Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Resume of Msnetty42

Caricato da

api-25122959Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Resume of Msnetty42

Caricato da

api-25122959Copyright:

Formati disponibili

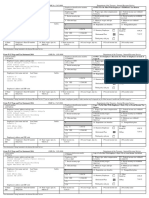

a Employee's social security number OMB No.

1545-0008

202-64-5295

b Employer identification number d Control number 1 Wages, tips, other compensation 2 Federal income tax withheld

35-9990000 7615.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

DFAS ATTN:DFASIN/JAMBE 7615.00 472.13

8899 EAST 56TH STREET 5 Medicare wages and tips 6 Medicare tax withheld

INDIANAPOLIS IN 46249-2410 7615.00 110.42

7 Social security tips 8 Allocated tips

e Employee's name, address, and ZIP code 9 Advance EIC payment 10 Dependent care benefits

JAMAR SINCLAIR SHERMAN

5ZC1D52C 4839 12 See instructions for box 12 14 See instructions for box 14

13 Statutory Retirement Third party

employee X Plan sick pay

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

DE 359990000 7615.00 115.18

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement 2009 Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

a Employee's social security number OMB No. 1545-0008

202-64-5295

b Employer identification number d Control number 1 Wages, tips, other compensation 2 Federal income tax withheld

35-9990000 7615.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

DFAS ATTN:DFASIN/JAMBE 7615.00 472.13

8899 EAST 56TH STREET 5 Medicare wages and tips 6 Medicare tax withheld

INDIANAPOLIS IN 46249-2410 7615.00 110.42

7 Social security tips 8 Allocated tips

e Employee's name, address, and ZIP code 9 Advance EIC payment 10 Dependent care benefits

JAMAR SINCLAIR SHERMAN

5ZC1D52C 4839 12 See instructions for box 12 14 See instructions for box 14

13 Statutory Retirement Third party

employee X Plan sick pay

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

DE 359990000 7615.00 115.18

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement 2009 Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

a Employee's social security number OMB No. 1545-0008

202-64-5295

b Employer identification number d Control number 1 Wages, tips, other compensation 2 Federal income tax withheld

35-9990000 7615.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

DFAS ATTN:DFASIN/JAMBE 7615.00 472.13

8899 EAST 56TH STREET 5 Medicare wages and tips 6 Medicare tax withheld

INDIANAPOLIS IN 46249-2410 7615.00 110.42

7 Social security tips 8 Allocated tips

e Employee's name, address, and ZIP code 9 Advance EIC payment 10 Dependent care benefits

JAMAR SINCLAIR SHERMAN

5ZC1D52C 4839 12 See instructions for box 12 14 See instructions for box 14

13 Statutory Retirement Third party

employee X Plan sick pay

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

DE 359990000 7615.00 115.18

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

Wage and Tax Department of the Treasury - Internal Revenue Service

Form

W-2 Statement 2009 Copy B To Be Filed With Employee's FEDERAL Tax Return

This information is being furnished to the Internal Revenue Service

a Employee's social security number OMB No. 1545-0008 This information is being furnished to the Internal Revenue Service. If you are required to file a

202-64-5295 tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

b Employer identification number d Control number 1 Wages, tips, other compensation 2 Federal income tax withheld

35-9990000 7615.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

DFAS ATTN:DFASIN/JAMBE 7615.00 472.13

8899 EAST 56TH STREET 5 Medicare wages and tips 6 Medicare tax withheld

INDIANAPOLIS IN 46249-2410 7615.00 110.42

7 Social security tips 8 Allocated tips

e Employee's name, address, and ZIP code 9 Advance EIC payment 10 Dependent care benefits

JAMAR SINCLAIR SHERMAN

5ZC1D52C 4839 12 See instructions for box 12 14 See instructions for box 14

13 Statutory Retirement Third party

employee X Plan sick pay

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

DE 359990000 7615.00 115.18

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement 2009 Copy C For EMPLOYEE'S RECORDS (See Notice to Employee on back of Copy B)

Potrebbero piacerti anche

- Or Wcomp 0.72 or Wcomp 0.72Documento1 paginaOr Wcomp 0.72 or Wcomp 0.72aaronNessuna valutazione finora

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Documento2 pagineTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNessuna valutazione finora

- Wage and Tax Statement: Page 1 / 4Documento4 pagineWage and Tax Statement: Page 1 / 4blon majorsNessuna valutazione finora

- W21225760934 0 PDFDocumento2 pagineW21225760934 0 PDFAnonymous czHLQeLPB4Nessuna valutazione finora

- Evans W-2sDocumento2 pagineEvans W-2sAlmaNessuna valutazione finora

- Loan AppDocumento9 pagineLoan Appanon-209253Nessuna valutazione finora

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocumento7 pagine2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNessuna valutazione finora

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Documento4 pagineKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonNessuna valutazione finora

- OMB Control No. 2900-0086 Respondent Burden: 15 MinutesDocumento2 pagineOMB Control No. 2900-0086 Respondent Burden: 15 MinutesPatrickCharlesNessuna valutazione finora

- Selection 26 144Documento1 paginaSelection 26 144Anonymous fu1jUQNessuna valutazione finora

- Federal Electronic Filing Instructions: Tax Year 2018Documento13 pagineFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNessuna valutazione finora

- Your Benefit Statement Tax Year 2019Documento2 pagineYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- 26 Jan 2020 ReturnDocumento2 pagine26 Jan 2020 Returnsandeep0% (1)

- TaxForms PDFDocumento2 pagineTaxForms PDFLMN214100% (1)

- A082000109a0298508172c001c: Contact InformationDocumento1 paginaA082000109a0298508172c001c: Contact InformationYudo KunaNessuna valutazione finora

- Fasfa DocsDocumento10 pagineFasfa DocsKira Rivera100% (1)

- DD 2870 Health Release Form - Scan PDFDocumento1 paginaDD 2870 Health Release Form - Scan PDFremolacha147Nessuna valutazione finora

- 2021 Tax Return: Prepared ByDocumento6 pagine2021 Tax Return: Prepared BySolomonNessuna valutazione finora

- Nolasco W2Documento2 pagineNolasco W2MARCOS NOLASCONessuna valutazione finora

- Ioana w2 PDFDocumento1 paginaIoana w2 PDFBlueberry13KissesNessuna valutazione finora

- Gov. Walz 2019 Federal Tax Return - RedactedDocumento11 pagineGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNessuna valutazione finora

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocumento15 pagineMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programdog dogNessuna valutazione finora

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Documento4 pagineCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNessuna valutazione finora

- LifeDocumento11 pagineLifejasNessuna valutazione finora

- U.S. Individual Income Tax Return: Filing StatusDocumento2 pagineU.S. Individual Income Tax Return: Filing Statusjakelong82100% (1)

- Ralston Medina W2Documento2 pagineRalston Medina W2bussinesl las100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocumento2 pagineU.S. Individual Income Tax Return: Filing StatusSammi Bowe100% (1)

- Dependent Student SheetDocumento4 pagineDependent Student SheetMaria GomezNessuna valutazione finora

- Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134 Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134Documento3 pagineHiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134 Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134Jenn BrownNessuna valutazione finora

- PDF DocumentDocumento1 paginaPDF DocumentAngelo DiloneNessuna valutazione finora

- I Pay Statements ServncoDocumento2 pagineI Pay Statements ServncoPablito Padilla100% (2)

- form-w2-Ramona-Crawford 2Documento9 pagineform-w2-Ramona-Crawford 2Nicole CarutherNessuna valutazione finora

- W2 PreviewDocumento1 paginaW2 Previewmrs merle westonNessuna valutazione finora

- Square 2022 W-2Documento2 pagineSquare 2022 W-2Zane CardinalNessuna valutazione finora

- TGDocumento2 pagineTGpr995Nessuna valutazione finora

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocumento1 paginaForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordssageNessuna valutazione finora

- Sarah Paredes 21w2Documento2 pagineSarah Paredes 21w2Sarah ParedesNessuna valutazione finora

- Selection-26 - 55 PDFDocumento1 paginaSelection-26 - 55 PDFAnonymous fu1jUQNessuna valutazione finora

- Pyw219s Ee PDFDocumento1 paginaPyw219s Ee PDFBeyonceNessuna valutazione finora

- Ajax PDFDocumento2 pagineAjax PDFGeorge AndoneNessuna valutazione finora

- Profit or Loss From Business: Linda Gercken 156-56-8670Documento2 pagineProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- AjaxDocumento2 pagineAjaxaccount.enquiry6770Nessuna valutazione finora

- 120s Az FormDocumento19 pagine120s Az FormStacey CanaleNessuna valutazione finora

- TAXES w2 REGAL HospitalityDocumento2 pagineTAXES w2 REGAL Hospitalityoskar_herrera2012Nessuna valutazione finora

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Documento2 pagineSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNessuna valutazione finora

- M. Giraldo PDFDocumento3 pagineM. Giraldo PDFMayken GiraldoNessuna valutazione finora

- Loan Rein Ex InfoDocumento5 pagineLoan Rein Ex InfoGomezLiliNessuna valutazione finora

- 2020 1040 Ramirez, Raul & Adriana Tax ReturnDocumento86 pagine2020 1040 Ramirez, Raul & Adriana Tax ReturnAlberto Lucio50% (2)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Documento2 pagineSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNessuna valutazione finora

- Justin w2Documento2 pagineJustin w2jusditzNessuna valutazione finora

- Rooksana Tax Return Form 2020-2021Documento19 pagineRooksana Tax Return Form 2020-2021MITON CHOWDHURYNessuna valutazione finora

- Edgar JDocumento2 pagineEdgar Japi-585014034Nessuna valutazione finora

- Screenshot 2020-03-13 at 4.33.54 PMDocumento6 pagineScreenshot 2020-03-13 at 4.33.54 PMJordan Leigh AuriemmaNessuna valutazione finora

- Printing H - FORMFLOW - SF3107.FRPDocumento10 paginePrinting H - FORMFLOW - SF3107.FRPKeller Brown JnrNessuna valutazione finora

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocumento11 pagineFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNessuna valutazione finora

- Profit or Loss From Business: Schedule C (Form 1040) 09Documento2 pagineProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeDa EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNessuna valutazione finora

- Wage and Tax StatementDocumento4 pagineWage and Tax StatementRich1781Nessuna valutazione finora

- UnknownDocumento4 pagineUnknownnayla marie santiago cuadradoNessuna valutazione finora

- ITR 1 Combined PDFDocumento4 pagineITR 1 Combined PDFcallmeasthaNessuna valutazione finora

- Family Pension FormDocumento4 pagineFamily Pension Formtelepk0% (1)

- M C Office of The Sangguniang BayanDocumento2 pagineM C Office of The Sangguniang BayanNitzshell Torres-Dela TorreNessuna valutazione finora

- Assignment Women As A LabourDocumento3 pagineAssignment Women As A Labourmakkala shireeshaNessuna valutazione finora

- AllowancesDocumento19 pagineAllowanceshanumanthaiahgowdaNessuna valutazione finora

- Iloilo City Regulation Ordinance 2014-326Documento2 pagineIloilo City Regulation Ordinance 2014-326Iloilo City CouncilNessuna valutazione finora

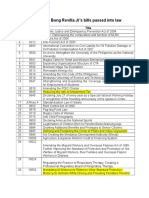

- Passed Into Law RBRJDocumento9 paginePassed Into Law RBRJJamie Dilidili-TabiraraNessuna valutazione finora

- Amos Gitonga 0790547715 ScammerDocumento7 pagineAmos Gitonga 0790547715 ScammertyaNessuna valutazione finora

- Claim Form For Telangana State Rythu Bandhu Group Life Insurance Scheme (Rythu Bima)Documento2 pagineClaim Form For Telangana State Rythu Bandhu Group Life Insurance Scheme (Rythu Bima)Kusuma VangalaNessuna valutazione finora

- Ipsos Mori Millennial Myths Realities Summary ReportDocumento32 pagineIpsos Mori Millennial Myths Realities Summary ReportjoaofresendeNessuna valutazione finora

- Central Administrative Tribunal Judgement On Modified Parity For Pre-2006 PensionersDocumento19 pagineCentral Administrative Tribunal Judgement On Modified Parity For Pre-2006 Pensionersgssekhon9406Nessuna valutazione finora

- Urban Poverty in IndiaDocumento11 pagineUrban Poverty in IndiaBushra HussainNessuna valutazione finora

- Rti CasesDocumento10 pagineRti CasesAakash Raj Chauhan100% (1)

- ScriedriebrochureDocumento32 pagineScriedriebrochureapi-317156030Nessuna valutazione finora

- FoundlingDocumento3 pagineFoundlingVincent John DalaotaNessuna valutazione finora

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsDocumento3 pagineQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarNessuna valutazione finora

- Act 3 The Parliamentary Pensions Amendment Act 2011Documento20 pagineAct 3 The Parliamentary Pensions Amendment Act 2011Mary AngelNessuna valutazione finora

- Seasons Greetin S: Department of Children & Families Monthly UpdateDocumento5 pagineSeasons Greetin S: Department of Children & Families Monthly UpdateMark ReinhardtNessuna valutazione finora

- Province of Batangas Vs Romulo - G.R. No. 152774. May 27, 2004Documento19 pagineProvince of Batangas Vs Romulo - G.R. No. 152774. May 27, 2004Ebbe DyNessuna valutazione finora

- Parreño Vs COADocumento3 pagineParreño Vs COAAnonymous 8SgE99Nessuna valutazione finora

- Lecture 11 - Audit in Public SectorDocumento56 pagineLecture 11 - Audit in Public SectorChuah Chong Ann100% (2)

- Open Letter For Prof. Rati Ram, Chairman, KVIB Haryana For Good GovernanceDocumento3 pagineOpen Letter For Prof. Rati Ram, Chairman, KVIB Haryana For Good GovernanceNaresh Kadyan Pfa HaryanaNessuna valutazione finora

- The Official Bulletin: 2011 Q2 / No. 632Documento30 pagineThe Official Bulletin: 2011 Q2 / No. 632IATSENessuna valutazione finora

- Salvation Army Housing Association Housing Application: Ersonal EtailsDocumento8 pagineSalvation Army Housing Association Housing Application: Ersonal EtailstiggieNessuna valutazione finora

- EC204 Topic 4 - General Equilibrium PDFDocumento12 pagineEC204 Topic 4 - General Equilibrium PDFKareena TekwaniNessuna valutazione finora

- FORMSDocumento6 pagineFORMSsaibal bagchiNessuna valutazione finora

- Part EOG (Page 1069 1212)Documento144 paginePart EOG (Page 1069 1212)dimbhaNessuna valutazione finora

- Police Injury Pensions - Home Office Circular 003/2004Documento5 paginePolice Injury Pensions - Home Office Circular 003/2004wdtkNessuna valutazione finora

- Morality and The Minimum WageDocumento3 pagineMorality and The Minimum WageIan Bertram100% (1)

- Carlos Superdrug Corp., Vs DSWD G.R. No. 166494Documento2 pagineCarlos Superdrug Corp., Vs DSWD G.R. No. 166494Lawrence Santiago100% (4)