Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

US GAAP Conversion To IFRS: A Case Study of The Balance Sheet

Caricato da

JasonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

US GAAP Conversion To IFRS: A Case Study of The Balance Sheet

Caricato da

JasonCopyright:

Formati disponibili

Journal of Business Case Studies March/April 2013

Volume 9, Number 2

US GAAP Conversion To IFRS:

A Case Study Of The Balance Sheet

Peter Harris, New Institute of Technology, USA

Liz Washington Arnold, The Citadel, USA

ABSTRACT

International Reporting Standards (IFRS) has become the required framework for most of the

world financial market economies. In the United States, US Generally Accepted Accounting

Principles (GAAP) is still required. However, plans are presently in place by the SEC to abandon

US GAAP and to adhere to IFRS requirements by as early as the period ending December 31,

2014. This case study requires the student to transform a US GAAP presented Balance Sheet to

IFRS and is most suitable for an Intermediary Accounting 11 and a Financial Analysis class at the

graduate level.

Keywords: US GAAP; IFRS; LIFO; Fair Market Value Accounting; Asset Impairment; Asset Revaluation;

Balance Sheet

INTRODUCTION

FRS International Reporting Standards (IFRS) has presently been adapted by most countries that have a

stock exchange. In the United States, however, companies report on several different principles-based

methods, including but not limited to US GAAP and IFRS, which makes comparability, understandability

and the presentation of financial data very difficult.

Much of the current financial crisis has been blamed on the inability to understand financial reporting and

the ability to somehow circumvent rules due to the difficult and inconsistent accounting financial statement

requirements.

The solution proposed by the SEC and other worldwide agencies is to have a single conforming set of

accounting principles which every publically traded company in the world would adhere to in presenting financial

information. The solution has been the adaption of IFRS and this action has been implemented by most countries

worldwide, such as Europe, Canada, and Australia. This trend has also transformed to the education scene as

professional examinations, such as the CPA and CFA exams, have materially incorporated IFRS into their

curriculum.

The US is in the transformation stage and it is expected that IFRS will be in place by as early as 2014. As

such, it is important to introduce IFRS accounting rules in the college curriculum and make it a major component of

accounting classes. This case study takes a US GAAP-prepared Balance Sheet and, based on the facts of the case,

requires students to prepare an IFRS-based Balance Sheet. It is important for the student to refer to our paper

entitled US GAAP Conversion to IFRS: A Case Study Of The Income Statement (Journal of Business Case

Studies, July/August 2012; Volume 8, Number 4) in doing this assignment to obtain a comprehensive understanding

of IFRS rules. This case expands on the Income Statement and focuses on the Balance Sheet. The need to

understand both US GAAP and IFRS rules is required to adequately address this case study.

2013 The Clute Institute http://www.cluteinstitute.com/

133

Journal of Business Case Studies March/April 2013

Volume 9, Number 2

BACKGROUND

AXE Corp, a publically-traded NYSE company (symbol AXEC), is a manufacturer of electrical light bulbs.

Its main headquarters is based in Denver, Colorado, and the company has been operating since 1976. The company

sells light bulbs to the retail market on a worldwide basis.

Their Balance Sheet and Income Statement for the Year Ending December 31, 2011 have been prepared

using US GAAP. The controller would like to begin to see the effects of using IFRS on the Balance Sheet and has

been assigned this task. The company would like to adapt IFRS by as early as next year as it is considering a new

stock issue in the London Stock Exchange, which requires IFRS compliance.

FINANCIAL STATEMENTS

ASSETS

Current Assets

Cash

33,000

Accounts Receivable

25,000

Investments(AFS) 10,000

Inventory (LIFO ) 50,000

Total Current Assets

118,000

Balance Sheet

(in 000s)

As of 12/31/2011

LIABILITIES AND SHAREHOLDERS EQUITY

Current Liabilities

Accounts payable

20,000

Accrued Expenses

15,000

Taxes payable

5,000

Total Current Liabilities

40,000

Property, Plant and Equipment

Assets (cost)

100,000

Less:

Accumulated Depreciation

Intangible Assets

Trademark

Goodwill

Total Assets

(30,000)

70,000

5,000

7,000

12,000

Noncurrent Liabilities

Bonds payable

Total Liabilities

50,000

90,000

Shareholders Equity

Common Stock ($1 par)

Retained Earnings

50,000

60,000

110,000

200,000

Total Liabilities and

Shareholders Equity

200,000

Income Statement

(In 000s)

1/1/2011-12/31/2011

INCOME FROM CONTINUING OPERATIONS

Sales

Cost of Goods Sold

Gross profit

Selling and Administrative Expenses

(exclusive of Amortization and Depreciation)

Earnings before Interest, Taxes, Depreciation and Amortization

Amortization and Depreciation Expense

Earnings before Interest and Taxes

Interest Expense

Income before tax

Tax Expense (30 %)

Earnings from continuing operations and before

Extraordinary Item

EXTRAORDINARY ITEM

Net loss from Hurricane (net of 4,500 taxes)

Net Income

134

250,000

175,000

75,000

31,000

45,000

10,000

34,000

4,000

30,000

9,000

21,000

(10,500)

10,500

http://www.cluteinstitute.com/ 2013 The Clute Institute

Journal of Business Case Studies March/April 2013

Volume 9, Number 2

ADDITIONAL INFORMATION

1.

AXE Corp. uses the LIFO method to account for its inventory. The LIFO reserve was $15,000 at the

beginning of the year and $20,000 as of year-end.

2.

Management has established that the fair market value of Property, Plant and Equipment as of 1/1/2011 is

$85,000, resulting in a $5,000 increase above Book Value.

3.

Upon review , management has established the following Fair Market Values for the presented assets as of

12/31/2011:

Goodwill

Trademark

10,000

10,000

4.

In 2010, there was a Goodwill impairment accounted for in the amount of $3,000.

5.

In 2008, there was a Trademark impairment of $2,000.

6.

Property, Plant and Equipment is depreciated over a 10-year period using the straight line depreciated

method. There is no salvage value. Amortizable Intangible assets are amortized over a 5-year period using

the straight line method. No salvage value is expected.

7.

Investments include Available for Sale Securities (AFS) with a fair market value of $10,000 as of

12/31/2011. The beginning-of-year value was $7,000 of which $2,000 is due to an exchange rate gain.

8.

There are long-term contingencies of $6,000 stemming from civil lawsuits. Legal council considers the

payout slightly more likely than not but not highly probable.

9.

The extraordinary loss was due to hurricane damage which is considered unusual and infrequent.

10.

The effective tax rate for AXE is 30 percent.

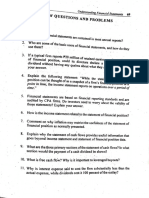

REQUIRED

For each scenario above (1 to 10):

1.

2.

3.

Identify the similarities and differences between the Balance Sheet effects of US GAAP and IFRS.

Record the differences above in journal entry form to satisfy IFRS rules.

Prepare an IFRS Balance Sheet for the 2011 calendar year.

2013 The Clute Institute http://www.cluteinstitute.com/

135

Journal of Business Case Studies March/April 2013

Volume 9, Number 2

SOLUTIONS

Parts 1 and 2

1.

2.

LIFO is not permitted under IFRS. As such, FIFO has to be used. The difference between the LIFO and

FIFO Cost of Goods Sold is the difference between the beginning of the year and year-end differential in

the LIFO Reserve. In this case, the difference will result in a decrease in Cost of Goods sold by virtue of a

greater Inventory total under FIFO in the amount of $ 5,000 ($20,000 less $15,000) (1A). Additionally,

another $15,000 additional inventory under FIFO should be recorded (1B), thus adding $20,000 to the

value of inventory (LIFO reserve amount). As such, the journal entries will be:

1A

Dr. Inventory 5,000

Cr. Cost of Goods Sold 5,000 - Income Statement

1B

Dr. Inventory 15,000

Cr. Deferred Income Tax 4,500

Cr. Retained Earnings 10,500

IFRS allows for Asset Revaluation for Property, Plant and Equipment and Intangible Assets. Both US

GAAP and IFRS allow for asset impairment which is tested on an annual basis. IFRS allows for an asset

reversal of impaired assets for all tangible and intangible long-term assets, excluding Goodwill. US GAAP

allows for impairment, but once lowered, no reversal of impairment is allowed. In no circumstance may

Property, Plant and Equipment assets or Intangible assets be written above its book value under US GAAP.

Resulting Accounting Treatment (US GAAP): The impairment loss for tangible and Intangible Assets is

recorded on the income Statement and results in a lower carrying value on the Balance Sheet.

Resulting Accounting Treatment (IFRS): The loss is treated similar to US GAAP.

The write-up of tangible and intangible assets is recorded as comprehensive income - a Balance Sheet

account in Shareholders Equity, and not on the Income Statement. Finally, reversal of losses, up to the

amount of the impairment, is recorded as a reduction in loss, which is a gain in the Income Statement and

any excess is recorded as part of comprehensive income. Goodwill may not be reversed once impairment

has occurred.

On 1/1/2011, the Property, Plant and Equipment assets were increased by $5,000 above Book Value. For

IFRS purposes, this results in an increase in the carrying value of these assets to Fair Market Value (2B)

and a resulting increase of depreciation expense and Accumulated Depreciation of $500 ($5,000 divided by

a 10-year useful life using the straight line depreciation method) (2A).The Adjusting entry then is:

2A

Dr. Depreciation Expense 500 - Income Statement

Cr. Accumulated Depreciation 500

2B

Dr. Property, Plant and Equipment 5,000

Cr. Shareholders Equity - Surplus (Deficit) (Comprehensive Income) 5,000

The trademark had an estimated fair market value of $10,000 as of year-end. IRFS allows the write-up of

intangible assets above book value if fair market value exceeds book value. US GAAP does not allow for

reversals of previously recorded impairments. Under IFRS, a previous impairment loss will be reversed to

the Income Statement as a reduction/loss, which is, in effect, a gain, and any excess over that is recorded as

Comprehensive Income - a Balance Sheet account in Shareholders Equity (not on the Income Statement).

The adjusting entry is:

136

http://www.cluteinstitute.com/ 2013 The Clute Institute

Journal of Business Case Studies March/April 2013

2C

Volume 9, Number 2

Dr. Trademark 5,000

Cr. Reversal of Impairment Loss - Trademark - Income Statement 2,000

Cr. Shareholders Equity - Surplus (Deficit) (Comprehensive Income) 3,000

3.

Finally, there is no adjustment for Goodwill as both US GAAP and IFRS have similar treatment for this

Intangible Asset. Also note that Trademarks and Goodwill are not amortizable Intangible Assets due to

their indefinite useful life.

4.

Available For Sale Securities (AFS)

Both US GAAP and IFRS treat AFS securities similar in that they are reported at Fair Market Value at the

Balance Sheet date. Any income or loss is part of comprehensive income (not Income Statement). The only

difference, however, is that IFRS treats the foreign currency exchange gain or loss as an income (loss) item,

which is reported in the Income Statement.

As such, $2,000 of the increase in the AFS value, which relates to currency gain, is part of non-operating

income. As such, the adjusting entry is:

4A

5.

US GAAP and IFRS record a contingency loss when the loss is deemed to be probable. This definition of

probable differs between the two groups. US GAAP defines probable as likely, whereas IFRS defines

probable as more likely than not. The result is that IFRS is more conservative in recognizing contingency

losses. In this situation, the loss is recorded for IFRS only, with a corresponding liability on the balance

Sheet. US GAAP only requires disclosure in this situation. The adjusting entry, then, is:

5A

6.

Dr. Shareholders Equity - Surplus (Deficit) (Comprehensive Income) 2,000

Cr. Currency Exchange Rate Gain - Income Statement 2,000

Dr. Contingency loss - Income Statement 6,000

Cr. Contingency Liability payable 6,000

Extraordinary Items - US GAAP v. IFRS

IRFS disallows extraordinary gains (losses) and, as such, is not existent. Consequently, this item needs to

be part of the non-operating income (loss) schedule of the Income Statement. The gross amount of the loss,

in this case, is the net of tax loss of $10,500 divided by .7 (1 less 30 percent tax rate), resulting in a loss

from hurricane before taxes of $15,000.

We reclassify this loss from Extraordinary to Non-operating Income (loss).

7.

Income Statement Adjustment: US GAAP to IFRS conversion.

Please refer to P. Harris, L. Washington Arnold, US GAAP Conversion to IFRS: A Case Study Of The

Income Statement (Journal of Business Case Studies, July/August 2012; Volume 8, Number 4) to see the

effects and calculations of US GAAP conversion to IRFS for the Income Statement.

ADJUSTING ENTRY (7)

Dr. Income Summary 2,500

Cr. Income Tax Payable Current 750

Cr. Retained Earnings 1,750

The difference in income between US GAAP and IFRS is 12,250-10,500, or a net income difference of

1,750. The income before tax is 2,500, or 1,770 divided by 1 less the tax rate of 30 percent (.7). The tax expense on

2013 The Clute Institute http://www.cluteinstitute.com/

137

Journal of Business Case Studies March/April 2013

Volume 9, Number 2

this difference is 750 and also represents a current liability tax payable account. Retained Earnings is increased due

to the increased net income total.

Part 3

IFRS Balance Sheet

Financial Statement - US GAAP - IFRS Reconciliation

Balance Sheet (in 000s)

As of 12/31/2011

US GAAP

ADJUSTMENTS

IFRS

ASSETS

Current Assets

Cash

Accounts Receivable

Investments (AFS)

Inventory

Total Current Assets

Property, Plant and Equipment

Assets (cost)

Accumulated Depreciation

Intangible Assets

Trademark

Goodwill

Total Assets

33,000

25,000

10,000

50,000

118,000

(1) 20,000

33,000

25,000

10,000

70,000

138,000

100,000

(30,000)

70,000

(2) 5,000

(2) (500)

105,000

(30,500)

74,500

5,000

7,000

12,000

(3) 5,000

10,000

7,000

17,000

200,000

29,500

229,500

(7) 750

750

20,000

15,000

5,750

40,750

0

50,000

90,000

(1) 4,500

(6) 6,000

10,500

11,250

50,000

4,500

6,000

60,500

101,250

50,000

0

60,000

110,000

(2)5,000 (3)3,000 (4)(2,000)

(1) 10,500 + (7) 1,750

18,250

50,000

6,000

72,250

128,250

LIABILITIES AND SHAREHOLDERS EQUITY

Current Liabilities

Accounts Payable

Accrued Expenses

Taxes Payable-Current

Total Current Liabilities

Non-current Liabilities

Bonds Payable

Taxes Payable-Noncurrent

Contingent Liability Payable

Total Current Liabilities

Total Liabilities

SHAREHOLDERS EQUITY

Common Stock ($1 Par)

Surplus(Deficit)

Retained Earnings

Total Shareholders Equity

Total Liabilities and

Shareholders Equity

138

20,000

15,000

5,000

40,000

50,000

200,000

29,500

229,500

http://www.cluteinstitute.com/ 2013 The Clute Institute

Journal of Business Case Studies March/April 2013

Volume 9, Number 2

Balance Sheet IFRS (in 000s)

As of 12/31/2011

LIABILITIES AND SHAREHOLDRERS EQUITY

ASSETS

Current Assets

Cash

Accounts Receivable

Investments (AFS)

Inventory

Total Current Assets

Property, Plant and Equipment

Assets (cost)

Accumulated Depreciation

Intangible Assets

Trademark

Goodwill

Total Assets

33,000

25,000

10,000

70,000

138,000

105,000

(30,500)

74,500

10,000

7,000

3,000

229,500

Current Liabilities

Accounts Payable

Accrued Expenses

Taxes Payable - Current

Total Current Liabilities

Non-current Liabilities

Bonds Payable

Taxes Payable- Noncurrent

Contingent Liability Payable

Total Non-current Liabilities

Total Liabilities

20,000

15,000

5,750

40,750

50,000

4,500

6,000

60,500

101,250

SHAREHOLDERS EQUITY

Common Stock ($1 Par)

Surplus (Deficit)

Retained Earnings

Total Shareholders Equity

50,000

6,000

72,250

128,250

Total Liabilities and

Shareholders Equity

229,500

CONCLUSION

IFRS is the future of worldwide financial reporting and should be included as a major part of any

accounting and/or business curriculum in the US, as well as the rest of the world. This case illustrates a situation

where a Balance Sheet is prepared using US GAAP as the basis and converting to IFRS for comparison purposes. In

this case study, IFRS rules are discussed and key Balance Sheet similarities and differences between US GAAP and

IFRS are addressed. We will follow up with other similar case studies that focus on an IFRS-prepared Cash Flow

Statement from a US GAAP-prepared Financial Statement.

AUTHOR INFORMATION

Peter Harris is a Professor and Chair of the Accounting and Finance department at the New York Institute of

Technology. Previously, he has worked for Ernst and Young LLP. He is an author of over 40 refereed journal

articles and has over 100 intellectual contributions. He has presented and continues to present seminars to nationally

and globally audiences on topics relating to financial reporting and taxation. He is a member of several professional

organizations. E-mail: pharris@nyit.edu (Corresponding author)

Liz Washington Arnold is an Associate Professor of Accounting at The Citadel. She has over 25 years of corporate

accounting experience and is an active member of various community and professional organization. Her research

on Corporate Accounting Malfeasance and other topics appears in journals such as Accounting and Taxation, the

Southeast Case Research Association Journal, and Business Education Innovations. She can be reached at The

Citadel, 171 Moultrie Street, Charleston, SC 29445, E-mail: liz.arnold@citadel.edu

REFERENCES

1.

2.

3.

Harris, P., L. Washington Arnold, US GAAP Conversion to IFRS: A Case Study Of The Income Statement

(Journal of Business Case Studies, July/August 2012; Volume 8, Number 4).

International Financial Accounting Standards (IFRS). IAS numbers: 2, 3, 36, 37, 38, 39.

PWCoopers.org

2013 The Clute Institute http://www.cluteinstitute.com/

139

Journal of Business Case Studies March/April 2013

4.

5.

6.

140

Volume 9, Number 2

Revise, Collins, Johnson, Financial Reporting and Analysis, 3rd Ed. Pearson, Prentice, Hall, 2004.

U.S Generally Accepted Accounting Principles (US GAAP). ASC Numbers: 320, 330, 360, 410, 985.

White, Sondhi, Fried, The Analysis and Uses of Financial Statements, 3rd Edition, Wiley, 2008.

http://www.cluteinstitute.com/ 2013 The Clute Institute

Potrebbero piacerti anche

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsDa EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsValutazione: 4 su 5 stelle4/5 (11)

- Differences Between IFRS and UGAAPDocumento8 pagineDifferences Between IFRS and UGAAPNigist WoldeselassieNessuna valutazione finora

- Financial Statements: International Accounting (IFRS)Da EverandFinancial Statements: International Accounting (IFRS)Nessuna valutazione finora

- Advance Cost AccountingDocumento37 pagineAdvance Cost Accountingashish_20kNessuna valutazione finora

- Gaap vs. IfrsDocumento5 pagineGaap vs. Ifrsمحاسب.أحمد شعبانNessuna valutazione finora

- An Introduction to the German Accountancy System: All you need - and not too muchDa EverandAn Introduction to the German Accountancy System: All you need - and not too muchNessuna valutazione finora

- Ifrs Us Gaap 12 2020Documento564 pagineIfrs Us Gaap 12 2020Jéssica GuimarãesNessuna valutazione finora

- Accountants' New World: The Essential Guide to Being a Valued Business PartnerDa EverandAccountants' New World: The Essential Guide to Being a Valued Business PartnerNessuna valutazione finora

- IFRSDocumento20 pagineIFRSkul.bhatia4755Nessuna valutazione finora

- A Comparison of IFRS, US GAAP and Belgian GAAPDocumento100 pagineA Comparison of IFRS, US GAAP and Belgian GAAPVoicu Dragomir67% (3)

- International Accounting and Transnational DecisionsDa EverandInternational Accounting and Transnational DecisionsS. J. GrayNessuna valutazione finora

- International Financial Reporting Standards (IFRS) OverviewDocumento212 pagineInternational Financial Reporting Standards (IFRS) OverviewVenkata Sambhasiva Rao Cheedella100% (1)

- Do You Want to Be a Digital Entrepreneur? What You Need to Know to Start and Protect Your Knowledge-Based Digital BusinessDa EverandDo You Want to Be a Digital Entrepreneur? What You Need to Know to Start and Protect Your Knowledge-Based Digital BusinessNessuna valutazione finora

- Differences Between IFRS and US GAAPDocumento7 pagineDifferences Between IFRS and US GAAPAderonke AjibolaNessuna valutazione finora

- KPMG GAAP Revenue RecognitionDocumento1.109 pagineKPMG GAAP Revenue Recognitionel inNessuna valutazione finora

- IAS 8 Accounting Policies Changes in Accounting Estimates and Errors (December 2003)Documento3 pagineIAS 8 Accounting Policies Changes in Accounting Estimates and Errors (December 2003)wenni89100% (3)

- IFRS 9 Financial InstrumentsDocumento38 pagineIFRS 9 Financial Instrumentssaoodali1988Nessuna valutazione finora

- Accounting For Deferred TaxDocumento14 pagineAccounting For Deferred TaxDeepan MarxNessuna valutazione finora

- Ifrs Versus GaapDocumento25 pagineIfrs Versus GaapNigist Woldeselassie100% (1)

- IFRS 16 LeasesDocumento21 pagineIFRS 16 LeasesNur ErrinaNessuna valutazione finora

- IFRS E-BookDocumento24 pagineIFRS E-BookpradiphdasNessuna valutazione finora

- Balance Sheet VerticalDocumento22 pagineBalance Sheet VerticalberettiNessuna valutazione finora

- Accounting Bank ReconciliationDocumento90 pagineAccounting Bank Reconciliationan2204Nessuna valutazione finora

- Short Guide To IFRS 2014Documento60 pagineShort Guide To IFRS 2014vramu_ca100% (6)

- Monetary or Non-Monetary - CPDbox - Making IFRS EasyDocumento97 pagineMonetary or Non-Monetary - CPDbox - Making IFRS EasyRachelle Anne M PardeñoNessuna valutazione finora

- Consolidation AccountingDocumento42 pagineConsolidation AccountingAliBerrada100% (2)

- Ifrs 16 (Property, Plant and Equpement)Documento82 pagineIfrs 16 (Property, Plant and Equpement)Irfan100% (7)

- Chapter 13 - Sales and Sales Returns Day BooksDocumento26 pagineChapter 13 - Sales and Sales Returns Day Booksshemida100% (3)

- IFRS in Your Pocket 2016 PDFDocumento120 pagineIFRS in Your Pocket 2016 PDFPiyush Shah100% (2)

- Ey Applying Ifrs Leases Transitions Disclsosures November2018Documento43 pagineEy Applying Ifrs Leases Transitions Disclsosures November2018BT EveraNessuna valutazione finora

- AccountingTools - Questions & Answers PDFDocumento4 pagineAccountingTools - Questions & Answers PDFTsvetomira Ivanova100% (1)

- Month End Close ChecklistDocumento10 pagineMonth End Close ChecklistKv kNessuna valutazione finora

- French Vs UK GAAPDocumento155 pagineFrench Vs UK GAAPKen Li0% (1)

- Group Statements of Cashflows PDFDocumento19 pagineGroup Statements of Cashflows PDFObey SitholeNessuna valutazione finora

- Model Public Sector Group: Addmkljylan) Õfyf (Aydklyl) E) FLK GJL') Q) Yj) F/) /+) ) Ez) J +Documento69 pagineModel Public Sector Group: Addmkljylan) Õfyf (Aydklyl) E) FLK GJL') Q) Yj) F/) /+) ) Ez) J +rahmaNessuna valutazione finora

- Consolidated Financial Statements by MR - Abdullatif EssajeeDocumento37 pagineConsolidated Financial Statements by MR - Abdullatif EssajeeSantoshNessuna valutazione finora

- Consolidation IIIDocumento36 pagineConsolidation IIIMuhammad Asad100% (1)

- Accounting Flow For Account PayableDocumento2 pagineAccounting Flow For Account PayableKiran Kumar MuraleedharanNessuna valutazione finora

- IFRS Reference ManualDocumento164 pagineIFRS Reference Manualsinghalmohan100% (3)

- 2019 Ifrs GuideDocumento5 pagine2019 Ifrs GuideLouremie Delos Reyes MalabayabasNessuna valutazione finora

- IFRSDocumento11 pagineIFRSAnupam Kumar0% (1)

- Acca F3Documento144 pagineAcca F3iftikharali184% (19)

- Ias 7Documento13 pagineIas 7Ajinkya MohadkarNessuna valutazione finora

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento24 pagineChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNessuna valutazione finora

- The Gaap and IfrsDocumento2 pagineThe Gaap and IfrsAlan Cheng100% (1)

- An Overview of SingerBDDocumento19 pagineAn Overview of SingerBDEmon Hossain100% (1)

- CertIPSAS Sample QuestionsDocumento2 pagineCertIPSAS Sample QuestionsTawanda ZimbiziNessuna valutazione finora

- IFRS 2 New WorkbookDocumento63 pagineIFRS 2 New WorkbooktparthasarathiNessuna valutazione finora

- PWC Ifrs Us Gaap Similarities and Differences PDFDocumento238 paginePWC Ifrs Us Gaap Similarities and Differences PDFMu'tashim Al QoyyimNessuna valutazione finora

- GAAPDocumento9 pagineGAAPgelli joy corpuzNessuna valutazione finora

- Deloitte - Illustrative Financial Statements For BanksDocumento288 pagineDeloitte - Illustrative Financial Statements For BanksErwincont100% (1)

- IFRS 16 PresentationDocumento33 pagineIFRS 16 PresentationWedi Tassew100% (3)

- The Nature and Operations of The IASBDocumento12 pagineThe Nature and Operations of The IASBTran AnhNessuna valutazione finora

- Financial Reporting Standards Summary PackDocumento3 pagineFinancial Reporting Standards Summary PackFoititika.netNessuna valutazione finora

- IFRS Implementation - Mohammad NurunnabiDocumento431 pagineIFRS Implementation - Mohammad Nurunnabikholil.reg100% (2)

- ISA 315 - MGT AssertionsDocumento5 pagineISA 315 - MGT AssertionsAwaisQureshiNessuna valutazione finora

- IFRS in Practice 2018 IFRS15Documento154 pagineIFRS in Practice 2018 IFRS15Corneliu TudorNessuna valutazione finora

- For December 31 20x1 The Balance Sheet of Baxter Corporation Was As FollowsDocumento4 pagineFor December 31 20x1 The Balance Sheet of Baxter Corporation Was As Followslaale dijaanNessuna valutazione finora

- Documents - MX - Ravens Advanced Progressive Matrices Test With Answers PDF Free Download PDFDocumento126 pagineDocuments - MX - Ravens Advanced Progressive Matrices Test With Answers PDF Free Download PDFJason50% (6)

- BVADocumento15 pagineBVAJasonNessuna valutazione finora

- The World of Creative WritingsDocumento1 paginaThe World of Creative WritingsJasonNessuna valutazione finora

- Elena, H., Catalina, M., Stefana, C., & Niculina, A. (2009) - Some Issues AboutDocumento3 pagineElena, H., Catalina, M., Stefana, C., & Niculina, A. (2009) - Some Issues AboutJasonNessuna valutazione finora

- MergerDocumento4 pagineMergerJasonNessuna valutazione finora

- Merger 103Documento14 pagineMerger 103JasonNessuna valutazione finora

- VZ Slides 2-5-15 FinalDocumento10 pagineVZ Slides 2-5-15 FinalJasonNessuna valutazione finora

- Transfer Pricing - F5 Performance Management - ACCA Qualification - Students - ACCA GlobalDocumento7 pagineTransfer Pricing - F5 Performance Management - ACCA Qualification - Students - ACCA Globaljoe004Nessuna valutazione finora

- Chapter 01 InternationalDocumento20 pagineChapter 01 InternationalJasonNessuna valutazione finora

- When Transfer Prices Are NeededDocumento3 pagineWhen Transfer Prices Are NeededJasonNessuna valutazione finora

- Taxation (Malawi) : Monday 6 June 2011Documento10 pagineTaxation (Malawi) : Monday 6 June 2011angaNessuna valutazione finora

- Petty Cash SampleDocumento11 paginePetty Cash SampleChyangNessuna valutazione finora

- Audit ManualDocumento546 pagineAudit ManualRajesh Babu100% (3)

- How Can A Seller-Lessee Use A Sale-Leaseback To Generate A Current Gain?Documento5 pagineHow Can A Seller-Lessee Use A Sale-Leaseback To Generate A Current Gain?jakeNessuna valutazione finora

- Section 80DD, Section 80DDB, Section 80U - Tax Deduction For Disabled PersonsDocumento19 pagineSection 80DD, Section 80DDB, Section 80U - Tax Deduction For Disabled Personsvvijayaraghava100% (1)

- Construction Contracts: Connolly - International Financial Accounting and Reporting - 4 EditionDocumento47 pagineConstruction Contracts: Connolly - International Financial Accounting and Reporting - 4 EditionJosette Mae AtanacioNessuna valutazione finora

- IND AS 103 - Bhavik Chokshi - FR ShieldDocumento26 pagineIND AS 103 - Bhavik Chokshi - FR ShieldSoham Upadhyay100% (1)

- Projected Cash Flow StatementDocumento6 pagineProjected Cash Flow StatementIqtadar AliNessuna valutazione finora

- Entrepreneurial SpectrumDocumento13 pagineEntrepreneurial SpectrumDr. Meghna DangiNessuna valutazione finora

- Mock Exam Paper For Accounting - MBADocumento14 pagineMock Exam Paper For Accounting - MBARasanjaliGunasekeraNessuna valutazione finora

- Financial Accounting and Reporting: Exercise 1Documento8 pagineFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- FAR.2806-PPE Depn.Documento4 pagineFAR.2806-PPE Depn.Kristian ArdoñaNessuna valutazione finora

- Replacement AnalysisDocumento22 pagineReplacement Analysismercedesferrer100% (1)

- Book 1Documento6 pagineBook 1Ronnie MoldogoNessuna valutazione finora

- ch13 PDFDocumento20 paginech13 PDFJAY AUBREY PINEDANessuna valutazione finora

- Reyes Solution Adjusting EntryDocumento4 pagineReyes Solution Adjusting EntryJustine ReyesNessuna valutazione finora

- HighFliers Day Care CenterDocumento48 pagineHighFliers Day Care CenterDanyal Salim100% (1)

- Chapter 5 Review Questions and ProblemsDocumento11 pagineChapter 5 Review Questions and ProblemsLars FriasNessuna valutazione finora

- Chapter 2 Cost Concepts and ClassificationDocumento40 pagineChapter 2 Cost Concepts and ClassificationJean Rae RemiasNessuna valutazione finora

- 2022 Final Exam Applied AuditingDocumento9 pagine2022 Final Exam Applied Auditingvee viajeroNessuna valutazione finora

- Audits of Voluntary Health and Welfare Organizations (1967) Indu PDFDocumento74 pagineAudits of Voluntary Health and Welfare Organizations (1967) Indu PDFFate LauNessuna valutazione finora

- Drill ABMDocumento1 paginaDrill ABMGeorge Gonzales78% (23)

- FINAL A Comparitive Study of Standard Costing 2003Documento31 pagineFINAL A Comparitive Study of Standard Costing 2003Jiten Gogri50% (2)

- Midterm ManaccDocumento13 pagineMidterm ManaccTheodora YenneferNessuna valutazione finora

- CR Ma 21Documento22 pagineCR Ma 21Sharif MahmudNessuna valutazione finora

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocumento57 pagineComparative Analysis of Prism Cement LTD With JK Cement LTDRajudimple100% (1)

- Acc101 RevCh1 3 PDFDocumento29 pagineAcc101 RevCh1 3 PDFWaqar AliNessuna valutazione finora

- Lease Worked ExampleDocumento3 pagineLease Worked Exampled1990dNessuna valutazione finora

- Case Digests - Taxation IDocumento5 pagineCase Digests - Taxation IFatima Sarpina HinayNessuna valutazione finora

- China Innovation Eco-SystemDocumento47 pagineChina Innovation Eco-SystemDRAGON-STAR PlusNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 4.5 su 5 stelle4.5/5 (14)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetDa EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetValutazione: 4.5 su 5 stelle4.5/5 (14)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDa EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCValutazione: 5 su 5 stelle5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingDa EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingValutazione: 4.5 su 5 stelle4.5/5 (760)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookDa EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookValutazione: 5 su 5 stelle5/5 (4)

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityDa EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookDa EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNessuna valutazione finora

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Da EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditDa EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditValutazione: 5 su 5 stelle5/5 (1)