Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SCooter Graph 2015

Caricato da

Dhruv BhandariCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SCooter Graph 2015

Caricato da

Dhruv BhandariCopyright:

Formati disponibili

January 2015: Two-Wheelers

Sales Analysis

In the first two parts of our January sales analysis, IAR

looked at Passenger Vehicle dispatches and Commercial Vehicle

sales. In this third and concluding part of sales analysis, we

look at the two-wheeler spectrum and how each segment

performed.

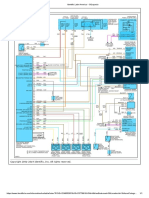

SCOOTERS

It wasnt a great month for two-wheelers as dispatches were

below expectations and the biggest segment recorded negative

growth. However, things did not change much for the Scooters

segment. By the time January ended, dispatches in the Scooters

segment had grown by 25.3% over previous year. The growth rate

that the segment enjoyed in 2014 has been maintained in 2015,

even

though

the

base

is

now

much

bigger.

As usual, segment leader Honda had a strong growth,

dispatching 29.2% higher number of units in the month as

compared to previous year. The faster than the segment growth

means that HMSI has once again nibbled at some more market

share of rivals.

Rival Hero Motor improved its dispatches by less than 19% over

previous year. This was an impressive growth but not in the

same league as Honda.

TVS grew even slower the South India based manufacturer

could improve its dispatches by only 10.5% over previous year.

In comparison, Mahindras growth of 128% was very impressive

but came off a very small base.

Losing marketshare was Piaggio which saw a 16% improvement in

dispatches. Ditto was the case with Yamaha as its dispatches

improved by 22.9%, slower than the segment average.

Losing marketshare and sales volumes both was Suzuki, which

saw dispatch volumes decline by 1.4%, marking a bad month

forth manufacturer.

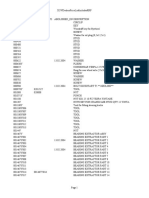

SUB 125 CC

The Motorcycles segment displayed quite contrasting behaviour.

The segment is huge and growth has been a struggle for

sometime. In January 2015, the sub-125cc segment saw a fall of

10.6% from previous year. Apart from Yamaha (up 23%) and TVS

(up 10.5%), every other manufacturer saw a decline in

dispatches. Bajaj Auto (down 48.2%) and Suzuki (down 48%)

experienced the biggest falls in dispatch numbers.

Segment leader Hero MotoCorp reported a 2.25% drop in

dispatches, a slower fall than the market helping the company

to gain some market share.

125CC 250CC

The sporty commuter market did much better than the sub 125cc

market. In the 125cc 250cc segments, dispatches wee 15.5%

better than January 2014. The rise was led by Bajaj Auto and

TVS Motor Bajaj improved its volumes by 32.4% while TVS

managed 31.5% higher dispatches over previous year. Yamaha

also recorded a 34% jump in dispatches. Significantly higher

growth was also recorded by Suzuki in the segment but from a

very small base.

Both hero and Honda reported declines in dispatches Heros

dispatches were down nearly 70% and relegated the company to a

marginal position in the segment.

BIG BIKES (>250CC)

The Big Bike segment is witnessing more launches in a month

that the mass-market segments manage in a year. The Big Bike

segments are growing aggressively and market leader Royal

Enfield had another strong month with a 42% growth in

dispatches.

Bajaj-KTM also had a strong month with dispatches more than

doubling over previous January.

Harley-Davidson improved its dispatch volumes by nearly 65% as

the Street 750 continues to do well. Rival Triumph shifted 88

bikes in the month, a 49% improvement on a very small base.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Kaplan and Haenlein 2010 - Social MediaDocumento10 pagineKaplan and Haenlein 2010 - Social Mediadnojima100% (3)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Varajet 2 Carburetor ManualDocumento3 pagineVarajet 2 Carburetor ManualWilber Manasés100% (1)

- Continental Data GuideDocumento48 pagineContinental Data GuideJose FontenlaNessuna valutazione finora

- BMW VO FaDocumento44 pagineBMW VO FaSanda NeumanNessuna valutazione finora

- Samsung Fest Mobikwik Offer TNCDocumento1 paginaSamsung Fest Mobikwik Offer TNCTamilNessuna valutazione finora

- M.Pharm (PS) PCS PDFDocumento21 pagineM.Pharm (PS) PCS PDFDhruv BhandariNessuna valutazione finora

- Samsung Fest MMT Offer TNC PDFDocumento2 pagineSamsung Fest MMT Offer TNC PDFDhruv BhandariNessuna valutazione finora

- JD - TSC Planning - v1 0Documento2 pagineJD - TSC Planning - v1 0Dhruv BhandariNessuna valutazione finora

- 1 - Impact of Social Entrepreneurial Innovation On Sustainable Development - A Study of Goonj - Clothing As A Matter of ConcernDocumento21 pagine1 - Impact of Social Entrepreneurial Innovation On Sustainable Development - A Study of Goonj - Clothing As A Matter of ConcernDhruv BhandariNessuna valutazione finora

- M.Pharm (PS) PCS PDFDocumento21 pagineM.Pharm (PS) PCS PDFDhruv BhandariNessuna valutazione finora

- Ba 3.4Documento213 pagineBa 3.4Dhruv BhandariNessuna valutazione finora

- Counter Strike CZDocumento1 paginaCounter Strike CZDeddyNessuna valutazione finora

- Fiscal PolicyDocumento22 pagineFiscal PolicyDhruv BhandariNessuna valutazione finora

- Current Affairs-April 2016, Current Affairs NewsDocumento4 pagineCurrent Affairs-April 2016, Current Affairs NewsDhruv BhandariNessuna valutazione finora

- Labour Law Reforms and Related Issues in India.: Project Outline / Research MethodologyDocumento1 paginaLabour Law Reforms and Related Issues in India.: Project Outline / Research MethodologyDhruv BhandariNessuna valutazione finora

- Robet MorganDocumento20 pagineRobet MorganR R Lidia ImaniarNessuna valutazione finora

- 2 1 E Marketing Mix Model and C DMDocumento8 pagine2 1 E Marketing Mix Model and C DMDhruv BhandariNessuna valutazione finora

- Problem DefinitionDocumento2 pagineProblem DefinitionDhruv BhandariNessuna valutazione finora

- Half-Life Version 1.1.1.1 Readme File 12/2/02Documento18 pagineHalf-Life Version 1.1.1.1 Readme File 12/2/02MemMinhNessuna valutazione finora

- Half-Life Version 1.1.1.1 Readme File 12/2/02Documento18 pagineHalf-Life Version 1.1.1.1 Readme File 12/2/02MemMinhNessuna valutazione finora

- Application FormatDocumento2 pagineApplication FormatDhruv BhandariNessuna valutazione finora

- OM NotesDocumento12 pagineOM NotesDhruv BhandariNessuna valutazione finora

- Access GuideDocumento22 pagineAccess GuideDhruv BhandariNessuna valutazione finora

- Mundell Fleming ModelDocumento22 pagineMundell Fleming ModelDhruv BhandariNessuna valutazione finora

- Management Information System Project: Section B - Group 2: Inventory Management System For Small/medium Scale IndustriesDocumento1 paginaManagement Information System Project: Section B - Group 2: Inventory Management System For Small/medium Scale IndustriesDhruv BhandariNessuna valutazione finora

- Aipmt - Nic.in Aipmt Online AdmitCardFinalShowDocumento1 paginaAipmt - Nic.in Aipmt Online AdmitCardFinalShowDhruv BhandariNessuna valutazione finora

- QT Levin NotesDocumento40 pagineQT Levin NotesssimisimiNessuna valutazione finora

- Do You Think Indians Should Rejoice by The Fact That Indian Nominal GDP Has CrossedDocumento4 pagineDo You Think Indians Should Rejoice by The Fact That Indian Nominal GDP Has CrossedDhruv BhandariNessuna valutazione finora

- Managerial Economics-Course HandoutDocumento2 pagineManagerial Economics-Course HandoutDhruv Bhandari100% (1)

- MWR LinksDocumento1 paginaMWR LinksDhruv BhandariNessuna valutazione finora

- Mandm Ar f12Documento197 pagineMandm Ar f12Dhruv BhandariNessuna valutazione finora

- Scholar Loan Check ListDocumento1 paginaScholar Loan Check ListDhruv BhandariNessuna valutazione finora

- Job PlanDocumento3 pagineJob Planbadwolf pubgNessuna valutazione finora

- Cambio y Rellenado Aceite de Transmision Al4Documento2 pagineCambio y Rellenado Aceite de Transmision Al4Paulina GarciaNessuna valutazione finora

- Diagrama 1 ABS 1 FUSEDocumento1 paginaDiagrama 1 ABS 1 FUSEaltechNessuna valutazione finora

- نقشه جعبه فیوز آریسان PDFDocumento1 paginaنقشه جعبه فیوز آریسان PDFnaser hasanzadehNessuna valutazione finora

- Disponible Al 10 Julio 2019Documento9 pagineDisponible Al 10 Julio 2019Eudiis CasstroNessuna valutazione finora

- Engine Powered Forklift Trucks: 2.0 - 3.5 TonnesDocumento5 pagineEngine Powered Forklift Trucks: 2.0 - 3.5 TonnesThanh0% (1)

- AXLE LOAD SURVEY Part IIIDocumento5 pagineAXLE LOAD SURVEY Part IIIEngineering ThingsNessuna valutazione finora

- X2 WDealers Price List Includes RRPDocumento2.228 pagineX2 WDealers Price List Includes RRPLasseNessuna valutazione finora

- WS PartsBook 2011Documento417 pagineWS PartsBook 2011Factel SANessuna valutazione finora

- Map Notes For RalliartDocumento4 pagineMap Notes For RalliartJames FlanneryNessuna valutazione finora

- Linde EN Ds t20 25 FP 1153 en B 0120 ViewDocumento6 pagineLinde EN Ds t20 25 FP 1153 en B 0120 ViewNadeem AhmedNessuna valutazione finora

- Cat 777E: Off-Highway TruckDocumento2 pagineCat 777E: Off-Highway Truckandie.notoNessuna valutazione finora

- 797F CMD Field RetrofitDocumento21 pagine797F CMD Field Retrofitsergio conchaNessuna valutazione finora

- RC10B5M-Team ManualDocumento34 pagineRC10B5M-Team Manualpeix.christopheNessuna valutazione finora

- Ace f16 HydraDocumento232 pagineAce f16 HydraSamir kumarNessuna valutazione finora

- GSO Technical Regulations Motor Vehicels 2020 Model Year 1Documento9 pagineGSO Technical Regulations Motor Vehicels 2020 Model Year 1RakeshKulkarniNessuna valutazione finora

- EITG Final Presentation - Telematics & Car InsuranceDocumento16 pagineEITG Final Presentation - Telematics & Car Insurancedevina2689Nessuna valutazione finora

- Wiring AT Honda BrioDocumento1 paginaWiring AT Honda BrioKadirKtg100% (1)

- Scan 15 Oct 2019Documento2 pagineScan 15 Oct 2019SANJINessuna valutazione finora

- Monitoring Breakdown 5 Maret 2020Documento2 pagineMonitoring Breakdown 5 Maret 2020Rheza IslamsyahNessuna valutazione finora

- Nissan BRC PDFDocumento122 pagineNissan BRC PDFmohhizbarNessuna valutazione finora

- Automan April 2011Documento84 pagineAutoman April 2011Automan MagazineNessuna valutazione finora

- McLaren 765LT Order ITBYYWB Summary 2023-06-10Documento6 pagineMcLaren 765LT Order ITBYYWB Summary 2023-06-10Kirtiman GuptaNessuna valutazione finora

- B15S-7 Sb1265e01Documento427 pagineB15S-7 Sb1265e01GORDNessuna valutazione finora

- Ficha Técnica Camion Iveco 11 ML 170e22h - UkDocumento2 pagineFicha Técnica Camion Iveco 11 ML 170e22h - UkEnzo VinciNessuna valutazione finora

- Datsun Giias Pengajuan OperationalDocumento25 pagineDatsun Giias Pengajuan Operationalriduan matodangNessuna valutazione finora