Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Untitled Document

Caricato da

xandercageCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Untitled Document

Caricato da

xandercageCopyright:

Formati disponibili

11/22/2014

Untitled Document

METHODS OF POLLUTION CONTROL

Market Mechanism does not allocate resources efficiently if production involves pollution externalities. Produces of a particular product

may emit pollutants into the atmosphere, which result in damage to others. The pollutants may adversely affect health of people

exposed to pollution, pollutants released into air or water may cause property damage or may have adverse impact on incomes of

people in the area.

The affected individuals are not compensated for damages. This causes divergence between private and social, costs of production

resulting in inefficiency in resources allocation. This happens because the affected individuals are not a party in the market decisionmaking process.

In a free market economy in which companies seek to maximize their profit, if private costs of production do not reflect social costs,

there is excessive production of the commodity as well of the associated pollution. Figure 1 illustrates this very clearly.

Figure 1

This industry also produces pollution as by-product, which is not compensated. BC represents the marginal private costs of production.

There are costs borne by the producers and they do not involve externalities. BE represents the original social costs of production. In

addition to marginal private costs, these costs include marginal costs to the society caused by pollution. AD represents the demand

curve for the commodity. It shows the price which buyers are prepared to pay for the various quantities of the commodity.

As discussed earlier, the demand curve is equivalent to the marginal benefit curve: it shows the marginal benefit to the society of extra

production of the commodity.

This form of the market is assumed to be perfectly competitive here. It is socially optimal to produce Q 1 amount of the commodity. At

this level of output, the products marginal social benefit is just equal to its marginal social cost of production.

In a unregulated market, the producers do not take into consideration the environmental costs. In such a situation the firms would

produce Q2 output. At this level of output, the products marginal benefit (or the price of the product) is just equal to its marginal

(private) costs of production. An unregulated market thus, produces output which is in excess of socially desirable level of output. The

associated pollution level is also higher than the socially desirable level.

Pigou (1932) 1 suggests that the excess production of the commodity can be reduced to the socially desirable level by imposing a

suitable tax on the commodity (see Fig. 2). If Rs. KL per unit tax is imposed on the commodity, the marginal (private) costs curve will

shift upwards by a vertical distance of Rs. KL. The marginal (private) cost curve with tax will be GH. The output produced in the industry

will now be Q 1, which is the socially desirable level of output as discussed earlier.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

1/8

11/22/2014

Untitled Document

If the market is not competitive, the Pigou taxation method may not be relied upon to achieve the desirable objective. If the industry in

question has only one producer (a monopoly situation), then the firm would produce an output lower then the competitive market level

and charge higher price from the consumers as shown in figure 3.

As the monopolist equates the products marginal (private) costs with the marginal revenue AM showing marginal revenue associated

with various levels of output, Q 3 output would be produced. It is lower than the competitive market output Q 2 it may, in fact be even

lower then Q 1, the socially desirable level of output. If tax on output is imposed, the monopolist will produce output less then Q 3, thus

moving further away (lower from Q 1, in case Q 3 is less than Q 1).

In Pigovian approach, the pollution is control is achieved through reduction in output. In this sense, it is an indirect method of pollution

control.

Figure 3

It is argued that a direct method involving taxation of the particular input in the production process, which is the main source of

pollution, may be more efficient method. This method is discussed a little later. The Pigovian method, despite being indirect and

relatively crude, is liked by some economists because it is relatively easy to implement. Since output is the tax base in this method, it

may be easier to monitor and enforce the regulations. To arrive at the desired level of output and pollution, a few trials would be

required. This method does not require very precise of measurement of effluents since effluent discharge is not the tax bare hire.

A simple model used by economists for discussing the efficient level of environmental quality is based on benefit/cost analysis of

control of emission of pollutants. Small reduction in emission of pollutants can be achieved easily using inexpensive method of pollution

control. Higher levels of emission control are, however, more expansive to obtain than lower levels. More sophisticated and complex

techniques must be used to achieve emission control after certain level. The total costs of pollution abatement increase at an increasing

rate. In Figure 4 the curve TC shows the relationship between the total costs of pollution abatement and the environmental quality.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

2/8

11/22/2014

Untitled Document

Figure 4

The slope of TC curve at any given level of environmental quality gives the marginal cost of pollution abatement (shown by MC curve).

The marginal costs of pollution abatement rises with improvement in environmental quality because as discussed above, higher levels

of emission control can be achieved only at higher costs.

Emission of pollutants causes damage to people, plants, animals and physical assets. Control of emissions leads to improvement in

environmental quality which in turn increases social welfare. The benefits to society of emission control can be quantitatively measured

in monetary terms. Although their actual measurement in practice poses a great many problems, conceptually The TB curve in Figure

5.

Figure 5

The total benefits of pollution abatement. In the beginning small reductions in emission of pollutants gives rise to substantial benefits.

However, after the first improvements, the total benefits increase at decreasing rates. The slope of TB curve gives the marginal benefit

(MB) curve. As shown in the figure marginal benefit of pollution abatement declines as the environmental quality improves.

The efficient level of environmental quality is given by the part of intersection of the MB and MC curves. It is desirable to reduce

emissions as long as the marginal benefits of doing so are higher than the marginal costs.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

3/8

11/22/2014

Untitled Document

Figure 6

In Figure 6 the socially optimal level is shown by E. At this level, marginal benefit and marginal costs of pollution abatement are equal

to each other. Further reduction in emissions would result in costs higher than benefits.

The desirable level of environmental quality (E) can be achieved by regulatory approach, Government can specify the allowed limits of

emission of pollutants for all polluting firms. This approach which calls for direct government involvement and control in the sphere of

economic activity is criticized on the ground that it is wasteful and leads to sub-optimal outcomes. There are several alternative

methods based on economic incentives, which can reduce the inefficiencies inherent in a regulatory approach. These methods are

discussed below.

The efficient level of environment quality (E) could be achieved by imposing a tax of Rs. T per unit of pollutant emitted. If it is cheaper to

reduce emission of pollutants than paying taxes, the polluters would choose the former. In other words as long as the marginal cost of

pollution abatement is less than the tax (per unit) on the emission of pollutants, it would be advantageous for polluters to reduce their

emissions. On the other hand, if the marginal cost of pollution abatement is higher than the per unit tax on the emission of pollutants,

polluters would prefer to pay taxes. The equilibrium would be reached at E* which is the socially optimal level of emission of pollutants.

Coase (1960) has suggested another method, which could be used to achieve the desired objective. In this method, the sufferers (i.e.,

the parties damaged by pollution) pay (bribe) polluters to reduce their level of pollution. This is, however, not only difficult to put in

practice but is also ethically unjustifiable.

A method equivalent method to Coases method would be a subsidy system where by pollutants is paid subsidy for not releasing

pollution. MC curve in Figure 7 represent the marginal amounts when polluters would require compensating them for their cost of

abating pollution. If subsidy is fixed at Rs. 5 per unit on reduction of emission of pollutants than profit maximising polluting fins would

undertake reduction of emissions upto level E 1. If S is fixed equal to T (as in figure 6), then E 1 would be equal to E*, the efficient level

of environmental quality. 3. coase, R (1960) The Problem of Social Waste, the journal of law and Economics, 3 pp 1-44.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

4/8

11/22/2014

Untitled Document

Figure 7

Dales has suggested another method of reducing emission of pollutants.

This method requires fixing of a target for reduction of pollution. Once the acceptable amount of emission of pollutants is decided, the

polluting firms could be sold pollution rights.

Dales method of controlling pollution can be illustrated by means of figure 8.

Figure 8

Point D on the horizontal axis represents the existing level of emission of pollutants. If the target of reduction of emission is R, the

socially desirable levels of emission of pollutants are D-R. The number of pollution rights made available to the firms is D-R, gives the

vertical line S in the figure showing fixed supply of pollution rights. Polluters demand for pollution rights is shown by AD. As usual it is

negatively sloped curve. It is equal to the marginal cost of pollution abatement curve, MC in Figure 7. As discussed earlier, some

reduction in emission of pollutants can be done at very low cost, but further reductions are very costly . If the aim is to reduce emission

of pollutants only marginally then the number of pollution rights supplied to the firms would be very close to the existing level of

emissions. In that case, the firms would not be willing to purchase pollution rights at a very high price. Point C on the demand curve

reflects such a situation. On the other hand, if the target of pollution reduction is very ambitions, then the number of pollution rights

made available to the firms would be very low. The firms the would have to cut emission of pollutants drastically, thereby incurring

heavy costs. They will be willing to pay high price for pollution rights. Point B on the demand curve reflects such a situation.

The intersection point of the demand and supply curves would give the equilibrium market price of pollution rights. As shows in Figure

8, the polluters would purchase the D-R amount of pollution rights at price P. If the target of reduction of emission of pollutants R is

chosen in such a way that D-R corresponds to E*, then the market price P would be equal to Rs. T per unit tax discussed in connection

with Figure 6. Dales method achieves the desired level of environmental quality at least cost to the society. It also encourages firms to

adopt pollution reduction technology.

We have discussed four approaches to pollution control in this chapter. These are: regulatory approach, taxation of effluents, subsidy

system and sale of pollution rights. We compare below these methods in terms of their revenue implications and impact on output. This

comparison considers the efficient level of control for each system.

Figure 9, MC represents the marginal cost of pollution abatement. It is equivalent to MC in figure 6 and AD in figure 8. The existing level

of emission of pollutants is given by point E. The socially optimal level of emission of pollutants or the efficient level of environmental

quality is given by point D.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

5/8

11/22/2014

Untitled Document

Figure 9

First, let us consider the regulatory approach to pollution control. If the specified limit of emission of pollutants is OD, polluters would

have to reduce emissions by DE amount. The cost of reduction of emissions is given by area AED. This cost will be borne by polluters.

If a tax of T per unit is imposed on emission of pollutants, polluters will reduce emissions by DE amount. The cost of reduction of

emissions is given by area AED. This cost will be borne by polluters.

If a tax of T per unit is imposed on emission of pollutants, polluters will reduce emissions by DE amount. Like in the regulatory

approach, the cost of reduction of emissions, AED, will be borne by polluters in this care also. In addition, however, polluters would

have to pay taxes to the government for emitting OD amount of pollutants. Area OTAD gives the amount of taxes. Thus, in comparison

with regulatory approach, taxation approach gives government additional revenues given by area OTAD.

As discussed above, control of pollution can also be achieved by sale of pollution rights. If OD amount of pollution rights are made

available to polluters, they would pay OT price for purchase of pollution rights.

In this case also they would themselves undertake reduction of emission by DE amount, incurring cost of reduction of emissions giving

area AED. Additionally, they would spend OTAP amount to purchase pollution rights. This approach is thus similar to taxation approach

in terms of revenue implications.

If polluters are paid a subsidy of Rs T per unit on reduction of emission of pollutants, then they would reduce emissions by DE amount.

This would cost them area ADE. They would, however, receive subsidy-given by area ADEB. Their net gain is then given by area AEB.

A comparison of the four systems shows that costs to polluters are increased by regulation, taxation of effluents, and sales of pollution

rights, but are reduced by subsidies. Taxation of effluents and sales of pollution rights cause higher increase in costs them regulation.

Changes in costs of production affect individual firms supply curves. Industrys supply curve, which is an aggregate of individual firms

supply curves, is thus also affected in the process. Shift in industrys supply curve has implications for market price and quantity of final

goods as well as for total emission of pollutants.

When a regulatory system is adopted, a polluting firms costs of production rise. This increase in cost shifts firms average cost (AC)

and marginal cost (MC) upward to AC 1 and MC 1 is shown in figure 10. All polluting firms would experience such shift in their cost

curves.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

6/8

11/22/2014

Untitled Document

Figure 10

Industrys supply curve is horizontal summation of all individual firms supply curves (MC curves). It also shifts upward from S to S 1 as

shown in Figure 11. D represents demand the commodity. Industrys output is reduced from Q to Q 1 as a result of adoption of

regulating system of pollution control. Buyers would have to pay higher price for the product: Market price increases from P to P 1.

Figure 11

With increase in costs of production each polluting firm is forced to reduce its output of final goods. Some firms with very high pollution

control costs will drop out of the industry. The number of firms operating in the industry thus would be less once the regulatory system

is adopted. These two effects the reduction in output produced by each firm and the reduction in number of firms in the industry

would both work to reduce the output of final goods produced in the industry.

Similar effects will be witnessed when method of taxation of pollutants or sales of pollution rights is used to control emissions as far as

the direction of changes is concerned. There would, however, be a difference in magnitude of shifts.

Since increase in costs of production is larger in case of taxation of pollutants and sales of pollution rights methods in comparison to a

regulatory system, magnitude of shift in individual firms cost curves and in industry supply curve would be larger in the former cases.

As a result, increase in market price as well as reduction in output of final goods would be more in there cases. Since the magnitude of

cost increase is higher, the number of firms dropping out of the industry would be higher under taxation of pollutants and sales of

pollution rights systems in comparison with regulatory system.

If polluters are paid subsidies, their cost of production decreases. As a result, individual polluting firms cost curves shift downward as

shown in Figure 12.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

7/8

11/22/2014

Untitled Document

Figure 12

Industry supply curves will alone shift downward from S to S 1 as shown in Figure 13. Unlike the three method discussed above,

output of final goods would increase and market price would decrease in this case.

If all the required information is available, all the four methods can be used to achieve the efficient level of emissions for a source.

Under subsidy system, the number of firms operating in the industry would increase. Some new firms would join the industry. These

firms are high cost firms, without subsidy, these firms would not be able to operate profitably in the market. Subsidies by reducing costs

would make their operations profitable. (This level in shown by point D in figure 9.) However, these methods differ in terms of their

impact on the total emission of pollutants (by all sources in the industry).

Let us consider the regulatory approach first. Each firm would reduce the emission of pollutants up to the specified limit. The number of

firms operating in the industry would decline. Total emission of pollutants by all sources in the industry would thus register a fall. Under

taxation of pollutants and sales of pollution rights systems the number of firms dropping out of market would be much higher. In

comparison to regulatory system, these two systems would achieve greater reduction in total emission of pollutants. Under subsidy

system also, each firms would reduce emissions of pollutants. However, given that the number of firms in the industry is likely to

increase, the net effect of subsidy systems on total emission of pollutant by all sources is not possible to predict with certainty.

http://nptel.ac.in/courses/122102006/mod4/mod4_4.htm

8/8

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Loss of Efficiency Due To MonopoliesDocumento5 pagineLoss of Efficiency Due To MonopoliesW.t. LamNessuna valutazione finora

- Lesson 7 ElasticityDocumento8 pagineLesson 7 ElasticityleblanjoNessuna valutazione finora

- Judicial ReveiwDocumento7 pagineJudicial ReveiwxandercageNessuna valutazione finora

- PolygamyDocumento2 paginePolygamyxandercageNessuna valutazione finora

- D22 04 175 RewriteDocumento17 pagineD22 04 175 RewritexandercageNessuna valutazione finora

- Supply Chain IntegrationDocumento2 pagineSupply Chain IntegrationxandercageNessuna valutazione finora

- The Effect of Supply Chain Integration and Employee Commitment On Organizational PerformanceDocumento2 pagineThe Effect of Supply Chain Integration and Employee Commitment On Organizational PerformancexandercageNessuna valutazione finora

- Omnichannel Marketing: A New Era of Customer EngagementDocumento17 pagineOmnichannel Marketing: A New Era of Customer EngagementxandercageNessuna valutazione finora

- 17 74 Supply Clerk Recieving Super WHDocumento4 pagine17 74 Supply Clerk Recieving Super WHxandercageNessuna valutazione finora

- New Microsoft Word DocumentDocumento5 pagineNew Microsoft Word DocumentxandercageNessuna valutazione finora

- Supplier Chain Ustomer IntegrationDocumento3 pagineSupplier Chain Ustomer IntegrationxandercageNessuna valutazione finora

- Field Visit To F-7 & F-8Documento3 pagineField Visit To F-7 & F-8xandercageNessuna valutazione finora

- Discussion: Aggregate Production PlanningDocumento1 paginaDiscussion: Aggregate Production PlanningxandercageNessuna valutazione finora

- Internal Integration and Organizational PerformanceDocumento9 pagineInternal Integration and Organizational PerformancexandercageNessuna valutazione finora

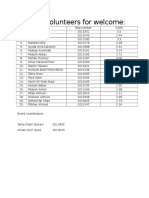

- List of Voulenteer For WelcomeDocumento1 paginaList of Voulenteer For WelcomexandercageNessuna valutazione finora

- Production Management QuestionairesDocumento6 pagineProduction Management QuestionairesxandercageNessuna valutazione finora

- Inferential StatisticsDocumento35 pagineInferential StatisticsxandercageNessuna valutazione finora

- SolutionDocumento243 pagineSolutionxandercageNessuna valutazione finora

- For Students: Solutions To Odd Numbered End of Chapter ExercisesDocumento72 pagineFor Students: Solutions To Odd Numbered End of Chapter Exercisesxandercage100% (1)

- IJCAS v2 n3 pp263-278Documento16 pagineIJCAS v2 n3 pp263-278xandercageNessuna valutazione finora

- Exercises Probability and Statistics: Bruno Tuffin Inria, FranceDocumento33 pagineExercises Probability and Statistics: Bruno Tuffin Inria, FrancexandercageNessuna valutazione finora

- Scope of EconomicsDocumento46 pagineScope of EconomicsBalasingam Prahalathan100% (2)

- Imperfect Competition: Economics 302 - Microeconomic Theory II: Strategic BehaviorDocumento11 pagineImperfect Competition: Economics 302 - Microeconomic Theory II: Strategic BehaviorNikanon AvaNessuna valutazione finora

- MR - MC ApproachDocumento4 pagineMR - MC ApproachChanchal80% (5)

- Answer Scheme For Tutorial 1 (Microeconomics)Documento2 pagineAnswer Scheme For Tutorial 1 (Microeconomics)Nur Shahirah AzmanNessuna valutazione finora

- ECO2023 - Exam 2 Index Card TemplateDocumento1 paginaECO2023 - Exam 2 Index Card TemplateElizabeth TremblayNessuna valutazione finora

- Assignment 2 Apllied EcoDocumento10 pagineAssignment 2 Apllied EcoAthikah AnuarNessuna valutazione finora

- Market EquilibriumDocumento11 pagineMarket EquilibriumClaudine SumalinogNessuna valutazione finora

- Law of DemandDocumento3 pagineLaw of DemandMonalisa Das100% (1)

- Elasticity of Demand and Types of DemandDocumento8 pagineElasticity of Demand and Types of Demanddeepa_kamalim1722Nessuna valutazione finora

- Income and Substitution EffectDocumento44 pagineIncome and Substitution EffectAndane TaylorNessuna valutazione finora

- Problem Set V (PGP Micro)Documento2 pagineProblem Set V (PGP Micro)RohitKumarNessuna valutazione finora

- Income and Substitution Effects ExplainedDocumento4 pagineIncome and Substitution Effects ExplainedVenkat NarayananNessuna valutazione finora

- EC201 Tutorial Exercise 3 SolutionDocumento6 pagineEC201 Tutorial Exercise 3 SolutionPriyaDarshani100% (1)

- The Weapon of TheoryDocumento116 pagineThe Weapon of TheoryFa BaNessuna valutazione finora

- 09B Importance of Managerial EconomicsDocumento8 pagine09B Importance of Managerial EconomicsSaTish Kdka100% (1)

- EC202 CourseOutlineDocumento4 pagineEC202 CourseOutlineEthan XuNessuna valutazione finora

- Tom Holden: Curriculum VitaeDocumento2 pagineTom Holden: Curriculum VitaeMuhammad Arslan UsmanNessuna valutazione finora

- Lecture2 MonopolyDocumento58 pagineLecture2 MonopolyGaurav JainNessuna valutazione finora

- Modern Interest TheoryDocumento10 pagineModern Interest TheoryAppan Kandala VasudevacharyNessuna valutazione finora

- Eco 415 Assignment 1Documento3 pagineEco 415 Assignment 1capeto01100% (3)

- Monopoly Questions AnswersDocumento4 pagineMonopoly Questions AnswersRoi'z NinoNessuna valutazione finora

- Basic Concepts of EconomicsDocumento20 pagineBasic Concepts of EconomicsravinbharathiNessuna valutazione finora

- Relation Between ElasticityDocumento3 pagineRelation Between Elasticityभवेश अाँशूNessuna valutazione finora

- Eabd 01Documento40 pagineEabd 01Rajeev KrishnaNessuna valutazione finora

- Managerial Economics - Course OutlineDocumento4 pagineManagerial Economics - Course OutlinekartikNessuna valutazione finora

- Assigment EKONOMIDocumento6 pagineAssigment EKONOMIKhaidhir HarunNessuna valutazione finora

- UNIT-3 (Managerial Economics) UPTU GBTU MTU Mba Sem1 PDFDocumento16 pagineUNIT-3 (Managerial Economics) UPTU GBTU MTU Mba Sem1 PDFSimmi KhuranaNessuna valutazione finora