Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Comparison Between Two Private Sector Banks

Caricato da

Parag MoreTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Comparison Between Two Private Sector Banks

Caricato da

Parag MoreCopyright:

Formati disponibili

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 1

INTRODUCTION

The world of banking has assumed a new dimension at dawn of the 21st century

with the advent of tech banking, thereby lending the industry a stamp of

universality. In general, banking may be classified as retail and corporate

banking. Retail banking, which is designed to meet the requirement of

individual customers and encourage their savings, includes payment of utility

bills, consumer loans, credit cards, checking account and the like. Corporate

banking, on the other hand, caters to the need of corporate customers like bills

discounting, opening letters of credit, managing cash, etc. Metamorphic changes

took place in the Indian financial system during the eighties and nineties

consequent upon deregulation and liberalization of economic policies of the

government. India began shaping up its economy and earmarked ambitious plan

for economic growth. Consequently, a sea change in money and capital markets

took place. Application of marketing concept in the banking sector was

introduced to enhance the customer satisfaction he policy of privatization of

banking services aims at encouraging the competition in banking sector and

introduction of financial services. Consequently, services such as Demat,

Internet banking, Portfolio Management, Venture capital, etc, came into

existence to cater to the needs of public. An important agenda for every banker

today is greater operational efficiency and customer satisfaction. The mew

watchword for the bank is pretty ambitious: customer delight. The introduction

to the marketing concept to banking sectors can be traced back to American

Banking Association Conference of 1958. Banks marketing can be defined as

the part of management activity, which seems to direct the flow of banking

services profitability to the customers. The marketing concept basically requires

that there should be thorough understanding of customer need and to learn about

1

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

market it operates in. Further the market is segmented so as to understand the

requirement of the customer at a profit to the banks.

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 2

DEFINITION OF BANK

The Oxford dictionary defines the Bank as,

An establishment for the custody of money, which it pays out, on a customers

order.

According to Whitehead

A Bank is defined as an institution which collects surplus funds from the

public, safeguards the, and makes them available to the true owner when

required and also lends sums be their true owners to those who are in need of

funds and can provide security.

Banking Company in India has been defined in the Banking Companies

act1949,One which transacts the business of banking which means the

accepting, for the purpose of lending or investment of the deposits of money

from the public, repayable on demand, or otherwise and withdraw able be

cheque draft, order or otherwise.The banking system is an integral subsystem

of the financial system. It represents an important channel of collecting small

savings form the households and lending it to the corporate sector. The Indian

banking system has Reserve Bank of India (RBI) as the apex body for all

matters relating to the banking system. It is the central Bank of India. It is also

known as the Banker to All Other Banks.

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 3

PRIVATE SECTOR BANKS

All those banks where greater parts of stake or equity are held by the private

shareholders and not by government are called "private-sector banks". These are

the major players in the banking sector as well as in expansion of the business

activities India. The present private-sector banks equipped with all kinds of

contemporary innovations, monetary tools and techniques to handle the

complexities are a result of the evolutionary process over two centuries. They

have a highly developed organizational structure and are professionally

managed. Thus they have grown faster and stronger since past few years

The part of the economy that is not state controlled, and is run by individuals

and companies for profit. The private sector encompasses all for-profit

businesses that are not owned or operated by the government. Companies and

corporations that are government run are part of what is known as the public

sector, while charities and other nonprofit organizations are part of the voluntary

sector.

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 4

PRIVATIZATION OF INDIAN BANKING

For the public sector banks, the era of bumper profit is over. For much of the

last decade the process of collaborated financial liberalization had cleared up

the Banks balance sheet enabling them to with stand increased competition,

global financing, turmoil and even unprotected industrial slow down. But the

cycle of liberalization has run its full course. Now it is the time for the big

structural leap, rationalization, mergers, and privatization. Unless the banks

undertake these fundamental changes, their profit will stay under pressure.

There are two areas of competitions which banking industry is facing

internationally and nationally. In the pre-liberalization era, Indian banks could

grow in a closed economy but the banking sector opened up for private

competition. It is possible that private banks could become dominant players

even within India. It has been recorded a rapid rise of the new private sector

banks and it has tracked the transformation of the public sector banks as they

grapple with the changes of financial deregulation.

Use of ATM cards, Internet Banking, Phone Banking, Mobile Banking are the

new innovative channels of banking which are being widely used as they result

in saving both time and money which are two essential things that every one is

short of and is running to catch hold of them. Moreover private sector banks

are aligning its infrastructures, marketing quality and technology to build

deep commitment in building consumer and retail banking. The main focus of

these banks is on innovative range of services or products.

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 5

HISTORY & EVALUATION OF PRIVATE SECTOR

BANKS

Private-sector banks have been functioning in India since the very beginning of

the banking system. Initially, during 1921, the private banks like bank of

Bengal, bank of Bombay and bank of Madras were in service, which all

together formed Imperial Bank of India.

Reserve Bank of India (RBI) came in picture in 1935 and became the centre of

every other bank taking away all the responsibilities and functions of Imperial

bank. Between 1969 and 1980 there was rapid increase in the number of

branches of the private banks. In April 1980, they accounted for nearly 17.5

percent of bank branches in India. In 1980, after 6 more banks were

nationalized, about 10 percent of the bank branches were those of private-sector

banks. The share of the private bank branches stayed nearly same between 1980

and 2000.

Then from the early 1990s, RBI's liberalization policy came in picture and with

this the government gave licenses to a few private banks, which came to be

known as new private-sector banks.

There are two categories of the private-sector banks: "old" and "new".

The old private-sector banks have been operating since a long time and may be

referred to those banks, which are in operation from before 1991 and all those

banks that have commenced their business after 1991 are called as new privatesector banks.[

6

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Housing Development Finance Corporation Limited was the first private bank

in India to receive license from RBI as a part of the RBI's liberalization policy

of the banking sector, to set up a bank in the private-sector banks in India.

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

LIST OF PRIVATE SECTOR BANKS

Old private sector banks

New private banks

Catholic Syrian Bank Ltd.

Axis Bank Ltd.

City Union Bank Ltd.

Development Credit Bank Ltd.

Dhanalakshmi bank Ltd.

HDFC Bank Ltd.

Federal Bank Ltd.

ICICI Bank Ltd.

ING Vysya Bank Ltd.

Induslnd Bank Ltd.

Jammu & Kashmir Bank Ltd.

Kotak Mahindra Bank Ltd.

Karnataka Bank Ltd.

Yes Bank Ltd.

Karur Vysya Bank Ltd.

Lakshmi Vilas Bank Ltd.

Nainital Bank Ltd.

Ratnakar Bank Ltd.

South Indian Bank Ltd.

Tamilnad Mercantile Bank Ltd.

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 6

7 PS OF THE PRIVATE SECTOR BANKS

PRODUCT

(A) DEPOSITS: Savings, Current, Fixed etc.

(B) ADVANCES: a) Term Loan, b) Clean Loan, c) Bills Discounting, d)

Advances, e) Pre-shipment Finance, f) Post-shipment finance, g) Secured and

Unsecured lines of credit.

(2) Non-fund oriented: a) Guarantees, and b) Letter of Credit.

(C) INTERNATIONAL BANKING: a) Letter of Credit, and b) Foreign

Currency.

(D) CONSULTANCY: a) Investment Counseling, b) Project Counseling, c)

Merchant Banking, and d) Tax Consultancy.

(E) MISCELLANEOUS: a) Traveler Cheques, b) Credit card, c) Remittances,

d) Collections, e) Sale of Drafts, f) Standing instructions, and g) Trusteeship.

As seen in the goods-service continuum, your product can have both tangible

and intangible aspects, and is the thing you offer to satisfy your customers

wants and needs. Within this element, you need to consider such things as your

product range; its quality and design; its features and the benefits it offers;

sizing and packaging; and any add-on guarantees and customer service

offerings.

PRICE

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

The price mix in the banking sector is nothing but the interest rates charged by

the different banks.

Let's understand this with an example. A particular buyer approaches for a car

loan say for a period of 3 years. He is charged Rs. 20,000 as interest. however if

a sales representative of another bank comes to know of this deal he will try to

attract the customer by giving him a better deal that is a loan at a lower rate on

interest. In this way due to the high level of competition the customer benefits.

PROMOTION

Promotion is nothing but making the customer more and more aware of the

services and benefits provided by the bank.

The banks today can use a lot of new technology to communicate to their

customers. Two of the fastest growing modern tools of communicating with the

customers are:

1. Internet Banking

2. Mobile Banking

PLACE

Place mix is the location analysis for banks branches. There are number a

factors affecting the determination of the location of the branch of bank. Like

population characteristics, commercial, proximity of other commercial outlets.

Your choice of such channels is important, as is the variety of channels you use.

For example, a common issue for businesses beginning to trade on-line is how

that will affect their off-line business, for example selling directly through the

10

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

web could alienate retail outlets that have been the mainstay of your business in

the past.

PEOPLE

The impact that your people can have on your marketing cannot be

underestimated. At its most obvious, this element covers your front line sales

and customer service staff who will have a direct impact on how your product is

perceived. You need to consider the knowledge and skills of your staff; their

motivation and investment in supporting your brand. Any element of the

marketing mix will also have its impact on other elements of your business, but

the people element is one where the importance of regarding marketing as an

integral part of the way you do business is crystal clear.

PROCESS

The process mix constitutes the overall procedure involved in using the services

offered by the bank.

Let's take for example the process for application for a car loan.

Now this mainly involves 3 things.

1. Producing of proper documents

2. Filling up of application form

3. Paying for the initial down payment

PHYSICAL EVIDENCE

Physical evidence is the overall layout of the place. How the entire bank has

been designed. Physical evidence refers to all those factors that helps make the

11

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

process much easier and smoother. For example in case of a bank the physical

evidence would be the placement of the customer service executive's desk, or

the location of the place for depositing Cheques.

CHAPTER 7

COMPANY PROFILE

INDUSTRIAL CREDIT & INVESTMENT

CORPORATION OF INDIA

INTRODUCTION TO ICICI BANK

ICICI Bank is Indias second-largest bank with total assets of Rs. 3,663.74

billion (US$ 76 billion) at September 30, 2009 and profit after tax Rs. 19.18

billion (US$ 398.8 million) for the half year ended September 30, 2009. The

Bank has a network of 1,588 branches and about 4,883 ATMs in India and

presence in 18 countries. ICICI Bank offers a wide range of banking products

12

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

and financial services to corporate and retail customers through a variety of

delivery channels and through its specialised subsidiaries and affiliates in the

areas of investment banking, life and non-life insurance, venture capital and

asset management. The Bank currently has subsidiaries in the United

Kingdom, Russia and Canada, branches in United States, Singapore, Bahrain,

Hong Kong, Sri Lanka, Qatar and Dubai International Finance Centre and

representative offices in United Arab Emirates, China, South Africa,

Bangladesh, Thailand, Malaysia and Indonesia. Our UK subsidiary has

established branches in Belgium and Germany.

ICICI Banks equity shares are listed in India on Bombay Stock Exchange and

the National Stock Exchange of India Limited and its American Depositary

Receipts (ADRs) are listed on the New York Stock Exchange (NYSE).

HISTORY OF ICICI BANK

ICICI Bank was originally promoted in 1994 by ICICI Limited, an Indian

financial institution, and was its wholly-owned subsidiary. ICICIs

shareholding in ICICI Bank was reduced to 46% through a public offering of

shares in India in fiscal 1998, an equity offering in the form of ADRs listed on

the NYSE in fiscal 2000, ICICI Banks acquisition of Bank of Madura Limited

in an all-stock amalgamation in fiscal 2001, and secondary market sales by

ICICI to institutional investors in fiscal 2001 and fiscal 2002. ICICI was

formed in 1955 at the initiative of the World Bank, the Government of India

and representatives of Indian industry. The principal objective was to create a

development financial institution for providing medium-term and long-term

project financing to Indian businesses. In the 1990s, ICICI transformed its

business from a development financial institution offering only project finance

to a diversified financial services group offering a wide variety of products and

13

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

services, both directly and through a number of subsidiaries and affiliates like

ICICI Bank. In 1999, ICICI become the first Indian company and the first

bank or financial institution from non-Japan Asia to be listed on the NYSE.

After consideration of various corporate structuring alternatives in the context

of the emerging competitive scenario in the Indian banking industry, and the

move towards universal banking, the managements of ICICI and ICICI Bank

formed the view that the merger of ICICI with ICICI Bank would be the

optimal strategic alternative for both entities, and would create the optimal

legal structure for the ICICI groups universal banking strategy. The merger

would enhance value for ICICI shareholders through the merged entitys

access to low-cost deposits, greater opportunities for earning fee-based income

and the ability to participate in the payments system and provide transactionbanking services. The merger would enhance value for ICICI Bank

shareholders through a large capital base and scale of operations, seamless

access to ICICIs strong corporate relationships built up over five decades,

entry into new business segments, higher market share in various business

segments, particularly fee-based services, and access to the vast talent pool of

ICICI and its subsidiaries. In October 2001, the Boards of Directors of ICICI

and ICICI Bank approved the merger of ICICI and two of its wholly-owned

retail finance subsidiaries, ICICI Personal Financial Services Limited and

ICICI Capital Services Limited, with ICICI Bank.

14

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

THE 7 Ps OF ICICI BANK

PRODUCT MIX:

1. DEPOSITS:

ICICI Bank offers wide variety of Deposit Products to suit our requirements.

Coupled with convenience of networked branches/ over 1800 ATMs and

facility of E-channels like Internet and Mobile Banking, ICICI Bank brings

banking at your doorstep.

Savings Account: ICICI Bank offers a power packed Savings Account with a

host of convenient features and banking channels to transact through. So now

you can bank at your convenience, without the stress of waiting in queues.

15

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Senior Citizen Services: The Senior Citizen Services from ICICI Bank has

several advantages that are tailored to bring more convenience and enjoyment

in your life.

Young Stars: Its really important to help children learn the value of finances

and money management at an early age. Banking is a serious business, but we

make banking a pleasure and at the same time children learn how to manage

their personal finances.

Fixed Deposits: Safety, Flexibility, Liquidity and Returns!!!! A combination

of unbeatable features of the Fixed Deposit from ICICI Bank.

Recurring Deposits: Through ICICI Bank Recurring Deposit you can invest

small amounts of money every month that ends up with a large saving on

maturity. So you enjoy twin advantages- affordability and higher earnings.

Roaming Current Account: Only Roaming Current Account from ICICI

Bank travels the distance with your business. You can access your accounts at

over 500 networked branches across the country.

Bank @ Campus: Thanks to bank@campus, child can now surf the Net and

access all the details of his / her account at the click of a mouse! No need to

visit the bank branch at all.

ICICI Bank Salary Account: is a benefit-rich payroll account for Employers

and Employees. As an organization, you can opt for our Salary Accounts to

enable easy disbursements of salaries and enjoy numerous other benefits too.

2. INVESTMENTS

16

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Along with Deposit products and Loan offerings, ICICI Bank assists you to

manage your finances by providing various investment options such as:

ICICI Bank Tax Saving Bonds

Government of India Bonds

Investment in Mutual Funds

Initial Public Offers by Corporate

Investment in Pure Gold

Foreign Exchange Services

Senior Citizens Savings Scheme, 2004

3. ANYWHERE BANKING

ICICI Bank is the second largest bank in the country. It services a customer

base of more than 5 million customer accounts through a multi-channel access

network. This includes more than 500 branches and extension counters, over

1800 ATMs, Call Centre and Internet Banking.

Thus, one can access the various services ICICI Bank has to offer at anytime,

anywhere and from anyplace.

4. LOAN

a) Home Loans

b) Personal Loans

c) Car Loans

d) Two Wheeler Loans

e) Commercial Vehicle Loans

f) Loans against Securities

g) Farm Equipment Loans

h) Construction Equipment Loans

i) Office Equipment Loans

17

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

j) Medical Equipment Loans

5. CARDS

a) Credit Card: ICICI Bank Credit Cards give you the facility of cash,

convenience and a range of benefits, anywhere in the world. These benefits

range from life time free cards, Insurance benefits, global emergency

assistance service, discounts, utility payments, travel discounts and much

more.

b) Debit ATM Card: The ICICI Bank Debit Card is a revolutionary form of

cash that allows customers to access their bank account around the clock,

around the world. The ICICI Bank Debit Card can be used for shopping at

more than 100,000 merchants in India and 13 million merchants worldwide.

c) Travel Card: Presenting ICICI Bank Travel Card. The Hassle Free way to

Travel the world. Traveling with US Dollar, Euro, Pound Sterling or Swiss

Francs; Looking for security and convenience; take ICICI Bank Travel Card.

Issued in duplicate. Offers the Pin based security. Has the convenience of

usage of Credit or Debit card.

6. DEMAT SERVICES

ICICI Bank Demat Services boasts of an ever-growing customer base of over 7

lacs account holders. In their continuous endeavor to offer best of the class

services to our customers we offer the following features:

Digitally signed transaction statement by e-mail.

Corporate benefit tracking.

18

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

e-Instruction facility facility to transfer securities 24 hours a day, 7 days

a week through Internet Interactive Voice Response (IVR) at a lower cost.

Dedicated specially trained customer care executives at their call centre,

to handle all queries.

7. MOBILE BANKING

With ICICI Bank, banking is no longer what it used to be. ICICI Bank offers

Mobile Banking facility to all its Bank, Credit Card and Demat customers.

ICICI Bank Mobile Banking enables you to bank while being on the move.

8. NRI SERVICES

ONLINE MONEY TRANSFER facility available to NRIs worldwide

through www.money2India.com at the click of a button

Benefits:

FREE Money transfers into accounts with over 30 banks in India

Demand Drafts issued and payable at over 1250 locations in India

ONLINE Tracking of the status of your funds

SUPERIOR Exchange rates

OFFLINE MONEY TRANSFER facility is also available across

geographies through

Local branches and in association with partner banks/ exchange houses.

19

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

PRICING MIX:

The pricing decisions or the decisions related to interest and fee or commission

charged by banks are found instrumental in motivating or influencing the

target market.

The RBI and IBA are concerned with regulations. The rate of interest is

regulated by the RBI and other charges are controlled by IBA.

The pricing policy of a bank is considered important for raising the number of

customers the accretion of deposits. Also the quality of service provided has

direct relationship with the fees charged. Thus while deciding the price mix

customer services rank the top position.

20

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

The banking organizations are required to frame two- fold strategies. First, the

strategy is concerned with interest and fee charged and the second strategy is

related to the interest paid. Since both the strategies throw a vice- versa

impact, it is important that banks attempt to establish a correlation between

two. It is essential that both the buyers as well as the sellers have feeling of

winning.

PROMOTION MIX:

Advertising: Television, radio, movies, theatres

Print media: hoardings, newspaper, magazines

Publicity: road shows, campus visits, sandwich man, Sponsorship

Sales promotion: gifts, discount and commission, incentives,etc.

Personal selling: Cross-sale (selling at competitors place),personalized

service.

Telemarketing: ICICI one source Call center (mind space)

IMPORTANT 4 P`S OF ICICI BANK

PLACE:

This component of marketing mix is related to the offering of services. The

services are sold through the branches.

The 2 important decision making areas are: making available the promised

services to the ultimate users and selecting a suitable place for bank branches.

The number of branches OF ICICI: 1900 in India and 33 in Mumbai.

21

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

PEOPLE:

All people directly or indirectly involved in the consumption of banking

services are an important part of the extended marketing mix. Knowledge

Workers, Employees, Management and other Consumers often add significant

value to the total product or service offering. It is the employees of a bank

which represent the organisation to its customers.

In a bank organization, employees are essentially the contact personnel with

customer. Therefore, an employee plays an important role in the marketing

operations of a service organisation.

To realize its potential in bank marketing, ICICI become conscious in its

potential in internal marketing the attraction, development, motivation and

retention of qualified employee-customers through need meeting job-products.

Internal marketing paves way for external marketing of services. In internal

marketing a variety of activities are used internally in an active, marketing like

manner and in a coordinated way.

The starting point in internal marketing is that the employees are the first

internal market for the organization.

The basic objective of internal marketing is to develop motivated and customer

conscious employees.

A service company can be only as good as its people. A service is a

performance and it is usually difficult to separate the performance from the

people.

If the people meet customers expectations, then neither does the service.

Therefore, investing in people quality in service business means investing in

product quality.

22

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

PROCESS:

Flow of activities: All the major activities of ICICI banks follow RBI

guidelines. There has to be adherence to certain rules and principles in the

banking operations. The activities have been segregated into various

departments accordingly.

Standardization: ICICI bank has got standardized procedures got typical

transactions. In fact not only all the branches of a single-bank, but all the

banks have some standardization in them. This is because of the rules they are

subject to. Besides this, each of the banks has its standard forms,

documentations etc. Standardization saves a lot of time behind individual

transaction.

Customization: There are specialty counters at each branch to deal with

customers of a particular scheme. Besides this the customers can select their

deposit period among the available alternatives.

Number of steps: Numbers of steps are usually specified and a specific

pattern is followed to minimize time taken.

Simplicity: In ICICI banks various functions are segregated.

Separate

counters exist with clear indication. Thus a customer wanting to deposit

money goes to deposits counter and does not mingle elsewhere. This makes

procedures not only simple but consume less time. Besides instruction boards

in national boards in national and regional language help the customers further

.

23

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Customer involvement: ATM does not involve any bank employees. Besides,

during usual bank transactions, there is definite customer involvement at some

or the other place because of the money matters and signature requires.

PHYSICAL EVIDENCE:

Physical evidence is the material part of a service. Strictly speaking there are

no physical attributes to a service, so a consumer tends to rely on material

cues. There are many examples of physical evidence, including some of the

following:

Internet/web pages

Paperwork

Brochures

Furnishings

Business cards

The building itself (such as prestigious offices or scenic headquarters)

The physical evidences also include signage, reports, punch lines, other

tangibles, employees dress code etc.

Signage: Each and every bank has its logo by which a person can identify the

company. Thus such sign ages are significant for creating visualization and

corporate identity.

Financial reports: The Company financial reports are issued to the customers

to emphasis or credibility.

24

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Tangibles: Bank gives pens, writing pads to the internal customers. Even the

passbooks, cheque books, etc reduce the inherent intangibility of services.

Punch lines: Punch lines or the corporate statement depict the philosophy and

attitude of the bank. Banks have influential punch lines to attract the

customers.

Employees dress code: ICICI bank follows a dress code for their internal

customers. This helps the customers to feel the ease and comfort.

ICICI STRATEGY FOR PROMOTION OF FINANCIAL INCLUSION

ICICI Bank has taken up specific initiatives to ramp up financial literacy as well

as intermediation to the underserved and under banked segments in both rural

and urban areas.

ICICI Banks financial intermediation models, both through the microfinance

institutions and business correspondents have been designed to build a

repository of information with regard to financial behaviour of the customers.

ICICI Banks Financial Intermediation Models:

25

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

With focus on low-income segments, ICICI Bank has come up with innovative

delivery channels:

Microfinance

ICICI Bank works closely with MFIs and NGOs to adapt its products to suit

consumer needs.

Two innovative models have helped achieve scale in serving the low-income

household:

a) Partnership Model being implemented with NGOs and MFIs: Under this

model ICICI Bank forges an alliance with existing MFIs wherein the MFI

undertakes the promotional role of identifying, training and promoting the

micro-finance clients and the ICICI Bank finances the clients directly on the

recommendation of the MFI, so the customer and portfolio resides in the Banks

book.

b) Securitisation of Portfolios of MFIs: Under this model ICICI Bank buys out

portfolios from MFIs. The MFI continues to service the clients and acts as the

collection agent. Here again, the MFI shares the credit risk with the Bank. A

variant of the securitisation model is on-tap securitisation, wherein the MFI

receives an advance purchase consideration to create a portfolio of loans that

could then be periodically sold to ICICI Bank.

Technology

26

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

The Bank has been actively looking at technology solutions to scale up the

micro finance portfolio. Further, the Bank has been considering adopting a 'Core

Banking System' (CBS) for managing the loan portfolio generated under the

partnership model. In this regard, the Bank has found an able partner in FINO to

provide technology solutions to the micro finance sector. The technology

solution comprises of core banking and smart card systems. In light of the

technology solutions available through FINO, the Bank has designed a new

process for delivering loans under the partnership model.

Some of the key aspects where a strong technology platform will add value to

the micro finance operations include reduction in transaction cost; better data

management and reporting capacities and capability to interface with multiple

peripherals, etc. This will also enable enhanced disclosure and transparency in

the operations of MFIs, setting a platform for robust securitisation / buyout

opportunities to meet the priority sector lending objectives of the regulator.

Business Correspondent

In line with the RBI guidelines ICICI Bank employs Business Correspondent

(BC) model to extend financial services, especially the much-needed savings

services to rural customers.

In the pilot stage, the transactions by BC are being done with the help of an 'ePassbook' and an Authentication Device (AD). The e-Passbook can display and

store the customer KYC information, customer account details and the

transactions in each account. It also has a unique feature of biometric

authentication by the way of fingerprints, thereby mitigating the risk related to

PIN (Personal Identification Number) in the rural scenario.

27

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

ADs provide Customer interface with user-friendly menu options, enabling

transactions. An authorized operator is enrolled by capturing the fingerprints of

all the 10 fingers to mitigate fraud risk, can operate each AD. The transaction is

recorded on the AD, which at specific intervals would be uploaded and updated

in the Bank's system through a normal telephone line, which is a widely

available infrastructure even in remote rural areas. Further connectivity through

GSM and CDA would also be made possible to ensure that the transaction

details are updated in the Banks system at higher frequency.

Multiple products

ICICI Bank offers a complete suite of products and services to meet the

individual

financial requirements of customer segments. Savings, investments and

insurance

products are made available to its rural and agri customer base. The Bank also

offers microfinance services to low-income households and crop loans, farm

equipment loans, commodity based loans to farmers.

Hybrid channels

ICICI Bank employs delivery channels backed by technological innovations to

achieve scale and outreach in a sustainable manner. The Banks channel

28

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

architecture includes branch and non-branch channels. Branches act as a

business

hub providing banking services on the one hand, while facilitating the fulfilment

of

products that have been sourced by the business facilitators and business

correspondents.

Non-branch channels are of two types, business facilitators and business

correspondents.

CHAPTER 8

COMPANY PROFILE

HOUSING DEVELOPMENT FINANCE

CORPORATION

HDFC BANK

HDFC Bank is India's second-largest bank with total assets of Rs.

3,849.70 billion (US$ 82 billion) at September 30, 2008 and profit after tax Rs.

17.42 billion for the half year ended September 30, 2008. The Bank has a

network of about 1,400 branches and 4,530 ATMs in India and presence in 18

countries. HDFC Bank offers a wide range of banking products and financial

services to corporate and retail customers through a variety of delivery channels

and through its specialized subsidiaries and affiliates in the areas of investment

29

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

banking, life and non-life insurance, venture capital and asset management. The

Bank currently has subsidiaries in the United Kingdom, Russia and Canada,

branches in United States, Singapore, Bahrain, Hong Kong, Sri Lanka, Qatar

and Dubai International Finance Centre and representative offices in United

Arab Emirates, China, South Africa, Bangladesh, Thailand, Malaysia and

Indonesia. Our UK subsidiary has established branches in Belgium and

Germany.

HDFC Bank's equity shares are listed in India on Bombay Stock Exchange and

the National Stock Exchange of India Limited and its American Depositary

Receipts (ADRs) are listed on the New York Stock Exchange (NYSE).

HISTORY OF HDFC BANKS

HDFC Bank was originally promoted in 1994 by HDFC Limited, an Indian

financial institution, and was its wholly-owned subsidiary. HDFC's shareholding

in HDFC Bank was reduced to 46% through a public offering of shares in India

in fiscal 1998, an equity offering in the form of ADRs listed on the NYSE in

fiscal 2000, HDFC Bank's acquisition of Bank of Madura Limited in an allstock amalgamation in fiscal 2001, and secondary market sales by HDFC to

institutional investors in fiscal 2001 and fiscal 2002. HDFC was formed in 1955

at the initiative of the World Bank, the Government of India and representatives

of Indian industry.

The principal objective was to create a development financial institution for

providing medium-term and long-term project financing to Indian businesses. In

the 1990s, HDFC transformed its business from a development financial

30

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

institution offering only project finance to a diversified financial services group

offering a wide variety of products and services, both directly and through a

number of subsidiaries and affiliates like HDFC Bank. In 1999, HDFC become

the first Indian company and the first bank or financial institution from nonJapan Asia to be listed on the NYSE.

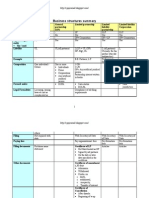

OBJECTIVES OF HDFC BANK

HDFC Bank has taken several initiatives as part of its corporate social

responsibility. It has collaborated with several NGOs to assist in its activities.

Initiative

Objective

Activities

Facts/Figures

Sustainable

Provide

Training for Occupation

Reached 20 lakh

Livelihood

livelihood

Skills

households across

finance to

Credit Counseling

24 states

empower rural

Financial Literacy

people,

Market Linkages

especially

women at the

31

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

bottom of the

pyramid

Provide

600 government

affordable

schools across

access to basic

banking

Literacy programs in

Financial

products and

schools

Literacy

services to

Power of Banking

excluded and

workshops

underprivileged

education by

Education

providing

quality

education to

children

Training

literacy programs

3365 students

across 6 locations

workshops

society

importance of

& Odisha in

covered in

sections of the

Spread the

Andhra Pradesh

Galli School Project

Grow with Books

Library programs

Engineering scholarships

Child development

program

Family based care

A large number of

students reached

through various

programs across

the country

programs

Enhance

Skill-based courses

More than 1500

employability

Technical & vocational

youth benefitted

of youth and

training

through various

women in the

Basic computer

programs across

weaker sections programming

32

the country

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

of the society

by providing

training and

capacity

Educational support for

children

development

Enable

Community

economic

Rain water harvesting

growth and

programs

sustainable

Setting up blood storage

development

facilities

through

Construction of sanitation

community

facilities in schools

building

Child Aid Foundation

programs

Go Green

150 tribal girls

benefitted through

sanitation project

350 poor and

needy children

supported

1600+ children

rescued

Take

Promoting paperless

As of Mar 2013,

responsibility

banking

82% of customer-

for the effects

Multi-channel delivery

initiated retail

of the

(Internet, Mobile, Phone,

transactions direct

operations of

ATM)

banking channels,

the Bank on the Energy efficiency

reducing the need

environment

to commute

Green infrastructure

and the society.

66 lakh retail

customers

subscribed for estatement

20 ATMs

33

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

operating on clean

energy

PRODUCTS PROVIDED BY HDFC BANK

NRI banking

Under NRI Banking, HDFC offers:

Accounts & Deposits

Money Transfer

Investments & Insurance

Research Reports

34

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Payment Services

Wholesale banking

HDFC offers Wholesale Banking for Corporates and Financial Institutions &

Trusts. The Bank also provides services such as Investment Banking and other

services in the Government sector.

SERVICES PROVIDED BY HDFC BANK

35

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Wholesale banking services

HDFC Bank provides a range of commercial and transactional banking services,

including working capital finance, trade services, transactional services, cash

management, etc. to large, small and mid-sized corporates and agriculture-based

businesses in India. The bank is also a leading provider of these services to its

corporate customers, mutual funds, stock exchange members and banks.[14]

Retail banking services

HDFC Bank was the first bank in India to launch an International Debit Card in

association with VISA (Visa Electron). The bank also issues the

MasterCard Maestro debit card. The Bank launched its credit card business in

late 2001. By the end of June 2013, it had a credit card base of 5.94 million. By

March 2012, the bank had a total card base (debit and credit cards) of over 19.7

million. The Bank is also one of the leading players in the "merchant acquiring"

business with over 240,000 point-of-sale (POS) terminals for debit / credit cards

acceptance at merchant establishments. The Bank is positioned in various net

based B2C opportunities including a wide range of Internet banking services for

Fixed Deposits, Loans, Bill Payments, etc.

Treasury

The bank has three main product areas - Foreign Exchange and Derivatives,

Local Currency Money Market & Debt Securities, and Equities. These services

are provided through the bank's Treasury team. To comply with statutory

reserve requirements, the bank is required to hold 25% of its deposits in

government securities. The Treasury business is responsible for managing the

returns and market risk on this investment portfolio.

EMPLOYMENT PROVIDED BY HDFC BANK

36

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

As of 31 March 2013, the company has 69,065 employees, out of which 12,295

are women (17.80%). In June 2013, the company reported an annual attrition

rate of approx. 20%. During the financial year 2012-13, the company incurred

INR 42 billion on employee benefit expenses.

OPERATIONAL AREA OF HDFC BANK

As of 30 September 2013, HDFC Bank has 3,251 branches and 11,177 ATMs,

in 2,022 cities in India, and all branches of the bank are linked on an online realtime basis. The Bank has overseas branch operations in Bahrain and Hong

Kong.

HDFC Bank has two subsidiaries:

HDB Financial Services Limited (HDBFS): HDBFS is engaged in retail asset

financing. It is a non-deposit taking non-bank finance company (NBFC). Apart

from lending to individuals, the company grants loans to micro, small and

medium business enterprises. It also runs call centers for collection services to

the HDFC Banks retail loan products. HDFC Bank holds 97.4% shares in

HDBFS. As of March 31, 2013, HDBFS has 230 branches in 184 cities. During

the FY 2012-13, HDBFS had turnover of INR 9.6 billion and profit after tax of

INR 1 billion. It has 6,404 employees as of 31 March 2013.

HDFC Securities Limited (HSL): HSL is engaged in stock broking. As of

March 31, 2013, HDBFS has 194 branches across 150 cities. HDFC Bank has

62.1% shareholding in HSL. During the FY 2012-13, HSL had turnover of INR

37

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

2.3 billion and profit after tax of INR 668 million. During the year, the

Company received the Best e-Brokerage Award - 2012 in the Outlook Money

Awards in the runner up category.

38

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

CHAPTER 9

SWOT ANALYSIS

ICICI:STRENGTHS:

Branch network, brand name, very fast service, No. one private sector bank of

India,

WEAKNESS:

High average balance maintenance, maintenances charges are high.

OPPORTUNITIES:

Untapped rural market of India

THREATS:

Emerging private banks like Citibank and HDFC bank

HDFC:STRENGTH:

Maintains the highest level of ethical standards, professional integrity, corporate

governance and regulatory compliance, Operational Excellence, Customer

Focus, Product Leadership and People.

WEAKNESS:

39

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Limited number of branches

OPPRTUNITIES:

Untapped rural markets of India.

THREATS:

Competition among the private players.

CHAPTER 10

COMPARISON OF FINANCIAL RATIOS OF TWO

BANKS

TOTAL ASSETS

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

491599.50

594641.60

590503

649129.29

120.11

109.16

TOTAL SHARE CAPITAL

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

479.81

1155.04

501.30

1159.66

100.70

100.39

NET WORTH

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

43478.63

62009.42

142.62

40

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

ICICI

73213.32

80429.36

109.85

DEPOSITS

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

367337.48

331913.66

450795.64

361562.73

122.71

108.93

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

303000.27

338702.65

365495.03

387552.07

120.62

114.42

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

120951.07

177021.82

166459.95

186580.03

137.62

105.39

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

39438.99

154759.05

45213.56

172417.35

114.64

111.41

ADVANCES

INVESTMENTS

BORROWINGS

TOTAL DEBT

41

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

406776.47

486672.71

496009.20

533980.08

121.93

109.72

TOTAL LIABILITIES

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

491599.50

594641.58

590503.08

649129.30

120.11

109.16

CASH & BALANCES WITH RBI

BANKS IN RS.

2014

2015

% change

(CRORES)

HDFC

ICICI

25345.63

21821.83

27510.45

25652.91

108.54

117.55

CHAPTER 11

CONCLUSION

42

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

Almost all the Banks offer similar features and facilities with their Savings

accounts. There are certain reasons for existing customers of Saving Account

of any Bank to shift to another Bank.

The level of service in terms of delivering whatever is promised, fast

response in case of problems, is the most important benefit that the

customers seek, from the Bank they have a Saving Account with.

1. Network reach and visibility of a Bank is a very important criterion for

the customer while opening a Saving Account. We can also conclude

from our analysis that network reach in terms of Branches and ATMs is

directly proportional to the market share in case of Private Players.

2. In case of a new customer, if a bank approaches it first for opening a

Saving Account with them, then there is a good chance for the bank of

getting many future businesses and cross sales from the deal.

3. Aggressive Marketing is the key to increasing the market share in this

area, since the market has a lot of potential both in terms of untapped

market.

AS COMPARED TO OTHER PRIVATE SECTOR BANKS IN INDIA,

NOW-A-DAYS HDFC BANK IS GROWING RAPIDLY IN IT`S ALL THE

DEPARTMENTS

LIKE

TOTAL

ASSETS,

SHARE

CAPITAL,

NETWORTH & IT`S INVESTMENTS.

WHEN WE COMPARED HDFC BANK AMONG ICICI BANK MOST

OF CUSTOMERS GO WITH THE HDFC BANK BECAUSE OF ITS

INNOVATIVE PRODUCTS & BETTER SERVICE QUALITY.

CHAPTER 12

WEBILOGRAPHY

43

COMPARISON BETWEEN TWO PRIVATE SECTOR BANKS

http://www.icicibank.com/

http://www.hdfcbank.com/

www.moneycontrol.com/

44

Potrebbero piacerti anche

- Introduction and Functions of Nationalized BankDocumento10 pagineIntroduction and Functions of Nationalized BankPrashant MunnolliNessuna valutazione finora

- SBIDocumento62 pagineSBISuru SurelaNessuna valutazione finora

- SBI (State Bank of India)Documento2 pagineSBI (State Bank of India)dashgreevlankeshNessuna valutazione finora

- Customer Services of ICICI and HDFC BankDocumento64 pagineCustomer Services of ICICI and HDFC BankShahzad Saif100% (1)

- Icici BankDocumento108 pagineIcici Bankmultanigazal_4254062100% (3)

- Axis Bank Research PaperDocumento53 pagineAxis Bank Research PaperRuchika Rai0% (1)

- Introduction To IciciDocumento3 pagineIntroduction To Iciciayushitanwar94Nessuna valutazione finora

- CP of Sbi BankDocumento4 pagineCP of Sbi Bankharman singh0% (1)

- Black Book ProjectDocumento4 pagineBlack Book ProjectSwapnil HengadeNessuna valutazione finora

- Axis Bank (Black Book) (1) TejuDocumento55 pagineAxis Bank (Black Book) (1) TejuTEJASHVINI PATEL0% (2)

- Case Study of SbiDocumento6 pagineCase Study of Sbiसंजय साहNessuna valutazione finora

- Report Axis BankDocumento32 pagineReport Axis Bankyakthung panyamboNessuna valutazione finora

- Finanial Analysis of HDFC BankDocumento15 pagineFinanial Analysis of HDFC BankShweta SinghNessuna valutazione finora

- Summer Internship Project HDFC Bank PDFDocumento109 pagineSummer Internship Project HDFC Bank PDFarunima100% (1)

- Comparative Analysis of The Products and Servies of Axis BankDocumento29 pagineComparative Analysis of The Products and Servies of Axis Bankpavan100% (1)

- SOUTH INDIAN BANK PresentationDocumento13 pagineSOUTH INDIAN BANK PresentationSourabh KondkarNessuna valutazione finora

- Bank of MaharashtraDocumento12 pagineBank of MaharashtraPravin Shivale67% (3)

- AXIS BANK Project Word FileDocumento28 pagineAXIS BANK Project Word Fileअक्षय गोयलNessuna valutazione finora

- Ramya Canara Bank Project Final ReportDocumento106 pagineRamya Canara Bank Project Final ReportShiva Kumar Mahadevappa79% (14)

- Evolution of SbiDocumento6 pagineEvolution of Sbiarchana_anuragiNessuna valutazione finora

- TJSBDocumento59 pagineTJSBMonik Maru Fakra He63% (8)

- Brief History of State Bank of IndiaDocumento3 pagineBrief History of State Bank of IndiaNikhil Sonawane67% (6)

- Comparative Analysis of HDFC Bank and SBIDocumento37 pagineComparative Analysis of HDFC Bank and SBIsiddhantkamdarNessuna valutazione finora

- Canara BankDocumento2 pagineCanara Bankkarthic kariappaNessuna valutazione finora

- Ms Archana. Wali MBA II Semester Exam No. MBA0702009Documento78 pagineMs Archana. Wali MBA II Semester Exam No. MBA0702009vijayakooliNessuna valutazione finora

- Indian Banking SystemDocumento57 pagineIndian Banking Systemsamadhandamdhar6109100% (1)

- HDFC BankDocumento46 pagineHDFC BankAakash Atri100% (1)

- HOME LOAN HDFC AND SBiDocumento48 pagineHOME LOAN HDFC AND SBiLucky XeroxNessuna valutazione finora

- Final Project SBI ProductDocumento56 pagineFinal Project SBI Productkunal hajareNessuna valutazione finora

- ICICI Bank StructureDocumento13 pagineICICI Bank StructureSonaldeep100% (1)

- Introduction of Banking IndustryDocumento15 pagineIntroduction of Banking IndustryArchana Mishra100% (1)

- Retail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To StudentDocumento51 pagineRetail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To Studentganeshkhale7052Nessuna valutazione finora

- Retail Banking Project BOIDocumento107 pagineRetail Banking Project BOIPooja Mathur100% (1)

- Bhavin kkkkkkkkk38Documento87 pagineBhavin kkkkkkkkk38Sandip ChovatiyaNessuna valutazione finora

- Project ReportDocumento57 pagineProject Reportadi6187100% (1)

- Idbi Bank Project ReportDocumento49 pagineIdbi Bank Project ReportVinay Chawla0% (1)

- Comprative Analysis of Services Provided by HDFC and Axis BankDocumento58 pagineComprative Analysis of Services Provided by HDFC and Axis BankNitinAgnihotriNessuna valutazione finora

- Report On IDBI BankDocumento9 pagineReport On IDBI BankParth patelNessuna valutazione finora

- Icici Bank FileDocumento7 pagineIcici Bank Fileharman singhNessuna valutazione finora

- HDFC ProjectDocumento93 pagineHDFC ProjectDevdutt Raina100% (1)

- Organisational Setup and Management of The State Bank of IndiaDocumento6 pagineOrganisational Setup and Management of The State Bank of IndiapandisivaNessuna valutazione finora

- Kotak Mahindra BanksDocumento73 pagineKotak Mahindra Banksanshu185100% (1)

- Union Bank of IndiaDocumento7 pagineUnion Bank of IndiamerlinjenniferNessuna valutazione finora

- Project Report PNBDocumento60 pagineProject Report PNBa_blackeyed86% (21)

- Bank of Baroda HomeloanDocumento63 pagineBank of Baroda HomeloansantoshNessuna valutazione finora

- Untitled 1Documento14 pagineUntitled 1Tushar BhatiNessuna valutazione finora

- Comparison of Two BanksDocumento49 pagineComparison of Two BanksAarti50% (2)

- Comparative Study On Seavices of Public Sector and Private Sector Banks OptDocumento49 pagineComparative Study On Seavices of Public Sector and Private Sector Banks OptWashik Malik100% (1)

- Introduction:-: MeaningDocumento6 pagineIntroduction:-: MeaningDeepak YadavNessuna valutazione finora

- Nonfund Banking BusinessDocumento95 pagineNonfund Banking BusinessAnkita GargNessuna valutazione finora

- 7 P's of Private Sector BankDocumento21 pagine7 P's of Private Sector BankMinal DalviNessuna valutazione finora

- Black BookDocumento104 pagineBlack BookSoni PalNessuna valutazione finora

- MBA Project Report On ICICI BankDocumento71 pagineMBA Project Report On ICICI BankCyberfun50% (2)

- Comparative Study Between Private Sectors Bank and Public Sector BanksDocumento36 pagineComparative Study Between Private Sectors Bank and Public Sector BanksjudeNessuna valutazione finora

- Executive Summary: SECTOR BANKS AND PUBLIC SECTOR BANKS" Aims To Analyze Various ServicesDocumento42 pagineExecutive Summary: SECTOR BANKS AND PUBLIC SECTOR BANKS" Aims To Analyze Various ServicesSidharth GeraNessuna valutazione finora

- Project Report On Comparative Analysis of Private Sector Bank On Basis of Current Account, Saving Account & Fixed DepositDocumento14 pagineProject Report On Comparative Analysis of Private Sector Bank On Basis of Current Account, Saving Account & Fixed DepositJamar WebbNessuna valutazione finora

- A Study On Project Report On Commercial BankDocumento8 pagineA Study On Project Report On Commercial BankGAME SPOT TAMIZHANNessuna valutazione finora

- Financial Services Offered by BankDocumento52 pagineFinancial Services Offered by BankIshan Vyas100% (2)

- Project On NPADocumento37 pagineProject On NPABasappaSarkarNessuna valutazione finora

- Travel InsuranceDocumento81 pagineTravel InsuranceParag MoreNessuna valutazione finora

- Project On Mutual FundsDocumento75 pagineProject On Mutual FundsParag MoreNessuna valutazione finora

- Rural InsuranceDocumento45 pagineRural InsuranceAmeySalaskarNessuna valutazione finora

- Metlife InsuranceDocumento73 pagineMetlife InsuranceParag More100% (1)

- Recruitment Project On Life Insurance Co.Documento87 pagineRecruitment Project On Life Insurance Co.Devpratapsinh Bilkha100% (1)

- HRM in Banking (100 Marks Project)Documento62 pagineHRM in Banking (100 Marks Project)Shekhar Nm85% (13)

- Chapter 1: Corporate GovernanceDocumento60 pagineChapter 1: Corporate Governancesteffibiswas2006Nessuna valutazione finora

- Swot Analysis in Bancassurance.Documento50 pagineSwot Analysis in Bancassurance.Parag More100% (2)

- Lucky 08bs0001551 Insurance Law ThesisDocumento29 pagineLucky 08bs0001551 Insurance Law Thesisluckyproject100% (2)

- CSR Project On InsuranceDocumento69 pagineCSR Project On Insurancedhwani0% (1)

- Micro Insurance ProjectDocumento56 pagineMicro Insurance ProjectParag More50% (4)

- Final Project On Health InsuranceDocumento61 pagineFinal Project On Health InsuranceYatriShah50% (14)

- Project On LICDocumento54 pagineProject On LICHament Singh71% (38)

- Aviavtion InsuranceDocumento75 pagineAviavtion InsuranceParag MoreNessuna valutazione finora

- Role of Merger Acquisition in BankingDocumento113 pagineRole of Merger Acquisition in BankingParag MoreNessuna valutazione finora

- Blackbook Project On Consumer Perception About Life Insurance PoliciesDocumento80 pagineBlackbook Project On Consumer Perception About Life Insurance PoliciesMohit Kumar89% (28)

- Project On Claims Management in Life InsuranceDocumento60 pagineProject On Claims Management in Life Insurancepriya_1234563236986% (7)

- Cargo Insurance ProjectDocumento63 pagineCargo Insurance ProjectParag More100% (2)

- Impact of Fiscal Policy On Indian EconomyDocumento24 pagineImpact of Fiscal Policy On Indian EconomyAzhar Shokin75% (8)

- Comparative Study of Life InsuranceDocumento61 pagineComparative Study of Life InsuranceParinShah83% (6)

- Social Media in Banking - ProjectDocumento29 pagineSocial Media in Banking - ProjectHiraj KotianNessuna valutazione finora

- Role of Banking Sector in IndiaDocumento75 pagineRole of Banking Sector in IndiaOna JacintoNessuna valutazione finora

- Role of Moenetary and Fiscal Policies in Economic DevelopmentDocumento16 pagineRole of Moenetary and Fiscal Policies in Economic Developmentprof_akvchary85% (13)

- Role of Advertising in BankingDocumento49 pagineRole of Advertising in BankingParag MoreNessuna valutazione finora

- Corporate BankingDocumento100 pagineCorporate BankingParag MoreNessuna valutazione finora

- Recent Trends in BankingDocumento8 pagineRecent Trends in BankingAdalberto MacdonaldNessuna valutazione finora

- Debt InstrumentsDocumento43 pagineDebt InstrumentsSiddhi Kadakia88% (16)

- Project On Indian Financial MarketDocumento44 pagineProject On Indian Financial MarketParag More85% (13)

- Corporate BankingDocumento122 pagineCorporate Bankingrohan2788Nessuna valutazione finora

- Project On Merchant BankingDocumento71 pagineProject On Merchant Bankingmandar_1381% (32)

- Teaching The Art of Market Making With A Game SimulationDocumento4 pagineTeaching The Art of Market Making With A Game SimulationRamkrishna LanjewarNessuna valutazione finora

- Shriram Life InsuranceDocumento78 pagineShriram Life InsuranceManoj N Jainani67% (12)

- Express Trust (Contract For Bailment)Documento2 pagineExpress Trust (Contract For Bailment)Michael Kovach100% (18)

- Class 12 Cbse Economics Sample Paper 2012-13Documento23 pagineClass 12 Cbse Economics Sample Paper 2012-13Sunaina RawatNessuna valutazione finora

- Chapter 4 - Working Capital and Cash Flow ManagementDocumento13 pagineChapter 4 - Working Capital and Cash Flow ManagementAnna Mae SanchezNessuna valutazione finora

- Relevant CostingDocumento40 pagineRelevant CostingUtsav ChoudhuryNessuna valutazione finora

- Full Assignment Tax RPGTDocumento19 pagineFull Assignment Tax RPGTVasant SriudomNessuna valutazione finora

- Chaitanya Godavari Grameena Bank - Economic Value AddDocumento3 pagineChaitanya Godavari Grameena Bank - Economic Value AddPhaniee Kumar VicharapuNessuna valutazione finora

- Legal Aspects of Business 3E PDFDocumento112 pagineLegal Aspects of Business 3E PDFsasikumarNessuna valutazione finora

- Branches of AccountingDocumento54 pagineBranches of AccountingAbby Rosales - Perez100% (1)

- Direct Tax AssignmentDocumento3 pagineDirect Tax AssignmentCHAITANYA ANNE100% (1)

- Aggregate Demand Aggregate SupplyDocumento32 pagineAggregate Demand Aggregate SupplySandesh Lokhande100% (1)

- Minor Project Report On Bajaj Automobiles IndiaDocumento55 pagineMinor Project Report On Bajaj Automobiles IndiaAmit Jain71% (7)

- QuestionsDocumento2 pagineQuestionsTeh Chu LeongNessuna valutazione finora

- ISJ005Documento99 pagineISJ0052imediaNessuna valutazione finora

- Pet Kingdom IncDocumento20 paginePet Kingdom Incjessica67% (3)

- THFJ Europe 50 2011Documento15 pagineTHFJ Europe 50 2011nickmontNessuna valutazione finora

- Presentation On Private Equity - Mrs Rupa Vora, IDFCDocumento17 paginePresentation On Private Equity - Mrs Rupa Vora, IDFCAnkit KesriNessuna valutazione finora

- Business Structures SummaryDocumento5 pagineBusiness Structures SummaryMrudula V.100% (2)

- Advacc 1001-1014Documento15 pagineAdvacc 1001-1014Camille SantosNessuna valutazione finora

- The Real Estate Development ProcessDocumento7 pagineThe Real Estate Development Processahmed100% (1)

- Audit ProgrammesDocumento11 pagineAudit ProgrammesSajjad CheemaNessuna valutazione finora

- Wyoming Entrepreneur-Business Plan TemplateDocumento13 pagineWyoming Entrepreneur-Business Plan TemplateBrooke TillmanNessuna valutazione finora

- John Gokongwei Success StoryDocumento11 pagineJohn Gokongwei Success StoryGershNessuna valutazione finora

- Corporate Level StrategiesDocumento26 pagineCorporate Level StrategiesIrin I.gNessuna valutazione finora

- What Is GAAP?: Accounting PrinciplesDocumento3 pagineWhat Is GAAP?: Accounting PrinciplesShoaib YousufNessuna valutazione finora

- ATW108 Chapter 24 TutorialDocumento1 paginaATW108 Chapter 24 TutorialShuhada ShamsuddinNessuna valutazione finora

- TBNC 60th Anniversary Celebration JournalDocumento29 pagineTBNC 60th Anniversary Celebration JournaleetbncNessuna valutazione finora

- LLC Subscription AgreementDocumento3 pagineLLC Subscription Agreementnworkman100% (1)

- SAP ConsolidationDocumento110 pagineSAP Consolidationnanduri.aparna161Nessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetDa EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetValutazione: 5 su 5 stelle5/5 (2)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- How to Measure Anything: Finding the Value of Intangibles in BusinessDa EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessValutazione: 3.5 su 5 stelle3.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsDa EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDa EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistValutazione: 4 su 5 stelle4/5 (32)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 5 su 5 stelle5/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameDa EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameNessuna valutazione finora