Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

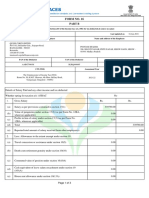

Income Tax Department 194C

Caricato da

Prabhakar ReddyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Income Tax Department 194C

Caricato da

Prabhakar ReddyCopyright:

Formati disponibili

3/9/2016

IncomeTaxDepartment

Paymentstocontractors.

61194C.(1)Anypersonresponsibleforpayinganysumtoanyresident(hereafterinthissection

referredtoasthecontractor)forcarryingoutanywork(includingsupplyoflabourforcarryingout

any work) in pursuance of a contract between the contractor and a specified person shall, at the

timeofcreditofsuchsumtotheaccountofthecontractororatthetimeofpaymentthereofincash

orbyissueofachequeordraftorbyanyothermode,whicheverisearlier,deductanamountequal

to

(i)onepercentwherethepaymentisbeingmadeorcreditisbeinggiventoanindividualora

Hinduundividedfamily

(ii)twopercentwherethepaymentisbeingmadeorcreditisbeinggiventoapersonother

thananindividualoraHinduundividedfamily,

ofsuchsumasincometaxonincomecomprisedtherein.

(2) Where any sum referred to in subsection (1) is credited to any account, whether called

"Suspenseaccount"orbyanyothername,inthebooksofaccountofthepersonliabletopaysuch

income,suchcreditingshallbedeemedtobecreditofsuchincometotheaccountofthepayeeand

theprovisionsofthissectionshallapplyaccordingly.

(3) Where any sum is paid or credited for carrying out any work mentioned in subclause (e)of

clause(iv)oftheExplanation,taxshallbedeductedatsource

(i)ontheinvoicevalueexcludingthevalueofmaterial,ifsuchvalueismentionedseparately

intheinvoiceor

(ii)onthewholeoftheinvoicevalue,ifthevalueofmaterialisnotmentionedseparatelyinthe

invoice.

(4) No individual or Hindu undivided family shall be liable to deduct incometax on the sum

creditedorpaidtotheaccountofthecontractorwheresuchsumiscreditedorpaidexclusivelyfor

personalpurposesofsuchindividualoranymemberofHinduundividedfamily.

(5) No deduction shall be made from the amount of any sum credited or paid or likely to be

creditedorpaidtotheaccountof,orto,thecontractor,ifsuchsumdoesnotexceedthirtythousand

rupees:

Provided that where the aggregate of the amounts of such sums credited or paid or likely to be

credited or paid during the financial year exceeds seventyfive thousand rupees, the person

responsibleforpayingsuchsumsreferredtoinsubsection(1)shallbeliabletodeductincometax

underthissection.

(6) No deduction shall be made from any sum credited or paid or likely to be credited or paid

during the previous year to the account of a contractor during the course of business of plying,

hiring or leasing goods carriages, 62[where such contractor owns ten or less goods carriages at

any time during the previous year and furnishes a declaration to that effect along with] his

PermanentAccountNumber,tothepersonpayingorcreditingsuchsum.

(7)Thepersonresponsibleforpayingorcreditinganysumtothepersonreferredtoinsubsection

(6) shall furnish, to the prescribed incometax authority or the person authorised by it, such

particulars,insuchformandwithinsuchtimeasmaybeprescribed.

Explanation.Forthepurposesofthissection,

(i)"specifiedperson"shallmean,

about:blank

1/2

3/9/2016

IncomeTaxDepartment

(a)theCentralGovernmentoranyStateGovernmentor

(b)anylocalauthorityor

(c)anycorporationestablishedbyorunderaCentral,StateorProvincialActor

(d)anycompanyor

(e)anycooperativesocietyor

(f)anyauthority,constitutedinIndiabyorunderanylaw,engagedeitherforthepurpose

of dealing with and satisfying the need for housing accommodation or for the

purposeofplanning,developmentorimprovementofcities,townsandvillages,or

forbothor

(g) any society registered under the Societies Registration Act, 1860 (21 of 1860) or

underanylawcorrespondingtothatActinforceinanypartofIndiaor

(h)anytrustor

(i)anyuniversityestablishedorincorporatedbyorunderaCentral,StateorProvincial

Actandaninstitutiondeclaredtobeauniversityundersection3oftheUniversity

GrantsCommissionAct,1956(3of1956)or

(j)anyGovernmentofaforeignStateoraforeignenterpriseoranyassociationorbody

establishedoutsideIndiaor

(k)anyfirmor

(l) any person, being an individual or a Hindu undivided family or an association of

personsorabodyofindividuals,ifsuchperson,

(A)doesnotfallunderanyoftheprecedingsubclausesand

(B) is liable to audit of accounts under clause (a) or clause (b) of section 44AB

duringthefinancialyearimmediatelyprecedingthefinancialyearinwhichsuch

sumiscreditedorpaidtotheaccountofthecontractor

(ii)"goodscarriage"shallhavethemeaningassignedtoitintheExplanationtosubsection(7)

ofsection44AE

(iii)"contract"shallincludesubcontract

(iv)"work"shallinclude

(a)advertising

(b) broadcasting and telecasting including production of programmes for such

broadcastingortelecasting

(c)carriageofgoodsorpassengersbyanymodeoftransportotherthanbyrailways

(d)catering

(e)manufacturingorsupplyingaproductaccordingtotherequirementorspecificationof

acustomerbyusingmaterialpurchasedfromsuchcustomer,

butdoesnotincludemanufacturingorsupplyingaproductaccordingtotherequirementor

specification of a customer by using material purchased from a person, other than such

customer.

about:blank

2/2

Potrebbero piacerti anche

- Gupta Satabhdi Panchagam110yeDocumento90 pagineGupta Satabhdi Panchagam110yeRaaja Shekhar61% (36)

- Nagaloka YagamDocumento427 pagineNagaloka YagamKhaderAli78% (63)

- Marakatha Manjusha 1&2 by MadhubabuDocumento476 pagineMarakatha Manjusha 1&2 by MadhubabuPrabhakar Reddy79% (14)

- Accomplishment Report 2021Documento9 pagineAccomplishment Report 2021Chacha CawiliNessuna valutazione finora

- Singtel Bill For DEC 2021 - Suraya IsmailDocumento3 pagineSingtel Bill For DEC 2021 - Suraya IsmailSuraya IsmailNessuna valutazione finora

- Income Tax DepartmentDocumento2 pagineIncome Tax DepartmentP DNessuna valutazione finora

- Section 194Documento10 pagineSection 194Hitesh NarwaniNessuna valutazione finora

- Explanation.-For The Purposes of This SectionDocumento2 pagineExplanation.-For The Purposes of This SectionJeremy RemlalfakaNessuna valutazione finora

- Deduction of Tax at Source - BComDocumento8 pagineDeduction of Tax at Source - BComAniket AgrawalNessuna valutazione finora

- Refund of Tax-Section 54Documento4 pagineRefund of Tax-Section 54RajgopalNessuna valutazione finora

- Provision For Filing of Return of IncomeDocumento13 pagineProvision For Filing of Return of Incomedata.mvgNessuna valutazione finora

- Short Title, Commencement and Application. - (1) These RulesDocumento41 pagineShort Title, Commencement and Application. - (1) These Rulessuvendu beheraNessuna valutazione finora

- 2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveDocumento24 pagine2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveAlezNessuna valutazione finora

- Rule 2 (1) (C)Documento3 pagineRule 2 (1) (C)jayesh khatriNessuna valutazione finora

- BGSTAct, 2017 (EN) 20 25Documento6 pagineBGSTAct, 2017 (EN) 20 25Ahsan ZakariyyaNessuna valutazione finora

- So Cilever LocDocumento13 pagineSo Cilever LocKagimu Clapton ENessuna valutazione finora

- CGST PDF NOTES PDFDocumento104 pagineCGST PDF NOTES PDFRaunak JainNessuna valutazione finora

- Input Tax CreditDocumento45 pagineInput Tax CreditGourav PareekNessuna valutazione finora

- Refund of TaxDocumento4 pagineRefund of Taxdhaval bhalodiaNessuna valutazione finora

- Deposit RuleDocumento5 pagineDeposit RulegurpreetNessuna valutazione finora

- Refunds PDFDocumento125 pagineRefunds PDFvaishaliNessuna valutazione finora

- Sec 194aDocumento3 pagineSec 194asayanghosh55Nessuna valutazione finora

- GST Weekly Update - 45 - 2023-24Documento5 pagineGST Weekly Update - 45 - 2023-24guptaharshit2204Nessuna valutazione finora

- Section 139Documento9 pagineSection 139Mkv Downloader2Nessuna valutazione finora

- Provisions For Filing of Return of IncomeDocumento17 pagineProvisions For Filing of Return of IncomeJoseph SalidoNessuna valutazione finora

- 12 Chapter 5Documento99 pagine12 Chapter 5Pavan SAMEER KUMARNessuna valutazione finora

- 52640bosfinal p6c Maynov19 Cp2Documento120 pagine52640bosfinal p6c Maynov19 Cp2SHASWAT DROLIANessuna valutazione finora

- Income Tax NotesDocumento37 pagineIncome Tax Notesgeegostral chhabraNessuna valutazione finora

- The Companies (Profits) Surtax Act, 1964Documento16 pagineThe Companies (Profits) Surtax Act, 1964Mrigendra MishraNessuna valutazione finora

- Tax Credits 61. Charitable Donations.Documento15 pagineTax Credits 61. Charitable Donations.Siddiqui Muhammad AshfaqueNessuna valutazione finora

- Bangar Sir Summary PDFDocumento172 pagineBangar Sir Summary PDFHimanshu Jeerawala0% (1)

- Section 139 - Return of IncomeDocumento7 pagineSection 139 - Return of IncomeAnand LakraNessuna valutazione finora

- Agreement Collection AgencyDocumento4 pagineAgreement Collection AgencyRickEspinaNessuna valutazione finora

- Basic Concepts of Income Tax ActDocumento14 pagineBasic Concepts of Income Tax ActRaghu CkNessuna valutazione finora

- Declaration 194c6Documento3 pagineDeclaration 194c6sajahan aliNessuna valutazione finora

- Gujarat GST Bill, 2017Documento199 pagineGujarat GST Bill, 2017JagdishLimbachiyaNessuna valutazione finora

- 2 Definitions.: But Does Not IncludeDocumento5 pagine2 Definitions.: But Does Not Includeuma mishraNessuna valutazione finora

- GST & Customs II Unit 1Documento11 pagineGST & Customs II Unit 1GagandeepNessuna valutazione finora

- Section 11 BankingDocumento6 pagineSection 11 BankingMay TanNessuna valutazione finora

- Dr. P. Sree Sudha, Associate Professor, DsnluDocumento47 pagineDr. P. Sree Sudha, Associate Professor, Dsnluammu arellaNessuna valutazione finora

- PD 1705Documento23 paginePD 1705Jobi BryantNessuna valutazione finora

- Section 16Documento17 pagineSection 16d-fbuser-65596417Nessuna valutazione finora

- Non Resident Taxation: After Studying This Chapter, You Will Be Able ToDocumento136 pagineNon Resident Taxation: After Studying This Chapter, You Will Be Able ToAtul AgrawalNessuna valutazione finora

- Meghalaya SGST PDFDocumento169 pagineMeghalaya SGST PDFNitin BhatnagarNessuna valutazione finora

- Basic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, DsnluDocumento47 pagineBasic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNessuna valutazione finora

- Income Tax AsgmentDocumento9 pagineIncome Tax AsgmentPARVATHA VARTHININessuna valutazione finora

- Tax Ordinance Sub Section 114 and 115Documento4 pagineTax Ordinance Sub Section 114 and 115faiz kamranNessuna valutazione finora

- Uttarakhand SGST - EnglishDocumento208 pagineUttarakhand SGST - EnglishNitin BhatnagarNessuna valutazione finora

- RR 2 - 98 As AmendedDocumento130 pagineRR 2 - 98 As AmendedHB AldNessuna valutazione finora

- Taxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveDocumento6 pagineTaxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveVamshi Krishna Reddy PathiNessuna valutazione finora

- 19 Say No To Cash TransactionDocumento6 pagine19 Say No To Cash TransactionAmit Mantry100% (1)

- CH 14 RefundDocumento33 pagineCH 14 RefundManas Kumar SahooNessuna valutazione finora

- Section - 33ABADocumento2 pagineSection - 33ABAwaqtkeebaatein12Nessuna valutazione finora

- Liquidation of Companies PDFDocumento8 pagineLiquidation of Companies PDFTippanna GodiNessuna valutazione finora

- Assessment and Audit: After Reading This Chapter, You Shall Be Equipped ToDocumento19 pagineAssessment and Audit: After Reading This Chapter, You Shall Be Equipped ToAnkitaNessuna valutazione finora

- Section 194LB Section 194LC Section 194LDDocumento2 pagineSection 194LB Section 194LC Section 194LDSid MehtaNessuna valutazione finora

- Assessment and Audit Under GSTDocumento19 pagineAssessment and Audit Under GSTSONICK THUKKANINessuna valutazione finora

- Refund of Un Utilised TaxDocumento4 pagineRefund of Un Utilised TaxcahardikkachavaNessuna valutazione finora

- 62304bos50449 Mod3 cp17Documento131 pagine62304bos50449 Mod3 cp17neeraj sharmaNessuna valutazione finora

- Unit-1: Basic Concepts and Framework of Income Tax Act, 1961Documento40 pagineUnit-1: Basic Concepts and Framework of Income Tax Act, 1961Saurab JainNessuna valutazione finora

- Procedure For RefundDocumento11 pagineProcedure For RefundDhaval ShahNessuna valutazione finora

- Chapter VIII Rebates and ReliefsDocumento14 pagineChapter VIII Rebates and ReliefsShweta VermaNessuna valutazione finora

- General Idea of Insolvency and Bankrupcty CodeDocumento5 pagineGeneral Idea of Insolvency and Bankrupcty CodeAnkit TewariNessuna valutazione finora

- SECTIONS TO BE REMEMBERED - TaxDocumento6 pagineSECTIONS TO BE REMEMBERED - TaxLekhya ChekkaNessuna valutazione finora

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- MBS Crime RachanaDocumento43 pagineMBS Crime RachanaPrabhakar ReddyNessuna valutazione finora

- Automatic Sprinkler System GuideDocumento4 pagineAutomatic Sprinkler System Guidebugoff700100% (2)

- PriyaVadika by RSandyadeviDocumento82 paginePriyaVadika by RSandyadeviPrabhakar Reddy75% (8)

- AnamakudiHatya by Kommuri SambasivaRao PDFDocumento57 pagineAnamakudiHatya by Kommuri SambasivaRao PDFPrabhakar Reddy100% (3)

- Physics For EveryoneDocumento50 paginePhysics For EveryonePrabhakar Reddy50% (2)

- World Map PDFDocumento1 paginaWorld Map PDFJeff Adlouie SuarezNessuna valutazione finora

- ChachhiBatiginaManishi by Kommuri SambasivaRaoDocumento57 pagineChachhiBatiginaManishi by Kommuri SambasivaRaoPrabhakar Reddy75% (4)

- SW 9may2014 by TEBDocumento55 pagineSW 9may2014 by TEBPrabhakar ReddyNessuna valutazione finora

- Sarada RachanaluDocumento238 pagineSarada RachanaluPrabhakar ReddyNessuna valutazione finora

- Trill by ParthaDocumento124 pagineTrill by ParthaPrabhakar Reddy50% (2)

- Realistic ApproachDocumento11 pagineRealistic ApproachPrabhakar ReddyNessuna valutazione finora

- Stainless SteelDocumento51 pagineStainless Steelcristian111111Nessuna valutazione finora

- HindawiDocumento14 pagineHindawiPrabhakar ReddyNessuna valutazione finora

- KSB Know-How, Volume 0 - Selecting-Centrifugal-Pumps-data PDFDocumento92 pagineKSB Know-How, Volume 0 - Selecting-Centrifugal-Pumps-data PDFRodrigo Astudillo AedoNessuna valutazione finora

- Pile Foundation DesignDocumento82 paginePile Foundation Designcuongnguyen89% (28)

- Stainless OverviewDocumento6 pagineStainless OverviewClaudia MmsNessuna valutazione finora

- Bio EthanolDocumento4 pagineBio Ethanolarik_cemNessuna valutazione finora

- EarthisroundteleguDocumento20 pagineEarthisroundteleguRaghuveer ChowdaryNessuna valutazione finora

- Manual Civil Engg - WorksDocumento175 pagineManual Civil Engg - WorksPrabhakar ReddyNessuna valutazione finora

- Guide To Stainless Steel Finishes PDFDocumento24 pagineGuide To Stainless Steel Finishes PDFAnup George ThomasNessuna valutazione finora

- Welding Defects, Causes and CorrectionsDocumento3 pagineWelding Defects, Causes and CorrectionsBinh Pham100% (2)

- 95 Excel Tips & Tricks: To Make You Awesome at WorkDocumento27 pagine95 Excel Tips & Tricks: To Make You Awesome at WorkPrabhakar ReddyNessuna valutazione finora

- Hindustan Petroleum Corporation Limited: Ennore Terminal ProjectDocumento6 pagineHindustan Petroleum Corporation Limited: Ennore Terminal ProjectPrabhakar ReddyNessuna valutazione finora

- BulliBalasiksha Free KinigeDotComDocumento62 pagineBulliBalasiksha Free KinigeDotComPrabhakar Reddy100% (1)

- Aminoacid ProfileDocumento3 pagineAminoacid ProfilePrabhakar ReddyNessuna valutazione finora

- Mahatmudu by Dasaradhi RangacharyaDocumento51 pagineMahatmudu by Dasaradhi RangacharyaPrabhakar ReddyNessuna valutazione finora

- Accounting Entries Under GSTDocumento3 pagineAccounting Entries Under GSTAshish RaiNessuna valutazione finora

- Rmo No 76-10 Annex CDocumento1 paginaRmo No 76-10 Annex CGil Pino100% (1)

- MC TemplatesDocumento4 pagineMC Templatesusaeed1979Nessuna valutazione finora

- Customer Name Quote: QUO291Documento2 pagineCustomer Name Quote: QUO291Deni HermawanNessuna valutazione finora

- 6-Confederation For Unity, Et. Al. vs. Bureau of Internal and RevenueDocumento6 pagine6-Confederation For Unity, Et. Al. vs. Bureau of Internal and RevenueLandrel MatagaNessuna valutazione finora

- ITA2004 Invitation & RegistrationDocumento6 pagineITA2004 Invitation & RegistrationCostas SachpazisNessuna valutazione finora

- Statement 5825212Documento1 paginaStatement 5825212Sita SidhartaNessuna valutazione finora

- Beckman Coulter Ac.T DiffDocumento1 paginaBeckman Coulter Ac.T DiffBasharatNessuna valutazione finora

- Liechtenstein's New Tax LawDocumento8 pagineLiechtenstein's New Tax LawMaksim DyachukNessuna valutazione finora

- NPS Contribution Instruction Slip (NCIS)Documento1 paginaNPS Contribution Instruction Slip (NCIS)Vijaya Krishna PondalaNessuna valutazione finora

- Review MaterialsDocumento6 pagineReview MaterialsShiela Marie Sta AnaNessuna valutazione finora

- MG 3027 TAXATION - Week 8 Income From EmploymentDocumento44 pagineMG 3027 TAXATION - Week 8 Income From EmploymentSyed SafdarNessuna valutazione finora

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocumento1 paginaBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPriti SharmaNessuna valutazione finora

- FS51853 KPMG PDFDocumento9 pagineFS51853 KPMG PDFAman AgrawalNessuna valutazione finora

- Chapter 10 - Installment Sales MethodDocumento13 pagineChapter 10 - Installment Sales MethodMohammad Allem AlegreNessuna valutazione finora

- NRB Commercial Bank Limited Principal Branch Statement of AccountsDocumento15 pagineNRB Commercial Bank Limited Principal Branch Statement of AccountsS.M. Shamsuzzaman SalimNessuna valutazione finora

- Solved Question Paper For November 2018 EXAM (New Syllabus)Documento21 pagineSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNessuna valutazione finora

- Negotiable Instruments 1229854285942730 1Documento59 pagineNegotiable Instruments 1229854285942730 1Sameer Gopal100% (1)

- Form 16-Part B - 2020-2021Documento3 pagineForm 16-Part B - 2020-2021Ravi S. SharmaNessuna valutazione finora

- BHU Registration Form Con 2Documento2 pagineBHU Registration Form Con 2kullsNessuna valutazione finora

- Nsefutures Contract 20211231 924P857 0571802Documento2 pagineNsefutures Contract 20211231 924P857 0571802PIVOT GRAVITYNessuna valutazione finora

- Certificate of Registration For Value Added Tax in The United Arab EmiratesDocumento1 paginaCertificate of Registration For Value Added Tax in The United Arab EmiratesHigh Trading LLCNessuna valutazione finora

- Invoice 0126-22 - Teraju Global Vision SDN BHD (Big Tas Tea Bandar Tropicana Aman)Documento1 paginaInvoice 0126-22 - Teraju Global Vision SDN BHD (Big Tas Tea Bandar Tropicana Aman)nor hafizaNessuna valutazione finora

- BNP Paribas - Paris Saint Paul - Le MaraisDocumento1 paginaBNP Paribas - Paris Saint Paul - Le MaraisfredericcroyNessuna valutazione finora

- Soa 0030300152406Documento1 paginaSoa 0030300152406Maria Theresa LimosNessuna valutazione finora

- PIONEER Current Account SOB Eff 1st Dec 2022Documento2 paginePIONEER Current Account SOB Eff 1st Dec 2022Rajat AgarwalNessuna valutazione finora

- Fees Rscoe 27 Oct 2022Documento1 paginaFees Rscoe 27 Oct 2022Pranav PatiLNessuna valutazione finora

- RMC No. 61-2016Documento6 pagineRMC No. 61-2016sandraNessuna valutazione finora