Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Luzon Stevedoring v. CTA - Tax Exemption for Tugboat Engines Denied

Caricato da

André Jan Lee Cardeño0%(1)Il 0% ha trovato utile questo documento (1 voto)

193 visualizzazioni1 paginaTax Case Digest RP.

Titolo originale

Luzon Stevedoring v CTA

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoTax Case Digest RP.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0%(1)Il 0% ha trovato utile questo documento (1 voto)

193 visualizzazioni1 paginaLuzon Stevedoring v. CTA - Tax Exemption for Tugboat Engines Denied

Caricato da

André Jan Lee CardeñoTax Case Digest RP.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

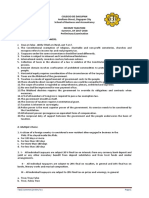

Luzon Stevedoring v. CTA Paras, J.

Petitioner: Luzon Stevedoring Corp.

Respondent: Court of Tax Appeals and Commissioner of

Internal Revenue

Concept: Construction of Tax Exemptions

Brief Facts: Luzon Stevedoring imported engines for the

repair of its tugboats. It claimed a refund from the

compensating tax it paid for the engines, based on Sec.

190 of the Tax code which provides that when articles to

be used by the importer himself as passenger and/or

cargo vessel, whether coastwise or oceangoing,

including engines and spare parts of said vessel, the

importer is exempt from compensating tax. The CIR

disagreed, arguing that Luzon Stevedoring is neither

engaged in coastwise or oceangoing shipping, nor can

tugboats be considered as cargo or passenger vessel.

Doctrine: Any claim for exemption from the tax statute

should be strictly construed against the taxpayer. Where

a provision of law speaks categorically, the need for

interpretation is obviated, no plausible pretense being

entertained to justify non-compliance. All that has to be

done is to apply it in every case that falls within its terms.

Statutes are to be construed in the light of purposes to be

achieved and the evils sought to be remedied.

FACTS:

1. Luzon Stevedoring Corporation imported various

engine parts and other equipment for the repair

and maintenance of its tugboats in 1961 and

1962.

2. It was assessed compensating tax of Php

33,442.13, which it paid, under protest.

3. Unable to secure a tax refund from the CIR,

Luzon Stevedoring filed at the CTA on January 2,

1964.

4. Luzon Stevedoring: Tugboats are included in the

term cargo vessel under the tax exemption

provisions of Sec. 190.

o The law treats a tugboat towing a barge

loaded with cargoes for loading and

unloading to constitute a single vessel.

o Thus, the engines, spare parts and

equipment imported by it to repair and

maintain its tugboats are exempt from

compensating tax.

5. The CTA denied the various claims for tax refund

in 1969.

6. The Motion for Reconsideration of Luzon

Stevedoring was also denied.

7. Hence this SC petition.

The amendatory provisions of RA 3176 limits tax

exemption from the compensating tax to

imported items to be used by the importer himself

as operator of passenger or cargo vessel or both,

whether coastwise or oceangoing, including

engines and spare parts of said vessel.

o Luzon Stevedorings "tugboats" are not

"cargo vessels" because they are mainly

employed for towing and pulling

purposes, not in carrying or transporting

passengers or cargoes.

o In fact, a tugboat is defined as a strongly

built, powerful steam or power vessel,

used for towing and, now, also used for

attendance on vessel.

Also the amendment of Sec. 190 was intended to

provide incentives and inducements to bolster

the shipping industry and not in the business of

stevedoring, in which the corporation is engaged

in.

The power of taxation is a high prerogative of

sovereignty,

the

relinquishment

is

never

presumed and any reduction or dimunition

thereof with respect to its mode or its rate, must

be strictly construed, and the same must be

coached in clear and unmistakable terms in

order that it may be applied.

o More specifically stated, the general rule

is that any claim for exemption from the

tax statute should be strictly construed

against the taxpayer.

DISPOSITIVE: Petition DISMISSED. The CTA decision is

AFFIRMED.

Digested by: Andr

ISSUES:

1. WON Luzon Stevedorings tugboats can be interpreted

to be included in the term cargo vessels for purposes of

the tax exemption provided for in Sec. 190 of the Tax

Code. (NO)

RATIO:

1. NO. Luzon Stevedoring Corp is not exempt from

compensation tax under Sec. 190, and is thus not entitled

for refund.

1

Potrebbero piacerti anche

- 117 Luzon Stevedoring Co. vs. CTADocumento1 pagina117 Luzon Stevedoring Co. vs. CTACleinJonTiuNessuna valutazione finora

- Luzon Stevedoring Corp vs. CTADocumento2 pagineLuzon Stevedoring Corp vs. CTAmaximum jicaNessuna valutazione finora

- Pascual Vs Secretary of Public WorksDocumento3 paginePascual Vs Secretary of Public WorksRhena SaranzaNessuna valutazione finora

- PLDT v. City of DavaoDocumento1 paginaPLDT v. City of Davaoashnee09Nessuna valutazione finora

- Cagayan Electric v. CIR tax exemption caseDocumento2 pagineCagayan Electric v. CIR tax exemption caseShandrei GuevarraNessuna valutazione finora

- Pepsi Cola Bottling Company Vs Municipality of TanauanDocumento2 paginePepsi Cola Bottling Company Vs Municipality of Tanauanmicky.silvosa100% (2)

- Pal vs. Edu DigestDocumento2 paginePal vs. Edu DigestVincent Ferrer100% (3)

- Vegetable Oil Corporation Tax Ruling ReversedDocumento1 paginaVegetable Oil Corporation Tax Ruling ReversedLouNessuna valutazione finora

- Domingo Vs GarlitosDocumento1 paginaDomingo Vs Garlitossally deeNessuna valutazione finora

- Caltex Philippines cannot offset tax obligations against claimsDocumento2 pagineCaltex Philippines cannot offset tax obligations against claimsKing Badong100% (1)

- Republic of The Philippines Vs CaguioaDocumento3 pagineRepublic of The Philippines Vs CaguioaCharlotte Louise Maglasang100% (3)

- CIR Vs John GotamcoDocumento2 pagineCIR Vs John GotamcoKristine Joy TumbagaNessuna valutazione finora

- Garrison v. CADocumento2 pagineGarrison v. CAershakiNessuna valutazione finora

- 027 CIR Vs BOACDocumento2 pagine027 CIR Vs BOACMiw CortesNessuna valutazione finora

- CIR v. Cebu PortlandDocumento2 pagineCIR v. Cebu PortlandChelle OngNessuna valutazione finora

- People vs. Castaneda RULING on tax amnesty benefitsDocumento2 paginePeople vs. Castaneda RULING on tax amnesty benefitsMarilyn Padrones PerezNessuna valutazione finora

- Republic Vs GonzalesDocumento2 pagineRepublic Vs GonzalesCarl MontemayorNessuna valutazione finora

- Eusebio Villanueva V City of Iloilo (Summary)Documento4 pagineEusebio Villanueva V City of Iloilo (Summary)Coyzz de GuzmanNessuna valutazione finora

- Madrigal Vs RaffertyDocumento1 paginaMadrigal Vs RaffertyClaire CulminasNessuna valutazione finora

- City of Manila vs. Coca-Cola BottlersDocumento2 pagineCity of Manila vs. Coca-Cola BottlersKhian JamerNessuna valutazione finora

- Pascual V CIRDocumento1 paginaPascual V CIRJocelyn MagbanuaNessuna valutazione finora

- Withholding Tax Liability Arises Upon Accrual, Not RemittanceDocumento2 pagineWithholding Tax Liability Arises Upon Accrual, Not RemittancePhillipCachaperoNessuna valutazione finora

- Atlas Mining VAT Refund CaseDocumento35 pagineAtlas Mining VAT Refund CaseDaley CatugdaNessuna valutazione finora

- JACINTO-HENARES vs. ST. PAUL COLLEGE OF MAKATIDocumento2 pagineJACINTO-HENARES vs. ST. PAUL COLLEGE OF MAKATIRose Ann VeloriaNessuna valutazione finora

- National Union Vs Stolt NielsenDocumento2 pagineNational Union Vs Stolt NielsenMarie Bernadette BartolomeNessuna valutazione finora

- Francia V Intermediate Appellate Court GR No L-67649, June 28, 1988Documento1 paginaFrancia V Intermediate Appellate Court GR No L-67649, June 28, 1988franzadonNessuna valutazione finora

- Hilado Vs CIRDocumento6 pagineHilado Vs CIRMi AmoreNessuna valutazione finora

- Roxas Vs CtaDocumento23 pagineRoxas Vs CtaMyra De Guzman PalattaoNessuna valutazione finora

- Case Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasDocumento1 paginaCase Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasAJMordenoNessuna valutazione finora

- Wonder Mechanical Tax Exemption CaseDocumento1 paginaWonder Mechanical Tax Exemption CaseKim DayagNessuna valutazione finora

- Floro Cement Vs GorospeDocumento2 pagineFloro Cement Vs GorospeRaymond RoqueNessuna valutazione finora

- Quo Warranto 1. Fortunato v. PalmaDocumento1 paginaQuo Warranto 1. Fortunato v. PalmaRay PiñocoNessuna valutazione finora

- Eastern Telecommunications Philippines Inc Vs CirDocumento4 pagineEastern Telecommunications Philippines Inc Vs CirAerwin AbesamisNessuna valutazione finora

- Hospital Property Tax ExemptionDocumento2 pagineHospital Property Tax ExemptionAriel Versola Gapasin100% (1)

- CIR Vs Baier-NickelDocumento4 pagineCIR Vs Baier-NickelJohnde MartinezNessuna valutazione finora

- CIR's Right to Collect Tax Not Barred by PrescriptionDocumento1 paginaCIR's Right to Collect Tax Not Barred by PrescriptionHollyhock Mmgrzhfm100% (1)

- CIR v. Algue Tax Deduction RulingDocumento1 paginaCIR v. Algue Tax Deduction Rulingfay garneth buscatoNessuna valutazione finora

- Verzosa vs. Lim. GR No. 20145, November 15, 1923Documento2 pagineVerzosa vs. Lim. GR No. 20145, November 15, 1923AJ LeoNessuna valutazione finora

- Cir Vs Mega GeneralDocumento2 pagineCir Vs Mega GeneralAiken Alagban LadinesNessuna valutazione finora

- Digest Iloilo Bottlers Inc Vs Iloilo CityDocumento2 pagineDigest Iloilo Bottlers Inc Vs Iloilo CitylilibethcabilloperezNessuna valutazione finora

- Manila Electric Company V Province of LagunaDocumento2 pagineManila Electric Company V Province of LagunaIan AuroNessuna valutazione finora

- Apostolic Prefect of Mt. Province vs. Treasurer of BaguioDocumento1 paginaApostolic Prefect of Mt. Province vs. Treasurer of BaguioRaquel DoqueniaNessuna valutazione finora

- CTA upholds Fortune Tobacco tax refundDocumento1 paginaCTA upholds Fortune Tobacco tax refundlenvfNessuna valutazione finora

- Davao Gulf Lumber Corp V CirDocumento1 paginaDavao Gulf Lumber Corp V CirAngelo Araullo BocitaNessuna valutazione finora

- DOMINGO VS. GARLITOS TAXES COMPENSATEDDocumento1 paginaDOMINGO VS. GARLITOS TAXES COMPENSATEDAdhara CelerianNessuna valutazione finora

- Digested (TAX 1) - Phil Health Care Providers Vs CIRDocumento2 pagineDigested (TAX 1) - Phil Health Care Providers Vs CIRChugsNessuna valutazione finora

- Republic v. Mambulao Reforestation Charges Not RefundableDocumento1 paginaRepublic v. Mambulao Reforestation Charges Not RefundableRhea BarrogaNessuna valutazione finora

- CIR Vs Algue, GR No. L-28896, February 17, 1988Documento5 pagineCIR Vs Algue, GR No. L-28896, February 17, 1988Machida AbrahamNessuna valutazione finora

- Gancayco vs. Collector - Case DigestDocumento6 pagineGancayco vs. Collector - Case DigestYvon BaguioNessuna valutazione finora

- City Parking Fees Upheld for Buses Loading PassengersDocumento1 paginaCity Parking Fees Upheld for Buses Loading PassengersJackie Canlas100% (1)

- Topic: Tax Laws and Implementing Rules and RegulationsDocumento2 pagineTopic: Tax Laws and Implementing Rules and RegulationsChariNessuna valutazione finora

- CIR vs. Mitsubishi MetalDocumento3 pagineCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- Republic Bank v. CTA DigestDocumento3 pagineRepublic Bank v. CTA DigestKaren Panisales100% (2)

- 5 Chavez Vs Ongpin - DigestDocumento2 pagine5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- Cir v. Cebu PortlandDocumento1 paginaCir v. Cebu PortlandShalini Kristy S DalisNessuna valutazione finora

- Atlas Consolidated Mining v. CIR / GR No. L - 26911 / January 27, 1981Documento1 paginaAtlas Consolidated Mining v. CIR / GR No. L - 26911 / January 27, 1981Mini U. SorianoNessuna valutazione finora

- G.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.Documento3 pagineG.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.carlo_tabangcuraNessuna valutazione finora

- 5) Domingo V GarlitosDocumento1 pagina5) Domingo V GarlitosZen FerrerNessuna valutazione finora

- 46 Luzon Stevedoring V CTADocumento2 pagine46 Luzon Stevedoring V CTARos PatNessuna valutazione finora

- Luzon Stevedoring Corp. V CTA 163 SCRA 647Documento2 pagineLuzon Stevedoring Corp. V CTA 163 SCRA 647Kyle DionisioNessuna valutazione finora

- PAL v. CAB and Grand Airways 1996Documento3 paginePAL v. CAB and Grand Airways 1996André Jan Lee CardeñoNessuna valutazione finora

- Transpo Digests 2016Documento33 pagineTranspo Digests 2016André Jan Lee Cardeño100% (1)

- Fores v. MirandaDocumento2 pagineFores v. MirandaAndré Jan Lee CardeñoNessuna valutazione finora

- Sun Insurance V CA (1992)Documento2 pagineSun Insurance V CA (1992)André Jan Lee CardeñoNessuna valutazione finora

- Francisco Realty V CA (Digest)Documento2 pagineFrancisco Realty V CA (Digest)André Jan Lee CardeñoNessuna valutazione finora

- Chavez v. PCGG (1999 Resolution)Documento3 pagineChavez v. PCGG (1999 Resolution)André Jan Lee CardeñoNessuna valutazione finora

- Albano V ReyesDocumento1 paginaAlbano V ReyesAndré Jan Lee CardeñoNessuna valutazione finora

- PAL vs. CAB (1968)Documento2 paginePAL vs. CAB (1968)André Jan Lee CardeñoNessuna valutazione finora

- FPIB v. CA (Oblicon Digest)Documento5 pagineFPIB v. CA (Oblicon Digest)André Jan Lee CardeñoNessuna valutazione finora

- Palanca V Fred Wilson DigestDocumento1 paginaPalanca V Fred Wilson DigestAndré Jan Lee CardeñoNessuna valutazione finora

- Reiss Vs Memije DigestDocumento3 pagineReiss Vs Memije DigestAndré Jan Lee CardeñoNessuna valutazione finora

- Carantes v. CA Supra (ObliCon)Documento17 pagineCarantes v. CA Supra (ObliCon)André Jan Lee CardeñoNessuna valutazione finora

- Tongoy V CA (Digest)Documento4 pagineTongoy V CA (Digest)André Jan Lee Cardeño0% (1)

- Zeigler V MooreDocumento9 pagineZeigler V MooreAndré Jan Lee CardeñoNessuna valutazione finora

- Liguez v. CA DigestDocumento3 pagineLiguez v. CA DigestAndré Jan Lee Cardeño75% (4)

- Oil and Natural Gas Commission Vs CA ObliConDocumento2 pagineOil and Natural Gas Commission Vs CA ObliConAndré Jan Lee Cardeño100% (1)

- (REVISED) PNB V Phil Vegetable Oil (1927)Documento2 pagine(REVISED) PNB V Phil Vegetable Oil (1927)André Jan Lee CardeñoNessuna valutazione finora

- Frenzel v. Catito DigestDocumento2 pagineFrenzel v. Catito DigestAndré Jan Lee Cardeño50% (4)

- Limketkai Sons Milling, Inc. v. CA Obligations & ContractsDocumento2 pagineLimketkai Sons Milling, Inc. v. CA Obligations & ContractsAndré Jan Lee Cardeño67% (3)

- 69 Atilano v. Atilano PDFDocumento1 pagina69 Atilano v. Atilano PDFAndré Jan Lee Cardeño100% (1)

- Rmo 20-2013Documento7 pagineRmo 20-2013Carlos105Nessuna valutazione finora

- In Re: GiantDocumento8 pagineIn Re: GiantAndré Jan Lee CardeñoNessuna valutazione finora

- Guiang v. CA Oblicon DigestDocumento1 paginaGuiang v. CA Oblicon DigestAndré Jan Lee CardeñoNessuna valutazione finora

- 69 Atilano v. Atilano PDFDocumento1 pagina69 Atilano v. Atilano PDFAndré Jan Lee Cardeño100% (1)

- ObliCon DigestsDocumento34 pagineObliCon DigestsAndré Jan Lee CardeñoNessuna valutazione finora

- Rule 113 Sec 5 Arrests Without WarrantDocumento2 pagineRule 113 Sec 5 Arrests Without WarrantAndré Jan Lee CardeñoNessuna valutazione finora

- Academic Calendar of UP Diliman SY 2015-2016Documento1 paginaAcademic Calendar of UP Diliman SY 2015-2016Sam ChuaNessuna valutazione finora

- 07 Santos v. CommissionerDocumento6 pagine07 Santos v. CommissionerAndré Jan Lee CardeñoNessuna valutazione finora

- Tax Reporting 2015Documento3 pagineTax Reporting 2015André Jan Lee CardeñoNessuna valutazione finora

- C. Types 1. With A Search Warrant D. Things That May Be Seized Rule On Dna EvidenceDocumento5 pagineC. Types 1. With A Search Warrant D. Things That May Be Seized Rule On Dna EvidenceAndré Jan Lee CardeñoNessuna valutazione finora

- Module 2 Sources of Intermediate and Long-Term FinancingDocumento24 pagineModule 2 Sources of Intermediate and Long-Term Financingcha11Nessuna valutazione finora

- Analysis of Z Score of Airline Companies - SayeekulkarniDocumento8 pagineAnalysis of Z Score of Airline Companies - Sayeekulkarniruchita sharmaNessuna valutazione finora

- 15-Step Tutorial on Finance ConceptsDocumento15 pagine15-Step Tutorial on Finance ConceptsAninda DuttaNessuna valutazione finora

- Accounting policies and bank reconciliationDocumento5 pagineAccounting policies and bank reconciliationHorace IvanNessuna valutazione finora

- Ocean Carriers Project AnalysisDocumento11 pagineOcean Carriers Project AnalysisSameer KumarNessuna valutazione finora

- Entrepreneurship Grade12Documento212 pagineEntrepreneurship Grade12Carmela Malabed0% (1)

- 75 - Industrial All RiskDocumento28 pagine75 - Industrial All RiskAMIT GUPTANessuna valutazione finora

- The Pocketbook of Economic Indicators PDFDocumento40 pagineThe Pocketbook of Economic Indicators PDFPertiwi PramaNessuna valutazione finora

- Credit Scoring Model For Smes in India: 1. Calculation of RatiosDocumento4 pagineCredit Scoring Model For Smes in India: 1. Calculation of RatiosKushal KapoorNessuna valutazione finora

- Economics XII ISC Sample PaperDocumento3 pagineEconomics XII ISC Sample PaperAkshay Pandey100% (2)

- Advanced Accounting 12th Edition Beams Solutions Manual Full Chapter PDFDocumento52 pagineAdvanced Accounting 12th Edition Beams Solutions Manual Full Chapter PDFToniPerryyedo100% (9)

- TAX LossDocumento38 pagineTAX LossBradNessuna valutazione finora

- Fringe Benefits PDFDocumento8 pagineFringe Benefits PDFImcha LongcharNessuna valutazione finora

- Understanding Planned GivingDocumento1 paginaUnderstanding Planned GivingFood and Water WatchNessuna valutazione finora

- Accounting ConceptsDocumento4 pagineAccounting ConceptsMa Hadassa O. FolienteNessuna valutazione finora

- Learning Check Chapter 14Documento12 pagineLearning Check Chapter 14ratihspNessuna valutazione finora

- Chapter 2 - Time Value of Money-1Documento63 pagineChapter 2 - Time Value of Money-1Prakrit PrakashNessuna valutazione finora

- Volume8-Bangladesh MFI ReportDocumento213 pagineVolume8-Bangladesh MFI ReportSaurabh PratapNessuna valutazione finora

- Harbison-Walker Refractories Company v. United States, 340 F.2d 410, 3rd Cir. (1965)Documento4 pagineHarbison-Walker Refractories Company v. United States, 340 F.2d 410, 3rd Cir. (1965)Scribd Government DocsNessuna valutazione finora

- Philippine Fiscal PolicyDocumento11 paginePhilippine Fiscal PolicyHoney De LeonNessuna valutazione finora

- Accounting Concepts and Procedures ExplainedDocumento15 pagineAccounting Concepts and Procedures ExplainedNänį RøÿalNessuna valutazione finora

- Court denies deduction for unreasonable media advertising expenseDocumento2 pagineCourt denies deduction for unreasonable media advertising expenseDexter Lee GonzalesNessuna valutazione finora

- Yogesh Nivrutti Padekar Project ReportDocumento62 pagineYogesh Nivrutti Padekar Project ReportSubodh SonawaneNessuna valutazione finora

- WAC11 2016 May AS QPDocumento15 pagineWAC11 2016 May AS QPAfrida AnanNessuna valutazione finora

- Answers To Concepts Review and Critical Thinking QuestionsDocumento6 pagineAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNessuna valutazione finora

- WB Economic ReportDocumento78 pagineWB Economic ReportIvo1407Nessuna valutazione finora

- WCM QuestionsDocumento13 pagineWCM QuestionsjeevikaNessuna valutazione finora

- Tax1 Prelim Summer 17Documento5 pagineTax1 Prelim Summer 17Sheena CalderonNessuna valutazione finora

- Cost of Capital, Optimal Capital Structure, and Leverages 1.0 The Fundamental ConceptDocumento5 pagineCost of Capital, Optimal Capital Structure, and Leverages 1.0 The Fundamental ConceptMacy AndradeNessuna valutazione finora

- SPACS FAQ - WPCP and Tax DeductionDocumento5 pagineSPACS FAQ - WPCP and Tax DeductionMandi Sebeny ReimerNessuna valutazione finora