ISL

deposited an amount of USD 5 million, at an interest of 2.5% per annum with a

maturity date of 31 March 2017. Interest will be received on maturity along with the

principal. Further, an additional 2% interest per annum would be payable by Invest

Bank in the event the value of USD increases by 5% or more. The contract is in line

with ISLs policy of making low risk investments in foreign as well as local currencies.

Required:

Explain how the above investment should be measured in ISLs books of account at

31 March 2015.

(05)

Advanced Accounting and Financial Reporting

(b)

Page 3 of 5

On 1 October 2014, ISL shifted its corporate head office to a three story building. The

fair value of building on the shifting date and as on 31 March 2014 was Rs. 325 million

and Rs. 310 million respectively.

This building was acquired five years ago at a cost of Rs. 240 million. Immediately

thereafter it was leased out to a subsidiary. Its remaining useful life is 10 years.

Depreciation on ISLs buildings is charged on straight line basis over their useful lives.

Required:

Prepare journal entries to record the above transaction.

(c)

On 1 April 2014, ISL disposed of its power generation system to Komal Limited (KL)

for a consideration of Rs. 135 million. At the same time, ISL entered into a long-term

agreement with KL whereby the assets were leased back under a 10-year operating

lease. At the time of sale, the fair value and the carrying value of the assets were

Rs. 160 million. The lease rentals are Rs. 22 million per annum. The market value of

lease rentals of such type of assets is Rs. 24 million

Required:

Prepare journal entries to record the above transactions for the year ended

31 March 2015.

Q.3

(a)

(04)

(04)

Tanzeem Limited (TL) operates a defined benefit pension plan for its employees. The

following details relate to the plan:

Discount rate for plan obligation

Expected return on plan assets

Present value of obligation at year-end

Fair value of plan assets at year-end

Current service cost

Benefits paid during the year

Contribution made during the year

2014

2013

9%

8%

10%

9%

----- Rs. in million ----2,040

2,300

1,784

2,150

125

143

99

110

105

118

Additional information:

Present value of pension obligation and fair value of plan assets as on

1 January 2013 were Rs. 2,050 million and Rs. 1,995 million respectively.

During the year 2013, TL amended the scheme whereby the benefits available

under the plan had been increased. It resulted in an increase in the present value

of the defined benefit pension obligation by Rs. 5 million and Rs. 8 million on

account of vested and non-vested benefits respectively. The period to vest is

4 years.

On 31 December 2014, TL sold a business segment to Sachai Limited (SL).

Accordingly, TL transferred the relevant component of its pension fund to SL.

The present value of the defined benefit pension obligation transferred was

Rs. 280 million and the fair value of plan assets transferred was Rs. 240 million.

TL also made a cash payment of Rs. 20 million to SL in respect of the plan.

Average remaining working lives of employees is 10 years.

Required:

(i) Prepare relevant extracts to be reflected in the statement of financial position,

statement of comprehensive income and notes to the financial statements for the

year ended 31 December 2014 in accordance with International Financial

Reporting Standards. (Show comparative figures)

(ii) Prepare entries to record the pension obligation:

on sale of business segment to SL

at the year-end.

(11)

(03)

Advanced Accounting and Financial Reporting

(b)

Page 4 of 5

On 1 January 2015, Mr. Talented was appointed as the President of Meharban Bank

Limited (MBL). According to the terms of the employment contract, MBL granted

Mr. Talented the right to receive either 100,000 shares of the bank or a cash payment

equivalent to the value of 80,000 shares. This grant is conditional to completion of

3 years of service with the bank and can be exercised within 1 year of vesting date. If he

chooses the share alternative he would have to hold the shares for a period of two years

after the vesting date.

The par value of MBLs shares is Rs. 10 each. At the grant date, MBLs share price was

Rs. 145 per share. The share prices on 31 December 2015, 2016, 2017 and 2018 are

estimated at Rs. 150, Rs. 156, Rs. 165 and Rs. 175 respectively. Dividends are not

expected to be announced during the next three years.

After taking into account the effects of the post-vesting transfer restrictions, MBL

estimates that the fair value of the share alternative on the date of appointment of

Mr. Talented was Rs. 135 per share.

Required:

Suggest journal entries to record the above transactions in the books of MBL for the

years ending 31 December 2015, 2016, 2017 and 2018 if Mr. Talented chooses the

share alternative in July 2018.

Q.4

(a)

(11)

Millat General Insurance Limited is a listed company. The following information for

the year ended 31 December 2014 has been extracted from the records:

Premium written

Unearned premium reserve - opening

Unearned premium reserve - closing

Reinsurance ceded

Prepaid reinsurance premium ceded - opening

Prepaid reinsurance premium ceded - closing

Net claims

Commission expenses

Fire &

Motor

Misc.

property

insurance

insurance

damage

------------ Rs. in 000 -----------286,000

154,000

89,000

42,900

20,020

14,240

51,480

18,480

11,570

228,800

15,400

53,400

34,320

2,002

8,544

41,184

1,848

6,942

38,803

95,000

28,029

27,742

15,554

9,167

Additional information:

(i)

The reinsurers allowed commission on fire & property damage and miscellaneous

insurance at the rate of 15% of the ceded amount of reinsurance.

(ii) Other direct management expenses amounting to Rs. 45 million have been

charged to revenue account of different classes of insurance in proportion to their

net premium earned.

(iii) Other operating expenses and other income for the year are Rs. 28 million and

Rs. 17 million respectively.

(b)

Required:

Prepare an extract of profit and loss account for the year ended 31 December 2014, in

accordance with the requirements of Insurance Ordinance, 2000.

(08)

Briefly explain the 1/24th method of determining the unearned premium reserve.

(02)

Advanced Accounting and Financial Reporting

Q.5

Page 5 of 5

Gohar Limited (GL), a listed company, is engaged in chemicals, soda ash, polyester, paints

and pharma businesses. Results of each business segment for the year ended 31 March 2015

are as follows:

Business

segments

Chemicals

Soda Ash

Polyester

Paints

Pharma

Gross

Operating

Assets

Liabilities

profit

expenses

------------------------- Rs. in million ------------------------1,790

1,101

63

637

442

216

117

57

444

355

227

48

23

115

94

247

26

16

127

108

252

31

12

132

98

Sales

Inter-segment sale by Chemicals to Polyester and Soda Ash is Rs. 28 million and

Rs. 10 million respectively at a contribution margin of 30%.

Operating expenses include GLs head office expenses amounting to Rs. 75 million which

have not been allocated to any segment. Furthermore, assets and liabilities amounting to

Rs. 150 million and Rs. 27 million have not been reported in the assets and liabilities of any

segment.

Required:

In accordance with the requirements of International Financial Reporting Standards:

(a) determine the reportable segments of Gohar Limited; and

(b) show how these reportable segments and the necessary reconciliation would be

disclosed in GLs financial statements for the year ended 31 March 2015.

Q.6

(07)

(08)

The following information has been extracted from draft statement of financial position of

Ittehad Industries Limited (IIL), as on 31 December 2014:

Share capital (Rs.10 each)

Share premium

Accumulated profit

11.5% Term finance certificates (TFCs)

2014

2013

---- Rs. in million ---1,800

1,200

380

230

3,756

3,556

250

-

The following information is also available:

(i)

(ii)

(iii)

(iv)

(v)

(vi)

The profit after tax earned by IIL during the year ended 31 December 2014 amounted

to Rs. 225 million.

On 1 April 2014, IIL issued 25% right shares to its existing shareholders at Rs. 15 per

share. Market value of the shares prior to the issue of right shares was Rs. 25 per share.

20% bonus shares for the year ended 31 December 2013 were issued on 1 May 2014.

The right shares issued on 1 April 2014 were also entitled for the bonus.

On 31 December 2014, 5 million shares were not yet vested under the employee share

option scheme. The exercise price of the option was Rs. 12 per share and average

market price per share during 2014 was Rs. 15 per share. The amount to be recognized

in relation to employee share option in profit and loss account over future accounting

periods up to vesting date is Rs. 10 million.

On 1 July 2014, IIL issued TFCs which are convertible into 20 million ordinary shares

on 31 December 2018.

IIL is subject to income tax at the rate of 35%.

Required:

Prepare relevant extracts to be reflected in the financial statements of Ittehad Industries

Limited for the year ended 31 December 2014 showing all necessary disclosures relating to

earnings per share. (Comparative figures are not required)

(THE END)

(15)

Potrebbero piacerti anche

- (L1) Financial Reporting PDFDocumento25 pagine(L1) Financial Reporting PDFCasius MubambaNessuna valutazione finora

- Statement of Cash Flows: Preparation, Presentation, and UseDa EverandStatement of Cash Flows: Preparation, Presentation, and UseNessuna valutazione finora

- Accounting For LeasesDocumento4 pagineAccounting For LeasesSebastian MlingwaNessuna valutazione finora

- IAS 16 Property Plant EquipmentDocumento4 pagineIAS 16 Property Plant EquipmentMD Hafizul Islam HafizNessuna valutazione finora

- Taxation of CompaniesDocumento10 pagineTaxation of CompaniesnikhilramaneNessuna valutazione finora

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionDocumento8 pagineMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoNessuna valutazione finora

- IAS 02: Inventories: Requirement: SolutionDocumento2 pagineIAS 02: Inventories: Requirement: SolutionMD Hafizul Islam Hafiz100% (1)

- Chap 4 - IAS 36 (Questions)Documento4 pagineChap 4 - IAS 36 (Questions)Kamoke LibraryNessuna valutazione finora

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- Weighted Average Cost of Capital: Banikanta MishraDocumento21 pagineWeighted Average Cost of Capital: Banikanta MishraManu ThomasNessuna valutazione finora

- Homework Chapter 18 and 19Documento7 pagineHomework Chapter 18 and 19doejohn150Nessuna valutazione finora

- Aafr Ias 12 Icap Past Paper With SolutionDocumento17 pagineAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Practice Questions - Ratio AnalysisDocumento2 paginePractice Questions - Ratio Analysissaltee100% (5)

- Sample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaDocumento36 pagineSample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaChristen CastilloNessuna valutazione finora

- December 2003 ACCA Paper 2.5 QuestionsDocumento10 pagineDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- Financial Reporting WDocumento345 pagineFinancial Reporting Wgordonomond2022Nessuna valutazione finora

- Week 1 - Problem SetDocumento3 pagineWeek 1 - Problem SetIlpram YTNessuna valutazione finora

- Lecture 9 M17EFA - Company Valuation 2 1Documento48 pagineLecture 9 M17EFA - Company Valuation 2 1822407Nessuna valutazione finora

- Business Combinations (Ifrs 3)Documento29 pagineBusiness Combinations (Ifrs 3)anon_253544781Nessuna valutazione finora

- Chapter Two Investment Allowances NotesDocumento12 pagineChapter Two Investment Allowances NotesTriila manillaNessuna valutazione finora

- Day 1Documento11 pagineDay 1Abdullah EjazNessuna valutazione finora

- Advanced Taxation Exam Nov 2010Documento10 pagineAdvanced Taxation Exam Nov 2010Kelvin KeNessuna valutazione finora

- FAR and IAs Quali Exams With AnswersDocumento17 pagineFAR and IAs Quali Exams With AnswersReghis AtienzaNessuna valutazione finora

- Chapters 11 and 12 EditedDocumento13 pagineChapters 11 and 12 Editedomar_geryesNessuna valutazione finora

- Marginal and Absorption CostingDocumento8 pagineMarginal and Absorption CostingEniola OgunmonaNessuna valutazione finora

- Foreign Branches QuestionsDocumento12 pagineForeign Branches QuestionsNicole TaylorNessuna valutazione finora

- Earning Per ShareDocumento51 pagineEarning Per ShareNdung'u Evans100% (1)

- Chapter 7 Asset Investment Decisions and Capital RationingDocumento31 pagineChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNessuna valutazione finora

- Tax Problem SolutionDocumento5 pagineTax Problem SolutionSyed Ashraful Alam RubelNessuna valutazione finora

- F8 Workbook Questions & Solutions 1.1 PDFDocumento188 pagineF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterNessuna valutazione finora

- Preparation of Published Financial StatementsDocumento46 paginePreparation of Published Financial StatementsBenard Bett100% (2)

- IAS 33 - Earnings Per ShareDocumento26 pagineIAS 33 - Earnings Per ShareTD2 from Henry HarvinNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Great Zimbabwe University Faculty of CommerceDocumento6 pagineGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNessuna valutazione finora

- IAS - 23 - Borrowing - Costs Edited 6 KiloDocumento19 pagineIAS - 23 - Borrowing - Costs Edited 6 KilonatiNessuna valutazione finora

- Gross Profit AnalysisDocumento5 pagineGross Profit AnalysisInayat Ur RehmanNessuna valutazione finora

- Sujit 1-134-380 PDFDocumento247 pagineSujit 1-134-380 PDFŞâh ŠůmiťNessuna valutazione finora

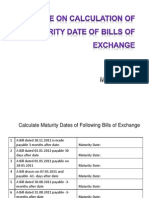

- Calculation of Maturity DateDocumento4 pagineCalculation of Maturity Dateyogeshdhuri22Nessuna valutazione finora

- Unit 3: Trial Balance: Learning OutcomesDocumento13 pagineUnit 3: Trial Balance: Learning Outcomesviveo23Nessuna valutazione finora

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaDocumento9 pagine6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghNessuna valutazione finora

- Problem Set 7 (With Instructions) : Regression StatisticsDocumento6 pagineProblem Set 7 (With Instructions) : Regression StatisticsLily TranNessuna valutazione finora

- LN01 Rejda99500X 12 Principles LN04Documento40 pagineLN01 Rejda99500X 12 Principles LN04Abdirahman M. SalahNessuna valutazione finora

- Couresot LineDocumento2 pagineCouresot LineSeifu BekeleNessuna valutazione finora

- Public Sector Accounting & Finance 2.5Documento20 paginePublic Sector Accounting & Finance 2.5financial reportingNessuna valutazione finora

- Assignment # 1: Submitted FromDocumento15 pagineAssignment # 1: Submitted FromAbdullah AliNessuna valutazione finora

- Employment Income UdomDocumento13 pagineEmployment Income UdomMaster KihimbwaNessuna valutazione finora

- Review Questions Final Accounts For A Sole TraderDocumento3 pagineReview Questions Final Accounts For A Sole TraderdhanyasugukumarNessuna valutazione finora

- Chapter 3-4 QuestionsDocumento5 pagineChapter 3-4 QuestionsMya B. Walker0% (1)

- Chapter 1 - Statement of Financial Position 1Documento22 pagineChapter 1 - Statement of Financial Position 1Frost GarisonNessuna valutazione finora

- IAS 40 ICAB QuestionsDocumento5 pagineIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- CHAPTER 4 - AssociatesDocumento11 pagineCHAPTER 4 - AssociatesSheikh Mass JahNessuna valutazione finora

- Spoiled Units/Loss Units OF ProductionDocumento15 pagineSpoiled Units/Loss Units OF ProductionClaire Barba100% (1)

- Paper 2 Audit and AssuranceDocumento479 paginePaper 2 Audit and AssuranceAashish AdhikariNessuna valutazione finora

- PDF VERSION Highveld BPP Amended CONSOLIDATION QUESTIONDocumento2 paginePDF VERSION Highveld BPP Amended CONSOLIDATION QUESTIONGueagen1969Nessuna valutazione finora

- BUSI 353 S18 Assignment 4 SOLUTIONDocumento2 pagineBUSI 353 S18 Assignment 4 SOLUTIONTanNessuna valutazione finora

- 201.01 Financial Statements From Incomplete Information - CMA - PL-II - AFA-I - Special Class No. 01 - 1st SessionDocumento15 pagine201.01 Financial Statements From Incomplete Information - CMA - PL-II - AFA-I - Special Class No. 01 - 1st SessionBiplob K. SannyasiNessuna valutazione finora

- Ias 7 Cash FlowDocumento15 pagineIas 7 Cash FlowManda simzNessuna valutazione finora

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Critical Financial Review: Understanding Corporate Financial InformationDa EverandCritical Financial Review: Understanding Corporate Financial InformationNessuna valutazione finora

- Rumi QoutesDocumento17 pagineRumi QoutesInternational Iqbal ForumNessuna valutazione finora

- l6 Processormgt2013Documento35 paginel6 Processormgt2013International Iqbal ForumNessuna valutazione finora

- Credentials PRIMACODocumento5 pagineCredentials PRIMACOInternational Iqbal ForumNessuna valutazione finora

- Corporate Laws: Page 1 of 7Documento7 pagineCorporate Laws: Page 1 of 7saadi_2713173Nessuna valutazione finora

- E-13 IT (Summer 2015)Documento7 pagineE-13 IT (Summer 2015)International Iqbal ForumNessuna valutazione finora

- E-13 ItmacDocumento2 pagineE-13 ItmacInternational Iqbal ForumNessuna valutazione finora

- Secret Wisdom MagazineDocumento44 pagineSecret Wisdom MagazineInternational Iqbal ForumNessuna valutazione finora

- Bang e Dra - Shikwa (With Sharah) - Allama Iqbal R.ADocumento32 pagineBang e Dra - Shikwa (With Sharah) - Allama Iqbal R.AInternational Iqbal Forum71% (7)

- Foreign Aid - Finalized NewDocumento23 pagineForeign Aid - Finalized NewInternational Iqbal ForumNessuna valutazione finora

- Secret Wisdom MagazineDocumento44 pagineSecret Wisdom MagazineInternational Iqbal ForumNessuna valutazione finora

- Quaid e Azan Muhammad Ali Jinnah R.A About Allama Muhammad Iqbal R.ADocumento3 pagineQuaid e Azan Muhammad Ali Jinnah R.A About Allama Muhammad Iqbal R.AInternational Iqbal ForumNessuna valutazione finora

- Iqbal Daroon e Khana Volume 2Documento309 pagineIqbal Daroon e Khana Volume 2International Iqbal ForumNessuna valutazione finora

- Magazine: Mujhe Hai Hukm e Azaan Sep 2012Documento33 pagineMagazine: Mujhe Hai Hukm e Azaan Sep 2012International Iqbal ForumNessuna valutazione finora

- Secret Wisdom - IQBAL AND JINNAH ON PALESTINEDocumento12 pagineSecret Wisdom - IQBAL AND JINNAH ON PALESTINEInternational Iqbal ForumNessuna valutazione finora

- Special Magazine "Khudi by Hudhrat Allama Iqbal (Alehe Rehma) " (Urdu/English)Documento13 pagineSpecial Magazine "Khudi by Hudhrat Allama Iqbal (Alehe Rehma) " (Urdu/English)Dar Haqq (Ahl'al-Sunnah Wa'l-Jama'ah)Nessuna valutazione finora

- Mujhe Hai Hukm e Azan July 2012Documento20 pagineMujhe Hai Hukm e Azan July 2012International Iqbal ForumNessuna valutazione finora

- The Reconstruction of Religious Thought in Islam UrduDocumento198 pagineThe Reconstruction of Religious Thought in Islam UrduInternational Iqbal ForumNessuna valutazione finora