Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

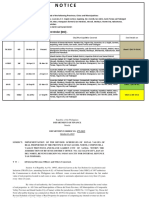

Business Permits Requirements

Caricato da

JurilBrokaPatiño100%(1)Il 100% ha trovato utile questo documento (1 voto)

241 visualizzazioni2 pagineThe document outlines the requirements for obtaining a new Mayor's Business Permit from the local government. It lists three main sections: I) documents required for permit assessment, II) documents needed for the actual permit issuance, and III) additional documents that must be verified within 60 days. Section I specifies identification documents and registration certificates needed based on business type. Section II lists the assessment sheet and tax payment receipts. Section III provides a lengthy list of compliance documents covering various areas like barangay clearance, health and safety, taxes, and any other agency requirements.

Descrizione originale:

Business Permit Requirements

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document outlines the requirements for obtaining a new Mayor's Business Permit from the local government. It lists three main sections: I) documents required for permit assessment, II) documents needed for the actual permit issuance, and III) additional documents that must be verified within 60 days. Section I specifies identification documents and registration certificates needed based on business type. Section II lists the assessment sheet and tax payment receipts. Section III provides a lengthy list of compliance documents covering various areas like barangay clearance, health and safety, taxes, and any other agency requirements.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

241 visualizzazioni2 pagineBusiness Permits Requirements

Caricato da

JurilBrokaPatiñoThe document outlines the requirements for obtaining a new Mayor's Business Permit from the local government. It lists three main sections: I) documents required for permit assessment, II) documents needed for the actual permit issuance, and III) additional documents that must be verified within 60 days. Section I specifies identification documents and registration certificates needed based on business type. Section II lists the assessment sheet and tax payment receipts. Section III provides a lengthy list of compliance documents covering various areas like barangay clearance, health and safety, taxes, and any other agency requirements.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

LIST OF REQUIREMENT FOR NEW MAYORS BUSINESS PERMIT:

I. For issuance of Assessment for Payments

1.Duly filled-up and notarized application form (must be signed by the owner if

Single Proprietor and by the representative if (Corporation/ Partnership/

Cooperative)

2.Photocopy of one valid ID of the signatory

3.Personal proof of billing of owner (if single proprietor)

4.Picture of the business location that includes the nearby establishments

For single proprietorship

Certified True Copy of Department of Trade and Industry Registration Certificate

For partnerships or corporations

Certified True Copy of Certificate of Registration from the Securities and Exchange

Commission, and Articles of Incorporation and By-laws

Original Copy of Secretary Certificate or Board Resolution of Authorized

Representative if signatory is not one of the incorporator

For cooperatives

Certified True Copy of Certificate from the Cooperative Development Authority,

Articles of Cooperative and By-laws; - Original Copy of Secretary Certificate or Board

Resolution of Authorized Representative

II. For the issuance of Mayors Business Permit

Assessment Sheet

Original Copy of Official Receipts of payment for business taxes, fees and charges

Original Copy of Community Tax Certificate of the current year

III. For verification of requirements (must be complied within 60 days from the

issuance of Mayors Business Permit) - Submit original and photocopy of the

following documents:

All of the documents enumerated under I and II above

Barangay Clearance with the official receipt of payment

SSS, PHILHEALTH, and PAG-IBIG Clearance

Sanitary Permit together of the List of Employees duly certified by the City Health

Officer

Fire Safety Inspection Certificate

Real Property Tax Clearance or Certificate of NO DELINQUENCY of the immediately

preceding year, if the property is owned by the applicant OR Contract of Lease if

renting the building and/or land (submit 2 photocopies)

Taxpayer Identification Number (TIN), BIR issued Certificate of Registration (COR),

Proof of Payment of BIR Annual Registration Fee of Php500.00 per establishment

Community Tax Certificate of Employees

Occupational Tax and Professional Tax of Employees

Official Receipt of the Registration of Weights and Measures if engaging with

Weights and Measures

Other Requirements from National and/or Local Government Agencies as the case

maybe (Additional Requirements based from the Joint Inspection Team Remarks)

NOTE: The Mayors Business Permit for New Application issued will be revoked after

sixty (60) days if all the mandatory requirements are not fully complied with.

Potrebbero piacerti anche

- Authorization Letter CompanyDocumento1 paginaAuthorization Letter CompanyГесамага ГецтегNessuna valutazione finora

- 13th Month 2020Documento1 pagina13th Month 2020SJ GeronimoNessuna valutazione finora

- How To Register A Business in The Philippines: Requirements and PermitsDocumento2 pagineHow To Register A Business in The Philippines: Requirements and PermitsBelle MadrigalNessuna valutazione finora

- Module 02 - BIR RegistrationDocumento95 pagineModule 02 - BIR RegistrationKristofer DomagosoNessuna valutazione finora

- Application FormDocumento1 paginaApplication FormLeah A. De GuzmanNessuna valutazione finora

- Tenant Application Form 2018Documento2 pagineTenant Application Form 2018Mae Camille VeraNessuna valutazione finora

- MTO - Recommended Flow of Business & Other Taxes Collection SchemeDocumento11 pagineMTO - Recommended Flow of Business & Other Taxes Collection SchemeChichi DayritNessuna valutazione finora

- Application For Construction Permit (2016!09!03)Documento1 paginaApplication For Construction Permit (2016!09!03)Rain Wynette LeyvaNessuna valutazione finora

- Bir Letter Request2019Documento1 paginaBir Letter Request2019katherine aquinoNessuna valutazione finora

- Mayor Permit RequirementsDocumento2 pagineMayor Permit RequirementsNorman CorreaNessuna valutazione finora

- Business Compliance GuideDocumento6 pagineBusiness Compliance GuideHannah BarrantesNessuna valutazione finora

- Securities and Exchange Commission:: Business Compliance Guide Stock CorporationDocumento5 pagineSecurities and Exchange Commission:: Business Compliance Guide Stock CorporationHannah BarrantesNessuna valutazione finora

- Income Tax Calculator and Form 16Documento10 pagineIncome Tax Calculator and Form 16vsmnglNessuna valutazione finora

- Actual Payee Receipt For All The ItemsDocumento1 paginaActual Payee Receipt For All The Itemsatiq xNessuna valutazione finora

- DTI BNRS - Business Name SearchDocumento3 pagineDTI BNRS - Business Name SearchAnonymous kE1e74yPINessuna valutazione finora

- How To Fill-Out BIR Form 1905Documento11 pagineHow To Fill-Out BIR Form 1905Jhon Michael VillafloresNessuna valutazione finora

- Dole - Request Letter For Cancellation TemplateDocumento1 paginaDole - Request Letter For Cancellation TemplateSecretary JoyNessuna valutazione finora

- Checklist PEZA PermitDocumento2 pagineChecklist PEZA PermitmcdaleNessuna valutazione finora

- RDO No. 112 Tagum City Davao Del NorteDocumento1.278 pagineRDO No. 112 Tagum City Davao Del NorteArvin Antonio OrtizNessuna valutazione finora

- Accounting ManualDocumento2 pagineAccounting ManualAshok Raaj100% (1)

- Del Logistics - Profile (Full)Documento36 pagineDel Logistics - Profile (Full)Dellogistics (Pvt.) Ltd.Nessuna valutazione finora

- 2019form RevGIS StockDocumento13 pagine2019form RevGIS StockMae De GuzmanNessuna valutazione finora

- Actual Payee ReceiptDocumento1 paginaActual Payee Receiptatiq xNessuna valutazione finora

- New Application Form (11!23!2010)Documento2 pagineNew Application Form (11!23!2010)Jessel Recelestino-EsculturaNessuna valutazione finora

- Susmina - Water Refilling Station-Elect.Documento1 paginaSusmina - Water Refilling Station-Elect.michael jan de celisNessuna valutazione finora

- Makati City PermitsDocumento78 pagineMakati City PermitsJustine Joy AvesNessuna valutazione finora

- Visit RelativesDocumento4 pagineVisit RelativesDarwin DavidNessuna valutazione finora

- 1905 January 2018 ENCS - Corrected PDFDocumento3 pagine1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayNessuna valutazione finora

- REquirements For Registration of Business Permits & LicensesDocumento2 pagineREquirements For Registration of Business Permits & Licensesmadelyn sarmientaNessuna valutazione finora

- Su001 1209en PDFDocumento2 pagineSu001 1209en PDFSujata MansukhaniNessuna valutazione finora

- Business Permit ApplicationDocumento2 pagineBusiness Permit Applicationtine delos santosNessuna valutazione finora

- Restaurant Expense Dictionary ReviewDocumento8 pagineRestaurant Expense Dictionary ReviewiMetsu eMailNessuna valutazione finora

- Plumbing Permit: Office of The Building OfficialDocumento2 paginePlumbing Permit: Office of The Building OfficialAlfred Harvey ElacionNessuna valutazione finora

- Petty Cash SampleDocumento11 paginePetty Cash SampleMohammed Ataullah KhanNessuna valutazione finora

- Legal Requirements FinalDocumento7 pagineLegal Requirements FinalJosh BustamanteNessuna valutazione finora

- New NGAS Account CodesDocumento16 pagineNew NGAS Account CodesRichelle RomboNessuna valutazione finora

- Trademark Application: Intellectual Property Office of The PhilippinesDocumento2 pagineTrademark Application: Intellectual Property Office of The PhilippinesJude ItutudNessuna valutazione finora

- Failures of Record KeepingDocumento11 pagineFailures of Record KeepingsomeguyinozNessuna valutazione finora

- FORM-Dorm Application For Upperclass 2016-Final2Documento1 paginaFORM-Dorm Application For Upperclass 2016-Final2MarkVergelBorjaNessuna valutazione finora

- Reportorial RequirementsDocumento2 pagineReportorial RequirementsNathalie QuinonesNessuna valutazione finora

- MSRTC - Online Reservation SystemDocumento2 pagineMSRTC - Online Reservation SystemGanesh GoreNessuna valutazione finora

- Simple PayslipDocumento1 paginaSimple PayslipJeyel Nni MmimilaidaNessuna valutazione finora

- Affidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atDocumento1 paginaAffidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atJheyps VillarosaNessuna valutazione finora

- 2307Documento16 pagine2307Marjorie JotojotNessuna valutazione finora

- Annex D Bir InventoryDocumento17 pagineAnnex D Bir InventoryDada SalesNessuna valutazione finora

- Application For Vendor AccreditationDocumento3 pagineApplication For Vendor AccreditationJohnArgielLaurenteVictorNessuna valutazione finora

- Makati City Business Registration FlowDocumento4 pagineMakati City Business Registration FlowAika Chescka DucaNessuna valutazione finora

- AuthorizationDocumento1 paginaAuthorizationKrishna NaiduNessuna valutazione finora

- Membership: National Master Plumbers Association of The Philippines, IncDocumento1 paginaMembership: National Master Plumbers Association of The Philippines, IncNavi BuereNessuna valutazione finora

- Business Permit Business Permit: General Santos City General Santos CityDocumento1 paginaBusiness Permit Business Permit: General Santos City General Santos Citybktsuna0201100% (1)

- PEZA Citizens CharterDocumento159 paginePEZA Citizens CharterLeah Marie Sernal100% (1)

- Trademark Application: Intellectual Property Office of The PhilippinesDocumento2 pagineTrademark Application: Intellectual Property Office of The PhilippinesRoi GatocNessuna valutazione finora

- Gasoline Station ModelDocumento1 paginaGasoline Station ModelJason PeredaNessuna valutazione finora

- Employer'S Virtual Pag-Ibig Enrollment FormDocumento2 pagineEmployer'S Virtual Pag-Ibig Enrollment FormJhonna Magtoto100% (2)

- DOLE Monitoring of Compliance With JMC 20-04A Checklist As of 08 Jun 21Documento4 pagineDOLE Monitoring of Compliance With JMC 20-04A Checklist As of 08 Jun 21Colleen Rose GuanteroNessuna valutazione finora

- HR fORMSDocumento7 pagineHR fORMSfhpilarbataanNessuna valutazione finora

- All Type of LetterDocumento27 pagineAll Type of LetterPRANAB DASNessuna valutazione finora

- Template For The Data Entry of FINANCIAL STATEMENTDocumento6 pagineTemplate For The Data Entry of FINANCIAL STATEMENTAugust Ponge100% (2)

- TAX 103-Topic 1 - Registration & EBIR FormsDocumento11 pagineTAX 103-Topic 1 - Registration & EBIR Formsmarialynnette lusterioNessuna valutazione finora

- Legal AspectsDocumento11 pagineLegal AspectsIsaiah CruzNessuna valutazione finora

- Opposition To Motion For Leave To File Demurrer To EvidenceDocumento4 pagineOpposition To Motion For Leave To File Demurrer To EvidenceJurilBrokaPatiño100% (1)

- Plaintiffs MemorandumDocumento4 paginePlaintiffs MemorandumJurilBrokaPatiñoNessuna valutazione finora

- Formal Entry of AppearanceDocumento2 pagineFormal Entry of AppearanceJurilBrokaPatiñoNessuna valutazione finora

- Affidavit of CohabitationDocumento2 pagineAffidavit of CohabitationJurilBrokaPatiñoNessuna valutazione finora

- Deman Letter For EntongDocumento2 pagineDeman Letter For EntongJurilBrokaPatiñoNessuna valutazione finora

- Affidavit of Discrepancy in NameDocumento2 pagineAffidavit of Discrepancy in NameJurilBrokaPatiño100% (1)

- Deed of Sale of Motor Vehicle With Assumption of Mortgage Paras To PaulinoDocumento3 pagineDeed of Sale of Motor Vehicle With Assumption of Mortgage Paras To PaulinoJurilBrokaPatiño100% (2)

- Petition For Declaration of Nullity of MarriageDocumento11 paginePetition For Declaration of Nullity of MarriageJurilBrokaPatiñoNessuna valutazione finora

- Sample ComplaintDocumento7 pagineSample ComplaintJurilBrokaPatiñoNessuna valutazione finora

- Motion For ReconsiderationDocumento7 pagineMotion For ReconsiderationJurilBrokaPatiño78% (9)

- Authority To Prosecute Cebu CityDocumento2 pagineAuthority To Prosecute Cebu CityJurilBrokaPatiñoNessuna valutazione finora

- Appellant's Brief SampleDocumento19 pagineAppellant's Brief SampleSakuraCardCaptor100% (4)

- Judicial Affidavit of CenasDocumento11 pagineJudicial Affidavit of CenasJurilBrokaPatiñoNessuna valutazione finora

- Demand Letter of Mam JayDocumento2 pagineDemand Letter of Mam JayJurilBrokaPatiñoNessuna valutazione finora

- Assigned Case - Bank of Luzon v. Reyes Sample DraftDocumento15 pagineAssigned Case - Bank of Luzon v. Reyes Sample DraftKim Roque-AquinoNessuna valutazione finora

- Sample Deed of Sale of Motor Vehicle With Assumption of MortgageDocumento3 pagineSample Deed of Sale of Motor Vehicle With Assumption of MortgageJurilBrokaPatiño76% (75)

- Deed of Sale of Motor Vehicle With Assumption of Mortgage Paras To PaulinoDocumento3 pagineDeed of Sale of Motor Vehicle With Assumption of Mortgage Paras To PaulinoJurilBrokaPatiño100% (1)

- Articles of Incorporation HoADocumento4 pagineArticles of Incorporation HoAJecky Delos ReyesNessuna valutazione finora

- Hlurb by Laws SampleDocumento17 pagineHlurb by Laws SampleJurilBrokaPatiño100% (1)

- Sample Memorandum of AgreementDocumento3 pagineSample Memorandum of AgreementJurilBrokaPatiño100% (3)

- Articles of PartnershipDocumento5 pagineArticles of PartnershipJuril PatiñoNessuna valutazione finora

- Notice of Pretermination of ContractDocumento2 pagineNotice of Pretermination of ContractJurilBrokaPatiñoNessuna valutazione finora

- Opposition To Motion To AmendDocumento4 pagineOpposition To Motion To AmendJurilBrokaPatiñoNessuna valutazione finora

- Chattel Mortgage CredoDocumento2 pagineChattel Mortgage CredoJurilBrokaPatiñoNessuna valutazione finora

- Notes On Pre-Trial Conference in Criminal CasesDocumento2 pagineNotes On Pre-Trial Conference in Criminal CasesJurilBrokaPatiño100% (2)

- Conducting Cross ExaminationDocumento1 paginaConducting Cross ExaminationJurilBrokaPatiñoNessuna valutazione finora

- Delinquent Members Board Reso 01-2016Documento2 pagineDelinquent Members Board Reso 01-2016JurilBrokaPatiño90% (29)

- Pre Trial BriefDocumento4 paginePre Trial BriefJurilBrokaPatiñoNessuna valutazione finora

- Affidavit of Loss AbasDocumento2 pagineAffidavit of Loss AbasJurilBrokaPatiñoNessuna valutazione finora

- Ch. 4: Financial Forecasting, Planning, and BudgetingDocumento41 pagineCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8Nessuna valutazione finora

- Price Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruDocumento8 paginePrice Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruBandono JnrNessuna valutazione finora

- Financially Efficient Dig-Line Delineation Incorporating Equipment Constraints and Grade UncertaintyDocumento23 pagineFinancially Efficient Dig-Line Delineation Incorporating Equipment Constraints and Grade UncertaintyhamidNessuna valutazione finora

- Game Theory (2) - Mechanism Design With TransfersDocumento60 pagineGame Theory (2) - Mechanism Design With Transfersjm15yNessuna valutazione finora

- Problem 2Documento2 pagineProblem 2Anonymous qiAIfBHnNessuna valutazione finora

- BARC CertificationDocumento1 paginaBARC CertificationsPringShock100% (6)

- Econ 102 Practice Questions Chapter 89-2Documento5 pagineEcon 102 Practice Questions Chapter 89-2team.tell.0qNessuna valutazione finora

- Test Bank For Principles of Macroeconomics 5th Edition N Gregory MankiwDocumento3 pagineTest Bank For Principles of Macroeconomics 5th Edition N Gregory MankiwMarlys Campbell100% (29)

- Tax AssignmentDocumento5 pagineTax AssignmentdevNessuna valutazione finora

- Calling DataDocumento54 pagineCalling DatainfoNessuna valutazione finora

- TAC0002 Bank Statements SelfEmployed ReportDocumento78 pagineTAC0002 Bank Statements SelfEmployed ReportViren GalaNessuna valutazione finora

- Presentation - Sacli 2018Documento10 paginePresentation - Sacli 2018Marius OosthuizenNessuna valutazione finora

- International Economic (Group Assignment)Documento12 pagineInternational Economic (Group Assignment)Ahmad FauzanNessuna valutazione finora

- $Ffhvvwr6Dih:Dwhu: Charting The Progress of PopulationsDocumento5 pagine$Ffhvvwr6Dih:Dwhu: Charting The Progress of PopulationskatoNessuna valutazione finora

- John Deere 6405 and 6605 Tractor Repair Technical ManualDocumento16 pagineJohn Deere 6405 and 6605 Tractor Repair Technical ManualJefferson Carvajal67% (6)

- Kotler Chapter 11Documento41 pagineKotler Chapter 11Duc Trung Nguyen83% (6)

- ASEAN Association of Southeast Asian NationsDocumento3 pagineASEAN Association of Southeast Asian NationsnicolepekkNessuna valutazione finora

- Truffle MarketDocumento14 pagineTruffle MarketAnonymous zL3aOc9Nessuna valutazione finora

- Rallis India AR 2014-15 Page 25Documento168 pagineRallis India AR 2014-15 Page 25bhomikjainNessuna valutazione finora

- Critique On The Design and PlanningDocumento2 pagineCritique On The Design and PlanningAngelica Dela CruzNessuna valutazione finora

- Economy of BangladeshDocumento22 pagineEconomy of BangladeshRobert DunnNessuna valutazione finora

- Invitation To Bid: Dvertisement ArticularsDocumento2 pagineInvitation To Bid: Dvertisement ArticularsBDO3 3J SolutionsNessuna valutazione finora

- Bata FactsDocumento3 pagineBata FactsPrashant SantNessuna valutazione finora

- H1 / H2 Model Economics Essay (SAMPLE MICROECONOMICS QUESTION)Documento2 pagineH1 / H2 Model Economics Essay (SAMPLE MICROECONOMICS QUESTION)ohyeajcrocksNessuna valutazione finora

- Entry Mode StrategyDocumento12 pagineEntry Mode StrategyMetiya RatimartNessuna valutazione finora

- CRN 7075614092Documento3 pagineCRN 7075614092Prasad BoniNessuna valutazione finora

- The Mastercard Index of Women EntrepreneursDocumento118 pagineThe Mastercard Index of Women EntrepreneursxuetingNessuna valutazione finora

- Macro Unit 2 WorksheetDocumento5 pagineMacro Unit 2 WorksheetSeth KillianNessuna valutazione finora

- EcoTourism Unit 8Documento20 pagineEcoTourism Unit 8Mark Angelo PanisNessuna valutazione finora

- Elasticity & SurplusDocumento6 pagineElasticity & SurplusakashNessuna valutazione finora