Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)

Caricato da

Shyam SunderDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

203, The Summit, Hanuman Road,

Kanu Doshi Associates

Western Express Highway, Vileparle (E), Mumbai - 400 057

Chartered Accountants

',

022-2615

00

E : info@kdg.co.in

F : 022 2615 0113

. W : www.kdg.co.in

Limited Review Report

To

The Board of Directors

Remsons !ndustries Limited

statement of unaudited financial resutts ("the

Statement") of REMSONS INDUSTR!ES LIMITED ("the Company") for the quarter ended June

30th,2014except for the disctosures regarding'Pubtic Sharehotding','Promoters and

Promoters Group Sharehotding' and investor comptaints which have been traced from

1. We have reviewed the accompanying

disctosures made by the management and have not been reviewed by us. This statement is the

of the

Company's management and has been approved by the Board of

Directors. Our responsibitity is to issue a report on the Statement based on our review.

responsibility

z.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410,

"Engagements to Review Financial lnformation performed by lndependent Auditor of the Entity"

issued by the lnstitute of Chartered Accountants of lndia. This standard requires that we ptan and

perform the review to obtain moderate assurance as to whether the financiat statements are

free of materia[ misstatement. A review is timited primarity to inquiries of company personnel

and anatytical procedures, apptied to financial data and thus provides [ess assurance than an

audit. We have not performed an audit and accordingty, we do not express an audit opinion.

Based on our review conducted as above, nothing has come

to our attention that causes us to

financiat resutts prepared in

accordance with appticabte accounting standards notified pursuant to the Companies (Accounting

Standard) Rutes,2006 read with General Circutar 1512013 dated 13th September 2013of the

Ministry of Corporate Affairs in respect of section 133 of Companies Act,2013 and other

recognised accounting practices and poticies has not disctosed the information required to be

disctosed in terms of Clause 41 of the Listing Agreement including the manner in which it is

to be disctosed, or that it contains any materiat misstatement.

betieve

that the

accompanying statement

For Kanu Doshi Associates

Chartered Accountonts

,,,^yy*ye.104746w

I

r,/'

Partfier

Membership No.:114622

: Mumbai

: August 9'h,2014

Ptace

Date

of unaudited

NEDTSO]VS

INDUSTRIES LTD.

CIN : 151900MH 1971P1C015141

Regd.Office:88B. Govt. lndl. Estate, Kandivli(West), Mumbai 400057.

Tel No:022- 28683883; Fax. No: 022-28682487

Email id: remsons@vsnl,com, website: www.remsons.com

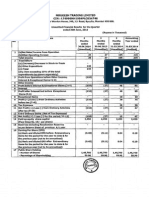

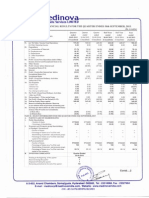

UNAUDITED FINANCIAT RESULTS FOR THE QUARTER ENDED 30.05.2014.

Amounts

- Rs. in Lacs

EPS

& No. of

Year ended

31.03.2014

(Audited) Refer

Note-3

from operations

. lncome

(a) Gross Sales

lncome from Operations

2,630.34

Less : Excise Duty

lncome from Operations (net of

Net Sales

72,277.03

274.53

excise duty)

(b) Other Operating lncome

Total lncome from operations (net)

Expenses

a) Cost of materials consumed

Purchase of stock in trade

t,496.06

L,641.99

1,409.30

6,450.23

9.s6

L2.70

6.82

50.81

c) Changes in inventories of finished goods,

-in-progress and stock-in-trade

d) Employees benefit expenses

e) Depreciation and amortisation expenses

.

Other Expenditure

9.91

417.27

(38.1s)

411.36

1.89

363.53

(s1.ss)

t,562.37

54.25

57.48

55.06

228.25

6r.3.00

652.47

489.22

2,46L.40

51.15

50.03

381.53

15.04

22.47

82.97

76.20

72.50

464.44.

62.9s

58.09

240.97

13.25

L4.4L

223.47

expenses

Profit

/ (Loss) from Operations before other

finance cost and exceptional items (1-

Other lncome

Protit

(Loss)

from ordinary activities

costs and exceptional items (314)

,

Finance Costs

. Protit

from ordinary activities after

(Loss)

finance costs but before exceptional items

Exceptional items

Prolit

from ordinary activities before

(Loss)

(7r8)

10. Tax Expenses

11. Profit

(Loss)

9.70

(6.10)

(st10)

3.55

20.51

12. Extraordinary items

13. Net Prolit

74.87

from ordinary activities after

(Loss)

for the period (11112)

14. Paid up equity share capital (Face Value of

10/-each)

l5.Reserves excluding Revaluation Reserves as

per balance sheet of previous accounting year

16. (i) Earnings Per Share (before Extraordinary

items)

Basic and Diluted Not Annualised (Rs.)

16. (ii) Earnings Per Share (After Extraordinary

items)

Basic and Diluted Not Annualised (Rs.)

571.34

148.50

I.ART II

A. PARTICULARS OF SHAREHOLDINGS

1. Public shareholding

- Number of Shares

L4,28,349

- Percentage of Shareholding

t4,28,349

t4,28,349

14,28,349

2501

250/,

25o/.

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

42,85,008

42,85,008

42,8s,008

42,85,008

25%

2. Promoters and

Promoter Group Shareholding

a) Pledged/ Encumbered

- Number of Shares

- Percentage of Shares ( as a % of the total

of promoter and promoter group)

-Percentageof Shares (asa% of thetotal

sh areholding

sh are capital of

the company)

b) Non-Encumbered

- Number of Shares

- Percentage of Shares ( as a % of the total

shareholding of promoter and promoter group)

- Percentage of Shares I as a % of the total

share capital

ofthe company)

t00%

lOOo/"

LOO%

LOl%

75%

75o/o

75o/o

75%

B. INVESTORS COMPLAINTS : Quarter ended 30th June,2014

L Pending at the beginnins ofthe quarter- Nil

ll. Received during the quarter- Nil

lll. Disposed of during the quarter - Nil

the quarter - Nil

lV.Remaining unresolved at the end of

1. The Company operates in single segment only, i.e.Automotive Components parts.

for the quarters/year are net of Provision for lncome Tax/ MAT and Deferred tax liabilities (assets) under lncome

2. Tax expenses

Tax Act,1961.

quarter ended 31.03.2014 are the balancing figures between audited figures of the full financial year and

published year to date figures upto nine month ended 31.12.2013 of the financial year.

3. The figures of

4. The Company has realigned its

1st April, 2014

depreciation policy in accordance with Schedule ll to Companies Act, 2013. Consequently w.e.f.

(a) the carrying value of assets is now depreciated over its revised remaining useful life.

(b) where the remaining useful life of the assets is nil as on 1st April, 2014, carrying value of assets has been adjusted against

)pening reserves (net of deferred tax) amounting to Rs.32.45 Lacs in accordance with transitional provision of schedule ll (7).

:. on account of above change, depreciation for the current quarter is higher by Rs. 1.30 Lacs,

5.Figures of previous year's/ periods' have been regrouped/ rearranged wherever necessary

to make them comparable.

The above results, as reviewed by the Audit Committe have been approved by the Board of Directors in its meeting held on '

)th August, 2014, Limited review has been carried out by the Statutory Auditors of the company as per clause 41 of the Listing

5.

nent with stock exchanges.

6.,S

: Mumbai

ffirr,ri-\

:09.08.2014.

A Recognised

W?r

For REMSONS INDUSTRIES LIMITED

1-

/.-W

K.KEJRIWAL

MANAGING DIRECTOR

Potrebbero piacerti anche

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento10 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Consolidated Financial StatementsDocumento28 pagineConsolidated Financial Statementsswissbank333Nessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results 201920Documento26 pagineFinancial Results 201920Ankush AgrawalNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Idea Cellular Services 2009-10Documento16 pagineIdea Cellular Services 2009-10sanamohamedNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento2 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- 06-Infra & Property DevelopmentDocumento9 pagine06-Infra & Property Developmentmadhura_454Nessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Absl Fy 2015Documento20 pagineAbsl Fy 2015junkyNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento9 pagineStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento8 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Updates On Financial Results For June 30, 2015 (Result)Documento7 pagineUpdates On Financial Results For June 30, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Delhi Airport Metro Express Private Limited Annual Accounts For THE FY 2014-15Documento21 pagineDelhi Airport Metro Express Private Limited Annual Accounts For THE FY 2014-15Youmna ShatilaNessuna valutazione finora

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Da Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Nessuna valutazione finora

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Da EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Nessuna valutazione finora

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Ho and Branch and Agency AcctgDocumento38 pagineHo and Branch and Agency AcctgNiño Dwayne TuboNessuna valutazione finora

- Diploma in International Financial Reporting: Thursday 6 December 2007Documento9 pagineDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariNessuna valutazione finora

- Lease AccountingDocumento7 pagineLease AccountingSandeep Shenoy100% (1)

- Allowance For Doubtful Accounts - Solutions PDFDocumento1 paginaAllowance For Doubtful Accounts - Solutions PDFPrecious NosaNessuna valutazione finora

- MGT101 Finalterm Solved Paper1Documento16 pagineMGT101 Finalterm Solved Paper1Erica Lindsey100% (1)

- Unit - II Module IIIDocumento7 pagineUnit - II Module IIIpltNessuna valutazione finora

- Study Plan: Tracker For Strategic Business Reporting (SBR)Documento96 pagineStudy Plan: Tracker For Strategic Business Reporting (SBR)Fahad Ahmad KhanNessuna valutazione finora

- CV Samples PDFDocumento4 pagineCV Samples PDFCelineKevinNessuna valutazione finora

- Paper TheEffectofEarningsQualityDocumento16 paginePaper TheEffectofEarningsQualitySaffana AzkaNessuna valutazione finora

- Your Firm Has Recently Been Appointed As External Auditor To EWheelsDocumento4 pagineYour Firm Has Recently Been Appointed As External Auditor To EWheelsJoe FarringtonNessuna valutazione finora

- Cash Flow Statement - Indirect MethodDocumento5 pagineCash Flow Statement - Indirect MethodBimal KrishnaNessuna valutazione finora

- Deutsche BrauereiDocumento22 pagineDeutsche Brauereiusergurl0% (2)

- Chapter 2Documento40 pagineChapter 2ellyzamae quiraoNessuna valutazione finora

- Bulletin Sep 15Documento16 pagineBulletin Sep 15Cryptic LollNessuna valutazione finora

- 2015 ACCA P7 Revision Kit BPPDocumento496 pagine2015 ACCA P7 Revision Kit BPPZuko Dzumhur100% (1)

- AT05 Further Audit Procedures (Tests of Controls) PSA 520Documento4 pagineAT05 Further Audit Procedures (Tests of Controls) PSA 520John Paul SiodacalNessuna valutazione finora

- RC Tax Consultancy LLP PROFILEDocumento26 pagineRC Tax Consultancy LLP PROFILEAbhishek JhaNessuna valutazione finora

- Financial Statements: By: Dr. Angeles A. de Guzman Dean, College of Business EducationDocumento19 pagineFinancial Statements: By: Dr. Angeles A. de Guzman Dean, College of Business EducationJay-L TanNessuna valutazione finora

- De George, E. T., Li, X., - Shivakumar, L. (2016)Documento115 pagineDe George, E. T., Li, X., - Shivakumar, L. (2016)Ikhsan Al IzyraNessuna valutazione finora

- Types of Financial Statements - Explanation - Examples - TemplatesDocumento3 pagineTypes of Financial Statements - Explanation - Examples - TemplatesPrasanta GhoshNessuna valutazione finora

- Account MCQ PDFDocumento93 pagineAccount MCQ PDFsunil kalura100% (1)

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocumento38 pagineSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (14)

- Answer and Question Financial Accounting Chapter 6 InventoryDocumento7 pagineAnswer and Question Financial Accounting Chapter 6 Inventoryukandi rukmanaNessuna valutazione finora

- WFH Internships JDDocumento7 pagineWFH Internships JDAsia NehaNessuna valutazione finora

- Unilever Pakistan LimitedDocumento126 pagineUnilever Pakistan LimitedXohaib UQNessuna valutazione finora

- Major Assignment - Act 201 - Sec 20Documento15 pagineMajor Assignment - Act 201 - Sec 20Nishat FarhatNessuna valutazione finora

- Solution Manual08Documento66 pagineSolution Manual08yellowberries100% (2)

- Flash - Memory - Inc From Website 0515Documento8 pagineFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Baps March 2021Documento34 pagineBaps March 2021Adjin LomoteyNessuna valutazione finora

- Interpreting Company AccountsDocumento10 pagineInterpreting Company Accountsclaudio.silv8390Nessuna valutazione finora