Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case Ariel

Caricato da

Badr0%(5)Il 0% ha trovato utile questo documento (5 voti)

1K visualizzazioni2 pagineIMBA Multinational Financial Management Group Work and Exercises. GROUPE ARIEL S.A. - case study: analyze the investment proposal. Make an,,up or down" recommendation based on the analysis.

Descrizione originale:

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoIMBA Multinational Financial Management Group Work and Exercises. GROUPE ARIEL S.A. - case study: analyze the investment proposal. Make an,,up or down" recommendation based on the analysis.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0%(5)Il 0% ha trovato utile questo documento (5 voti)

1K visualizzazioni2 pagineCase Ariel

Caricato da

BadrIMBA Multinational Financial Management Group Work and Exercises. GROUPE ARIEL S.A. - case study: analyze the investment proposal. Make an,,up or down" recommendation based on the analysis.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Core Module

Multinational Financial Management

Group Work and Exercises

IMBA Multinational Financial Management

Prof. Dr. Carola Spiecker-Lampe

Exercises

GROUPE ARIEL S.A. Case Study- Academic Essay

Perform an analysis of the investment proposal and make an up or down recommendation!

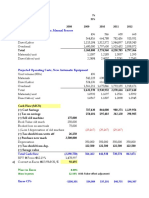

1. Compute the net present value of Ariel-Mexicos recycling equipment in pesos by discounting

incremental peso cash flows at a peso discount rate. How should this NPV be translated into

Euros? Assume expected future inflation for France is 3% per year.

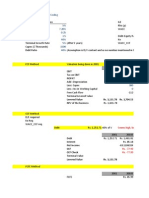

2. Compute the NPV in Euros by translating the projects future peso cash flows into Euros at

expected future spot exchange rates. Note that Ariels Euro hurdle rate for a project ot this type

was 8%. Assume that annual inflation rates are expected to be 7% in Mexico and 3% in

France.

3. Compare the two sets of calculations and the corresponding NPVs. How and why do they

differ? Which approach should Arnaud Martin use?

4. Suppose Mexican inflation is projected at 3% instead of 7% per year (assume French inflation

remains at 3%). How does this affect the NPV calculations?

5. Suppose Ariel expects a significant real depreciation of the peso against the Euro. How should

Martin incorporate such an expectation into his NPV analysis? (For simplicity you may

continue with the assumption that inflation is expected to be 3% in both countries.) What is its

effect on the concluded NPV under each of the approaches in questions 1 and 2?

IMBA Multinational Financial Management

Prof. Dr. Carola Spiecker-Lampe

Exercises

Potrebbero piacerti anche

- Groupe Ariel CaseDocumento9 pagineGroupe Ariel CasePaco Colín86% (7)

- Group ArielDocumento5 pagineGroup ArielSumit SharmaNessuna valutazione finora

- Groupe Ariel Project AnalysisDocumento1 paginaGroupe Ariel Project AnalysisGiorgi Kharshiladze100% (4)

- Paginas Amarelas Case Week 8 ID 23025255Documento4 paginePaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- (Shared) Day5 Harmonic Hearing Co. - 4271Documento17 pagine(Shared) Day5 Harmonic Hearing Co. - 4271DamTokyo0% (2)

- Groupe Ariele SolutionDocumento5 pagineGroupe Ariele SolutionSergio García100% (1)

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Documento4 pagineProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyNessuna valutazione finora

- The Case Solution of AES Tiete: Expansion Plant in BrazilDocumento19 pagineThe Case Solution of AES Tiete: Expansion Plant in BrazilParbon Acharjee0% (1)

- Groupe Ariel SA Case AnalysisDocumento7 pagineGroupe Ariel SA Case Analysiskarthikmaddula007_66100% (1)

- Group Ariel S.A. Parity Conditions and Cross Border ValuationDocumento13 pagineGroup Ariel S.A. Parity Conditions and Cross Border Valuationmatt100% (1)

- Albert Adusei BrobbeyDocumento10 pagineAlbert Adusei BrobbeyNana Quame GenzNessuna valutazione finora

- AES Case StudyDocumento12 pagineAES Case StudyTim Castorena33% (3)

- Groupe Ariel - SolutionDocumento6 pagineGroupe Ariel - SolutiontrangngqNessuna valutazione finora

- Groupe Ariel - Questions PDFDocumento1 paginaGroupe Ariel - Questions PDFDebbie RiceNessuna valutazione finora

- Module4 CaseAssignmentDocumento1 paginaModule4 CaseAssignmentDevin Butchko0% (2)

- CARREFOUR S.A. Case SolutionDocumento3 pagineCARREFOUR S.A. Case SolutionShubham PalNessuna valutazione finora

- Cases Qs MBA 6003Documento5 pagineCases Qs MBA 6003Faria CHNessuna valutazione finora

- GroupeAriel S.ADocumento3 pagineGroupeAriel S.AEina GuptaNessuna valutazione finora

- Noble GroupDocumento3 pagineNoble GroupromanaNessuna valutazione finora

- AES Capital BudgetingDocumento3 pagineAES Capital BudgetingShubham KesarkarNessuna valutazione finora

- Online AnswerDocumento4 pagineOnline AnswerYiru Pan100% (2)

- Mercury Athletic SlidesDocumento28 pagineMercury Athletic SlidesTaimoor Shahzad100% (3)

- Group Ariel CaseDocumento3 pagineGroup Ariel Casemibebradford33% (9)

- MSDI Excel SheetDocumento4 pagineMSDI Excel SheetSurya AduryNessuna valutazione finora

- 11 Simple Linear Regression WorkbookDocumento23 pagine11 Simple Linear Regression WorkbookJohn SmithNessuna valutazione finora

- Aes Case SolutionDocumento3 pagineAes Case SolutionXimenaLopezCifuentes100% (1)

- Aspen CaseDocumento15 pagineAspen CaseWee Chuen100% (1)

- Globalizing The Cost of Capital and Capital Budgeting at AESDocumento33 pagineGlobalizing The Cost of Capital and Capital Budgeting at AESK Ramesh100% (1)

- FPL Dividend Policy-1Documento6 pagineFPL Dividend Policy-1DavidOuahba100% (1)

- Tottenham Case SolutionDocumento14 pagineTottenham Case SolutionVivek SinghNessuna valutazione finora

- Apache Case StudyDocumento14 pagineApache Case StudySreenandan NambiarNessuna valutazione finora

- FX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargDocumento9 pagineFX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargSarvagya JhaNessuna valutazione finora

- BNYC and Mellons Merger, Grp-11, MACR-BDocumento2 pagineBNYC and Mellons Merger, Grp-11, MACR-Balok_samal_250% (2)

- ArielDocumento3 pagineArielmemfida100% (1)

- Groupe Ariel Assignment Instructions and Rubric 1121Documento9 pagineGroupe Ariel Assignment Instructions and Rubric 1121gadisika0% (1)

- Ariel - ICFDocumento9 pagineAriel - ICFSannya DuggalNessuna valutazione finora

- Group Ariel StudentsDocumento8 pagineGroup Ariel Studentsbaashii4Nessuna valutazione finora

- LinearDocumento6 pagineLinearjackedup211Nessuna valutazione finora

- Sampa VideoDocumento24 pagineSampa VideoHenny ZahranyNessuna valutazione finora

- Globalizing The Cost of Capital and Capital Budgeting at AESDocumento22 pagineGlobalizing The Cost of Capital and Capital Budgeting at AESkartiki_thorave6616100% (2)

- Mercury Athletic Footwear Case (Work Sheet)Documento16 pagineMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNessuna valutazione finora

- Cost of Capital at AesDocumento4 pagineCost of Capital at Aesharsh29890% (1)

- Msdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleDocumento24 pagineMsdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleShashank Shekhar100% (1)

- Yell Part IDocumento5 pagineYell Part IAdithi RajuNessuna valutazione finora

- Msdi - Alcala de Henares, SpainDocumento4 pagineMsdi - Alcala de Henares, SpainDurgesh Nandini Mohanty100% (1)

- AirThread Class 2020Documento21 pagineAirThread Class 2020Son NguyenNessuna valutazione finora

- Facebook IPO caseHBRDocumento29 pagineFacebook IPO caseHBRCrazy Imaginations100% (1)

- Sampa VideoDocumento24 pagineSampa VideodoiNessuna valutazione finora

- Case 2: MSDI - Alcala de Henares, Spain For All Three Questions, Assume The FollowingsDocumento2 pagineCase 2: MSDI - Alcala de Henares, Spain For All Three Questions, Assume The FollowingsSammy Dalie Soto BernaolaNessuna valutazione finora

- 25th June - Sampa VideoDocumento6 pagine25th June - Sampa VideoAmol MahajanNessuna valutazione finora

- WrigleyDocumento28 pagineWrigleyKaran Rana100% (1)

- Group 3-Case 1Documento3 pagineGroup 3-Case 1Yuki Chen100% (1)

- Debt Policy at UST IncDocumento5 pagineDebt Policy at UST Incggrillo73Nessuna valutazione finora

- Capital Budget Structure For Aes CorpDocumento3 pagineCapital Budget Structure For Aes CorpArpita Gupta100% (1)

- Sampa Video IncDocumento4 pagineSampa Video IncarnabpramanikNessuna valutazione finora

- Final Project Instructions SACMDocumento2 pagineFinal Project Instructions SACMJustin RuffingNessuna valutazione finora

- Mergers and Acquisitions End Term ExaminationDocumento2 pagineMergers and Acquisitions End Term ExaminationHaritha V HNessuna valutazione finora

- Vragen TA 2013Documento4 pagineVragen TA 2013guusjuh2Nessuna valutazione finora

- 08 Interest Rates Exchange Rates and InflationDocumento39 pagine08 Interest Rates Exchange Rates and InflationEneida HaskoNessuna valutazione finora

- Economics Managers Final-ExamDocumento5 pagineEconomics Managers Final-Examdavit kavtaradzeNessuna valutazione finora