Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Product Factsheet Sunflower Oil Europe Vegetable Oils Oilseeds 2014 PDF

Caricato da

Ștefan SanduDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Product Factsheet Sunflower Oil Europe Vegetable Oils Oilseeds 2014 PDF

Caricato da

Ștefan SanduCopyright:

Formati disponibili

CBI Product Factsheet:

Sunflower oil in the EU

and EFTA

Practical market insights into your product

Sunflower oil consumption is increasing at a fast pace in Europe.

Although sunflower seeds are cultivated and crushed in Europe, a

large share of the sunflower oil imports comes from the Black Sea

area, with Russia and Ukraine as main supplying countries. A

growing segment in the European market is high oleic sunflower

oil, originating from hybrid sunflower seeds. Whereas demand for

high oleic sunflower oil is generally increasing in Europe, supplies

remain tight, which points toward an interesting opportunity for

exporters.

Product definition

The sunflower plant (Helianthus annuus) is native the North-American continent.

The seeds from the sun-shaped flower were originally taken to Europe during

the Spanish colonisation of North-America. The crop can be cultivated at cooler

temperatures and has spread out through Europe and the Black Sea region.

Sunflower seeds are used for direct edible consumption as well as the crushing

of the seeds to extract oil. Sunflower oil is used as food ingredient for frying,

cooking, in salad dressings and as an ingredient in products such as margarines,

due to its light colour and mild flavour.

HS code

Description

1512 11 91

Sunflower seed oil

Product specification

Quality

General

Crude sunflower oil is obtained through crushing of the thin and

smaller black grade sunflower seeds (crushing grade). The black

sunflower seeds have a relatively high oil content (between 3949%).

Sunflower oil can be processed by three different methods. 1)

cold-pressing: (crude) light yellow oil, 2) hot-pressing: (crude)

brown-coloured oil, 3) refined sunflower oil: colourless liquid.

Sunflower oil should have a maximum acid value of 0.9- 1.1%.

Excessive acid values can cause a sour taste and decolourisation

of the oil.

Sunflower oil containing a high level of oleic acid is preferred in

Source: Seed Oil Press

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

the food industry; the oil with a higher linoleic acid content is preferred by

paint or fuel industry. High-oleic sunflower oil is naturally stable and does

not need to be hydrogenated.

The main quality problems associated with sunflower oil are contamination

and oxidation (rancidity). Sunflower oil has a relatively high oxidative

stability (i.e. long shelf life), but this stability is dependent on the extraction

method and seed pre-treatment. This makes it crucial that special care is

taken in all steps of the production process, from harvesting to distribution.

High-oleic sunflower oil has a higher stability and resistance to rancidity due

to the high content of natural Tocopherol and the low level of

polyunsaturated fatty acids.

Make sure that the raw material (i.e. sunflower seeds) is fresh and that

there are no long delays between harvesting and extraction. Sunflower

seeds should also be free from sand, stalk, plant debris and other foreign

materials.

Some of the most important quality factors concerning sunflower seeds are:

odour and flavour, oil content, and damaged/mouldy seeds. Sunflower seeds

should also be free from mycotoxins and harmful microbiological activity;

this will avoid contamination of the oil. Aflatoxin B1 and ochratoxin

contamination are known to be a problem for many producers, and buyers

closely monitor these aspects.

Prevent contamination by keeping facilities and equipment clean.

Ensure proper storage and transportation (see Packaging).

Organic (if relevant)

Comply with organic standards for the production of sunflower seeds and

sunflower oil extraction. Refer to the section on Niche requirements for

further details on organic production and labelling.

Labelling

Ensure traceability of individual batches.

Use English for labelling purposes, unless your buyer has

indicated otherwise.

Labels must include the following:

o Product name

o Manufacturers lot or batch code

o Whether or not the product is destined for use in food

products

o Name and address of exporter

o Products country of origin

o Shelf life: Best-before date / use-by date

o Net weight / volume in metric units

o Recommended storage conditions

Source: Farinex

Packaging

Sunflower oil is commonly transported in liquid bulk (in

tank containers and flexi tanks) or in intermediate bulk

containers (IBC).

Ensure preservation of quality by:

o Thoroughly cleaning the barrels or tanks before

loading the oil.

o Filling up the tanks as much as possible to prevent

rancidity due to oxygen exposure. Take the possible

cubic expansion into consideration (indicated range:

Source: Elburg Global

80-95%).

o Filtering out crystallizing substances out of untreated

sunflower oil; crystallization in cold conditions can greatly affect quality.

o Ensuring the right temperature range (5-26C) during transport; this is

needed to prevent solidification.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

Protecting the cargo from moisture and humidity to avoid rancidity.

Prevent ventilation, rust particles, spoilage, seawater contamination

and self-heating due to contact with sawdust.

Requirements you must meet

Maximum level for erucic acid in oils and fats: EU legislation fixes a

maximum level of erucic acid in oils and fats intended for human consumption.

CFA1: Check out the maximum levels for erucic acid on EU legislation:

Maximum level for erucic acid in oils and fats.

Extraction solvents for food: There are EU rules for the marketing and

application of extraction solvents used in the production of foodstuffs and food

ingredients.

CFA: Find out which Extraction solvents for food you can use and the conditions

for use.

Contaminants in food: The EU has laid down maximum levels of contaminants

in food, including ingredients such as vegetable oils.

CFA: For more information, read the CBI study on EU legislation: Contaminants

in food.

Maximum Residue Levels (MRLs) of pesticides in food: EU legislation has

been laid down to regulate the presence of pesticide residues (MRLs) in food

products.

CFA: If the agricultural raw material (sunflower seeds) for your oil has been

treated with pesticides, verify that residues remain within limits. For more

information, consult the specific EU legislation: CBI has a report on Maximum

Residue Levels (MRLs) of pesticides in food.

Additives, enzymes and flavourings in food: The EU has set a list of

permitted flavourings and requirements for their use in foodstuffs intended for

human consumption, which includes vegetable oils. This is particularly relevant

to food manufacturers. However, insight into this legislation can help you to

understand their requirements.

CFA: Familiarize yourself with the concerns of the end-users of your products by

checking EU legislation on Additives, enzymes and flavourings in food.

Hygiene of foodstuffs: Food business operators shall put in place, implement

and maintain a permanent procedure, or procedures, based on the HACCP

(Hazard Analysis and Critical Control Points) principles. This also applies to the

import of food to the EU and export from the EU.

CFA: Ensure compliance with EU legislation on Hygiene of foodstuffs (HACCP).

Labelling: In case you are supplying consumer labelled products (in for

example bottles and containers) you will have to take into account labelling

requirements laid down in EU Regulation 1169/2011.

CFA: Read more about food labelling in the EU Export Helpdesk.

Consideration for action

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

Common requirements

Food safety management: Buyers commonly require their suppliers that they

have a quality/food safety management system in place. These systems require

companies to demonstrate their ability to control food safety hazards in order to

ensure that food is safe at the time of human consumption.

CFA: Suppliers can apply a basic HACCP system. However, if they aim to supply

food manufacturers more directly, it is necessary to have a certified food safety

management system recognised by the Global Food Safety Initiative, such as

ISO 22000, BRC or IFS. Visit the website of the Global Food Safety Initiative for

more information.

Niche requirements

Regulation (EC) 834/2007 on organic agriculture: The EU has established

requirements on the production and labelling requirements with which an

organic product of agricultural origin must comply in order to be marketed in

the EU as organic.

CFA: In general, organic sunflower oil caters to a niche segment. However, it is

a market which is growing alongside the overall organic food market in Europe.

If you do choose to obtain a certificate for organic production, find out more

about Organic production and labelling.

CFA: Make sure that your organic certification is harmonised with the EU/EFTA

legislation.

Trade statistics

Imports

Figure 1: Total imports of sunflower oil to the EU and EFTA, in 1,000

tonnes.

3,000

2,500

Total imports to EU and

EFTA

2,000

1,500

Imports to EU and EFTA

from DCs

1,000

500

0

2009

Source: Eurostat (2014)

2011

2013

Total imports of sunflower oil in the EU and EFTA reached 2.8 thousand

tonnes ( 2.8 billion) in 2013. Since 2009, the total amount of imports

increased at an annual average rate of 3.3% in volume and 11% in value.

In the period 2009-2013, the Netherlands has become the largest importer

of sunflower oil in Europe (20% share in volume), recording an average

annual growth of 17% in volume and 26% in value. In 2013, Dutch imports

amounted to 550 thousand tonnes ( 517 million). The port of Rotterdam is

an important trade hub for vegetable oils, re-exporting significant volumes

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

of sunflower oil to other European countries. The Netherlands also has a

prominent cluster of refining companies, mainly located around the

Zaandam area.

Belgium is another large European importer of sunflower oil, with a 13%

share of the total imported volume in Europe. Since 2009, Belgium has

increased its imports at an annual rate of 5.7 in volume with 5.7% and 12%

in value. Belgiums significant role as a trade hub reflects the importance of

the port of Antwerp in this sector.

Spain and Italy also import a significant amount of sunflower oil, accounting

for the respective shares of 11% and 10 % in volume. In the period 20092013, the imported volume of Spain had a slight annual increase of 0.9% in

volume, but a significant 9.8% annual increase in value. Italy registered a

sharp annual growth of 9.1% in volume and 20% in value.

Almost a quarter of all Europes sunflower oil imports originates from DC

suppliers, reaching 662 thousand tonnes ( 610 million) in 2013. However,

the amount has declined with an average annual percentage of 2.6% in

volume, but increased by 6.9% in value.

CFA: Keep track of developments in the European trade for sunflower oil and

identify developments such as the emergence of new suppliers and decline of

established ones. A good source for analysing EU and EFTA trade dynamics

yourself is the Eurostat Statistics Database. Another interesting source is the

website of Fediol (Federation of the European Vegetable Oil and Protein Meal

Industry).

Figure 2: Imports of sunflower oil to the EU and EFTA; the largest

markets (in terms of 2013 volume) exporting sunflower oil to

the EU and EFTA, 2009-2013 in 1,000 tonnes

600

Hungary

500

Ukraine

400

France

300

Netherlands

200

Russia

100

0

2009

DCs (excl.

Ukraine)

2011

2013

Source: Eurostat (2014)

The large European crushing industry in countries such as France, Spain and

Hungary contributes to the relatively low volume of sunflower oil imports

sourced from DCs. A high share of imports from DCs happens in the form of

raw material (sunflower seeds), to be crushed in Europe.

The Black Sea region has the largest contribution in terms of sunflower oil

sourced from DCs. Ukraine is the largest DC supplier of sunflower oil to

Europe (16% share in volume), amounting to 449 thousand tonnes ( 402

million). Other DC suppliers are Serbia (3.2%), Argentina (1.8%) and

Moldova (1.6%).

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

Since 2009, Ukraine recorded an average annual decline of 2.3% and a

growth of 7.8% in value. This annual volume decline significantly contributes

to the decrease in total share of imports from DC suppliers. In contrast, for

instance, Argentina (one of the worlds largest producers of sunflower oil)

recorded a rapid average annual decline of 22% in European import volume

and 16% in value in the period 2009-2013.

In 2008, the detection of mineral paraffin contamination in Ukrainian

sunflower oil resulted in severe European import restrictions. The installed

requirements and random testing of Ukrainian sunflower oil has become less

strict over time, but the restrictions have only been lifted recently.

In addition, the EU approved a proposal (April 2014) to remove Ukrainian

import tariffs of certain agricultural commodities, among which crude and

refined sunflower oil, in the framework of the free trade agreement between

EU and Ukraine,. The new 0% tariff is expected to improve the position of

Ukraine as a supplier to the European Union, which represents a threat to

other possible DC suppliers.

The production of high oleic sunflower oil in Ukraine, Russia and Argentina

remain largely linoleic, due to the costly supply chain segregation from

traditional crops. France has made headway in growing high-oleic hybrid

sunflower crops and is transitioning into a large acreage destined for this

niche segment.

CFA: The FAOSTAT is an interesting source to keep up-to-date on the statistics

of sunflower seed and sunflower oil-producing countries. Identify your potential

competitors and learn from them in terms of:

Marketing: website, social media, trade fair participation, etc.

Product characteristics: origin, quality, taste, etc.

Value addition: certifications, processing techniques

Exports

Figure 3: Exports of sunflower oil from the EU and EFTA market; largest

countries exporting sunflower oil to the EU and EFTA (in terms

of 2013 volume), 2009-2013 in 1,000 tonnes.

400

350

Netherlands

300

Belgium

250

Germany

200

UK

150

Spain

100

France

50

0

2009

South Africa

2011

2013

Source: Eurostat (2014)

In 2013, total European exports of sunflower oil reached 2.3 million tonnes

( 2.3 billion). Since 2009, the recorded average annual growth was 12% in

volume and 18% in value.

Hungary and the Netherlands are the largest exporters of sunflower oil in the

EU and EFTA. In the period 2009-2013, Hungary has seen a staggering

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

annual increase in average volume of 123% and 140% in value, making it

the largest exporter in the EU and EFTA, with a respective share of 22% in

volume. The Netherlands recorded a slight average annual increase of 3.3%

in volume and a significant growth of 10% in value in the same period.

Other important exporters of sunflower oil in the EU and EFTA are France

(12% share in volume), Romania (8.3%) and Bulgaria (7.3%)

The largest destinations for European export are the Netherlands and

Belgium, marking 16% and 13% shares in volume. Other destinations for

sunflower oil exports are Germany (13%), the UK (7.9%) and Spain (5.7%).

Consumption

Figure 4: Consumption of sunflower oil in the EU, in 1,000 tonnes*

3,500

3,000

2,500

2,000

1,500

1,000

500

0

2008

2010

2012

Source: FEDIOL (2014)

* Figures cover EU-27, excluding Luxembourg, Cyprus and Malta

Total consumption of sunflower oil in the EU amounted to almost 3.5 million

tonnes in 2012. In the period 2008-2012, consumption of sunflower oil

increased with an average rate of 2.6% annually.

In European countries, sunflower oil is used extensively as a cooking oil. In

many of the producing countries such as France, sunflower oil has become

the most commonly used oil in recent years. In addition, sunflower oil is

increasingly replacing palm oil in specific industrial applications (refer to the

Market Trends section).

The largest consumption market in Europe by far is Spain, reaching 660

thousand tonnes. Since 2012, Spanish sunflower oil consumption grew by an

average rate of 5.1% annually. Use of both sunflower and olive oil is high in

Spanish and other Mediterranean dishes.

In 2012, both Italy and France consumed the respectable amounts of 387

and 341 thousand tonnes of sunflower oil. Other large consumption markets

are UK (309 thousand tonnes) and the Netherlands (230 thousand tonnes).

Consumer preferences can vary between countries. In France, consumers

prefer a strong yellow colour with a medium to high sunflower-like taste,

where Italians and Germans favour a nutty and grain-like flavour to

accompany the taste. In comparison, Dutch consumers prefer their

sunflower oil with a neutral taste and odour.

CFA: Study your target market(s) in order to make an educated decision when

exporting sunflower oil. It is important to understand factors such as product

application, taste preferences, competing suppliers and potential buyers in the

specific destination countries. A general sources for learning more about specific

countries in Europe include CIA s World Factbook.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

Production

Figure 5: Production of sunflower oil in the EU, in 1,000 tonnes*

3,000

2,500

2,000

1,500

1,000

500

0

2008

2010

2012

Source: FEDIOL (2014)

* Figures cover EU-27, excluding Luxembourg, Cyprus and Malta

Total production of sunflower oil in the EU amounted to 2.7 million tonnes in

2012. In the period 2008-2010, production of sunflower oil increased at an

annual average rate of 7.6%, but experienced an annual average decline of

6.8% between 2010 and 2012.

The largest producer of sunflower oil in the EU is France, accounting for 20%

(550 tonnes) of total production. Spain, accounting for an 18% share (482

tonnes) of total production, is also a large producer of sunflower oil in the

EU. Other large sunflower oil producers in the EU are Hungary (14% share,

at 390 tonnes) and Romania (12% share, at 339 tonnes).

CFA: Find out more about production of sunflower in Europe through the

statistics provided by FAOSTAT and Fediol (Federation of the European

Vegetable Oil and Protein Meal Industry).

Market trends

Healthy diets

The overall demand in EU for healthy ingredients in food processing is growing

rapidly. According to the European Food Safety Authority (EFSA), the high

content of linoleic acid, essential fatty acids and vitamin E in sunflower oil

provides, have positively-assessed health claims that contribute to healthy

blood cholesterol concentrations, childrens growth (omega 3 and 6), and other

protective qualities (FEDIOL). With the end-consumer becoming aware of these

characteristics, European food processors are increasingly opting for the use of

sunflower oil for frying and cooking purposes.

High oleic sunflower oil (HOSO)

The traditional sunflower oil seed has a 65% linoleic acid and 20% oleic acid

content, and can therefore be categorised with oilseeds such as soybean,

cottonseed corn and peanuts, containing 18-carbon fatty acids.

In the last 20 years, breeders have made progress in making hybrid sunflowers

that produce high-oleic seeds ranging from 60% to 90% in oleic acids,

increasing the oils oxidation stability. This has opened applications for high oleic

sunflower oil as a stabilising food ingredient, increasing the shelf-life as

ingredient and spray oil. The lower concentration of saturated fats in high-oleic

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

sunflower oil is often preferred as a healthy ingredient, opening up space in

niche markets for health foods as well.

In France and other West European countries, the market has been slowly

switching to high-oleic sunflower oil, stimulating growers to do the same. In

addition, European importers report that the demand for high-oleic sunflower oil

surpasses its current availability, which can be translated into prospective

market opportunities for exporters who can fill in this gap.

CFA: Promote the various applications and health properties of sunflower oil.

Make sure to provide your buyer with accurate product specifications and

composition.

CFA: Make sure your product characteristics and quality match your target

market and end-user in terms of:

o Taste, odour and colour

o Linoleic, oleic acid content and oxidative stability

CFA: Create partnerships with your buyer in product development and Research

& Development (R&D), which will allow you to incorporate technologies such as

the production of high-oleic sunflower oil.

Sunflower oil as a palm oil substitute

A growing concern for European palm oil importers / end-user industries is the

negative image of this oil by consumers, especially regarding the highlypublicised impact of palm production in Southeast Asia, which is strongly

associated to deforestation and bad working conditions.

In the last decade, several large companies (e.g. Lays) have switched to

sunflower oil in food processing due to the negative image of palm oil. Casino, a

large French supermarket chain, has explicitly advertised non-palm oil products

in TV commercials. Palm oil production has especially received bad publicity in

France and Belgium.

In addition, the European Parliament and the Council of the European Union

approved a new regulation on 25 October 2011 which includes re-labelling of

vegetable oils and fats on food products. Therefore, by 13 December 2014, all

products containing palm oil will have to be labelled accordingly, instead of

simply stating vegetable oil. This will bring more emphasis to the presence of

palm oil in specific products, and might influence the purchasing behaviour of

consumers.

It is important to mention, however, that palm oil remains a vital vegetable oil

to the food industry in Europe. Total European consumption of palm oil

amounted to around 6 million tonnes in 2012, having increased with an annual

average rate of 8.5% since 2008. Despite the sustainability and bad publicity

issues pointed out above, the palm oil industry is mainstreaming sustainability

efforts through the Roundtable on Sustainable Palm Oil (RSPO), which is a

multi-stakeholder initiative dedicated to promoting sustainable production of

palm oil worldwide. Read more about the palm oil market in the CBI Factsheet

Palm Oil in the EU and EFTA.

CFA: Consider the country-specific image of palm oil and follow the latest news

on European policies which impact the vegetable oil sector such as the

implementation of Regulation (EU) No 1169/2011, on the provision of food

information to consumers.

CFA: If you have the sufficient quality and volume capacities, target end-user

industries which are gradually shifting from palm oil to sunflower oil.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

The importance of food safety

The database of EUs Rapid Alert System for Food and Feed (RASSF) indicates

that import of sunflower oil can be alerted and/or rejected for numerous reasons.

For example, because of improper health certificates, benzopyrene

contamination or the presence of mineral oil. Although a relatively limited

amount of notifications has been identified in the last years, food safety alerts

can have severe consequences.

In 2008, French authorities discovered high mineral contaminated sunflower oil

in originating from Ukraine. The oil had been re-exported to different European

export countries. In reaction, the EU blocked all imports from Ukraine until extra

sampling procedures had been installed.

CFA: On the website of the Rapid Alert System for Food and Feed (RASFF), you

can browse through various border rejections and alerts for sunflower oil

under category fats and oils. In this manner, you can learn about common

problems faced by suppliers during border controls and adopt appropriate

measures to avoid them.

Market channels and segments

Market channels

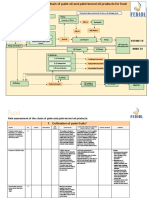

Figure 6: Trade channels for sunflower oil in the EU and EFTA

Developing country

EU/EFTA market

EU/EFTA market segments

Re-exports

Food industry

Traders

Producer/

exporter of

vegetable oils

Bottling

Importers

Refining

industry

Retailers

Food processing

Brokers

Catering

industry

Chemical industry

Producer/

exporter of

oilseeds

Crushing

industry in

EU/EFTA

(crude oil)

The trade channels for sunflower oil do not deviate from the general structure

for vegetable oils as described in CBI Market Channels and Segments for

Vegetable Oils.

In general, the following margins can be expected:

Brokers: ranging from approximately 0.5 to 2%, or fixed price per

tonne

Importers: will depend on whether the oil is simply being forwarded (510%), or whether the importer has to re-sell specific quantities (1020%).

Refiners charge a fixed amount per tonne of oil refined, approx. 200300/tonne.

The margins charged by other industry players such as food

manufacturers, bottlers and retailers will highly depend on the nature

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

of the final product. Figure 7 provides an overview of the main

segments for sunflower oil.

CFA: If you are able to supply directly to food processors or crushers in terms

of volume, as well as consistent delivery and quality, make sure you have

adequate quality control systems. The different systems available are described

under Common requirements. Make sure to consult your (potential) buyer on

the certifications which are required by them.

CFA: If you are dealing with smaller volumes or specialised sunflower oil (e.g.

high-oleic, organic), importers are quite certainly the most suitable entry point.

CFA: If you are a starting exporter, brokers can be your entry point into Europe

as they are trusted by the European edible oil sector, which can make up the

lack of reputation of a starting DC exporter.

CFA: Comply with sustainability standards required by your specific segment

and stay up-to-date on developments in this respect. For information on the

various sustainability standards visit the ITC website on the voluntary standards

that are available for exporters.

Market segments

Sunflower oil is mostly used in the food industry, where it can be segmented

into:

Food processing industry: ingredient to manufacture semi-finished or

final food products

Bottling industry: bottled as a final product

Figure 7 describes the main uses of sunflower oil in Europe within these two

segments.

Sunflower oil can be further segmented into commodity and speciality oil. The

main differences between commodity and speciality sunflower oil are described

in Figure 7, and further elaborated (at a more general level for vegetable oils) in

CBI Market Channels and Segments for Vegetable Oils.

Figure 7: Segmentation of sunflower oil in the EU and EFTA

Food industry segmentation

Bottling industry:

Multi-purpose cooking oil: frying, roasting, salad dressings, etc.

Food processing industry:

Margarine, sauces, mayonnaise, frying, spray oil on cereals and

biscuits, etc.

Commodity

Speciality

Conventional sunflower oil:

Specialty sunflowert oil:

Futures market/international

prices

Standard quality: refined, heat

extracted

Premium quality: virgin, cold

pressed, high-oleic

Organic certification

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

CBI Product Factsheet: Sunflower oil in the EU and EFTA

Price

Figure 8 shows export prices for sunflower oil sourced in the USA. Sunflower oil

prices from other origins are either incomplete or non-existent in the sources

consulted. For this reason, the prices presented below are discussed as

reference prices for exporters from other origins. Other supply-demand

dynamics for sunflower oil, and their influences on prices, are presented in

textual form.

Figure 8: Sunflower Oil, US export price from Gulf of Mexico, 2009-2013,

annual averages in USD per tonne

1,800

1,600

1,400

1,200

1,000

800

600

400

200

2009

2010

2011

2012

2013

2014

Source: Index Mundi, 2014

Export prices of sunflower oil from the Ukraine, the largest supplier to the EU

and EFTA, have followed an upward trend in the last months. The prevailing

military crisis in Ukraine has escalated the prices of crude sunflower oil. While

the Russian troops have started tightening their grip over Ukraine, the import

shipments from the latter are getting delayed. In March 2014, prices of the

vegetable oil were pushed up by about 10-12 per cent in less than a month

(Hindu Business Line, 2014).

CFA: More information on developments in other supplying countries and their

effect on global prices, can be found on websites such as Index Mundi and

Public Ledger.

CFA: Develop sustainable, trust-based, relationships with new buyers in order

to profit from the current international scenario for groundnuts in the long run.

CFA: Develop good market information systems so as to be aware of market

movements in groundnuts worldwide.

Interesting Sources

The EU Vegetable Oil and Protein meal Industry - www.fediol.eu

The Food and Agriculture Organisation of the United Nations has a variety of

agricultural databases - faostat3.fao.org

For information on the latest market developments in the Oils and seeds

sector, visit The Public Ledger - publicledger.agra-net.com/oils

National Sunflower Association Market News www.sunflowernsa.com/growers/marketing/daily-market-news

This survey was compiled for CBI by ProFound Advisers In Development

in collaboration with CBI expert Joost Pierrot

Disclaimer CBI market information tools: http://www.cbi.eu/disclaimer

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketintel@cbi.eu www.cbi.eu/disclaimer

Potrebbero piacerti anche

- Become Unstoppable - Your Guide To Self-MasteryDocumento13 pagineBecome Unstoppable - Your Guide To Self-MasterySimon Brassard100% (1)

- Sibo Gut Healing Protocol PDFDocumento2 pagineSibo Gut Healing Protocol PDFLee Ming Hin100% (1)

- Beef Ramen Noodle RecipesDocumento3 pagineBeef Ramen Noodle RecipestiggydeeNessuna valutazione finora

- Baking Terminology and DefinitionDocumento10 pagineBaking Terminology and DefinitionRosemarie Gaspar50% (2)

- Withdrawal ManualDocumento47 pagineWithdrawal Manualatvenu16160Nessuna valutazione finora

- Health Through The Diet - An Ayurvedic Perspective - Pratibha Shah, BAMS, MD-AyuDocumento40 pagineHealth Through The Diet - An Ayurvedic Perspective - Pratibha Shah, BAMS, MD-AyuPriya Sharma SabaradNessuna valutazione finora

- Microbiology - Bad Bug BookDocumento264 pagineMicrobiology - Bad Bug BookkanetrebleNessuna valutazione finora

- Fundamentals of Food Freezing (Norman W. Desrosier, Donald K. Tressler (Auth.) )Documento639 pagineFundamentals of Food Freezing (Norman W. Desrosier, Donald K. Tressler (Auth.) )ferdyansyah jafarNessuna valutazione finora

- Global Food Traceability PDFDocumento10 pagineGlobal Food Traceability PDFKristina HartzNessuna valutazione finora

- Sorbic AcidDocumento3 pagineSorbic Acid4461ursNessuna valutazione finora

- Food SpoilageDocumento13 pagineFood SpoilageKrithishNessuna valutazione finora

- Commodities and Defect Action LevelsDocumento32 pagineCommodities and Defect Action LevelsDrSoumitra SoniNessuna valutazione finora

- Final Draft prEN 16636 Pest Management Services - Requirements & CompetencesDocumento34 pagineFinal Draft prEN 16636 Pest Management Services - Requirements & CompetencesMidou Zizou100% (1)

- The Importance of Food PH in Commercial Canning Operations: William McglynnDocumento8 pagineThe Importance of Food PH in Commercial Canning Operations: William McglynnSena Kartika PNessuna valutazione finora

- Culinar y Nutrition News:: June 10 The Function of Functional FoodsDocumento4 pagineCulinar y Nutrition News:: June 10 The Function of Functional FoodsLu GaldinoNessuna valutazione finora

- Ippc Guide to Pest Risk Communication: A Guide for National Plant Protection Organizations on Communicating with Stakeholders about Pest RisksDa EverandIppc Guide to Pest Risk Communication: A Guide for National Plant Protection Organizations on Communicating with Stakeholders about Pest RisksNessuna valutazione finora

- Compendium of The Microbiological Spoilage of Foods and BeveragesDocumento1 paginaCompendium of The Microbiological Spoilage of Foods and BeveragesDavid Stiven RNessuna valutazione finora

- Oxalate 2008Documento11 pagineOxalate 2008NMMarauder100% (4)

- 2073 2005 For Manufacturers FINALDocumento6 pagine2073 2005 For Manufacturers FINALjercherwinNessuna valutazione finora

- Food Preservation: Chemical Preservation: Dr. Pradeep PariharDocumento30 pagineFood Preservation: Chemical Preservation: Dr. Pradeep PariharSmileeyNessuna valutazione finora

- Overview of Food Quality by M.SivarajanDocumento27 pagineOverview of Food Quality by M.SivarajanervaishaliNessuna valutazione finora

- Infant Formula Gmp-EngDocumento39 pagineInfant Formula Gmp-EngPhilippe TrotinNessuna valutazione finora

- Risk Assessment Palm Food FEDIOL Final 160522Documento18 pagineRisk Assessment Palm Food FEDIOL Final 160522Jayashri chitteNessuna valutazione finora

- Spice Microbiological ProfilesDocumento6 pagineSpice Microbiological ProfilesainnurkhalisNessuna valutazione finora

- The Evaluation of Microbiological Criteria For Food Products of AnimalDocumento44 pagineThe Evaluation of Microbiological Criteria For Food Products of AnimalAchara MatiyaNessuna valutazione finora

- Cheese of ItalyDocumento78 pagineCheese of ItalyHemant ChopraNessuna valutazione finora

- Blueberry PDFDocumento50 pagineBlueberry PDFn.maiaNessuna valutazione finora

- R2 For PrintDocumento17 pagineR2 For PrintIvan Bautista0% (1)

- Introduction HaccpDocumento28 pagineIntroduction HaccpErick Efren Diaz RodriguezNessuna valutazione finora

- Farmhouse Cheesemakers Workbook FINALDocumento67 pagineFarmhouse Cheesemakers Workbook FINALIshan PoudelNessuna valutazione finora

- 19 Probiotics PrebioticsDocumento22 pagine19 Probiotics PrebioticsGâtlan Lucian100% (1)

- Kansas Foodborne Illness ManualDocumento186 pagineKansas Foodborne Illness ManualLeo M. Pedro Jr.Nessuna valutazione finora

- 2ND TQ in Tle 10Documento2 pagine2ND TQ in Tle 10Imjesrel PeriodNessuna valutazione finora

- Turismul Romaniei 2016 PDFDocumento68 pagineTurismul Romaniei 2016 PDFȘtefan SanduNessuna valutazione finora

- Fd7103 Food Processing and PreservationDocumento1 paginaFd7103 Food Processing and PreservationKevinXavier0% (1)

- Food AllergiesDocumento19 pagineFood Allergiesjacky786100% (1)

- Short food supply chains Complete Self-Assessment GuideDa EverandShort food supply chains Complete Self-Assessment GuideNessuna valutazione finora

- Algae Organisms For Imminent Biotechnology Challenges and Opportunities in The Present Era of Marine Algal ApplicationsDocumento40 pagineAlgae Organisms For Imminent Biotechnology Challenges and Opportunities in The Present Era of Marine Algal ApplicationsSilviu-Laurentiu BadeaNessuna valutazione finora

- Food Safety in the Seafood Industry: A Practical Guide for ISO 22000 and FSSC 22000 ImplementationDa EverandFood Safety in the Seafood Industry: A Practical Guide for ISO 22000 and FSSC 22000 ImplementationNessuna valutazione finora

- HaccpDocumento67 pagineHaccpPaulo DantasNessuna valutazione finora

- Food Crisis, Gender, and Resilience in The Sahel: Lessons From The 2012 Crisis in Burkina Faso, Mali, and NigerDocumento58 pagineFood Crisis, Gender, and Resilience in The Sahel: Lessons From The 2012 Crisis in Burkina Faso, Mali, and NigerOxfamNessuna valutazione finora

- The Microbiological Safety of Minimally Processed VegetablesDocumento22 pagineThe Microbiological Safety of Minimally Processed VegetablesDiego Alberto CastellanosNessuna valutazione finora

- Novel Foods and AllergyDocumento15 pagineNovel Foods and AllergyErvantogatoropNessuna valutazione finora

- Codex HACCP and Hazard Analysis For Risk Based Measures White Paper 11 July 2018Documento26 pagineCodex HACCP and Hazard Analysis For Risk Based Measures White Paper 11 July 2018Alvaro MontañoNessuna valutazione finora

- Microorganisms & Microbial-Derived Ingredients Used in Food (Partial List)Documento5 pagineMicroorganisms & Microbial-Derived Ingredients Used in Food (Partial List)Aaron WoodNessuna valutazione finora

- Nutraceuticals Functional Foods: Handbook ofDocumento13 pagineNutraceuticals Functional Foods: Handbook ofshekharNessuna valutazione finora

- Microbiological Criteria Fishery ProductsDocumento65 pagineMicrobiological Criteria Fishery Productsvladyda04687Nessuna valutazione finora

- Module 5 TranscriptDocumento27 pagineModule 5 TranscriptHakim AliNessuna valutazione finora

- Adulteration Detection in Milk and Milk ProductsDocumento10 pagineAdulteration Detection in Milk and Milk Productscrneetesh0% (1)

- Food Poisoning: - Also Known As Foodborne Illness - Is Any Illness That Results FromDocumento24 pagineFood Poisoning: - Also Known As Foodborne Illness - Is Any Illness That Results FromTheodiffer Digal TemblorNessuna valutazione finora

- Design and Construction of Food PremisesDocumento62 pagineDesign and Construction of Food PremisesAkhila MpNessuna valutazione finora

- Whitepaper - Microbiological Risk AssessmentDocumento9 pagineWhitepaper - Microbiological Risk AssessmentEddie Ajalcriña BocangelNessuna valutazione finora

- Haccp TerminologyDocumento16 pagineHaccp Terminologynoman_sheeraz7455Nessuna valutazione finora

- Water in Foods: Fundamental Aspects and Their Significance in Relation to Processing of FoodsDa EverandWater in Foods: Fundamental Aspects and Their Significance in Relation to Processing of FoodsFitoNessuna valutazione finora

- Pesticides Residues Regulation CSADocumento80 paginePesticides Residues Regulation CSASamantha HoNessuna valutazione finora

- FDA Handbook On Defect ActionDocumento21 pagineFDA Handbook On Defect ActionTim Alvaran100% (1)

- Safety Data Sheet: Areca / Eco / Palm - Leaf Dinnerware PlatesDocumento2 pagineSafety Data Sheet: Areca / Eco / Palm - Leaf Dinnerware PlatesMohammad MukarramNessuna valutazione finora

- Rice Fortification Success Stories in 9 Countries PDFDocumento16 pagineRice Fortification Success Stories in 9 Countries PDFjavedafridiNessuna valutazione finora

- Allergens Slides Luccioli 031617Documento26 pagineAllergens Slides Luccioli 031617soniaditia_chemistNessuna valutazione finora

- ff5 - Haccp Frying (2004)Documento22 pagineff5 - Haccp Frying (2004)Banuraspati100% (1)

- AIB The Mock (Recall) Myth PDFDocumento2 pagineAIB The Mock (Recall) Myth PDFGaganpreet KaurNessuna valutazione finora

- Food Intolerances and Allergies: © Livestock & Meat Commission For Northern Ireland 2015Documento19 pagineFood Intolerances and Allergies: © Livestock & Meat Commission For Northern Ireland 2015soniaditia_chemistNessuna valutazione finora

- Case Study:: Pathogens and SpicesDocumento40 pagineCase Study:: Pathogens and SpicesLina DiazNessuna valutazione finora

- Hypobaric Storage in Food Industry: Advances in Application and TheoryDa EverandHypobaric Storage in Food Industry: Advances in Application and TheoryNessuna valutazione finora

- NanotechnologyApplicationsintheFoodIndustry PDFDocumento319 pagineNanotechnologyApplicationsintheFoodIndustry PDFjesus cuevasNessuna valutazione finora

- Prebiotic JuiceDocumento7 paginePrebiotic JuicePriscila MariaNessuna valutazione finora

- The Microbial World and YouDocumento4 pagineThe Microbial World and Youanum786110Nessuna valutazione finora

- Gso 147Documento11 pagineGso 147Q ANessuna valutazione finora

- HACCP Plan WorksheetDocumento2 pagineHACCP Plan WorksheetzhonglulogisticsNessuna valutazione finora

- Turismul Romaniei 2014Documento68 pagineTurismul Romaniei 2014andreeab123Nessuna valutazione finora

- Turismul Romaniei - 2013 InsseDocumento71 pagineTurismul Romaniei - 2013 InssezamurcaralucaNessuna valutazione finora

- Turismul Romaniei - Breviar Statistic 2012Documento72 pagineTurismul Romaniei - Breviar Statistic 2012MarianNessuna valutazione finora

- Rural Tourism in Romania - Evolutions and DiscontinuitiesDocumento6 pagineRural Tourism in Romania - Evolutions and DiscontinuitiesȘtefan SanduNessuna valutazione finora

- Mobile Catering WikiDocumento2 pagineMobile Catering WikiȘtefan SanduNessuna valutazione finora

- Catering WikiDocumento2 pagineCatering WikiȘtefan SanduNessuna valutazione finora

- Curs Control Vegetale PDFDocumento67 pagineCurs Control Vegetale PDFȘtefan SanduNessuna valutazione finora

- Sunflower Oil Market Analysis - 04052011Documento32 pagineSunflower Oil Market Analysis - 04052011Ștefan SanduNessuna valutazione finora

- PROJECT-Biomolecules: Name: - Period: - Reading GuideDocumento8 paginePROJECT-Biomolecules: Name: - Period: - Reading Guidejennifer nogueraNessuna valutazione finora

- Bahasa Ing GrisDocumento14 pagineBahasa Ing GrisAmelia Wulandari SafitriNessuna valutazione finora

- Plant-Based Protein SourcesDocumento4 paginePlant-Based Protein SourcesedliraNessuna valutazione finora

- Samosa Chaat Recipe BBC Good FoodDocumento1 paginaSamosa Chaat Recipe BBC Good FoodSheenaNessuna valutazione finora

- NEW PRICE Pavilion Grandest Wedding & Regular Wedding PackageDocumento3 pagineNEW PRICE Pavilion Grandest Wedding & Regular Wedding PackageRoseCastilloOrfano50% (2)

- Product List Barentz UpdateDocumento1 paginaProduct List Barentz UpdateSholahudin LatifNessuna valutazione finora

- Food Categorization CodeDocumento7 pagineFood Categorization CodejainshinesNessuna valutazione finora

- 09 Agriculture R0323Documento60 pagine09 Agriculture R0323abbicox.stlNessuna valutazione finora

- Effect of Flour Composition (Arrowroot, Lesser Yam and Potato) On Its Nutritional and Functional PropertiesDocumento13 pagineEffect of Flour Composition (Arrowroot, Lesser Yam and Potato) On Its Nutritional and Functional PropertiesDanaNessuna valutazione finora

- Lab 2A Exercising Control Over Your Physical Activity and Nutrition EnvironmentDocumento3 pagineLab 2A Exercising Control Over Your Physical Activity and Nutrition EnvironmentGabbie BoudreauxNessuna valutazione finora

- Hpc1: Kitchen Essentials and Basic Food Preparation: Talisay City CollegeDocumento10 pagineHpc1: Kitchen Essentials and Basic Food Preparation: Talisay City CollegeDennice April AligangaNessuna valutazione finora

- GowardhanDocumento11 pagineGowardhanBaiju SivaramanNessuna valutazione finora

- Montreaux Chocolate USA: Are Americans Ready For Healthy Dark Chocolate ?Documento20 pagineMontreaux Chocolate USA: Are Americans Ready For Healthy Dark Chocolate ?vivek pandeyNessuna valutazione finora

- Ahafo North Updated JD'sDocumento6 pagineAhafo North Updated JD'sDuku PatrickNessuna valutazione finora

- The Effect of Cloud Ear FungusDocumento2 pagineThe Effect of Cloud Ear FungusElyza Joy RallosNessuna valutazione finora

- Case Study - PlanningDocumento9 pagineCase Study - PlanningRUTVIKA DHANESHKUMARKUNDAGOLNessuna valutazione finora

- Thesis On Cocoa ProductionDocumento7 pagineThesis On Cocoa Productionafbtmznam100% (2)

- Enjoy Your Meal!: in The RestaurantDocumento6 pagineEnjoy Your Meal!: in The RestaurantHugo HernándezNessuna valutazione finora

- Grab Magazine ISSUE01 English 01 11Documento11 pagineGrab Magazine ISSUE01 English 01 11vangogh1238Nessuna valutazione finora

- Business Proposal - Food StopDocumento8 pagineBusiness Proposal - Food StopSk Washim RajaNessuna valutazione finora