Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Klarman Searches For Bargains: 1991 Barron's On Spinoffs

Caricato da

Giovanni GrazianoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Klarman Searches For Bargains: 1991 Barron's On Spinoffs

Caricato da

Giovanni GrazianoCopyright:

Formati disponibili

Klarman Searches For Bargains: 1991 Barron's On Spinos

1/03/2016 5:40 pm

The Value Hunter Seth Klarman Searches For Bargains Barrons

1991 Interview Spinoffs

Continued from part two.

Moving away from distressed debt, Seth Klarman started to discuss a traditional Graham and Dodd

value play that he was currently interested in.

The company in question was called Esco Electronics, a spinoff from Emerson Electric.

Get The Full Seth Klarman Series in PDF

Get the entire 10-part series on Seth Klarman in PDF. Save it to your desktop, read it on your tablet, or

email to your colleagues.

seth klarman

Seth Klarman: True value

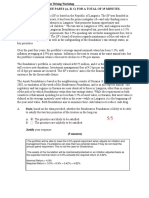

Esco Electronics was a traditional value play that was trading at such a deep discount to book, it was

difficult to pass up the opportunity. Indeed, at the time Esco was trading at only 8% of book value, had

over 6,000 employees working over three million square feet of space, generating over $500 million of

sales per year, but the company's market value was a miniscule $35 million when Klarman started

buying.

By the time of the Barron's interview, Esco's market value had risen to $70 million, $6 1/2 per share.

Klarman believed that the company was worth at least double.

http://www.valuewalk.com/2015/07/the-value-hunter-seth-klarman-searches-for-bargains-barrons-1991-interview-spinos/

Page 1 of 3

Klarman Searches For Bargains: 1991 Barron's On Spinos

1/03/2016 5:40 pm

"...when we look at this company, a good part of their business comes from the Hazeltine

acquisition. In fact, the company's goodwill also comes from that acquisition. They bought

Hazeltine about four years ago for, give or take, $180 million. That is alone $15 per Esco

share. So if everything else they have is worthless and Hazeltine is worth 40% of what they

paid for it, that explains Esco's stock price right there."

Esco was spunoff from Emerson Electric. Emerson, which had been trying to sell Esco for several

years, wanted to get rid of the subsidiary without selling it at a knock-down price that would have

blemished its reported earnings.

"The best thing of all is that the company was spun off with virtually no debt. I think that, at

the time of the spinoff, it had $25 or so million of debt. And their debt is down to $18 million

total, including short-term and long-term. And they have $42 million of cash on the books.

So in fact, this company has almost $4 a share of cash, or $2.25 a share net of debt."

Esco had a book value of $40 per share and tangible book value of $26. Cash flow from depreciation

and amortization alone totalled $22 million per annum. But Seth Klarman identified several factors

holding Esco back. Firstly, the company was booking hefty goodwill amortization charges from the

Hazeltine acquisition, which amounted to $0.50 per share per year. The second factor holding the

company back was a $7.4 million-a-year charge for five years that Emerson had put in place as a

guarantee fee. This charge amounted to $0.50 per share per annum.

The third factor holding Esco back was a number of fixed-cost development contracts that the

company had entered into, but was struggling to complete on budget, tying up capacity and working

capital.

All of these three negative factors were, of course, temporary.

"Seth Klarman: Of course, the thing we like about it is we don't know how high it can go. We

imagine that if it came into favor the stock could double or triple or more. The key thing for

us is we don't think there is a lot of downside. Given the tangible assets, given the cash, given

the cash flow, we would be very surprised to lose money over a meaningful time frame

here."

Seth Klarman: Final pick

The Barron's interview then moved on to Seth Klarman's final pick, Safeguard Scientifics.

Safeguard was another clear value play, as Klarman explains:

"They own approximately 70% of CompuCom, a computer reseller. And the value per

Safeguard share of their CompuCom of about 2 3/4 just about explains the entire market

http://www.valuewalk.com/2015/07/the-value-hunter-seth-klarman-searches-for-bargains-barrons-1991-interview-spinos/

Page 2 of 3

Klarman Searches For Bargains: 1991 Barron's On Spinos

1/03/2016 5:40 pm

capitalization of Safeguard. That is worth about $55 million at current market, and

Safeguard's market cap is about $62 million. So just the CompuCom and the Novell [another

shareholding] alone are worth, at market prices, $15. And the stock is trading at $12."

"In addition to that, they have a number of other businesses, all doing better than they have

done over the past several years...They also own some warrents in QVC, the homeshiopping company, which are worth at market price about $8 million. And several other

situations."

http://www.valuewalk.com/2015/07/the-value-hunter-seth-klarman-searches-for-bargains-barrons-1991-interview-spinos/

Page 3 of 3

Potrebbero piacerti anche

- FDCPA FraudDocumento44 pagineFDCPA FraudJeff Wilner92% (25)

- How to Get a Second Passport and CitizenshipDocumento9 pagineHow to Get a Second Passport and CitizenshipGiovanni Graziano100% (2)

- Wisdom From Seth KlarmanDocumento9 pagineWisdom From Seth Klarmanpriyank18100% (4)

- Kinder Morgan Summary AnalysisDocumento2 pagineKinder Morgan Summary Analysisenergyanalyst100% (2)

- Is Enron OverpricedDocumento3 pagineIs Enron Overpricedgarimag2kNessuna valutazione finora

- Notes From Jim Chanos' Presentation at The CFA Institute's Annual ConferenceDocumento3 pagineNotes From Jim Chanos' Presentation at The CFA Institute's Annual ConferenceCameron Wright100% (1)

- Klarman - Channeling Graham and Dodd - VII - Security - Analysis - 2008Documento5 pagineKlarman - Channeling Graham and Dodd - VII - Security - Analysis - 2008Fabian SchilcherNessuna valutazione finora

- Investor Outstanding: DigestDocumento6 pagineInvestor Outstanding: Digestakhildhawan100% (1)

- Forbes On BuffettDocumento32 pagineForbes On Buffettguruek100% (3)

- Isaac Asimov - "Nightfall"Documento20 pagineIsaac Asimov - "Nightfall"Aditya Sharma100% (1)

- Seth Klarman 2 PDFDocumento39 pagineSeth Klarman 2 PDFvuhieptran100% (2)

- Target Copo. Ackman Vs The BoardDocumento3 pagineTarget Copo. Ackman Vs The BoardAshutosh K TripathyNessuna valutazione finora

- Introduction AstralDocumento12 pagineIntroduction AstralMbavhalelo100% (1)

- Wisdom From Seth Klarman - Part 6Documento4 pagineWisdom From Seth Klarman - Part 6suresh420Nessuna valutazione finora

- Wisdom From Seth Klarman - Part 1Documento3 pagineWisdom From Seth Klarman - Part 1suresh420Nessuna valutazione finora

- Vital StatisticsDocumento35 pagineVital StatisticsRadha100% (1)

- Hedge Fund Wisdom: Free Sample IssueDocumento85 pagineHedge Fund Wisdom: Free Sample Issuemarketfolly.comNessuna valutazione finora

- The Collected Wisdom of Seth KlarmanDocumento11 pagineThe Collected Wisdom of Seth KlarmanSantangel's Review93% (15)

- Seth Klarman's Baupost Fund Semi-Annual Report 19991Documento24 pagineSeth Klarman's Baupost Fund Semi-Annual Report 19991nabsNessuna valutazione finora

- Wall Street Expose: Monkey Business Reveals Investment Banking RealitiesDocumento2 pagineWall Street Expose: Monkey Business Reveals Investment Banking Realitiestorquewip100% (1)

- If It's Raining in Brazil, Buy StarbucksDa EverandIf It's Raining in Brazil, Buy StarbucksValutazione: 4.5 su 5 stelle4.5/5 (4)

- 2015 Bollore Business ReportDocumento48 pagine2015 Bollore Business ReportGiovanni GrazianoNessuna valutazione finora

- MathsDocumento27 pagineMathsBA21412Nessuna valutazione finora

- Distressed Debt Investing - Wisdom From Seth Klarman - Part 1Documento5 pagineDistressed Debt Investing - Wisdom From Seth Klarman - Part 1pjs15100% (1)

- Seth Klarman Notes 170510 (CFA Institute)Documento5 pagineSeth Klarman Notes 170510 (CFA Institute)neo269100% (2)

- Blackstone Group Annual Report No. 1Documento80 pagineBlackstone Group Annual Report No. 1Giovanni GrazianoNessuna valutazione finora

- Sram & Mram - Invested Billions, - But Does It Have The MoneyDocumento11 pagineSram & Mram - Invested Billions, - But Does It Have The MoneyNikki Agarr100% (1)

- C ProgrammingDocumento205 pagineC ProgrammingSrinivasan RamachandranNessuna valutazione finora

- Pathophysiology of Cardiogenic Pulmonary EdemaDocumento8 paginePathophysiology of Cardiogenic Pulmonary EdemaLili Fiorela CRNessuna valutazione finora

- Tax Reduction Case Studies v2Documento12 pagineTax Reduction Case Studies v2Arkel KingNessuna valutazione finora

- 2015 Nutrition Diagnosis Terminologi 2015Documento9 pagine2015 Nutrition Diagnosis Terminologi 2015Vivin Syamsul ArifinNessuna valutazione finora

- Cursos Link 2Documento3 pagineCursos Link 2Diego Alves100% (7)

- Distressed Debt Investing: Seth KlarmanDocumento4 pagineDistressed Debt Investing: Seth Klarmanjt322Nessuna valutazione finora

- The 21 Most Famous Shark Tank Failures: What You Can Learn From Them? - The Hustle StoryDocumento27 pagineThe 21 Most Famous Shark Tank Failures: What You Can Learn From Them? - The Hustle Storyhustle storyNessuna valutazione finora

- 2012 q3 Letter DdicDocumento5 pagine2012 q3 Letter DdicDistressedDebtInvestNessuna valutazione finora

- Allan Sloan - An Unsavory S...Documento3 pagineAllan Sloan - An Unsavory S...K B-g B-gNessuna valutazione finora

- Why Young Investors Bet The Farm On Cryptocurrencies - Financial TimesDocumento5 pagineWhy Young Investors Bet The Farm On Cryptocurrencies - Financial TimesGonzalo Alonso Labraga100% (1)

- June, 2021: Where Are We Now?Documento13 pagineJune, 2021: Where Are We Now?l chanNessuna valutazione finora

- Analysis of The Economic Concepts in The Movie The Dark KnightDocumento9 pagineAnalysis of The Economic Concepts in The Movie The Dark KnightAkanksha AgrahariNessuna valutazione finora

- How Much Is That Guarantee in The WindowDocumento4 pagineHow Much Is That Guarantee in The WindowRuss ThorntonNessuna valutazione finora

- FRM Final ReportDocumento13 pagineFRM Final ReportDhaval DholabhaiNessuna valutazione finora

- Investment Theory #22 - Klarman's 2000 Letter - Wiser DailyDocumento4 pagineInvestment Theory #22 - Klarman's 2000 Letter - Wiser DailyVladimir OlefirenkoNessuna valutazione finora

- Ram's removal as CEO and interim chairman appointment followed protocolDocumento3 pagineRam's removal as CEO and interim chairman appointment followed protocolAnsh GulatiNessuna valutazione finora

- GlaucusResearch Report On China Metal Recycling Holdings Ltd-HK0773-Strong Sell January 28 2013Documento38 pagineGlaucusResearch Report On China Metal Recycling Holdings Ltd-HK0773-Strong Sell January 28 2013Billy LeeNessuna valutazione finora

- Essay On William Shakespeare BiographyDocumento7 pagineEssay On William Shakespeare Biographyezmv3axt100% (2)

- Buffett SalomonltrDocumento6 pagineBuffett Salomonltruew702Nessuna valutazione finora

- Company Law - Salomon V Salomon & Co. LTD CaseDocumento9 pagineCompany Law - Salomon V Salomon & Co. LTD CaseKandarp Jha100% (2)

- What'S Inside: 19th Annual Advanced Restructuring and Plan of Reorganization ConferenceDocumento5 pagineWhat'S Inside: 19th Annual Advanced Restructuring and Plan of Reorganization ConferenceKHOA NGUYEN ANHNessuna valutazione finora

- Introduction To Algorithms Second Edition By: Cormen, Leiserson, Rivest & SteinDocumento14 pagineIntroduction To Algorithms Second Edition By: Cormen, Leiserson, Rivest & Steinkp75_pwNessuna valutazione finora

- Chapter 06Documento14 pagineChapter 06hrturkan42Nessuna valutazione finora

- Whitman 3.31.09Documento2 pagineWhitman 3.31.09Alan SilbermanNessuna valutazione finora

- ReactionPaper DeloitteDocumento2 pagineReactionPaper DeloittePatrik Oliver PantiaNessuna valutazione finora

- ContentsDocumento3 pagineContentsHimanshu DeshpandeNessuna valutazione finora

- Comparative AnalysisDocumento8 pagineComparative Analysisshaikhasifali158Nessuna valutazione finora

- Bill Gross Investment Outlook Mar - 08Documento3 pagineBill Gross Investment Outlook Mar - 08Brian McMorrisNessuna valutazione finora

- 2011 Berkshire Annual Meeting NotesDocumento25 pagine2011 Berkshire Annual Meeting NotesbenclaremonNessuna valutazione finora

- Five Lessons of The WorldCom DebacleDocumento3 pagineFive Lessons of The WorldCom DebacleFolke ClaudioNessuna valutazione finora

- A Very Special Dividend - DoombergDocumento10 pagineA Very Special Dividend - Doombergchrisden1812Nessuna valutazione finora

- Bill Ackman, Dan Loeb, Carl Icahn, and Herbalife - The Big Short War - VanityDocumento4 pagineBill Ackman, Dan Loeb, Carl Icahn, and Herbalife - The Big Short War - Vanitybmichaud758Nessuna valutazione finora

- Is Enron OverpricedDocumento4 pagineIs Enron OverpricedHendra Gun DulNessuna valutazione finora

- Selector December 2003 Quarterly NewsletterDocumento5 pagineSelector December 2003 Quarterly Newsletterapi-237451731Nessuna valutazione finora

- Queries Answered by Charlie MungerDocumento5 pagineQueries Answered by Charlie MungerWayne GonsalvesNessuna valutazione finora

- CR Workshop Q11-20 Ryan Ebner SDDocumento26 pagineCR Workshop Q11-20 Ryan Ebner SDRyan EbnerNessuna valutazione finora

- The Coming Wave of Corporate FraudDocumento5 pagineThe Coming Wave of Corporate FraudẤu DềNessuna valutazione finora

- Gaap-Uccino 1.5 - Part I of III - FinalDocumento39 pagineGaap-Uccino 1.5 - Part I of III - FinalmistervigilanteNessuna valutazione finora

- Cramer's Calls For: 12/21/2012 C Al L Pric e Portfo LioDocumento12 pagineCramer's Calls For: 12/21/2012 C Al L Pric e Portfo LioAshleyNessuna valutazione finora

- Assignment 5 AnswersDocumento5 pagineAssignment 5 AnswersLionButtNessuna valutazione finora

- Petrobras - Century Bond: BackgroundDocumento11 paginePetrobras - Century Bond: Background千舞神乐Nessuna valutazione finora

- Satyam ScamDocumento6 pagineSatyam Scamjeevan_v_mNessuna valutazione finora

- StrikingitRich.Com: Profiles of 23 Incredibly Successful Websites You've Probably Never Heard OfDa EverandStrikingitRich.Com: Profiles of 23 Incredibly Successful Websites You've Probably Never Heard OfNessuna valutazione finora

- Cfs 2014 PDFDocumento250 pagineCfs 2014 PDFGiovanni GrazianoNessuna valutazione finora

- Trafigura How A Trade Is DeliveredDocumento1 paginaTrafigura How A Trade Is DeliveredGiovanni GrazianoNessuna valutazione finora

- Goldman Sachs - Business Principles and Standards - Goldman Sachs Business PrinciplesDocumento3 pagineGoldman Sachs - Business Principles and Standards - Goldman Sachs Business PrinciplesGiovanni GrazianoNessuna valutazione finora

- Australia Government Consolidated Financial Statements 2015Documento192 pagineAustralia Government Consolidated Financial Statements 2015Giovanni GrazianoNessuna valutazione finora

- 2016 Australian Government Consolidated Financial StatementsDocumento176 pagine2016 Australian Government Consolidated Financial StatementsGiovanni GrazianoNessuna valutazione finora

- Growth Summit 15 Brochure OnlineDocumento10 pagineGrowth Summit 15 Brochure OnlineGiovanni GrazianoNessuna valutazione finora

- Harper Competition Policy ReviewDocumento548 pagineHarper Competition Policy ReviewGiovanni GrazianoNessuna valutazione finora

- Private Equity AsiaDocumento12 paginePrivate Equity AsiaGiovanni Graziano100% (1)

- AussieDocumento95 pagineAussiepragthedogNessuna valutazione finora

- Whole of Football PlanDocumento112 pagineWhole of Football PlanGiovanni GrazianoNessuna valutazione finora

- Australias Banking IndustryDocumento76 pagineAustralias Banking Industrypsychoguy88Nessuna valutazione finora

- Future of JournalismDocumento60 pagineFuture of JournalismGiovanni GrazianoNessuna valutazione finora

- Apex Mines 2002 Letter To ShareholdersDocumento4 pagineApex Mines 2002 Letter To ShareholdersGiovanni GrazianoNessuna valutazione finora

- Stopping Australian Coal Export Boom - Green Peace Report Funded by Rockefeller Family Fund (Standard Oil)Documento17 pagineStopping Australian Coal Export Boom - Green Peace Report Funded by Rockefeller Family Fund (Standard Oil)Carl CordNessuna valutazione finora

- What Should I Do With My LifeDocumento1 paginaWhat Should I Do With My LifeGiovanni GrazianoNessuna valutazione finora

- Cpi UsDocumento13 pagineCpi UsGiovanni GrazianoNessuna valutazione finora

- Nistha Tamrakar Chicago Newa VIIDocumento2 pagineNistha Tamrakar Chicago Newa VIIKeshar Man Tamrakar (केशरमान ताम्राकार )Nessuna valutazione finora

- 3 5 3Documento4 pagine3 5 3Amr Mohamed RedaNessuna valutazione finora

- Megneto TherapyDocumento15 pagineMegneto TherapyedcanalNessuna valutazione finora

- AP Biology Isopod LabDocumento5 pagineAP Biology Isopod LabAhyyaNessuna valutazione finora

- DesignWS P1 PDFDocumento673 pagineDesignWS P1 PDFcaubehamchoi6328Nessuna valutazione finora

- Hics 203-Organization Assignment ListDocumento2 pagineHics 203-Organization Assignment ListslusafNessuna valutazione finora

- Conics, Parametric Equations, and Polar CoordinatesDocumento34 pagineConics, Parametric Equations, and Polar CoordinatesGARO OHANOGLUNessuna valutazione finora

- Import Sample 2Documento63 pagineImport Sample 2akkyNessuna valutazione finora

- M and S Code of ConductDocumento43 pagineM and S Code of ConductpeachdramaNessuna valutazione finora

- DrainHoles - InspectionDocumento14 pagineDrainHoles - Inspectionohm3011Nessuna valutazione finora

- Vestax VCI-380 Midi Mapping v3.4Documento23 pagineVestax VCI-380 Midi Mapping v3.4Matthieu TabNessuna valutazione finora

- Ferain Et Al, 2016 - The Fatty Acid Profile of Rainbow Trout Liver Cells Modulates Their Tolerance To Methylmercury and CadmiumDocumento12 pagineFerain Et Al, 2016 - The Fatty Acid Profile of Rainbow Trout Liver Cells Modulates Their Tolerance To Methylmercury and Cadmiumarthur5927Nessuna valutazione finora

- Pantone and K100 Reverse White MedicineDocumento16 paginePantone and K100 Reverse White MedicinepaanarNessuna valutazione finora

- PP 12 Maths 2024 2Documento21 paginePP 12 Maths 2024 2Risika SinghNessuna valutazione finora

- Optra - NubiraDocumento37 pagineOptra - NubiraDaniel Castillo PeñaNessuna valutazione finora

- EMB 690-1 SM Course Outline Spring 21Documento8 pagineEMB 690-1 SM Course Outline Spring 21HasanNessuna valutazione finora

- ListDocumento4 pagineListgeralda pierrelusNessuna valutazione finora

- Wicks Angela, Roethlein Christopher - A Satisfaction - Based Definition of QualityDocumento1 paginaWicks Angela, Roethlein Christopher - A Satisfaction - Based Definition of Qualityalfdjole0% (1)

- Simple Present 60991Documento17 pagineSimple Present 60991Ketua EE 2021 AndrianoNessuna valutazione finora

- Move Over G7, It's Time For A New and Improved G11: Long ShadowDocumento16 pagineMove Over G7, It's Time For A New and Improved G11: Long ShadowVidhi SharmaNessuna valutazione finora

- Environmental ScienceDocumento5 pagineEnvironmental Sciencearijit_ghosh_18Nessuna valutazione finora

- Chapter 63 Standard Integration: EXERCISE 256 Page 707Documento9 pagineChapter 63 Standard Integration: EXERCISE 256 Page 707Khaerul UmamNessuna valutazione finora