Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tightening The Purse Strings

Caricato da

Indicus Analytics0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni1 paginaEconomists expect hike in interest rates in the current fiscal

The Reserve Bank of India (RBI) is due to unveil the annual monetary policy statement for the fiscal ending March 2011 (FY 2011) on 20 April 2010. The challenges facing the central bank are managing the recovery as well as maintain price stability with the fasterthan- expected recovery in industrial production and inflation. Capital Market’s Yogesh Kulkarni and Vijay Ghutukade,

quizzed Manoranjan Sharma, Chief Economist and Deputy General Manager, Canara Bank; Sumita Kale, Chief Economist, Indicus Analytics; Indranil Pan, Chief Economist, Kotak Mahindra Bank; Sujan Hajra, Chief Economist, Anand Rathi Financial Services; and Krupesh Thakkar, Research Analyst, India Capital Markets, on the options for the central bank.

Excerpts:

Higher inflation is raising anxiety. What should the RBI do?

Manoranjan Sharma: The RBI should continue with its stance of monetary tightening throughout this calendar year. We see all rates — cash reserve ratio (CRR), statutory liquidity ratio, repo and reverse repo — going steeply up by December 2010. The Raghuram Rajan Committee’s report on the financial sector reforms made a case for inflation targeting as done in of the world,

including the US and the UK and the European Central Bank.

Sumita Kale: Monetary tightening has been on the cards for a while now. The question of timing and quantum of raise at each step over the year will depend on how the credit flows are increasing to the requisite sectors and whether capex plans are being undertaken or not. Inflation has already picked up in manufacturing items. So rates are warranted to influence inflation expectations.

Indranil Pan: The RBI could be increasing the reverse repo rate by around 100 bps-150 bps in FY 2011 over the current 3.25%. Further, we expect the CRR to rise by around 75 bps-100 bps including a 50-bp hike on 20 April 20 in FY 2011. In its effort to remove the monetary stimulus, the central bank’s actions are likely to remain measured and, in turn, ensuring that the reverse repo rate remains the operative rate in FY 2011.

Sujan Hajra: The RBI is likely to go for at least another 25-bp hike in the repo and reverse repo rates in the policy meet on 20 April 2010.

Krupesh Thakkar: We expect a cumulative hike of at least 100 basis points (bps) in key policy rates and 75 bps in CRR in the current fiscal, with expectation of a possible 25-bp rise in the repo and reverse repo rate in the coming policy meet. Is growing food inflation becoming an obstacle for growth?

Manoranjan Sharma: Monetary policy can have only a limited impact on managing food inflation.

Sumita Kale: Inflation eats away at household budgets, negating the positive impact of growth. The need to overhaul the pricing policies, distribution strategies, and raise productivity have all been well known for many years now. The political will to make these changes is needed urgently now.

Krupesh Thakkar: The short-term interest rates on commercial paper and corporate deposits could go up in the near term. So the yield curve would get steeper suggesting two things: economy growth for a longer period and high future inflation. This, in turn, will result in upward pressure on long-term rates to attract savings.

What are your expectations on inflation numbers amid the faster-than-expected recovery in industrial production?

Manoranjan Sharma: Inflation would continue to be at a high level for the next two months but gradually fall because of mutually reinforcing dynamics of good rabi crop, lagged effect of monetary tightening measures by the RBI and the base effect.

Sumita Kale: There has been a upsurge in prices of commodities such as crude, steel and rubber globally, not just in India, this year. Clearly inflationary pressures cannot be ruled out over the year. The Wholesale Price Index estimates will trend down over the year touching 5%-6% by December 2010.

Krupesh Thakkar: With better prospects for rabi

Titolo originale

Tightening the Purse Strings

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoEconomists expect hike in interest rates in the current fiscal

The Reserve Bank of India (RBI) is due to unveil the annual monetary policy statement for the fiscal ending March 2011 (FY 2011) on 20 April 2010. The challenges facing the central bank are managing the recovery as well as maintain price stability with the fasterthan- expected recovery in industrial production and inflation. Capital Market’s Yogesh Kulkarni and Vijay Ghutukade,

quizzed Manoranjan Sharma, Chief Economist and Deputy General Manager, Canara Bank; Sumita Kale, Chief Economist, Indicus Analytics; Indranil Pan, Chief Economist, Kotak Mahindra Bank; Sujan Hajra, Chief Economist, Anand Rathi Financial Services; and Krupesh Thakkar, Research Analyst, India Capital Markets, on the options for the central bank.

Excerpts:

Higher inflation is raising anxiety. What should the RBI do?

Manoranjan Sharma: The RBI should continue with its stance of monetary tightening throughout this calendar year. We see all rates — cash reserve ratio (CRR), statutory liquidity ratio, repo and reverse repo — going steeply up by December 2010. The Raghuram Rajan Committee’s report on the financial sector reforms made a case for inflation targeting as done in of the world,

including the US and the UK and the European Central Bank.

Sumita Kale: Monetary tightening has been on the cards for a while now. The question of timing and quantum of raise at each step over the year will depend on how the credit flows are increasing to the requisite sectors and whether capex plans are being undertaken or not. Inflation has already picked up in manufacturing items. So rates are warranted to influence inflation expectations.

Indranil Pan: The RBI could be increasing the reverse repo rate by around 100 bps-150 bps in FY 2011 over the current 3.25%. Further, we expect the CRR to rise by around 75 bps-100 bps including a 50-bp hike on 20 April 20 in FY 2011. In its effort to remove the monetary stimulus, the central bank’s actions are likely to remain measured and, in turn, ensuring that the reverse repo rate remains the operative rate in FY 2011.

Sujan Hajra: The RBI is likely to go for at least another 25-bp hike in the repo and reverse repo rates in the policy meet on 20 April 2010.

Krupesh Thakkar: We expect a cumulative hike of at least 100 basis points (bps) in key policy rates and 75 bps in CRR in the current fiscal, with expectation of a possible 25-bp rise in the repo and reverse repo rate in the coming policy meet. Is growing food inflation becoming an obstacle for growth?

Manoranjan Sharma: Monetary policy can have only a limited impact on managing food inflation.

Sumita Kale: Inflation eats away at household budgets, negating the positive impact of growth. The need to overhaul the pricing policies, distribution strategies, and raise productivity have all been well known for many years now. The political will to make these changes is needed urgently now.

Krupesh Thakkar: The short-term interest rates on commercial paper and corporate deposits could go up in the near term. So the yield curve would get steeper suggesting two things: economy growth for a longer period and high future inflation. This, in turn, will result in upward pressure on long-term rates to attract savings.

What are your expectations on inflation numbers amid the faster-than-expected recovery in industrial production?

Manoranjan Sharma: Inflation would continue to be at a high level for the next two months but gradually fall because of mutually reinforcing dynamics of good rabi crop, lagged effect of monetary tightening measures by the RBI and the base effect.

Sumita Kale: There has been a upsurge in prices of commodities such as crude, steel and rubber globally, not just in India, this year. Clearly inflationary pressures cannot be ruled out over the year. The Wholesale Price Index estimates will trend down over the year touching 5%-6% by December 2010.

Krupesh Thakkar: With better prospects for rabi

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni1 paginaTightening The Purse Strings

Caricato da

Indicus AnalyticsEconomists expect hike in interest rates in the current fiscal

The Reserve Bank of India (RBI) is due to unveil the annual monetary policy statement for the fiscal ending March 2011 (FY 2011) on 20 April 2010. The challenges facing the central bank are managing the recovery as well as maintain price stability with the fasterthan- expected recovery in industrial production and inflation. Capital Market’s Yogesh Kulkarni and Vijay Ghutukade,

quizzed Manoranjan Sharma, Chief Economist and Deputy General Manager, Canara Bank; Sumita Kale, Chief Economist, Indicus Analytics; Indranil Pan, Chief Economist, Kotak Mahindra Bank; Sujan Hajra, Chief Economist, Anand Rathi Financial Services; and Krupesh Thakkar, Research Analyst, India Capital Markets, on the options for the central bank.

Excerpts:

Higher inflation is raising anxiety. What should the RBI do?

Manoranjan Sharma: The RBI should continue with its stance of monetary tightening throughout this calendar year. We see all rates — cash reserve ratio (CRR), statutory liquidity ratio, repo and reverse repo — going steeply up by December 2010. The Raghuram Rajan Committee’s report on the financial sector reforms made a case for inflation targeting as done in of the world,

including the US and the UK and the European Central Bank.

Sumita Kale: Monetary tightening has been on the cards for a while now. The question of timing and quantum of raise at each step over the year will depend on how the credit flows are increasing to the requisite sectors and whether capex plans are being undertaken or not. Inflation has already picked up in manufacturing items. So rates are warranted to influence inflation expectations.

Indranil Pan: The RBI could be increasing the reverse repo rate by around 100 bps-150 bps in FY 2011 over the current 3.25%. Further, we expect the CRR to rise by around 75 bps-100 bps including a 50-bp hike on 20 April 20 in FY 2011. In its effort to remove the monetary stimulus, the central bank’s actions are likely to remain measured and, in turn, ensuring that the reverse repo rate remains the operative rate in FY 2011.

Sujan Hajra: The RBI is likely to go for at least another 25-bp hike in the repo and reverse repo rates in the policy meet on 20 April 2010.

Krupesh Thakkar: We expect a cumulative hike of at least 100 basis points (bps) in key policy rates and 75 bps in CRR in the current fiscal, with expectation of a possible 25-bp rise in the repo and reverse repo rate in the coming policy meet. Is growing food inflation becoming an obstacle for growth?

Manoranjan Sharma: Monetary policy can have only a limited impact on managing food inflation.

Sumita Kale: Inflation eats away at household budgets, negating the positive impact of growth. The need to overhaul the pricing policies, distribution strategies, and raise productivity have all been well known for many years now. The political will to make these changes is needed urgently now.

Krupesh Thakkar: The short-term interest rates on commercial paper and corporate deposits could go up in the near term. So the yield curve would get steeper suggesting two things: economy growth for a longer period and high future inflation. This, in turn, will result in upward pressure on long-term rates to attract savings.

What are your expectations on inflation numbers amid the faster-than-expected recovery in industrial production?

Manoranjan Sharma: Inflation would continue to be at a high level for the next two months but gradually fall because of mutually reinforcing dynamics of good rabi crop, lagged effect of monetary tightening measures by the RBI and the base effect.

Sumita Kale: There has been a upsurge in prices of commodities such as crude, steel and rubber globally, not just in India, this year. Clearly inflationary pressures cannot be ruled out over the year. The Wholesale Price Index estimates will trend down over the year touching 5%-6% by December 2010.

Krupesh Thakkar: With better prospects for rabi

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

InFocus

Annual monetary policy

Tightening the purse strings

Economists expect hike in interest rates in the current fiscal

The Reserve Bank of India (RBI) is due to remain measured and, in turn, ensuring that Manoranjan Sharma: Inflation would

unveil the annual monetary policy statement the reverse repo rate remains the operative continue to be at a high level for the next

for the fiscal ending March 2011 (FY 2011) rate in FY 2011. two months but gradually fall because of

on 20 April 2010. The challenges facing the Sujan Hajra: The RBI is likely to go for at mutually reinforcing dynamics of good rabi

central bank are managing the recovery as least another 25-bp hike in the repo and crop, lagged effect of monetary tightening

well as maintain price stability with the faster- reverse repo rates in the policy meet on 20 measures by the RBI and the base effect.

than-expected recovery in industrial April 2010. Sumita Kale: There has been a upsurge in

production and inflation. Capital Market’s Krupesh Thakkar: We expect a cumulative prices of commodities such as crude, steel

Yogesh Kulkarni and Vijay Ghutukade, hike of at least 100 basis points (bps) in key and rubber globally, not just in India, this

quizzed Manoranjan Sharma, Chief policy rates and 75 bps in CRR in the current year. Clearly inflationary pressures cannot

Economist and Deputy General Manager, fiscal, with expectation of a possible 25-bp be ruled out over the year. The Wholesale

Canara Bank; Sumita Kale, Chief rise in the repo and reverse repo rate in the Price Index estimates will trend down over

Economist, Indicus Analytics; Indranil Pan, coming policy meet. the year touching 5%-6% by December 2010.

Chief Economist, Kotak Mahindra Bank; Is growing food inflation becoming an Krupesh Thakkar: With better prospects

Sujan Hajra, Chief Economist, Anand Rathi obstacle for growth? for rabi crop harvesting, normal monsoon

Financial Services; and Krupesh Thakkar, Manoranjan Sharma: Monetary policy and stabilising global prices of commodities,

Research Analyst, India Capital Markets, on can have only a limited impact on managing especially oil, we expect inflationary

the options for the central bank. Excerpts: food inflation. pressures to ease.

Sumita Kale: Inflation eats away at Will the clamp-down on money supply

Higher inflation is raising anxiety. What household budgets, negating the positive affect credit offtake?

should the RBI do? impact of growth. The need to overhaul the Manoranjan Sharma :The RBI should

Manoranjan Sharma: The RBI should pricing policies, distribution strategies, and actively manage liquidity to ensure that credit

continue with its stance of monetary raise productivity have all been well known demands of productive sectors are adequately

tightening throughout this calendar year. We for many years now. The political will to met consistent with price stability and

see all rates — cash reserve ratio (CRR), make these changes is needed urgently now. maintain an interest rate environment

statutory liquidity ratio, repo and reverse Krupesh Thakkar: The short-term consistent with price and financial stability

repo — going steeply up by December 2010. interest rates on commercial paper and and in support of the growth process.

The Raghuram Rajan Committee’s report on corporate deposits could go up in the near Krupesh Thakkar::With improving

the financial sector reforms made a case for term. So the yield curve would get steeper sentiments, both consumption and investment

inflation targeting as done in of the world, suggesting two things: economy growth for demand have been picking up, resulting in credit

including the US and the UK and the a longer period and high future inflation. expansion from both bank and non-bank

European Central Bank. This, in turn, will result in upward pressure sources. We expect bank credit to be above

Sumita Kale: Monetary tightening has been on long-term rates to attract savings. 20% in FY 2011, even after considering

on the cards for a while now. The question of What are your expectations on inflation government borrowing, as there is still enough

timing and quantum of raise at each step over numbers amid the faster-than-expected liquidity in the system.

the year will depend on how the credit flows recovery in industrial production? There is a huge gap between short- and long-

are increasing to the requisite sectors term interest rate. How will rising

and whether capex plans are being What do indicators foretell? interest rates affect corporate

undertaken or not. Inflation has already investment plans?

picked up in manufacturing items. So Macroeconomic signals Manoranjan Sharma: Corporate

rates are warranted to influence 2009-10 2008-09 investment is a function of various inter-

inflation expectations. related forces and factors. While interest

ACTUAL JAN APRIL ACTUAL JAN APRIL

Indranil Pan: The RBI could be rate is certainly a significant factor, it is

POLICY POLICY POLICY POLICY

increasing the reverse repo rate by by no means the only factor.

around 100 bps-150 bps in FY 2011 GDP ^7.2 7.5 6.0 6.7 *7.0 8-8.5 Where do you see the rupee?

over the current 3.25%. Further, we WPI inflation (period-end) 8.5 4.0 1.2 #3.0 Manoranjan Sharma: The rupee will

expect the CRR to rise by around 75 Non-food credit 16.9 16.0 20.0 17.8 24.0 20.0 largely be range bound because of the

bps-100 bps including a 50-bp hike Aggregate deposit 17.0 17.0 18.0 19.9 19.0 17.0 operation of the impossible trinity

on 20 April 20 in FY 2011. In its effort (capital mobility, fixed exchange rates and

M3 money supply 16.7 16.5 17.0 18.6 19.0 16.5-17

to remove the monetary stimulus, the interest rate autonomy). However, there

Figures in %. ^ Advance Estimates (CSO) * With a downward bias, # Below

central bank’s actions are likely to is still some upside for the rupee.

Apr 19 – May 02, 2010 CAPITAL MARKET 1

Potrebbero piacerti anche

- Expanding Financial InclusionDocumento1 paginaExpanding Financial InclusionIndicus AnalyticsNessuna valutazione finora

- Short End of The Growth StickDocumento2 pagineShort End of The Growth StickIndicus AnalyticsNessuna valutazione finora

- Indicus Ma Foi Randstad Employment Trends Survey - Wave 1 - 2011Documento26 pagineIndicus Ma Foi Randstad Employment Trends Survey - Wave 1 - 2011Indicus AnalyticsNessuna valutazione finora

- Young and Upwardly MobileDocumento4 pagineYoung and Upwardly MobileIndicus AnalyticsNessuna valutazione finora

- The Luxe LifeDocumento4 pagineThe Luxe LifeIndicus AnalyticsNessuna valutazione finora

- Saving Up For A Larger FamilyDocumento5 pagineSaving Up For A Larger FamilyIndicus AnalyticsNessuna valutazione finora

- A Wide Variety in DemandDocumento4 pagineA Wide Variety in DemandIndicus AnalyticsNessuna valutazione finora

- Homogenous Only To A Certain PointDocumento3 pagineHomogenous Only To A Certain PointIndicus AnalyticsNessuna valutazione finora

- Predominantly Self EmployedDocumento5 paginePredominantly Self EmployedIndicus AnalyticsNessuna valutazione finora

- Climbing Up The Income LadderDocumento3 pagineClimbing Up The Income LadderIndicus AnalyticsNessuna valutazione finora

- Bihar Development Report 2010Documento95 pagineBihar Development Report 2010Indicus AnalyticsNessuna valutazione finora

- Diversity in Socio-EconomicsDocumento3 pagineDiversity in Socio-EconomicsIndicus AnalyticsNessuna valutazione finora

- Tracking Young HouseholdsDocumento3 pagineTracking Young HouseholdsIndicus AnalyticsNessuna valutazione finora

- Web of JobsDocumento6 pagineWeb of JobsIndicus AnalyticsNessuna valutazione finora

- India Health ReportDocumento10 pagineIndia Health ReportIndicus AnalyticsNessuna valutazione finora

- Car Sales On The RunDocumento5 pagineCar Sales On The RunIndicus AnalyticsNessuna valutazione finora

- A Slice of Life in Peri-Urban IndiaDocumento1 paginaA Slice of Life in Peri-Urban IndiaIndicus AnalyticsNessuna valutazione finora

- Supporting Home at A Young AgeDocumento3 pagineSupporting Home at A Young AgeIndicus AnalyticsNessuna valutazione finora

- Independent and IndividualisticDocumento5 pagineIndependent and IndividualisticIndicus AnalyticsNessuna valutazione finora

- No Relief From InflationDocumento3 pagineNo Relief From InflationIndicus AnalyticsNessuna valutazione finora

- Social Infrastructure - Urban Health and EducationDocumento26 pagineSocial Infrastructure - Urban Health and EducationIndicus Analytics100% (1)

- New Migrants To The CitiesDocumento5 pagineNew Migrants To The CitiesIndicus AnalyticsNessuna valutazione finora

- Aspiring For The Next GenerationDocumento5 pagineAspiring For The Next GenerationIndicus AnalyticsNessuna valutazione finora

- The Rise of Nuclear FamilyDocumento5 pagineThe Rise of Nuclear FamilyIndicus AnalyticsNessuna valutazione finora

- The Freedom of Self EmploymentDocumento5 pagineThe Freedom of Self EmploymentIndicus AnalyticsNessuna valutazione finora

- The Smallest Urban SegmentDocumento5 pagineThe Smallest Urban SegmentIndicus AnalyticsNessuna valutazione finora

- At The Beginning of Their CareersDocumento5 pagineAt The Beginning of Their CareersIndicus AnalyticsNessuna valutazione finora

- Ibm Mainframe StrangleholdDocumento2 pagineIbm Mainframe StrangleholdIndicus AnalyticsNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Senior 12 FABM2 Q1 - M8Documento22 pagineSenior 12 FABM2 Q1 - M8Sitti Halima Amilbahar AdgesNessuna valutazione finora

- LJK Latihan Ukk Ud WirastriDocumento8 pagineLJK Latihan Ukk Ud WirastriHera MasdiyantiNessuna valutazione finora

- Problems For Chapter 1Documento1 paginaProblems For Chapter 1Görkem DamdereNessuna valutazione finora

- April 2018 PDFDocumento16 pagineApril 2018 PDFPallaviNessuna valutazione finora

- Invoice - Source One Dec'22Documento2 pagineInvoice - Source One Dec'22Sydney DorairajNessuna valutazione finora

- A Case Study On Mega Merger of SBI With Its Five SubsidariesDocumento4 pagineA Case Study On Mega Merger of SBI With Its Five SubsidariesPooja MauryaNessuna valutazione finora

- Export FinanceDocumento6 pagineExport FinanceMallikarjun RaoNessuna valutazione finora

- SKBDN Dan Curah HujanDocumento4 pagineSKBDN Dan Curah HujanEdy CahyonoNessuna valutazione finora

- Auto Repair Invoice TemplateDocumento2 pagineAuto Repair Invoice TemplateEscapayd ENessuna valutazione finora

- 03-04. Opening Procedure of Letter of Credit, Amendment of LCDocumento86 pagine03-04. Opening Procedure of Letter of Credit, Amendment of LCMasud Khan ShakilNessuna valutazione finora

- Alt - Bank Company Brief PDFDocumento1 paginaAlt - Bank Company Brief PDFBruno MottaNessuna valutazione finora

- Bankers Discount PDFDocumento9 pagineBankers Discount PDFVikram GaikwadNessuna valutazione finora

- OpTransactionHistoryUX307 11 2020Documento4 pagineOpTransactionHistoryUX307 11 2020Ajay MauryaNessuna valutazione finora

- Bank of Credit and Commerce InternationalDocumento9 pagineBank of Credit and Commerce InternationalMd. FaysalNessuna valutazione finora

- Sss GuideDocumento1 paginaSss GuideLui26 GNessuna valutazione finora

- Summer Internship at ICICI Bank 2015Documento20 pagineSummer Internship at ICICI Bank 2015Vineel KambalaNessuna valutazione finora

- Types of BanksDocumento10 pagineTypes of Bankssaeed BarzaghlyNessuna valutazione finora

- 0746-2023-00589 - Deped Bulak Es DauinDocumento1 pagina0746-2023-00589 - Deped Bulak Es Dauinprincipals deskphNessuna valutazione finora

- EI Fund Transfer Intnl TT Form V3.0Documento1 paginaEI Fund Transfer Intnl TT Form V3.0Mbamali Chukwunenye100% (1)

- Loan Sanction - DocumentsDocumento2 pagineLoan Sanction - DocumentsChini ChandrashekarNessuna valutazione finora

- Capital Adequacy Norms in Indian Banks - 303Documento18 pagineCapital Adequacy Norms in Indian Banks - 303Aayush VarmaNessuna valutazione finora

- Basel Accord IIDocumento13 pagineBasel Accord IIAdnan HadziibrahimovicNessuna valutazione finora

- A - 24 - IB Assignment 1Documento7 pagineA - 24 - IB Assignment 1KAJAL RAINessuna valutazione finora

- Wells Fargo Bank Statement PDFDocumento4 pagineWells Fargo Bank Statement PDFEmily RiceNessuna valutazione finora

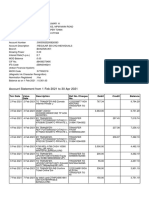

- Account Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento11 pagineAccount Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday AbhiNessuna valutazione finora

- 2 Interest - For STUDENTSDocumento4 pagine2 Interest - For STUDENTSSandy BellNessuna valutazione finora

- 2.negotiable Instruments Act, 1881 - Q&ADocumento16 pagine2.negotiable Instruments Act, 1881 - Q&AJuhi RamnaniNessuna valutazione finora

- ch07 SM Carlon 5eDocumento39 paginech07 SM Carlon 5eKyle100% (1)

- FABM2121 Fundamentals of Accountancy Q2 Long Quiz 001Documento7 pagineFABM2121 Fundamentals of Accountancy Q2 Long Quiz 001Christian TeroNessuna valutazione finora

- The Secret Burial: The Hidden History of Money & New World Order Usury Secrets Revealed at Last! Page 29Documento1 paginaThe Secret Burial: The Hidden History of Money & New World Order Usury Secrets Revealed at Last! Page 29foro35Nessuna valutazione finora