Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Risk Aversion and Utility Theory

Caricato da

anirudhjayCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Risk Aversion and Utility Theory

Caricato da

anirudhjayCopyright:

Formati disponibili

Utility Theory and Risk Aversion

John Y. Campbell

Ec2723

September 2011

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

1 / 35

Outline

Outline

Utility Theory

I

I

Basics

Jensens Inequality

Risk Aversion

I

I

I

Measurement and Comparison

The Arrow-Pratt Approximation

Declining Absolute Risk Aversion

Tractable Utility Functions

Rabin Critique

Comparing Risks

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

2 / 35

Utility Theory

Basics

Ordinal and Cardinal Utility

There is a basic contrast between:

Ordinal utility (x ) is invariant to monotonic transformations, so

(x ) is equivalent to ((x )) for any strictly increasing .

Cardinal utility (x ) is invariant to positive a ne (aka linear)

transformations, so (x ) is equivalent to a + b(x ) for any b > 0.

In nance we rely heavily on von Neumann-Morgenstern utility theory

which says that choice over lotteries, satisfying certain axioms, implies

maximization of the expectation of a cardinal utility function, dened over

outcomes.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

3 / 35

Utility Theory

Basics

Reducing the Dimension of Utility

Finance theory generally works with low-dimensional arguments of the

utility function. Proceeding from greater to lesser generality:

Multiple goods, dates, and states (ordinal utility)

Multiple goods and dates, taking expectation over states (cardinal

utility)

Multiple dates only (one-good simplication)

Time-separable utility, adding up over dates (U (C1 ) + U (C2 ) + ...)

Single-date utility U (C1 ), which is equivalent to utility dened over

wealth U (W1 ).

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

4 / 35

Utility Theory

Jensens Inequality

Jensens Inequality

Consider a random variable e

z and a function f .

Denition: f is concave i for all 2 [0, 1] and values a, b,

f (a) + (1

)f (b )

f (a + (1

)b ).

If f is twice dierentiable, then concavity implies that f 00

Jensens Inequality : Ef (e

z)

John Y. Campbell (Ec2723)

0.

f (Ee

z ) for all possible e

z i f is concave.

Utility Theory and Risk Aversion

September 2011

5 / 35

Utility Theory

Jensens Inequality

Jensens Inequality and Risk Aversion

Jensens Inequality : Ef (e

z)

f (Ee

z ) for all possible e

z i f is concave.

Denition: an agent is risk averse if he dislikes all zero-mean risk at all

levels of wealth. That is, for all w0 and risk e

x with Ee

x = 0,

This is equivalent to

where e

z = w0 + e

x.

Eu (w0 + e

x)

Eu (e

z)

u ( w0 ) .

u (Ee

z ),

Thus risk aversion is equivalent to concavity of the utility function.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

6 / 35

Risk Aversion

Measurement and Comparison

Measuring Risk Aversion

A natural measure of risk aversion is f 00 , scaled to avoid dependence on

the units of measurement for utility. Absolute risk aversion A is dened by

A=

f 00

.

f0

Note that in general this is a function of the initial level of wealth.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

7 / 35

Risk Aversion

Measurement and Comparison

Comparing Risk Aversion

Let u1 and u2 have the same initial wealth. u1 is more risk-averse than u2

if u1 dislikes all lotteries that u2 dislikes, regardless of the common initial

wealth level.

Dene (x ) = u1 (u2 1 (x )). What are the properties of this function?

1. u1 (z ) = (u2 (z )), so (.) turns u2 into u1 .

2. u10 (z ) = 0 (u2 (z ))u20 (z ), so 0 = u10 /u20 > 0.

3. u100 (z ) = 0 (u2 (z ))u200 (z ) + 00 (u2 (z ))u20 (z )2 , so

00 =

John Y. Campbell (Ec2723)

u100

0 u200

u20 2

u10

(A2

u20 2

Utility Theory and Risk Aversion

A1 ).

September 2011

8 / 35

Risk Aversion

Measurement and Comparison

Comparing Risk Aversion

4. Consider a risk e

x that is disliked by u2 , that is a risk s.t.

Eu2 (w0 + e

x ) u2 (w0 ). We have

Eu1 (w0 + e

x ) = E(u2 (w0 + e

x ))

(Eu2 (w0 + e

x ))

for all e

x i is concave or equivalently 00

we must have A1 A2 .

John Y. Campbell (Ec2723)

(u2 (w0 )) = u1 (w0 )

0. But then from property 3

Utility Theory and Risk Aversion

September 2011

9 / 35

Risk Aversion

Measurement and Comparison

Comparing Risk Aversion

5. The risk premium is the amount one is willing to pay to avoid a pure

(zero-mean) risk. It solves

Dening z = w0

Eu (w0 + e

x ) = u ( w0

).

and ye = + e

x , this can be rewritten as

Eu (z + ye) = u (z ).

Now dene 2 as the risk premium for agent 2, and dene z2 and ye2

accordingly. We have

Eu2 (z2 + ye2 ) = u2 (z2 ).

If u1 is more risk-averse than u2 , then

which implies 1

John Y. Campbell (Ec2723)

2 .

Eu1 (z2 + ye2 )

u1 (z2 ),

Utility Theory and Risk Aversion

September 2011

10 / 35

Risk Aversion

Measurement and Comparison

Comparing Risk Aversion

6. Consider a risk that may have a nonzero mean . It pays + e

x where

e

x has zero mean. The certainty equivalent C e satises

Eu (wo + + e

x ) = u ( w0 + C e ) .

This implies that

C e (w0 , u, + e

x) =

(w0 + , u, e

x ).

Thus if u1 is more risk-averse than u2 , then C1e

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

C2e .

September 2011

11 / 35

Risk Aversion

Measurement and Comparison

Comparing Risk Aversion

In summary, the following statements are equivalent:

u1 is more risk-averse than u2 .

u1 is a concave transformation of u2 .

A1

A2 .

2 .

C1e

C2e .

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

12 / 35

Risk Aversion

The Arrow-Pratt Approximation

The Arrow-Pratt Approximation

Consider a pure risk ye = ke

x , where k is a scale factor. Write the risk

premium as a function g (k ): g (k ) = (w0, u, ke

x ) satises

Eu (w0 + ke

x ) = u ( w0

g (k )).

Note that g (0) = 0.

Now dierentiate w.r.t. k:

Ee

x u 0 (w0 + ke

x) =

g 0 ( k ) u 0 ( w0

g (k )).

Since Ee

x = 0, this implies that g 0 (0) = 0.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

13 / 35

Risk Aversion

The Arrow-Pratt Approximation

The Arrow-Pratt Approximation

Dierentiate w.r.t. k a second time:

Ee

x 2 u 00 (wo + ke

x ) = g 0 (k )2 u 00 (w0

g (k ))

g 00 (k )u 0 (w0

g (k )),

which implies that

g 00 (0) =

John Y. Campbell (Ec2723)

u 00 (w0 ) 2

Ee

x = A(w0 )Ee

x 2.

u 0 ( w0 )

Utility Theory and Risk Aversion

September 2011

14 / 35

Risk Aversion

The Arrow-Pratt Approximation

The Arrow-Pratt Approximation

Now take a Taylor approximation of g (k ):

g (k )

1

g (0) + kg 0 (0) + k 2 g 00 (0).

2

Substituting in, we get

1

1

A(w0 )k 2 Ee

x 2 = A(w0 )Ee

y 2.

2

2

The risk premium is proportional to the square of the risk. This property

of dierentiable utility is known as second-order risk aversion. It implies

that people are approximately risk-neutral with respect to small risks.

We also nd that

1

A(w0 )k 2 Ee

x 2,

Ce

k

2

so a positive mean has a dominant eect for small risks.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

15 / 35

Risk Aversion

The Arrow-Pratt Approximation

Relative Risks

b as

Dene a multiplicative risk by w

e = w0 (1 + ke

x ) = w0 (1 + ye). Dene

the share of wealth one would pay to avoid this risk:

b=

Then

(w0 , u, w0 ke

x)

.

w0

1

1

w0 A(w0 )k 2 Ee

x 2 = R (w0 )Ee

y 2,

2

2

where R (w0 ) = w0 A(w0 ) is the coe cient of relative risk aversion.

b

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

16 / 35

Risk Aversion

Decreasing Absolute Risk Aversion

Decreasing Absolute Risk Aversion

The following conditions are equivalent:

is decreasing in w0 .

A(w0 ) is decreasing in w0 .

u 0 is a concave transformation of u, so u 000 /u 00

u 00 /u 0

000

00

everywhere. The ratio u /u = P has been called absolute

prudence by Kimball, who relates it to the theory of precautionary

saving.

Decreasing absolute risk aversion (DARA) seems intuitively appealing.

Certainly we should be uncomfortable with increasing absolute risk

aversion.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

17 / 35

Tractable Utility Functions

Tractable Utility Functions

Almost all applied theory and empirical work in nance uses some member

of the class of linear risk tolerance (LRT) or hyperbolic absolute risk

aversion (HARA) utility functions. These are dened by

u (z ) = ( +

z 1

)

dened over z s.t. + z/ > 0.

For these utility functions, we get

T (z ) =

z

1

=+ ,

A(z )

which is linear in z, and

A(z ) =

z

+

which is hyperbolic in z.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

18 / 35

Tractable Utility Functions

Important Special Cases

Quadratic utility has = 1. This implies increasing absolute risk

aversion and the existence of a bliss point at which u 0 = 0. These

are important disadvantages, although quadratic utility is tractable in

models with additive risk.

Exponential or constant absolute risk averse (CARA) utility is the

limit as ! . To obtain constant absolute risk aversion A, we

need

u 00 (z ) = Au 0 (z ).

Solving this dierential equation, we get

u (z ) =

exp( Az )

,

A

where A = 1/. This form of utility is tractable with normally

distributed risks because then utility is lognormally distributed.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

19 / 35

Tractable Utility Functions

Important Special Cases

Power or constant relative risk averse (CRRA) utility has = 0 and

> 0. Relative risk aversion R = . For 6= 1,

u (z ) =

z1

.

1

For = 1,

u (z ) = log(z ).

Power utility is appealing because it implies stationary risk premia and

interest rates even in the presence of long-run economic growth. Also

it is tractable in the presence of multiplicative lognormally distributed

risks.

A negative represents a subsistence level. Rubinstein has argued

for this model, but economic growth renders any xed subsistence

level irrelevant in the long run. Models of habit formation have

time-varying subsistence levels which can grow with the economy.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

20 / 35

Rabin Critique

Rabin Critique

Matthew Rabin (2000) has argued that standard utility theory cannot

explain observed aversion to small gambles without implying ridiculous

aversion to large gambles. This follows from the fact that dierentiable

utility has second-order risk aversion.

To understand Rabins critique, consider a gamble that wins $11 with

probability 1/2, and loses $10 with probability 1/2. With diminishing

marginal utility, the utility of the win is at least 11u 0 (w0 + 11). The utility

cost of the loss is at most 10u 0 (w0 10). Thus if a person turns down

this gamble, we must have 10u 0 (w0 10) > 11u 0 (w0 + 11) which implies

10

u 0 (w0 + 11)

< .

0

u (w0 10)

11

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

21 / 35

Rabin Critique

Rabin Critique

u 0 (w0 + 11)

10

< .

0

u (w0 10)

11

Now suppose the person turns down the same gamble at an initial wealth

level of w0 + 21. Then

u 0 (w0 + 21 + 11)

u 0 (w0 + 32)

10

=

< .

0

0

u (w0 + 21 10)

u (w0 + 11)

11

Combining these two inequalities,

u 0 (w0 + 32)

<

u 0 (w0 10)

10

11

100

.

121

If this iteration can be repeated, it implies extremely small marginal utility

at high wealth levels, which would induce people to turn down apparently

extremely attractive gambles.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

22 / 35

Rabin Critique

Responses to Rabin Critique

1. As we increase wealth, a person will continue to turn down a given

absolute gamble indenitely only if absolute risk aversion is constant or

increasing. Rabins most extreme results assume this, and can be

understood as a critique of constant or increasing absolute risk aversion.

2. Observed aversion to small risks probably results from some other

aspect of human psychology besides declining marginal utility of wealth.

But this does not necessarily mean that we should abandon utility theory

for studying large risks in nancial markets.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

23 / 35

Rabin Critique

Responses to Rabin Critique

3. What does explain the observed aversion to small risks? One simple

story would be that people suer xed disutility from any loss, regardless

of size. More attractive are nonstandard preference models with

rst-order risk aversion, in which the premium paid to avoid a small loss

is proportional to the loss, not the squared loss. Such models have a kink

in the utility function at the initial level of wealth. Kahneman and

Tverskys (1979) prospect theory has this feature.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

24 / 35

Rabin Critique

Responses to Rabin Critique

4. Barberis, Huang, and Thaler (2006) point out that even rst-order risk

aversion cannot generate substantial aversion to small delayed gambles.

During the time between the decision to take a gamble and the resolution

of uncertainty, the agent will be exposed to other risks and will merge

these with the gamble under consideration. If the gamble is uncorrelated

with the other risks, it is diversifying. In eect the agent will have

second-order risk aversion with respect to delayed gambles. To deal with

this problem, Barberis et al. argue that people treat gambles in isolation,

that is, they use narrow framing.

5. Chetty and Szeidl (2007) show that consumption commitments (xed

costs to adjust a portion of consumption) raise risk aversion over small

gambles, relative to risk aversion over large gambles where extreme

outcomes would justify paying the cost to adjust all consumption.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

25 / 35

QJE May 2007

Comparing Risks

Comparing Risks

We would like to compare the riskiness of dierent distributions. Three

possible notions of increasing risk:

1) Something that all concave utility functions dislike.

2) More weight in the tails of the distribution.

3) Added noise.

The classic analysis of Rothschild and Stiglitz shows that these are all

equivalent. They are not equivalent to higher variance.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

26 / 35

Comparing Risks

Comparing Risks

e and Y

e which have the same expectation.

Consider random variables X

e is weakly less risky than Y

e if no individual with a concave utility

1) X

e to X

e:

function prefers Y

h

i

h

i

e)

e)

E u (X

E u (Y

e is less risky (without qualication) if there is

for all concave u (.). X

e.

some concave u (.) which strictly prefers X

e and

Note that this is a partial ordering. It is not the case that for any X

e , either X

e is weakly less risky than Y

e or Y

e is weakly less risky than X

e.

Y

We can get a complete ordering if we restrict attention to a smaller class

of utility functions than the concave, such as the quadratic.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

27 / 35

Comparing Risks

Comparing Risks

e is less risky than Y

e if the density function of Y

e can be obtained from

2) X

e by applying a mean-preserving spread (MPS). An MPS s (x ) is

that of X

dened by

1

0

for c < x < c + t

B for c 0 < x < c 0 + t C

C

B

for d < x < d + t C

s (x ) = B

C

B

@ for d 0 < x < d 0 + t A

0 elsewhere

where , , t > 0 ; c + t < c 0 < d

(c 0 c ) = (d 0

can move it.

John Y. Campbell (Ec2723)

t < d + t < d 0 ; and

d ), that is, the more mass you move, the less far you

Utility Theory and Risk Aversion

September 2011

28 / 35

Comparing Risks

Comparing Risks

An MPS is something you add to a density function f (x ). If

g (x ) = f (x ) + s (x ), then (i) g (x ) is also a density function, and (ii) it

has the same mean as f (x ).

(i) is obvious because

s (x ) dx = area under s (x ) = 0.

(ii) follows from the fact that the mean of s (x ),

follows from (c 0 c ) = (d 0 d ).

xs (x ) = 0, which

In what sense is an MPS a spread? Its obvious that if the mean of f (x ) is

between c 0 + t and d, then g (x ) has more weight in the tails. Its not so

obvious when the mean of f (x )is o to the left or the right. Nevertheless,

e with density g is riskier than X

e with density f in the

we can show that Y

sense of 1) above. In this sense the term spread is appropriate.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

29 / 35

Comparing Risks

Comparing Risks

e is less risky than Y

e if Y

e

3) A formal denition of added noise is that X

e + e, where E [ejX ] = 0 for all values of X .

has the same distribution as X

We say that e is a fair game with respect to X .

e

This condition is stronger than zero covariance, Cov e, X

e

weaker than independence, Cov f (e) , g X

e

and g . It is equivalent to Cov e, g X

John Y. Campbell (Ec2723)

= 0. It is

= 0 for all functions f

= 0 for all functions g .

Utility Theory and Risk Aversion

September 2011

30 / 35

Comparing Risks

Comparing Risks

3) is su cient for 1):

h

i

e + e)jX

E U (X

h

i

e + ejX ) = U (X )

U (E X

h

i

h

i

e + e)

e)

) E U (X

E U (X

h

i

h

i

e)

e)

) E U (Y

E U (X

e and X

e + e have the same distribution.

because Y

In fact, Rothschild-Stiglitz show that 1), 2) and 3) are all equivalent. This

is a powerful result because one or the other condition may be most useful

in a particular application.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

31 / 35

Comparing Risks

Comparing Risks

e having greater variance than X

e ? It is

Why are these not equivalent to Y

e

e

e

obvious from 3) that if Y is riskier than X then Y has greater variance

e . The problem is that the reverse is not true in general. Greater

than X

e could have

variance is necessary but not su cient for increased risk. Y

e but still be preferred by some concave utility

greater variance than X

functions if it has more desirable higher-moment properties. This

possibility can only be eliminated if we conne attention to a limited class

of distributions such as the normal distribution.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

32 / 35

Comparing Risks

Stochastic Dominance

The following are denitions.

e dominates Y

e if Y

e =X

e +e

X

, where e

0.

e rst-order stochastically dominates Y

e if Y

e has the distribution of

X

e

e

e

e and G (.) is the

X + , where 0. Equivalently, if F (.) is the cdf of X

e , then X

e rst-order stochastically dominates Y

e if F (z ) G (z )

cdf of Y

for every z. First-order stochastic dominance implies that every increasing

e.

utility function will prefer X

e second-order stochastically dominates Y

e if Y

e has the distribution of

X

e

e

e

X + + e, where 0 and E [ejX + ] = 0. Second-order stochastic

dominance implies that every increasing, concave utility function will prefer

e . Increased risk is the special case of second-order stochastic dominance

X

where e

= 0.

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

33 / 35

Comparing Risks

Application: The Principle of Diversication

Consider n lotteries with payos e

x1 , e

x2 , ..., e

xn that are independent and

identically distributed (iid). You are asked to choose weights 1 , 2 , ....,

n subject to the constraint that i i = 1. It seems obvious that the

best choice is complete diversication, with weights i = 1/n for all i.

The payo is then

1 n

xi .

e

z = e

n i =1

John Y. Campbell (Ec2723)

Utility Theory and Risk Aversion

September 2011

34 / 35

Comparing Risks

Application: The Principle of Diversication

To prove that this is optimal, note that the payo on any other strategy is

i exi = ez +

i

and

E [ejz ] =

John Y. Campbell (Ec2723)

1

n

1

n

e

xi = e

z + e,

E [e

xi jz ] = k i

i

Utility Theory and Risk Aversion

1

n

= 0.

September 2011

35 / 35

Potrebbero piacerti anche

- Stochastic Modelling 2000-2004Documento189 pagineStochastic Modelling 2000-2004Brian KufahakutizwiNessuna valutazione finora

- yit = β0 + β1xit,1 + β2xit,2 + β3xit,3 + β4xit,4 + uit ,x ,x ,x ,β ,β ,β ,βDocumento10 pagineyit = β0 + β1xit,1 + β2xit,2 + β3xit,3 + β4xit,4 + uit ,x ,x ,x ,β ,β ,β ,βSaad MasoodNessuna valutazione finora

- Harvard Economics 2020a Problem Set 4Documento4 pagineHarvard Economics 2020a Problem Set 4J100% (1)

- 2014 - Lectures Notes On Game Theory - WIlliam H SandholmDocumento167 pagine2014 - Lectures Notes On Game Theory - WIlliam H SandholmDiego Velasquez ZuñigaNessuna valutazione finora

- Macro AssignmentDocumento28 pagineMacro AssignmentSabin SadafNessuna valutazione finora

- FinalExam Mar21 SolutionsDocumento9 pagineFinalExam Mar21 SolutionsHasanul BannaNessuna valutazione finora

- 3 Multiple Linear Regression: Estimation and Properties: Ezequiel Uriel Universidad de Valencia Version: 09-2013Documento37 pagine3 Multiple Linear Regression: Estimation and Properties: Ezequiel Uriel Universidad de Valencia Version: 09-2013penyia100% (1)

- HJB EquationsDocumento38 pagineHJB EquationsbobmezzNessuna valutazione finora

- MHR 520 Midterm Review 2022Documento27 pagineMHR 520 Midterm Review 2022humaira.rahman100% (1)

- Alpha Chiang Chapter 19Documento10 pagineAlpha Chiang Chapter 19ansarabbasNessuna valutazione finora

- The Economics of Inaction: Stochastic Control Models with Fixed CostsDa EverandThe Economics of Inaction: Stochastic Control Models with Fixed CostsNessuna valutazione finora

- Emerson Mentor MP ManualDocumento182 pagineEmerson Mentor MP ManualiampedrooNessuna valutazione finora

- Skirmishes Graham Harman PDFDocumento383 pagineSkirmishes Graham Harman PDFparaiaNessuna valutazione finora

- Hayashi CH 1 AnswersDocumento4 pagineHayashi CH 1 AnswersLauren spNessuna valutazione finora

- Micro Prelim SolutionsDocumento32 pagineMicro Prelim SolutionsMegan JohnstonNessuna valutazione finora

- Essential Reading: Choice Under UncertaintyDocumento28 pagineEssential Reading: Choice Under UncertaintyDương DươngNessuna valutazione finora

- General Equilibrium TheoryDocumento128 pagineGeneral Equilibrium Theorymeagon_cjNessuna valutazione finora

- Z Summ Notes New 5 PDFDocumento59 pagineZ Summ Notes New 5 PDFbirendraNessuna valutazione finora

- 7 - General Equilibrium Under UncertaintyDocumento5 pagine7 - General Equilibrium Under UncertaintyLuis Aragonés FerriNessuna valutazione finora

- MWG Microeconomic Theory NotesDocumento102 pagineMWG Microeconomic Theory Notes胡卉然Nessuna valutazione finora

- Estimating Volatilities and Correlations: Options, Futures, and Other Derivatives, 9th Edition, 1Documento34 pagineEstimating Volatilities and Correlations: Options, Futures, and Other Derivatives, 9th Edition, 1seanwu95Nessuna valutazione finora

- Chapter 01Documento15 pagineChapter 01Arinze3Nessuna valutazione finora

- 05 Dynamic Game TheoryDocumento29 pagine05 Dynamic Game TheoryIrenaNessuna valutazione finora

- Hull RMFI3 RD Ed CH 09Documento24 pagineHull RMFI3 RD Ed CH 09Ella Marie WicoNessuna valutazione finora

- Problem Set 2021Documento63 pagineProblem Set 2021Co londota2Nessuna valutazione finora

- Mean Preserving SpreadDocumento5 pagineMean Preserving Spreadmokus2000Nessuna valutazione finora

- Basel I, Basel II, and Solvency IIDocumento35 pagineBasel I, Basel II, and Solvency IIjlosamNessuna valutazione finora

- Lecture 1 - Lucas Islands ModelDocumento6 pagineLecture 1 - Lucas Islands ModelLuis Aragonés FerriNessuna valutazione finora

- Advanced MicroeconomicDocumento70 pagineAdvanced Microeconomicalbi_12291214100% (1)

- Lecture 14 - Mutual Fund Theorem and Covariance Pricing TheoremsDocumento16 pagineLecture 14 - Mutual Fund Theorem and Covariance Pricing TheoremsLuis Aragonés FerriNessuna valutazione finora

- Advanced Microeconomics - Game TheoryDocumento78 pagineAdvanced Microeconomics - Game TheoryrosNessuna valutazione finora

- Lecture 1 - Is-lM & AD-As AnalysisDocumento25 pagineLecture 1 - Is-lM & AD-As AnalysisLuis Aragonés FerriNessuna valutazione finora

- Mid Session Exam SolutionsDocumento20 pagineMid Session Exam SolutionssaravanansatkumaranNessuna valutazione finora

- Problem Set 2: Theory of Banking - Academic Year 2016-17Documento5 pagineProblem Set 2: Theory of Banking - Academic Year 2016-17thanhpham0505Nessuna valutazione finora

- EconometricsDocumento310 pagineEconometricsHerwan GalinggingNessuna valutazione finora

- How To Solve DSGE ModelsDocumento33 pagineHow To Solve DSGE ModelsLuis Aragonés FerriNessuna valutazione finora

- Intro Heterogeneous Agents ModelDocumento84 pagineIntro Heterogeneous Agents Modeljc224Nessuna valutazione finora

- 2011 Micro Homework3 PDFDocumento4 pagine2011 Micro Homework3 PDFEdmund Zin100% (1)

- Hull RMFI4 e CH 12Documento25 pagineHull RMFI4 e CH 12jlosamNessuna valutazione finora

- General Equilibrium Theory Lecture Notes, Bisin PDFDocumento76 pagineGeneral Equilibrium Theory Lecture Notes, Bisin PDFshotorbariNessuna valutazione finora

- PHD Thesis Bernardo R C Costa Lima Final SubmissionDocumento204 paginePHD Thesis Bernardo R C Costa Lima Final SubmissionSohaib ShamsiNessuna valutazione finora

- Advanced Macro IDocumento335 pagineAdvanced Macro IzaurNessuna valutazione finora

- An Introduction Game TheoryDocumento8 pagineAn Introduction Game TheoryhenfaNessuna valutazione finora

- Linear Algebra and Designs: C. D. GodsilDocumento209 pagineLinear Algebra and Designs: C. D. GodsilKatarina ŠupeNessuna valutazione finora

- Ps7 SolutionDocumento6 paginePs7 SolutionRagini ChaurasiaNessuna valutazione finora

- Macro BookDocumento237 pagineMacro BookcorishcaNessuna valutazione finora

- Game Theory 93 2 Slide01Documento44 pagineGame Theory 93 2 Slide01amiref100% (1)

- Chapter 2: Introduction To MATLAB Programming ExercisesDocumento19 pagineChapter 2: Introduction To MATLAB Programming Exerciseskhushi maheshwariNessuna valutazione finora

- How To Use Log TableDocumento2 pagineHow To Use Log TableArun M. PatokarNessuna valutazione finora

- Homework EconometricsDocumento7 pagineHomework EconometricstnthuyoanhNessuna valutazione finora

- Micro BarloDocumento141 pagineMicro Barlovahabibrahim6434Nessuna valutazione finora

- Econometrics 2019 PDFDocumento143 pagineEconometrics 2019 PDFOlivia PriciliaNessuna valutazione finora

- Takashi's Econ633 Lecture Notes May 18 2010Documento105 pagineTakashi's Econ633 Lecture Notes May 18 2010hadi.salami3684Nessuna valutazione finora

- 2 Growth Neoclassical GrowthDocumento71 pagine2 Growth Neoclassical GrowthPAOLA NELLY ROJAS VALERONessuna valutazione finora

- DSGE Models - Solution Strategies: Stefanie Flotho IFAW-WT, Albert-Ludwigs-University FreiburgDocumento33 pagineDSGE Models - Solution Strategies: Stefanie Flotho IFAW-WT, Albert-Ludwigs-University FreiburgNicolas BaroneNessuna valutazione finora

- Working Paper: A Neo-Kaleckian - Goodwin Model of Capitalist Economic GrowthDocumento33 pagineWorking Paper: A Neo-Kaleckian - Goodwin Model of Capitalist Economic Growthlcr89Nessuna valutazione finora

- Generalized Method of Moments Estimation PDFDocumento29 pagineGeneralized Method of Moments Estimation PDFraghidkNessuna valutazione finora

- IGNOU MEC-001 Free Solved Assignment 2012Documento8 pagineIGNOU MEC-001 Free Solved Assignment 2012manuraj40% (1)

- Week 11 General Equilibrium (Jehle and Reny, Ch.5) : Serçin AhinDocumento26 pagineWeek 11 General Equilibrium (Jehle and Reny, Ch.5) : Serçin AhinBijita BiswasNessuna valutazione finora

- The Complete Guide to Capital Markets for Quantitative ProfessionalsDa EverandThe Complete Guide to Capital Markets for Quantitative ProfessionalsValutazione: 4.5 su 5 stelle4.5/5 (7)

- Bayesian in Actuarial ApplicationDocumento22 pagineBayesian in Actuarial Applicationtarekmn1Nessuna valutazione finora

- 4 FWL HandoutDocumento12 pagine4 FWL HandoutmarcelinoguerraNessuna valutazione finora

- Derivative Stock Pick 8 Jun 2021 Tcs Jun FutDocumento3 pagineDerivative Stock Pick 8 Jun 2021 Tcs Jun FutanirudhjayNessuna valutazione finora

- ETF Note - July 21-202107091524452442313Documento6 pagineETF Note - July 21-202107091524452442313anirudhjayNessuna valutazione finora

- Introduction To The Rugarch Package PDFDocumento50 pagineIntroduction To The Rugarch Package PDFanirudhjayNessuna valutazione finora

- BDNF With Fasting and ExerciseDocumento4 pagineBDNF With Fasting and ExerciseanirudhjayNessuna valutazione finora

- Trey Causey - Hiring Data ScientistsDocumento6 pagineTrey Causey - Hiring Data ScientistsanirudhjayNessuna valutazione finora

- Heavy-Tailed Innovations in The R Package Stochvol: PrefaceDocumento8 pagineHeavy-Tailed Innovations in The R Package Stochvol: PrefaceanirudhjayNessuna valutazione finora

- LaTeX Resume TemplateDocumento3 pagineLaTeX Resume TemplateanirudhjayNessuna valutazione finora

- Monopoly Practice ProblemsDocumento4 pagineMonopoly Practice ProblemsanirudhjayNessuna valutazione finora

- R Programming Coursera Verified CertificateDocumento1 paginaR Programming Coursera Verified CertificateanirudhjayNessuna valutazione finora

- Oligopoly Practice QuestionsDocumento2 pagineOligopoly Practice QuestionsanirudhjayNessuna valutazione finora

- Consumer Theory Practice ProblemsDocumento4 pagineConsumer Theory Practice ProblemsanirudhjayNessuna valutazione finora

- Markets Practice ProblemsDocumento4 pagineMarkets Practice ProblemsanirudhjayNessuna valutazione finora

- Caroline G Babin: Undergraduate Degree at Louisiana State University in Baton Rouge, Louisiana - Currently EnrolledDocumento2 pagineCaroline G Babin: Undergraduate Degree at Louisiana State University in Baton Rouge, Louisiana - Currently EnrolledCaroline BabinNessuna valutazione finora

- Fiedler1950 - A Comparison of Therapeutic Relationships in PsychoanalyticDocumento10 pagineFiedler1950 - A Comparison of Therapeutic Relationships in PsychoanalyticAnca-Maria CovaciNessuna valutazione finora

- Code of Federal RegulationsDocumento14 pagineCode of Federal RegulationsdiwolfieNessuna valutazione finora

- Piaggio MP3 300 Ibrido LT MY 2010 (En)Documento412 paginePiaggio MP3 300 Ibrido LT MY 2010 (En)Manualles100% (3)

- 5 Grade: Daily MathDocumento130 pagine5 Grade: Daily MathOLIVEEN WILKS-SCOTT100% (3)

- Dpb6013 HRM - Chapter 3 HRM Planning w1Documento24 pagineDpb6013 HRM - Chapter 3 HRM Planning w1Renese LeeNessuna valutazione finora

- Cimo Guide 2014 en I 3Documento36 pagineCimo Guide 2014 en I 3lakisNessuna valutazione finora

- ALTS150-12P Datasheet1Documento2 pagineALTS150-12P Datasheet1mamloveNessuna valutazione finora

- WT Capability Statement PE 2020Documento1 paginaWT Capability Statement PE 2020Muhannad SuliemanNessuna valutazione finora

- Basic Approach To The Audit of Electronically Processed DataDocumento2 pagineBasic Approach To The Audit of Electronically Processed DataJestell Ann ArzagaNessuna valutazione finora

- Types of ComputersDocumento7 pagineTypes of ComputersSyed Badshah YousafzaiNessuna valutazione finora

- Ship Recognition Manual TOSDocumento138 pagineShip Recognition Manual TOSCody Lees94% (17)

- GATE Chemical Engineering 2015Documento18 pagineGATE Chemical Engineering 2015Sabareesh Chandra ShekarNessuna valutazione finora

- Headlight Washer System: Current Flow DiagramDocumento3 pagineHeadlight Washer System: Current Flow DiagramLtBesimNessuna valutazione finora

- MGNM801 Ca2Documento19 pagineMGNM801 Ca2Atul KumarNessuna valutazione finora

- (Word 365-2019) Mos Word MocktestDocumento4 pagine(Word 365-2019) Mos Word MocktestQuỳnh Anh Nguyễn TháiNessuna valutazione finora

- 3DD5036 Horizontal.2Documento6 pagine3DD5036 Horizontal.2routerya50% (2)

- Group 4 - When Technology and Humanity CrossDocumento32 pagineGroup 4 - When Technology and Humanity CrossJaen NajarNessuna valutazione finora

- GE Uno Downlight Backlit BLDocumento2 pagineGE Uno Downlight Backlit BLChen KengloonNessuna valutazione finora

- Conflict Management A Practical Guide To Developing Negotiation Strategies Barbara A Budjac Corvette Full ChapterDocumento67 pagineConflict Management A Practical Guide To Developing Negotiation Strategies Barbara A Budjac Corvette Full Chapternatalie.schoonmaker930100% (5)

- CE-23113-SP-902-R01-00 Asset SpecificationDocumento14 pagineCE-23113-SP-902-R01-00 Asset SpecificationСветлана ФайберNessuna valutazione finora

- Dissertation MA History PeterRyanDocumento52 pagineDissertation MA History PeterRyaneNessuna valutazione finora

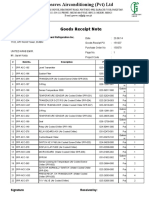

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDocumento4 pagineGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanNessuna valutazione finora

- T54125ADocumento64 pagineT54125ARaúl FroddenNessuna valutazione finora

- Hexoloy SP Sic TdsDocumento4 pagineHexoloy SP Sic TdsAnonymous r3MoX2ZMTNessuna valutazione finora

- Module 1 Supply Chain Management in Hospitality IndustryDocumento39 pagineModule 1 Supply Chain Management in Hospitality IndustryHazelyn BiagNessuna valutazione finora

- Formulae HandbookDocumento60 pagineFormulae Handbookmgvpalma100% (1)

- Stress: Problem SetDocumento2 pagineStress: Problem SetDanielle FloridaNessuna valutazione finora