Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Transport

Caricato da

Amit0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

21 visualizzazioni4 pagineTransport Industry future

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoTransport Industry future

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

21 visualizzazioni4 pagineTransport

Caricato da

AmitTransport Industry future

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

Indias logistics sector is poised for accelerated growth, led by GDP

revival, ramp up in transport infrastructure, e-commerce penetration,

impending GST implementation, and other initiatives like Make in

India.

This offers opportunities across the spectrum for companies in

transportation, storage, distribution, and allied services, according to a

report by Motilal Oswal Securities Ltd.

Empirical evidence suggests the Indian logistics industry grows at 1.5-2

times the GDP growth. Moreover, infrastructural bottlenecks that have

stifled sectors growth and promoted inefficiency are being addressed

by the government.

Building of dedicated rail freight corridors will promote efficient

haulage of containerised cargo by rail. One key advantage of the

dedicated freight corridor is that freight trains could be run on time

tables similar to passenger trains, and the frequency can be

theoretically increased to one train in 10 minutes. This will reduce time

for goods transportation between Mumbai and Delhi to 18 hours from

60 hours now.

Also, setting up of various industrial corridors along the dedicated

freight route will metamorphose the warehousing business from small

warehouses spread across the country to large, global-size warehouses

concentrated in a few hubs.

The proposed new goods and services tax (GST) regime and ecommerce will alter the landscape in warehousing, supply chain

management and third party logistics business. GST implementation

will be a game-changing event for businesses and particularly for

organised logistics players.

The report says logistics requirement for e-commerce will grow as

exponentially as e-commerce.

Indian logistics sector is estimated to have grown at a healthy 15% in

the last five years. However, growth in sub-sectors varies, with the

lowest being in basic trucking operations and highest in supply chain

and e-tailing logistics. Some studies estimate the share of Indias

logistics spend in GDP at 13% (versus 7-8% in developed countries),

implying overall size of $180-220 bn (direct costs +wastages from

inefficiencies). A comparison with other countries shows inefficiencies

are high in the Indian logistics sector.

Infrastructural bottlenecks across modes (rail, road, waterways) have

stifled the sectors growth. Capacity constraints and inefficiencies can

be noted from the high transit time in rail as key train routes operate

at >110% utilisation, thus leading to an average speed of 25 km per

hour. The road sector is fraught with inadequate and low-quality

highway availability, thereby limiting the trucks size and impacting

economies of operation.

Despite being an economical mode of transport, railways has lost

market share in freight movement to roads in the last few decades due

to capacity constraints. Compared to other countries, Indias rail share

in goods transport is 31%, which has come down from 60% in 1980s

and 48% in 1990s.

Another key constraint is administrative delays. Despite being a

relatively low-cost country, logistics cost in India is higher due to

administrative delays led by paper workleading to huge inventory

investments and wastageand a complex tax structure.

Also, low penetration of new technology in the supply chain process is

resulting in damage of goods. India has the least warehouse capacity

with modern facilities, and given the fragmented industry state (large

share with unorganised players), investment in IT infrastructure is

almost absent at required scale.

Logistics encompasses a wide array of services like transportation (air,

surface, internal waterways, sea), storage (warehousing, logistics

parks, container depots, cold chains) distribution (courier service, e-tail

deliveries),and integrated/allied services (freight forwarding, 3PL) and

investment in logistics boosts growth in its upstream and downstream

economic activities, says the report.

First Published on March 18, 2015 12:05 am

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Transport ContractDocumento9 pagineTransport ContractTrueIDNessuna valutazione finora

- Airborne ExpressDocumento5 pagineAirborne Expresscychen_scribd100% (1)

- Evergreen PDFDocumento1 paginaEvergreen PDFOai PhạmNessuna valutazione finora

- Universal Capacity Solutions - Order# 1700277 - Pickup Thu May 7, 2020 8 - 00 AM PDFDocumento2 pagineUniversal Capacity Solutions - Order# 1700277 - Pickup Thu May 7, 2020 8 - 00 AM PDFIvan PetrovicNessuna valutazione finora

- Practical Handbook of Warehousing: Kenneth B. AckermanDocumento16 paginePractical Handbook of Warehousing: Kenneth B. AckermanEwketbirhan Alemu0% (1)

- Jessica Mendez PDF - Miami Office ManagerDocumento2 pagineJessica Mendez PDF - Miami Office ManagerSvetlana BukowksyNessuna valutazione finora

- Ilo Guidelines For Flag State Inspections Under The MLCDocumento88 pagineIlo Guidelines For Flag State Inspections Under The MLCMariyath Muraleedharan Kiran100% (1)

- Managing Maritime Infrastructure: Lessons From UAE and ChinaDocumento18 pagineManaging Maritime Infrastructure: Lessons From UAE and ChinaKantaJupolaNessuna valutazione finora

- Hydrabadcustom Cha 95Documento52 pagineHydrabadcustom Cha 95Ravi SrivastavaNessuna valutazione finora

- Fireman's V Metro DigestDocumento2 pagineFireman's V Metro Digestvepeterga100% (1)

- Lufthansa German Airlines Vs IACDocumento1 paginaLufthansa German Airlines Vs IACGerald DacilloNessuna valutazione finora

- 21 Preventive Maintenance Aa PDFDocumento20 pagine21 Preventive Maintenance Aa PDFMaleficaruMTNessuna valutazione finora

- Application: 1. Personal DataDocumento6 pagineApplication: 1. Personal Databasem100% (1)

- Delivered at Place Incoterm®: Group 4Documento9 pagineDelivered at Place Incoterm®: Group 4Ngoc NguyenNessuna valutazione finora

- Koastal Company Profile 2012Documento12 pagineKoastal Company Profile 2012Pragathees WaranNessuna valutazione finora

- SahilVatsa (2 7)Documento2 pagineSahilVatsa (2 7)Pragya Sharma RajoriyaNessuna valutazione finora

- MM-03 Inventory Management & Physical InventoryDocumento38 pagineMM-03 Inventory Management & Physical InventoryDivyang PatelNessuna valutazione finora

- PO - Box (Countries Accepting)Documento14 paginePO - Box (Countries Accepting)Ana-Maria IordacheNessuna valutazione finora

- Summer Internship Project Report On WareDocumento27 pagineSummer Internship Project Report On WareArun Prakash SudarsanamNessuna valutazione finora

- (Original For Recipient) : INR One Thousand and Seventy Six and Twenty Four Paise OnlyDocumento2 pagine(Original For Recipient) : INR One Thousand and Seventy Six and Twenty Four Paise OnlyElakya muniNessuna valutazione finora

- Ellram, Siferd 1993Documento23 pagineEllram, Siferd 1993Michel Van SuijlekomNessuna valutazione finora

- A Comparative Analysis of Carbon Emissions From Online Retailing of Fast Moving Consumer GoodsDocumento9 pagineA Comparative Analysis of Carbon Emissions From Online Retailing of Fast Moving Consumer GoodsdadanalhakNessuna valutazione finora

- Act 515 Merchant Shipping Oil Pollution Act 1994Documento34 pagineAct 515 Merchant Shipping Oil Pollution Act 1994Adam Haida & Co100% (1)

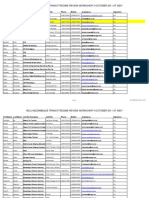

- MCLI - Email List 2Documento5 pagineMCLI - Email List 2Vincs Kong100% (1)

- Supply Chain Management Practices in AmazonDocumento14 pagineSupply Chain Management Practices in Amazonaustraliaexperts100% (5)

- GOMO Complete Document December 2022Documento309 pagineGOMO Complete Document December 2022Luana Marchiori100% (1)

- Aadil Rashid KhanDocumento3 pagineAadil Rashid KhanAadil Rashid KhanNessuna valutazione finora

- Air Cargo Freight Rates From USA To Australia and PacificDocumento3 pagineAir Cargo Freight Rates From USA To Australia and Pacifica2globalNessuna valutazione finora

- Bill of Lading Terms and Conditions LV 06-16Documento1 paginaBill of Lading Terms and Conditions LV 06-16johana unriza100% (1)

- Amendment 34 To IMDGDocumento34 pagineAmendment 34 To IMDGOkeke Pascal Onyeka EinsteinNessuna valutazione finora