Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Visa Rates

Caricato da

mls28Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Visa Rates

Caricato da

mls28Copyright:

Formati disponibili

Disclosure Statement and Rate and Fee Schedule

The following is a summary of certain terms, including the interest and fees, of the ATB Financial MasterCard Personal Cardholder

Agreement (the Cardholder Agreement) that will apply to your ATB Financial MasterCard Card Account (the Card Account) if your

application is approved. You will receive the Cardholder Agreement if your application is approved. The following information applicable

to your ATB Financial MasterCard Card (the Card) is correct as of 11/15 (mm/yy) and is subject to change.

For any questions about the Card, please call 1-888-999-1108.

The annual interest rates that will apply to your Card Account depend

upon which Card you receive as set out below. These annual interest

rates are in effect the day the Card Account is opened.

Card Name

Annual Interest Rates

Purchases:

Cash Advances:

Alberta MasterCard

Gold My Rewards

Travel Gold Cash

Rewards Platinum

Cash Rewards World

US Dollar MasterCard

Standard Rate:

Standard Rate:

19.90% Default Rate: 21.90% Default

24.90%

Rate: 26.90%

Preferred Fixed-Rate

Preferred Rate:

Preferred Rate:

10.90% Standard

9.90% Standard

Rate: 15.90%

Rate: 15.90% Default

Default Rate:

Rate: 22.90%

22.90%

Standard Rate:

Between ATB

Prime + 5% and

Preferred Variable-Rate ATB Prime + 7%

Annual Interest Rate:

Standard Rate:

Between ATB

Prime + 6% and

ATB Prime + 8%

Default Rate:

Default Rate:

Standard Rate +

4%

Standard Rate +

4%

For all Cards except the Preferred Fixed Rate Card: You will lose the

benefit of the Standard Rates that apply to your Card, as set out above,

if, for two consecutive Billing Periods, you fail to pay at least the minimum

balance due for each Statement when due, in which case your annual

interest rates will increase to the Default Rates that apply to the Card you

receive, as set out above, beginning on the first day of the following

Billing Period.

For the Preferred Fixed Rate Card only: Your initial annual interest rates

will be our Preferred Rates set out above. You will lose the benefit of the

Preferred Rates if you fail to pay at least the minimum balance due for a

particular Statement when due, in which case the Preferred Rates will

increase to the Standard Rates that apply to this Card beginning on the

first day of the following Billing Period. The Standard Rates will continue

to apply until either:

(a) For three consecutive Billing Periods, you pay at least the minimum

balance due for each Statement when due, in which case the Standard

Rates will be decreased to the Preferred Rates set out above, or (b) You

fail to pay, for two consecutives Billing Periods, at least the minimum

balance due for each Statement when due, in which case the Standard

Rates will be increased to the Default Rates that apply to this Card

beginning on the first day of the following Billing Period.

For the Preferred Variable Card only: The Standard Rates for which you

are approved will depend upon your credit rating at the time of application

and will be disclosed to you in the Card Carrier. ATB Prime means the

annual rate of interest announced by us from time to time as our

Canadian Dollar Prime Lending Rate; our Canadian Dollar Prime Lending

Rate may be obtained at any time from our website at www.atb.com.

Any change in the ATB Prime will cause a corresponding change in the

annual interest rates applicable to the Card Account, effective on the first

day of the Billing Period during which the change in the ATB Prime Rate

occurs.

Interest-free Grace Period

Minimum Payment

Foreign Currency

Conversion

For more information about our interest rates, see the attached Terms

and Conditions.

If the entire new balance indicated on a particular Statement is paid by

the payment due date shown on that Statement, we will waive the interest

charges on those purchases and fees which appear on that Statement for

the first time. This means those new purchases and fees will be subject

to an interest-free period of at least 21 days if the entire balance is paid

in full by the payment due date indicated on that Statement. There is no

interest-free period for cash advances (including balance transfers,

money orders, travelers cheques, wire transfers and gambling

transactions) and cheques, or their associated fees.

The Minimum Balance Due for each Statement will be equal to:

(a) $10.00 plus all outstanding interest and fees on your Card Account;

plus (b) any amount that exceeds the Credit Limit; plus (c) any amount

that is overdue.

However, if the new balance indicated on the Statement is less than

$10.00, it must be paid in full by the payment due date shown on that

Statement.

If you use your Card for a transaction in a currency other than Canadian

Dollars, the foreign currency will be converted into Canadian Dollars

before it is posted on your Card Account. We will convert the amount of

your transaction to Canadian Dollars at the conversion rate established

by MasterCard International Inc. (MCI). For purchases and cash

advances, that rate is set at the time the transaction is presented for

payment to MCI. For credits to the Card Account, that rate is set at the

time the credit is presented for payment to us from MCI. When the

transaction is posted to your Card Account, in addition to the conversion

rate, you will be charged a foreign currency conversion fee of 2.9% of

the amount of the foreign currency transaction after the foreign currency

has been converted to Canadian Dollars. This fee applies to both debits

and credits. For the US Dollar MasterCard, transactions incurred in a

currency other than US Dollars will be converted to US Dollars using the

same principles as described above, and the same 2.9% foreign

currency conversion fee will apply.

The annual fee, if any, will appear and be due on your second Statement,

whether or not you have activated your Card, and thereafter will appear

annually on your Statement anniversary date.

Card Name

Annual Fees

Alberta MasterCard

Gold My Rewards Travel

Gold Cash Rewards

Alberta MasterCard - Secured

Platinum Cash Rewards World

Preferred Fixed-Rate

Preferred Variable-Rate

US Dollar MasterCard

Primary

Each Co-Applicant

or Authorized User

None

None

$49

$120

$29

$29

$19

$25

$25

Free

Free

Free

Other Fees

You will be charged on the day the transaction or event occurs:

ATM Cash Advance in Canada: $2.50 for each cash advance

ATM Cash Advance outside Canada: $5.00 for each cash advance

Over the counter Cash Advance in Canada: $5.00 for each cash

advance

Over the counter Cash Advance outside Canada: $7.50 for each cash

advance

Promotional Balance Transfer/Cheque Fee: Up to 2% of the amount of

each balance transfer made and cheque written to take advantage of a

promotional interest rate offer. The fee will be charged to you at the same

time that the balance transfer or cheque is posted to your Card Account.

Foreign Currency ATB MasterCard Cheque: $7.50 per cheque

Sales Slip Copy: $5.00 for each copy of a sales slip

Statement Reprint: $10.00 for each statement reprinted

Cheque Copy: $10.00 for each copy of a cheque

Over the Limit: $30.00 charged once per billing cycle on each Statement

if your balance exceeds your credit limit at the end of the billing cycle.

NSF Fee: $40.00 This fee applies if we dishonour a MasterCard cheque

because it is for an amount that exceeds your credit limit and if any

payment you make to us is returned as dishonoured or unprocessed from

your financial institution.

Rush Replacement Card: $29.00

MyPic Fee: $15.00for each card image change

Credit Balance Inactivity Fee: $25.00 or full credit balance, whichever is

less, charged on your February Statement if you have a credit balance on

that Statement and there has been no activity on the Card Account for at

least 12 months.

For the US Dollar MasterCard only, these fees are charged in US Dollars.

Potrebbero piacerti anche

- PAMFC16 Call For Papers Info Sheet English 26 Oct 15Documento1 paginaPAMFC16 Call For Papers Info Sheet English 26 Oct 15mls28Nessuna valutazione finora

- 1-Lab Problems. Rock PropertiesDocumento1 pagina1-Lab Problems. Rock Propertiesmls28Nessuna valutazione finora

- Secrets To Writing A Captivating ResumeDocumento11 pagineSecrets To Writing A Captivating Resumemls28Nessuna valutazione finora

- SAGD Simulation TutorialDocumento104 pagineSAGD Simulation Tutorialmls28100% (1)

- I-11 Excel Scratch 0Documento32 pagineI-11 Excel Scratch 0mls28Nessuna valutazione finora

- Winter CoursesWinter Courses U of CDocumento3 pagineWinter CoursesWinter Courses U of Cmls28Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Aac Terms and Condition - InstallationDocumento2 pagineAac Terms and Condition - InstallationChimmy GonzalezNessuna valutazione finora

- MCMP V MonarkDocumento7 pagineMCMP V MonarkCarlMarkInopiaNessuna valutazione finora

- UCT Student Fees Handbook 2016Documento132 pagineUCT Student Fees Handbook 2016LukeMin100% (1)

- ERRC Grid: Eliminate RaiseDocumento5 pagineERRC Grid: Eliminate RaiseAmna PervaizNessuna valutazione finora

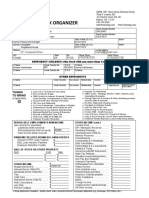

- 2020 Income Tax Organizer: 211 Crescent DriveDocumento2 pagine2020 Income Tax Organizer: 211 Crescent DriveLeslie HutchinsonNessuna valutazione finora

- NFC and PricingDocumento14 pagineNFC and Pricingsatya deoNessuna valutazione finora

- Minstay:: To Any Applicable Fare DifferenceDocumento50 pagineMinstay:: To Any Applicable Fare DifferenceSreenivas PogakulaNessuna valutazione finora

- ASQ Certification Exam Application DeadlinesDocumento2 pagineASQ Certification Exam Application DeadlinesZaid Raslan AyoubNessuna valutazione finora

- RICS Official Definition: Isurv Recommended Reading and ServicesDocumento5 pagineRICS Official Definition: Isurv Recommended Reading and ServicesFiloch MaweredNessuna valutazione finora

- Fehr Bros Garage Door CatalogDocumento52 pagineFehr Bros Garage Door CatalogMauricio J. GongoraNessuna valutazione finora

- Lifestyle Liberation Audio TranscriptDocumento80 pagineLifestyle Liberation Audio TranscriptDaniyal AbbasNessuna valutazione finora

- Blessings Residential Matriculation Higher Secondary SchoolDocumento9 pagineBlessings Residential Matriculation Higher Secondary Schoolblessings_19960% (1)

- Presentation ON International Cash Management: Submitted by Vandana Meena M.Ocm 2 YearDocumento6 paginePresentation ON International Cash Management: Submitted by Vandana Meena M.Ocm 2 YearpriyaNessuna valutazione finora

- Standards of Professional Practice (SPP) On Pre-Design Services SPP Document 201Documento51 pagineStandards of Professional Practice (SPP) On Pre-Design Services SPP Document 201ScarletNessuna valutazione finora

- Consumer FinanceDocumento36 pagineConsumer FinanceLucky Chougale0% (1)

- KAL NTR Captain Brief PDFDocumento6 pagineKAL NTR Captain Brief PDFgonzalo gorositoNessuna valutazione finora

- Chapter 26 Answer KeyDocumento3 pagineChapter 26 Answer KeyShane Tabunggao100% (2)

- ROI - PCE - SLB - Octli-2 - 01272020 PDFDocumento19 pagineROI - PCE - SLB - Octli-2 - 01272020 PDFnadihe13Nessuna valutazione finora

- 2010 CC Spring ScheduleDocumento152 pagine2010 CC Spring Schedulekadaj1127Nessuna valutazione finora

- Deposit Slip Dubai Islamic Bank Deposit Slip Dubai Islamic Bank Deposit Slip Dubai Islamic BankDocumento1 paginaDeposit Slip Dubai Islamic Bank Deposit Slip Dubai Islamic Bank Deposit Slip Dubai Islamic BankFahad BataviaNessuna valutazione finora

- Compound Property Management, Et Al. v. BUild Realty, Et Al. - ComplaintDocumento98 pagineCompound Property Management, Et Al. v. BUild Realty, Et Al. - ComplaintFinney Law Firm, LLCNessuna valutazione finora

- UCLA Zipcar Case Study: Cost-Effective Car Sharing AlternativeDocumento9 pagineUCLA Zipcar Case Study: Cost-Effective Car Sharing AlternativeRedf BenitezNessuna valutazione finora

- Role of Education Loan in Indian Higher EducationDocumento10 pagineRole of Education Loan in Indian Higher EducationJaspreetkakeNessuna valutazione finora

- Choosing The Executor or TrusteeDocumento22 pagineChoosing The Executor or TrusteeSeasoned_Sol100% (1)

- Savyu - Your Business Loyalty SolutionDocumento18 pagineSavyu - Your Business Loyalty SolutionLê Hữu TríNessuna valutazione finora

- AccountRight Basics 2013 User Guide NZDocumento212 pagineAccountRight Basics 2013 User Guide NZeiphyotheinNessuna valutazione finora

- Bank Statment Wells FargoDocumento7 pagineBank Statment Wells FargoYu ShilohNessuna valutazione finora

- Srinagar Ladakh Siachen Base Camp Manali Delhi Motorbike Trip 2021Documento4 pagineSrinagar Ladakh Siachen Base Camp Manali Delhi Motorbike Trip 2021Nimraj PatelNessuna valutazione finora

- Math Connects Course 1 Word Problem Practice WorkbookDocumento7 pagineMath Connects Course 1 Word Problem Practice Workbookafiwgjbkp100% (1)