Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ch07 Sarbanes-Oxley, Internal Control, & Cash

Caricato da

Christian De LeonCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ch07 Sarbanes-Oxley, Internal Control, & Cash

Caricato da

Christian De LeonCopyright:

Formati disponibili

Chapter 7

Sarbanes-Oxley, Internal Control, & Cash

OBJECTIVES

Obj 1

Obj 2

Obj 3

Obj 4

Obj 5

Obj 6

Obj 7

Describe the Sarbanes-Oxley Act of 2002 and its impact on internal controls and

financial reporting.

Describe and illustrate the objectives and elements of internal control.

Describe and illustrate the application of internal controls to cash.

Describe the nature of a bank account and its use in controlling cash.

Describe and illustrate the use of a bank reconciliation in controlling cash.

Describe the accounting for special-purpose cash funds.

Describe and illustrate the reporting of cash and cash equivalents in the financial

statements.

QUESTION GRID

True/False

No Objective

.

1

07-01

2

07-01

3

07-01

4

07-01

5

07-01

6

07-02

7

07-02

8

07-02

9

07-02

10

07-03

11

07-03

12

07-03

13

07-03

14

07-03

15

07-03

16

07-03

17

07-03

18

07-03

19

07-03

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Easy

Easy

Easy

Easy

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

07-03

07-03

07-03

07-03

07-04

07-04

07-04

07-04

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

07-05

07-05

07-05

07-05

07-05

07-06

07-06

07-06

07-06

07-06

07-06

07-06

07-07

07-07

07-07

07-07

Easy

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

355

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 356

Multiple Choice

No Objective

.

1

07-02

2

07-02

3

07-02

4

07-02

5

07-02

6

07-02

7

07-02

8

07-02

9

07-02

10

07-02

11

07-03

12

07-03

13

07-03

14

07-03

15

07-03

16

07-03

17

07-03

18

07-03

19

07-03

20

07-03

21

07-03

22

07-03

23

07-03

24

07-03

25

07-04

26

07-04

Difficulty

No.

Objective

Difficulty

No.

Objective

Difficulty

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

07-04

07-04

07-04

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

Easy

Easy

Moderate

Easy

Easy

Easy

Moderate

Moderate

Easy

Easy

Easy

Easy

Easy

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

Easy

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-05

07-06

07-06

07-06

07-06

07-07

07-07

07-07

07-07

07-07

07-07

07-07

Easy

Easy

Easy

Easy

Easy

Easy

Moderate

Moderate

Moderate

Moderate

Moderate

Easy

Easy

Easy

Easy

Easy

Moderate

Easy

Easy

Easy

Easy

Easy

Easy

Moderate

Moderate

Difficulty

07-04

07-04

07-04

07-05

07-05

07-05

Exercise/Other

No Objectiv

.

e

1

07-01

2

07-02

3

07-02

4

07-03

5

07-03

Easy

Easy

Easy

Easy

Easy

No

.

7

8

9

10

11

Easy

12

Difficulty

No

.

07-03

Problem

No Objectiv

.

e

Objective

Objective

Difficult

y

Easy

Easy

Easy

Easy

Moderat

e

Moderat

e

No

.

13

14

15

16

17

Objectiv

e

07-05

07-05

07-06

07-06

07-07

Difficult

y

Moderate

Moderate

Moderate

Moderate

Easy

Difficult

y

No

.

Objectiv

e

Difficult

y

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 357

1

2

3

07-02

07-02

07-05

Easy

Moderate

Moderate

4

5

6

07-05

07-05

07-05

Difficult

Difficult

Moderat

e

7

8

9

07-06

07-06

07-06

Moderate

Moderate

Moderate

Chapter 7Sarbanes-Oxley, Internal Control, and Cash

TRUE/FALSE

1.

The Sarbanes-Oxley Act of 2002 was passed by Congress due to the public outcry after the financial

scandals of the early 2000s.

ANS: T

DIF: Easy OBJ: 07-01

NAT: AACSB Ethics | AICPA BB-Legal

2. Sarbanes-Oxleys purpose is to improve financial reporting.

ANS: F

DIF: Easy OBJ: 07-01

NAT: AACSB Ethics | AICPA BB-Legal

3.

There are two internal control objectives and they are to ensure accurate financial reports, and ensure

compliance with applicable laws.

ANS: F

DIF: Easy OBJ: 07-01

NAT: AACSB Ethics | AICPA BB-Legal

4.

Sarbanes-Oxley requires companies to maintain strong and effective internal controls and thus

prevent fraud and misleading financial statements.

ANS: F

DIF: Easy OBJ: 07-01

NAT: AACSB Ethics | AICPA BB-Legal

5.

The Sarbanes-Oxley Act requires that financi al statements of all public companies report on

management's conclusions about the effectiveness of the company's internal control

procedures.

ANS: T

DIF: Moderate

OBJ: 07-01

NAT: AACSB Ethics | AICPA BB-Legal

6.

The control environment in an internal control structure is the attitude and awareness of

internal control by all employees.

ANS: T

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

7.

Separating the responsibilities for purchasing, receiving, and paying for equipment is an

example of the control procedure: separating operations, custody of assets, and accounting.

ANS: F

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

358 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

8.

Internal control is enhanced by separating the control of a transaction from the recordkeeping function.

ANS: T

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

9.

A backlog in recording transactions is an example of a warning sign from the accounting

system.

ANS: T

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA FN-Measurement

10. Money orders are considered cash.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

11. A customer's check received in settlement of an account receivable is considered cash.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

12. Businesses who have several bank accounts, petty cash, and cash on hand, would maintain a

separate ledger account for each type of cash.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

13. For strong internal control system over cash, it is important to have the duties related to cash

receipts and cash payments divided among different employees.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

14. When a clerk enters a sale and the customer can see the amount displayed and is given a

cash receipt, this is an example of a preventive control.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

15. If the balance in Cash Short and Over at the end of a period is a credit, it indicates that cash

shortages have exceeded cash overages for the period.

ANS: F

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

16. If the balance in Cash Short and Over at the end of a period is a credit, it should be reported

as an "other income" item on the income statement.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 359

17. An example of good internal controls over cash payments is the taking of all cash discounts

offered.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

18. A voucher is a form on which is recorded pertinent data about a liability and the particulars

of its payment.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

19. When the voucher system is used, the amount due on each voucher represents the credit

balance of an account payable if the voucher is in full payment to a creditor.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

20. A voucher system is an example of an internal control procedure over cash payments.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

21. A voucher is a written authorization to make a cash payment.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

22. A payment system that uses computerized electronic impulses to effect a cash transaction is

called electronic funds transfer (EFT).

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

23. A remittance advice is the notification accompanying the check issued to a creditor that

states the specific invoice being paid.

ANS: T

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

24. The bank often informs the depositor of bank service charges by including a credit

memorandum with the monthly bank statement.

ANS: F

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

25. Bank customers are considered creditors of the bank so the bank shows their accounts with

credit balances on the bank's records.

ANS: T

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

360 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

26. Depositing all cash, checks, etc. in a bank and paying with checks is an internal control

procedure over cash.

ANS: T

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

27. For efficiency of operations and better control over cash, a company should maintain only

one bank account.

ANS: F

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

28. In preparing a bank reconciliation, the amount of deposits in transit is deducted from the

balance per bank statement.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

29. In preparing a bank reconciliation, the amount of outstanding checks is added to the balance

per bank statement.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

30. In preparing a bank reconciliation, the amount indicated by a debit memorandum for bank

service charges is added to the balance per depositor's records.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

31. In preparing a bank reconciliation, the amount of a check omitted from the journal is added

to the balance per depositor's records.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

32. A check for $456 was erroneously charged by the bank as $654. In order for the bank

reconciliation to balance, you must add $198 to the bank statement balance.

ANS: T

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

33. If an adjustment for an NSF check is made in a companys bank reconciliation, then the

company must have written a bad check during the month.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

34. The amount of the "adjusted balance" appearing on the bank reconciliation as of a given date

is the amount that is shown on the balance sheet for that date.

ANS: T

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 361

35. All bank memorandums reported on the bank reconciliation require entries in the depositor's

accounts.

ANS: T

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

36. The bank reconciliation is an important part of the system of internal controls.

ANS: T

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

37. The main reason that the bank statement cash balance and the depositor's cash balance do

not initially balance is due to timing differences.

ANS: T

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

38. The bank reconciles its statement to the depositor's records.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

39. In preparing a bank reconciliation, the amount indicated by a credit memorandum for a note

receivable collected by the bank is added to the balance per depositor's records.

ANS: T

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

40. In preparing a bank reconciliation, the amount of an error indicating the recording of a check

in the journal for an amount larger than the amount of the check is added to the balance per

depositor's records.

ANS: T

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

41. A check outstanding for two consecutive months will appear only on the first month's bank

reconciliation.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

42. After a bank reconciliation is completed, adjusting entries are prepared for items in the

balance per depositor's records as well as items in the balance per bank statement.

ANS: F

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

43. A business who requires that all cash payments be made by check, can not use a petty cash

system.

ANS: T

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

362 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

44. In establishing a petty cash fund, a check is written for the amount of the fund and is

recorded as a debit to Accounts Payable and a credit to Petty Cash.

ANS: F

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

45. Expenditures from a petty cash fund are documented by a petty cash receipt.

ANS: T

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

46. The sum of the money on hand and petty cash receipts in a petty cash fund will always be

equal to the balance in the Petty Cash account.

ANS: F

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

47. When the petty cash fund is replenished, the petty cash account is credited for the total of all

expenditures made since the fund was last replenished.

ANS: F

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

48. Most companies who have several bank accounts, petty cash, and cash on hand, would list

each separately on the balance sheet..

ANS: F

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

49. A petty cash fund is used to pay relatively large amounts.

ANS: F

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

50. The petty cash fund eliminates the need for a bank checking account.

ANS: F

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

51. A compensating balance occurs when a bank may require a depositor to maintain a

maximum cash balance.

ANS: F

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

52. Cash equivalents are short -term investments that will be converted to cash within 120 days.

ANS: F

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

53. Money market accounts, commercial paper, and United States Treasury Notes are examples

of cash equivalents.

ANS: F

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 363

54. The doomsday ratio includes both cash and cash equivalents in the numerator.

ANS: T

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

MULTIPLE CHOICE

1.

Which one of the following below is not an element of internal control?

a. risk assessment

b. monitoring

c. information and communication

d. behavior analysis

ANS: D

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

2.

Which one of the following below is not a factor that influences a business's control

environment?

a. management's philosophy and operating style

b. organizational structure

c. proofs and security measurers

d. personnel policies

ANS: C

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

3.

When a firm uses internal auditors, it is adhering to which one of the following internal

control elements?

a. risk assessment

b. monitoring

c. proofs and security measures

d. separating responsibilities for related operations

ANS: B

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

4.

The objectives of internal control are to

a. control the internal organization of the accounting department personnel and equipment

b. provide reasonable assurance that operations are managed to achieve goals, financial

reports are accurate, and laws and regulations are complied with

c. prevent fraud, and promote the social interest of the company

d. provide control over "internal-use only" reports and employee internal conduct

ANS: B

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

364 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

5.

Which one of the following below reflects a weak internal control system?

a. all employees are well supervised

b. a single employee is responsible for comparing a receiving report to an invoice

c. all employees must take their vacations

d. a single employee is responsible for collecting and recording of cash

ANS: D

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

6.

Internal control does not consist of policies and procedures that

a. protect assets from misuse

b. aid management in directing operations toward achieving business goals

c. guarantee the company will not go bankrupt

d. ensure that business information is accurate

ANS: C

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

7.

A firm's internal control environment is not influenced by

a. management's operating style

b. organizational structure

c. personnel policies

d. monitoring policies

ANS: D

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

8.

An element of internal control is

a. risk assessment

b. journals

c. subsidiary ledgers

d. controlling accounts

ANS: A

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

9.

A necessary element of internal control is

a. database

b. systems design

c. systems analysis

d. information and communication

ANS: D

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 365

10. In management's internal control report that is now required of all public companies, which

of the following does not have a direct effect on a company's internal control system.

a. internal auditors

b. independent accountants

c. Board of Director's audit committee

d. Board of trustees

ANS: D

DIF: Moderate

OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Legal

11. Which of the following should not be considered cash by an accountant?

a. money orders

b. bank checking accounts

c. postage stamps

d. travelers' checks

ANS: C

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

12. The cash account in the depositor's ledger is a(n)

a. asset with a debit balance

b. asset with a credit balance

c. liability with a debit balance

d. liability with a credit balance

ANS: A

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

13. The notification accompanying a check that indicates the specific invoice being paid is

called a

a. remittance advice

b. voucher

c. debit memorandum

d. credit memorandum

ANS: A

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

14. The debit balance in Cash Short and Over at the end of an accounting period is reported as

a. an expense on the income statement

b. income on the income statement

c. an asset on the balance sheet

d. a liability on the balance sheet

ANS: A

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

366 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

15. An example of a preventive control is

a. the use of a bank account

b. separation of the Purchasing Department and Accounting Department personnel

c. bonding employees who handle cash

d. accepting payment in currency only

ANS: B

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

16. Procedures designed to protect cash from theft and misuse from the time it is received until

it can be deposited in a bank are called

a. accounting controls

b. cash controls

c. preventive controls

d. detective controls

ANS: C

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

17. A special form on which is recorded pertinent data about a liability and the particulars of its

payment is called a(n)

a. invoice

b. voucher

c. debit memorandum

d. remittance advice

ANS: B

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

18. EFT

a. means Efficient Funds Transfer

b. can process certain cash transactions at less cost than by using the mail

c. makes it easier to document purchase and sale transactions

d. means Effective Funds Transfer

ANS: B

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

19. A voucher

a. is received from customers to explain the purpose of a payment

b. is normally prepared in the Accounting Department

c. system is used to control cash receipts

d. system is an internal control procedure to verify that the assets in the ledger are the ones

the company owns

ANS: B

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 367

20. A voucher is usually supported by

a. a supplier's invoice

b. a purchase order

c. a receiving report

d. all of the above

ANS: D

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

21. Under the voucher system, every transaction is recorded at the time of

a. requisitioning

b. ordering

c. incurring

d. paying

ANS: C

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

22. The reconciliation of the cash register tape with the cash in the register is an example of

a. other controls.

b. independent internal verification.

c. establishment of responsibility.

d. segregation of duties.

ANS: B

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

23. Which of the following is not an internal control activity for cash?

a. The number of persons who have access to cash should be limited.

b. All cash receipts should be recorded promptly.

c. The functions of record keeping and maintaining custody of cash should be combined.

d. Surprise audits of cash on hand should be made occasionally.

ANS: C

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

24. The term cash includes

a. coins, currency (paper money), checks

b. money orders, and money on deposit that is available for unrestricted withdrawal

c. short-term receivables

d. a and b

ANS: D

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

368 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

25. On the bank's accounting records, customers' accounts are normally shown as

a. debit balances

b. expenses

c. an asset

d. a liability

ANS: D

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

26. Credit memorandums from the bank

a. decrease a bank customer's account

b. are used to show a bank service charge

c. show that a company has deposited a customer's NSF check

d. show the bank has collected a note receivable for the customer

ANS: D

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

27. A bank statement

a. is a credit reference letter written by the depositor's bank.

b. lets a depositor know the financial position of the bank as of a certain date.

c. is a bill from the bank for services rendered.

d. shows the activity that increased or decreased the depositor's account balance.

ANS: D

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

28. Which one of the following would not cause a bank to debit a depositor's account?

a. Bank service charge

b. Collection of a note receivable

c. Checks marked NSF

d. Wiring of funds to other locations

ANS: B

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

29. There are three parties to a check. The drawer is

a. a written document signed by the depositor

b. is the one who signs the check ordering payment by the bank

c. the bank on which the check is drawn

d. the party to whom payment is to be made

ANS: B

DIF: Moderate

OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 369

30. A debit or credit memorandum describing entries in the depositor's bank account may be

enclosed with the bank statement. An example of a credit memorandum is

a. deposited checks returned for insufficient funds

b. a promissory note left for collection

c. a service charge

d. notification that a customer's check for $375 was recorded by the depositor as $735 on

the deposit ticket

ANS: B

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

31. Following the completion of the bank reconciliation, an adjusting entry was made that

debited cash and credited Interest Revenue. Therefore the bank reconciliation must have

included an item that was

a. deducted from the balance per depositor's records

b. deducted from the balance per bank statement

c. added to the balance per bank statement

d. added to the balance per depositor's records

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

32. A person authorized to write checks drawn on a checking account at a bank must sign and

have on file with the bank a

a. signature card

b. deposit ticket

c. checkbook

d. bank card

ANS: A

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

33. A check drawn by a depositor for $180 in payment of a liability was recorded in the journal

as $810. This item would be included on the bank reconciliation as a(n)

a. addition to the balance per the depositor's records

b. addition to the balance per the bank statement

c. deduction from the balance per the bank statement

d. deduction from the balance per the depositor's records

ANS: A

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

370 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

34. A check drawn by a depositor for $180 in payment of a liability was recorded in the journal

as $810. What entry is required in the depositor's accounts?

a. debit Accounts Payable; credit Cash

b. debit Cash; credit Accounts Receivable

c. debit Cash; credit Accounts Payable

d. debit Accounts Receivable; credit Cash

ANS: C

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

35. A bank reconciliation should be prepared periodically because

a. the depositor's records and the bank's records are in agreement

b. the bank has not recorded all of its transactions

c. any differences between the depositor's records and the bank's records should be

determined, and any errors made by either party should be discovered and corrected

d. the bank must make sure that its records are correct

ANS: C

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

36. The bank reconciliation

a. should be prepared by an employee who records cash transactions

b. is part of the internal control system

c. is for information purposes only

d. is sent to the bank for verification

ANS: B

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

37. Journal entries based on the bank reconciliation are required in the depositor's accounts for

a. outstanding checks

b. deposits in transit

c. bank errors

d. book errors

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

38. Accompanying the bank statement was a debit memorandum for bank service charges. On

the bank reconciliation, the item is

a. a deduction from the balance per depositor's records

b. an addition to the balance per bank statement

c. a deduction from the balance per bank statement

d. an addition to the balance per depositor's records

ANS: A

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 371

39. Accompanying the bank statement was a debit memorandum for bank service charges. What

entry is required in the depositor's accounts?

a. debit Miscellaneous Administrative Expense; credit Cash

b. debit Cash; credit Other Income

c. debit Cash; credit Accounts Payable

d. debit Accounts Payable; credit Cash

ANS: A

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

40. A check drawn by a depositor in payment of a voucher for $725 was recorded in the journal

as $257. This item would be included in the bank reconciliation as a(n)

a. deduction from the balance per the depositor's records

b. addition to the balance per the bank statement

c. deduction from the balance per the bank statement

d. addition to the balance per the depositor's records

ANS: A

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

41. A check drawn by a depositor in payment of a voucher for $725 was recorded in the journal

as $257. What entry is required in the depositor's accounts?

a. debit Accounts Payable; credit Cash

b. debit Cash; credit Accounts Receivable

c. debit Cash; credit Accounts Payable

d. debit Accounts Receivable; credit Cash

ANS: A

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

42. Receipts from cash sales of $9,500 were recorded incorrectly in the cash receipts journal as

$5,900. This item would be included on the bank reconciliation as a(n)

a. deduction from the balance per depositor's records

b. addition to the balance per bank statement

c. deduction from the balance per bank statement

d. addition to the balance per depositor's records

ANS: D

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

43. Receipts from cash sales of $9,500 were recorded incorrectly in the cash receipts journal as

$5,900. What entry is required in the depositor's accounts?

a. debit Sales; credit Cash

b. debit Cash; credit Accounts Receivable

c. debit Cash; credit Sales

d. debit Accounts Receivable; credit Cash

ANS: C

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

372 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

44. Accompanying the bank statement was a credit memorandum for a short-term note collected

by the bank for the depositor. This item is a(n)

a. deduction from the balance per depositor's records

b. addition to the balance per bank statement

c. deduction from the balance per bank statement

d. addition to the balance per depositor's records

ANS: D

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

45. Accompanying the bank statement was a credit memorandum for a short-term note collected

by the bank for the customer. What entry is required in the depositor's accounts?

a. debit Notes Receivable; credit Cash

b. debit Cash; credit Miscellaneous Income

c. debit Cash; credit Notes Receivable

d. debit Accounts Receivable; credit Cash

ANS: C

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

46. The amount of deposits in transit is included on the bank statement as a(n)

a. deduction from the balance per the depositor's books

b. deduction from the balance per bank statement

c. addition to the balance per bank statement

d. addition to the balance per depositor books

ANS: C

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

47. The amount of the outstanding checks is included on the bank reconciliation as a(n)

a. deduction from the balance per depositor's records

b. addition to the balance per bank statement

c. deduction from the balance per bank statement

d. addition to the balance per depositor's records

ANS: C

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

48. Which of the following items that appeared on the bank reconciliation did not require an

adjusting entry?

a. bank service charges

b. deposits in transit

c. NSF checks

d. A check for $520, recorded in the check register for $250.

ANS: B

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 373

49. What entry is required in the depositor's accounts to record outstanding checks?

a. debit Accounts Receivable; credit Cash

b. debit Cash; credit Accounts Receivable

c. debit Cash; credit Accounts Payable

d. none

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

50. Accompanying the bank statement was a debit memorandum for an NSF check received

from a customer. This item would be included on the bank reconciliation as a(n)

a. deduction from the balance per depositor's records

b. addition to the balance per bank statement

c. deduction from the balance per bank statement

d. addition to the balance per depositor's records

ANS: A

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

51. Accompanying the bank statement was a debit memorandum for an NSF check received

from a customer. What entry is required in the depositor's accounts?

a. debit Other Income; credit Cash

b. debit Cash; credit Other Income

c. debit Cash; credit Accounts Receivable

d. debit Accounts Receivable; credit Cash

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

52. During the month, a company was informed that a check they had issued was accidentally

destroyed. On the bank reconciliation, the company would

a. deduct the amount from the balance per the depositor's records

b. deduct the amount from the balance per the bank statement

c. Add the amount to the balance per the bank statement

d. Add the amount to the balance per the depositor's records

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

53. The amount of cash to be reported on the balance sheet at June 30 is the

a. total of the cash column in the cash receipts journal as of June 30

b. adjusted balance appearing in the bank reconciliation for June 30

c. total of the cash column in the cash payments journal as of June 30

d. balance as of June 30 on the bank statement

ANS: B

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

374 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

54. Which of the following would be deducted from the balance per books on a bank

reconciliation?

a. Service charges

b. Outstanding checks

c. Deposits in transit

d. Notes collected by the bank

ANS: A

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

55. Which of the following would be added to the balance per books on a bank reconciliation?

a. Service charges

b. Outstanding checks

c. Deposits in transit

d. Notes collected by the bank

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

56. Which of the following would be subtracted from the balance per books on a bank

reconciliation?

a. Outstanding checks

b. Deposits in transit

c. Notes collected by the bank

d. Service charges

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

57. Which of the following would be subtracted from the balance per bank on a bank

reconciliation?

a. Outstanding checks

b. Deposits in transit

c. Notes collected by the bank

d. Service charges

ANS: A

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

58. A bank reconciliation should be prepared

a. whenever the bank refuses to lend the company money.

b. to explain any difference between the depositor's balance per books with the balance per

bank.

c. when an employee is suspected of fraud.

d. by the person who is authorized to sign checks.

ANS: B

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 375

59. Jones Company had checks outstanding totaling $5,400 on its June bank reconciliation. In

July, Jones Company issued checks totaling $38,900. The July bank statement shows that

$26,300 in checks cleared the bank in July. A check from one of Jones Company's customers

in the amount of $300 was also returned marked "NSF." The amount of outstanding checks

on Davis Company's July bank reconciliation should be

a. $7,200.

b. $12,600.

c. $17,700.

d. $18,000.

ANS: D

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

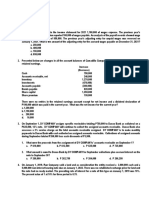

60. Santos Company gathered the following reconciling information in preparing its August

bank reconciliation:

Cash balance per books, 8/31

Deposits in transit

Notes receivable and interest collected by bank

Bank charge for check printing

Outstanding checks

NSF check

The adjusted cash balance per books on August 31 is

a.

b.

c.

d.

ANS:

NAT:

$3,500

150

850

20

2,000

170

$4,160.

$4,010.

$2,310.

$2,460.

A

DIF: Moderate

OBJ: 07-05

AACSB Analytic | AICPA FN-Measurement

61. Jonas Company gathered the following reconciling information in preparing its April bank

reconciliation:

Cash balance per books, 4/30

Deposits in transit

Notes receivable and interest collected by bank

Bank charge for check printing

Outstanding checks

NSF check

The adjusted cash balance per books on April 30 is

$2,200

300

740

25

1,500

140

376 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

a.

b.

c.

d.

ANS:

NAT:

$3,075.

$2,940.

$2,775.

$3,055.

C

DIF: Moderate

OBJ: 07-05

AACSB Analytic | AICPA FN-Measurement

62. Marcus Company developed the following reconciling information in preparing its

September bank reconciliation:

Cash balance per bank, 9/30

Note receivable collected by bank

Outstanding checks

Deposits-in-transit

Bank service charge

NSF

$11,000

6,000

9,000

4,500

75

1,200

Using the above information, determine the cash balance per books (before adjustments) for

the Marcus Company.

a. $9,775

b. $15,725

c. $15,500

d. $1,775

ANS: D

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

63. Morris Company developed the following reconciling information in preparing its

December bank reconciliation:

Cash balance per bank, 12/31

Note receivable collected by bank

Outstanding checks

Deposits-in-transit

Bank service charge

NSF check

$13,000

6,000

8,000

4,500

75

1,200

Using the above information, determine the cash balance per books (before adjustments) for

the Morris Company.

a. $4,775

b. $14,225

c. $15,500

d. $17,725

ANS: A

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 377

64. A $100 petty cash fund has cash of $18 and receipts of $80. The journal entry to replenish

the account would include a

a. credit to Petty Cash for $84.

b. debit to Cash for $80.

c. debit to Cash Over and Short for $2.

d. credit to Cash for $80

ANS: C

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

65. A $100 petty cash fund has cash of $16 and receipts of $86. The journal entry to replenish

the account would include a

a. credit to Petty Cash for $86.

b. debit to Cash for $86.

c. credit to Cash Over and Short for $2.

d. credit to Cash for $80

ANS: C

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

66. Entries are made to the Petty Cash account when

a. making payments out of the fund.

b. recording shortages in the fund.

c. replenishing the petty cash fund.

d. establishing the fund.

ANS: D

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

67. The type of account and normal balance of Petty Cash is a(n)

a. revenue, credit

b. asset, debit

c. liability, credit

d. expense, debit

ANS: B

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

68. The debit recorded in the journal to reimburse the petty cash fund is to

a. Petty Cash

b. Accounts Receivable

c. Cash

d. various accounts for which the petty cash was disbursed

ANS: D

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

378 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

69. A $100 petty cash fund contains $92 in petty cash receipts, and $6.50 in currency and coins.

The journal entry to record the replenishment of the fund would include a

a. credit to Petty Cash for $93.50

b. credit to Cash for $92

c. debit to Cash Short and Over for $1.50

d. credit to Cash Short and Over for $1.50

ANS: C

DIF: Moderate

OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

70. A $100 petty cash fund has cash of $16 and receipts of $80. The journal entry to replenish

the account would include a credit to

a. Cash for $80.

b. Cash Over and Short for $4.

c. Petty Cash for $84.

d. Cash for $84.

ANS: D

DIF: Easy OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

71. Cash equivalents include

a. checks

b. coins and currency

c. money market accounts and commercial paper

d. stocks and short-term bonds

ANS: C

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

72. Cash equivalents

a. are illegal in some states

b. will be converted to cash within two years

c. will be converted to cash within 90 days

d. will be converted to cash within 120 days

ANS: C

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

73. A minimum cash balance required by a bank is called

a. cash in bank

b. cash equivalents

c. compensating balance

d. EFT

ANS: C

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 379

74. During 2007, Creative Inc has monthly cash expenses of $150,000. On December 31, 2007,

their cash balance is $1,550,000. The ratio of cash to monthly cash expenses is

a. 9.7

b. 10.3

c. 10.7

d. 11.1

ANS: B

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

75. During a bank reconciliation process,

a. Outstanding checks and deposits in transit are added to the bank statement balance.

b. Outstanding checks are subtracted and deposits in transit are added to the bank statement

balance.

c. Outstanding checks and deposits in transit are subtracted from the bank statement

balance.

d. Outstanding checks are added and deposits in transit are subtracted to the bank statement

balance.

ANS: B

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

76. In the normal operation of business you receive a check from a customer and deposit it into

your checking account. With your bank statement you are advised that this check for $450 is

NSF. The bank also informs you that due to the amount of activity on your business

account the monthly service charge is $40.

During a bank reconciliation:

a. subtract both values from balance according to bank.

b. add both values from balance according to books.

c. add both values from balance according to bank.

d. subtract both values from balance according to books.

ANS: D

DIF: Moderate

OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

77. Which of the following would not be included with the Cash and Equivalents on the Balance

Sheet?

a. Commercial Paper

b. Short-Term Receivables

c. Certificates of Deposit

d. Municipal Securities

e. Money Market Mutual Funds

ANS: B

DIF: Moderate

OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

380 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

EXERCISE/OTHER

1.

Identify each of the following as relating to (a) the control environment, (b) risk assessment,

or (c) control procedures.

(1) Mandatory vacations

(2) Personnel policies

(3) Report of outside consultants on future market changes

ANS:

(1) (c) control procedures

(2) (a) the control environment

(3) (b) risk assessment

DIF: Easy OBJ: 07-01 TOP: Example Exercise 7-1

2.

Distinguish preventive controls from detective controls and give examples of each as they

relate to cash.

ANS:

Preventive controls are to protect cash from theft and misuse. They are meant to prevent theft

and misuse. Detective controls are to detect theft or misuse of cash. They are meant to detect a

theft or misuse after it occurs. An example of preventive controls is the use of cash registers. An

example of detective controls is the use of bank accounts and bank reconciliation.

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA FN-Measurement

3. List the objectives of internal control and give an example of how each is implemented.

ANS:

Internal control provides reasonable assurance that

(1) assets are safeguarded and used for business purposes

(2) business information is accurate

(3) employees comply with laws and regulations

Examples are

(1) duties are separated

(2) duties are rotated

(3) reports are submitted to management

There are many other examples that would be correct.

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 381

4.

The following selected transactions relate to cash collections for a firm that maintains a

$100 change fund at all times. Present entries to record the transactions for each of the two

days of cash receipts from sales.

(a)

(b)

Actual cash in cash register, $3,012.26; cash receipts per cash register tally,

$2,913.21.

Actual cash in cash register, $2,912.95; cash receipts per cash register tally,

$2,812.32.

ANS:

(a)

Cash

Cash Short and Over

Sales

(b)

Cash

Cash Short and Over

Sales

2,912.26

0.95

2,913.21

2,812.95

0.63

2,812.32

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

5.

Describe the features of a voucher system and list typical supporting documents for a

voucher.

ANS:

A voucher system is used to control cash disbursements. For example, the voucher system should

provide reasonable assurance that only authorized payments are made. Another example is that a

voucher system should ensure that all cash discounts are taken.

Specifically, a voucher system is a set of procedures for authorizing and recording liabilities and

cash payments. It usually consists of vouchers, a file for unpaid vouchers and a file for paid

vouchers.

Typical supporting documents for a voucher are a supplier's invoice, a purchase order, and a

receiving report.

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

382 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

6.

The actual cash received during the week ended January 7 for cash sales was $17,547.00,

and the amount indicated by the cash register total was $17,541.00. Journalize the entry to

record the cash receipts and cash sales.

Journal

Post

Date

Description

Ref

Debit

Credit

ANS:

Journal

Date

Jan 7

Description

Post

Ref

Cash

Sales

Cash Short and Over

Debit

17,547.00

Credit

17,541.00

6.00

DIF: Easy OBJ: 07-03

NAT: AACSB Analytic | AICPA FN-Measurement

7. List the principal advantage of Electronic Funds Transfers.

ANS:

Advantage: more efficient transfer and recording of cash among companies.

DIF: Easy OBJ: 07-04

NAT: AACSB Technology | AICPA BB-Leveraging Technology

8. Why would a bank require a company to maintain a compensating balance?

ANS:

Usually it is part of a loan agreement or line of credit.

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA BB-Industry

9.

The following items may appear on a bank statement:

1.

2.

3.

4.

NSF check

EFT Deposit

Service charge

Bank correction of an error from recording a $300 check as $30.

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 383

Indicate whether the item would appear as debit or credit memorandum on the bank

statement and whether the item would increase or decrease the balance of your account. Use

the following format:

Appears on the

Bank Statement as a

Increases (Decreases) the

a Debit or Credit

Balance of the Depositors

Item No.

Memorandum

Bank Account

ANS:

Item No.

1.

2.

3.

4.

Appears on the

Bank Statement as a

a Debit or Credit

Memorandum

Debit Memorandum

Credit Memorandum

Debit Memorandum

Debit Memorandum

Increases (Decreases) the

Balance of the Depositors

Bank Account

Decreases

Increases

Decreases

Decreases

DIF: Easy OBJ: 07-04

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 7-2

10. Using the following bank reconciliation for Cole Co. for May 31, 2007, record the

appropriate journal entries that would be necessary.

Cole Co.

Bank Reconciliation

May 31, 2007

Cash balance according to bank statement

Add deposits in transit not recorded by bank

$3,012

704

$3,716

590

$3,126

$3,165

Deduct outstanding checks

Adjusted balance

Cash balance according to depositor's records

Deduct: Bank service charge

Error in recording

Adjusted balance

ANS:

Miscellaneous Administrative Expense

Supplies

Cash

DIF: Easy OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

$ 30

9

39

$3,126

30

9

39

384 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

11. Using the following bank reconciliation for Allen Co. for June 30, 2007, record the

appropriate journal entries that would be necessary.

Allen Co.

Bank Reconciliation

June 30, 2007

Cash balance according to bank statement

Add deposits in transit not recorded by bank

Deduct outstanding checks

Adjusted balance

Cash balance according to depositor's records

Add: Note collected by bank, including

$50 interest

Error in recording cash sales of

$342 as $324

Deduct: NSF check from Alice Bell

Bank service charges

Adjusted balance

ANS:

Cash

Notes Receivable

Interest Revenue

Sales

Accounts Receivable-Alice Bell

Miscellaneous Administrative Expense

Cash

$8,000.00

500.00

$8,500.00

2,200.00

$6,300.00

$3,675.00

$2,850.00

18.00

$ 218.00

25.00

2,868.00

$6,543.00

243.00

$6,300.00

2,868.00

2,800.00

50.00

18.00

218.00

25.00

243.00

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

12. Using the following information, prepare a bank reconciliation for Cole Co. for May 31,

2007:

(a)

(b)

(c)

(d)

(e)

(f)

The bank statement balance is $3,012.

The cash account balance is $3,165.

Outstanding checks amounted to $590.

Deposits in transit are $704.

The bank service charge is $30.

A check for $76 for supplies was recorded as $67 in the ledger.

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 385

ANS:

Cole Co.

Bank Reconciliation

May 31, 2007

Cash balance according to bank statement

Add deposits in transit not recorded by bank

Deduct outstanding checks

Adjusted balance

Cash balance according to depositor's records

Deduct: Bank service charge

Error in recording

Adjusted balance

$3,012

704

$3,716

590

$3,126

$3,165

$ 30

9

39

$3,126

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

13. Identify each of the following reconciling items as (a) an addition to the cash balance

according to the bank statement, (b) deduction from the cash balance according to the bank

statement, (c) an addition to the cash balance according to the companys records, or (d) a

deduction from the cash balance according to the companys records. Assume that none of

the transactions reported by bank debit and credit memorandums have been recorded by the

depositor. Also, indicate by writing (Entry) those items that will require a journal entry in the

companys accounts.

1.

2.

3.

4.

5.

6.

Deposits in transit.

Bank service charges.

NSF check.

Outstanding checks.

Check for $570 incorrectly recorded by the company as $750.

Check for $540 incorrectly recorded by the company as $450.

ANS:

1. (a) an addition to the cash balance according to the bank statement

2. (d) a deduction from the cash balance according to the companys records (entry)

3. (d) a deduction from the cash balance according to the companys records (entry)

4. (b) deduction from the cash balance according to the bank statement

5. (c) an addition to the cash balance according to the companys records (entry)

6. (d) a deduction from the cash balance according to the companys records (entry)

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 7-3

386 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

14. Using the following information, prepare a bank reconciliation for Nature Co. for July 31,

2007:

(a)

(b)

(c)

(d)

(e)

(f)

The bank statement balance is $4,062

The cash account balance is $4,165.

Outstanding checks amounted to $640.

Deposits in transit are $704.

The bank service charge is $30.

A check for $76 for supplies was recorded as $67 in the ledger.

ANS:

Nature Co.

Bank Reconciliation

July 31, 2007

Cash balance according to bank statement

Add deposits in transit not recorded by bank

Deduct outstanding checks

Adjusted balance

Cash balance according to depositor's records

Deduct: Bank service charge

Error in recording

Adjusted balance

$4,062

704

$4,766

640

$4,126

$4,165

$ 30

9

39

$4,126

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

15. Journalize the entries to record the following:

Jan 1

Established a petty cash fund of $500.00

Jan 31 The amount of cash in the petty cash fund is now $123.00. The fund is

replenished based on the following receipts: office supplies, $215.00; selling

expenses, $168.00.

Record any discrepancy in the cash short and over account.

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 387

Journal

Date

Post

Ref

Description

Debit

Credit

ANS:

Journal

Date

Jan 1

Jan 31

Description

Petty Cash

Cash

Office Supplies

Selling Expenses

Cash Short and Over

Cash

Post

Ref

Debit

500.00

Credit

500.00

215.00

168.00

6.00

377.00

DIF: Moderate

OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 7-4

16. On January 2nd Mega Sales decides to establish a $100.00 Petty Cash Account to relieve the

burden on Accounting.

(a)

Journalize this event.

(b) On January 10th the petty cash fund has receipts for mail and postage of

$37.50, contributions and donations of $14.75, meals and entertainment of

$36.25 and $11.25 in cash. Journalize the replenishment of the fund.

(c)

On January 11th Mega Sales decides to increase petty cash to $200.00.

Journalize this event.

388 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

ANS:

(a) Jan 2

(b) Jan 10

(c) Jan 11

Petty Cash

Cash

Mail and Postage Expense

Contributions and Donations Expense

Meals and Entertainment Expense

Cash Over and Under

Cash

Petty Cash

Cash

100.00

100.00

37.50

14.75

36.25

0.25

88.75

100.00

100.00

DIF: Moderate

OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement TOP: Example Exercise 7-4

17.

(a)

(b)

Where are cash equivalents disclosed in the financial statements?

List three examples of cash equivalents.

ANS:

(a) Cash account on the balance sheet.

(b) Money market funds; notes of major corporations (commercial paper); United

States Treasury Bills.

DIF: Easy OBJ: 07-07

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 389

PROBLEM

1. List and define each of the five elements of internal control.

ANS:

(1) Control Environment. The control environment is the overall attitude of

management and employees about the importance of internal controls.

(2) Risk assessment. Risk assessment is the identification of risks faced by an

organization so that management can take necessary actions to control them.

(3) Control Procedures. The control procedures are the policies and procedures

designed to provide reasonable assurance that the business goals are met and

fraud is prevented.

(4) Monitoring. Monitoring locates deficiencies in the internal control system

and improves control effectiveness.

(5) Information and Communication. Information and communication to

management about the control environment, risk assessment, control

procedures, and monitoring elements of internal control are needed by

management to guide operations and ensure compliance with reporting,

legal, and regulatory requirements.

DIF: Easy OBJ: 07-02

NAT: AACSB Analytic | AICPA BB-Industry

390 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

2.

Two features of internal control are presented in the following sections. Each is followed by

a list of four irregularities that occurred in processing data. Identify the one irregularity from

each list that would be discovered or prevented by the feature of internal control described.

(a)

The sum of the balances of the accounts in the customers ledger is compared at the

end of each month with the balance of the accounts receivable account in the

general ledger by a person who has no responsibility for maintaining either the

general ledger or the customers ledger.

(1)

(2)

(3)

(4)

(b)

Five hours of services were rendered but the customer was only billed for four

hours.

A cash receipt of $750 was recorded correctly in the accounts receivable

controlling account but was posted to the customers ledger as $75.

A bill for services rendered to Cole Co. was erroneously posted to the account

of Coleman Co. in the customers ledger.

No entry was made in the accounting records for services rendered to a

customer.

Both cash and credit charges for services rendered are recorded on prenumbered

invoices. At the end of the day, all invoices are accounted for before the duplicate

copies of the invoices are routed to the accounting department for entry into the

accounts and the cash is sent to the cashier's department for deposit.

(1)

(2)

(3)

(4)

Some charge customers complained that the monthly statements of account did

not add all amounts correctly.

Some clerks used incorrect hourly rates in preparing invoices.

Some clerks destroyed duplicate copies of cash invoices and misappropriated

the cash.

Some charge customers complained that the monthly statement of account did

not indicate credits for payments made.

ANS:

(a) (2)

(b) (3)

DIF: Moderate

OBJ: 07-02

NAT: AACSB Analytic | AICPA FN-Measurement

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 391

3.

The bank statement for Allen Co. indicates a balance of $8,000.00 on June 30, 2007. After

the journals for June had been posted, the cash account had a balance of $3,675.00. Prepare

a bank reconciliation on the basis of the following reconciling items:

(a)

(b)

(c)

(d)

(e)

(f)

Cash sales of $342 had been erroneously recorded in the cash receipts journal as

$324.

Deposits in transit not recorded by bank, $500.00.

Bank debit memorandum for service charges, $25.00.

Bank credit memorandum for note collected by bank, $2850, including $50 interest.

Bank debit memorandum for $218.00 NSF (not sufficient funds) check from Alice

Bell, a customer.

Checks outstanding, $2,200.00.

ANS:

Allen Co.

Bank Reconciliation

June 30, 2007

Cash balance according to bank statement

Add deposits in transit not recorded by bank

Deduct outstanding checks

Adjusted balance

Cash balance according to depositor's records

Add: Note collected by bank, including

$50 interest

Error in recording cash sales of

$342 as $324

Deduct: NSF check from Alice Bell

Bank service charges

Adjusted balance

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

$8,000.00

500.00

$8,500.00

2,200.00

$6,300.00

$3,675.00

$2,850.00

18.00

$ 218.00

25.00

2,868.00

$6,543.00

243.00

$6,300.00

392 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

4.

Western Flyers received its bank statement for the month of July with an ending balance of

$11,065.00. Western Flyers determined that check #598 for $125.00 and check #601 for

$375.00 were both outstanding. Also, a $7,500.00 deposit for July 30th was in transit as of

the end of the month. Big Bucks Bank also collected a $5,000.00 notes receivable on July

1st that was issued January 1st at 12% annual interest. No interest revenue has been accrued

on this note and Big Bucks Bank charged a $15.00 fee for the collection service.The

companys morning reports resulted in a bank service charge of $20.00 and a customer

check for $75.00 was returned with the statement marked NSF. The ending balance of the

Western Flyers cash account is $12,875.00.

Complete a bank/account reconciliation and write any necessary journal entries for the

reconciliation.

ANS:

Bank balance July 31:

$11,065.00

Add deposits in transit

7,500.00

Less outstanding checks

125.00

375.00

(500.00)

Adjusted balance - bank:

$18,065.0

0

Company balance July 31:

Add N/R

Interest Revenue

Less collection fee

Less morning report fee

Less NSF check

Adjusted balance - company

Jul 31

Jul 31

Jul 31

$12,875.0

0

5,000.00

300.00

(15.00) 5,285.00

(20.00)

(75.00)

$18,065.0

0

Cash

Bank Service Charge Expense

Notes Receivable

Interest Revenue

5,285.00

15.00

Bank Service Charge Expense

Cash

20.00

Accounts Receivable

Cash

75.00

5,000.00

300.00

20.00

75.00

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 393

DIF: Difficult

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

5.

Big Vault Bank sent Paper Punchers their end of month bank statement for March. The end

of month balance by the bank is $9,755.00. The statement shows that a deposit for $5,750 is

in transit at the end of the statement period. The statement also revealed that checks for

$75.00, $145.00, and $85.00 are outstanding. Big Vault collected a 90 day, 10% interest

$3,000.00 note receivable charging $10 for the service. No interest has been accrued on the

note. The bank charges a monthly account fee of $10.00. The end of month balance per

company books is $12,145.00.

Complete a bank/account reconciliation and write any necessary journal entries for the

reconciliation.

ANS:

Bank balance March 31:

9,755.00

Add deposits in transit

5,750.00

Less outstanding checks

75.00

145.00

85.00

(305.00)

Adjusted balance - bank:

15,200.00

Company balance July 31:

Add N/R

Interest Revenue

Less collection fee

Less bank service charge

12,145.00

3,000.00

75.00

(10.00)

Adjusted balance - company

Jul 31

Jul 31

3,065.00

(10.00)

15,200.00

Cash

Bank Service Charge Expense

Notes Receivable

Interest Revenue

3,065.00

10.00

Bank Service Charge Expense

Cash

10.00

DIF: Difficult

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

3,000.00

75.00

10.00

394 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

6.

The cash account for JKL Co. on March 31,2007 indicated a balance of $16,450.00. The

March bank statement indicated an ending balance of $18,345.00. Comparing the bank

statement, the canceled checks, and the accompanying memorandums with the records

revealed the following reconciling items:

(a)

(b)

(c)

(d)

(e)

(f)

Checks outstanding totaled $3,620.00

A deposit of $4,496.00 had been made too late to appear on the bank statement.

A check for $1,233.00 returned with the statement had been incorrectly

recorded as $233.00. The check was originally credited to accounts payable.

The bank collected $4,541.00 on a note left for collection.

Bank service charges for March amounted to $25.00.

A check for $745.00 was returned by the bank because of insufficient funds.

Prepare a bank reconciliation as of March 31, 2007. Journalize the necessary entries.

JKL Co.

Bank Reconciliation

March 31, 2007

Journal

Date

Description

Post

Ref

Debit

Credit

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 395

ANS:

JKL Co.

Bank Reconciliation

March 31, 2007

Cash balance according to bank statement

Add: Deposits not recorded by bank

$18,345.00

4,496.00

22,841.00

3,620.00

$19,221.00

Deduct: Outstanding Checks

Adjusted balance

Cash balance according to depositors records

Add: Proceeds of note collected by bank

$16,450.00

4,541.00

20,991.00

Deduct: Error in recording check

Service Charges

Nonsufficient funds check

Adjusted balance

$1,000

25.00

745.00

1,770.00

$19,221.00

Journal

Date

Mar 31

Description

Post

Ref

Cash

Note Receivable

Accounts Payable

Bank Charge Expense

Accounts Receivable

Cash

Debit

4,541.00

Credit

4,541.00

1,000.00

25.00

745.00

1,770.00

DIF: Moderate

OBJ: 07-05

NAT: AACSB Analytic | AICPA FN-Measurement

7.

On February 3rd Mega Sales decides to establish a $100.00 Petty Cash Account to relieve

the burden on Accounting.

(a) Journalize this event.

(b) On February 11th the petty cash fund has receipts for mail and postage of

$36.75, contributions and donations of $15.25, meals and entertainment of

$35.50 and $12.75 in cash. Journalize the replenishment of the fund.

(c) On February 12th Mega Sales decides to increase petty cash to $200.00.

Journalize this event.

396 Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash

ANS:

(a) Feb 3

Petty Cash

Cash

(b) Feb 11

Mail and Postage Expense

Contributions and Donations Expense

Meals and Entertainment Expense

Cash Over and Under

Cash

(c) Feb 12

Petty Cash

Cash

100.00

100.00

36.75

15.25

35.50

0.25

87.25

100.00

100.00

DIF: Moderate

OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

8.

Present entries to record the following transactions:

(a)

(b)

(c)

Established a petty cash fund of $350.

The petty cash fund now has a balance of $75.80. Replenished the fund, based on

the following disbursements as indicated by a summary of the petty cash receipts:

office supplies expense, $89.50; miscellaneous administrative expense, $108.75;

and miscellaneous selling expense, $65.60.

Increased the petty cash fund to $400.

ANS:

(a)

Petty Cash

Cash

(b)

Office Supplies Expense

Miscellaneous Administrative Expense

Miscellaneous Selling Expense

Cash Short and Over

Cash

(c)

Petty Cash

Cash

DIF: Moderate

OBJ: 07-06

NAT: AACSB Analytic | AICPA FN-Measurement

350.00

350.00

89.50

108.75

65.60

10.35

274.20

50.00

50.00

Chapter 7 /Sarbanes-Oxley, Internal Control, & Cash 397

9.

On February 3rd Mega Sales decides to establish a $200.00 Petty Cash Account to relieve

the burden on Accounting.

(a)

Journalize this event.

(b) On February 11th the petty cash fund has receipts for mail and postage of

$84.75, contributions and donations of $45.25, meals and entertainment of

$35.50 and $25.75 in cash. Journalize the replenishment of the fund.

(c)

On February 12th Mega Sales decides to increase petty cash to $300.00.