Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Latin Americas Decade - FDI Trends and Perspecives

Caricato da

Philip YJ KangDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Latin Americas Decade - FDI Trends and Perspecives

Caricato da

Philip YJ KangCopyright:

Formati disponibili

Latin Americas Decade?

FDI trends and perspectives

April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Table of contents

Page

Introduction

Economic overview of Latin America

What is the panorama of FDI in Latin America?

Investment climate in Latin America

Source and destination markets

10

Who is investing where?

12

Latin America as an FDI source market

13

Capitalising on the rise of Latin America

15

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Introduction

Over the last decade, most Latin Americans

celebrated the 200th anniversaries of their

independence from Spain. After two centuries plagued by economic crises, military

dictatorships, fiscal populism and economic

stagnation, the region is now emerging as

an haven of economic growth in the midst

of global uncertainty. In a

historic about-turn, the Head of the

International Monetary Fund (IMF),

Christine Lagarde, visited the region last

year to gather support to contain the effects

of the euro-debt crisis, while praising the

political and economic stability the region

has reached in the present decade1. Other

global thought leaders, such as Luis Alberto

Moreno, Head of the Inter-American

Development Bank (IDB), have been

popularising the idea that we are living now

in the Decade of Latin America2.

As each day passes, this idea of a Latin

American decade is garnering more attention from investors, analysts and businessmen alike. In 2010, The Economist ran a

special report called Nobodys backyard

drawing attention to the economic and political transformation the region is undergoing,

currently materialised in economic growth

and increasing inflows of FDI3. In fact, according to the Economic Commission for

Latin America and the Caribbean (ECLAC),

the region grew by 4.3% in 2011, resulting

in a 3.2% increase in the regions per capita

GDP. Additionally, FDI to Latin America

rose by an estimated 3.5% in 2011 to USD

216 billion. And, even in the midst of

unfavourable international conditions, the

ECLAC is now forecasting regional

economic growth of 3.7% for 20124.

The region has an exciting decade ahead.

Brazil, Latin Americas leading economy,

already surpassed the United Kingdom as

the worlds sixth-largest economy in 2011,

and the regions economic giant is expected

to overtake all European economies when it

surpasses Germany in 20205. As many

people turn their attention to this years

Olympic Games in London, many business

leaders and investors will also be looking

further ahead to the opportunities offered by

the 2014 FIFA World Cup and 2016

Olympic Games in Rio de Janeiro. While

both events will take place in Brazil, the FDI

opportunities and investor interest these

games will evoke are certain to extend to

other markets in the region, which are also

increasingly top of mind among investors.

"We are targeting architecture,

construction and engineering firms

already working in Brazil which are

looking forward to the Olympic

Games and the FIFA World Cup

Juan Balparda,

Head of Investment Uruguay XXI

In this paper, we examine the opportunities

arising from the emergence of Latin

America in the international economy. This

comprises an economic and political

outlook of the region, placing special

emphasis on the divergent economic

realities of this complex and diverse region.

We then provide an in-depth analysis of the

FDI flows and statistics to reveal the main

trends and opportunities from the

investment perspective. Finally, we will

provide an analysis of the different

countries with regards to their business

climate and attractiveness for doing

business. Based on all these approaches,

we intend to come up with the general

implications that might guide strategies for

doing business and tapping into

opportunities in Latin America.

1. Bloomberg: IMFs Largarde seeks Latin America help in historic about-turn, 28/11/2011

2. Inter-American Development Bank: IDB calls on Latin America and the Caribbean to cut poverty to 10% of

population by 2025, 27/5/2011

3. Economist: Nobodys Back Yard, 9/9/2010

4. Economic Commission for Latin America: Preliminary overview of the Economies of Latin America and the

Caribbean, December 2011

5. BBC: Brazilian economy overtakes UKs, says CEBR, 26/12/2011

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Economic overview of Latin America

In 2011, the debates over fiscal

consolidation in the United States, the debt

crisis in the Euro-zone countries, and even

the contraction that followed the earthquake

in Japan, all helped to create an

environment of economic uncertainty

throughout the developed world. However,

the developing economies as a whole

expanded at a 6.1% rate in 2011, with

China, in particular, presenting a robust

growth of 9.1%, albeit slightly slower than in

the previous year. The performance of the

emerging Asian economies counteracted

the negative trends from the developed

world, and thus, the global economy

reached a positive growth of 2.8%.

In this context, Latin America and the

Caribbean followed the trend of other

emerging economies, presenting an

economic growth rate of 4.3% in 2011,

which expanded the per capita GDP by

3.2%. Although this is a slower pace when

compared to figures of 2010, it is overall

positive when compared to the performance

of the developed economies. It is important

to note that such economic growth was

uneven across the region, with South

America and Central America presenting

expansions of 4.6% and 4.1% respectively,

while the Caribbean grew a significantly

slower rate of 0.7%. Likewise, there are

significant differences when statistics are

disaggregated at country level. Panama,

Argentina, Ecuador, Peru and Chile were

the fastest growing economies with

economic growth rates above 6%, while

Brazil, the regional economic giant,

achieved a moderate 2.9% following

monetary and fiscal policy measures to

avoid the overheating of the economy.

In contrast to the US and Europe,

which are struggling with financial

woes and a frustrated middle class,

Latin Americas middle class in

many cases continues to grow

strongly

Woods Staton,

CEO, McDonalds, Argentina

Figure 1: GDP Growth (%) Latin America and Caribbean 2004-2012

Source: ECLAC

6. ECLAC: The region in the decade of the emerging economies, August 2011

7. ECLAC: Preliminary overview of the Economies of Latin America and the Caribbean, December 2011

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

In 2012, it is expected that the region will

grow by 3.7%, with South America growing

slightly faster (3.9%). The growth will be led

by the commodity-exporting countries such

as Peru, Ecuador, Argentina, Colombia and

Chile. Panama will again be the fastest

growing economy albeit with a significantly

slower rate of 6.5%, while Brazil will recover

impetus showing an increase in the

economic growth rate which is expected to

be around 3.5%. In general, most

economists agree that Latin America is

today in a better position to face the global

financial crisis because it has more fiscal

space to implement countercyclical

measures. In fact, the debt ratio was

brought down by around 28% of the GDP

which is the lowest in the regions recent

economic history. However, Latin America

will not be immune to the uncertain climate

of the global economy, and some negative

effects are expected from the sluggish

www.ocoinsight.com

environment in the developed economies

particularly in Europe and the slight

decline in the growth of emerging

economies, following the cooling of the

internal demand in China and India. This

will probably drive down the demand of

food products and have an impact on the

commodity prices, thus undermining the

terms of the trade of the region.

"We had a very good year [] the

region was very profitable for us []

Theres growth in most markets in

Latin America because the economies are doing well."

Roger Crook,

CEO DHL Express International

Americas

Figure 2: GDP Growth Forecast, Latin America, 2012

Source: ECLAC

8. ECLAC: The region in the decade of the emerging economies, Op. Cit.

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

What is the panorama of FDI in Latin America?

According to UNCTAD, global foreign direct

investments (FDI) inflows rose by 17% in

2011, to USD 1.5 trillion, surpassing the pre

-crisis average for the first time since 2008.

In this group, the 2011 increase in FDI

flows was largely driven by Latin America

and the Caribbean with an increase in 35%,

when compared to the 2010, reaching the

record figure of USD 216 billion, slightly

higher than FDI inflows to the United

States. The growth pace of the region is

also faster than other world regions when

compared to the 22.8% growth in Europe,

the 11.4% growth in South East Asia, and

the 30.6% growth of transition economies.9

It is important to note that UNCTAD

includes the data of some offshore financial

centres in the Caribbean, such as the

Cayman Islands and the British Virgin

Islands in their account, and this might

distort the overall FDI statistics of the

region. Following the methodology of the

World Bank, the region presented the

greatest increases in both inward and

outward FDI flows among world regions in

2010, reaching USD 112 billion, a 40%

increase on 2009. The World Bank estimate

of 145.5 million USD for 2011 represents a

significantly higher amount than the precrisis average and the historic record of

2008.10

Figure 3: FDI Inflows (selected world regions) in USD billions

Source: UNCTAD

According to the ECLAC, the bulk of the

FDI goes to the South American sub-region

which received US$85.1 billion - more than

70% of the regional inflows. These inflows

were largely driven by Brazil which accounted $48.4 billion, followed by Chile with 15

USD billion and Peru with $7.3 billion. For

2011, recent UNCTAD figures showed a

continuous positive trend for South American FDI recipients. FDI in Brazil rose 35.3%

to reach $65.5 billion, whereas the FDI to

Chile increased 17.6%, slightly lower than

the inflows to Mexico. Colombia

experienced an impressive jump of 113% in

2011, reaching $14.4 billion, and

surpassing Peru on its way to closing the

gap with the leading recipients.11

9. UNCTAD: Global Investment Trends Monitor January 24 2012

10. World Bank: Global economic prospects 2012

11. ECLAC: Foreign Direct Investment in Latin America and the Caribbean 2010

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Figure 5: Main recipients of FDI in

Latin America 2010-11 (USD billion)

Figure 4: Geographic distribution

of FDI 2010

Country

Brazil

2010

48.4

2011

65.5

Growth

35.3%

Mexico

19.6

17.9

- 8.8%

Chile

15.1

17.6

16.4%

Colombia

6.8

14.4

113.4%

Peru

7.3

7.9

7.4%

Argentina

7.0

6.3

-10%

Source: UNCTAD

Source: ECLAC

There are some trends to highlight with

regards to the panorama of inward FDI in

terms of inflows. As a whole, the region has

benefited from the economic scenario

presented in the previous section. The

robust growth of emerging economies in

Asia increased the prices of natural

resources and food products, which are the

bulk of the export basket of the region, but

also increased demand for manufacturing

and services. Resource-seeking FDI, driven

by these higher commodity prices,

prompted large investments to the

sub-region, particularly in mining and hydro-

carbon rich countries such as Colombia,

Chile and Peru.

The sub-region has also benefited from a

surge in local market-seeking FDI which

was attracted by the rising local demand

triggered by higher employment, economic

growth and currency appreciation, and in

general, due to the expansion of the middle

class, particularly in Brazil (but also in

Chile, Colombia and Argentina). According

to the ECLAC, around 43% of the FDI in the

region is focused on natural resources,

which reflects once more the raw-material

orientation of South America.12

Figure 6: Destinations and types of FDI

Destination Macro-Sector

Sub-Region

South America

Services

30%

Manufacturing

27%

Natural

Resources

43%

Prevalent type of FDI

Local/Regional

Market-seeking FDI.

Resource-seeking FDI.

Mexico / Central

America

41%

54%

5%

Efficiency-seeking FDI.

Source: OCO Global, based on statistics from the ECLAC

12. Ibid.

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

The experience of Mexico and Central

America is however different due to its

greater commercial integration and links

with North America. FDI going to these

markets intends to capture not only the

internal markets, but also use these

countries as low-cost export platforms to

tap into opportunities in the United States

and Canada, due to location and wage

advantages. For instance, the sluggish

demand in the United States explains partly

the decline in the FDI going into Mexico in

2011. Although manufacturing plays an

important role in the FDI attracted to the

sub-region, most Central American nations

are shifting rapidly to services-oriented

economies. Some of the advantages that

positioned the region as a textile and

www.ocoinsight.com

garment export platform are now becoming

targeted assets for investors in business

and professional services, especially those

provided by call centres and business

processing outsourcing (BPO) companies.

Latin America is very important for

Samsung because it is an area that

is growing fast [] Countries where

GDP grows faster [means] people

have more money to spend

Teobaldo Palacios

VP Latin America,

Samsung Electronics

Investment climate in Latin America

The global slowdown will affect the

countries in different ways, depending on

their participation in global value chains and

export destinations markets. Investors

should take care to understand how

different countries are integrated into global

economy and how flexible their trade

structure is to re-direct exports if demand

declines in a given market. In general

terms, the integration of Latin America into

the international economy has been

irregular, and hence, diverse degrees of

international openness and pro-business

orientation can be found throughout the

region. In fact, Latin America is less

integrated than other world regions with

less than 20% of its exports being

intra-regional, significantly lower trade

figures, when compared to the Asia Pacific

region where it accounts for 45% of the

total trade.13 One of the reasons behind this

lack of intra-regional trade is the natural

resource orientation of Latin American

exports whose main markets are found

outside the region. Nonetheless, the lack of

convergence of Latin American economic

blocs and the divergent degrees of

openness also play a key role. Currently

the integration landscape is dominated by

three customs unions: the Mercosur, the

Andean Community and the Central

American Common Market, with four

countries of the region (Mexico, Chile,

Panama and the Dominican Republic) not

belonging to any of these customs unions.

13. ECLAC: The region in the decade of the emerging economies

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Figure 7: Selected Business Climate Indices

Compiled by OCO Global

Chile is the most open economy of the

region, having in force sixteen Free Trade

Agreements, which allow investors and

domestic companies access the markets of

most countries in the Americas, Europe

(both the European Union and the

European Free Trade Association), and

increasingly the Asia-Pacific region.14 For

this reason, Chile has the most balanced

trade basket in terms of destinations with

China and Japan as the main destination of

its exports (29.4%), followed very closely

by Europe (21%). From a political point of

view, Chile has a very consistent pro-

business with the best business

environment of the region, ranking first on

the World Economic Forums Global

Competitiveness Index, the World Banks

Doing Business 2012 and the Heritage

Foundations Economic Freedom Indexes.

The economic policies of Chile will remain

stable in the coming decades, having been

implemented by the successive socialist

governments of the Concertacion, and

recently ratified by the conservative

government of President Sebastian Piera,

who is also a prominent businessman.

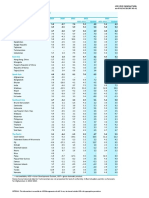

Figure 8: Average Geographic Distribution of Exports, 2007-2011 (% of Exports)

Argentina

Brazil

Uruguay

Paraguay

Chile

Colombia

Peru

Ecuador

Bolivia

Mexico

Panama

Costa Rica

El Salvador

Honduras

Nicaragua

Guatemala

Dominican Rep.

United States

6.9

12.5

6.1

1.8

11.6

39.1

18.1

39.1

8.2

80.8

16.1

37.2

48.5

45.2

34.3

40.4

60.1

Europe

17.8

23.2

17.7

8.4

21.0

13.7

17.3

13.1

8.2

5.3

3.4

17.4

5.8

19.7

11.5

5.6

12.8

China and Japan

9.4

14.0

4.1

2.8

29.4

4.1

19.4

2.4

8.1

1.6

1.7

7.7

0.5

2.0

1.2

1.9

3.8

Latin America

40.9

21.1

39.7

67.2

18.7

30.4

18.1

37.5

62.0

6.4

69.3

24.9

42.0

26.9

40.4

41.9

4.8

Source: ECLAC

14. Details on Free Trade Agreements and Customs Unions can be checked at the Foreign Commerce Information

System from the American States Organisation (OAS) http://www.sice.oas.org/agreements_e.asp

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

Politics should not be a matter of great

concern for investors in Mexico, the second

most open economy in the region with

twelve Free Trade Agreements in force,

and with one of the best business

environments in the region. After several

governments from the Revolutionary

Institutional Party (PRI), the last two

governments from the conservative

National Alliance party (PAN) have pursued

the bulk of the same economic policies the

PRI started a decade ago, and it is unlikely

that in the coming presidential elections,

either PRI or PAN candidates will propose

to change the path the country is following.

However, unlike Chile, Mexico might be

more vulnerable to external shocks

because it concentrates the bulk of its

exports in one market: the United States.

As a full member of the North American

Free Trade Agreement (NAFTA), the

performance of Mexico will hence rely

heavily on the performance of the American

economy, destination of more than 80% of

its exports

As a whole, the MERCOSUR countries

(Brazil, Argentina, Paraguay and Uruguay)

are among the less integrated to the

international economy with few free trade

OCO Global Ltd, April 2012

www.ocoinsight.com

agreements in force. The members of the

trade bloc concentrate their exports at an

intra-regional level. The exports to the

United States could be as low as in the

case of Paraguay which represents less

than 2% of the total exports. The sub-region

could be moderately exposed to a drop in

demand from the European Union, which is

on average the second destination of their

exports, but since the export basket is

comprised mostly by commodities, it is

expected that the region could re-direct

their exports to the emerging Asian

economies which are becoming

increasingly important trading partners.

Although most investors and analysts agree

that MERCOSUR countries lag behind in

terms of ease of doing business and

openness, Uruguay stands out in the group

due to its performance on competitiveness

and business investments rankings. In the

last decade, Uruguay has been very

successful in capitalising the market

opportunities that arise from the regional

market, reaching a FDI-to-GDP ratio of

5.9%, second only to Chile (7.4%) in South

America.

Latin Americas Decade? FDI trends and perspectives

The political and economic outlook of the

Andean Community presents the contrasting scenario between Colombia and

Peru, on one side, and Bolivia, Ecuador

and Venezuela, on the other. The first two

countries have championed internationalisation and free trade, while the other countries pursue an inward-looking economic

model. Peru, in particular, has followed the

Chilean experience and currently has (10)

free trade agreements in force, which include the Asian markets of China, Japan

and South Korea. Like Chile, Peru has

been also enthusiastic in cultivating a special relation with the growing Asia Pacific

region, which is now the main destination of

its exports. The recent election of Ollanta

Humala last year created fears that Peru

would lose its pro-investment orientation,

but after several months in office, the government has been credited by the local media for balancing its social agenda with a

strong pro-business orientation, considering

that it still has the overall third best business environment, based on the most credited investment climate rankings. With a diverse, young and growing population, Colombia is counted as one of the CIVETS

nations, the new generation of BRICS.

However, when compared to Peru, the

trade of Colombia is less diversified and it

currently is concentrated in the United

States and its neighbours in Latin America.

The government of Juan Manuel Santos

has manifested the interest of Colombia in

diversifying its exports, particularly opening

up linkages with the Asia Pacific region, following the experiences of Peru and Chile.15

The geographic location of Colombia

makes it an interesting emerging market

with a double opportunity of being a gateway to avoid trade barriers to the markets

of South America, and a strategic platform

for tapping opportunities in the US and

Canada, due to the recent approval of the

FTAs with these two countries.

www.ocoinsight.com

Two trends will be shaping the economic

integration landscape in the region over the

coming decade. Pivotal for the influence of

Brazil in South America will be the implementation of the economic measures included in the Declaration of Cuzco16, which

foresees the creation of a common market

between the MERCOSUR, the Andean

Community and Chile, on the framework of

the Union of South American Nations

(UNASUR). The other initiative, mostly

championed by Colombia and Chile is the

recent establishment of the so-called

Alliance of the Pacific, which integrates

the economies of Colombia, Peru, Chile

and Mexico, all of them located in the Latin

American Pacific rim. These countries not

only share a high degree of openness and

competitiveness, but have also taken concrete measures to increase their commercial and economic linkages. For instance,

they recently launched the MILA (the Spanish acronym for Integrated Latin American

Market), a single stock market that integrates the former stock markets of Lima,

Bogota and Santiago. Likewise, the investment and export promotion agencies of

Mexico, Colombia, Peru and Chile have also agreed to share international offices

worldwide to channel investors to the region

and increase the exports to the markets of

Asia and Africa17.

15. Wold Politics Review: http://www.worldpoliticsreview.com/articles/8383/colombias-santos-moves-to-diversifyforeign-policy

16. Declaration of Cuzco (Peru) http://www.comunidadandina.org/ingles/documentos/documents/cusco8-12-04.htm

17. MercoPress

OCO Global Ltd, April 2012

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

FDI Projects to Latin America: source and destination markets

Figure 9: Inward FDI Projects Latin America & Caribbean 2003-11

Source: fDi Markets

FDI projects are an interesting measure for

informing the strategies of Investment

Promotion Agencies of the region.

According to the FDI Markets data monitor,

Latin America and the Caribbean attracted

1,364 projects in 2011 which accounted for

around 9% of all projects globally. Although

the region still lags behind Asia Pacific,

North America and Western Europe in

terms of number of projects; it witnessed a

fast growth of 18,4% in 2011. In terms of

jobs, the region saw a 34% growth in job

creation, the fastest of any world region,

whereas in terms of capital expenditures

the region presented a growth of 10%

compared to 2010. It is important to note

that although Latin America lags behind in

terms of project numbers, it was the

second region globally both in terms of

capital expenditure and jobs in 2011, with

shares of 19% and 18% respectively. This

means that the FDI projects attracted to the

region in the last couple of years are

generally more capital- and labourintensive than those attracted to other

world regions.

Figure 10: Inward FDI Projects Latin America & Caribbean 2003-11

Source: fDi Markets

OCO Global Ltd, April 2012

10

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Most of these FDI projects to Latin America

came from Western Europe which accounted for 40% of the share, followed closely by

North America with 34%, and then by the

increasingly important Asia Pacific region

with 13%. Although Europe is the main

source of FDI for the region, the main investor by far is the United States with a

30% share of the FDI projects, followed

then by Spain with 11%. Investment Promotion Agencies targeting investors in the

United States should note that the bulk of

investors come from California, New York,

Texas and Florida. In the rest of the world,

all sources of FDI presented an increase

last year, especially Japan and the United

Kingdom. The latter increased its projects

in more than 50%, surpassing Germany as

the second source of FDI from Western Europe. According to the ECLAC, China has

become the third source of investment behind the United States and Europe in Latin

America, reaching 15 billion USD in 2010.

The countrys primary sectoral focus is on

hydrocarbons and natural resources, which

explains why its share of overall FDI projects lags behind other source markets.

Figure 10: Main source countries

FDI projects 2011

Figure 11: Main destination countries

FDI projects 2011

Source: fDi Markets

Most of the companies investing in Latin

America are looking to avoid certain trade

barriers and tap into opportunities from domestic or regional markets. It is natural that

Brazil is thus the main destination in terms

of projects with a share of 36% in 2011, followed by Mexico, Argentina and Colombia.

These four countries are also the biggest

domestic markets of the region and accounted for approximately 75% of the projects tracked in 2011. In sub-national

terms, the city of Sao Paulo was the pre-

OCO Global Ltd, April 2012

ferred destination with 9% of the FDI projects, followed by Rio de Janeiro with 3.2%

of the regional share. The capitals of Argentina, Mexico, Colombia and Chile were

the preferred destinations in their respective countries due to their significant share

in the national GDPs, but it is important to

note that secondary medium-sized cities

such as Guadalajara and Monterrey in

Mexico and Curitiba in Brazil are increasingly catching the attention of investors.

11

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Who is investing where?

When crossing historic FDI data from 2003

to 2011 in terms of source and destination

countries, some trends are uncovered.

American and Canadian companies usually

prefer Mexico as their main destination,

accounting for 34% and 35% of the

projects respectively. These companies

draw on Mexico as a low-cost export

platform in the context of the NAFTA

agreement. Western European FDI prefers

Brazil as their main destination, particularly

when it comes from Portugal (88%), the

United Kingdom (41%), France (40%), Italy

(51%) or Netherlands (53%), in order to

avoid trade barriers and reach the domestic

market of this country. The only European

exceptions are the Spanish companies

which usually prefer Mexico (28%) and other Spanish speaking countries in the

Americas, due to cultural and linguistic particularities. Asia-Pacific FDI concentrates

heavily in Brazil with it attracting 50% of the

Chinese FDI, 43% of the Indian FDI, 49%

of the Korean FDI and 39% of Japanese

FDI. For all Asian countries, Mexico is the

second destination, but other markets,

such as Colombia, Argentina and Chile are

becoming top of mind among investors as

well.

In 2011, most of the projects were focused

on services with Software and IT Services

leading the trend, followed by Business

Services, which represented almost a third

of the projects. This is partly explained by

the positioning of the region as an offshoring and near-shoring platform to serve

the markets of Europe and the United

States, due to wage, location and human

capital advantages. The strategies of

American, Spanish and Indian companies

have created a new scenario with leading

multinationals such as IBM, Microsoft, Tata

Consultancy Services, Accenture, Oracle,

HP and Intel shaping the trend. More interesting is the rise of projects in Metals and

Industrial Machinery which is partly a result

of the growing regional demand due to the

mining and infrastructure boom in the region, particularly in South America. A negative trend is seen in Hotels and Tourism as

a response to the sluggish demand of tourism due the global slowdown, which has

particularly affected the countries of the

Caribbean.18

When reviewing historic data from 2003 to

2011, interesting trends are found in terms

of sectors and sources of FDI. The two

leading sources of FDI to the region, Spain

and the United States have historically

been sources of FDI in the Business Services, IT Services and Communications

sectors, with Spain being also important in

Financial Services. Other Western European countries have also been sources of IT

services, with increasingly leading roles in

Financial Services (United Kingdom, Switzerland), Tourism (France), Metals (United

Kingdom, Sweden, Italy), Industrial Machinery (Italy, Sweden), and Chemicals

(Netherlands).

18. ECLAC: Foreign Direct Investment in Latin America and the Caribbean 2010

OCO Global Ltd, April 2012

12

Latin Americas Decade? FDI trends and perspectives

Germany is the second investor in most

Latin American countries and it is an important source of FDI in Automotive OEM,

Automotive components and Chemicals.

FDI from the Asia Pacific region focuses on

manufacturing projects in Metals (Japan,

China, Korea), Industrial Machinery

(China), Automotive Components (Japan),

Automotive OEM (Japan, China, Korea)

and Electronics (Japan, Korea). Around

50% of Indian companies concentrate their

investments in IT and Business Services,

with Pharmaceuticals being the second key

sector for Indian companies in the region.

Finally, it is important to note that around

58% of Canadian projects and 56% of

Australian projects are found in the Metals

sectors, making these two countries a great

source for that particular sector.

A similar analysis can be done crossing the

historic data in terms of sectors and destinations of FDI to define any sector-specific

trends. The data shows that most of the

projects in Metals, Business Services, Soft-

www.ocoinsight.com

ware & IT Services, Communications and

Financial Services have a more or less

even distribution among countries of the

region with Brazil and Mexico always as

their main destination. In other sectors the

bulk of the FDI is concentrated in one of

the biggest markets of the region such as

the case of Industrial Machinery (45% in

Brazil), Automotive Components (49% in

Mexico), Chemicals (45% in Brazil), Automotive OEM (39% in Brazil), Electronic

Components (55% in Mexico), Plastics

(44% in Mexico) or Consumer Electronics

(35% in Mexico). Although other countries

have a small share in comparison to Mexico and Brazil, it is important to note upward

trends in Metals (Chile, Peru), Minerals

(Colombia, Peru, Chile, Argentina), Food

Products (Argentina, Chile), Chemicals

(Argentina, Colombia, Chile), Automotive

(Argentina), Renewable Energies (Chile,

Peru), and Pharmaceuticals (Colombia, Argentina).

Latin America as an FDI source market

Following a global trend of consolidation of

new multinational companies from emerging markets, Latin America and the Caribbean reached a record of 43, 1 billion USD

in outward FDI, according to the Economic

Commission for Latin America and the Caribbean (ECLAC). It means that the share of

Latin American outward investments in FDI

flows originating from the emerging world

nearly tripled from 6% in 2000 to 17% in

2010.

ECLAC figures for 2010 registered that

around 47% of the mergers and acquisitions and that 59% of the Greenfield investments happened within the region.19

One of the reasons behind the rise in the

Latin American outward FDI has to do with

the emergence of the so called Trans Latins or Trans-Latin American corporations

whose main investments are usually directed to neighbouring countries. The

Allan Toledo

International Business President

Banco do Brasil

In five years, we want to have 20

branches in the United States []

we will invest close to 25 million

USD to do so

19. Ibid.

OCO Global Ltd, April 2012

13

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Figure 12: FDI Outflows, Share in Latin American FDI outflows

and FDI-to-GDP Ratios, 2010

Country

FDI Outflow (Million)

Share Lat Am

GDP Ratio

Mexico

12,694

29%

1.2%

Brazil

11,500

27%

0.6%

Chile

8,744

20%

4.6%

Colombia

6,744

16%

2.3%

Source: ECLAC

Mexico, Brazil, Chile and Colombia

accounted for 92% of the outward FDI from

the region, while in per capita terms Chile

and Colombia have the highest

FDI-to-GDP ratios with 4.6% and 2.3%,

respectively, showing the internationalization of these two countries. Mexico was the

leading source of FDI from the region with

around 12,6 billion USD, largely driven by

acquisitions such as those of Bimbo

(acquired Sara Lee Group in US) and

Televisa (acquired shares in Univision), or

investments by America Mvil in

telecommunications. Brazil was the second

source with around 11.5 billion USD,

largely driven by companies from natural

resources, such as Vale do Rio or Gerdau.

Finally, the third source of FDI in the region

was Chile, reaching 8.7 billion USD,

focusing mostly on financial services and

the retail sector, driven by investments of

Cencosud and Fallabella.

In terms of projects, FDI Markets tracked

230 outward FDI projects from the region.

The preferred destination was Latin

America (57%), followed by North America

(18%) and Western Europe (8%). In terms

of countries, the United States is the main

destination with a 17% share in 2010,

followed by other Latin American countries

such as Argentina (9%) and Colombia

(9%). China is also becoming a destination

for Latin American countries with a share of

6% of the projects. As in the ECLAC

figures, the main source of FDI were Brazil

(35%), Mexico (18%) and Chile (16%) in

2010, partly due to the internationalisation

processes of these countries. When

crossing historic statistics of FDI sources

and destination, interesting trends are

found. Brazilian firms have an important

share in overall Latin American FDI into the

United States (36%)20, China (61%) and

Mexico (35%). Mexican firms are important

in Brazil (33%) and Panama (19%),

whereas Chilean firms are key investors in

Argentina (23%), Colombia (31%) and Peru

(29%).

[We] understand that large LatinAmerican companies, the

multilatinas, are rolling out ambitious strategies of globalisation.

These powerhouse players need

consistency across their global operations, in their home bases and all

over the world. That is exactly what

our investments allow us to deliver

to them.

Jeff Kelly

CEO, BT Global Services

20. % of Total FDI Projects that comes from that specific Latin American country

OCO Global Ltd, April 2012

14

Latin Americas Decade? FDI trends and perspectives

www.ocoinsight.com

Capitalising on the rise of Latin America

We can argue in conclusion that Latin

America has an exciting decade ahead. Investors and Economic Development Organisations could tap into many opportunities arising from the emerging markets of

the region. But, in order to capitalise on

these opportunities, it is worth to bear in

mind key points mentioned throughout this

paper, which might inform the strategies to

attract investment into Latin America, or to

invest in the region.

Key learnings for Latin American

Economic Development Organisations

(EDOs):

A targeted, market-driven approach is

crucial:

EDOs from the region must have a marketdriven approach and build value

propositions based on the supply-side

opportunities over the coming decades.

For instance, countries such as Chile or

Peru should target Engineering Services or

IT Services companies that serve the

booming mining sectors. Company

targeting should take into account these

supply-side opportunities arising from the

growth in infrastructure, housing and

agriculture sectors, and also highlight the

rising local private demand.

Know geographical sources of FDI and

focus efforts accordingly:

Most of the FDI into Latin America comes

from Western Europe (mainly from

Germany and Spain) and followed by North

America (United States) and Asia Pacific

(China). EDOs attracting investments for

the region should target the US states of

Florida, New York, California and Florida.

Those targeting activities in Europe should

focus on the United Kingdom, France,

Germany and Spain, depending on sectorspecific strengths. Asia Pacific is

becoming an increasingly important source

of projects, particularly from emerging

multinationals in China, India, Japan and

South Korea.

OCO Global Ltd, April 2012

Understand the main drivers behind

regions investments:

Trends show that American and Canadian

investors prefer Mexico as their principal

FDI destination to use it as a platform to

export to North America. EDOs from

Central American and Andean countries,

with strong commercial linkages to the

United States and similar wage and

location advantages can catch further

opportunities arising from these markets.

Western European FDI prefers Brazil as

their main destination triggered by local

demand and the interest of avoiding trade

barriers. This could be an opportunity for

other countries linked to Brazil, such as

Uruguay, which could become low-cost and

business-friendly platforms to target the

Brazilian market. In the case of Asia

Pacific, most FDI is mainly concentrated in

Brazil, which means that EDOs from Latin

America should increase their presence in

the region to attract a greater share of

projects.

Beyond economic management in

the country, Colombias key factors

have been an export diversification

policy and tax legislation focused on

ensuring legal security, which has

generated investor confidence.

Proexport Colombia

15

Latin Americas Decade? FDI trends and perspectives

Know where to focus your sectoral

targeting:

Most of the FDI attracted to the region is

concentrated on IT Services, Business

Services and Financial Services due to the

positioning of the region as platforms for

offshoring and near-shoring. Metals and

Industrial Machinery sectors have jumped

in the recent years due to the infrastructure

and mining booms in South America. Latin

American EDOs targeting projects on

Services should focus their activities in the

United States, United Kingdom, India and

Spain. Those targeting manufacturing

activities should focus on Germany, Japan,

China and South Korea. In the Metals

sector, Australia and Canada are becoming

an interesting source of projects, while

India is increasingly being important for

pharmaceuticals.

With the aim of diversifying our FDI

inflows beyond the mining sector,

[Chiles] Foreign Investment Committee has set up a comprehensive

portfolio of public and private projects. This will allow us to promote

concrete business opportunities in

infrastructure such as airports, maritime works, renewable energies and

electric transmission, among others.

Matias Mori,

Vice President, Foreign Investment

Committee of Chile

Latin America as a growing FDI source

for the Americas:

Latin America is becoming a source of FDI

with a new record on outward investments

in 2011. Colombia, Brazil, Chile and

Mexico are the main sources of FDI due to

the internationalisation of their firms.

Most of the outward FDI is concentrated in

Latin America, followed by North America.

OCO Global Ltd, April 2012

www.ocoinsight.com

The emergence of Trans Latin corporations

creates an opportunity for American EDOs

attracting FDI in the context of economic

slowdown in Europe, and they should

consider strengthening their activities in the

main source countries of the region.

Key learnings for investors:

Understand the drivers of growth and

consequent investment opportunities:

Investors must be aware that the rise of

Latin America is explained by a

combination of external and internal

factors. Externally, the rise of commodity

prices has created positive gains of terms

of trade for South American countries,

whose export basket is composed mainly

of food products, hydrocarbons and

minerals. The high commodity prices,

particularly in mineral and food products,

create huge opportunities for investors in

the mineral-energetic and agro-industrial

value chains. For instance, Engineering

Services or IT Services companies serving

the mining industries might find many

opportunities in the booming mining sector

of South America. Likewise, Agro-Chemical

producers could take advantage of the

booming agricultural sectors.

Meanwhile, internally, the rise of local

demand has to do with a boost on

investment as a consequence of cheaper

imports and a boost in private consumption

due to the expansion of the middle class in

several countries. From the investment

side, many investors from Industrial

Machinery and Equipment sectors could

find opportunities as a result of the drive of

modernisation of Latin American

companies. Likewise, consumptionoriented sector such as Food & Beverages

or FMCG (Fast Moving Consumer Goods)

producers could take advantage of an

increasing demand from the booming

middle class in countries such as Brazil or

Argentina.

16

FDI in Renewable Energy: a promising year ahead

Understand sub-regional differences:

Although the rising of the local demand

triggered the attraction of market-seeking

FDI across the region, investors must be

aware of the differences between the

opportunities to invest in South and Central

America. Most of the FDI going to South

America is raw-material seeking, driven by

high commodity prices and the endowment

of natural resources of the sub-region. FDI

going to Central America and Mexico is

largely attracted by the wage and location

advantages to tap into the opportunities in

North America. Investors from Electronics,

Automotive and Aerospace sectors

targeting the US market, might take

advantage to the commercial linkages this

sub-region has with that market. Likewise,

BPO and IT services companies could take

advantage of wage differentials in Central

America to near-shore from the sub-region.

Investors approaching the region should

also have a good understanding of the

often complex and different economic

OCO Global Ltd, April 2012

www.ocoinsight.com

realities and investment climates within the

region. Mexico and Central America might

be dependent on the situation of the US

economy, whereas some countries such as

Chile, Brazil and Peru might be more

resilient due to strong links with booming

Asian economies. Likewise, investors

should examine the degrees of openness

and investment climates before expanding

to the region in order to make the right

decisions to face the current slowdown.

Emerging Latin American corporates

create significant investment

opportunities:

Latin America is becoming a source of FDI

with a new record for outward investments

in 2011. The emergence of Trans-Latin

corporations creates an opportunity for

investors that might be interested in

supplying products or services to this new

generation of multinationals. It also creates

further opportunities for mergers,

acquisitions, joint-ventures and

partnerships with local regions.

17

Publication Title

www.ocoinsight.com

About OCO Insight:

OCO Insight adds value to economic development

organisations and international investors through timely

intelligence, topical publications as well as online and face-to-face

training from world-leading economic development advisors.

In the past decade, OCO has earned its reputation as one of the

worlds leading authorities on foreign investment, having worked

with some 300 economic development organisations and more

than 100 private clients on location decisions. We have

actively supported agencies in defining their strategy, delivered

training, business intelligence and investor targeting services.

Further information:

For information on our other products, upcoming schedule,

subscriptions and other packages, contact Daniel Nicholls on:

Tel: +44 (0)207 822 0710

Mobile / Cell: +44 (0)7827 383835

Email: daniel.nicholls@ocoglobal.com

www.ocoinsight.com

Join our conversations and follow us online

@OCOGlobal

OCO Forum

Potrebbero piacerti anche

- SSD FaqDocumento4 pagineSSD Faqaimen_riyadhNessuna valutazione finora

- Optical Distortion Marketing Plan for Chicken Contact LensDocumento28 pagineOptical Distortion Marketing Plan for Chicken Contact LensBhawna Khosla100% (3)

- E&Y-Accelerating PPP in India - 2012 PDFDocumento48 pagineE&Y-Accelerating PPP in India - 2012 PDFPhilip YJ KangNessuna valutazione finora

- LBL 2009WindPowerreportDocumento88 pagineLBL 2009WindPowerreportapi-27263175Nessuna valutazione finora

- Faghmous-U.S. Mobile Advertising MarketDocumento16 pagineFaghmous-U.S. Mobile Advertising MarketPhilip YJ KangNessuna valutazione finora

- The Mckinsey Chinese Luxury Consumer Survey 2012Documento40 pagineThe Mckinsey Chinese Luxury Consumer Survey 2012Philip YJ KangNessuna valutazione finora

- TRG-Onboard Versus Off-Board NavigationDocumento5 pagineTRG-Onboard Versus Off-Board NavigationPhilip YJ KangNessuna valutazione finora

- HSC Business Studies-Global Business Strategy - 2001Documento3 pagineHSC Business Studies-Global Business Strategy - 2001Philip YJ KangNessuna valutazione finora

- Annual Energy ReviewDocumento446 pagineAnnual Energy ReviewSon TranNessuna valutazione finora

- Mckinsey-Economics of Solar PowerDocumento11 pagineMckinsey-Economics of Solar PowerPhilip YJ KangNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- International Flow of FundsDocumento42 pagineInternational Flow of FundsIrfan Baloch100% (1)

- Ninth Edition: Political Economy of TradeDocumento18 pagineNinth Edition: Political Economy of Tradeprokophailaanh100% (1)

- Kenya ImportsDocumento3 pagineKenya ImportsSahil DodhiwalaNessuna valutazione finora

- Us Travel Answer SheetDocumento1 paginaUs Travel Answer SheettullerkNessuna valutazione finora

- Soft Corporate Offer (Sco) HMS 1&2: To, MisoDocumento3 pagineSoft Corporate Offer (Sco) HMS 1&2: To, MisoTrindra PaulNessuna valutazione finora

- Assignment On WB, IMF & WTODocumento18 pagineAssignment On WB, IMF & WTOdead_fahad100% (1)

- What Is NeocolonialismDocumento35 pagineWhat Is NeocolonialismKram AlviorNessuna valutazione finora

- PDocumento13 paginePTirtha MukherjeeNessuna valutazione finora

- Contract Euro Usd - 2016 - Usd ProviderDocumento21 pagineContract Euro Usd - 2016 - Usd Providerthienvupleiku0% (1)

- Hyundai Case StudyDocumento2 pagineHyundai Case StudyMuhammad Saquib Siddiqui0% (1)

- China National LC-1Documento6 pagineChina National LC-1mutantchowNessuna valutazione finora

- Ethiopia's Top Trading PartnersDocumento6 pagineEthiopia's Top Trading PartnersYohannes MulugetaNessuna valutazione finora

- Thayer China's Relations With Laos and CambodiaDocumento65 pagineThayer China's Relations With Laos and CambodiaCarlyle Alan Thayer100% (1)

- Chapter 5 Nontariff Trade BarriersDocumento57 pagineChapter 5 Nontariff Trade BarriersHeap Ke XinNessuna valutazione finora

- Notice: Certain Cut-to-Length Carbon Steel Plate From Russia: Extension of Time Limit For Final Results of Changed Circumstances ReviewDocumento1 paginaNotice: Certain Cut-to-Length Carbon Steel Plate From Russia: Extension of Time Limit For Final Results of Changed Circumstances ReviewJustia.comNessuna valutazione finora

- List of QP-NOS by SectorDocumento1.596 pagineList of QP-NOS by SectorHarshal BamboleNessuna valutazione finora

- Cotton KingDocumento2 pagineCotton Kingsarfraj_2Nessuna valutazione finora

- 2c.purchasing Power Parity TheoryDocumento9 pagine2c.purchasing Power Parity Theoryamitkmundra100% (1)

- Global Management in Today's WorldDocumento34 pagineGlobal Management in Today's Worldachintbt50% (2)

- 19th Century Changes: Economic Changes Cultural Changes Political Changes Social ChangesDocumento1 pagina19th Century Changes: Economic Changes Cultural Changes Political Changes Social ChangesShina P ReyesNessuna valutazione finora

- ADO 2021 Statistical Table GDP Growth RatesDocumento1 paginaADO 2021 Statistical Table GDP Growth RatesKarl LabagalaNessuna valutazione finora

- Benefits and Disadvantages of Make in IndiaDocumento2 pagineBenefits and Disadvantages of Make in Indiaarunabh bhattacharyaNessuna valutazione finora

- Certificate of Origin: Form ADocumento2 pagineCertificate of Origin: Form AAdministrasi Bisnis 18.03Nessuna valutazione finora

- Investment 1 To 8 Percent Growth Rate ModelDocumento16 pagineInvestment 1 To 8 Percent Growth Rate Modelmohamed.k.ismail6467Nessuna valutazione finora

- TX Client ListDocumento4 pagineTX Client Listsatishnavayuga0% (1)

- How Globalisation Has Shaped Economies and PoliticsDocumento2 pagineHow Globalisation Has Shaped Economies and PoliticsRohit KumarNessuna valutazione finora

- Group 2 - Question 5Documento18 pagineGroup 2 - Question 5Thùy Linh DươngNessuna valutazione finora

- PPP Debate—Long-Run Exchange RatesDocumento24 paginePPP Debate—Long-Run Exchange RatesCosmin TurcuNessuna valutazione finora

- Unit 3 Superpower Geographies - Power Point PresentationDocumento20 pagineUnit 3 Superpower Geographies - Power Point PresentationSanduni JinasenaNessuna valutazione finora

- Purchase Order Sheet: Unico Global IncDocumento1 paginaPurchase Order Sheet: Unico Global IncSang HàNessuna valutazione finora