Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Results, Limited Review Report For December 31, 2015 (Result)

Caricato da

Shyam SunderDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Results, Limited Review Report For December 31, 2015 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

LAHOTI OVERSEAS LIMITED

REGD. OFFICE:

307, ARUN CHAMBERS, TARDEO ROAD,

MUMBAI .4OO 034. INDIA

TEL.:91-22"40 500100. FAX :91-2240 500 150

February 12,2016

Internet: http://wunrt.lahotioverseas.com

E-Mail : umesh@lahotioverseas.com

Gorporate ldentity No. L74999MH1995PLC087643

To

Corporate Relations Department

BSE Limited

P. J. Towers, Dalal Street,

Fort, Mumbai

-400 001.

Dear Sir.

We enclose herewith Quarterly Unaudited Financial Results for the period ended December

3l,Z0l5

duly approved by the Board of Directors in their meeting held on February 12, 2016 alongwith

Limited Review Report received from the Statutory Auditors of the Company.

This is to comply with the SEBI (Listing Obligations and Disclosure Requirement) Regulations,

2015.

Thanking you.

Yours faithfully,

For Lahoti Overseas Limited

A.at

W

X

UmesH Lahoti

Managing Director

Encl: As above.

ffi

?,

SGSI

#-'q)

ery:a;

LAHOTI OVERSEAS LIMITED

ffi

REGD. OFFICE:

307, ARUN CHAMBERS, TARDEO ROAD,

MUMBAI .4OO 034. INDIA

TEL.:91-2240 500 100. FAX :91-2240 500150

Internet: http://www.lahotioverseas.com

E-Mail : umesh@lahotioverseas.com

Gorporate ldentity No. L74999MH1995PLC087643

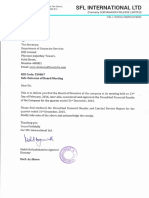

STANADLONE UNAUDITED RESULTS FOR TH

in I akhsl

5.

No.

Precedlng 3

3 month8

PARTICULARS

ended 31.12.{5

(UNAUDITED)

1

lncome From Operations

[a) Net Sales / Income from Operation

(b) Other Operating income

Total Income From Operatlons (Net)

2

la) Purchase of Stock in Trade

E) Other Exoenses

fotal Expenses

previous year

ended

31.12.2014

(UNAUDITED)

Year to date

flgures forthe

current perlod

ended

31.12.201s

(UNAUDITEO)

31.12.2014

(UNAUDITEDI

(AUDITED)

10,352.76

18,006.87

33,805.1 3

40,370.18

365.70

524.25

1,232.50

1,215.24

1.834.49

12,512.28

10.7{8.46

18,531.12

35,037.63

41.585.41

58.804.78

11,276.80

9,808.31

17,793.56

32,211.10

40,8't't.42

55,286.78

9.30)

(708.31

48.10

46.56

44.28

139.28

104.99

105.00

30.52

314.98

(1

(1

36.1 5)

(2j2s.93)

56,970.29

(636.1 sl

122.77

178.05

t.56

265.51

600.51

477.42

739.76

1,654.69

1.830.31

2.817.06

12,381.40

10.317.99

17.899.81

34.183.89

40,726.13

57,911.26

130.88

400.

63r.32

853.74

859.29

893.52

20.61

(6.461

148.75

468.89

1,(X0.36

-2

f,ther Income

20.1

-re[ rlloss,

rrom operauons Delore Itnance

tost and exceptional item(3+41

251.O7

421.08

624.86

1.002-t!8

Finance Cost

1,328.18

r,933.88

187.73

219.01

224.61

626.20

616.68

894.87

63.34

202.08

400.25

376.28

7l t.50

1.039.0t

63.34

202.O8

400.25

376.28

711,49

1.039.01

ProffU (Loss) from ordlnary actlvlty after flnance

(5-6)

costs but before erceptional

item

:xceDtional ltem

trofiu(Loss) from ordinary activities before tax

10 Tax Expenses

Current Tax

11

Defened Tax

flet ProfiU (Loss) from ordinary activlties after

iax (9-10)

16.76

73.88

141.52

78.87

253.08

220.00

16.86

16.86

12.94

50.58

38.81

67.45

29.73

111.34

245.79

246.83

4t9.59

751.56

29.73

111.34

245.79

246.83

4t9.59

751.56

583.43

583.43

583.43

583.43

583.43

583.43

l2 Extra Ordinary ltem (net of Tax)

13

14

IET PROFIT(LOSS) Forthe perlod (11-12]

raid-up Equity Capital (Face Value Rs. 2/- Each)

15

Reserves Exduding Revaluation Reserves as per

the balance sheet of the previous accounting yea0

16 l. tamrng per share (before extraordinary item) of

Rs. Z-each (notAnnualised)

(a) Basic (ln Rs.)

(b) Diluted (ln Rs.)

17 ll. Earning per share (after extraordinary item) of

Z-each (not Annualised)

(a) Basic (ln t)

(b) Diluted (ln {)

8.667.7t

0.10

0.38

0.84

0.85

1.44

2.58

0.10

0.38

0.84

0.85

1.44

2.58

0.10

0.38

0.84

0.85

1.44

2.58

0.10

0.38

0.84

0.85

1.44

2.58

.t

g

ffi

7

Previous year

ended

31.03.20t5

475.60

ProfiU(Loss) from operations before other

ncome, flnance cost and exceptional item (

Year to date

figures for the

prevlous period

ended

12,036.68

351.00

'D) Depreciation

& Amortisation Expenses

(UNAUD|TEO)

ilpenses

ib) (lncrease) / Decrease in Stock in Trade

'C) Employees Benefit Expenses

months ended

30.09.20t5

Corespondlng

months in the

Sclfl

Strr\

il.B

'-a9

LAHOTI OVERSEAS LIMITED

REGD. OFFICE

307, ARUN CHAMBERS, TARDEO ROAD,

.400 034. tNDtA

TEL.: 9l-2240 500 100. FAX 291-2240 500 150

lnternet: hftp ://www. lahotioverseas.com

E-tflail : umesh@lahotioverseas.com

Gorporate ldentity No. L74999MH1995P1C087643

MUMBAT

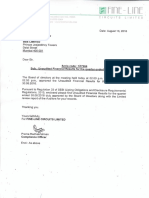

Segment-wise Revenue, Results and Capital Employed For the Quarter & Nine Month Ended 31st

December,20l5

Partlculars

3 months

3 months ended

30r09/201s

ended

w1a2u5

Unaudited

l. Segment

Audlted

Correspondlng

3 month3 in the

previous year

Year to dato

figures for the

current perlod

ended

31.12.2014

ended

31.12.2015

Unaudlted

Unaudlted

Year to date

Frevtous Year

snded

flgures for the 31/03/201 5

previous period

ended

31.12.2014

Unaudited

Audited

Revenue

(a) Export Division

(b) Power Division

12,&4.97

t07.31

58,338.71

10,515.22

18,479.03

34,527.29

41,218.44

203.24

52.09

510.34

366.97

466.0i

12.512.28

10.7r8.46

18.s31.12

35.037.63

41.585.4t

58,804.78

(a) Export Division

(b) Power Division

233.1!

301.68

503.99

760.82

1,061.25

12.73

106.98

114.89

216.12

242.33

258.57

fotal

245.92

408.6(

r,303.5!

{,600.0t

187.71

2{9.0t

616.68

894.8;

Net sales/lncome From Operatlons

2. Segment Results

ProfiV(Loss) before Interest & Tax

618.8!

976.9!

1,U',t.1',!

Less:

li) Finance Cost

lii) Other Un-allocable Expenditure net of Unrllocable Income

224.61

626.20

(333.80

(5.r61

(12.431

(5.96,

(25.s31

(24.58i,

182.57

206.5t

218.64

600.6'l

592.1(

56r.0?

63.31

202,Ot

400.2:

376.21

711.11

1,039.01

lsegment assets - Segment Liabilities)

B) Export Division

I,047.07

7,885.71

,557.5e

8,047.0i

7,557.5(

8,033.4(

ib) Power Division

1,452.07

1,548.69

1,501.4t

1.452.0i

1,501.41

1,218.9(

fotal

9,499.1r

9,434.4(

9,058.9!

9,499.1r

9,058.9!

9,252.3(

total Profit Before Tax

I Capltal Employed

NOTES:

The above results were reviewed by the Audit Committee and approved by the Board of Directors of the Company in their meetings held on 12th

February,2016. The Statutory Auditor of the Company have carried out a Limited Review of the aforesaid Result.

The Figures for the corresponding previous period have been re-grouped/rearanged/recast to make them comparable with the figures of the

current period.

The above financial results are available on the website of the Company - www.lahotioverseas.in

For LAHOTI OVERSEAS LIMITED

PLACE

DATE

MUMBAI

: 12th Feb.,2016

ffuuqir\,

5[r'rur'asnr

l5

F\---i"t

ffi

?

.se$

.00

fYt/

uiIEsH LAHOTI

MANAGING DIRECTOR

c Ghndinli nrud co LLP

lc*'P

I=t\r,r

CHARTEREDACCoUNTANTS

TO WHOMSOEVER IT MAY CONCERN

We have reviewed the accompanying statement of unaudited financial results of LAHoTI

ovERsEAS LIMITED for the period ended December 31,2016. This statement is the

Board of

responsibility of the Company's management and has been approved by the

based on our

Directors. Our responsibility is to issue a report on these financial statements

review.

(SRE)

We conducted our review in accordance with the Standard on Review Engagement

Institute of Chartered

Z4OO, Engagements fo Review Financiat Statements issued by the

perform the review to obtain

Accountants of India. This standard requires that we plan and

material

moderate assurance as to whether the financial statements are free of

personnel and analytical

misstatement. A review is limited primarily to inquiries of company

We have

procedures applied to financial data and thus provide less assurance than an audit.

not performed an audit and accordingly, we do not express an audit opinion'

that causes us

Based on our review conducted as above, nothing has come to our attention

to believe that the accompanying statement of unaudited financial results prepared in

accounting practice

accordance with applicable accounting standard and other recognized

of

and policies has not disclosed the information required to be disclosed in terms

Regulations,

Regulation 33 of the sEBl (Listing obligations and Disclosure Requirements)

any material

2015 including the manner in which it is to be disclosed, or that it contains

misstatement.

Pannkaj Ghadiali

Managing Partner

Membership Number: 0317 45

For and on behalf of

P C Ghadiali and Go LLP

Chartered Accountants

Firm No. 103132W

Place. Mumbai

Dated: FebruarY 12, 2016

207, ARUN CHAMBERS, TARDEO, MUMBAI-400 034. TEL: 43335000

website: www'pcqhadiali'com

Potrebbero piacerti anche

- Credit Appraisal Process & Financial ParametersDocumento35 pagineCredit Appraisal Process & Financial ParametersAbhishek Barman100% (1)

- 2022 Ultimate Guide To SOC 2 EbookDocumento20 pagine2022 Ultimate Guide To SOC 2 EbookMark Starmin100% (1)

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Testbank AuditingDocumento57 pagineTestbank AuditingJane Gavino100% (1)

- Mutual Fund Holdings in DHFLDocumento7 pagineMutual Fund Holdings in DHFLShyam SunderNessuna valutazione finora

- Chapter 1 Outline: The Demand For Audit and Other Assurance ServicesDocumento6 pagineChapter 1 Outline: The Demand For Audit and Other Assurance Servicestjn8240100% (1)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento2 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Documento5 pagineAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- JUSTDIAL Mutual Fund HoldingsDocumento2 pagineJUSTDIAL Mutual Fund HoldingsShyam SunderNessuna valutazione finora

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 pagineSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 paginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNessuna valutazione finora

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 pagineFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 pagineSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNessuna valutazione finora

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 paginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderNessuna valutazione finora

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 pagineOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNessuna valutazione finora

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 pagineExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For Mar 31, 2014 (Result)Documento2 pagineFinancial Results For Mar 31, 2014 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 pagineFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Financial Results For September 30, 2013 (Result)Documento2 pagineFinancial Results For September 30, 2013 (Result)Shyam SunderNessuna valutazione finora

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Financial Results For Dec 31, 2013 (Result)Documento4 pagineFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento2 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Audit of The Sales and Collection CycleDocumento43 pagineAudit of The Sales and Collection CyclesusilawatiNessuna valutazione finora

- Thompson Et Al.2022Documento20 pagineThompson Et Al.2022hanieyraNessuna valutazione finora

- Forensic Accounting and Fraud Examination in IndiaDocumento4 pagineForensic Accounting and Fraud Examination in IndiaAniket PandeyNessuna valutazione finora

- Johnstone 9e Auditing 1Documento98 pagineJohnstone 9e Auditing 1didiNessuna valutazione finora

- Advance Account Book by CA Ajay RathiDocumento192 pagineAdvance Account Book by CA Ajay RathiSanket GuptaNessuna valutazione finora

- Accepting An Engagement AuditingDocumento7 pagineAccepting An Engagement AuditingCarlo FrioNessuna valutazione finora

- Module 3 Topic 3 in Cooperative ManagementDocumento34 pagineModule 3 Topic 3 in Cooperative Managementharon franciscoNessuna valutazione finora

- 2020 21 RGICL Annual ReportDocumento113 pagine2020 21 RGICL Annual ReportShubrojyoti ChowdhuryNessuna valutazione finora

- Management Variant 5 SolutionsDocumento10 pagineManagement Variant 5 Solutionsruchika kumariNessuna valutazione finora

- Zambia Bata Shoe Company PLC Swot Analysis BacDocumento13 pagineZambia Bata Shoe Company PLC Swot Analysis Bacphilipmwangala0Nessuna valutazione finora

- Audit of Inventories 1Documento2 pagineAudit of Inventories 1Raz MahariNessuna valutazione finora

- ACCT 340 - Ch9Notes - Withanswers-2Documento5 pagineACCT 340 - Ch9Notes - Withanswers-2Alex MorrisonNessuna valutazione finora

- Review of Major Events and Rail Infrastructure ReportsDocumento218 pagineReview of Major Events and Rail Infrastructure ReportsalemayehuNessuna valutazione finora

- Capital Budgeting (Aasavari Jagdale)Documento39 pagineCapital Budgeting (Aasavari Jagdale)savri jagdaleNessuna valutazione finora

- Business Process Modeling Ass 1,2,3Documento20 pagineBusiness Process Modeling Ass 1,2,3NOORI Khana0% (1)

- Asset Management Manual A Guide For Practitioners: PlanningDocumento71 pagineAsset Management Manual A Guide For Practitioners: Planningjorge GUILLENNessuna valutazione finora

- TRI-MIXed Financial Tools for Challenging TimesDocumento15 pagineTRI-MIXed Financial Tools for Challenging TimesJay Lord FlorescaNessuna valutazione finora

- Accounting Professional: Corporate - Insolvency - CharteredDocumento2 pagineAccounting Professional: Corporate - Insolvency - Charteredsamwilson0501Nessuna valutazione finora

- COA Circular on Postal Money Order and Telegraphic Transfer AccountingDocumento3 pagineCOA Circular on Postal Money Order and Telegraphic Transfer AccountingbolNessuna valutazione finora

- VP Finance CAO Controller in Houston TX Resume Donald HelmerDocumento3 pagineVP Finance CAO Controller in Houston TX Resume Donald HelmerDonaldHelmerNessuna valutazione finora

- Chapter23 Audit of Cash BalancesDocumento37 pagineChapter23 Audit of Cash BalancesJesssel Marian AbrahamNessuna valutazione finora

- 8 Branches of Accounting SlideShareDocumento6 pagine8 Branches of Accounting SlideShareDjamilla CaparrosNessuna valutazione finora

- Pending Points To Be DiscussedDocumento6 paginePending Points To Be DiscussedGaurav ModiNessuna valutazione finora

- 2014 C Cash and Cash EquivalentsDocumento44 pagine2014 C Cash and Cash Equivalentsridwanali96Nessuna valutazione finora

- Report On TVS Srichakra Ltd.Documento48 pagineReport On TVS Srichakra Ltd.Nilesh Sorde100% (1)

- PMP - ProcurementDocumento17 paginePMP - Procurementmarks2muchNessuna valutazione finora