Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Null

Caricato da

api-25889552Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Null

Caricato da

api-25889552Copyright:

Formati disponibili

Single Barrier Reverse Convertible on ING GROEP NV-CVA

Coupon 6% p.a. - American Barrier at 80% - 3 Months - EUR

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 16.04.2010 Client pays EUR 1000 (Denomination)

Rating: Fitch A

Underlying ING GROEP NV-CVA On 16.07.2010 Client receiv es 1,5% in fine (6% p.a.) Coupon

Bbg Ticker INGA NA Equity

Payment Date 16,04,2010 PLUS

Valuation Date 12,07,2010

Maturity 16,07,2010 Scenario 1: if the Underlying has never traded at or below the Barrier level

Strike Level EUR 7,53 (100%)

The Investor will receive a Cash Settlement equal to the Denomination

Barrier Level EUR 6,02 (80%)

EU Saving Tax Option Premium Component 0,92% (3,68% p.a.)

Scenario 2: if the Underlying traded at least once at or below the Barrier level

Interest Component 0,58% (2,32% p.a.)

Details Physical Settlement American Barrier a. If the Final Fixing Level is at or below the Strike Level, the Investor will

Conversion Ratio 158,9067 receive a predefined round number (i.e. Conversion Ratio) of the

ISIN CH0111528144 Underlying per Denomination.

Valoren 11152814

b. If the Final Fixing Level is above the Strike Level, the Investor will receive a

SIX Symbol Not Listed

Cash Settlement in the Settlement Currency equal to: Denomination

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________

Commerzbank AG attracts deposits and offers retail and commercial banking services. The Bank offers mortgage loans, securities brokerage and asset

management services, private banking, foreign exchange, and treasury services worldwide.

Opportunities______________________________________________________________ Risks__________________________________________________________________________

1. A guaranteed Coupon of 1,5% in fine (6% p.a.) 1. Maximum yield is limited to 1,5% in fine (6% p.a.)

2. Protection against 20% drop in Underlying's price 2. Exposure to v olatility changes

3. Low er v olatility than direct equity exposure

4. Secondary market as liquid as a share

5. Optimization of EU Tax components

Best case scenario_________________________________________________________ Worst case scenario___________________________________________________________

The Underlying has nev er traded below the Barrier Lev el The Underlying traded below the Barrier Lev el and on the Final Fixing Date

closes under the Barrier Lev el

Redemption: Denomination + Coupon of 1,5% in fine (6% p.a.) Redemption: Underlying + Coupon of 1,5% in fine (6% p.a.)

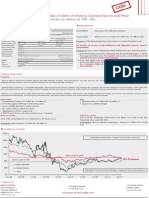

Historical Chart

12 importer depuis la deuxieme feuille

11

10

Redemption: 100% and a Coupon of 1,5% in fine (6% p.a.)

8 Strike: EUR 7,53 (100% of Spot Reference)

7 25% Protection

6

Barrier: EUR 6,02 (80% of Strike Level)

5

4 Redemption: 158,9067

shares and a Coupon of 1,5% in fine (6% p.a.)

3

2

Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10

Contacts

Filippo Colombo Christophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial

instruments mentio ned in this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by

the Swiss Financial M arket Superviso ry A utho rity FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial

situatio n; the info rmatio n co ntained in this do cument do es no t substitute such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct

do cumentatio n can be o btained directly at EFG Financial P ro ducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subject

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers

co sts and fees. EFG Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity

o f the financial pro ducts. © EFG Financial P ro ducts A G A ll rights reserved.

Potrebbero piacerti anche

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocumento1 paginaCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552Nessuna valutazione finora

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocumento1 paginaCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552Nessuna valutazione finora

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocumento1 paginaCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552Nessuna valutazione finora

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDocumento1 paginaCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552Nessuna valutazione finora

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocumento1 paginaCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552Nessuna valutazione finora

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocumento1 paginaCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Nessuna valutazione finora

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocumento1 paginaCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Nessuna valutazione finora

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocumento1 paginaCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552Nessuna valutazione finora

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDocumento1 paginaCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552Nessuna valutazione finora

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocumento1 paginaCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552Nessuna valutazione finora

- Single Barrier Reverse Convertible On GERDAU SADocumento1 paginaSingle Barrier Reverse Convertible On GERDAU SAapi-25889552Nessuna valutazione finora

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocumento1 paginaCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552Nessuna valutazione finora

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocumento1 paginaCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552Nessuna valutazione finora

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocumento1 paginaCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552Nessuna valutazione finora

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDDocumento1 paginaCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Nessuna valutazione finora

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocumento1 paginaCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552Nessuna valutazione finora

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocumento1 paginaCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552Nessuna valutazione finora

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocumento1 paginaCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552Nessuna valutazione finora

- Coupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCDocumento1 paginaCoupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCapi-25889552Nessuna valutazione finora

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDocumento1 paginaCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552Nessuna valutazione finora

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocumento1 paginaCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552Nessuna valutazione finora

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocumento1 paginaCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552Nessuna valutazione finora

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNDocumento1 paginaCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Nessuna valutazione finora

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNDocumento1 paginaCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552Nessuna valutazione finora

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocumento1 paginaCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552Nessuna valutazione finora

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDocumento1 paginaCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552Nessuna valutazione finora

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocumento1 paginaCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Nessuna valutazione finora

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocumento1 paginaCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552Nessuna valutazione finora

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDocumento1 paginaCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Nessuna valutazione finora

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocumento1 paginaCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552Nessuna valutazione finora

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocumento1 paginaCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Nessuna valutazione finora

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocumento1 paginaExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552Nessuna valutazione finora

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocumento1 paginaCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552Nessuna valutazione finora

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocumento1 pagina1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552Nessuna valutazione finora

- Worst of Autocall Certificate With Memory EffectDocumento1 paginaWorst of Autocall Certificate With Memory Effectapi-25889552Nessuna valutazione finora

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocumento1 paginaCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552Nessuna valutazione finora

- Doubled-Up Worst of Barrier Reverse ConvertibleDocumento1 paginaDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Nessuna valutazione finora

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocumento1 paginaCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552Nessuna valutazione finora

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocumento1 paginaCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552Nessuna valutazione finora

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocumento1 pagina4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552Nessuna valutazione finora

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Documento1 pagina86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552Nessuna valutazione finora

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDocumento1 paginaCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552Nessuna valutazione finora

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Documento1 paginaCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856Nessuna valutazione finora

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Documento1 pagina75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552Nessuna valutazione finora

- Doubled-Up Worst of Barrier Reverse ConvertibleDocumento1 paginaDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Nessuna valutazione finora

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Documento1 pagina1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552Nessuna valutazione finora

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocumento1 pagina7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552Nessuna valutazione finora

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocumento1 pagina67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552Nessuna valutazione finora

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocumento1 pagina6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552Nessuna valutazione finora

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocumento1 paginaCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856Nessuna valutazione finora

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Documento1 pagina61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552Nessuna valutazione finora

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocumento1 pagina15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552Nessuna valutazione finora

- Bonus Certificate On The EURO STOXX 50Documento1 paginaBonus Certificate On The EURO STOXX 50api-25889552Nessuna valutazione finora

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocumento1 paginaCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Nessuna valutazione finora

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Documento1 pagina153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552Nessuna valutazione finora

- Worst of Autocall Certificate With Memory EffectDocumento1 paginaWorst of Autocall Certificate With Memory Effectapi-25889552Nessuna valutazione finora

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDocumento1 pagina6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552Nessuna valutazione finora

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocumento1 pagina2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552Nessuna valutazione finora

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Documento1 pagina98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552Nessuna valutazione finora

- In Search of Returns 2e: Making Sense of Financial MarketsDa EverandIn Search of Returns 2e: Making Sense of Financial MarketsNessuna valutazione finora

- Daily Markets UpdateDocumento37 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- CG European Capital Growth Fund: StrategyDocumento2 pagineCG European Capital Growth Fund: Strategyapi-25889552Nessuna valutazione finora

- CG European Income Fund: StrategyDocumento2 pagineCG European Income Fund: Strategyapi-25889552Nessuna valutazione finora

- Morning News 1 June 2010Documento3 pagineMorning News 1 June 2010api-25889552Nessuna valutazione finora

- Weekly Markets UpdateDocumento39 pagineWeekly Markets Updateapi-25889552Nessuna valutazione finora

- NullDocumento10 pagineNullapi-25889552Nessuna valutazione finora

- Daily Markets UpdateDocumento35 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- NullDocumento6 pagineNullapi-25889552Nessuna valutazione finora

- Daily Markets UpdateDocumento38 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- Morning News 1 June 2010Documento3 pagineMorning News 1 June 2010api-25889552Nessuna valutazione finora

- Global Financial Centres: March 2010Documento41 pagineGlobal Financial Centres: March 2010api-25889552Nessuna valutazione finora

- NullDocumento41 pagineNullapi-25889552Nessuna valutazione finora

- NullDocumento15 pagineNullapi-25889552Nessuna valutazione finora

- Daily Markets UpdateDocumento35 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- Daily Markets UpdateDocumento30 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- Daily Markets UpdateDocumento33 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Documento1 pagina1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Nessuna valutazione finora

- NullDocumento1 paginaNullapi-25889552Nessuna valutazione finora

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocumento65 pagineUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552Nessuna valutazione finora

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocumento1 paginaGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552Nessuna valutazione finora

- NullDocumento39 pagineNullapi-25889552Nessuna valutazione finora

- Worldwide Real Estates: Gibraltar LettingsDocumento8 pagineWorldwide Real Estates: Gibraltar Lettingsapi-25889552Nessuna valutazione finora

- Daily Markets UpdateDocumento36 pagineDaily Markets Updateapi-25889552Nessuna valutazione finora

- Morning News 28 May 2010Documento3 pagineMorning News 28 May 2010api-25889552Nessuna valutazione finora

- NullDocumento6 pagineNullapi-25889552Nessuna valutazione finora

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Documento1 pagina1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Nessuna valutazione finora

- NullDocumento3 pagineNullapi-25889552Nessuna valutazione finora

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocumento1 paginaCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Nessuna valutazione finora

- NullDocumento1 paginaNullapi-25889552Nessuna valutazione finora

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocumento1 paginaCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Nessuna valutazione finora