Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Homework For Next Class

Caricato da

Simo El KettaniDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Homework For Next Class

Caricato da

Simo El KettaniCopyright:

Formati disponibili

BA10_C09.

qxd 16/12/04 11:31 am Page 100

Part 2 l The financial statements of sole traders

Review questions

9.1

From the following information, draw up the trading account of J Bell for the year ended

31 December 20X7, which was his first year in business:

980

840

1,290

162,918

121,437

11,320

Carriage inwards

Returns outwards

Returns inwards

Sales

Purchases

Stocks of goods: 31 December 20X7

9.2A

The following information is available for the year ended 31 March 20X8. Draw up the

trading account of P Frank for that year.

52,400

16,220

19,480

394,170

2,490

469,320

Stocks: 31 March 20X8

Returns inwards

Returns outwards

Purchases

Carriage inwards

Sales

9.3

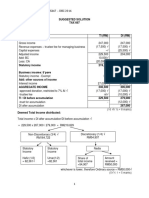

From the following trial balance of G Still, draw up a trading and profit and loss account for

the year ended 30 September 20X9, and a balance sheet as at that date.

Dr

Stock 1 October 20X8

Carriage outwards

Carriage inwards

Returns inwards

Returns outwards

Purchases

Sales

Salaries and wages

Warehouse rent

Insurance

Motor expenses

Office expenses

Lighting and heating expenses

General expenses

Premises

Motor vehicles

Fixtures and fittings

Debtors

Creditors

Cash at bank

Drawings

Capital

41,600

2,100

3,700

1,540

100

3,410

188,430

380,400

61,400

3,700

1,356

1,910

412

894

245

92,000

13,400

1,900

42,560

31,600

5,106

22,000

484,253

Stock at 30 September 20X9 was 44,780.

Cr

68,843

484,253

BA10_C09.qxd 16/12/04 11:31 am Page 101

Chapter 9 l Trading and profit and loss accounts and balance sheets: further considerations

9.4

The following trial balance was extracted from the books of F Sorley on 30 April 20X7. From

it, and the note about stock, prepare his trading and profit and loss account for the year ended

30 April 20X7, and a balance sheet as at that date.

Dr

Cr

Sales

Purchases

Stock 1 May 20X6

Carriage outwards

Carriage inwards

Returns inwards

Returns outwards

Salaries and wages

Motor expenses

Rent

Sundry expenses

Motor vehicles

Fixtures and fittings

Debtors

Creditors

Cash at bank

Cash in hand

Drawings

Capital

210,420

108,680

9,410

1,115

840

4,900

3,720

41,800

912

6,800

318

14,400

912

23,200

14,100

4,100

240

29,440

247,067

18,827

247,067

Stock at 30 April 20X7 was 11,290.

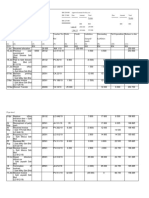

9.5A The following is the trial balance of T Owen as at 31 March 20X9. Draw up a set of financial

statements for the year ended 31 March 20X9.

Dr

52,800

276,400

141,300

1,350

5,840

2,408

Stock 1 April 20X8

Sales

Purchases

Carriage inwards

Carriage outwards

Returns outwards

Wages and salaries

Business rates

Communication expenses

Commissions paid

Insurance

Sundry expenses

Buildings

Debtors

Creditors

Fixtures

Cash at bank

Cash in hand

Drawings

Capital

Cr

63,400

3,800

714

1,930

1,830

208

125,000

45,900

24,870

1,106

31,420

276

37,320

514,194

210,516

514,194

Stock at 31 March 20X9 was 58,440.

101

BA10_C09.qxd 16/12/04 11:31 am Page 102

Part 2 l The financial statements of sole traders

9.6A F Brown drew up the following trial balance as at 30 September 20X8. You are to draft the

trading and profit and loss account for the year ended 30 September 20X8 and a balance sheet as

at that date.

Capital

Drawings

Cash at bank

Cash in hand

Debtors

Creditors

Stock 30 September 20X7

Van

Office equipment

Sales

Purchases

Returns inwards

Carriage inwards

Returns outwards

Carriage outwards

Motor expenses

Rent

Telephone charges

Wages and salaries

Insurance

Office expenses

Sundry expenses

Dr

Cr

49,675

28,600

4,420

112

38,100

26,300

72,410

5,650

7,470

391,400

254,810

2,110

760

1,240

2,850

1,490

8,200

680

39,600

745

392

216

468,615

468,615

Stock at 30 September 20X8 was 89,404.

9.7 Enter the following transactions in the ledger of A Baker and prepare a trial balance at

31 May, together with a calculation of the profit for the month and a balance sheet at 31 May.

May 31

May 31

102

Started in business with 1,500 in the bank and 500 cash

Purchased goods to the value of 1,750 from C Dunn, agreeing credit terms of 60 days

Bought fixtures and fittings for the bakery for 150, paying by cheque

Bought goods on credit from E Farnham for 115

Paid rent of 300 paying cash

Bought stationery cash book and invoices for 75 paying by cash

Sold goods on credit, value 125, to G Harlem

Bought an old van for deliveries for 2,000 on credit from I Jumpstart

Paid wages of 450 net for the month by cheque, Inland Revenue deductions of 75 to

be paid in the following month

Summarised cash sales for the month and found them to be 2,500. Took a cheque for

500 as own wages for the month. Banked 2,000 out of the cash sales over the month

Closing stock was 500

May 1

May 2

May 3

May 6

May 10

May 12

May 14

May 20

May 30

Potrebbero piacerti anche

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Documento9 pagineDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860Nessuna valutazione finora

- Capital flight affects exchange ratesDocumento4 pagineCapital flight affects exchange ratesTunggal PrayogaNessuna valutazione finora

- Walkthrough ExampleDocumento2 pagineWalkthrough ExampleXaralisa Jazz50% (2)

- Tutorial 1a - Budgeting Functional QDocumento4 pagineTutorial 1a - Budgeting Functional QNur Dina AbsbNessuna valutazione finora

- Accounting Tutorial 2 Part 2Documento18 pagineAccounting Tutorial 2 Part 2Sim Pei Ying100% (1)

- Pyq Acc 116Documento7 paginePyq Acc 116HaniraMhmdNessuna valutazione finora

- SC Structure of AyamasDocumento2 pagineSC Structure of AyamasRaajKumarNessuna valutazione finora

- FAR460 - Feb 2021 - Q - Set 1Documento7 pagineFAR460 - Feb 2021 - Q - Set 1Ahmad Adlan Bin RosliNessuna valutazione finora

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Documento11 pagineUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNessuna valutazione finora

- Group Project GuidelineDocumento2 pagineGroup Project Guidelinesyazanii22Nessuna valutazione finora

- Tax317 Group Project SSTDocumento23 pagineTax317 Group Project SSTNik Syarizal Nik MahadhirNessuna valutazione finora

- Taxation Suggested Solution: LessDocumento9 pagineTaxation Suggested Solution: LesskannadhassNessuna valutazione finora

- Past Year Far460 - Dec 2014Documento7 paginePast Year Far460 - Dec 2014Alief Zazman100% (1)

- 股权代持协议英文版Documento4 pagine股权代持协议英文版sununilabNessuna valutazione finora

- Fundamentals Level – Skills Module Taxation (MalaysiaDocumento12 pagineFundamentals Level – Skills Module Taxation (MalaysiaBeeJuNessuna valutazione finora

- Assignment MBA 1003Documento34 pagineAssignment MBA 1003KAWongCy100% (1)

- BKAF3073 Chapter 3Documento84 pagineBKAF3073 Chapter 3Shahrul IzwanNessuna valutazione finora

- Assignment 2 - N4am2261a - Group4Documento27 pagineAssignment 2 - N4am2261a - Group4zuewaNessuna valutazione finora

- Report For Assignment Chapter 6 (Bankruptcy Among Young People in Malaysia)Documento10 pagineReport For Assignment Chapter 6 (Bankruptcy Among Young People in Malaysia)Aida KarimNessuna valutazione finora

- Solution Dec 2014Documento8 pagineSolution Dec 2014anis izzatiNessuna valutazione finora

- Jawabab MK WayanDocumento1 paginaJawabab MK WayanErica LesmanaNessuna valutazione finora

- FINANCIAL STATEMENT ANALYSISDocumento2 pagineFINANCIAL STATEMENT ANALYSISphoenixNessuna valutazione finora

- Revision of Published Accounts Format With Selected Mfrs Reference-May2019Documento12 pagineRevision of Published Accounts Format With Selected Mfrs Reference-May2019Amin OthmanNessuna valutazione finora

- ACC106-FORMAT OF FINAL ACCOUNTS-amendedDocumento2 pagineACC106-FORMAT OF FINAL ACCOUNTS-amendedhaziqkings20100% (1)

- Law Report Ques 41Documento15 pagineLaw Report Ques 41Syahirah AliNessuna valutazione finora

- Solution Tax667 - Dec 2016Documento7 pagineSolution Tax667 - Dec 2016Zahiratul QamarinaNessuna valutazione finora

- Introduction To Cost Accounting - Week 2Documento1 paginaIntroduction To Cost Accounting - Week 2fatin niniNessuna valutazione finora

- Accounting Questions PracticesDocumento2 pagineAccounting Questions PracticesSusanna Ng50% (2)

- Tutorial 3 Answer SegmentalDocumento6 pagineTutorial 3 Answer Segmental--bolabolaNessuna valutazione finora

- Accounting transactions and journalsDocumento18 pagineAccounting transactions and journalsAzymah Eyzzaty D'redRibbon100% (1)

- Assignment Far 110 UitmDocumento56 pagineAssignment Far 110 UitmFarah HusnaNessuna valutazione finora

- Experian Corporate Report: Particulars of The Subject Provided by YouDocumento6 pagineExperian Corporate Report: Particulars of The Subject Provided by YouIman AzimNessuna valutazione finora

- Dutch Lady Profile and Financial OverviewDocumento39 pagineDutch Lady Profile and Financial OverviewHazim YusoffNessuna valutazione finora

- Role Play 20204 - Fin242Documento2 pagineRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNessuna valutazione finora

- Tutorial 2 Capital Allowances - Q&ADocumento8 pagineTutorial 2 Capital Allowances - Q&AKamal JabriNessuna valutazione finora

- Table of Content: Num. PagesDocumento14 pagineTable of Content: Num. Pagescrossbonez9350% (2)

- Financial Ratio Analysis and Company RecommendationDocumento2 pagineFinancial Ratio Analysis and Company RecommendationVeenesha MuralidharanNessuna valutazione finora

- ACCT 2112 2013/2014 Solution For Tutorial 9Documento6 pagineACCT 2112 2013/2014 Solution For Tutorial 9Weiyee WongNessuna valutazione finora

- Questions Level 2 Series 2006 3Documento4 pagineQuestions Level 2 Series 2006 3Ppii FfrtrNessuna valutazione finora

- Assignment - Dutch Lady VS NestleDocumento25 pagineAssignment - Dutch Lady VS NestlesyafiqahanidaNessuna valutazione finora

- Case Notes - Topic 6Documento8 pagineCase Notes - Topic 6meiling_1993Nessuna valutazione finora

- Financial Planning and Forecasting From Brigham & EhrhardtDocumento52 pagineFinancial Planning and Forecasting From Brigham & EhrhardtAsif KhanNessuna valutazione finora

- Bay Al Inah in Islamic BankingDocumento2 pagineBay Al Inah in Islamic BankingkhalidaNessuna valutazione finora

- Advanced Financial Reporting: Semester 2 - Module 2 Cash Flow StatementDocumento26 pagineAdvanced Financial Reporting: Semester 2 - Module 2 Cash Flow Statementmy VinayNessuna valutazione finora

- TAX Treatment For TAX267 and TAX317 Budget 2019Documento5 pagineTAX Treatment For TAX267 and TAX317 Budget 2019nonameNessuna valutazione finora

- F6mys 2013 Dec ADocumento8 pagineF6mys 2013 Dec AĐàm TrangNessuna valutazione finora

- Jan22 QQ PDFDocumento5 pagineJan22 QQ PDFSYAZWINA SUHAILINessuna valutazione finora

- VOTE Book PSADocumento4 pagineVOTE Book PSAJulma Jaiiy100% (1)

- Acc406 - Acc07 Test 2 QS Feb 2022Documento6 pagineAcc406 - Acc07 Test 2 QS Feb 2022Assignments HelperNessuna valutazione finora

- Financial Reporting FoundationDocumento4 pagineFinancial Reporting FoundationAre FixNessuna valutazione finora

- Muhammad Lukman Nur Hakim Bin Mohd Rashidi Ec1104o Assignment 1Documento16 pagineMuhammad Lukman Nur Hakim Bin Mohd Rashidi Ec1104o Assignment 1Lukman HakimNessuna valutazione finora

- Acc106 Feb2021 Question Set 1Documento15 pagineAcc106 Feb2021 Question Set 1Fara husna0% (1)

- From Low Cost To Global LeadershipDocumento14 pagineFrom Low Cost To Global LeadershipTanu Lahoti100% (1)

- Tutorial 5 Eco 415Documento7 pagineTutorial 5 Eco 415ZhiXNessuna valutazione finora

- Compilation Pyq - Far570Documento109 pagineCompilation Pyq - Far570Nur SyafiqahNessuna valutazione finora

- FAR270 JULY 2022 SolutionDocumento8 pagineFAR270 JULY 2022 SolutionNur Fatin AmirahNessuna valutazione finora

- Far410 Chapter 1 Fin Regulatory FrameworkDocumento19 pagineFar410 Chapter 1 Fin Regulatory Frameworkafdhal50% (4)

- Integrated Case Study Complete EditionDocumento34 pagineIntegrated Case Study Complete EditionWan Ramss Jr.100% (10)

- SWOT Analysis TasekDocumento4 pagineSWOT Analysis Taseknor aimanNessuna valutazione finora

- For The Full Essay Please WHATSAPP 010-2504287Documento11 pagineFor The Full Essay Please WHATSAPP 010-2504287Simon RajNessuna valutazione finora

- Review Questions Final Accounts For A Sole TraderDocumento3 pagineReview Questions Final Accounts For A Sole TraderdhanyasugukumarNessuna valutazione finora

- F - T 4.15PM T N 5 2009 All Completed Answers To Be Dropped in The Economics Post Box On The Ground Floor of Rhetoric HouseDocumento3 pagineF - T 4.15PM T N 5 2009 All Completed Answers To Be Dropped in The Economics Post Box On The Ground Floor of Rhetoric Houseghu5926Nessuna valutazione finora

- Piyush TahkitDocumento44 paginePiyush TahkitPankaj VishwakarmaNessuna valutazione finora

- CH 6 Reverse Logistics PresentationDocumento27 pagineCH 6 Reverse Logistics PresentationSiddhesh KolgaonkarNessuna valutazione finora

- Market IndicatorsDocumento7 pagineMarket Indicatorssantosh kumar mauryaNessuna valutazione finora

- The Complete Field Guide For Solar Sales Leaders - SPOTIODocumento29 pagineThe Complete Field Guide For Solar Sales Leaders - SPOTIOrenewenergymanNessuna valutazione finora

- Summer Training Report On Talent AcquisitionDocumento56 pagineSummer Training Report On Talent AcquisitionFun2ushhNessuna valutazione finora

- Production Planning and ControlDocumento16 pagineProduction Planning and Controlnitish kumar twariNessuna valutazione finora

- Premium Paid AcknowledgementDocumento1 paginaPremium Paid Acknowledgementharsh421Nessuna valutazione finora

- Capital Structure of DR Reddy's LaboratoriesDocumento11 pagineCapital Structure of DR Reddy's LaboratoriesNikhil KumarNessuna valutazione finora

- ENGG951 - Group T1-2 - Assessment 5 ADocumento9 pagineENGG951 - Group T1-2 - Assessment 5 Akumargotame7Nessuna valutazione finora

- Book Channel ManagementDocumento117 pagineBook Channel ManagementParisa Asgari SabetNessuna valutazione finora

- Quiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDocumento2 pagineQuiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDianeNessuna valutazione finora

- 2 Intro ERP Using Global Bike Slides en v3.3Documento21 pagine2 Intro ERP Using Global Bike Slides en v3.3Trixi Morales FernandezNessuna valutazione finora

- Sop Finaldraft RaghavbangadDocumento3 pagineSop Finaldraft RaghavbangadraghavNessuna valutazione finora

- ADMS 3585 Course Outline Fall 2019 Keele CampusDocumento16 pagineADMS 3585 Course Outline Fall 2019 Keele CampusjorNessuna valutazione finora

- Staff WelfareDocumento2 pagineStaff Welfaremalikiamcdonald23Nessuna valutazione finora

- Chapter 5: Property, Plant and EquipmentDocumento4 pagineChapter 5: Property, Plant and EquipmentNicole PhangNessuna valutazione finora

- TUTORIAL 6 & 7 QuestionsDocumento1 paginaTUTORIAL 6 & 7 QuestionsgasdadsNessuna valutazione finora

- TB 14Documento67 pagineTB 14Dang ThanhNessuna valutazione finora

- Vascon Engineers - Kotak PCG PDFDocumento7 pagineVascon Engineers - Kotak PCG PDFdarshanmadeNessuna valutazione finora

- Swedish Electricity MarketDocumento32 pagineSwedish Electricity MarketCarloNessuna valutazione finora

- Castle (Met BKC)Documento38 pagineCastle (Met BKC)aashishpoladiaNessuna valutazione finora

- VRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisDocumento5 pagineVRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisKaran VasheeNessuna valutazione finora

- Excel Case 6Documento2 pagineExcel Case 6Huế ThùyNessuna valutazione finora

- Accounts Project FinalDocumento13 pagineAccounts Project FinalesheetmodiNessuna valutazione finora

- Marketing Executive AssignmentDocumento4 pagineMarketing Executive AssignmentVinayak PandlaNessuna valutazione finora

- GST ChallanDocumento1 paginaGST ChallannavneetNessuna valutazione finora

- ANNUAL Report Sardar Chemical 2014Documento44 pagineANNUAL Report Sardar Chemical 2014Shabana KhanNessuna valutazione finora

- 2012 - ALTO - ALTO - Annual Report PDFDocumento120 pagine2012 - ALTO - ALTO - Annual Report PDFNuvita Puji KriswantiNessuna valutazione finora