Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Corporate Governance in Myanmar

Caricato da

Samit DebCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Corporate Governance in Myanmar

Caricato da

Samit DebCopyright:

Formati disponibili

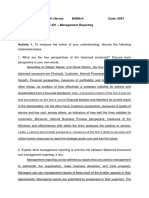

Emerging trends in the Myanmar

Governance landscape

Myanmar Governance scorecard

Myanmar is going through

enormous economic, political

and social transformation in

recent times.

Analysts and industry commentators have adopted a cautious stance on

doing business in Myanmar, especially with regards to governance failure

given that the regulatory framework still evolving.

Change is happening rapidly

and companies are gearing up

to embrace thorough strategic

and transformational initiatives.

However, challenges do remain

in the areas of Governance

to cope up with such

unprecedented development.

Inadequate

segregation of

roles between the

Ownership, Board

and Management

functions

In general, for emerging economies facing the rapid liberalisation of markets,

a window exists in which governance infrastructure and controls struggle to

catch up with the pace of development.

Corporate

Governance

Calegories

Average Scores by Country

Singapore

India

Philippines

Indonesia

Our

Comparative

Score

Myanmar

Corporate

Governance

in Myanmar

CG Rules and

Practices

Enforcement

Board members

lack relevant

operational,

financial and

industrial

experience

Politcal and

Regulatory

IGAAP

CG Culture

Leading

Limited

transparency

around selection,

performance

evaluation and

remuneration of

Board members

Establishing and

maintaining a

risk management

framework not

prioritised

Optimising

Developing

Contacts

Greg Unsworth

+65 6236 3738 / +65 9848 6025

greg.unsworth@sg.pwc.com

Sanjoy Banerjee

+65 6236 4452

sanjoy.banerjee@sg.pwc.com

Jasmine Thazin Aung

+959 450023 688

jasmine.t.aung@mm.pwc.com

Succession plans

for key personnel

not formalised

Samit Deb

+959 961049 664 / +65 8168 4135

samitendra.k.deb@sg.pwc.com

2015 PricewaterhouseCoopers LLP. All rights reserved. In this document, PwC refers to PricewaterhouseCoopers LLP or, as the context requires, the PricewaterhouseCoopers global network or other member firms of

the network, each of which is a separate legal entity.

Developing Governance,

enhancing performance

Our Corporate Governance

Framework

Our approach to delivering value

Our Corporate Governance

framework will help you

identify existing gaps and areas

opportunities for improvement

within your organisation.

At PwC, we understand that all business needs are unique. We tailor our approach to suit you, from providing you with market

comparisons to building your governance framework.

Our Governance Framework focuses

on the following key areas:

Strategy oversight

Availability of quality information

Implementation and monitoring

Monitoring major capital expenditure

Understanding your requirements

Comparison with regional peers

Gap Analysis Report

Implementation roadmap

Consultation with executives and

management

Building the Corporate

Governance Framework

Risk and Crisis Management

Risk Management Framework

Cyber and technology impact

Crisis Response Framework

Corporate ethics

Communication of clear expectation

Availability of clear channels of reporting to employees

Investigation and consistent enforcement

Monitoring company performance

KPI alignment to strategy

Presence of non-financial KPI

Periodic evaluation of performance metrics

Transformational transactions

Management evaluation,

compensation & succession

Linking incentives and rewards with performance

Succession planning and evaluation

What we offer you

Key

focus

Business alliances

Mergers, acquisitions and carve-outs

Diagnostic study and

gap analysis

Financial reporting

Disclosures on financial risk and other methods

Transparency of other disclosures (non-regulatory)

Corporate communication

Board dynamics

Board composition

Board processes

Board training and education

Board evaluations

How we can help

Communicate with stakeholders

Governance

structure

Corporate Governance

Framework

development and

enhancement

(charters, Governance

structure, etc.)

Code of Ethics and

other supporting

documents evaluation

Organisation

structure assessment

Diagnostic studies for

overall structure and

skill sets

Assessment of roles &

responsibilities

Target Operating

Model generation and

evaluation

Internal controls

Policy-procedure

development

Process

documentation and

evaluation

Fraud risk assessment

Rollout of Control Self

Assessment

Internal audit set up

Establishing IA

Charter, Methodology,

Framework and

strategic audit plan

Training and assistance

to develop competency

Quality Assurance

Review

Enterprise risk

advisory

Workshop on

developing risk

registers with risk

assessment and risk

treatments

Review of risk

management

framework

Help develop

risk manual with

risk policy, risk

management structure,

roles & responsibilities

and processes

Potrebbero piacerti anche

- Dynamic Management PhilosophyDocumento22 pagineDynamic Management PhilosophyVarma DantuluriNessuna valutazione finora

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldDa EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNessuna valutazione finora

- BEC Study Guide 4-19-2013Documento220 pagineBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- CGMA - Role - of - Management - Accounting PDFDocumento5 pagineCGMA - Role - of - Management - Accounting PDFAbdulaziz Khattak Abu FatimaNessuna valutazione finora

- Who's Driving Performance Management?: STRATEGY: Key To Determining The Right DriverDocumento3 pagineWho's Driving Performance Management?: STRATEGY: Key To Determining The Right DriverHamood RehmanNessuna valutazione finora

- M1-1 MGT Accounting & OrgDocumento19 pagineM1-1 MGT Accounting & OrgKetoisophorone WongNessuna valutazione finora

- Research On The Dimensions and Path Selection of Enterprise Performance Evaluation Under Balanced ScorecardDocumento4 pagineResearch On The Dimensions and Path Selection of Enterprise Performance Evaluation Under Balanced ScorecardBhavish RamroopNessuna valutazione finora

- ISCADocumento11 pagineISCAaramsivaNessuna valutazione finora

- Balance ScorecardDocumento11 pagineBalance ScorecardkirandeepNessuna valutazione finora

- Management AuditingDocumento30 pagineManagement Auditingmukeshkumar91Nessuna valutazione finora

- Strategy Implementation-Balanced Score CardDocumento109 pagineStrategy Implementation-Balanced Score CardNisha Mary100% (3)

- Balance Scorecard and BenchmarkingDocumento12 pagineBalance Scorecard and BenchmarkingGaurav Sharma100% (1)

- Makerere University Business School Strategic Management CourseDocumento21 pagineMakerere University Business School Strategic Management CourseSoniya Omir VijanNessuna valutazione finora

- Controls For Differentiated StrategiesDocumento26 pagineControls For Differentiated Strategiesaparnaiyer8867% (3)

- AF313 Lecture 2.1 Strategic Management AccountingDocumento28 pagineAF313 Lecture 2.1 Strategic Management Accountings11186706Nessuna valutazione finora

- 20231215205245D6289 6.strategyperformancemeasurementDocumento19 pagine20231215205245D6289 6.strategyperformancemeasurementtediprasetyo44Nessuna valutazione finora

- Auditing QuizzesDocumento30 pagineAuditing QuizzesScarlett FernandezNessuna valutazione finora

- Non Financial Performance EvaluationDocumento18 pagineNon Financial Performance EvaluationRachel GreeneNessuna valutazione finora

- Importance Transparancy and DisclosourDocumento11 pagineImportance Transparancy and DisclosourLingaraj SubudhiNessuna valutazione finora

- Chapter 4Documento11 pagineChapter 4Bedri M AhmeduNessuna valutazione finora

- Cpa As Cfo WhitepaperDocumento9 pagineCpa As Cfo WhitepaperHamza Any100% (1)

- Introduction To Performance Managemen: Lecture # 1Documento91 pagineIntroduction To Performance Managemen: Lecture # 1Muhammad SaleemNessuna valutazione finora

- Managerial AccountingDocumento14 pagineManagerial Accounting2023-2-95-013Nessuna valutazione finora

- Strategic HRM and Emerging TrendsDocumento18 pagineStrategic HRM and Emerging Trendsakashcc1985Nessuna valutazione finora

- U4 Performance MGMTDocumento29 pagineU4 Performance MGMTlaket64875Nessuna valutazione finora

- PM Commission Issue Paper 4Documento4 paginePM Commission Issue Paper 4omonydrewNessuna valutazione finora

- Management Accounting in The 21st CenturyDocumento3 pagineManagement Accounting in The 21st Centuryzkolololo100% (1)

- GRC PWC IntegritydrivenperformanceDocumento52 pagineGRC PWC IntegritydrivenperformanceDeepak YakkundiNessuna valutazione finora

- Strategy EvaluationDocumento15 pagineStrategy EvaluationAnkit BawaNessuna valutazione finora

- Chapter 1 - Introduction To Managerial AccountingDocumento18 pagineChapter 1 - Introduction To Managerial AccountingEnrique Miguel Gonzalez Collado75% (4)

- Chap 11Documento20 pagineChap 11Kirankumar ParmarNessuna valutazione finora

- Resume: Cost Management and StrategyDocumento4 pagineResume: Cost Management and StrategyAniya SaburoNessuna valutazione finora

- Strategic Management & Business PlanningDocumento43 pagineStrategic Management & Business PlanningharshcfmNessuna valutazione finora

- TATA Businesss Excellence ModelDocumento4 pagineTATA Businesss Excellence ModelSaurabh ChoudharyNessuna valutazione finora

- M&M PmsDocumento27 pagineM&M PmsAshishNessuna valutazione finora

- Balanced ScorecardDocumento22 pagineBalanced Scorecardshreyas_1392100% (1)

- COMPANY A - BPM Assessment - Final PDFDocumento35 pagineCOMPANY A - BPM Assessment - Final PDFhussein jardali100% (1)

- Disney Balanced ScorecardDocumento33 pagineDisney Balanced ScorecardAishah Abdul HalimNessuna valutazione finora

- CBME 2 Module 9Documento30 pagineCBME 2 Module 9Rohny AbaquinNessuna valutazione finora

- 1:1 ABSTRACT: The Continuous Pursuit of Excellence Is The Underlying and EverDocumento29 pagine1:1 ABSTRACT: The Continuous Pursuit of Excellence Is The Underlying and EveryudhistharNessuna valutazione finora

- Overcoming Barriers To Effective Risk ManagememtDocumento3 pagineOvercoming Barriers To Effective Risk ManagememtpeterwtcNessuna valutazione finora

- 54268-The Balanced ScorecardDocumento33 pagine54268-The Balanced Scorecardshahzad2689100% (2)

- A Study of Performance Management System in WiproDocumento11 pagineA Study of Performance Management System in WiproSahajada Alam100% (1)

- Eval and CTRLDocumento20 pagineEval and CTRLanitikaNessuna valutazione finora

- Strategic HRM and Emerging TrendsDocumento18 pagineStrategic HRM and Emerging TrendsSharadakle CkleNessuna valutazione finora

- Code of Corporate GovernanceDocumento30 pagineCode of Corporate GovernanceJagrityTalwarNessuna valutazione finora

- What Is A Well Governed CompanyDocumento40 pagineWhat Is A Well Governed CompanyFatima RamosNessuna valutazione finora

- Chapter 1 - Business PolicyDocumento6 pagineChapter 1 - Business PolicyNilcah Ortico100% (3)

- Salman Siddiqui CVDocumento5 pagineSalman Siddiqui CVsalman_siddiquie-1Nessuna valutazione finora

- Most Widely Used Managament Tools and TechniquesDocumento4 pagineMost Widely Used Managament Tools and Techniquesahtaha100% (1)

- Strategic Alignment For Driving Superior Business ResultsDocumento34 pagineStrategic Alignment For Driving Superior Business ResultsRohan RajNessuna valutazione finora

- Hervas - Uloa Let's AnalyzeDocumento2 pagineHervas - Uloa Let's AnalyzeClarizzaNessuna valutazione finora

- BSC - GeneralDocumento3 pagineBSC - Generalmohd1234567Nessuna valutazione finora

- Corporate Governance Using Balanced ScorecardDocumento11 pagineCorporate Governance Using Balanced Scorecardapi-3820836100% (2)

- Monitoring and Continuous AuditingDocumento0 pagineMonitoring and Continuous AuditingWarnherNessuna valutazione finora

- Ey Implementing A Governance Risk and Compliance ProgramDocumento2 pagineEy Implementing A Governance Risk and Compliance Programhellsailor100% (1)

- The Malcolm Baldrige Criteria For Performance Excellence 200910Documento4 pagineThe Malcolm Baldrige Criteria For Performance Excellence 200910drustagi100% (1)

- 2014-15 TBEM CriteriaDocumento110 pagine2014-15 TBEM Criteriavishbha50% (2)

- Chain of CommandDocumento6 pagineChain of CommandDale NaughtonNessuna valutazione finora

- Student Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDocumento2 pagineStudent Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDANIELA SIMONELLINessuna valutazione finora

- 1634313583!Documento24 pagine1634313583!Joseph Sanchez TalusigNessuna valutazione finora

- La Fonction Compositionnelle Des Modulateurs en Anneau Dans: MantraDocumento6 pagineLa Fonction Compositionnelle Des Modulateurs en Anneau Dans: MantracmescogenNessuna valutazione finora

- Visual Images of America in The Sixteenth Century: Elaine BrennanDocumento24 pagineVisual Images of America in The Sixteenth Century: Elaine Brennanjoerg_spickerNessuna valutazione finora

- GemDocumento135 pagineGemZelia GregoriouNessuna valutazione finora

- Entrenamiento 3412HTDocumento1.092 pagineEntrenamiento 3412HTWuagner Montoya100% (5)

- Q3 Lesson 5 MolalityDocumento16 pagineQ3 Lesson 5 MolalityAly SaNessuna valutazione finora

- Oral Communication in ContextDocumento31 pagineOral Communication in ContextPrecious Anne Prudenciano100% (1)

- Custom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityDocumento1 paginaCustom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityAndrew HunterNessuna valutazione finora

- PHD Thesis - Table of ContentsDocumento13 paginePHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- Present Continuous WorkshopDocumento5 paginePresent Continuous WorkshopPaula Camila Castelblanco (Jenni y Paula)Nessuna valutazione finora

- Physiology PharmacologyDocumento126 paginePhysiology PharmacologyuneedlesNessuna valutazione finora

- 9francisco Gutierrez Et Al. v. Juan CarpioDocumento4 pagine9francisco Gutierrez Et Al. v. Juan Carpiosensya na pogi langNessuna valutazione finora

- Answers To Quiz No 19Documento5 pagineAnswers To Quiz No 19Your Public Profile100% (4)

- Mathematics Into TypeDocumento114 pagineMathematics Into TypeSimosBeikosNessuna valutazione finora

- Personal Training Program Design Using FITT PrincipleDocumento1 paginaPersonal Training Program Design Using FITT PrincipleDan DanNessuna valutazione finora

- Deseret First Credit Union Statement.Documento6 pagineDeseret First Credit Union Statement.cathy clarkNessuna valutazione finora

- Matthew DeCossas SuitDocumento31 pagineMatthew DeCossas SuitJeff NowakNessuna valutazione finora

- Churches That Have Left RCCG 0722 PDFDocumento2 pagineChurches That Have Left RCCG 0722 PDFKadiri JohnNessuna valutazione finora

- DLL LayoutDocumento4 pagineDLL LayoutMarife GuadalupeNessuna valutazione finora

- Apple Festival Program 2017Documento3 pagineApple Festival Program 2017Elizabeth JanneyNessuna valutazione finora

- Chapter 3C Problem Solving StrategiesDocumento47 pagineChapter 3C Problem Solving StrategiesnhixoleNessuna valutazione finora

- Employer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailsDocumento2 pagineEmployer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailstheffNessuna valutazione finora

- Echeverria Motion For Proof of AuthorityDocumento13 pagineEcheverria Motion For Proof of AuthorityIsabel SantamariaNessuna valutazione finora

- Network Function Virtualization (NFV) : Presented By: Laith AbbasDocumento30 pagineNetwork Function Virtualization (NFV) : Presented By: Laith AbbasBaraa EsamNessuna valutazione finora

- Rele A Gas BuchholtsDocumento18 pagineRele A Gas BuchholtsMarco GiraldoNessuna valutazione finora

- Recent Cases On Minority RightsDocumento10 pagineRecent Cases On Minority RightsHarsh DixitNessuna valutazione finora

- Chapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFDocumento58 pagineChapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFAbdul Rahman SholehNessuna valutazione finora

- Information Security Policies & Procedures: Slide 4Documento33 pagineInformation Security Policies & Procedures: Slide 4jeypopNessuna valutazione finora