Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2

Caricato da

Joyce SampoernaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2

Caricato da

Joyce SampoernaCopyright:

Formati disponibili

November 17, 2015

Siloam Hospitals

Patricia Gabriela

Reduces estimates, maintain BUY

(patricia.gabriela@trimegah.com)

Higher opex from capacity cost, hence lower profit

We reduced our 2015/16F earnings estimates by 28/27% as we now

assume significantly higher opex (our new operating margins for

2015/16F is 5.6/5.7% versus previously 5.9/6.4%). This follows a disappointing 3Q result in which operating profit was down 25% YoY. Management has added more manpower costs than we previously expected

and Yogya hospital remains delayed (has been ready to open since

Apr15 but has not received license yet). Our new earnings estimates for

2016F is 20% below consensus. We think share price has already

moved ahead of earnings downgrades (SILO is down 45% since its high

of Rp16,900 on Aug15).

Solid patient volume growth

Albeit hospital expansion plan is not on track, SILO managed to post a

robust patient volume growth of 25% YoY (vs MIKA at -1%). In 9M15,

SILOs number of inpatient days and outpatient visits grew 21% and

27% YoY. The strong patient volume translates to revenue growth of

24% YoY (vs MIKA of 9%). SILO 9M15 top line formed 71% of TRIM and

51% of consensus forecast, in line with historical performance. On

quarterly basis, total patient volume down by 3% while revenue down

by 1% due to Lebaran season.

Siloam Hospital Group is the leader of integrated healthcare services in Indonesia. It operates 20 hospitals in total with

more than 3,900 bed capacity.

Buy

Rp 12,200

Company Update

Share Price

Sector

Price Target

Rp 9,300

Healthcare

Rp 12,200 (+31%)

Stock Data

Longer gestation period but remains optimistic on growth outlook

We downgrade our margin forecast on SILO but remains optimistic as to

margin expansion. We expect SILOs net margin to grow CAGR 201518F of 36% on the back of more mature hospitals which serves better

profitability. We assume revenue per in and out-patient to grow 2% in

2015-18F.

Reuters Code

Bloomberg Code

Issued Shares

Mkt Cap. (Rp bn)

Avg. Value Daily 6

Month (Rp bn)

52-Wk range

SILO.JK

SILO.IJ

1,156

10,752

45.8

17,100 / 8,600

Major Shareholders

Maintain BUY but lower TP at Rp 12,200

We use DCF methodology to derive our TP at Rp 12,200. The stock

currently trades at 2016F EV/EBITDA 17.1x, -2.5 stdev of forward EV/

EBITDA.

PT Megapratama Karya Persada

60.5%

Public

29.5%

Consensus

Core EPS

Consensus (Rp)

TRIM vs Cons. (%)

16F

112

-9.6

17F

172

-21.5

Companies Data

Year end Dec

Net Sales (Rp bn)

EBITDA (Rp bn)

Net Profit (Rp bn)

EPS (Rp)

EPS Growth (%)

DPS (Rp)

BVPS (Rp)

EV/EBITDA (x)

P/E (x)

Div Yield (%)

2013

2014

2015F

2016F

2017F

1,847

220

50

48

-6%

1,565

30.4

195.3

0.0

2,472

455

63

54

14%

1,430

23.2

171.8

0.0

3,115

510

82

71

31%

5

1,559

20.3

131.5

0.1

4,006

607

116

101

42%

7

1,653

17.1

92.3

0.1

5,092

721

156

135

34%

15

1,773

14.5

68.8

0.2

PT Trimegah Securities Tbk - www.trimegah.com

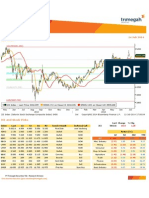

Stock Price

Avg. 5 Day MA Trading Value (RHS)

18,000

Price (LHS)

(Rpbn)

350.0

16,000

300.0

14,000

250.0

12,000

10,000

200.0

8,000

150.0

6,000

100.0

4,000

50.0

2,000

Nov-14

0.0

Jan-15

Mar-15

May-15

Jul-15

Sep-15

COMPANY FOCUS

Nov-15

Figure 1. 9M15 results - poor profitability

3Q14

2Q15

QoQ Chg.

(%)

3Q15

YoY Chg.

(%)

FY15E

9M15 /

FY15E

(%)

9M15 /

Cons.

(%)

Net revenue

624

746

740

-0.7%

18.5%

3,121

71.1%

51.1%

Gross profit

236

259

290

12.1%

23.3%

1,219

70.2%

68.8%

26

56

21

-63.5%

-19.8%

218

64.6%

60.6%

28

-69.7%

2.1%

114

61.8%

69.9%

37.7%

34.8%

39.2%

39.2%

Operating margin (%)

4.1%

7.6%

2.8%

5.9%

Net margin (%)

1.3%

3.7%

1.1%

3.7%

Operating profit

Net profit

Gross margin (%)

Source: TRIM Research

Figure 2. SILOs patient volume - double-digit YoY growth

600,000

530,463

517,095

1Q15

2Q15

3Q15

466,421

500,000

400,000

527,025

318,706

300,000

200,000

100,000

3Q14

4Q14

Source: TRIM Research

Valuation and Price Target

We lower our 2015-16F earnings by 28% and 27%, respectively, on the back of further IDR depreciation and

higher financial expenses.

We use DCF methodology to derive TP of Rp 12,200. We still apply 8.4% risk-free rate and 10.4% WACC. SILO

currently trades at 2016F EV/EBITDA 17x. We view this serves as an attractive entry point.

PT Trimegah Securities Tbk - www.trimegah.com

COMPANY FOCUS

Figure 3. Forecast changes

Previous

FY15E

No of hospitals

Current

FY16E

FY15E

Changes

FY16E

FY15E

FY16E

21

25

21

25

0%

0%

2,086,936

2,584,345

2,086,936

2,584,345

0%

0%

Gross sales

4,209

5,404

4,209

5,404

0%

0%

Net sales

3,123

4,013

3,115

4,006

0%

0%

Gross profit

1,224

1,581

1,202

1,563

-2%

-1%

Operating profit

184

255

173

227

-6%

-11%

Net profit

114

160

82

116

-28%

-27%

39.2%

39.4%

38.6%

39.0%

Operating margin

5.9%

6.4%

5.6%

5.7%

Net margin

3.7%

4.0%

2.6%

2.9%

Total patient volume

Gross margin

Source: TRIM Research

Figure 4. DCF calculations

2017F

2018F

2019F

2020F

2021F

2022F

2023F

2024F

2025F

2026F

EBIT

290

409

536

730

957

1,210

1,751

2,152

2,631

3,203

EBIT (1-T)

185

261

342

466

611

773

1,118

1,374

1,680

2,045

Capex

(506)

(582)

(536)

(600)

(672)

(753)

(843)

(944) (1,057) (1,184)

Changes in working capital

(113)

(147)

(185)

(242)

(222)

(264)

(335)

(381)

(456)

(546)

Depreciation

431

489

543

603

670

745

830

924

1,030

1,148

FCFF (Rp bn)

(3)

22

165

227

388

502

770

974

1,197

1,464

Discounted FCFF

(3)

20

135

169

261

306

425

487

543

601

Terminal value

PV of terminal value

Total company value

Net debt

NAV

Source: TRIM Research

NAV / share

30,296

11,277

14,223

98

14,124

12,217

PT Trimegah Securities Tbk - www.trimegah.com

COMPANY FOCUS

Figure 5. Forward EV/EBITDA band

40.00

+2 stdev

35.00

+1 stdev

30.00

average

25.00

-1 stdev

20.00

-2 stdev

-2.5 stdev

15.00

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Feb-15

Mar-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

Apr-14

May-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

Oct-13

Sep-13

10.00

Source: TRIM Research

PT Trimegah Securities Tbk - www.trimegah.com

COMPANY FOCUS

Income Statement (Rpbn)

Balance Sheet (Rpbn)

Year end Dec

2013

2014

2015F

2016F

2017F

Net Revenue

Revenue Growth

(%)

Gross Profit

Opr. Profit

1,847

45.0%

2,472

33.9%

3,115

26.0%

4,006

28.6%

5,092

27.1%

659

79

952

134

1,202

173

1,563

227

1,995

290

306

453

510

607

721

48.1%

12.7%

19.1%

18.7%

(40)

(50)

(49)

(50)

EBITDA

EBITDA Growth (%)

Net Int Inc/(Exp)

Gain/(loss) Forex

Other Inc/(Exp)

Pre-tax Profit

Tax

Minority Int.

Extra. Items

Reported Net Profit

Core Net Profit

(7)

-

3

72

(34)

94

(48)

124

(62)

178

(75)

240

(22)

0

(34)

(3)

(45)

(3)

(64)

(3)

(87)

(3)

50

50

60

63

79

82

114

116

153

156

Year end Dec

2013

2014

2015F

2016F

2017F

Cash and equivalents

515

280

445

401

352

Other curr asset

392

561

607

761

950

1,402

1,589

1,567

1,627

1,702

291

414

404

404

404

2,601

2,844

3,023

3,193

3,408

Net fixed asset

Other asset

Total asset

ST debt

17

16

16

16

16

Other curr liab

279

462

492

554

630

LT debt

430

446

446

446

446

Other LT Liab

236

266

266

266

266

28

79

79

79

962

1,190

1,221

1,282

1,359

1,639

1,654

1,803

1,911

2,050

(69)

182

17

62

111

2,305

2,366

2,515

2,623

2,762

Minority interest

Total Liabilities

Shareholders Equity

Net debt / (cash)

-1.2%

25.5%

30.7%

42.4%

34.1%

Total cap employed

Dividend per share

15

Net Working capital

612

363

543

592

655

growth (%)

30.7%

113.6%

Debt

447

462

462

462

462

Dividend payout

ratio

10%

10%

15%

2013

2014

2015F

2016F

2017F

35.7%

38.5%

38.6%

39.0%

39.2%

4.3%

5.4%

5.6%

5.7%

5.7%

16.6%

18.3%

16.4%

15.2%

14.2%

Core Net Margin (%)

2.7%

2.5%

2.6%

2.9%

3.1%

ROAE (%)

5.3%

3.8%

4.7%

6.3%

7.9%

ROAA (%)

2.4%

2.3%

2.8%

3.7%

4.7%

Growth (%)

Cash Flow (Rpbn)

Year end Dec

Net Profit

Depr / Amort

Chg in Working Cap

Others

CF's from oprs

Capex

Key Ratio Analysis

2013

2014

2015F

2016F

2017F

Year end Dec

50

63

82

116

156

Profitability

142

321

336

381

431

Gross Margin (%)

(2)

(100)

(16)

(93)

(113)

43

(157)

189

284

403

404

475

Opr Margin (%)

EBITDA Margin (%)

(386)

(331)

(314)

(440)

(506)

(6)

(8)

(17)

Others

(375)

(179)

(0)

CFs from investing

(761)

(511)

(321)

(448)

(524)

CFs from financing

904

(8)

Net cash flow

418

(236)

82

(44)

(49)

Interest Coverage (x)

Dividend

Stability

Current ratio (x)

3.1

1.8

2.1

2.0

2.0

Net Debt to Equity (x)

(0.0)

0.1

0.0

0.0

0.1

Net Debt to EBITDA (x)

(0.2)

0.4

0.0

0.1

0.2

4.0

3.0

4.0

5.3

6.6

Cash at BoY

169

601

363

445

401

Efficiency

Cash at EoY

601

363

445

401

352

A/P (days)

48

43

39

37

38

Free Cashflow

227

319

336

381

431

A/R (days)

45

49

47

44

44

Inventory (days)

26

24

22

21

22

Interim Result (Rpbn)

Capital History

3Q14

4Q14

1Q15

2Q15

3Q15

Sales

624

926

732

746

740

Gross Profit

236

285

307

259

290

EBITDA

147

106

145

140

104

26

33

64

56

21

Net profit

34

28

Core profit

35

28

Gross Margins (%)

37.7%

30.8%

41.9%

34.8%

39.2%

EBITDA Margins (%)

Opr. Profit

23.5%

11.5%

19.8%

18.8%

14.1%

Opr Margins (%)

4.1%

4.9%

8.7%

7.6%

2.8%

Net Margins (%)

1.1%

0.9%

4.6%

3.8%

0.8%

Core Margins (%)

1.3%

0.9%

4.7%

3.7%

1.1%

PT Trimegah Securities Tbk - www.trimegah.com

Date

12-Sept-13

IPO@Rp9,000

COMPANY FOCUS

PT Trimegah Securities Tbk

Gedung Artha Graha 18th Floor

Jl. Jend. Sudirman Kav. 52-53

Jakarta 12190, Indonesia

t. +62-21 2924 9088

f. +62-21 2924 9150

www.trimegah.com

DISCLAIMER

This report has been prepared by PT Trimegah Securities Tbk on behalf of itself and its affiliated companies and is provided for information

purposes only. Under no circumstances is it to be used or considered as an offer to sell, or a solicitation of any offer to buy. This report has

been produced independently and the forecasts, opinions and expectations contained herein are entirely those of Trimegah Securities.

While all reasonable care has been taken to ensure that information contained herein is not untrue or misleading at the time of publication,

Trimegah Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. This report is

provided solely for the information of clients of Trimegah Securities who are expected to make their own investment decisions without reliance

on this report. Neither Trimegah Securities nor any officer or employee of Trimegah Securities accept any liability whatsoever for any direct or

consequential loss arising from any use of this report or its contents. Trimegah Securities and/or persons connected with it may have acted

upon or used the information herein contained, or the research or analysis on which it is based, before publication. Trimegah Securities may in

future participate in an offering of the companys equity securities.

Potrebbero piacerti anche

- Audit Forensik Sesi 01 Dosen LainDocumento29 pagineAudit Forensik Sesi 01 Dosen LainJoyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento14 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento14 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- BT 28 MeiDocumento4 pagineBT 28 MeiJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento16 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Trimegah Economy 20151120 Economy Outlook 2016 2Documento20 pagineTrimegah Economy 20151120 Economy Outlook 2016 2Joyce SampoernaNessuna valutazione finora

- TRIM Technical Call: JCI ChartDocumento5 pagineTRIM Technical Call: JCI ChartJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento15 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- Created by Trial Version: Market ShareDocumento1 paginaCreated by Trial Version: Market ShareJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento17 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Press Release Agen Penjual Ori012 2015 Eng Final 17sep15 Website 1Documento2 paginePress Release Agen Penjual Ori012 2015 Eng Final 17sep15 Website 1Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento9 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM Technical Call: JCI ChartDocumento5 pagineTRIM Technical Call: JCI ChartJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento9 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento15 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- 2Documento8 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento7 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- td140414 2Documento6 paginetd140414 2Joyce SampoernaNessuna valutazione finora

- td140417 2Documento8 paginetd140417 2Joyce SampoernaNessuna valutazione finora

- td140502 2Documento12 paginetd140502 2Joyce SampoernaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Circular 02 2020Documento154 pagineCircular 02 2020jonnydeep1970virgilio.itNessuna valutazione finora

- Principles of BankingDocumento33 paginePrinciples of BankingMANAN MEHTANessuna valutazione finora

- Process Costing Study GuideDocumento14 pagineProcess Costing Study GuideTekaling NegashNessuna valutazione finora

- Stock Market Course ContentDocumento12 pagineStock Market Course ContentSrikanth SanipiniNessuna valutazione finora

- Exercise 6-3Documento1 paginaExercise 6-3Ammar TuahNessuna valutazione finora

- RTM Company ProfileDocumento10 pagineRTM Company ProfileBy StandNessuna valutazione finora

- Contents of Project ProposalDocumento2 pagineContents of Project ProposalFatima Razzaq100% (1)

- RBL Mitc FinalDocumento16 pagineRBL Mitc FinalVivekNessuna valutazione finora

- Siddharth Arya - DIW - Individual Assignment 1 PDFDocumento13 pagineSiddharth Arya - DIW - Individual Assignment 1 PDFSiddhartha AryaNessuna valutazione finora

- Chapter 2 ExerciseDocumento5 pagineChapter 2 Exercisegirlyn abadillaNessuna valutazione finora

- Shapiro CHAPTER 3 Altered SolutionsDocumento17 pagineShapiro CHAPTER 3 Altered SolutionsNimi KhanNessuna valutazione finora

- RFBT RC ExamDocumento9 pagineRFBT RC Examjeralyn juditNessuna valutazione finora

- Agrotech Business ModelDocumento53 pagineAgrotech Business ModelAriful Hassan Saikat100% (1)

- Aspen Polymers DatasheetDocumento2 pagineAspen Polymers DatasheetSyed Ubaid AliNessuna valutazione finora

- EMPEA CaseStudy OlamDocumento2 pagineEMPEA CaseStudy Olamcatiblacki420Nessuna valutazione finora

- Entrepreneurial Mind Learning Activity Sheet: 2 Sem. S.Y.2020-2021Documento6 pagineEntrepreneurial Mind Learning Activity Sheet: 2 Sem. S.Y.2020-2021Sheila Mae Tundag-ColaNessuna valutazione finora

- VP Director Bus Dev or SalesDocumento5 pagineVP Director Bus Dev or Salesapi-78176257Nessuna valutazione finora

- Operational Plan SampleDocumento5 pagineOperational Plan Sampletaylor swiftyyyNessuna valutazione finora

- HDFC Bank DDPI - Resident Ver 2 - 17102022Documento4 pagineHDFC Bank DDPI - Resident Ver 2 - 17102022riddhi SalviNessuna valutazione finora

- SM Assignment PDFDocumento21 pagineSM Assignment PDFSiddhant SethiaNessuna valutazione finora

- Checklist For Issue of CCDDocumento1 paginaChecklist For Issue of CCDrikitasshahNessuna valutazione finora

- Inbound 9092675230374889652Documento14 pagineInbound 9092675230374889652Sean Andrew SorianoNessuna valutazione finora

- Final ResearchDocumento60 pagineFinal ResearchLoduvico LopezNessuna valutazione finora

- Development of The Clarence T.C. Ching Athletic ComplexDocumento18 pagineDevelopment of The Clarence T.C. Ching Athletic ComplexHonolulu Star-AdvertiserNessuna valutazione finora

- Yu V NLRCDocumento2 pagineYu V NLRCStefanRodriguezNessuna valutazione finora

- Company Profile - (Eng) 日通インドネシア物流 会社案内 Pt Nx Lemo Indonesia LogistikDocumento10 pagineCompany Profile - (Eng) 日通インドネシア物流 会社案内 Pt Nx Lemo Indonesia LogistikJka SugiartoNessuna valutazione finora

- Commerce MCQ Sem 4Documento12 pagineCommerce MCQ Sem 4VufydyNessuna valutazione finora

- Receipt Types (Receiving Transactions)Documento16 pagineReceipt Types (Receiving Transactions)prashanthav2006Nessuna valutazione finora

- Brands and Brand ValuesDocumento18 pagineBrands and Brand ValuesChalani KaushalyaNessuna valutazione finora

- Assignment 4Documento6 pagineAssignment 4Ma. Yelena Italia TalabocNessuna valutazione finora