Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Santa Clara County Real Estate Report - Jan. 2016

Caricato da

Steve Mun GroupCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Santa Clara County Real Estate Report - Jan. 2016

Caricato da

Steve Mun GroupCopyright:

Formati disponibili

Local Market Trends

Santa Clara County

January/February 2016

Steve Mun

Keller Williams Realty

19400 Stevens Creek Blvd., #200

Cupertino, CA 95014

(650) 605-3188

steve@stevemun.com

http://www.stevemungroup.com

CalBRE #01358433

The Real Estate Report

The Hottest U.S. Housing Markets in December 2015

Just as wed expected, the residential real estate

market cooled down a bit in the last month of 2015,

with reduced demand and inventory in most major

marketsthough not as much of a slowdown as

the same time last year, according to a preliminary

analysis of the months data on realtor.com.

Jonathan Smoke, chief economist of realtor.com,

and his team carried out the data analysis and

identified the top 20 medium-to-large markets

where homes are moving fastest and interest

(based on listing views on realtor.com) is highest.

At the top of the list, for the second month in a row,

is San Francisco, followed by its sister Bay Area

city San Jose.

While California closed out our latest ranking still

firmly in control of the hottest markets, the Midwest

and Florida are both seeing substantial

improvement, said Smoke. Pent-up demand and

robust economic growth combined with limited

supply will keep California tight in 2016, but more

markets will challenge them as demand improves

elsewhere.

A few markets are new to the hot list this month:

Tampa, FL; Fort Wayne, IN; and Midland, TX.

These markets typically represent a greater metro

area, since people might work in a city but reside

in a nearby suburb. For example, San Francisco

also includes Oakland andHayward; San Jose

includes Sunnyvale and Santa Clara.

On the whole, the hottest markets receive about

1.4 to 2.9 times the number of views per listing

compared with the national average. Their homes

move off market 29 to 51 days more quickly than

the rest of the U.S., and they have also seen days

on market drop by a combined average of 15%

year over year.

At the top of the list, for the

second month in a row, is San

Francisco, followed by its sister

Bay Area city San Jose.

The hot list

1.

2.

3.

4.

5.

San Francisco, CA

San Jose, CA

Vallejo, CA

Dallas, TX

Sacramento, CA

Trends at a Glance

(Single-family Homes)

Dec 15

Nov 15

Dec 14

Median Price: $925,000

$970,000

$849,975

Av erage Price: $1,172,540 $1,220,730 $1,088,090

Home Sales:

811

684

676

Pending Sales:

536

838

519

Activ e Listings:

538

818

492

Sale/List Price Ratio:

102.5%

102.5%

102.3%

Day s on Market:

33

28

33

Day s of Inv entory :

20

35

22

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

San Diego, CA

Denver, CO

Santa Rosa, CA

Yuba City, CA

Stockton, CA

Los Angeles, CA

Oxnard, CA

Nashville, TN

Palm Bay, FL

Modesto, CA

Detroit, MI

Boulder, CO

Tampa, FL

Fort Wayne, IN

Midland, TX

Santa Clara County Homes: Momentum

60.0

_______________________

VISIT

http://www.stevemungroup.com

40.0

20.0

0.0

0MM J S N 0MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N

-20.0 8

9

0

1

2

3

4

5

-40.0

-60.0

Median Price

Sales

Pending

2016 rereport.com

for a free on-line market

analysis of your property.

You can also perform your

own personal search of

properties for sale.

Steve Mun | (650) 605-3188 | steve@stevemun.com | http://www.stevemungroup.com

Local Market Trends

Santa Clara County

January/February 2016

December Stats

SINGLE-FAMILY HOMES

30-Year Fixed Mortgage Rates

01-16

10-15

07-15

04-15

01-15

10-14

07-14

04-14

01-14

10-13

07-13

04-13

01-13

10-12

07-12

04-12

01-12

10-11

07-11

04-11

01-11

10-10

07-10

04-10

01-10

10-09

07-09

04-09

01-09

10-08

07-08

04-08

01-08

3.0%

CONDOMINIUMS

Year-Over-Year

Year-Over-Year

Median home prices increased by 8.8% year-over Median condo prices increased by 25.9% year-overyear to $925,000 from $849,975.

year to $632,500 from $502,500.

The average home sales price rose by 7.8% yearover-year to $1,172,540 from $1,088,090.

The average condo sales price rose by 22.5% yearover-year to $686,730 from $560,693.

Home sales rose by 20.0% year-over-year to 811

from 676.

Condo sales rose by 5.2% year-over-year to 324 from

308.

Total inventory* rose 6.2% year-over-year to 1,074

from 1,011.

Total inventory* rose 2.3% year-over-year to 307 from

300.

Sales price vs. list price ratio rose by 0.2% year-overyear to 102.5% from 102.3%.

Sales price vs. list price ratio rose by 1.7% year-overyear to 103.7% from 102.0%.

The average days on market fell by 1.2% year-overyear to 33 from 33.

The average days on market fell by 29.8% year-overyear to 21 from 30.

Month-Over-Month

Month-Over-Month

Median home prices slipped by 4.6% to $925,000

Median condo prices improved by 0.4% to $632,500

from $970,000.

from $630,000.

The average home sales price fell by 3.9% to

$1,172,540 from $1,220,730.

$686,730 from $695,679.

Home sales up by 18.6% to 811 from 684.

Total inventory* dropped 35.1% to 1,074 from 1,656.

Sales price vs. list price ratio dropped by 0.0% to

102.5% from 102.5%.

33 from 28.

5.0%

6.0%

7.0%

Condo sales up by 12.1% to 324 from 289.

Total inventory* dropped 38.7% to 307 from 501.

Sales price vs. list price ratio dropped by 0.2% to

103.7% from 103.9%.

The average days on market increased by 17.0% to

4.0%

The average condo sales price fell by 1.3% to

The average days on market increased by 1.8% to 21

from 21.

* Total inventory is active listings plus contingent or pending

8.0%

listings. Active listings do not include contingent listings.

The chart above shows the National

monthly average for 30-year fixed rate

mortgages as compiled by HSH.com.

The average includes mortgages of all

sizes, including conforming, "expanded

conforming," and jumbo.

Santa Clara County Homes: Median & Average Prices and Sales

$1,500

(3-month moving average price in 000's)

1,300

$1,300

1,100

$1,100

900

$900

700

$700

500

$500

$300

1,500

300

100

0MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N

9

0

1

2

3

4

5

2016 rereport.com

Santa Clara County - December 2015

Single-Family Homes

Cities

SCC

Campbell

Cupertino

Gilroy

Los Altos

Los Altos Hills

Los Gatos

Milpitas

Monte Sereno

Morgan Hill

Mountain View

Palo Alto

San Jose

Santa Clara

Saratoga

Sunny v ale

Prices

Median

Average Sales Pend Inven

$ 925,000 $ 1,172,540

811

536

538

$ 1,042,500 $ 1,147,830

26

9

11

$ 1,775,000 $ 1,848,370

19

15

8

$ 657,500 $

732,973

42

48

72

$ 2,610,000 $ 2,758,210

19

3

2

$ 3,875,000 $ 4,442,500

4

3

17

$ 1,825,000 $ 2,019,200

40

15

65

$ 755,000 $

804,115

13

31

17

$ 2,610,000 $ 2,596,500

6

0

4

$ 847,500 $

966,054

34

25

44

$ 1,710,000 $ 1,811,670

15

13

4

$ 2,503,500 $ 2,775,810

20

12

12

$ 820,000 $

896,105

453

306

231

$ 932,000 $

982,531

59

26

10

$ 2,150,000 $ 2,168,310

19

8

31

$ 1,355,280 $ 1,370,560

42

22

10

% Change from Year Before

DOI

20

13

13

51

3

128

49

39

20

39

8

18

15

5

49

7

SP/LP

102.5%

101.9%

106.6%

98.4%

102.6%

98.9%

98.9%

104.9%

108.3%

98.6%

109.0%

106.7%

102.2%

105.4%

103.4%

105.4%

Prices

Med Ave

8.8% 7.8%

4.3% 12.6%

-0.5% 4.8%

9.4% 13.3%

5.5% -8.4%

-23.4% -0.6%

-0.1% -1.3%

-5.6% 0.5%

-18.4% -8.2%

2.4% 11.3%

13.5% 13.5%

11.3% 15.3%

7.9% 8.5%

10.2% 6.3%

4.9% -5.7%

11.5% 12.3%

Sales

20.0%

52.9%

58.3%

10.5%

5.6%

-33.3%

81.8%

-53.6%

100.0%

0.0%

50.0%

11.1%

20.5%

103.4%

72.7%

-10.6%

Pend' Inven'

3.3%

9.3%

-10.0%

57.1%

50.0% 166.7%

29.7%

16.1%

-72.7% -33.3%

-40.0%

21.4%

0.0% 109.7%

34.8%

70.0%

n/a -55.6%

47.1%

0.0%

116.7%

33.3%

50.0%

9.1%

2.7%

1.3%

-7.1%

25.0%

-50.0%

34.8%

-8.3%

66.7%

% Change

Median Price

Peak Trough

6.5% 108.4%

0.5%

89.6%

-1.4%

90.9%

-19.3% 108.7%

4.2% 123.1%

-23.4% 124.6%

-6.4%

93.6%

-8.5%

81.9%

-61.8% 208.9%

-15.3%

91.1%

5.2% 131.7%

-19.1% 110.4%

3.4% 102.5%

3.8%

79.2%

-4.7% 150.6%

5.9% 160.6%

Local Market Trends

Santa Clara County

January/February 2016

If your property is listed with a real estate

broker, please disregard. It is not our

intention to solicit the offerings of other

real estate brokers. We are happy to work

with them and cooperate fully.

Santa Clara County Homes: Year-Over-Year Median Price Change

40.0%

30.0%

20.0%

Based on information from MLS Listings.

Inc. Due to MLS reporting and allowable

reporting policy, this data is only informational and may not be completely accurate. Therefore, we do not guarantee the

data accuracy.

10.0%

0.0%

-10.0%

-20.0%

0MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N

9

0

1

2

3

4

5

Data maintained by the MLS may not

reflect all real estate activity in the market.

-30.0%

-40.0%

-50.0%

2016 rereport.com

Santa Clara County Homes: Year-over-year change in Median Price

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

Table Definitions

_______________

0

6

0

7

0

8

0

9

1

0

1

1

1

2

1

3

1

4

1

5

Median Price

The price at which 50% of prices

were higher and 50% were lower.

2016 rereport.com

Average Price

Add all prices and divide by the

number of sales.

Santa Clara County Condos: Median & Average Prices and Sales

SP/LP

(3-month moving average price in 000's)

$800

500

$700

450

$600

400

350

$500

300

$400

250

$300

200

$200

150

$100

100

0MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N 1MM J S N

9

0

1

2

3

4

5

2016 rereport.com

Sales price to list price ratio or the

price paid for the property divided

by the asking price.

DOI

Days of Inventory, or how many

days it would take to sell all the

property for sale at the current rate

of sales.

Pend

Property under contract to sell that

hasnt closed escrow.

Inven

Number pf properties actively for

sale as of the last day of the month.

Santa Clara County - December 2015

Condos/Townhomes

Cities

SCC

Campbell

Cupertino

Gilroy

Los Altos

Los Gatos

Milpitas

Morgan Hill

Mountain View

Palo Alto

San Jose

Santa Clara

Saratoga

Sunny v ale

Prices

Median

Average Sales Pend Inven

$ 632,500 $

686,730

324

182

125

$ 683,136 $

661,659

8

1

3

$ 1,065,600 $ 1,091,030

6

2

5

$ 343,000 $

347,963

3

1

1

$ 1,409,750 $ 1,409,750

2

3

2

$ 1,090,000 $ 1,049,170

9

2

1

$ 640,000 $

598,310

21

6

4

$ 600,000 $

591,743

7

3

2

$ 900,000 $

920,285

22

12

7

$ 1,337,500 $ 1,349,110

8

8

5

$ 580,000 $

576,001

193

118

79

$ 712,000 $

723,804

23

11

9

$ 1,445,000 $ 1,445,000

2

0

1

$ 973,000 $

945,175

20

15

6

% Change from Year Before

DOI

12

11

25

10

30

3

6

9

10

19

12

12

15

9

SP/LP

103.7%

104.3%

108.6%

100.1%

105.4%

103.5%

102.8%

101.0%

107.7%

103.3%

103.0%

104.1%

96.7%

107.4%

Prices

Med Ave

25.9% 22.5%

4.1% 8.0%

27.6% 25.4%

31.9% 23.2%

-39.4% -39.4%

14.1% 18.3%

7.0% 2.9%

33.3% 34.5%

10.6% 10.4%

13.8% 14.1%

24.7% 20.6%

31.9% 24.9%

97.9% 86.5%

22.7% 21.7%

Sales

5.2%

-27.3%

100.0%

0.0%

100.0%

0.0%

16.7%

-22.2%

120.0%

33.3%

-0.5%

0.0%

-33.3%

11.1%

Pend' Inven'

-9.5%

26.3%

-85.7%

50.0%

100.0%

n/a

-75.0%

0.0%

200.0%

n/a

-50.0% -50.0%

0.0% -42.9%

-57.1% -33.3%

100.0% 600.0%

100.0%

n/a

-9.2%

2.6%

10.0%

50.0%

n/a

n/a

-11.8%

n/a

% Change

Median Price

Peak Trough

15.2% 200.5%

-14.6% 135.6%

11.0%

96.3%

-32.7%

#DIV/0!

-39.4% 178.8%

9.0% 222.5%

-0.9% 218.4%

1.9% 212.5%

3.4% 129.3%

-12.2% 162.3%

14.6% 213.5%

22.1% 167.2%

22.1% 167.2%

22.7% 182.0%

THE REAL ESTATE REPORT

Santa Clara County

Steve Mun

Keller Williams Realty

19400 Stevens Creek Blvd., #200

Cupertino, CA 95014

(650) 605-3188

steve@stevemun.com

Santa Clara County Homes: Pending & Existing Home Sales

2,500

(3-month moving average)

2,000

1,500

1,000

500

0

0 MM J S N 1 MM J S N 1 MM J S N 1 MM J S N 1 MM J S N 1 MM J S N 1 MM J S N

9

0

1

2

3

4

5

2016 rereport.com

Santa Clara County Homes: Sales Price/Listing Price Ratio

109%

107%

105%

103%

101%

99%

97%

95%

0MMJ SN0MMJ SN0MMJ SN0MMJ SN1MMJ SN1MMJ SN1MMJ SN1MMJ SN1MMJ SN1MMJ SN

6

7

8

9

0

1

2

3

4

5

2016 rereport.com

This Real Estate Report is published and copyrighted by http://rereport.com.

Information contained herein is deemed accurate and correct, but no warranty is implied or given.

Potrebbero piacerti anche

- Cliff Deal Keeps Tax Hel.Documento1 paginaCliff Deal Keeps Tax Hel.Steve Mun GroupNessuna valutazione finora

- 2012 Base API County List of Schools - SANTA CLARA CountyDocumento15 pagine2012 Base API County List of Schools - SANTA CLARA CountySteve Mun GroupNessuna valutazione finora

- Cash Incentives FlyerDocumento1 paginaCash Incentives FlyerSteve Mun GroupNessuna valutazione finora

- The Modesto Bee - Jail Time in Stanislaus Real Estate FraudDocumento1 paginaThe Modesto Bee - Jail Time in Stanislaus Real Estate FraudSteve Mun GroupNessuna valutazione finora

- Bofa Approval LetterDocumento3 pagineBofa Approval LetterSteve Mun GroupNessuna valutazione finora

- WF Approval LetterDocumento6 pagineWF Approval LetterSteve Mun GroupNessuna valutazione finora

- Ha Fa UpdatesDocumento1 paginaHa Fa UpdatesSteve Mun GroupNessuna valutazione finora

- Wells Fargo ApprovalDocumento3 pagineWells Fargo ApprovalSteve Mun GroupNessuna valutazione finora

- Ha Fa UpdatesDocumento1 paginaHa Fa UpdatesSteve Mun GroupNessuna valutazione finora

- FBI StatsDocumento1 paginaFBI StatsSteve Mun GroupNessuna valutazione finora

- Mortgage Payments Weighing You Down ReportDocumento3 pagineMortgage Payments Weighing You Down ReportSteve Mun GroupNessuna valutazione finora

- Bofa AnnouncementDocumento2 pagineBofa AnnouncementSteve Mun GroupNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Mongodb Use Case GuidanceDocumento25 pagineMongodb Use Case Guidancecresnera01Nessuna valutazione finora

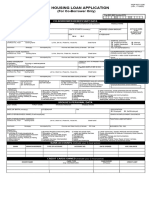

- HLF1036 HousingLoanApplicationCoBorrower V01Documento2 pagineHLF1036 HousingLoanApplicationCoBorrower V01Andrei Notario Manila100% (1)

- 96boards Iot Edition: Low Cost Hardware Platform SpecificationDocumento15 pagine96boards Iot Edition: Low Cost Hardware Platform SpecificationSapta AjieNessuna valutazione finora

- A Coming Out Guide For Trans Young PeopleDocumento44 pagineA Coming Out Guide For Trans Young PeopleDamilare Og0% (1)

- Banyuwangi Legend PDFDocumento10 pagineBanyuwangi Legend PDFVerolla PetrovaNessuna valutazione finora

- SALES - Cui Vs Cui - Daroy Vs AbeciaDocumento5 pagineSALES - Cui Vs Cui - Daroy Vs AbeciaMariaAyraCelinaBatacan50% (2)

- Executive Case Digest - CompleteDocumento15 pagineExecutive Case Digest - CompleteKatherine Aquino100% (1)

- Lungi Dal Caro Bene by Giuseppe Sarti Sheet Music For Piano, Bass Voice (Piano-Voice)Documento1 paginaLungi Dal Caro Bene by Giuseppe Sarti Sheet Music For Piano, Bass Voice (Piano-Voice)Renée LapointeNessuna valutazione finora

- Oscar Niemeyer: History StyleDocumento1 paginaOscar Niemeyer: History StyleAntonette RabuyaNessuna valutazione finora

- Pre Shipment and Post Shipment Finance: BY R.Govindarajan Head-Professional Development Centre-South Zone ChennaiDocumento52 paginePre Shipment and Post Shipment Finance: BY R.Govindarajan Head-Professional Development Centre-South Zone Chennaimithilesh tabhaneNessuna valutazione finora

- Capital InsuranceDocumento8 pagineCapital InsuranceLyn AvestruzNessuna valutazione finora

- BDA Advises JAFCO On Sale of Isuzu Glass To Basic Capital ManagementDocumento3 pagineBDA Advises JAFCO On Sale of Isuzu Glass To Basic Capital ManagementPR.comNessuna valutazione finora

- M5a78l-M Lx3 - Placas Madre - AsusDocumento3 pagineM5a78l-M Lx3 - Placas Madre - AsusjuliandupratNessuna valutazione finora

- BLCTE - MOCK EXAM II With Answer Key PDFDocumento20 pagineBLCTE - MOCK EXAM II With Answer Key PDFVladimir Marquez78% (18)

- Claim Form - Part A' To 'Claim Form For Health Insurance PolicyDocumento6 pagineClaim Form - Part A' To 'Claim Form For Health Insurance Policyanil sangwanNessuna valutazione finora

- Socialism and IslamDocumento5 pagineSocialism and IslamAbdul kalamNessuna valutazione finora

- Quality Manual.4Documento53 pagineQuality Manual.4dcol13100% (1)

- CSI Effect PaperDocumento6 pagineCSI Effect PaperDanelya ShaikenovaNessuna valutazione finora

- Owner Contractor AgreementDocumento18 pagineOwner Contractor AgreementJayteeNessuna valutazione finora

- Intellectual Property and Domain Name Dispute Resolution in Arbitration in Malaysia - A Practical GuideDocumento29 pagineIntellectual Property and Domain Name Dispute Resolution in Arbitration in Malaysia - A Practical GuideDBNessuna valutazione finora

- Mandel 1965 Thesis On Jish Immign 1882-1914Documento580 pagineMandel 1965 Thesis On Jish Immign 1882-1914Gerald SackNessuna valutazione finora

- Giants of DawleyDocumento94 pagineGiants of DawleytoobaziNessuna valutazione finora

- Tabang vs. National Labor Relations CommissionDocumento6 pagineTabang vs. National Labor Relations CommissionRMC PropertyLawNessuna valutazione finora

- Application Form For Business Permit 2016Documento1 paginaApplication Form For Business Permit 2016Monster EngNessuna valutazione finora

- Conflict Management HandbookDocumento193 pagineConflict Management HandbookGuillermo FigueroaNessuna valutazione finora

- Necrowarcasters Cards PDFDocumento157 pagineNecrowarcasters Cards PDFFrancisco Dolhabaratz100% (2)

- Chapter 13Documento30 pagineChapter 13Michael Pujalte VillaflorNessuna valutazione finora

- POCSODocumento12 paginePOCSOPragya RaniNessuna valutazione finora

- US v. Esmedia G.R. No. L-5749 PDFDocumento3 pagineUS v. Esmedia G.R. No. L-5749 PDFfgNessuna valutazione finora

- Entrep Q4 - Module 5Documento10 pagineEntrep Q4 - Module 5Paula DT PelitoNessuna valutazione finora