Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2015 URC Earnings Report

Caricato da

gwapongkabayoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2015 URC Earnings Report

Caricato da

gwapongkabayoCopyright:

Formati disponibili

TUESDAY, 01 DECEMBER 2015

Universal Robina Corporation:

FY16 core earnings in line with COL;

management cautious on FY16

FY16 core earnings in line with expectation. URC booked Php4.2Bil in core earnings in

4QFY15, higher by 18.3% y/y. This brought FY15 core earnings to Php16.4Bil, higher by 15.1%

y/y. Results were in line with COL estimates, accounting for 99.9% of our forecast. 4QFY15

revenues grew by 17.2% to Php27.1Bil, bringing FY15 revenues to Php109.1Bil, higher by

18.1 y/y and in line with estimates. Domestic branded sales grew by only 7.4% in 4QFY15 on

continued competition in coffee and weak sales in El Nio-affected areas. International sales

growth was also muted at only ~7% (ex-Griffins) due to foreign exchange volatility and as the

macro environment remained weak. Nonetheless, EBIT margins still improved by 50 bps to

16.0% in 4QFY15 on higher scale and lower input prices.

Management cautious on FY16; EBIT guidance lower than estimates. Management is

cautious on FY16 due to sustained competition in coffee, the impact of El Nio on domestic

demand, weak macro in Thailand and Indonesia. Management expects sales growth of 8% to

9% in FY16, slightly slower than our forecast of 9.8% and significantly lower the than consensus

estimate of 12.8% growth rate. Further, because EBIT margins are expected to remain flat

in FY16, EBIT is expected to range between Php18.5Bil and Php19Bil, 4-6% lower than our

forecast and 6-9% lower than consensus.

Maintain HOLD rating. We are maintaining our HOLD rating on URC with a FV estimate of

Php209/sh. Although we like URC in the long run for its strategic position in the domestic and

ASEAN branded foods segment, the company is facing difficulties on many fronts. The domestic

space remains challenging due intense competition in coffee and softer demand due to El

Nio. Meanwhile, a weak macro environment continues to hamper growth in the international

segment. At current prices, URC is trading at 30X FY16E P/E, which may be difficult to justify

given managements cautious guidance of only 8-9% sales growth and flattish margins for next

year, which is below expectations.

FORECAST SUMMARY

Year to September 30 (Php Mil)

Revenues

% change y/y

Operating Income

% change y/y

Operating Margin (%)

Core Profits

% change y/y

Core Profit Margin (%)

Net Income

% change y/y

Net Profit Margin (%)

EPS

% change y/y

RELATIVE VALUE

P/E(X)

P/BV(X)

ROE(%)

Dividend Yield (%)

Source: URC, COL est imat es

2012

71,204

6.0

7,810

13.0

11.0

8,377

17.6

11.8

7,763

66.8

10.9

3.70

63.7

2013

80,995

13.8

10,279

31.6

12.7

11,263

34.4

13.9

10,045

29.4

12.4

4.60

24.3

2014

92,376

14.1

14,119

37.4

15.3

14,214

26.2

15.4

11,559

15.1

12.5

5.30

15.2

2015E

111,577

20.8

17,580

24.5

15.8

16,382

15.2

14.7

12,944

12.0

11.6

5.93

12.0

2016E

122,478

9.8

19,730

12.2

16.1

18,749

14.5

15.3

14,866

14.9

12.1

6.81

14.9

55.2

9.2

16.8

0.9

43.9

8.7

19.8

1.2

38.1

7.9

20.7

1.5

34.0

7.2

21.1

1.7

29.6

6.5

21.9

1.9

SHARE DATA

HOLD

Rating

Ticker

Fair Value (Php)

Current Price

Upside (%)

URC

209.00

193.80

7.84

SHARE PRICE MOVEMENT

120

110

100

90

80

70

1-Sep-15

1-Oct-15

1-Nov-15

URC

1-Dec-15

PSEi

ABSOLUTE PERFORMANCE

URC

PSEi

1M

-3.39

-1.73

3M

0.94

-1.24

YTD

-0.43

-3.04

MARKET DATA

Market Cap

Outstanding Shares

52 Wk Range

3Mo Ave Daily T/O

422,775.07Mil

2,181.50Mil

173.00 - 234.00

397.14Mil

Jed Frederick Pilarca

jed.pilarca@colfinancial.com

PHILIPPINE EQUITY RESEARCH

FY16 core earnings in line with expectations

URC booked Php4.2Bil in core earnings in 4QFY15, higher by 18.3% y/y. This brought FY15 core

earnings to Php16.4Bil, higher by 15.1% y/y. Results were in line with COL estimates, accounting for

99.9% of our forecast. 4QFY15 revenues grew by 17.2% to Php27.1Bil, bringing FY15 revenues to

Php109.1Bil, higher by 18.1 y/y and in line with estimates. Domestic branded sales grew by only 7.4%

in 4QFY15 on continued competition in coffee and weak sales in El Nio-affected areas. International

sales growth was also muted at only ~7% (ex-Griffins) due to foreign exchange volatility and as the

macro environment remained weak. Nonetheless, EBIT margins still improved by 50 bps to 16.0% in

4QFY15 on higher scale and lower input prices.

Net income grew slower by 4.8% to Php3.2Bil in 4QFY15 and by 9.7% to Php12.7Bil in FY15 due to

higher finance costs, forex losses and equitized losses from joint ventures. Full year net income was

in line with COL and consensus at 97.9% and 95.9% of estimates, respectively.

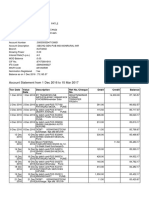

Exhibit 1: Results Summary

in PhpMil

4QFY14

4QFY15

%Change

Revenue

Operating Income

Operating Margin (%)

Core Earnings

Core Margin (%)

Net Income

Net Margin (%)

23,137

3,595

15.5

3,523

15.2

3,006

13.0

27,108

4,345

16.0

4,169

15.4

3,151

11.6

17.2

20.9

0.5

18.3

0.2

4.8

-1.4

FY14

FY15

92,376 109,051

14,119 17,404

15.3

16.0

14,214 16,364

15.4

15.0

11,559 12,678

12.5

11.6

%Change

18.1

23.3

0.7

15.1

-0.4

9.7

-0.9

% of Forecast

COL

Consensus

97.7

97.1

99.0

97.4

99.9

97.9

95.9

-

Source: URC, COL estimates, Bloomberg

Domestic slowdown persists

The domestic branded segment continued to be challenged during the quarter with sales of Php14.5Bil

in 4QFY15, higher by 7.4% y/y. Competition in the coffee category remained intense. According to

URC, the increasing prevalence twin packs for coffee with lower selling price per gram has been

diluting the entire categorys value. Twin packs are now being offered by all three big coffee players:

URC, Mayora Indah and Nestl. Sales have also been weak in Visayas and Mindanao due to the

impact of El Nio. These regions account for 20% of domestic branded sales. Segment EBIT margins

improved 170 bps for both 4QFY15 and for FY15 to 18.7% and 18.2%, respectively.

International facing headwinds from FX and weak macro

In peso terms, international branded sales grew by 7%, excluding Griffins, and by 42%, including

Griffins. Weakness in local currencies against the peso affected Indonesia, Vietnam and Griffins

sales. Additionally, the macroeconomic environment remained weak, particularly in Thailand and

Indonesia. Only Vietnam appears to be improving with sales growth accelerating to 13% in 4Q from

9% in 3Q. According to URC, sales of energy drinks (+50%) and larger size of ready-to-drink tea

(+35%) have been strong in Vietnam.

TUESDAY, 01 DECEMBER 2015

URC

EARNINGS ANALYSIS

page 2

PHILIPPINE EQUITY RESEARCH

Exhibit 2: International branded sales growth

Vietnam

Thailand

New Zealand

Indonesia

in Php in local currency

8%

13%

10%

10%

-4%

2%

24%

35%

Source: URC

Management cautious on FY16; EBIT guidance lower than estimates

Management is cautious on FY16 due to sustained competition in coffee, the impact of El Nio on

domestic demand, weak macro in Thailand and Indonesia. Management expects sales growth of 8%

to 9% in FY16, slightly slower than our forecast of 9.8% and significantly lower the than consensus

estimate of 12.8% growth rate. Further, because EBIT margins are expected to remain flat in FY16,

EBIT is expected to range between Php18.5Bil and Php19Bil, 4-6% lower than our forecast and 6-9%

lower than consensus.

Maintain HOLD rating

We are maintaining our HOLD rating on URC with a FV estimate of Php209/sh. Although we like

URC in the long run for its strategic position in the domestic and ASEAN branded foods segment, the

company is facing difficulties on many fronts. The domestic space remains challenging due intense

competition in coffee and softer demand due to El Nio. Meanwhile, a weak macro environment

continues to hamper growth in the international segment. At current prices, URC is trading at 30X

FY16E P/E, which may be difficult to justify given managements cautious guidance of only 8-9%

sales growth and flattish margins for next year, which is below expectations.

TUESDAY, 01 DECEMBER 2015

URC

EARNINGS ANALYSIS

page 3

PHILIPPINE EQUITY RESEARCH

Investment Rating Definitions

BUY

HOLD

SELL

Stocks that have a BUY rating have attractive

fundamentals and valuations, based on

our analysis. We expect the share price

to outperform the market in the next six to

twelve months.

Stocks that have a HOLD rating have either

1.) attractive fundamentals but expensive

valuations; 2.) attractive valuations but

near term earnings outlook might be poor

or vulnerable to numerous risks. Given the

said factors, the share price of the stock may

perform merely inline or underperform the

market in the next six to twelve months.

We dislike both the valuations and

fundamentals of stocks with a SELL rating.

We expect the share price to underperform in

the next six to twelve months.

Important Disclaimers

Securities recommended, offered or sold by COL Financial Group, Inc.are subject to investment risks, including the possible loss of the principal amount

invested. Although information has been obtained from and is based upon sources we believe to be reliable, we do not guarantee its accuracy and it may

be incomplete or condensed. All opinions and estimates constitute the judgment of COLs Equity Research Department as of the date of the report and are

subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a

security. COL Financial ans/or its employees not involved in the preparation of this report may have investments in securities or derivatives of securities of

securities of the companies mentioned in this report, and may trade them in ways different from those discussed in this report.

2401-B East Tower, Philippine Stock Exchange Centre, Exchange Road, Ortigas Center, Pasig City, 1605 Philippines

Tel: +632 636-5411

TUESDAY, 01 DECEMBER 2015

URC

Fax: +632 635-4632

EARNINGS ANALYSIS

Website: http://www.colfinancial.com

page 4

Potrebbero piacerti anche

- INPAG Exposure DraftDocumento188 pagineINPAG Exposure DraftgwapongkabayoNessuna valutazione finora

- Techspotlight 8 27 2021Documento3 pagineTechspotlight 8 27 2021gwapongkabayoNessuna valutazione finora

- COL Financial - Weekly Notes 20180413Documento4 pagineCOL Financial - Weekly Notes 20180413gwapongkabayoNessuna valutazione finora

- Earnings Analysis - MWCDocumento7 pagineEarnings Analysis - MWCgwapongkabayoNessuna valutazione finora

- Earnings Analysis - Bloomberry Resorts CorporationDocumento8 pagineEarnings Analysis - Bloomberry Resorts CorporationgwapongkabayoNessuna valutazione finora

- Earnings Analysis - MBTDocumento7 pagineEarnings Analysis - MBTgwapongkabayoNessuna valutazione finora

- COL Financial - Company Update EWDocumento7 pagineCOL Financial - Company Update EWgwapongkabayoNessuna valutazione finora

- Whitepaper Automating Fraud Detection GuideDocumento8 pagineWhitepaper Automating Fraud Detection GuideJongNessuna valutazione finora

- HSBC Advance TOCDocumento42 pagineHSBC Advance TOCgwapongkabayoNessuna valutazione finora

- Credit Card Fees and ChargesDocumento2 pagineCredit Card Fees and ChargesgwapongkabayoNessuna valutazione finora

- Earnings Analysis - PXDocumento7 pagineEarnings Analysis - PXgwapongkabayoNessuna valutazione finora

- Earnings Analysis - PIZZADocumento7 pagineEarnings Analysis - PIZZAgwapongkabayoNessuna valutazione finora

- COL Financial - Philippine Daily Notes 20170905Documento4 pagineCOL Financial - Philippine Daily Notes 20170905gwapongkabayoNessuna valutazione finora

- Philippine Equity Research FocusDocumento6 paginePhilippine Equity Research FocusgwapongkabayoNessuna valutazione finora

- AP: Postponement of Davao Coal Plant Expansion To Have Minimal Impact On FVDocumento4 pagineAP: Postponement of Davao Coal Plant Expansion To Have Minimal Impact On FVgwapongkabayoNessuna valutazione finora

- COL Financial PCG ScreenPlay - Sept 15 2016Documento6 pagineCOL Financial PCG ScreenPlay - Sept 15 2016gwapongkabayoNessuna valutazione finora

- COL Financial - Company UpdateDocumento2 pagineCOL Financial - Company UpdategwapongkabayoNessuna valutazione finora

- MedTech PRC Board Exam Topnotcher 2017Documento1 paginaMedTech PRC Board Exam Topnotcher 2017gwapongkabayoNessuna valutazione finora

- COL Financial - Bull's Eye July 11, 2016Documento7 pagineCOL Financial - Bull's Eye July 11, 2016gwapongkabayoNessuna valutazione finora

- PhilEquity Corner - April 25, 2016Documento3 paginePhilEquity Corner - April 25, 2016gwapongkabayoNessuna valutazione finora

- PhilEquity Corner - March 21, 2016Documento3 paginePhilEquity Corner - March 21, 2016gwapongkabayoNessuna valutazione finora

- Focus Items: Philippine Equity ResearchDocumento7 pagineFocus Items: Philippine Equity ResearchgwapongkabayoNessuna valutazione finora

- COL Financial - Tech Spotlight March 8 2016Documento7 pagineCOL Financial - Tech Spotlight March 8 2016gwapongkabayoNessuna valutazione finora

- PhilEquity Corner - March 14, 2016Documento4 paginePhilEquity Corner - March 14, 2016gwapongkabayoNessuna valutazione finora

- Security Bank - UITF Investment ReportDocumento2 pagineSecurity Bank - UITF Investment ReportgwapongkabayoNessuna valutazione finora

- COLing The Shots 2016-02-16Documento6 pagineCOLing The Shots 2016-02-16gwapongkabayoNessuna valutazione finora

- Vantage Point - March 22, 2016Documento1 paginaVantage Point - March 22, 2016gwapongkabayoNessuna valutazione finora

- COL Financial - BPIDocumento3 pagineCOL Financial - BPIgwapongkabayoNessuna valutazione finora

- Col Financial - Philippine Equity ResearchDocumento5 pagineCol Financial - Philippine Equity ResearchgwapongkabayoNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Global Hotels and ResortsDocumento32 pagineGlobal Hotels and Resortsgkinvestment0% (1)

- Infra Projects Total 148Documento564 pagineInfra Projects Total 148chintuuuNessuna valutazione finora

- ReidtaylorDocumento326 pagineReidtayloralankriti12345Nessuna valutazione finora

- Russia and Lithuania Economic RelationsDocumento40 pagineRussia and Lithuania Economic RelationsYi Zhu-tangNessuna valutazione finora

- Adp Pay Stub TemplateDocumento1 paginaAdp Pay Stub Templateluis gonzalezNessuna valutazione finora

- Bajaj Chetak PLCDocumento13 pagineBajaj Chetak PLCVinay Tripathi0% (1)

- 25-07-2023 DSRDocumento4 pagine25-07-2023 DSRRishavNessuna valutazione finora

- EP-501, Evolution of Indian Economy Midterm: Submitted By: Prashun Pranav (CISLS)Documento8 pagineEP-501, Evolution of Indian Economy Midterm: Submitted By: Prashun Pranav (CISLS)rumiNessuna valutazione finora

- Placements IIM ADocumento8 paginePlacements IIM Abhanu1991Nessuna valutazione finora

- High Potential Near MissDocumento12 pagineHigh Potential Near Missja23gonzNessuna valutazione finora

- ACC 690 Final Project Guidelines and RubricDocumento4 pagineACC 690 Final Project Guidelines and RubricSalman KhalidNessuna valutazione finora

- Unit 6 Mutual FundDocumento46 pagineUnit 6 Mutual Fundpadmakar_rajNessuna valutazione finora

- Chapt 12Documento50 pagineChapt 12KamauWafulaWanyamaNessuna valutazione finora

- Agricultural Mechanisation Investment Potential in TanzaniaDocumento2 pagineAgricultural Mechanisation Investment Potential in Tanzaniaavinashmunnu100% (3)

- No Plastic Packaging: Tax InvoiceDocumento12 pagineNo Plastic Packaging: Tax Invoicehiteshmohakar15Nessuna valutazione finora

- Kami Export - Gilded Age Photo Analysis - PDF (Student)Documento44 pagineKami Export - Gilded Age Photo Analysis - PDF (Student)Nalani CarrilloNessuna valutazione finora

- Urbanization and Rural-Urban Migration: Theory and PolicyDocumento42 pagineUrbanization and Rural-Urban Migration: Theory and PolicyJunaid AhmedNessuna valutazione finora

- Crop Insurance - BrazilDocumento3 pagineCrop Insurance - Brazilanandekka84Nessuna valutazione finora

- Measuring and Valuing Intangible AssetsDocumento52 pagineMeasuring and Valuing Intangible AssetsFilip Juncu100% (1)

- March-April - The Indian Down UnderDocumento60 pagineMarch-April - The Indian Down UnderindiandownunderNessuna valutazione finora

- Farmers, Miners and The State in Colonial Zimbabwe (Southern Rhodesia), c.1895-1961Documento230 pagineFarmers, Miners and The State in Colonial Zimbabwe (Southern Rhodesia), c.1895-1961Peter MukunzaNessuna valutazione finora

- Tourism 2020: Policies To Promote Competitive and Sustainable TourismDocumento32 pagineTourism 2020: Policies To Promote Competitive and Sustainable TourismHesham ANessuna valutazione finora

- ECON F312: Money, Banking and Financial Markets I Semester 2020-21Documento16 pagineECON F312: Money, Banking and Financial Markets I Semester 2020-21AKSHIT JAINNessuna valutazione finora

- Account statement showing transactions from Dec 2016 to Feb 2017Documento4 pagineAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNessuna valutazione finora

- Income from House PropertyDocumento5 pagineIncome from House PropertyKaustubh BasuNessuna valutazione finora

- Curriculum Vitae (CV)Documento6 pagineCurriculum Vitae (CV)Adriana DumitriuNessuna valutazione finora

- Digital Duplicator DX 2430 Offers High-Speed PrintingDocumento2 pagineDigital Duplicator DX 2430 Offers High-Speed PrintingFranzNessuna valutazione finora

- Geography Repeated Topics CSSDocumento12 pagineGeography Repeated Topics CSSAslam RehmanNessuna valutazione finora

- Extrajudicial Settlement of Estate With Special Power of Attorney To Sell or To Enter Into Develpoment Agreement-1Documento5 pagineExtrajudicial Settlement of Estate With Special Power of Attorney To Sell or To Enter Into Develpoment Agreement-1Lucille Teves78% (23)

- ABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFDocumento18 pagineABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFamitsh20072458Nessuna valutazione finora