Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Banknifty Bear Put Ratio Spread 100215

Caricato da

Jignesh Rampariya0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

12 visualizzazioni2 pagineBanknifty Bear Put Ratio Spread 100215

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBanknifty Bear Put Ratio Spread 100215

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

12 visualizzazioni2 pagineBanknifty Bear Put Ratio Spread 100215

Caricato da

Jignesh RampariyaBanknifty Bear Put Ratio Spread 100215

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

PCG Desk| | INDIA 10 Feb 2014

Option Strategy (Equity Derivatives)

BANKNIFTY BEAR PUT RATIO SPREAD

SCRIPT BANKNIFTY

STRATEGY BEAR PUT RATIO SPREAD

VIEW LIMITED DOWNSIDE

BUY 1 LOT BANKNIFTY 18300 FEB PUT AT 230

SELL 2 LOT BANKNIFTY 18200 FEB PUT AT 215

(Please note that the strategy has to be initiated with minimum inflow of 200 points)

TARGET 300 (Rs 7500; if Banknifty expires at 18200)

SL 150 ( Rs 3750; as soon as the ratio spread incur loss of 150 points, strategy has to be squared off)

The strategy has been initiated with a view that the down side for the Banknifty will be limited from the current

level of 18880

If Banknifty rallies from the current level then this strategy will earn minimum profit of 5000 irrespective of the

extent of upside in Banknifty.

The maximum profit can be achieved if Banknifty expires at 18200.

Time decay and any decrease in volatility will be beneficial for this strategy.

This strategy will start making losses in case of downward movement in Banknifty.

This strategy has to be squared off in case of strategy start making losses of 150 points (Rs 3750).

Anand D. Shendge (Derivative Research Analyst)

PCG Desk| | INDIA 10 Feb 2014

Option Strategy (Equity Derivatives)

BANKNIFTY BEAR PUT RATIO SPREAD

Disclosures and Disclaimers

This is a technical / derivatives / alternative research report prepared by our analysts based on their study of certain charts, statistical data and their interpretation of the same.

Accordingly, the views and opinions expressed in this document may or may not match or may be contrary at times with the views, estimates, rating, target price of the other research

reports / materials issued by PhillipCapital (India) Pvt. Ltd.

This report is issued by PhillipCapital (India) Pvt. Ltd. which is regulated by SEBI. PhillipCapital (India) Pvt. Ltd. is a subsidiary of Phillip (Mauritius) Pvt. Ltd. References to "PCIPL" in this

report shall mean PhillipCapital (India) Pvt. Ltd unless otherwise stated. This report is prepared and distributed by PCIPL for information purposes only and neither the information

contained herein nor any opinion expressed should be construed or deemed to be construed as solicitation or as offering advice for the purposes of the purchase or sale of any security,

investment or derivatives. The information and opinions contained in the Report were considered by PCIPL to be valid when published. The report also contains information provided to

PCIPL by third parties. The source of such information will usually be disclosed in the report. Whilst PCIPL has taken all reasonable steps to ensure that this information is correct, PCIPL

does not offer any warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading does so entirely at his or her own risk

and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements and past performance is not necessarily

an indication to future performance.

This report does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors must

undertake independent analysis with their own legal, tax and financial advisors and reach their own regarding the appropriateness of investing in any securities or investment strategies

discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. In no circumstances it be used or considered as an offer

to sell or a solicitation of any offer to buy or sell the Securities mentioned in it. The information contained in the research reports may have been taken from trade and statistical services

and other sources, which we believe are reliable. PhillipCapital (India) Pvt. Ltd. or any of its group/associate/affiliate companies do not guarantee that such information is accurate or

complete and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice.

Important: These disclosures and disclaimers must be read in conjunction with the research report of which it forms part. Receipt and use of the research report is subject to all aspects

of these disclosures and disclaimers. Additional information about the issuers and securities discussed in this research report is available on request.

.

Certifications: The research analyst(s) who prepared this research report hereby certifies that the views expressed in this research report accurately reflect the research analysts

personal views about all of the subject issuers and/or securities, that the analyst have no known conflict of interest and no part of the research analysts compensation was, is or will be,

directly or indirectly, related to the specific views or recommendations contained in this research report. The Research Analyst certifies that he /she or his / her family members does not

own the stock(s) covered in this research report.

Independence: PhillipCapital (India) Pvt. Ltd. has not had an investment banking relationship with, and has not received any compensation for investment banking services from, the

subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek compensation for investment banking services from the

subject issuers in the next three (3) months. PhillipCapital (India) Pvt. Ltd is not a market maker in the securities mentioned in this research report, although it or its affiliates may hold

either long or short positions in such securities. PhillipCapital (India) Pvt. Ltd does not hold more than 1% of the shares of the company(ies) covered in this report.

.

Suitability and Risks: This research report is for informational purposes only and is not tailored to the specific investment objectives, financial situation or particular requirements of any

individual recipient hereof. Certain securities may give rise to substantial risks and may not be suitable for certain investors. Each investor must make its own determination as to the

appropriateness of any securities referred to in this research report based upon the legal, tax and accounting considerations applicable to such investor and its own investment objectives

or strategy, its financial situation and its investing experience. The value of any security may be positively or adversely affected by changes in foreign exchange or interest rates, as well

as by other financial, economic or political factors. Past performance is not necessarily indicative of future performance or results.

Sources, Completeness and Accuracy: The material herein is based upon information obtained from sources that PCIPL and the research analyst believe to be reliable, but neither

PCIPL nor the research analyst represents or guarantees that the information contained herein is accurate or complete and it should not be relied upon as such. Opinions expressed

herein are current opinions as of the date appearing on this material and are subject to change without notice. Furthermore, PCIPL is under no obligation to update or keep the

information current.

.

Copyright: The copyright in this research report belongs exclusively to PCIPL. All rights are reserved. Any unauthorized use or disclosure is prohibited. No reprinting or reproduction, in

whole or in part, is permitted without the PCIPLs prior consent, except that a recipient may reprint it for internal circulation only and only if it is reprinted in its entirety.

Caution: Risk of loss in trading in can be substantial. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and

other relevant circumstances.

PhillipCapital (India) Pvt. Ltd.

No. 1, 18th Floor, Urmi Estate,

Lower Parel West, Mumbai 400013.

Anand D. Shendge (Derivative Research Analyst)

Potrebbero piacerti anche

- Top Diwali Fundamental PicksDocumento7 pagineTop Diwali Fundamental PicksJignesh RampariyaNessuna valutazione finora

- Association of Mutual Funds in India: Application Form For Renewal of Arn/ EuinDocumento4 pagineAssociation of Mutual Funds in India: Application Form For Renewal of Arn/ Euingrr.homeNessuna valutazione finora

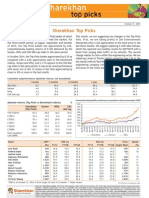

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocumento7 pagineSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNessuna valutazione finora

- (Blume) Investment Report #13 A B C (H2 2014)Documento12 pagine(Blume) Investment Report #13 A B C (H2 2014)Jignesh RampariyaNessuna valutazione finora

- The Toyland-Theme For PTMDocumento29 pagineThe Toyland-Theme For PTMJignesh RampariyaNessuna valutazione finora

- Sip Plus FormDocumento7 pagineSip Plus FormJignesh RampariyaNessuna valutazione finora

- Gold BeESDocumento17 pagineGold BeESNeha SureshNessuna valutazione finora

- Job Placement Agencies in Vapi - Grotal ComDocumento4 pagineJob Placement Agencies in Vapi - Grotal ComJignesh RampariyaNessuna valutazione finora

- NselDocumento22 pagineNselJignesh RampariyaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- DoL & DoFL AnalysisDocumento4 pagineDoL & DoFL AnalysisSharjeel AlviNessuna valutazione finora

- Financial Reporting 2 Final Exam 2020Documento3 pagineFinancial Reporting 2 Final Exam 2020kateNessuna valutazione finora

- A 1-12-2016 Petition DGVCL True-Up For FY 2015-16 V4Documento119 pagineA 1-12-2016 Petition DGVCL True-Up For FY 2015-16 V4onlineNessuna valutazione finora

- UNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocumento15 pagineUNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNessuna valutazione finora

- Accenture AHR Overview FinalDocumento6 pagineAccenture AHR Overview FinalUdit SinghalNessuna valutazione finora

- Balance Sheet ParleDocumento2 pagineBalance Sheet ParleDhruvi PatelNessuna valutazione finora

- Cost of QualityDocumento33 pagineCost of QualitydrrajputNessuna valutazione finora

- 4 Classical Theory of The Interest RateDocumento28 pagine4 Classical Theory of The Interest RateAYUSHI PATELNessuna valutazione finora

- Central University of South Bihar: School of Law & Governance Financial Market RegulationDocumento22 pagineCentral University of South Bihar: School of Law & Governance Financial Market RegulationRajeev RajNessuna valutazione finora

- Venture Capital FinalDocumento26 pagineVenture Capital Finalaarzoo dadwalNessuna valutazione finora

- Lyceum of The Philippines University Preliminary Examination ECON01A-Principles of Economics With Land Reform and Taxation Prof. Nestor C. VelascoDocumento3 pagineLyceum of The Philippines University Preliminary Examination ECON01A-Principles of Economics With Land Reform and Taxation Prof. Nestor C. VelascoJM Hernandez VillanuevaNessuna valutazione finora

- What Is A Business PlanDocumento16 pagineWhat Is A Business PlanGhilany Carillo CacdacNessuna valutazione finora

- Taxation PDFDocumento69 pagineTaxation PDFcpasl123Nessuna valutazione finora

- Investment Office ANRS: Project Profile On The Establishment of Banana PlantationDocumento24 pagineInvestment Office ANRS: Project Profile On The Establishment of Banana Plantationbig john100% (3)

- Banking Midterms ReviewerDocumento6 pagineBanking Midterms ReviewerFlorence RoseteNessuna valutazione finora

- Forex Signals Success PDF - Forex Trading Lab (PDFDrive)Documento30 pagineForex Signals Success PDF - Forex Trading Lab (PDFDrive)scorp nxNessuna valutazione finora

- Stock Market and Astrological AspectsDocumento3 pagineStock Market and Astrological Aspectsabcd1234Nessuna valutazione finora

- Sure Short Questions Business Studies Class-Xii (Commerce)Documento35 pagineSure Short Questions Business Studies Class-Xii (Commerce)JaspreetNessuna valutazione finora

- Assignment 1 - Compare and Contrast The Potential Outlook of PLCsDocumento9 pagineAssignment 1 - Compare and Contrast The Potential Outlook of PLCsNadhirah Abd Rahman0% (1)

- Chapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)Documento18 pagineChapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)XNessuna valutazione finora

- Madhya Pradesh APRIL 2017Documento77 pagineMadhya Pradesh APRIL 2017Akshay PatidarNessuna valutazione finora

- DEPRECIATIONDocumento10 pagineDEPRECIATIONJohn Francis IdananNessuna valutazione finora

- Starting A New Venture: Module For Principles of Entrepreneurship (ENT 530)Documento31 pagineStarting A New Venture: Module For Principles of Entrepreneurship (ENT 530)Mohd Azrul Hisham AmranNessuna valutazione finora

- Brampton Financial ReviewDocumento55 pagineBrampton Financial ReviewToronto StarNessuna valutazione finora

- McDonalds Marketing AuditingDocumento3 pagineMcDonalds Marketing AuditingRawan AdelNessuna valutazione finora

- MidTerm ExamDocumento15 pagineMidTerm ExamYonatan Wadler100% (2)

- The Baptist Foundation of Arizona: A Focus On Evidence - Significant TransactionsDocumento4 pagineThe Baptist Foundation of Arizona: A Focus On Evidence - Significant TransactionsCryptic LollNessuna valutazione finora

- Marketing Strategy of Bharti Axa Life Insurance - 191468884Documento36 pagineMarketing Strategy of Bharti Axa Life Insurance - 191468884Jammu & kashmir story catcherNessuna valutazione finora

- Capital Markets, Consumption, and Investment: NtroductionDocumento14 pagineCapital Markets, Consumption, and Investment: NtroductionThuyển ThuyểnNessuna valutazione finora

- The Effect of Financial Literacy and Attitude On Financial Management Behavior and SatisfactionDocumento7 pagineThe Effect of Financial Literacy and Attitude On Financial Management Behavior and SatisfactionAldo Setyawan JayaNessuna valutazione finora