Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

#280 BBB 03-25-10 115

Caricato da

bmoak0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

26 visualizzazioni1 paginaCopyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

26 visualizzazioni1 pagina#280 BBB 03-25-10 115

Caricato da

bmoakCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

MAGNOLIA

CLIPPING SERVICE

(601) 856·0911 I (205) 7~8·8610

MESSENGER

OKOLONA, MS

Circulation = 1165

WEEKLY

03/03/2010

\1111111111111111111111\1 III 1\ II1I111

BBB EXl?l~ins Impact of New

Credit Ciiel Regulations

February 22 was when new to payoff the balance under the

consumer protections kick in that original terms,

are laid out in the Credit' Card Older age restrictions added.

Accountability Responsibility Card issuers are no longer al

and Disclosure Act of 2009 lowed to issue a credit card to

(CARD). The Bctter Business anyone under 21 unless they can

Bureau (BBB) Serving Missis prove they have the means to

sippi cxplaim what these new na 'repay debt or if an adult over 21

tionwide consumer protections co-si gns on the account. Credit

mean to cardholders. card companies also filce new re

It is reported in a strictions on how they can pro

CreditCards.com survey that mote cards to' college students

nearly 75 percent of cardholders and can no longer offer free gifts

admit to not reading the terms as enticements.

and conditions of theit credit New rules for monthly state

cards, The BBB recommends ments. In response to complaints

that all card holders familiarize that bill due dates were being

themselves with the fine print moved up-and leading to in

and review the new provisions creased late fees-monthly state

set out by the new CARD Act. ments must now be mailed or

"Credit card debt can mount delivered 21 days prior to the due

when times arc tight, and con date. Additionally, card issuers

sumers need to take the time to can no longer set a payment

understand the fine points oftheir deadline before 5 p.m. and can

credit card agreements and thc not charge card holders if they

different fees and penalties that pay online, over the phone or by

can chisel away at the family fi mail-unless the payment is

nances," said Bill Moak, Presi made over the phone either on

dent/CEO of the Mississippi the due date or the previous day.

BBB. "While CARD provides Overpayments go toward high

more consumer protections, card est interest balances, If the card

holders ~1i11 need to keep an eye holder has varied interest rates

on changes to their accounts and .furdifferent services or accounts,

rcspond quickly if they aren't sat any overpayments must be ap

isfied." plied to those that are incurring

Following are just a few of thc the highest interest rate,

ncw credit eard regulations and Over the limit opt-in. Card

consumer protections as a result holders must opt-in to be able to

of the Credit CARD Act: exceed their credit limit-and

More notice for interest rate subsequently be charged an ovcr

changes. Card issuers must give limit fee by the issuer, If a card

an advance notice of 45 days holder chooses not to opt-in, then

when making interest rate he or she will not be able to ex

changes. Additionally, promo ceed their credit limit and incur

tional rates must last for at least any resulting fees,

six months and, unless disclosed Increased disclosure on mini

up- front, card holders cannot mum payments. Card issuers

have their rate increased in the must disclose how long it will

first year, take the card holder to payoff

Cardholder opt-out If there are their bill ifthey pay only the min

significant changes made to the imum monthly payment as well

terms ofthe account, card holders as how much the they would

can choose to rej ect those need to pay every month to pay

changes and will have five years off the balance in 36 months.

Say goodbye to double-billing

cycles. When calculating finance

charges, card issuers can no

longer employ twQ:£Yc1e or dou

6Ie 6Iihng) . a il1ethod that causes

cardholders to pay interest on

previously paid balances.

To learn more about the new

consumer protections, Credit

cards.com has a comprehensive

breakdown of the CARD Act of

2009.

Potrebbero piacerti anche

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsDa EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNessuna valutazione finora

- New Credit Card Regulations Aid ConsumersDocumento1 paginaNew Credit Card Regulations Aid ConsumersbmoakNessuna valutazione finora

- #280 BBB 04-29-10 104Documento1 pagina#280 BBB 04-29-10 104bmoakNessuna valutazione finora

- Fairer Simpler Banking - Fact SheetDocumento5 pagineFairer Simpler Banking - Fact SheetAustralianLaborNessuna valutazione finora

- What Is Credit Card DefaultDocumento3 pagineWhat Is Credit Card Defaultvsmitha122Nessuna valutazione finora

- 26 March 2024 - Amendment To The Master Direction - Finance 360Documento13 pagine26 March 2024 - Amendment To The Master Direction - Finance 360Aniket RathoreNessuna valutazione finora

- C1T4 - Intro To Credit Cards Part 2 PDFDocumento10 pagineC1T4 - Intro To Credit Cards Part 2 PDFTanmoy IimcNessuna valutazione finora

- Kuch Bhi On EMI - KBE 3 Months Offer Terms and ConditionsDocumento1 paginaKuch Bhi On EMI - KBE 3 Months Offer Terms and Conditionsdevpal78Nessuna valutazione finora

- Allocating Unauthorised Credit Card Payment Losses: The Credit Card Guidelines and Consumer ProtectionDocumento14 pagineAllocating Unauthorised Credit Card Payment Losses: The Credit Card Guidelines and Consumer ProtectionHobart Zi Ying LimNessuna valutazione finora

- Rbi 202324 132Documento11 pagineRbi 202324 132ambarishramanuj8771Nessuna valutazione finora

- New Credit Card Law: BasicsDocumento2 pagineNew Credit Card Law: BasicsJerry419Nessuna valutazione finora

- Signet Banking Corp v. Commissioner, 4th Cir. (1997)Documento9 pagineSignet Banking Corp v. Commissioner, 4th Cir. (1997)Scribd Government DocsNessuna valutazione finora

- Unit 4 Banking MbaDocumento18 pagineUnit 4 Banking MbaBadal JaiswalNessuna valutazione finora

- Risky Borrowers Find Credit Again, at A PriceDocumento4 pagineRisky Borrowers Find Credit Again, at A PriceSimply Debt SolutionsNessuna valutazione finora

- Credit Card Operations of BanksDocumento11 pagineCredit Card Operations of Bankssantucan2Nessuna valutazione finora

- Chapter 6 Review QuestionsDocumento3 pagineChapter 6 Review Questionsapi-242667057100% (1)

- Credit Card by Urmimala MukherjeeDocumento47 pagineCredit Card by Urmimala Mukherjeeurmimala21Nessuna valutazione finora

- Rightrespcc EngDocumento20 pagineRightrespcc Engapi-200845891Nessuna valutazione finora

- Grace PeriodDocumento2 pagineGrace PeriodHaider UsmanNessuna valutazione finora

- Bank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Documento16 pagineBank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Arun CHNessuna valutazione finora

- Signet Banking Corporation v. Commissioner of Internal Revenue, 118 F.3d 239, 4th Cir. (1997)Documento5 pagineSignet Banking Corporation v. Commissioner of Internal Revenue, 118 F.3d 239, 4th Cir. (1997)Scribd Government DocsNessuna valutazione finora

- #280 BBB 01-22-09 39Documento1 pagina#280 BBB 01-22-09 39bmoakNessuna valutazione finora

- Macalinao Vs BPI Case SummaryDocumento2 pagineMacalinao Vs BPI Case SummaryEmelie Marie Diez100% (2)

- ILO7 Extent of Liability of Ict ProfessionalDocumento7 pagineILO7 Extent of Liability of Ict ProfessionalCharlotte De Guzman DoloresNessuna valutazione finora

- Assignment Credit Card pfm2Documento2 pagineAssignment Credit Card pfm2MuHd MuIzNessuna valutazione finora

- Definition of CreditDocumento16 pagineDefinition of Creditisma aliahNessuna valutazione finora

- Credit, Collection and Compliance Application # 3 - Managing CreditDocumento3 pagineCredit, Collection and Compliance Application # 3 - Managing CreditGabriel Matthew Lanzarfel GabudNessuna valutazione finora

- BSP Circular 454Documento6 pagineBSP Circular 454Nadz FajardoNessuna valutazione finora

- Secrets of Banking IndustryDocumento5 pagineSecrets of Banking IndustryFreeman Lawyer100% (2)

- Citi Payall Frequently Asked QuestionsDocumento14 pagineCiti Payall Frequently Asked QuestionsM ANessuna valutazione finora

- Extent of LiabilityDocumento13 pagineExtent of LiabilityWarren Nabing MalangisNessuna valutazione finora

- Credit CardDocumento5 pagineCredit CardRitesh TolaniNessuna valutazione finora

- Eco 2ND YrDocumento23 pagineEco 2ND YrKrishna SaklaniNessuna valutazione finora

- PNB MITC ConditionsDocumento38 paginePNB MITC Conditionswestm4248Nessuna valutazione finora

- Ledda V BpiDocumento6 pagineLedda V BpiPaul de PhoenixNessuna valutazione finora

- Prepaid CreditDocumento8 paginePrepaid CreditJavier RojasNessuna valutazione finora

- Pantaleon vs. Amex Our Ruling: of Harris Trust & Savings Bank V. MccrayDocumento94 paginePantaleon vs. Amex Our Ruling: of Harris Trust & Savings Bank V. MccrayAnonymous GMUQYq8Nessuna valutazione finora

- Presentation On Credit Card Business Opportunities and ThraeatsDocumento74 paginePresentation On Credit Card Business Opportunities and ThraeatsGarvit JainNessuna valutazione finora

- CreditCard Companies-Case Study PDFDocumento3 pagineCreditCard Companies-Case Study PDFHamza EjazNessuna valutazione finora

- Legg HdubbyaDocumento6 pagineLegg Hdubbyaapi-583094736Nessuna valutazione finora

- Personal Finance GAC3000Documento10 paginePersonal Finance GAC3000nawal zaheerNessuna valutazione finora

- Loan PolicyDocumento5 pagineLoan PolicySoumya BanerjeeNessuna valutazione finora

- Which - Clean Up Credit - March2013 PDFDocumento3 pagineWhich - Clean Up Credit - March2013 PDFKezia Dugdale MSPNessuna valutazione finora

- BOG Notice No BG-GOV-SEC-2021 - 12 - Abolition of Unfair Practices Final...Documento5 pagineBOG Notice No BG-GOV-SEC-2021 - 12 - Abolition of Unfair Practices Final...Fuaad DodooNessuna valutazione finora

- SCB EMI Terms and ConditionsDocumento2 pagineSCB EMI Terms and ConditionsSanam PandeyNessuna valutazione finora

- Credit CardsDocumento11 pagineCredit CardsAleenah InayatNessuna valutazione finora

- FIN 438 - Chapter 15 QuestionsDocumento6 pagineFIN 438 - Chapter 15 QuestionsTrần Dương Mai PhươngNessuna valutazione finora

- Designing A Sustainable Card ModelDocumento8 pagineDesigning A Sustainable Card ModelvishusinghalNessuna valutazione finora

- Credit CardDocumento6 pagineCredit Cardsrikanth647637Nessuna valutazione finora

- What Is A Credit CardDocumento6 pagineWhat Is A Credit CardPrince AschwellNessuna valutazione finora

- Section 609 of The Fair Credit Reporting Act LoopholeDocumento7 pagineSection 609 of The Fair Credit Reporting Act LoopholeFreedomofMind97% (39)

- SLOCPI ACA Enrollment Form 15OCT2021 John Rick Benedicto Kausapin 1Documento2 pagineSLOCPI ACA Enrollment Form 15OCT2021 John Rick Benedicto Kausapin 1Lyne IbarraNessuna valutazione finora

- Chapter IIDocumento13 pagineChapter IIKlaus AlmesNessuna valutazione finora

- Islamicen tcm8-27898Documento5 pagineIslamicen tcm8-27898Faysal MadiNessuna valutazione finora

- Credit CardDocumento51 pagineCredit CardSmita JainNessuna valutazione finora

- Annexure-A Guidelines For Conventional Banking CustomersDocumento2 pagineAnnexure-A Guidelines For Conventional Banking Customersumerbashir743Nessuna valutazione finora

- Credit Card Operations of BanksDocumento13 pagineCredit Card Operations of Banksshailesh100% (1)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsDa EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNessuna valutazione finora

- #280 BBB 04-29-10 188Documento1 pagina#280 BBB 04-29-10 188bmoakNessuna valutazione finora

- #280 BBB 12-30-10 21Documento1 pagina#280 BBB 12-30-10 21bmoakNessuna valutazione finora

- #280 BBB 12-30-10 59Documento1 pagina#280 BBB 12-30-10 59bmoakNessuna valutazione finora

- #280 BBB 12-30-10 67Documento1 pagina#280 BBB 12-30-10 67bmoakNessuna valutazione finora

- #280 BBB 12-30-10 99Documento1 pagina#280 BBB 12-30-10 99bmoakNessuna valutazione finora

- #280 BBB 12-30-10 141Documento1 pagina#280 BBB 12-30-10 141bmoakNessuna valutazione finora

- #280 BBB 12-30-10 100Documento1 pagina#280 BBB 12-30-10 100bmoakNessuna valutazione finora

- #280 BBB 12-30-10 218Documento1 pagina#280 BBB 12-30-10 218bmoakNessuna valutazione finora

- #280 BBB 12-30-10 215Documento1 pagina#280 BBB 12-30-10 215bmoakNessuna valutazione finora

- Russia Salary SurveyDocumento5 pagineRussia Salary SurveymughalasadNessuna valutazione finora

- Bank Account TypesDocumento1 paginaBank Account TypesDoorga SatpathyNessuna valutazione finora

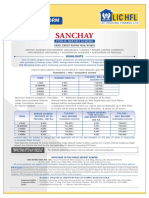

- LIC Housing Finance LTD FDDocumento6 pagineLIC Housing Finance LTD FDBiswa Jyoti GuptaNessuna valutazione finora

- Competitors of KarvyDocumento23 pagineCompetitors of Karvy123_don100% (2)

- Aehbl Shae1705167Documento2 pagineAehbl Shae1705167idris_ali_7Nessuna valutazione finora

- Ross4ppt ch19Documento36 pagineRoss4ppt ch19씨나젬Nessuna valutazione finora

- AICPA - Develops Standards For Audits ofDocumento3 pagineAICPA - Develops Standards For Audits ofAngela PaduaNessuna valutazione finora

- PESONet ParticipantsDocumento2 paginePESONet ParticipantsKylene Maranan VillamarNessuna valutazione finora

- 7 P's of MarketingDocumento42 pagine7 P's of MarketingSagar Kumar0% (1)

- IIF ReportDocumento152 pagineIIF ReportJuan Manuel Lopez LeonNessuna valutazione finora

- Swot AnalysisDocumento5 pagineSwot AnalysisZara KhanNessuna valutazione finora

- Habib Bank LimitedDocumento64 pagineHabib Bank Limitedviper959550% (2)

- Catering PDFDocumento2 pagineCatering PDFminitha_1984Nessuna valutazione finora

- THE OF Outsourcing: J U N e 2 0 0 8Documento60 pagineTHE OF Outsourcing: J U N e 2 0 0 8kamaraniNessuna valutazione finora

- Banking Law Assigment (Silk Bank)Documento6 pagineBanking Law Assigment (Silk Bank)Muzamil AshrafNessuna valutazione finora

- PAT Agency Digest3Documento6 paginePAT Agency Digest3bcarNessuna valutazione finora

- CBS FaqDocumento55 pagineCBS FaqFaisal Mirza100% (1)

- Thomas Weisel Partners Case StudyDocumento1 paginaThomas Weisel Partners Case StudyHEM BANSALNessuna valutazione finora

- Question For ReviewDocumento6 pagineQuestion For ReviewNila AyuniaNessuna valutazione finora

- Executive Order No 172Documento9 pagineExecutive Order No 172Merceditas PlamerasNessuna valutazione finora

- AsdadasDocumento13 pagineAsdadasSwindlerNessuna valutazione finora

- Auditing and AttestationDocumento45 pagineAuditing and Attestationmira01Nessuna valutazione finora

- Sap Tables ListDocumento0 pagineSap Tables Listbogusbogus45Nessuna valutazione finora

- MCTC Refund FormDocumento1 paginaMCTC Refund FormdsdsNessuna valutazione finora

- Kfs Current AccountsDocumento10 pagineKfs Current Accountsritika sainiNessuna valutazione finora

- 72-Finman Assurance Corporation vs. Court of Appeals, 361 SCRA 514 (2001)Documento7 pagine72-Finman Assurance Corporation vs. Court of Appeals, 361 SCRA 514 (2001)Jopan SJNessuna valutazione finora

- 5th Amended Motion To VacateDocumento13 pagine5th Amended Motion To Vacateajv3759Nessuna valutazione finora

- ShipRocket ProposalDocumento7 pagineShipRocket ProposalShashi Bhushan SinghNessuna valutazione finora

- Project by Vidhi Seth and Nandini KediaDocumento19 pagineProject by Vidhi Seth and Nandini KediavidhisethNessuna valutazione finora

- 2016 2017 PDFDocumento44 pagine2016 2017 PDFHay Jirenyaa100% (1)