Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MBF13e Chap08 Pbms - Final

Caricato da

Brandon Steven MirandaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MBF13e Chap08 Pbms - Final

Caricato da

Brandon Steven MirandaCopyright:

Formati disponibili

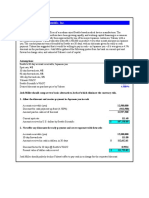

Problem 8.

1 Amber McClain

Amber McClain, the currency speculator we met earlier in the chapter,sells eight June futures contracts for

500,000 pesos at the closing price quoted in Exhibit 8.1.

a. What is the value of her position at maturity if the ending spot rate is $0.12000/Ps?

b. What is the value of her position at maturity if the ending spot rate is $0.09800/Ps?

c. What is the value of her position at maturity if the ending spot rate is $0.11000/Ps?

Assumptions

Number of pesos per futures contract

Number of contracts

Buy or sell the peso futures?

Ending spot rate ($/peso)

June futures settle price from Exh8.1 ($/peso)

Spot - Futures

Value of total position at maturity (US$)

Value = - Notional x (Spot - Futures) x 8

a.

Values

500,000

8.00

Sell

b.

Values

500,000

8.00

Sell

c.

Values

500,000

8.00

Sell

$0.12000

$0.10773

$0.01227

$0.09800

$0.10773

($0.00973)

$0.11000

$0.10773

$0.00227

($49,080.00)

$38,920.00

($9,080.00)

Interpretation

Amber buys at the spot price and sells at the futures price.

If the futures price is greater than the ending spot price, she makes a profit.

Problem 8.2 Peleh's Puts

Peleh writes a put option on Japanese yen with a strike price of $0.008000/ (125.00/$) at a premium of 0.0080 per yen and with an expiration date six months from now.

The option is for 12,500,000. What is Peleh's profit or loss at maturity if the ending spot rates are 110/$, 115/$, 120/$, 125/$, 130/$, 135/$, and 140/$.

a)

Values

12,500,000

180

$0.008000

$0.000080

b)

Values

12,500,000

180

$0.008000

$0.000080

c)

Values

12,500,000

180

$0.008000

$0.000080

d)

Values

12,500,000

180

$0.008000

$0.000080

e)

Values

12,500,000

180

$0.008000

$0.000080

f)

Values

12,500,000

180

$0.008000

$0.000080

g)

Values

12,500,000

180

$0.008000

$0.000080

110.00

$0.009091

115.00

$0.008696

120.00

$0.008333

125.00

$0.008000

130.00

$0.007692

135.00

$0.007407

140.00

$0.007143

Gross profit on option

Less premium

Net profit (US$/)

$0.000000

($0.000080)

($0.000080)

$0.000000

($0.000080)

($0.000080)

$0.000000

($0.000080)

($0.000080)

$0.000000

($0.000080)

($0.000080)

$0.000308

($0.000080)

$0.000228

$0.000593

($0.000080)

$0.000513

$0.000857

($0.000080)

$0.000777

Net profit, total

($1,000.00)

($1,000.00)

($1,000.00)

($1,000.00)

$2,846.15

$6,407.41

$9,714.29

Assumptions

Notional principal ()

Maturity (days)

Strike price (US$/)

Premium (US$/)

Ending spot rate (/US$)

in US$/

Problem 8.3 Ventosa Investments

Jamie Rodriguez, a currency trader for Chicago-based Ventosa Investments, uses the following futures quotes on the British pound () to speculate on the value of

the pound.

British Pound Futures, US$/pound (CME)

Maturity

March

June

a.

b.

c.

d.

Open

1.4246

1.4164

High

1.4268

1.4188

Low

1.4214

1.4146

Settle

1.4228

1.4162

Change

0.0032

0.0030

If Jaime buys 5 June pound futures, and the spot rate at maturity is $1.3980/, what is the value of her position?

If Jamie sells 12 March pound futures, and the spot rate at maturity is $1.4560/, what is the value of her position?

If Jamie buys 3 March pound futures, and the spot rate at maturity is $1.4560/, what is the value of her position?

If Jamie sells 12 June pound futures, and the spot rate at maturity is $1.3980/, what is the value of her position?

a)

Values

62,500

June

5

buys

b)

Values

62,500

March

12

sells

c)

Values

62,500

March

3

buys

d)

Values

62,500

June

12

sells

$1.3980

$1.4162

($0.0182)

$1.4560

$1.4228

$0.0332

$1.4560

$1.4228

$0.0332

$1.3980

$1.4162

($0.0182)

Value of position at maturity ($)

($5,687.50)

buys: Notional x (Spot - Futures) x contracts

sells: Notional x (Spot - Futures) x contracts

($24,900.00)

$6,225.00

$13,650.00

Assumptions

Pounds () per futures contract

Maturity month

Number of contracts

Did she buy or sell the futures?

Ending spot rate ($/)

Pound futures contract, settle price ($

Spot - Futures

Interpretation

Buys a future: Jamie buys at the futures price and sells at the ending spot price. She therefore profits when the futures price is

less than the ending spot price.

Sells a future: Jamie buys at the ending spot price and sells at the futures price. She therefore profits when the futures price is

greater than the ending spot price.

Contract = 62,500 pounds

Open

High

Interest

1.4700

25,605

1.4550

809

Problem 8.4 Sallie Schnudel

Sallie Schnudel trades currencies for Keystone Funds in Jakarta. She focuses nearly all of her time and attention on the U.S.

dollar/Singapore dollar ($/S$) cross-rate. The current spot rate is $0.6000/S$. After considerable study, she has concluded

that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7000/S$. She

has the following options on the Singapore dollar to choose from:

Option

Put on Sing $

Call on Sing $

Strike Price

$0.6500/S$

$0.6500/S$

Premium

$0.00003/S$

$0.00046/S$

a. Should Sallie buy a put on Singapore dollars or a call on Singapore dollars?

b. What is Sallie's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Sallie's gross profit and net profit (including premium) if the spot rate at the

end of 90 days is indeed $0.7000/S$?

d. Using your answer from part (a), what is Sallie's gross profit and net profit (including premium) if the spot rate at the

end of 90 days is $0.8000/S$?

Option choices on the Singapore dollar:

Strike price (US$/Singapore dollar)

Premium (US$/Singapore dollar)

Call on S$

$0.6500

$0.00046

Assumptions

Current spot rate (US$/Singapore dollar)

Days to maturity

Expected spot rate in 90 days (US$/Singapore dollar)

Put on S$

$0.6500

$0.00003

Values

$0.6000

90

$0.7000

a. Should Sallie buy a put on Singapore dollars or a call on Singapore dollars?

Since Sallie expects the Singapore dollar to appreciate versus the US dollar, she should buy a call on Singapore dollars.

This gives her the right to BUY Singapore dollars at a future date at $0.65 each, and then immediately resell them in the

open market at $0.70 each for a profit. (If her expectation of the future spot rate proves correct.)

b. What is Sallie's breakeven price on the option purchased in part a)?

Note this does not include any interest cost on the premium.

Strike price

Plus premium

Breakeven

Per S$

$0.65000

$0.00046

$0.65046

c. What is Sallie's gross profit and net profit (including premium) if the ending spot rate is $0.70/S$?

Spot rate

Less strike price

Less premium

Profit

Gross profit

(US$/S$)

$0.70000

($0.65000)

$0.05000

Net profit

(US$/S$)

$0.70000

($0.65000)

($0.00046)

$0.04954

d. What is Sallie's gross profit and net profit (including premium) if the ending spot rate is $0.80/S$?

Spot rate

Less strike price

Less premium

Profit

Gross profit

(US$/S$)

$0.80000

($0.65000)

$0.15000

Net profit

(US$/S$)

$0.80000

($0.65000)

($0.00046)

$0.14954

Problem 8.5 Blade Capital (A)

Christoph Hoffeman trades currency for Blade Capital of Geneva. Christoph has $10 million to begin with, and he must state all

profits at the end of any speculation in U.S. dollars. The spot rate on the euro is $1.3358/, while the 30-day forward rate is

$1.3350/.

a. If Christoph believes the euro will continue to rise in value against the U.S. dollar, so that he expects the spot rate to be

$1.3600/ at the end of 30 days, what should he do?

b. If Christoph believes the euro will depreciate in value against the U.S. dollar, so that he expects the spot rate to be $1.2800/

at the end of 30 days, what should he do?

Assumptions

Initial investment (funds available)

Current spot rate (US$/)

30-day forward rate (US$/)

Expected spot rate in 30 days (US$/)

a.

Values

$10,000,000

$1.3358

$1.3350

$1.3600

b.

Values

$10,000,000

$1.3358

$1.3350

$1.2800

Strategy for Part a):

One of the more interesting dimensions of speculating in the forward market is that if the speculator has access to the forward

market (bank lines or relationships when working on behalf of an established firm), many forward speculation strategies require

no actual cash flow position up front. In this case, Christoph believes the dollar will be trading at $1.36/ in the open market at

the end of 30 days, but he has the ability to buy or sell dollars at a forward rate of $1.3350/. He should therefore buy euros

forward 30 days (requires no actual cash flow up front), and at the end of 30 days take delivery of those euros and sell in the spot

market at the higher dollar rate for profit.

Initial investment principle

30 day forward rate (US$/)

Euros bought forward (Investment / forward rate)

Spot rate in open market at end of 30 days (US$/)

US$ proceeds (euros bought forward exchanged to US$ spot)

Profit in US$

$10,000,000.00

$1.3350

7,490,636.70

$1.3600

$10,187,265.92

$187,265.92

Strategy for Part b):

Again, a profitable strategy can be executed without any actual cash flow changing hands at the beginning of the period. Since

Christoph believes that the dollar will strengthen to $1.28 in 30 days, he should sell euros forward now at the higher dollar rate,

wait 30 days and buy the euros needed on the open market at $1.28, and immediately then use those euros to fulfill his forward

contract to sell euros for dollars at $1.3350. For a profit.

Investment funds needed in 30 days

Spot rate in open market at end of 30 days

Euros bought in open market in 30 days (Investment / spot rate)

$10,000,000.00

$1.2800

7,812,500.00

Stefan had sold these euros forward at the start of the 30 day period.

30 day forward rate (US$/)

US$ proceeds (euros sold forward into US$)

Profit in US$

$1.3350

$10,429,687.50

$429,687.50

Problem 8.6 Blade Capital (B)

Christoph Hoffeman of Blade Capital now believes the Swiss franc will appreciate versus the U.S. dollar in the

coming three-month period. He has $100,000 to invest. The current spot rate is $0.5820/SF, the three-month

forward rate is $0.5640/SF, and he expects the spot rates to reach $0.6250/SF in three months.

a. Calculate Christoph's expected profit assuming a pure spot market speculation strategy.

b. Calculate Christoph's expected profit assuming he buys or sells SF three months forward.

Assumptions

Initial investment (funds available)

Current spot rate (US$/Swiss franc)

Six-month forward rate (US$/Swiss franc)

Expected spot rate in six months (US$/Swiss franc)

Strategy for Part a:

1. Use the $100,000 today to buy SF at spot rate

2. Hold the SF indefinitely.

3. At the end of six months, convert SF at expected rate

4. Yielding expected dollar revenues of

5. Realize profit (revenues less $100,000 initial invest)

Strategy for Part b:

1. Buy SF forward six months (no cash outlay required)

2. Fulfill the six months forward in six months

cost in US$

3. Convert the SF into US$ at expected spot rate

4. Realize profit

a.

Values

$100,000

$0.5820

$0.5640

$0.6250

b.

Values

$100,000

$0.5820

$0.5640

$0.6250

SFr. 171,821.31

$0.6250

$107,388.32

$7,388.32

SFr. 177,304.96

($100,000.00)

$110,815.60

$10,815.60

Problem 8.7 Chavez S.A.

Chavez S.A., a Venezuelan company, wishes to borrow $8,000,000 for eight

weeks. A rate of 6.250% per annum is quoted by potential lenders in New York,

Great Britain, and Switzerland using, respectively, international, British, and the

Swiss-Eurobond definitions of interest (day count conventions). From which

source should Chavez borrow?

Assumptions

Principal borrowing need

Maturity needed, in weeks

Rate of interest charged by ALL potential lenders

New York interest rate practices

Interest calculation uses:

Exact number of days in period

Number of days in financial year

So the interest charge on this principal is

Great Britain interest rate practices

Interest calculation uses:

Exact number of days in period

Number of days in financial year

So the interest charge on this principal is

Swiss interest rate practices

Interest calculation uses:

Assumed 30 days per month for two months

Number of days in financial year

So the interest charge on this principal is

Values

8,000,000

8

6.250%

56

360

77,777.78

56

360

77,777.78

60

360

83,333.33

Andina should borrow in Great Britain because it has the lowest interest cost.

Problem 8.8 Botany Bay Corporation

Botany Bay Corporation of Australia seeks to borrow US$30,000,000 in the Eurodollar market. Funding is needed for two years.

Investigation leads to three possibilities. Compare the alternatives and make a recommendation.

#1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 5% rate of interest

#2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.5%. LIBOR is currently 3.5%, and the rate would be reset every six

months

#3. Botany Bay could borrow the US$30,000,000 for one year only at 4.5%. At the end of the first year Botany Bay would have to

negotiate for a new one-year loan.

Assumptions

Principal borrowing need

Maturity needed, in years

Fixed rate, 2 years

Floating rate, six-month LIBOR + spread

Current six-month LIBOR

Spread

Fixed rate, 1 year, then re-fund

Values

30,000,000

2.00

5.000%

3.500%

1.500%

4.500%

First 6-months

#1: Fixed rate, 2 years

Interest cost per year

Certainty over access to capital

Certainty over cost of capital

Certain

Certain

#2: Floating rate, six-month LIBOR + spread

Interest cost per year

$

Certainty over access to capital

Certainty over cost of capital

750,000

Certain

Certain

#3: Fixed rate, 1 year, then re-fund

Interest cost per year

Certainty over access to capital

Certainty over cost of capital

Certain

Certain

Second 6-months

$

Third 6-months

1,500,000

Certain

Certain

750,000

Certain

Uncertain

1,350,000

Certain

Certain

Fourth 6-months

$

1,500,000

Certain

Certain

750,000

Certain

Uncertain

Certain

Certain

750,000

Certain

Uncertain

???

Uncertain

Uncertain

Only alternative #1 has a certain access and cost of capital for the full 2 year period.

Alternative #2 has certain access to capital for both years, but the interest costs in the final 3 of 4 periods is uncertain.

Alternatvie #3, possessing a lower interest cost in year 1, has no guaranteed access to capital in the second year.

Depending on the company's business needs and tolerance for interest rate risk, it could choose between #1 and #2.

???

Uncertain

Uncertain

Problem 8.9 Vatic Capital

Cachita Haynes works as a currency speculator for Vatic Capital of Los Angeles. Her latest speculative

position is to profit from her expectation that the U.S. dollar will rise significantly against the Japanese yen.

The current spot rate is 120.00/$. She must choose between the following 90-day options on the Japanese

yen:

Option

Put on yen

Call on yen

Strike Price

125/$

125/$

Premium

$0.00003/S$

$0.00046/S$

a. Should Cachita buy a put on yen or a call on yen?

b. What is Cachita's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Cachita's gross profit and net profit (including premium) if the

spot rate at the end of 90 days is 140/$?

Assumptions

Current spot rate (Japanese yen/US$)

in US$/yen

Maturity of option (days)

Expected ending spot rate in 90 days (yen/$)

in US$/yen

Values

120.00

$0.00833

90

140.00

$0.00714

Call on yen

125.00

$0.00800

$0.00046

Strike price (yen/US$)

in US$/yen

Premium (US$/yen)

Put on yen

125.00

$0.00800

$0.00003

a. Should she buy a call on yen or a put on yen?

Cachita should buy a put on yen to profit from the rise of the dollar (the fall of the yen).

b. What is Cachita's break even price on her option of choice in part a)?

Cachita buys a put on yen. Pays premium today.

In 90 days, exercises the put, receiving US$.

Strike price

Less premium

Breakeven

$0.00800

-$0.00003

$0.00797

in yen/$

125.00

125.47

c. What is Cachita's gross profit and net profit if the end spot rate is 140 yen/$?

Strike price

Less spot rate

Less premium

Profit

Gross profit

(US$/yen)

$0.00800

-$0.00714

$0.00086

Net profit

(US$/yen)

$0.00800

-$0.00714

-$0.00003

$0.00083

Problem 8.10 Calling All Profits

Assume a call option on euros is written with a strike price of $1.2500/ at a premium of 3.80 per euro ($0.0380/) and with an expiration date three months from now. The

option is for 100,000. Calculate your profit or loss should you exercise before maturity at a time when the euro is traded spot at .....

Note: the option premium is 3.8 cents per euro, not 38 cents per euro.

Assumptions

Notional principal (euros)

Maturity (days)

Strike price (US$/euro)

Premium (US$/euro)

Ending spot rate (US$/euro)

Gross profit on option

Less premium

Net profit (US$/euro)

Net profit, total

a.

Values

100,000.00

90

$1.2500

$0.0380

$1.1000

b.

Values

100,000.00

90

$1.2500

$0.0380

$1.1500

c.

Values

100,000.00

90

$1.2500

$0.0380

$1.2000

d.

Values

100,000.00

90

$1.2500

$0.0380

$1.2500

e.

Values

100,000.00

90

$1.2500

$0.0380

$1.3000

f.

Values

100,000.00

90

$1.2500

$0.0380

$1.3500

g.

Values

100,000.00

90

$1.2500

$0.0380

$1.4000

$0.0000

($0.0380)

($0.0380)

$0.0000

($0.0380)

($0.0380)

$0.0000

($0.0380)

($0.0380)

$0.0000

($0.0380)

($0.0380)

$0.0500

($0.0380)

$0.0120

$0.1000

($0.0380)

$0.0620

$0.1500

($0.0380)

$0.1120

($3,800.00)

($3,800.00)

($3,800.00)

($3,800.00)

$1,200.00

$6,200.00

$11,200.00

Problem 8.11 Mystery at Baker Street

Arthur Doyle is a currency trader for Baker Street, a private investment house in London. Baker Streets clients are a collection of

wealthy private investors who, with a minimum stake of 250,000 each, wish to speculate on the movement of currencies. The investors

expect annual returns in excess of 25%. Although officed in London, all accounts and expectations are based in U.S. dollars.

Arthur is convinced that the British pound will slide significantly -- possibly to $1.3200/ -- in the coming 30 to 60 days. The current

spot rate is $1.4260/. Arthur wishes to buy a put on pounds which will yield the 25% return expected by his investors. Which of the

following put options would you recommend he purchase? Prove your choice is the preferable combination of strike price, maturity, and

up-front premium expense.

Strike Price

$1.36/

$1.34/

$1.32/

$1.36/

$1.34/

$1.32/

Maturity

30 days

30 days

30 days

60 days

60 days

60 days

Assumptions

Current spot rate (US$/)

Expected endings spot rate in 30 to 60 days (US$/)

Potential investment principal per person ()

Premium

$0.00081/

$0.00021/

$0.00004/

$0.00333/

$0.00150/

$0.00060/

Values

$1.4260

$1.3200

250,000.00

Put options on pounds

Strike price (US$/)

Maturity (days)

Premium (US$/)

Put #1

$1.36

30

$0.0008

Put #2

$1.34

30

$0.0002

Put #3

$1.32

30

$0.0000

Put options on pounds

Strike price (US$/)

Maturity (days)

Premium (US$/)

Put #4

$1.36

60

$0.0033

Put #5

$1.34

60

$0.0015

Put #6

$1.32

60

$0.0006

Issues for Sydney to consider:

1. Because his expectation is for "30 to 60 days" he should confine his choices to the 60 day options to be sure and capture

the timing of the exchange rate change. (We have no explicit idea of why he believes this specific timing.)

2. The choice of which strike price is an interesting debate.

* The lower the strike price (1.34 or 1.32), the cheaper the option price.

* The reason they are cheaper is that, statistically speaking, they are increasingly less likely to end up in the money.

* The choice, given that all the options are relatively "cheap," is to pick the strike price which will yield the required return.

* The $1.32 strike price is too far 'down,' given that Sydney only expects the pound to fall to about $1.32.

Strike price

Less expected spot rate

Less premium

Profit

Put #4

Net profit

$1.36000

(1.32000)

(0.00333)

$0.03667

Put #5

Net profit

$1.34000

(1.32000)

(0.00150)

$0.01850

Put #6

Net profit

$1.32000

(1.32000)

(0.00060)

($0.00060)

If Sydney invested an individual's principal purely

in this specific option, they would purchase an

option of the following notional principal ():

75,075,075.08

166,666,666.67

416,666,666.67

$2,753,003.00

$356,500.00

772%

$3,083,333.33

$356,500.00

865%

-$250,000.00

$356,500.00

-70%

Expected profit, in total (profit rate x notional):

Initial investment at current spot rate

Return on Investment (ROI)

Risk: They could lose it all (full premium)

Problem 8.12 Contrarious Calandra

Calandra Panagakos works for CIBC Currency Funds in Toronto. Calandra is something of a contrarian -- as opposed to

most of the forecasts, she believes the Canadian dollar (C$) will appreciate versus the U.S. dollar over the coming 90

days. The current spot rate is $0.6750/C$. Calandra may choose between the following options on

the Canadian dollar:

Option

Strike Price

Premium

Put on C$

$0.7000

$0.00003/S$

Call on C$

$0.7000

$0.00049/S$

a. Should Calandra buy a put on Canadian dollars or a call on Canadian dollars?

b. What is Calandra's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at

the end of 90 days is indeed $0.7600?

d. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at

the end of 90 days is $0.8250?

Assumptions

Current spot rate (US$/Canadian dollar)

Days to maturity

Values

$0.6750

90

Option choices on the Canadian dollar:

Strike price (US$/Canadian dollar)

Premium (US$/Canadian dollar)

Call option

$0.7000

$0.00049

Put option

$0.7000

$0.0003

a) Which option should Calandra buy?

Since Giri expects the Canadian dollar to appreciate versus the US dollar, he should buy a call on Canadian dollars.

b) What is Calandra's breakeven price on the option purchased in part a)?

Strike price

Plus premium

Breakeven

$0.7000

0.00049

$0.7005

c) What is Calandra's gross profit and net profit (including premium) if the ending spot rate is $0.7600/C$?

Spot rate

Less strike price

Less premium

Profit

Gross profit

(US$/C$)

$0.7600

(0.7000)

$0.0600

Net profit

(US$/C$)

$0.7600

(0.7000)

(0.00049)

$0.05951

d) What is Calandra's gross profit and net profit (including premium) if the ending spot rate is $0.8250/C$?

Spot rate

Less strike price

Less premium

Profit

Gross profit

(US$/C$)

$0.8250

(0.7000)

$0.1250

Net profit

(US$/C$)

$0.8250

(0.7000)

(0.00049)

$0.12451

Problem 8.13 Raid Gauloises

Raid Gauloises is a rapidly growing French sporting goods and adventure racing outfitter. The company has decided to borrow 20,000,000 via a euroeuro floating rate loan for four years. Raid must decide between two competing loan offerings from two of its banks.

Banque de Paris has offered the four-year debt at euro-LIBOR + 2.00% with an up-front initiation fee of 1.8%. Banque de Sorbonne, however, has

offered euro-LIBOR + 2.5%, a higher spread, but with no loan initiation fees up-front, for the same term and principal. Both banks reset the interest

rate at the end of each year.

Euro-LIBOR is currently 4.00%. Raids economist forecasts that LIBOR will rise by 0.5 percentage points each year. Banque de Sorbonne,

however, officially forecasts euro-LIBOR to begin trending upward at the rate of 0.25 percentage points per year. Raid Gauloisess cost of capital is

11%. Which loan proposal do you recommend for Raid Gauloises?

Assumptions

Principal borrowing need

Maturity needed, in years

Current euro-LIBOR

Banque de Paris' spread & expectation

Banque de Paris' initiation fee

Banque de Sorbonne's spread & expectation

Banque de Sorbonne's initiation fee

Values

20,000,000

4.00

4.000%

2.000%

1.800%

2.500%

0.000%

Expected Chg

in LIBOR

0.500%

0.250%

Raid Gauloises must evaluate both loan proposals under both potential interest rate scenarios.

Banque de Paris Loan Proposal

Expected interest rates & payments:

Expected euro-LIBOR

Bank spread

Interest rate

Funds raised, net of fees

Expected interest costs

Repayment of principal

Total cash flows

All-in-cost of funds if:

euro-LIBOR rises 0.500% per year

euro-LIBOR rises 0.250% per year

Banque de Sorbonne Loan Proposal

Expected interest rates & payments:

Expected euro-LIBOR

Bank spread

Interest rate

Funds raised, net of fees

Expected interest costs

Repayment of principal

Total cash flows

All-in-cost of funds if:

euro-LIBOR rises 0.500% per year

euro-LIBOR rises 0.250% per year

Year 0

Year 1

Year 2

Year 3

Year 4

4.000%

2.000%

6.000%

4.500%

2.000%

6.500%

5.000%

2.000%

7.000%

5.500%

2.000%

7.500%

6.000%

2.000%

8.000%

- 1,300,000

- 1,400,000

- 1,500,000

- 1,300,000

- 1,400,000

- 1,500,000

- 1,600,000

- 20,000,000

- 21,600,000

19,640,000

19,640,000

7.7438%

7.1365%

Found by plugging in .250% in expectations above.

Year 0

Year 1

Year 2

Year 3

Year 4

4.000%

2.500%

6.500%

4.250%

2.500%

6.750%

4.500%

2.500%

7.000%

4.750%

2.500%

7.250%

5.000%

2.500%

7.500%

- 1,350,000

- 1,400,000

- 1,450,000

- 1,350,000

- 1,400,000

- 1,450,000

- 1,500,000

- 20,000,000

- 21,500,000

20,000,000

20,000,000

7.0370%

7.1036%

Found by plugging in .500% in expectations above.

The Banque de Sorbonne loan proposal is actually lower all-in-cost under either interest rate scenario.

Problem 8.14 Schifano Motors

Schifano Motors of Italy recently took out a 4-year 5 million loan on a floating rate basis. It is now worried, however, about rising interest

costs. Although it had initially believed interest rates in the Euro-zone would be trending downward when taking out the loan, recent

economic indicators show growing inflationary pressures. Analysts are predicting that the European Central Bank will slow monetary

growth driving interest rates up.

Schifano is now considering whether to seek some protection against a rise in euro-LIBOR, and is considering a Forward Rate

Agreement (FRA) with an insurance company. According to the agreement, Schifano would pay to the insurance company at the end of

each year the difference between its initial interest cost at LIBOR + 2.50% (6.50%) and any fall in interest cost due to a fall in LIBOR.

Conversely, the insurance company would pay to Schifano 70% of the difference between Schifanos initial interest cost and any increase in

interest costs caused by a rise in LIBOR.

Purchase of the floating Rate Agreement will cost 100,000, paid at the time of the initial loan. What are Schifanos annual financing

costs now if LIBOR rises and if LIBOR falls.? Schifano uses 12% as its weighted average cost of capital. Do you recommend that Schifano

purchase the FRA?

Assumptions

Principal borrowing need

Maturity needed, in years

Current LIBOR

Felini's bank spread

Proportion of differential paid by FRA

Cost of FRA

Values

5,000,000

4.00

4.000%

2.500%

70%

100,000

If LIBOR Falls 50 Basis Pts Per Year

Year 0

Year 2

Year 3

Year 4

3.500%

2.500%

6.000%

3.000%

2.500%

5.500%

2.500%

2.500%

5.000%

2.000%

2.500%

4.500%

- 100,000

- 300,000

- 25,000

- 275,000

- 50,000

- 250,000

- 75,000

4,900,000

- 325,000

- 325,000

- 325,000

- 225,000

- 100,000

- 5,000,000

- 5,325,000

Year 1

Year 2

Year 3

Year 4

4.500%

2.500%

7.000%

5.000%

2.500%

7.500%

5.500%

2.500%

8.000%

6.000%

2.500%

8.500%

- 100,000

- 350,000

17,500

- 375,000

35,000

- 400,000

52,500

4,900,000

- 332,500

- 340,000

- 347,500

- 425,000

70,000

- 5,000,000

- 5,355,000

Expected annual change in LIBOR

LIBOR

Bank spread

Interest rate

Funds raised, net of fees

Expected interest (interest rate x principal)

Forward Rate Agreement

Repayment of principal

Total cash flows

All-in-cost of funds (IRR)

If LIBOR Rises 50 Basis Pts Per Year

-0.500%

4.000%

2.500%

6.500%

5,000,000

7.092%

Year 0

Expected annual change in LIBOR

LIBOR

Bank spread

Interest rate

Funds raised, net of fees

Expected interest (interest rate x principal)

Forward Rate Agreement

Repayment of principal

Total cash flows

All-in-cost of funds (IRR)

Year 1

0.500%

4.000%

2.500%

6.500%

5,000,000

7.458%

This rather unusual forward rate agreement is somewhat one-sided in the favor of the insurance company. When Schifano is correct,

Schifano pays the full difference in rates to the insurance company. But when interest rates move against Schifano, the insurance company

pays Schifano only 70% of the difference in rates. And all of that is after Schifano paid 100,000 up-front for the agreement regardless of

outcome. Not a very good deal.

A final note of significance is that since Schifano receives only 70% of the difference in rates, its total cost of funds is not effectively

"capped"; they could in fact rise with no limit over the period as interest rates rose.

Problem 8.15 Chrysler LLC

Chrysler LLC, the now privately held company sold-off by DaimlerChrysler, must pay floating rate interest

three months from now. It wants to lock in these interest payments by buying an interest rate futures contract.

Interest rate futures for three months from now settled at 93.07, for a yield of 6.93% per annum.

a. If the floating-rate interest three months from now is 6.00%, what did Chrysler gain or lose?

b. If the floating-rate interest three months from now is 8.00% , what did Chrysler gain or lose?

Assumptions

Interest rate futures, closing price

Effective yield on interest rate futures

Chrysler's interest rate payments with futures

Interest payment due in three months

Sell a future (take a short position)

Gain or loss on position

Values

93.07

6.930%

Three Months From Now

Floating Rate is

Floating Rate is

6.000%

8.000%

6.000%

-6.930%

-0.930%

Loss

8.000%

-6.930%

1.070%

Gain

Problem 8.16 CB Solutions

Heather O'Reilly, the treasurer of CB Solutions, believes interest rates are going to rise, so she wants to swap her future floating

rate interest payments for fixed rates. At present she is paying LIBOR + 2% per annum on $5,000,000 of debt for the next two

years, with payments due semiannually. LIBOR is currently 4.00% per annum. Heather has just made an interest payment today,

so the next payment is due six months from today.

Heather finds that she can swap her current floating rate payments for fixed payments of 7.00% per annum. (CB Solutions's

weighted average cost of capital is 12%, which Heather calculates to be 6% per six month period, compounded semiannually).

a. If LIBOR rises at the rate of 50 basis points per six month period, starting tomorrow, how much does Heather save or cost her

company by making this swap?

b. If LIBOR falls at the rate of 25 basis points per six month period, starting tomorrow, how much does Heather save or cost her

company by making this swap?

Assumptions

Notional principal

LIBOR, per annum

Spread paid over LIBOR, per annum

Swap rate, to pay fixed, per annum

Values

5,000,000

4.000%

2.000%

7.000%

First

6-months

Second

6-months

Third

6-months

Fourth

6-months

0.500%

4.500%

5.000%

5.500%

6.000%

Current loan agreement:

Expected LIBOR (for 6 months)

Spread (for 6 months)

Expected interest payment

-2.250%

-1.000%

-3.250%

-2.500%

-1.000%

-3.500%

-2.750%

-1.000%

-3.750%

-3.000%

-1.000%

-4.000%

Swap Agreement:

Pay fixed (for 6-months)

Receive floating (LIBOR for 6 months)

-3.500%

2.250%

-3.500%

2.500%

-3.500%

2.750%

-3.500%

3.000%

Net interest (loan + swap)

-4.500%

-4.500%

-4.500%

-4.500%

Interest & Swap Payments

a. LIBOR increases 50 basis pts/6 months

Expected LIBOR

Swap savings?

Net interest after swap

Loan agreement interest

Swap savings (swap cost)

$

$

(225,000)

(162,500)

(62,500)

$

$

(225,000)

(175,000)

(50,000)

$

$

(225,000)

(187,500)

(37,500)

$

$

(225,000)

(200,000)

(25,000)

b. LIBOR decreases 25 basis pts/6 months

Expected LIBOR

-0.250%

3.750%

3.500%

3.250%

3.000%

Current loan agreement:

Expected LIBOR (for 6 months)

Spread (for 6 months)

Expected interest payment

-1.875%

-1.000%

-2.875%

-1.750%

-1.000%

-2.750%

-1.625%

-1.000%

-2.625%

-1.500%

-1.000%

-2.500%

Swap Agreement:

Pay fixed (for 6-months)

Receive floating (LIBOR for 6 months)

-3.500%

1.875%

-3.500%

1.750%

-3.500%

1.625%

-3.500%

1.500%

Net interest (loan + swap)

-4.500%

-4.500%

-4.500%

-4.500%

Swap savings?

Net interest after swap

Loan agreement interest

Swap savings (swap cost)

$

$

(225,000)

(143,750)

(81,250)

$

$

(225,000)

(137,500)

(87,500)

$

$

In both cases CB Solutions is suffering higher total interest costs as a result of the swap.

(225,000)

(131,250)

(93,750)

$

$

(225,000)

(125,000)

(100,000)

Problem 8.17 Lluvia and Paraguas

Lluvia Manufacturing and Paraguas Products both seek funding at the lowest possible cost. Lluvia would

prefer the flexibility of floating rate borrowing, while Paraguas wants the security of fixed rate

borrowing. Lluvia is the more credit-worthy company. They face the following rate structure. Lluvia,

with the better credit rating, has lower borrowing costs in both types of borrowing.

Lluvia wants floating rate debt, so it could borrow at LIBOR+1%. However it could borrow fixed at

8% and swap for floating rate debt. Paraguas wants fixed rate, so it could borrow fixed at 12%. However

it could borrow floating at LIBOR+2% and swap for fixed rate debt. What should they do?

Assumptions

Credit rating

Prefers to borrow

Fixed-rate cost of borrowing

Floating-rate cost of borrowing:

LIBOR (value is unimportant)

Spread

Total floating-rate

Comparative Advantage in Borrowing

Lluvia's absolute advantage:

in fixed rate borrowing

in floating-rate borrowing

Comparative advantage in fixed rate

One Possibility

Lluvia borrows fixed

Paraguas borrows floating

Lluvia pays Paraguas floating (LIBOR)

Paraguas pays Lluvia fixed

Net interest after swap

Savings (own borrowing versus net swap):

If Lluvia borrowed floating

If Lluvia borrows fixed & swaps with Paraguas

If Paraguas borrows fixed

If Paraguas borrows floating & swaps with Lluvia

Xavier

AAA

Floating

8.000%

Zulu

BBB

Fixed

12.000%

5.000%

1.000%

6.000%

5.000%

2.000%

7.000%

Values

4.000%

1.000%

3.000%

Xavier

-8.000%

---5.000%

8.500%

-4.500%

Zulu

---7.000%

5.000%

-8.500%

-10.500%

6.000%

4.500%

1.500%

12.000%

10.500%

1.500%

The 3.0% comparative advantage enjoyed by Lluvia represents the opportunity set for improvement for

both parties. This could be a 1.5% savings for each (as in the example shown) or any other combination

which distributes the 3.0% between the two parties.

Problem 8.18 Trident's Cross Currency Swap: Sfr for US$

Trident Corporation entered into a three-year cross currency interest rate swap to receive U.S. dollars and pay Swiss francs. Trident, however, decided

to unwind the swap after one year thereby having two years left on the settlement costs of unwinding the swap after one year. Repeat the

calculations for unwinding, but assume that the following rates now apply:

Assumptions

Notional principal

Original spot exchange rate, SFr./$

New (1-year later) spot exchange rate, SFr./$

New fixed US dollar interest

New fixed Swiss franc interest

a. Interest & Swap Payments

Receive fixed rate dollars at this rate:

On a notional principal of:

Trident will receive cash flows:

Values

10,000,000

1.5000

1.5560

5.20%

2.20%

Year 0

Year 1

Year 2

Year 3

5.56%

5.56%

5.56%

###

###

###

SFr. 301,500

SFr. 301,500

SFr. 15,301,500

SFr. 15,000,000

b. Unwinding the swap after one-year

Settlement:

Cash inflow

Cash outflow

Net cash settlement of unwinding

3-year ask

5.59%

2.01%

10,000,000

Trident will pay cash flows:

On a notional principal of:

Pay fixed rate Swiss francs at this rate:

Remaining Swiss franc cash outflows

PV factor at now current fixed SF interest

PV of remaining SF cash outflows

Cumulative PV of SF cash outflows

New current spot rate, SFr./$

Cumulative PF of SF cash outflows in $

3- year bid

5.56%

1.93%

1.5000

Exchange rate, time of swap (SFr./$)

Remaining dollar cash inflows

PV factor at now current fixed $ interest

PV of remaining dollar cash inflows

Cumulative PV of dollar cash inflows

Swap Rates

Original: US dollar

Original: Swiss franc

2.01%

2.01%

2.01%

Year 1

Year 2

Year 3

$

5.20%

$

$

556,000

0.9506

528,517

$

$

10,066,750

2.20%

SFr. 301,500

0.9785

SFr. 295,010

SFr. 14,944,827

1.5560

$

9,604,645

$

$

10,556,000

0.9036

9,538,232

10,066,750

(9,604,645)

462,105

This is a cash receipt by Trident from the swap dealer.

SFr. 15,301,500

0.9574

SFr. 14,649,818

Problem 8.19 Trident's Cross Currency Swap: Yen for Euros

Using the table of swap rates in the chapter (Exhibit 8.13), and assume Trident enters into a swap agreement to receive euros and pay Japanese yen,

on a notional principal of 5,000,000. The spot exchange rate at the time of the swap is 104/.

a. Calculate all principal and interest payments, in both euros and Swiss francs, for the life of the swap agreement.

b. Assume that one year into the swap agreement Trident decides it wishes to unwind the swap agreement and settle it in euros. Assuming that a

two-year fixed rate of interest on the Japanese yen is now 0.80%, and a two-year fixed rate of interest on the euro is now 3.60%, and the spot rate of

exchange is now 114/, what is the net present value of the swap agreement? Who pays whom what?

Assumptions

Notional principal

Spot exchange rate, Yen/euro

Values

5,000,000

104.00

a) Interest & Swap Payments

Receive fixed rate euros at this rate:

On a notional principal of:

Trident will receive cash flows:

Swap Rates

Euros --

Japanese yen

Year 0

3- year bid

3.24%

0.56%

3-year ask

3.28%

0.59%

Year 1

Year 2

Year 3

3.24%

3.24%

3.24%

5,000,000

###

###

###

523,068,000

Exchange rate, time of swap (/)

104.00

Trident will pay cash flows:

On a notional principal of (yen):

Pay fixed rate Japanese yen at this rate:

b) Unwinding the swap after one-year

Remaining euro cash inflows

PV factor at now current fixed interest

PV of remaining cash inflows

Cumulative PV of cash infllows

Remaining cash outflows

PV factor at now current fixed interest

PV of remaining cash outflows

Cumulative PV of cash outflows

New current spot rate, /

Cumulative PV of cash outflows in

Settlement:

Cash inflow

Cash outflow

Net cash settlement of unwinding

3,068,000

3,068,000

520,000,000

3.60%

0.59%

0.59%

0.59%

Year 1

Year 2

Year 3

162,000

0.9653

156,371

5,162,000

0.9317

4,809,484

SFr. 3,068,000

0.9921

SFr. 3,043,651

SFr. 523,068,000

0.9842

SFr. 514,798,280

4,965,855

0.80%

517,841,931

114.00

4,542,473

4,965,855

(4,542,473)

423,382

This is a cash receipt by Trident from the swap dealer.

Problem 8.20 Falcor

Falcor is the U.S.-based automotive parts supplier which was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets

far beyond the traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify

the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $50 million 7-year cross currency interest rate swap to do just that pay euro and receive

dollars. Using the data in Exhibit 8.13, solve the following:

a. Calculate all principal and interest payments in both currencies for the life of the swap.

b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35% and 4-year fixed rate dollars have

fallen to 4.40%, and the current spot exchange rate of $1.02/, what is the net present value of the swap agreement? Who pays who mwhat?

Assumptions

Notional principal

Spot exchange rate, $/

Values

50,000,000

1.16

a. Interest & Swap Payments

Receive fixed rate dollars at rate:

Notional principal of:

Receive cash inflows of:

Year 0

Swap Rates

US dollar

Euros

Year 1

7- year bid

5.86%

4.01%

7-year ask

5.89%

4.05%

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

5.86%

50,000,000

$ 2,930,000 $ 2,930,000 $ 2,930,000 $ 2,930,000 $ 2,930,000 $ 2,930,000 $ 52,930,000

Spot exchange rate, $/

1.16

Pay cash outflows of:

Notional principal of:

Pay fixed rate euros at rate:

1,745,690

1,745,690

1,745,690

1,745,690

1,745,690

1,745,690

44,849,138

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

43,103,448

4.05%

b. Unwindingthe Swap

Year 0

If the swap is unwound three years later, there are four years of cash flows remaining:

Remaining dollar cash inflows

PV factor at now current fixed $ interest

PV of remaining dollar cash inflows

Cumulative PV of $ cash infllows

Remaining euro cash outflows

PV factor at now current fixed interest

PV of remaining euro cash outflows

Cumulative PV of cash outflows

Spot exchange rate at unwinding ($/)

Cumulative PV of cash outflows, $

Settlement:

Cash inflow

Cash outflow

Net cash settlement of unwinding

4.40%

$

$ 2,930,000 $ 2,930,000 $ 2,930,000 $ 52,930,000

0.9579

0.9175

0.8788

0.8418

$ 2,806,513 $ 2,688,231 $ 2,574,934 $ 44,555,354

52,625,033

5.35%

1,745,690

0.9492

1,657,038

41,132,542

1.02

$ 41,955,193

52,625,033

(41,955,193)

$ 10,669,840

This is a net cash payment to Falcor from the swap dealer.

1,745,690

0.9010

1,572,889

1,745,690

0.8553

1,493,012

44,849,138

0.8118

36,409,603

Problem 8.21 U.S. dollar/Euro

Pricing Currency Options on the Euro

A U.S.-based firm wishing to buy

or sell euros (the foreign currency)

Value

$1.2480

$1.2500

1.453%

2.187%

1.000

365.00

12.000%

Call option premium (per unit fc)

Put option premium (per unit fc)

(European pricing)

c

p

Call option premium (%)

Put option premium (%)

c

p

Spot rate (domestic/foreign)

Strike rate (domestic/foreign)

Domestic interest rate (% p.a.)

Foreign interest rate (% p.a.)

Time (years, 365 days)

Days equivalent

Volatility (% p.a.)

Variable

S0

X

rd

rf

T

A European firm wishing to buy

or sell dollars (the foreign currency)

Variable

S0

Value

0.8013

0.8000

2.187%

1.453%

1.000

365.00

12.000%

$0.0534

$0.0643

c

p

0.0412

0.0342

4.28%

5.15%

c

p

5.15%

4.27%

X

rd

rf

T

When the volatility is increased to 12.000% from 10.500%, the premium on the call option on euros rises to $0.0412/, or 5.15%.

Problem 8.22 U.S. Dollar/Japanese Yen

Pricing Currency Options on the Japanese yen

A Japanese firm wishing to buy

or sell dollars (the foreign currency)

Value

JPY 105.64

JPY 100.00

0.089%

1.453%

1.000

365.00

12.000%

Call option premium (per unit fc)

Put option premium (per unit fc)

(European pricing)

c

p

Call option premium (%)

Put option premium (%)

c

p

Spot rate (domestic/foreign)

Strike rate (domestic/foreign)

Domestic interest rate (% p.a.)

Foreign interest rate (% p.a.)

Time (years, 365 days)

Days equivalent

Volatility (% p.a.)

Variable

S0

X

rd

rf

T

A U.S.-based firm wishing to buy

or sell yen (the foreign currency)

Variable

S0

X

rd

rf

T

s

Value

$0.0095

$0.0100

1.453%

0.089%

1.000

365.00

12.000%

JPY 7.27

JPY 3.06

c

p

$0.0003

$0.0007

6.88%

2.90%

c

p

3.06%

7.27%

A Japanese firm wishing to sell U.S. dollars would need to purchase a put on dollars. The put option premium listed above is JPY3.06/$.

Put option premium (JPY/US$)

Notional principal (US$)

Total cost (JPY)

JPY 3.06

$750,000

JPY 2,297,243

Problem 8.23 Euro/Japanese Yen

Pricing Currency Options on the Euro/Yen Crossrate

A Japanese firm wishing to buy

or sell euros (the foreign currency)

Value

JPY 133.89

JPY 136.00

0.088%

2.187%

0.247

90.00

10.000%

Call option premium (per unit fc)

Put option premium (per unit fc)

(European pricing)

c

p

Call option premium (%)

Put option premium (%)

c

p

Spot rate (domestic/foreign)

Strike rate (domestic/foreign)

Domestic interest rate (% p.a.)

Foreign interest rate (% p.a.)

Time (years, 365 days)

Days equivalent

Volatility (% p.a.)

Variable

S0

X

rd

rf

T

A European firm wishing to buy

or sell yen (the foreign currency)

Variable

S0

X

rd

rf

T

s

Value

0.0072

0.0074

2.187%

0.088%

0.247

90.00

10.000%

JPY 1.50

JPY 4.30

c

p

0.0001

0.0002

1.12%

3.21%

c

p

1.30%

2.90%

A European-based firm like Legrand (France) would need to purchase a put option on the Japanese yen. The company wishes a strike rate of 0.0072 euro

for each yen sold (the strike rate) and a 90-day maturity. Note that the "Time" must be entered as the fraction of a 365 day year, in this case, 90/365 = 0.247.

Put option premium (euro/JPY)

Notional principal (JPY)

Total cost (euro)

0.0002

JPY 10,400,000

2,167.90

Problem 8.24 U.S. Dollar/British Pound

Pricing Currency Options on the British pound

A U.S.-based firm wishing to buy

or sell pounds (the foreign currency)

Value

$1.8674

$1.8000

1.453%

4.525%

0.493

180.00

9.400%

Call option premium (per unit fc)

Put option premium (per unit fc)

(European pricing)

c

p

Call option premium (%)

Put option premium (%)

c

p

Spot rate (domestic/foreign)

Strike rate (domestic/foreign)

Domestic interest rate (% p.a.)

Foreign interest rate (% p.a.)

Time (years, 365 days)

Days equivalent

Volatility (% p.a.)

Variable

S0

X

rd

rf

T

Value

0.5355

0.5556

4.525%

1.453%

0.493

180.00

9.400%

$0.0696

$0.0306

c

p

0.0091

0.0207

3.73%

1.64%

c

p

1.70%

3.87%

Call option premiums for a U.S.-based firm buying call options on the British pound:

180-day maturity ($/pound)

90-day maturity ($/pound)

Difference ($/pound)

$0.0696

$0.0669

$0.0027

The maturity doubled while the option premium rose only about 4%.

A British firm wishing to buy

or sell dollars (the foreign currency)

Variable

S0

X

rd

rf

T

Problem 8.25 Euro/British Pound

Pricing Currency Options on the British pound/Euro Crossrate

A European firm wishing to buy

or sell pounds (the foreign currency)

Value

1.4730

1.5000

4.000%

4.160%

0.247

90.00

11.400%

Call option premium (per unit fc)

Put option premium (per unit fc)

(European pricing)

c

p

Call option premium (%)

Put option premium (%)

c

p

Spot rate (domestic/foreign)

Strike rate (domestic/foreign)

Domestic interest rate (% p.a.)

Foreign interest rate (% p.a.)

Time (years, 365 days)

Days equivalent

Volatility (% p.a.)

Variable

S0

X

rd

rf

T

A British firm wishing to buy

or sell euros (the foreign currency)

Value

0.6789

0.6667

4.160%

4.000%

0.247

90.00

11.400%

0.0213

0.0487

c

p

0.0220

0.0097

1.45%

3.30%

c

p

3.24%

1.42%

When the euro's interest rate rises from 2.072% to 4.000%, the call option premium on British pounds rises:

Call option on pounds when euro interest is 4.000%

Call option on pounds when euro interest is 2.072%

Change, an increase in the premium

0.0213

0.0189

0.0213

Variable

S0

X

rd

rf

T

Potrebbero piacerti anche

- International FinanceDocumento10 pagineInternational FinancelabelllavistaaNessuna valutazione finora

- Chap12 Pbms MBF12eDocumento10 pagineChap12 Pbms MBF12eBeatrice BallabioNessuna valutazione finora

- BUS322Tutorial8 SolutionDocumento10 pagineBUS322Tutorial8 Solutionjacklee1918100% (1)

- Problem 11.3Documento1 paginaProblem 11.3SamerNessuna valutazione finora

- Fund 4e Chap07 PbmsDocumento14 pagineFund 4e Chap07 Pbmsjordi92500100% (1)

- Almarai 2014 Annual Report: Quality You Can TrustDocumento128 pagineAlmarai 2014 Annual Report: Quality You Can TrustBrandon Steven MirandaNessuna valutazione finora

- MBF14e Chap05 FX MarketsDocumento20 pagineMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- Questions On International FinanceDocumento31 pagineQuestions On International FinanceSaada100% (1)

- MBF13e Chap07 Pbms - FinalDocumento21 pagineMBF13e Chap07 Pbms - FinalMatthew Stojkov100% (6)

- Chap07 Pbms MBF12eDocumento22 pagineChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- Week 2 Tut SolsDocumento8 pagineWeek 2 Tut SolsDivya chandNessuna valutazione finora

- MBF14e Chap05 FX MarketsDocumento20 pagineMBF14e Chap05 FX Marketskk50% (2)

- MBF14e Chap02 Monetary System PbmsDocumento13 pagineMBF14e Chap02 Monetary System PbmsKarlNessuna valutazione finora

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Documento11 pagineExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%rufik der100% (2)

- Chapter 4-Exchange Rate DeterminationDocumento21 pagineChapter 4-Exchange Rate DeterminationMelva CynthiaNessuna valutazione finora

- MBF14e Chap04 Governance PbmsDocumento16 pagineMBF14e Chap04 Governance PbmsKarl60% (5)

- Currency Derivatives C (Chapter 5)Documento10 pagineCurrency Derivatives C (Chapter 5)Evelina WiszniewskaNessuna valutazione finora

- Foreign Exchange Markets, End of Chapter Solutions.Documento27 pagineForeign Exchange Markets, End of Chapter Solutions.PankajatSIBMNessuna valutazione finora

- Solnik & McLeavey - Global Investment 6th EdDocumento5 pagineSolnik & McLeavey - Global Investment 6th Edhotmail13Nessuna valutazione finora

- International Financial Management Problem Set 2 SolutionsDocumento15 pagineInternational Financial Management Problem Set 2 SolutionsSagar Bansal67% (3)

- Week 5 Tutorial ProblemsDocumento6 pagineWeek 5 Tutorial ProblemsWOP INVESTNessuna valutazione finora

- Chapter 8-Relationships Among Inflation, Interest Rates, and Exchange Rates QuizDocumento15 pagineChapter 8-Relationships Among Inflation, Interest Rates, and Exchange Rates Quizhy_saingheng_7602609100% (1)

- MBF14e Chap06 Parity Condition PbmsDocumento23 pagineMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- Solution Manual CH 7 Multinational Financial ManagementDocumento5 pagineSolution Manual CH 7 Multinational Financial Managementariftanur100% (2)

- Chap11 Translation PbmsDocumento10 pagineChap11 Translation Pbmskk100% (2)

- Chapter 6 Excel - CIA1Documento10 pagineChapter 6 Excel - CIA1tableroof100% (1)

- Translation Gains and Losses Under Current and Temporal MethodsDocumento10 pagineTranslation Gains and Losses Under Current and Temporal MethodsnahorrNessuna valutazione finora

- Foreign Exchange Rate MarketDocumento92 pagineForeign Exchange Rate Marketamubine100% (1)

- Solnik & Mcleavey - Global Investment 6th EdDocumento5 pagineSolnik & Mcleavey - Global Investment 6th Edhotmail13Nessuna valutazione finora

- BUS322Tutorial5 SolutionDocumento20 pagineBUS322Tutorial5 Solutionjacklee191825% (4)

- R42 Derivatives Strategies IFT Notes PDFDocumento24 pagineR42 Derivatives Strategies IFT Notes PDFZidane KhanNessuna valutazione finora

- Question Bank 2014Documento63 pagineQuestion Bank 2014Jovan Ssenkandwa100% (1)

- MBF13e Chap10 Pbms - FinalDocumento17 pagineMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- CH 7Documento7 pagineCH 7Asad Ehsan Warraich100% (3)

- Chap08 Pbms SolutionsDocumento25 pagineChap08 Pbms SolutionsDouglas Estrada100% (1)

- Ch07 SSolDocumento7 pagineCh07 SSolvenkeeeee100% (1)

- Sallie Schnudel speculates on Singapore dollar appreciationDocumento25 pagineSallie Schnudel speculates on Singapore dollar appreciationveronika100% (1)

- Bus 322 Tutorial 5-SolutionDocumento20 pagineBus 322 Tutorial 5-Solutionbvni50% (2)

- Finance - Module 7Documento3 pagineFinance - Module 7luckybella100% (1)

- Week 3 Tutorial ProblemsDocumento6 pagineWeek 3 Tutorial ProblemsWOP INVESTNessuna valutazione finora

- BioTron Medical Foreign Exchange Risk AnalysisDocumento19 pagineBioTron Medical Foreign Exchange Risk AnalysisQurratul Asmawi100% (2)

- MBF13e Chap06 Pbms - FinalDocumento20 pagineMBF13e Chap06 Pbms - Finalaveenobeatnik100% (2)

- FX II PracticeDocumento10 pagineFX II PracticeFinanceman4Nessuna valutazione finora

- MBF13e Chap20 Pbms - FinalDocumento11 pagineMBF13e Chap20 Pbms - FinalAnonymous 8ooQmMoNs1100% (3)

- BUS322Tutorial9 SolutionDocumento15 pagineBUS322Tutorial9 Solutionjacklee1918100% (1)

- Ex - TransExposure SOLDocumento5 pagineEx - TransExposure SOLAlexisNessuna valutazione finora

- Summer 2021 FIN 6055 New Test 2Documento2 pagineSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Chapter 07Documento3 pagineChapter 07Suzanna RamizovaNessuna valutazione finora

- Chap 6 ProblemsDocumento5 pagineChap 6 ProblemsCecilia Ooi Shu QingNessuna valutazione finora

- Problem 8.1 Peregrine Funds - JakartaDocumento5 pagineProblem 8.1 Peregrine Funds - JakartaAlexisNessuna valutazione finora

- 6.18 East Asiatic CompanyDocumento2 pagine6.18 East Asiatic Companydummy yummyNessuna valutazione finora

- FNE306 Assignment 6 AnsDocumento9 pagineFNE306 Assignment 6 AnsCharles MK ChanNessuna valutazione finora

- CHP 6Documento8 pagineCHP 6Nicky Supakorn100% (1)

- CH 18Documento4 pagineCH 18Ahmed_AbdelkariemNessuna valutazione finora

- Currency Risk HedgingDocumento12 pagineCurrency Risk Hedginggilli1tr100% (1)

- Pbm7 2Documento1 paginaPbm7 2jordi92500Nessuna valutazione finora

- Chapter 11Documento2 pagineChapter 11atuanaini0% (1)

- Blades Case Exposure to International Flow of FundsDocumento1 paginaBlades Case Exposure to International Flow of FundsWulandari Pramithasari50% (2)

- Solnik Chapter 3 Solutions To Questions & Problems (6th Edition)Documento6 pagineSolnik Chapter 3 Solutions To Questions & Problems (6th Edition)gilli1trNessuna valutazione finora

- Problem 7.1 Peso Futures: A) B) C) Assumptions Values Values ValuesDocumento15 pagineProblem 7.1 Peso Futures: A) B) C) Assumptions Values Values ValuesShiro DekuNessuna valutazione finora

- Shrikhande International Finance Fall 2010 Problem Set 1: NswerDocumento7 pagineShrikhande International Finance Fall 2010 Problem Set 1: NswerHwa Tee HaiNessuna valutazione finora

- FOREX QuestionsDocumento16 pagineFOREX QuestionsParvesh AghiNessuna valutazione finora

- ch06 IMDocumento7 paginech06 IMlokkk333Nessuna valutazione finora

- USM1 FIN 614 Week02 WorkProblemsWorksheetDocumento13 pagineUSM1 FIN 614 Week02 WorkProblemsWorksheetwaszenvNessuna valutazione finora

- Research Paper on Int'l Marketing Entry of Beko, Almarai or Chips Oman in IndiaDocumento2 pagineResearch Paper on Int'l Marketing Entry of Beko, Almarai or Chips Oman in IndiaBrandon Steven MirandaNessuna valutazione finora

- Fund 4e Chap09 PbmsDocumento12 pagineFund 4e Chap09 Pbmsbobbyx12100% (1)

- MBF13e Chap06 Pbms - FinalDocumento20 pagineMBF13e Chap06 Pbms - Finalaveenobeatnik100% (2)

- ET ArticlesDocumento3 pagineET ArticlesBrandon Steven MirandaNessuna valutazione finora

- Session 5Documento11 pagineSession 5Brandon Steven MirandaNessuna valutazione finora

- S4 - Equity Valuation ModelDocumento5 pagineS4 - Equity Valuation ModelBrandon Steven MirandaNessuna valutazione finora

- 3 SessionDocumento21 pagine3 SessionBrandon Steven MirandaNessuna valutazione finora

- 4.36 M.com Banking & FinanceDocumento18 pagine4.36 M.com Banking & FinancegoodwynjNessuna valutazione finora

- Best For International FinanceDocumento45 pagineBest For International FinanceAbraha Girmay Gebru0% (2)

- Book - IFM - Lecture NotesDocumento261 pagineBook - IFM - Lecture NotesasadNessuna valutazione finora

- International Financial Management 11 Edition: by Jeff MaduraDocumento33 pagineInternational Financial Management 11 Edition: by Jeff MaduraChourp SophalNessuna valutazione finora

- Quiz Internal AccountingDocumento3 pagineQuiz Internal AccountingMili Dit100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Documento10 pagine3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- EserciziDocumento6 pagineEserciziAlessandro d'IserniaNessuna valutazione finora

- Foreign Exchange Risk ManagementDocumento10 pagineForeign Exchange Risk ManagementThomas nyadeNessuna valutazione finora

- Foreign Currency Derivatives: Futures and OptionsDocumento43 pagineForeign Currency Derivatives: Futures and Optionsanon_355962815Nessuna valutazione finora

- CH 14 Country and Political RiskDocumento32 pagineCH 14 Country and Political Riskklm klmNessuna valutazione finora

- ch07 IMDocumento7 paginech07 IMlokkk333Nessuna valutazione finora

- Week Two International Financial Organizations and ArrangementsDocumento17 pagineWeek Two International Financial Organizations and ArrangementsWanjiku MathuNessuna valutazione finora

- SFM RTP Nov 22Documento16 pagineSFM RTP Nov 22Accounts PrimesoftNessuna valutazione finora

- Foreign Currency Transactions and Hedging Foreign Exchange RiskDocumento144 pagineForeign Currency Transactions and Hedging Foreign Exchange RiskMarwa HassanNessuna valutazione finora

- Foreign Currency TransactionsDocumento40 pagineForeign Currency TransactionsJuliaMaiLeNessuna valutazione finora

- Forwards Futures and OptionsDocumento11 pagineForwards Futures and OptionsSHELIN SHAJI 1621038Nessuna valutazione finora

- BAB 13 InggrisDocumento33 pagineBAB 13 InggrisPindy Widiya PamungkasNessuna valutazione finora

- Global Finance - Introduction ADocumento268 pagineGlobal Finance - Introduction AfirebirdshockwaveNessuna valutazione finora

- Cash Management: Guide To Trading InternationallyDocumento4 pagineCash Management: Guide To Trading InternationallySumanto SharanNessuna valutazione finora

- Managing Transaction ExposureDocumento30 pagineManaging Transaction ExposureImtiaz MasroorNessuna valutazione finora

- Currency Derivatives Forex Market Project-1Documento102 pagineCurrency Derivatives Forex Market Project-1AshleyNessuna valutazione finora

- Answers To Chapter ExercisesDocumento4 pagineAnswers To Chapter ExercisesMuhammad Ibad100% (6)

- Currency Future & Option For StudentsDocumento8 pagineCurrency Future & Option For StudentsAmit SinhaNessuna valutazione finora

- Answers To Questions Chapter 06.part IIDocumento19 pagineAnswers To Questions Chapter 06.part IIDaniel TadejaNessuna valutazione finora

- Examination On Foreign Currency MarketsDocumento10 pagineExamination On Foreign Currency MarketsRandy ManzanoNessuna valutazione finora

- DerivaGem Options Software GuideDocumento62 pagineDerivaGem Options Software GuideDHRUV SONAGARANessuna valutazione finora

- EitemanDocumento49 pagineEitemanDiegoFradeNessuna valutazione finora