Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Topic 5 - Sukokokopplemental Tasks and Exercises (Week 17)

Caricato da

Taylor Kongitti PraditDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Topic 5 - Sukokokopplemental Tasks and Exercises (Week 17)

Caricato da

Taylor Kongitti PraditCopyright:

Formati disponibili

Topic 5: Seminar Tasks and Exercises

5.1

What is the difference between an interim dividend and a final dividend?

Interim dividend is paid to shareholders before the companys final annual earnings are to be

ascertained. Interim dividends are paid out at the time that the company reports its profits and

interim financial statements for the period. Interim dividends are paid from undistributed

profits that have been brought forward. Interim dividends may be paid quarterly or every six

months, depending on thereserves that the company holds.

final dividends will be paid at the end of the financial year. Final dividends are declared and

calculated once the companys overall financial position and profitability has been

determined. Since final dividends will be paid out once the companys end of year financial

statements have been prepared and audited, the decisions regarding final dividend payments

will be fuelled by more insights and information on the companys financial health. This

means that in the event that the company is unable to make dividend payments at year end,

the dividends maybe carried forward to the next accounting period.

5.2 Explain how each of the following reserves may arise:

Share Premium

Share premium is the amount received by a company over and above the face value of its shares.

Face value of a share is its value that is printed on the share certificate. For example, face

value of a $1 share is one dollar. But just because the value of share is printed $1 does not necessarily

mean that the share is worth only one dollar. If a company has a history of good financial

performance, it can sell its shares at a price higher than the face value of the shares. This difference

between the selling price and the face value of a share is known as share premium.

It is important to note that share premium arises only when the company sells the shares. It

arises only when a company issues new equity shares. It does not arise when the investor sells

shares at a price greater than face value. If a company sells a share whose face value is $1 at a price of

$2, the company earns a share premium of $1. But subsequently if the investor sells the same share to

someone else at a price of $4, no share premium will be gained by the company. The investor will

benefit from this gain.

Retained earnings

Retained earnings are the profits generated by a company that are not distributed as dividends to the

shareholders. The retained earnings are the sum of profits that have been retained by a company since

its inception. They are reduced by the losses. Retained earnings are also known as accumulated

surplus, accumulated profits, accumulated earnings, undivided profits and earned surplus.

When a company makes profits, the board of directors has two choices. It can either distribute these

profits as cash dividends or it can retain these profits and reinvest them for future growth. A company

may retain its profits in a reserve to serve some specific objectives. For example, a company may

retain its profits to create a reserve for paying off a debt or for purchasing an expensive capital asset.

Revaluation Reserve

Revaluation reserves (or, more precisely, revaluation surplus reserves) arise when the value of an asset

becomes greater than the value at which it was previously carried on the balance sheet, increasing

shareholders funds. Not every increase in value is added to the revaluation reserve, and the exact

treatment depends on the history of the asset: in particular, whether it has been impaired.

5.3 This exercise is formally assessed

Show how the Capital and Reserves section of the Statement of Financial Position will look for the

following company, after taking all of the following into account.

i)

Authorised Share Capital is 1 million 50p Ordinary shares of which 700,000 have

been issued, all being issued at 2 each. The market price for each share is now 3.

The Share Capital Account shown on Balance Sheet = Nominal value x no. of shares issued

=>700,000 x 0.5 =350,000.

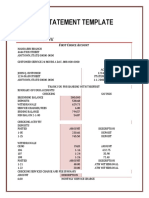

Statement of Financial Position Extract

Current Assets:

Bank

(700,000x3)

1,400,000

Equity

Ordinary Share Capital of 0.50p each

350,000

Share Premium Account

(1,400k-350k=) 1,050,000

Market Capitalisation= 700,000*3 = 2,100,000

ii)

The company has re-valued land owned to 300,000. It had previously been shown

in the accounts at its cost price of 75,000.

Revaluation of property, plant and equipment Under IFRS it is acceptable, but not required, to restate

the values of property, plant and equipment to fair value. A surplus on revaluation would be

recorded as a reserve movement, not as income.

Revaluation Reserve surplus: 300,000-75,000 = 225,000

iii)

This years profit for the year attributable to shareholders was 250,000. A final

dividend of 10p per share was paid for the previous year (there was no interim

dividend).

Retained profits brought forward into this year totalled 110,000.

It is a key link between the statement of financial position and the income statement:

Beginning Retained Earnings

+/- Net Income (Loss)

- Dividends

= Ending Retained Earnings

Total dividend payment = 10p x 700,000 =70,000

Beginning Retained Earnings 110,000

Net Income

250,000

Dividend

(70,000)

Ending Retained Earnings

290,000

5.4 At the end of the Annual General Meeting of Better Brewers Ltd, a shareholder has asked the

following question:

Why does the company leave so much money in the Retained Earnings account on the Statement of

Financial Position? Surely it would be better to spend it to modernise our machinery.

How would you reply to the shareholders?

1. Save Money:

Set aside cash for expected future expenses .Set aside cash for unexpected future expenses

2. Spend Money:

Buy fixed assets (capital expenditures) Research and develop new tools and products

Pay bonuses to executives and other employees. Pay down debt

Acquire another company.License intellectual property, such as patent rights .Expand the market for

your products .Make investments that, hopefully, will generate a profit

3)Stock Repurchase

Give money to you(shareholders) Increase the value of existing shares. Distribute cash directly. The

most common way for a company to increase the value of its shares is to buy a large number of them

on the open market and then take those shares out of circulation. This is called a stock repurchase or

share buyback.

Potrebbero piacerti anche

- Accounting For and Reporting of Preference SharesDocumento19 pagineAccounting For and Reporting of Preference SharesAis Syang DyaNessuna valutazione finora

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideDa EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNessuna valutazione finora

- Fin Man Dividend PolicyDocumento26 pagineFin Man Dividend PolicyMarriel Fate CullanoNessuna valutazione finora

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementDa EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNessuna valutazione finora

- Module 9 Stocks Bonds Mutual FundsDocumento7 pagineModule 9 Stocks Bonds Mutual FundsKristine MartinezNessuna valutazione finora

- BUSINESS FINANCE Week 2Documento7 pagineBUSINESS FINANCE Week 2Ace San GabrielNessuna valutazione finora

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocumento4 pagineBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingSamsung AccountNessuna valutazione finora

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocumento4 pagineBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingLoudie Ann MarcosNessuna valutazione finora

- Module 3 Divisible ProfitsDocumento8 pagineModule 3 Divisible ProfitsVijay KumarNessuna valutazione finora

- Company AccountingDocumento7 pagineCompany AccountingMsuBrainBoxNessuna valutazione finora

- FM10e ch17Documento51 pagineFM10e ch17gurleen_2Nessuna valutazione finora

- Lesson 6 - Statement of Financial Position (Part 2)Documento9 pagineLesson 6 - Statement of Financial Position (Part 2)yana jungNessuna valutazione finora

- Chapter 17 Dividend PolicyDocumento7 pagineChapter 17 Dividend PolicyAia GarciaNessuna valutazione finora

- Corporate Action Final DhirajDocumento32 pagineCorporate Action Final Dhirajmishradhiraj533_gmaiNessuna valutazione finora

- Dividend Policy-Lecture and ExercisesDocumento6 pagineDividend Policy-Lecture and ExercisesRica RegorisNessuna valutazione finora

- Dividend: Factors Affecting Dividend PolicyDocumento11 pagineDividend: Factors Affecting Dividend PolicyNouman SheikhNessuna valutazione finora

- Different Types of DividendDocumento7 pagineDifferent Types of DividendAnshul Mehrotra100% (1)

- Appropriated P & L DetailsDocumento10 pagineAppropriated P & L DetailsM Usman AslamNessuna valutazione finora

- Dividend Policy (S)Documento3 pagineDividend Policy (S)Nahian ShalimNessuna valutazione finora

- Module 8 - Shareholders' Equity, Retained Earnings, and DividendsDocumento10 pagineModule 8 - Shareholders' Equity, Retained Earnings, and DividendsLaurio, Genebabe TagubarasNessuna valutazione finora

- Financial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFDocumento67 pagineFinancial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFKristieKelleyenfm100% (11)

- Chapter 16Documento17 pagineChapter 16Punit SharmaNessuna valutazione finora

- CH 18: Dividend PolicyDocumento55 pagineCH 18: Dividend PolicySaba MalikNessuna valutazione finora

- Dividends: 1.1 Definition of DividendDocumento11 pagineDividends: 1.1 Definition of Dividendshiza sheikhNessuna valutazione finora

- Dividends: 1.1 Definition of DividendDocumento11 pagineDividends: 1.1 Definition of Dividendshiza sheikhNessuna valutazione finora

- Accounting For Corporation - Retained EarningsDocumento50 pagineAccounting For Corporation - Retained EarningsAlessandraNessuna valutazione finora

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingDocumento39 pagineWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooNessuna valutazione finora

- Dividend Policy - 072 - MBS - 1st - Year PDFDocumento5 pagineDividend Policy - 072 - MBS - 1st - Year PDFRasna ShakyaNessuna valutazione finora

- Valuation Methods: Common StocksDocumento17 pagineValuation Methods: Common StocksJacinta Fatima ChingNessuna valutazione finora

- Week 9Documento76 pagineWeek 9BookAddict721Nessuna valutazione finora

- Chapter 7 Stockholers Equity FinalDocumento77 pagineChapter 7 Stockholers Equity FinalSampanna ShresthaNessuna valutazione finora

- AS20Documento10 pagineAS20Selvi balanNessuna valutazione finora

- Mutual FundDocumento10 pagineMutual FundmadhuNessuna valutazione finora

- Unit IV: Dividend DecisionsDocumento7 pagineUnit IV: Dividend DecisionsGANESH RAPARTHINessuna valutazione finora

- Corporate Finance BasicsDocumento27 pagineCorporate Finance BasicsAhimbisibwe BenyaNessuna valutazione finora

- Dividend Policy of Reliance Industries SwatiDocumento24 pagineDividend Policy of Reliance Industries SwatiYashasvi KothariNessuna valutazione finora

- Accounting Quizzes Answer KeyDocumento11 pagineAccounting Quizzes Answer KeyRae SlaughterNessuna valutazione finora

- Sec: B Financial AnalysisDocumento8 pagineSec: B Financial AnalysisSaifiNessuna valutazione finora

- What Is Specialized Mutual FundDocumento7 pagineWhat Is Specialized Mutual FundNoman KhosaNessuna valutazione finora

- Analyzing Investing Activities:: Special TopicsDocumento40 pagineAnalyzing Investing Activities:: Special TopicsAbhishek PandaNessuna valutazione finora

- Bonusshares 1227282760548069 8Documento4 pagineBonusshares 1227282760548069 8Samvid JhinganNessuna valutazione finora

- Retained EarningsDocumento39 pagineRetained EarningsPrincess Aubrey BalbinNessuna valutazione finora

- Corporations Part 3Documento20 pagineCorporations Part 3Miss LunaNessuna valutazione finora

- 10 Chapter UGLEDocumento26 pagine10 Chapter UGLEMahek AroraNessuna valutazione finora

- Dividend Policy of Reliance Industries Itd.Documento24 pagineDividend Policy of Reliance Industries Itd.rohit280273% (11)

- Financial ManagementDocumento48 pagineFinancial ManagementHardik SharmaNessuna valutazione finora

- Group 3 - Mombasa CampusDocumento26 pagineGroup 3 - Mombasa CampusMaina EricNessuna valutazione finora

- Change in PSR (I)Documento7 pagineChange in PSR (I)Payal bhatiaNessuna valutazione finora

- Goodwill PDFDocumento14 pagineGoodwill PDFShaileshNessuna valutazione finora

- Share CapitalDocumento6 pagineShare CapitalAashi DharwalNessuna valutazione finora

- Dividends PDFDocumento41 pagineDividends PDFHarold EspirituNessuna valutazione finora

- Accounting Chapter 9Documento7 pagineAccounting Chapter 9Angelica Faye DuroNessuna valutazione finora

- Dividend Decision Part 1Documento10 pagineDividend Decision Part 1avinashchoudhary2043Nessuna valutazione finora

- Accumulated Profits or LossesDocumento6 pagineAccumulated Profits or LossesMayaNessuna valutazione finora

- Reporting and Analyzing Owner FinancingDocumento38 pagineReporting and Analyzing Owner FinancingNing WangNessuna valutazione finora

- Fsa 9NDocumento4 pagineFsa 9Npriyanshu.goel1710Nessuna valutazione finora

- Study Guide E4: Internal Sources of Finance and Dividend PolicyDocumento17 pagineStudy Guide E4: Internal Sources of Finance and Dividend Policysrgtlhr_325131857Nessuna valutazione finora

- Accounting For: Presentation OnDocumento24 pagineAccounting For: Presentation OnMonir Ahmmed Ovi50% (2)

- Free Cash Flow (Solution)Documento11 pagineFree Cash Flow (Solution)alliahnahNessuna valutazione finora

- WAC02 - 01 - MSC - 20150305 (Accounting Edexcel IAL 2015 January Unit 2 Mark Scheme)Documento18 pagineWAC02 - 01 - MSC - 20150305 (Accounting Edexcel IAL 2015 January Unit 2 Mark Scheme)James JoneNessuna valutazione finora

- Mankiw Economics Chapter 12 NotesDocumento2 pagineMankiw Economics Chapter 12 Notesnolessthanthree0% (1)

- Coffeeville: End of Financial Year StatementsDocumento5 pagineCoffeeville: End of Financial Year StatementsAndresPradaNessuna valutazione finora

- SwapDocumento61 pagineSwapKajal ChaudharyNessuna valutazione finora

- Islamic BK CH 3 PDFDocumento27 pagineIslamic BK CH 3 PDFAA BB MMNessuna valutazione finora

- Gaju HumairaDocumento431 pagineGaju Humairagaju619Nessuna valutazione finora

- Info On House Joint Resolution 192Documento4 pagineInfo On House Joint Resolution 192Freeman Lawyer75% (4)

- Sanction Letter MitaBrickDocumento15 pagineSanction Letter MitaBricktarique2009Nessuna valutazione finora

- Bin GeneratorDocumento3 pagineBin GeneratorShashank GuptaNessuna valutazione finora

- Specialized Government BanksDocumento5 pagineSpecialized Government BanksCarazelli AysonNessuna valutazione finora

- Product Disclosure SheetDocumento3 pagineProduct Disclosure SheetshamsulNessuna valutazione finora

- Investment Banking in BangladeshDocumento19 pagineInvestment Banking in BangladeshMahir DaiyanNessuna valutazione finora

- Registration Form: A. Training Schedule (Cidb CCD Points)Documento1 paginaRegistration Form: A. Training Schedule (Cidb CCD Points)Amyfarhana91Nessuna valutazione finora

- XII Test (Death, Ret - Diss)Documento4 pagineXII Test (Death, Ret - Diss)MLastTryNessuna valutazione finora

- Chapter 14 - Post Employment BenefitsDocumento4 pagineChapter 14 - Post Employment Benefitslooter198Nessuna valutazione finora

- Ch. 14 Payout PolicyDocumento68 pagineCh. 14 Payout PolicyRiyan DarmawanNessuna valutazione finora

- Untitled Form - Google FormsDocumento4 pagineUntitled Form - Google FormsPavan RoochandaniNessuna valutazione finora

- Asset Management ERP Core Module BrochureDocumento3 pagineAsset Management ERP Core Module BrochureIAS MENessuna valutazione finora

- Geeta Saar 21 Register of Members PDFDocumento8 pagineGeeta Saar 21 Register of Members PDFMuthu KumaranNessuna valutazione finora

- Chapter 5 Accounting For Revenue and Other ReceiptsDocumento49 pagineChapter 5 Accounting For Revenue and Other ReceiptsKapoy-eeh LazanNessuna valutazione finora

- Mvpreitii A PPMDocumento120 pagineMvpreitii A PPMAndoniAlvzNessuna valutazione finora

- Assetreconstructioncompany 170423155939 PDFDocumento27 pagineAssetreconstructioncompany 170423155939 PDFsrivastavasonali1106Nessuna valutazione finora

- Bank Statement Template 16 PDFDocumento2 pagineBank Statement Template 16 PDFBara Creatives50% (2)

- Share MarketDocumento14 pagineShare Marketbholu436100% (6)

- CHAPTER 6 - Development Budget and AppraisalsDocumento14 pagineCHAPTER 6 - Development Budget and Appraisalsnaurahiman100% (1)

- Financial Statements For Jollibee Foods CorporationDocumento7 pagineFinancial Statements For Jollibee Foods CorporationFretelle Rimafranca75% (4)

- Weeks 1 To 4 Fundamental AnalysisDocumento166 pagineWeeks 1 To 4 Fundamental Analysismuller1234Nessuna valutazione finora

- CONDOMINIUM NOTES Atty. DomingoDocumento2 pagineCONDOMINIUM NOTES Atty. Domingothalia alfaroNessuna valutazione finora

- Sl. No. ID No. Project Topic: National Law School of India University, BengaluruDocumento3 pagineSl. No. ID No. Project Topic: National Law School of India University, BengaluruPreyashi ShrivastavaNessuna valutazione finora

- PIS Report 2Documento1 paginaPIS Report 2Ravi MalikNessuna valutazione finora

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsDa EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsValutazione: 4.5 su 5 stelle4.5/5 (21)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyDa EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyValutazione: 3 su 5 stelle3/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressDa EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressNessuna valutazione finora

- Mind over Money: The Psychology of Money and How to Use It BetterDa EverandMind over Money: The Psychology of Money and How to Use It BetterValutazione: 4 su 5 stelle4/5 (24)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDa EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistValutazione: 4 su 5 stelle4/5 (32)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 5 su 5 stelle5/5 (2)

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceDa EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceValutazione: 4 su 5 stelle4/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismDa EverandThe Value of a Whale: On the Illusions of Green CapitalismValutazione: 5 su 5 stelle5/5 (2)

- Applied Corporate Finance. What is a Company worth?Da EverandApplied Corporate Finance. What is a Company worth?Valutazione: 3 su 5 stelle3/5 (2)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursDa EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursValutazione: 5 su 5 stelle5/5 (13)