Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chap-1, An Overview of Financial Management and The Financial Environment' 2015

Caricato da

Md. Monirul islamTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chap-1, An Overview of Financial Management and The Financial Environment' 2015

Caricato da

Md. Monirul islamCopyright:

Formati disponibili

What Is Finance?

An Overview of Financial

Management and the Financial

Environment

Finance is the art and science of managing

money

Science? In some situations, its fundamental

concepts, principles, theories, and models can be

applied universally to make decisions

Art? In some situations, precise models cannot be

created/used, rather intuition or insight or

creativity is used to make decisions

1

Financial Management (13th edt)

By E.F. Bringham and M.C. Ehrhardt

1-1

What Is Corporate or Managerial

Finance?

What Is Finance?

At the personal level, finance is concerned

with individuals decisions about:

How much of their earnings they spend

How much they save

How they invest their savings

1-2

An important area of finance that deals with

The sources of funding,

The capital structure of firms,

The tools and analysis used to allocate financial

In a business context, finance involves:

resources, and

How firms raise money from investors

How firms invest money in to earn profits

How firms decide whether to reinvest profits in the

business or distribute them back to investors.

The actions taken to maximize the firms value

to the shareholders

Continued

1-3

What Is Corporate or Managerial

Finance?

1-4

Finance VS Economics & Accounting

Finance grew out of Economics and Accounting

Is concerned with the duties of the financial

manager working in a business

Helps financial managers administer the

financial affairs of all types of businesses

Tasks include:

Developing a financial plan

Evaluating proposed large expenditures

Raising money to finance the firms operations

Extending credit to customer

1-5

Economics

Accounting

Finance

Provides structure

for decision making

and suggests that

assets value is

based on its ability

to generate CFs

now and in the

future

Deals with collection

and presentation of

financial data and

measures firms

performance

Deals with evaluating

accounting statement,

developing additional data,

and making decisions based

on associated risk and return

and makes plans for CFs to

maintain firms solvency

May be positive or

normative

Is backward looking and

deals with historical

data

Is forward looking and makes

analysis and decisions about

future

1-6

Four Golden Rules of Finance

Finance Within the Organization

Board of Directors

Chief Executive Officer (CEO)

Chief Operating Officer (COO)

Chief Financial Officer (CFO)

Marketing, Production, Human

Resources, and Other Operating

Departments

Accounting, Treasury, Credit,

Legal, Capital Budgeting, and

Investor Relations

If it dont jingle, it dont count

Risk is the possibility that bad or good things

may happen

The greater the risk, the greater the expected

reward

A $1 today is worth more than a $1 tomorrow

1-7

1-8

Basic Forms of Business Organization

Basic Forms of Business Organization

Sole Proprietorship

Owned by one person

Legal entity created by law

Operated for personal profit

Mandatory registration

Unlimited liability

Legally functions separate and apart from its

owners

Partnerships (general and limited)

Owners liability is limited to the amount of their

investment

Owned by two or more people

Operated for joint profit

Owners hold common stock, and ownership can be

transferred

Liable personally and collectively

Run by partnership deed

Corporations

Continued

1-9

1-10

Corporation

Proprietorships and Partnerships

Advantages

Ease of formation

Advantages

Disadvantages

Subject to few regulations

Limited Liability

Double taxation

No corporate income taxes

Permanency

Disadvantages

Transferability of

ownership

Cost of set-up and

report filing

Difficult to raise capital

Better access to capital

markets

Unlimited liability

Separation of owners

from management

Limited life

1-11

1-12

Separation of Ownership and

Control

Partnership Vs. Corporations

Board of Directors

Assets

Shareholders

Debt

Debtholders

Management

Equity

Corporation

Partnership

Liquidity

Shares can easily be

exchanged.

Subject to substantial

restrictions.

Voting Rights

Usually each share

gets one vote

Taxation

Double

General Partner is in

charge; limited

partners may have

some voting

Partners

payrights.

taxes

Reinvestment and

dividend payout

Broad latitude

Liability

Limited liability

Continuity

Perpetual life

on distributions.

All NCF is distributed

to partners.

General partners may

have unlimited liability.

Limited partners enjoy

limited liability.

Limited life

1-13

1-14

Becoming a Public Corporation and

Growing Afterwards

Agency Problems, Agency Costs and

Corporate Governance

Initial public offering (IPO) of stock

Raises cash

Allows founders and pre-IPO investors to

harvest some of their wealth

Subsequent issues of debt and equity

Agency problem arises when managers act in

their own interests and not on behalf of owners

Agency costs arise from agency problems that

are borne by shareholders and represent a loss of

shareholder wealth

Corporate governance is the set of rules that

control a companys behavior towards its directors,

managers, employees, shareholders, creditors,

customers, competitors, and community

Can help control agency problems

1-15

1-16

Types of Agency Problems

Mitigating Agency Problems

Type-I agency problem: The conflict of interests

between managers and stockholders (the classic

agency problem)

Type-II agency problem: When controlling

stockholders (families) have an incentive to extract

private benefits of control at the expense of minority

stockholders

Type-III agency problem: Stockholders through

managers could take actions to maximize stock price

that are detrimental to creditors

1-17

Factors affecting managerial behavior:

The role of board of directors*

Managerial compensation packages

Direct intervention by shareholders

The threat of firing

The threat of takeover

Audited financial statements

Corporate governance code (soft laws)

1-18

The Balance-Sheet Model of the Firm

Continued

Financial Management Decisions

Risk Management

What financial risks should we take on or hedge

out

Capital structure

How should we pay for our assets?

Should we use debt or equity or both?

From which source should we raise capital?

1-22

Capital budgeting

What LT investments should we engage in?

Where, when & how to make LT investments?

1-20

The Balance-Sheet Model of the Firm

1-21

Financial Management Decisions

Continued

1-19

The Balance-Sheet Model of the Firm

Continued

The Balance-Sheet Model of the Firm

Capital Analysis

What is something worth?

How can we create value for the firm?

Working capital management

How do we manage the day-to-day CFs?

Continued

1-23

1-24

Cash Flows Between the Firm and

Financial Markets

Capital Allocation Process

Transfers of capital between savers and users

Direct transfers--businesses issue securities like

commercial papers directly to savers

Indirect transfers--through investment banking

house (ICB, IDLC) which underwrites the issue

Indirect transfers--through a financial

intermediary where individual deposits money in

banks and banks make commercial loans to firms

1-25

Types of Securities

1-26

Types of Financial Markets

Financial securities are simply pieces of paper with

contractual provisions that entitle their owners to

specific rights and claims on specific CFs or values

Debt instruments typically have specified payments and

a specified maturity (capital market security, money

market security)

Equity instruments are a claim upon a residual value

Derivatives are securities whose values depend on the

values of some other traded assets (e.g. options, futures,

forward, etc.)

Spot markets are the markets where assets are

bought or sold for on-the-spot delivery (literally,

within a few days)

Futures markets are the markets where assets are

bought or sold for delivery at some future date, such

as 6 months or a year into the future

1-28

Types of Financial Markets

Money markets are the markets for ST, highly liquid

debt securities (bankers acceptance, commercial

paper) with a maturity of less than 1 year

Capital markets are the markets for corporate

stocks and debt maturing more than a year in the

future

Mortgage markets deal with loans on residential,

agricultural, commercial, and industrial real estate

Consumer credit markets involve loans for autos,

appliances, education, vacations, and so on

Continued

Financial asset markets deal with stocks, bonds,

notes, mortgages, derivatives, and other financial

instruments

Continued

1-27

Types of Financial Markets

Physical asset markets (called real asset

markets) are markets for such products as wheat,

autos, real estate, computers, and machinery

1-29

Primary markets are the markets in which the

original security is directly sold to the public by the

issuer (corporation/government) with the help of

investment banking houses

IPO market is a subset of the primary market. Here

firms go public by offering shares to the public for

the first time

Secondary markets are the markets in which

existing, already outstanding securities are traded

among investors

Private markets are markets where transactions are

worked out directly between two parties

1-30

The Primary objective of the

Corporation

The Primary objective of the

Corporation

Decision rule for managers: Only take actions

that are expected to increase the share price.

Which one?

Survive?

Avoid financial distress and bankruptcy?

Beat the competition?

Maximize sales or market share?

Maintain steady earnings growth?

Minimize costs?

Maximize profit!!!

Does this mean we should do anything and

everything to maximize profit?

Fig: Financial decisions maximizing stock price

Continued

Which Investment is Preferred?

Earnings per share (EPS)

Year 1

Year 2

Year 3

Total (years 1-3)

Rotor

1.40

1.00

0.40

2.80

Valve

0.60

1.00

1.40

3.00

SHAREHOLDER WEALTH MAXIMIZATION

The same as:

Maximizing market price of stock

Maximizing intrinsic value of stock

Maximizing value of the equity

Maximizing value of the firm

Profit maximization may not lead to the highest possible

stock price for at least three reasons:

1. Timing is importantthe receipt of funds sooner is preferred

2. Profits do not necessarily result in CFs available to stockholders

3. Profit maximization fails to account for risk

Continued

Continued

1-33

The Primary objective of the

Corporation

1-32

The Primary objective of the

Corporation

The Primary objective of the

Corporation

Investment

Continued

1-31

1-34

Stock Prices and Intrinsic Value

Why best goal?

A comprehensive goal for the firm, its managers,

and employees

In equilibrium, a stocks price should equal its

true or intrinsic value

Intrinsic value is a long-run concept

This goal can be explored through EVA

To the extent that investor perceptions are incorrect, a

stocks price in the short run may deviate from its

intrinsic value

This goal avoids actions that prove to be

detrimental to stakeholders

This goal meets triple bottom line

Economic (generating monetary value)

Social (the impact of business on people inside and outside)

Ideally, managers should avoid actions that

reduce intrinsic value, even if those decisions

increase the stock price in the short run

Environmental (the total impact on natural environment)

Continued

1-35

1-36

Determinants of Intrinsic Values and

Stock Prices

Managerial Actions, the Economic

Environment, Taxes, and the Political Climate

True Investor

Returns

True

Risk

Perceived

Investor Returns

Stocks

Intrinsic Value

Is Stock Price Maximization the Same

as Profit Maximization?

No,

despite a generally high correlation

amongst stock price, EPS, and CFs

Perceived

Risk

Current stock price depends on current as well as

future earnings and CFs

Some actions may cause earnings to increase, yet

cause the stock price to decrease and vice-versa

Stocks

Market Price

Market Equilibrium:

Intrinsic Value = Stock Price

1-37

1-37

The Goal of Non-Business Firm

1-38

Three Basic Questions

To maximize the interests (benefits) of

stakeholders given a set of resources

The goal of a university:

Quality education for the students

Good management for the university

Right contribution to the society and to the country

Financially healthy condition

Do firms have any responsibilities to society

at large? YES! Shareholders are also

members of society

Should firms behave ethically? YES!

Is stock price maximization good or bad for

the society, employees, and customers?

YES, Good!

1-39

Three Aspects of CFs Affecting An

Investments Value

Stock Price Maximization Increases

Social Welfare

To a large extent, the owners of stock are society

When a manager takes actions to maximize the stock price, this

improves the quality of life for most citizens as they are shareholders

Amount of expected CFs (bigger is better)

Timing of the CF stream (sooner is better)

Risk of the CFs (less risk is better)

Consumer benefits

Stock price maximization requires efficient, low-cost businesses that

produce high-quality goods and services at the lowest possible cost.

1-40

Employees benefits

Companies that successfully increase stock prices also grow and add

more employees, thus benefiting society

Consumer welfare is higher in capitalist free market economies than

in communist economies

1-41

1-42

The Big Picture: The Determinants of

Intrinsic Value Using FCF and WACC

Sales

Revenue

Operating costs

and taxes

Free cash flow

(FCF)

Value =

Determinants of a Firms Value

Required investments

in operating capital

FCF

The cash available for distribution to all investors after

meeting all expenses and making required investment in

operations to support growth

FCF1

FCF2

FCF

+

+ +

(1 + WACC)1 (1 + WACC)2

(1+WACC)

WACC

The minimum return a company needs to earn to satisfy all

of its investors, including stockholders, bondholders, and

preferred stockholders (from investors perspective)

Weighted average

cost of capital

(WACC)

Market interest rates

Determined by the capital structure, interest rates, the firms

risk, and attitude toward risk

Firms debt/equity mix

Cost of debt

Market risk aversion

The cost of capital for the firm as a whole (from the firms

perspective)

Cost of equity

Firms business risk

1-43

Calculation of WACC

1-44

The Cost of Money or Fund

Equity capital of $50,000 and the required rate of return is

12%.

Preferred stock of $10,000 and preferred dividend is 6%.

Bank loan of $20,000 @ 15% interest and tax rate is 40%.

Bonds of $20,000 @ 10% interest and tax rate is 40%.

Funds

(1)

Amount

(2)

Weight

(3)

Rate

(4)

WACC

(5)=(3)(4) (1-t)

Equity

$50,000

0.5

0.12

0.50.12=0.060

Pref Stock

$10,000

0.1

0.06

0.2.15(1-0.4) =0.006

Bank Loan

$20,000

0.2

0.15

0.2.15(1-0.4) =0.018

Bonds

$20,000

0.2

0.10

0.2.10(1-0.4) =0.012

Total

$50,000

1.0

For debt, it is the interest rate

For equity, it is the cost of equity consisting of

the dividends and capital gains stockholders

expect

0.096

1-45

Economic Conditions and Policies

Affecting the Cost of Money

Factors Affecting the Cost of Money

1-46

Production opportunities (the ability to turn

capital into benefits)

How open market operations influence the price of Tbills, loanable fund and interest rate

Inverse relation between T-bills price and interest rate

Time preferences for consumption (as

opposed to saving for future consumption)

Risk of return

Expected inflation

The policy of central bank

A low interest rates stimulates economy by allowing firms to

borrow fund at a low cost for new projects

The national budget deficit or surplus

Government borrowing by issuing new T-bills

The same impact

Continued

1-47

1-48

Economic Conditions and Policies

Affecting the Cost of Money

Economic Conditions and Policies

Affecting the Cost of Money

The level of business activities

Interest rates and inflation rise prior to a recession and

fall afterwards

During recession:

International trade deficits or surpluses.

Trade deficit is financed by debt

Increased borrowing drives up interest rates

International investors are willing to hold country debt

Consumer demand slows, keeping companies from increasing

prices, which reduces price inflation

Companies also cut back on hiring, which reduces wage inflation

Less disposable income causes consumers to reduce their

purchases of homes and automobiles, reducing consumer

demand for loans

if and only if the risk-adjusted rate paid on this debt is

competitive

If the trade deficit is large relative to the size of the

Companies reduce investments in new operations, which reduce

their demand for funds

The cumulative effect is downward pressure on inflation and

interest rates

Continued

overall economy, it will hinder the central banks ability

to reduce interest rates and combat a recession

Continued

1-49

1-50

Economic Conditions and Policies

Affecting the Cost of Money

International country risk

A particular countrys economic, political, and social

environment can increase the cost of money that is

invested abroad

Exchange Rate Risk

The value of an investment depends on what happens

to exchange rates.

This is known as exchange rate risk.

1-51

Potrebbero piacerti anche

- M14 Gitman50803X 14 MF AC14Documento70 pagineM14 Gitman50803X 14 MF AC14Joan Marie100% (2)

- Goals of Financial ManagementDocumento22 pagineGoals of Financial ManagementBhuvanNessuna valutazione finora

- The Role of Finacial ManagementDocumento25 pagineThe Role of Finacial Managementnitinvohra_capricorn100% (1)

- 13 Capital Structure (Slides) by Zubair Arshad PDFDocumento34 pagine13 Capital Structure (Slides) by Zubair Arshad PDFZubair ArshadNessuna valutazione finora

- 6 Dividend DecisionDocumento31 pagine6 Dividend Decisionambikaantil4408Nessuna valutazione finora

- Introduction To Financial Management. 2018Documento42 pagineIntroduction To Financial Management. 2018Martin Idowu100% (1)

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDocumento4 pagineChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNessuna valutazione finora

- FM Notes PDFDocumento311 pagineFM Notes PDFhitmaaaccountNessuna valutazione finora

- Capital Budgeting and Cash FlowsDocumento49 pagineCapital Budgeting and Cash FlowsArun S BharadwajNessuna valutazione finora

- Cost of Capital 2Documento29 pagineCost of Capital 2BSA 1A100% (2)

- Act1108 Midterm ExaminationDocumento9 pagineAct1108 Midterm ExaminationRizelle MillagraciaNessuna valutazione finora

- Financial System & BSPDocumento46 pagineFinancial System & BSPZenedel De JesusNessuna valutazione finora

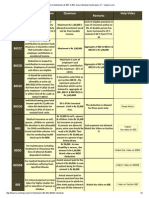

- Chapter 17 Financial Planning and ForecastingDocumento39 pagineChapter 17 Financial Planning and ForecastingYu BabylanNessuna valutazione finora

- Risk and Return LectureDocumento67 pagineRisk and Return LectureRanin, Manilac Melissa S100% (3)

- © 2012 Pearson Prentice Hall. All Rights ReservedDocumento28 pagine© 2012 Pearson Prentice Hall. All Rights ReservedRaktimNessuna valutazione finora

- The Financial System of The Philippines: and Selected Items of Monetary and Fiscal PoliciesDocumento16 pagineThe Financial System of The Philippines: and Selected Items of Monetary and Fiscal PoliciesJohn Marthin ReformaNessuna valutazione finora

- Dividend PolicyDocumento44 pagineDividend PolicyShahNawazNessuna valutazione finora

- Financial Planning Forecasting Financial Statements Bahria University 01012022 084944pmDocumento22 pagineFinancial Planning Forecasting Financial Statements Bahria University 01012022 084944pmmeaowNessuna valutazione finora

- Ch1 TFDocumento17 pagineCh1 TFKhaled A. M. El-sherifNessuna valutazione finora

- Questionnaire ControllershipDocumento8 pagineQuestionnaire ControllershipDavid Dave FuaNessuna valutazione finora

- Modules in Financial ManagementDocumento12 pagineModules in Financial ManagementMichael Linard Samiley100% (1)

- Managerial EconomicsDocumento10 pagineManagerial EconomicsDipali DeoreNessuna valutazione finora

- Pricing PracticesDocumento43 paginePricing PracticesLeiza FroyaldeNessuna valutazione finora

- The Cost of CapitalDocumento23 pagineThe Cost of CapitalMuhammad AmmadNessuna valutazione finora

- Cheat Sheet - CHE374Documento26 pagineCheat Sheet - CHE374JoeNessuna valutazione finora

- Integrated ReportingDocumento8 pagineIntegrated ReportingCut Hasna AushafNessuna valutazione finora

- Chapter: Bond FundamentalsDocumento28 pagineChapter: Bond FundamentalsUtkarsh VardhanNessuna valutazione finora

- Short Essay 1: UnrestrictedDocumento8 pagineShort Essay 1: UnrestrictedSatesh KalimuthuNessuna valutazione finora

- Financial Planning and Forecasting Financial StatementsDocumento70 pagineFinancial Planning and Forecasting Financial StatementsAziz Hotelwala100% (1)

- Investment Center and Transfer PricingDocumento10 pagineInvestment Center and Transfer Pricingrakib_0011Nessuna valutazione finora

- Final Examination Financial Management 2018Documento4 pagineFinal Examination Financial Management 2018Caryl Arciete100% (2)

- Financial Ratios Are Useful Indicators of A Firm's Performance and FinancialDocumento5 pagineFinancial Ratios Are Useful Indicators of A Firm's Performance and FinancialSef Getizo CadoNessuna valutazione finora

- Financial PlanningDocumento22 pagineFinancial Planningangshu002085% (13)

- Functions of Financial ManagementDocumento8 pagineFunctions of Financial ManagementpavaniNessuna valutazione finora

- Chapter 5 - Competitive Rivalry and DynamicsDocumento21 pagineChapter 5 - Competitive Rivalry and DynamicsNalyn SumaNessuna valutazione finora

- Role of Financial Markets and InstitutionsDocumento23 pagineRole of Financial Markets and InstitutionsIbnuIqbalHasanNessuna valutazione finora

- ABC Costing 12 NewDocumento20 pagineABC Costing 12 Newsyed khaleel0% (1)

- Chapter 2 MCSDocumento22 pagineChapter 2 MCSRuthNessuna valutazione finora

- Risk and Rate of ReturnDocumento35 pagineRisk and Rate of ReturnKristineTwo CorporalNessuna valutazione finora

- The Importance of Demand ForecastingDocumento2 pagineThe Importance of Demand Forecastingbroto_wasesoNessuna valutazione finora

- Fundamentals of Financial ManagementDocumento17 pagineFundamentals of Financial ManagementLawrence101100% (1)

- Managerial EconomicsDocumento12 pagineManagerial EconomicsChinni DurgaNessuna valutazione finora

- Tactical Decision MakingDocumento25 pagineTactical Decision MakingNizam JewelNessuna valutazione finora

- Difference Between Financial and Managerial AccountingDocumento10 pagineDifference Between Financial and Managerial AccountingRahman Sankai KaharuddinNessuna valutazione finora

- RWJLT CH 14 Cost of CapitalDocumento45 pagineRWJLT CH 14 Cost of CapitalHamdan HassinNessuna valutazione finora

- Cecchetti 6e Chapter 02Documento46 pagineCecchetti 6e Chapter 02Karthik LakshminarayanNessuna valutazione finora

- Chapter 5 Portfolio Risk and Return Part IDocumento25 pagineChapter 5 Portfolio Risk and Return Part ILaura StephanieNessuna valutazione finora

- ManagerialAccounting - 6E Atkinson6e - PPT - ch06REVISEDDocumento23 pagineManagerialAccounting - 6E Atkinson6e - PPT - ch06REVISEDالهيثم الحيدريNessuna valutazione finora

- Qualitiesofahighperformance Finance Executive:: An Aggregation of SkillsDocumento9 pagineQualitiesofahighperformance Finance Executive:: An Aggregation of Skillsvinni_30Nessuna valutazione finora

- FIN 439 Fall 17Documento4 pagineFIN 439 Fall 17samenNessuna valutazione finora

- Chapter 6Documento5 pagineChapter 6Silvia ReginaNessuna valutazione finora

- Portfolio ManagementDocumento28 paginePortfolio Managementagarwala4767% (3)

- Financial Management SummaryDocumento3 pagineFinancial Management SummaryChristoph MagistraNessuna valutazione finora

- Unit 1: Overview of Financial Management & Financial EnvironmentDocumento60 pagineUnit 1: Overview of Financial Management & Financial EnvironmentbadaberaNessuna valutazione finora

- Lecture 1Documento54 pagineLecture 1M Haris SiddiquiNessuna valutazione finora

- Financial Management - Chapter 01Documento26 pagineFinancial Management - Chapter 01Joe HizulNessuna valutazione finora

- Overview of Financial ManagementDocumento57 pagineOverview of Financial ManagementMohamedNessuna valutazione finora

- Concepts of Financial Management 2014Documento9 pagineConcepts of Financial Management 2014blokeyesNessuna valutazione finora

- Financial MNGT Module1Documento39 pagineFinancial MNGT Module1Stephanie FrescoNessuna valutazione finora

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocumento30 pagineIntroduction To Corporate Finance: Mcgraw-Hill/IrwinDaireen ShahrinNessuna valutazione finora

- Atlp Practice Questions Direct Tax & International TaxationDocumento82 pagineAtlp Practice Questions Direct Tax & International Taxationharsh bangNessuna valutazione finora

- 4 - 4-Credit Evaluation PDFDocumento20 pagine4 - 4-Credit Evaluation PDFadil sheikhNessuna valutazione finora

- Calderon Saln 2020Documento3 pagineCalderon Saln 2020Calderón Gutiérrez Marlón PówanNessuna valutazione finora

- Deutsche Bank - CSR Report 2003Documento104 pagineDeutsche Bank - CSR Report 2003iggymaxNessuna valutazione finora

- Foundations in Personal Finance High School EditionDocumento5 pagineFoundations in Personal Finance High School EditionJake LewisNessuna valutazione finora

- Overhead BudgetDocumento16 pagineOverhead BudgetRonak Singh67% (3)

- Deed Odeed of Sale With Assumption of Mortgage (Landf Sale With Assumption of Mortgage (Land)Documento2 pagineDeed Odeed of Sale With Assumption of Mortgage (Landf Sale With Assumption of Mortgage (Land)NOJ ADNUB100% (2)

- Ifs Cia 3.1Documento15 pagineIfs Cia 3.1Andriana MihobeeNessuna valutazione finora

- Egyptian Financial & Industrial: Restructuring Renews Hope! Strong Buy - High RiskDocumento13 pagineEgyptian Financial & Industrial: Restructuring Renews Hope! Strong Buy - High RiskwaleedthapetNessuna valutazione finora

- Problems of CooperationDocumento119 pagineProblems of CooperationSebestyén GyörgyNessuna valutazione finora

- Solutions Nss NC 11Documento19 pagineSolutions Nss NC 11saadullahNessuna valutazione finora

- Bir 2306 PLDTDocumento9 pagineBir 2306 PLDTKevinjhen ManaloNessuna valutazione finora

- Articles of IncorporationDocumento5 pagineArticles of IncorporationDave Lumasag CanumhayNessuna valutazione finora

- 2011 ANZ Annual ResultsDocumento132 pagine2011 ANZ Annual ResultsArvind BhisikarNessuna valutazione finora

- Cashflow Statements - ACCA GlobalDocumento3 pagineCashflow Statements - ACCA GlobalRith TryNessuna valutazione finora

- SandeshDocumento21 pagineSandeshhiteshvavaiya0% (1)

- Cheque IntDocumento6 pagineCheque Intneo_yasserNessuna valutazione finora

- Analysis of Housing Finance Schemes of HDFC Bank ICICI Bank PNB SBI BankDocumento80 pagineAnalysis of Housing Finance Schemes of HDFC Bank ICICI Bank PNB SBI BankChandan SrivastavaNessuna valutazione finora

- 04 October 2018Documento95 pagine04 October 2018krushnaNessuna valutazione finora

- Glossary of Banking, Economic and Financial TermsDocumento22 pagineGlossary of Banking, Economic and Financial Termssourav_cybermusicNessuna valutazione finora

- Concise Selina Solutions For Class 9 Maths Chapter 3 Compound Interest Using FormulaDocumento42 pagineConcise Selina Solutions For Class 9 Maths Chapter 3 Compound Interest Using FormulaNarayanamurthy AmirapuNessuna valutazione finora

- 6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocumento17 pagine6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman Mastura100% (1)

- Thesis SynopsisDocumento3 pagineThesis SynopsisShivani PandaNessuna valutazione finora

- Samsung v. Febtc DigestDocumento4 pagineSamsung v. Febtc DigestkathrynmaydevezaNessuna valutazione finora

- Dead Capital and The Poor: Soto, Hernando De, 1941Documento33 pagineDead Capital and The Poor: Soto, Hernando De, 1941Ahmad BorhamNessuna valutazione finora

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocumento2 pagineEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Nessuna valutazione finora

- Peoples Bank Vs Dahican Lumber DigestDocumento2 paginePeoples Bank Vs Dahican Lumber DigestNOLLIE CALISINGNessuna valutazione finora

- ContractDocumento10 pagineContractDhruvika JainNessuna valutazione finora

- Loan Amortization Schedule: Enter Values Loan SummaryDocumento8 pagineLoan Amortization Schedule: Enter Values Loan SummaryoscarwhiskyNessuna valutazione finora

- BOSS CPMP PresentationDocumento63 pagineBOSS CPMP PresentationMasterHomerNessuna valutazione finora