Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Economics 452/551 Assignment 3: Uwe We e U SS T T The Relation Between Output and Effort Is

Caricato da

Damian EmilioTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Economics 452/551 Assignment 3: Uwe We e U SS T T The Relation Between Output and Effort Is

Caricato da

Damian EmilioCopyright:

Formati disponibili

Econ 452, assign 3, 2007

Economics 452/551

Assignment 3

Dr. L. Welling

Due: 4 pm Thursday, March 22

March 19, 2007

Marks: 45

1.(18) Suppose an agent has a utility function U ( w, e) w e , where w denotes

wage income and e {0, 7} is effort expended by the agent. Let the agents

reservation utility by u 4 The principal is risk neutral, and receives a value

from production of 1000 if output is high, and 0 is output is low (so ( S , S ) (0,100)

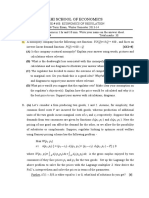

). Let payments to the agent by ( t , t ). The relation between output and effort is

given in the following table:

Effort

Low

High

Prob of output of

0

0.9

0.2

1000

0.1

0.8

Total

1

1

1. (3) What would effort level, wages, and agents utility be under full information

if the principal had all the bargaining power?

Ans:

1. As reservation utility is 4, so that will be expected utility under full info, given P

has all bargaining power.

2. Under full info, effort is observable A can be paid on the basis of effort.

3. if A chooses high effort, expected output is 0.8x1000=800, at cost 49+4, so

total surplus is 747; if A chooses low effort, expected output is 0.1x1000=100,

minus As reservation utility of 4, so social surplus is 100-16=84.. Since social

surplus is highest when high effort is chosen, P will choose high effort, and pay

( t , t ) (121,121).

2. (2) If effort is not observable, what are the incentive compatibility, participation,

and zero-profit constraints for high effort?

Ans: If effort is not observable, pay must be conditioned on output:

ICC for high effort: 0.2 t 0.8 t 7 0.9 t 0.1 t

PC for high effort: 0.2 t 0.8 t 7 4

Zero profit constraint: 0.2(0 t ) 0.8(1000 t ) 0

3. (3) What would utility be if the wage were fixed and could not depend on

output or effort?

Ans: if the wage did not depend on effort or output, then As EU would be t e ;

to max EU, A would choose e=0. Knowing this, P would pay only for low effort,

so to allow A to have reservation utility P would set t=16.

Page 1 of 6

Econ 452, assign 3, 2007

4. (4) What is the optimal contract? What is the agents utility?

Ans:

Assume first that P wants high effort: then the optimal contract is a pair of

payments, one for each realized output, which maxs the Ps EU subject to the

constraints that A is willing to participate, and to expend high effort. That is, the

solution to

max{0.2(0 t ) 0.8(1000 t ) subject to i)0.2

t 0.8 t 7 4

t ,t

and ii ).0.2 t 0.8 t 7 0.9 t 0.1 t

Suppose both constraints bind. Then (ii) says

t 10 . Substituting this

into (i) and solving for t gives t 3, so t 9 ; then t (13) 2 169. As EU had

better be 4! Ps EU= 0.2(0 t ) 0.8(1000 t ) 800 0.2 9 0.8 169 663 .

(If P is willing to accept low effort, then the cheapest way to induce low effort is to

offer the first best contract for low effort: U ( w, e) w 4, so w=16. Then Ps EU

is 84. Since Ps EU is higher with high effort, the first contract will be the optimal

one.)

5. (3) What is the agency cost, the loss in utility due to asymmetric information?

Who bears this cost?

Ans:

As EU is 4 with and without full info. Expected output is also the same with and

without full info. The only difference between the two settings is then the

expected payment to the agent. Under asymmetric information, the expected

payment to the agent is 0.2 t 0.8t 0.2 9 0.8 169 137 . Since under full info,

the payment to A is 121, the cost of asymmetric information is 16, paid by P.

6. (3) Suppose now that the agent has all the bargaining power. How does the

agency cost in this case compare to that in (5)? Explain briefly.

Ans: If the agent has all the bargaining power, the agent receives all of the social

surplus under full information. Since P maxs social surplus under full info, the

agent will choose the same outcome under full info as does P; the only difference

will be in the distribution of the surplus all will now go to A rather than P. AIf A

has all the bargaining power because of competition between principals, then

there will still be the issue of providing the correct incentives for A once the

contract is signed, so the ICC constraint will still be relevant. The other

constraint will be the zero profit constraint for P.

Page 2 of 6

Econ 452, assign 3, 2007

2. (17 ) Consider

a moral hazard insurance model. Let the consumer's utility of wealth

u ( w) w , let her initial wealth be w0 100 , and suppose

there are two loss levels, l 0 and l 51. There are two levels of effort,

e 0 and e 1. The consumer's disutility of effort is given by the function

be

d(e), where d(0)=0 and d(1)=1/3. Finally, suppose that the loss probabilities are

given by the following table:

e=0

e=1

l=0

1/3

2/3

l=51

2/3

1/3

a) (2) Verify that the probabilities in the table satisfy the MLRP.

Ans:

b) (2) Find the consumer's reservation utility assuming that there is only

one insurance company and that the consumer's only other option is to

self-insure.

Ans: reservation utility will depend on effort; consumer chooses the effort which

gives the higher EU without insurance:

- if low effort, EU = ( 100 2 100 51) / 3 8

- if high effort, EU = (2 100 100 51) / 3 1/ 3 26 / 3

Since EU is higher with high effort, the consumer will choose to expend high

effort, and reservation utility will by 26/3.

c) (3) What effort level will the consumer exert if no insurance is

available?

Ans: high effort; see (2)

d) (3) Show that if effort is observable, then it is optimal for the insurance

company to offer a policy that induces high effort.

Ans: If effort is observable, then insurance company will offer full insurance,

based on effort. If the insurance company is a monopoly, the consumer will get

only their reservation utility, even wilh full insurance all of the surplus from the

risk sharing will go to the firm.

- if low effort, firm charges p such that w pl 8 or pl 36

- if high effort, firm charges p such that

Firms expected profit?

- if low effort, Eprofit = 36-2x51/3=2

- if high effort, Eprofit = 19-51/3=2

w ph 27 / 3 or ph 19

Page 3 of 6

Econ 452, assign 3, 2007

Since offering a policy which induces low effort does not lead to higher profits, it

is optimal for the company to offer a policy which induces high effort.

Note: this approach assumed that if the individual did not buy full insurance for

low effort, they would choose low effort with no insurance . If instead they chose

high effort, the premium which utility from full insurance with low effort to the

reservation utility would yield negative expected profits for the monopoly insurer.

Hence inducing high effort would be strictly preferred by the firm.

e) (2) Show that the policy in (d) will not induce high effort if effort is not

observable.

Ans: If the firm offers full insurance, at whatever price, when effort is not

observable the consumer maxs EU by minimizing the cost of effort so

supplying zero effort.

f) (3) Find the optimal policy under asymmetric information.

Ans: optimal policy is an amount of insurance, I, and a per unit price p, which

maxs expected profit. If the policy induces high effort, the firms expected profit

is = pI I / 3 ; high effort will be induced if the policy satisfies

i) ICC: (2 100 pI 49 I (1 p)) / 3 1/ 3 100 pI 2 49 I (1 p)) / 3

ii) IR: (2 100 pI 49 I (1 p)) / 3 1/ 3 26 / 3

If both these constraints are satisfied as equalities, the simplify to

ICC: 100 pI 49 I (1 p )) 1

IR: 100 pI 0.5(27 49 I (1 p))

100 39

, ) : less than full insurance, at a premium

Together these imply that (I,p) = (

3 75

greater than the probability of loss for high effort.

g) (2) Compare the company's profits and the consumer's utility when

effort is observable, and when it is not.

Ans: in both cases the consumer gets their reservation utility, so any cost of the

asymmetric information is borne by the firm. When effort is observable, expected

profits =2; when effort is not observable, expected profits

100 39 100 36 4

2

= pI-(1-p)I =

3 75

3 75 3

3. (15) Workers in many occupations face compensation packages that have two

components: a fixed salary, B, and a piece rate b, for each unit of output

produced or sold. Total income, y, is then given by y=B+bq, where q is output.

Suppose that output is produced from effort according to the production function

q=e . The employer receives a payoff of S(q)=2q from output. The worker has a

cost of effort function c(e) 0.5e 2 , and a reservation utility of zero. Both employer

Page 4 of 6

Econ 452, assign 3, 2007

and employee are risk neutral, with payoffs U p S (q ) y and U w y c (e) , and

the employer has all the bargaining power.

a)

(5) Compute the first best level of output, the compensation package,

and the payoffs of the worker and the employer. Explain why your

calculations are correct, and illustrate in a diagram.

Ans: In first best, if P has all bargaining power, As utility = reservation utility = 0.

Thus y= c (e) 0.5e 2 , for whatever e P chooses. P chooses e to maximize:

U P 2q y subject to q e and y 0.5e 2 , First order conditions for Ps problem

yield e=q=2; thus y=2, and P has utility of 4-2=2.

The compensation package here? Any number of packages would work;

some examples:

i) b 0; B 2 if e 2, and B 0 otherwise

ii) B 2; b 2 ; in this case the employee chooses e to maximize

y 0.5e 2 2e 0.5e 2 , so e=2.

Suppose now that the production function has a random component, so q=e+r,

where r is uniformly distributed on the interval [-0.5, 0.5] .

Diagram: in e-y space. Worker has indifference curves given by

dy

e 0 is slope of IC at

Uw y 0.5e 2 k , for some constant k, so slope is

de

any given (e,y) pair. Thus, workers IC has positive slope, slope increases as

effort increases, and higher utility corresponds to ICs above and to the left of any

given point. Reservation utility is zero, so minimum feasible combinations are on

the IC for k=0.

Principal has indifference curves given by U p 2e y m , for some constant m,

dy

2 0 . Higher utility for P corresponds to points below

so slope of Ps IC is

de

and to the right of any given point in (e,y) space.

Optimal contract will have A on reservation utility curve. One such contract is the

point of tangency between this IC for A and an IC for P; this has (e,y) = (2, 2).

b)

(5) Suppose now that effort is unobservable. Derive the level of

output, and the compensation package chosen by the employer, and

the payoffs of the worker and the employer. Explain why your

calculations are correct, and illustrate in a diagram.

Ans:

Page 5 of 6

Econ 452, assign 3, 2007

First, consider workers problem: choose e to max EU A B bEq (e) 0.5e 2

(here, E(q(e) denotes the expected value of q, given e). if the worker accepts

the contract, the optimal solution for the worker is to choose e bq '(e) b : this is

the incentive compatibility constraint the principal must face. The worker will

accept the contract so long as EU A y 0.5e 2 0 . As the principal has all the

bargaining power, this constraint will bind in equilibrium, and the worker will

obtain EU=0; this means that y B bq B b 2 0.5b 2 , so B 0.5b 2 .

Now consider the principals problem: choose {B,b} to maximize

EU p 2 Eq B bEq subject to i ) B bEq 0.5e 2 0, and ii ) Eq e b

Substituting the constraints into the objective function, and using the optimal

choices for e and B above, leaves the principal maximizing 2b 0.5b 2 b 2 ;

solving this for b yields b=2, thus B = -2. This is one of the solutions above.

Diagram? As explained above.

Notice that this contract has the properties of a franchise contract: an upfront

lump sum paid by A to the employer, and As income depends on As effort. In

this context, another interpretation of the lump sum payment is as a minimum

amount of output/sales which much be achieved before the worker starts to earn

a commission on sales.

c)

(5) Suppose now that effort is unobservable, as in (b), but the worker is

risk averse. Using no more than one half page (single spaced),

explain how this change in risk aversion would affect the compensation

package and the optimal output. (NB: you do not need to calculate the

optimal output.)

Ans: In the contract above A bears all the risk of the venture. If A is risk averse,

the variability in y generated by this risk bearing will lower As EU, and hence

lower As choice of e for this contract. In order to induce higher effort on the part

of A, P needs to transfer some of the surplus to A, in the form of reduced

variability so the proportion of As income accounted for by the lump-sum

component rises. This reduces the surplus available to P, and reduces the

optimal effort induced in the optimal contract.

Page 6 of 6

Potrebbero piacerti anche

- Zimch: Hans BuhlmannDocumento14 pagineZimch: Hans BuhlmannelviapereiraNessuna valutazione finora

- Danthine ExercisesDocumento22 pagineDanthine ExercisesmattNessuna valutazione finora

- Ass QuestionsDocumento6 pagineAss QuestionsJulio S. Solís ArceNessuna valutazione finora

- Microeconomics - Problem Set 7 Choice Under Uncertainty Asymmetric Information ExternalitiesDocumento5 pagineMicroeconomics - Problem Set 7 Choice Under Uncertainty Asymmetric Information ExternalitiesMichael WittmannNessuna valutazione finora

- Dynamic Moral HazardDocumento15 pagineDynamic Moral HazardTarikNessuna valutazione finora

- Chapter 4Documento37 pagineChapter 4David GutierrezNessuna valutazione finora

- 03 Assessing RiskDocumento10 pagine03 Assessing RiskKhalid WaheedNessuna valutazione finora

- Introducción A La Economía de La Información - Inés Macho Stadler, David Pérez Castrillo - 2004 - Grupo Planeta (GBS) - 9788434445215 - Anna's ArchiveDocumento142 pagineIntroducción A La Economía de La Información - Inés Macho Stadler, David Pérez Castrillo - 2004 - Grupo Planeta (GBS) - 9788434445215 - Anna's ArchiveMiguel OuNessuna valutazione finora

- Midterm ECON 3110 SPRING 22Documento2 pagineMidterm ECON 3110 SPRING 22Ali ZaidiNessuna valutazione finora

- Math 370, Actuarial Problemsolving Spring 2008 A.J. Hildebrand. Practice Test, 1 - 28 - 2008 (With Solutions)Documento12 pagineMath 370, Actuarial Problemsolving Spring 2008 A.J. Hildebrand. Practice Test, 1 - 28 - 2008 (With Solutions)kiva90Nessuna valutazione finora

- ct62005 2010Documento236 paginect62005 2010mokus2000Nessuna valutazione finora

- Salanie Principal Agent 2Documento10 pagineSalanie Principal Agent 2example3335273Nessuna valutazione finora

- Past Exams Subject 106 2000-2004Documento208 paginePast Exams Subject 106 2000-2004Alex240707Nessuna valutazione finora

- Expected Utility Theory: XX X X P P PDocumento6 pagineExpected Utility Theory: XX X X P P PgopshalNessuna valutazione finora

- EC3099 - Industrial Economics - 2003 Examiners Commentaries - Zone-BDocumento6 pagineEC3099 - Industrial Economics - 2003 Examiners Commentaries - Zone-BAishwarya PotdarNessuna valutazione finora

- Department of Actuarial Mathematics and Statistics, Heriot-Watt University, Edinburgh EHI4 4AS, United KingdomDocumento20 pagineDepartment of Actuarial Mathematics and Statistics, Heriot-Watt University, Edinburgh EHI4 4AS, United KingdomhadihadihaNessuna valutazione finora

- Economics 152 - Wage Theory and Policy Problem Set #3 - SolutionsDocumento7 pagineEconomics 152 - Wage Theory and Policy Problem Set #3 - SolutionsJason LohNessuna valutazione finora

- Mec-001 Eng PDFDocumento82 pagineMec-001 Eng PDFnitikanehiNessuna valutazione finora

- Mock ExamDocumento7 pagineMock ExamJames DownesNessuna valutazione finora

- EC3099 - Industrial Economics - 2006 Examiners Commentaries - Zone-ADocumento5 pagineEC3099 - Industrial Economics - 2006 Examiners Commentaries - Zone-AAishwarya PotdarNessuna valutazione finora

- Information Economics From Jehle and RenyDocumento10 pagineInformation Economics From Jehle and RenyAbby PeraltaNessuna valutazione finora

- M P V S S M: Icroeconomics Rofessor Asiliki Kreta Ample IdtermDocumento13 pagineM P V S S M: Icroeconomics Rofessor Asiliki Kreta Ample Idtermdinh_dang_18Nessuna valutazione finora

- Chapter 3 For StudentsDocumento4 pagineChapter 3 For Studentsdesada testNessuna valutazione finora

- EC3099 - Industrial Economics - 2006 Examiners Commentaries - Zone-BDocumento5 pagineEC3099 - Industrial Economics - 2006 Examiners Commentaries - Zone-BAishwarya PotdarNessuna valutazione finora

- Econ 157 - Problem Set #2: Question 11 - Chapter 5Documento10 pagineEcon 157 - Problem Set #2: Question 11 - Chapter 5lkplmlhNessuna valutazione finora

- Principal Agent NotesDocumento19 paginePrincipal Agent Notessamiyah.haque01Nessuna valutazione finora

- Problemset3 2008keyDocumento9 pagineProblemset3 2008keyManu YadavNessuna valutazione finora

- Amd 03Documento20 pagineAmd 03MRINAL GAUTAMNessuna valutazione finora

- Dalen Efficiency ImproveDocumento12 pagineDalen Efficiency ImproveIsatNessuna valutazione finora

- Econ 384 Chapter15bDocumento47 pagineEcon 384 Chapter15bTise TegyNessuna valutazione finora

- ETC1010 S12015 Solution Part 1Documento7 pagineETC1010 S12015 Solution Part 1Mohammad RashmanNessuna valutazione finora

- Answers To Chapter 5 Exercises: Review and Practice ExercisesDocumento3 pagineAnswers To Chapter 5 Exercises: Review and Practice ExercisesHuyen NguyenNessuna valutazione finora

- Delhi School of Economics:, P) and D, P) - Here TheDocumento2 pagineDelhi School of Economics:, P) and D, P) - Here TheadamNessuna valutazione finora

- M.A. and B.Sc. Examination School of Economics & Finance EC2001 Intermediate MicroeconomicsDocumento5 pagineM.A. and B.Sc. Examination School of Economics & Finance EC2001 Intermediate Microeconomicssjassemi1Nessuna valutazione finora

- Solution Manual CHPT 6Documento7 pagineSolution Manual CHPT 6xlovemadnessNessuna valutazione finora

- X. Ejercicios Cap4Documento3 pagineX. Ejercicios Cap4Cristina Farré MontesóNessuna valutazione finora

- Externalities, Market Failure and GovernmentDocumento6 pagineExternalities, Market Failure and GovernmentMohammad SaifullahNessuna valutazione finora

- EC202 Past Exam Paper Exam 2013Documento7 pagineEC202 Past Exam Paper Exam 2013FRRRRRRRTNessuna valutazione finora

- Distribution of Labor in A Economically Competitive StructureDocumento7 pagineDistribution of Labor in A Economically Competitive StructureLalakisNessuna valutazione finora

- Comprehensive Exam in Microeconomic Theory Summer 2016Documento5 pagineComprehensive Exam in Microeconomic Theory Summer 2016hm512771Nessuna valutazione finora

- Microeconomics-Final.: October 8, 2010Documento3 pagineMicroeconomics-Final.: October 8, 2010Anu AmruthNessuna valutazione finora

- Institute and Faculty of Actuaries: Subject CT6 - Statistical Methods Core TechnicalDocumento5 pagineInstitute and Faculty of Actuaries: Subject CT6 - Statistical Methods Core TechnicalPraven NaiduNessuna valutazione finora

- Solutions Exercises Module B - NEWDocumento6 pagineSolutions Exercises Module B - NEWLuca100% (1)

- GT Past YearsDocumento30 pagineGT Past YearsrsunderyNessuna valutazione finora

- Solutions 1Documento9 pagineSolutions 1Shenghan LiNessuna valutazione finora

- Problem Set 12 With SolutionsDocumento8 pagineProblem Set 12 With SolutionsMinh Ngọc LêNessuna valutazione finora

- This Paper Is Not To Be Removed From The Examination HallsDocumento55 pagineThis Paper Is Not To Be Removed From The Examination Halls陈红玉Nessuna valutazione finora

- MEC-001 - ENG-J18 - Compressed PDFDocumento8 pagineMEC-001 - ENG-J18 - Compressed PDFTamash MajumdarNessuna valutazione finora

- Final Micro 2022 SpringDocumento14 pagineFinal Micro 2022 SpringCindy WuNessuna valutazione finora

- ECON 8010 Final Exam Prep Fall 2016Documento3 pagineECON 8010 Final Exam Prep Fall 2016Sky ShepheredNessuna valutazione finora

- Week 3 Tutorial Questions and SolutionsDocumento5 pagineWeek 3 Tutorial Questions and Solutionschi_nguyen_100Nessuna valutazione finora

- Battery 3Documento29 pagineBattery 3Indra Chandra SetiawanNessuna valutazione finora

- Lecture 1 Moral Hazard - Ver2Documento60 pagineLecture 1 Moral Hazard - Ver2An SiningNessuna valutazione finora

- Incentives and Performance Measurement Module 2: Basic Agency TheoryDocumento73 pagineIncentives and Performance Measurement Module 2: Basic Agency TheorymissepNessuna valutazione finora

- Second PracticeDocumento2 pagineSecond PracticeSheila FernándezNessuna valutazione finora

- Exam Review and Compensating Wage Di Erentials Econ 152 Fall 2008Documento6 pagineExam Review and Compensating Wage Di Erentials Econ 152 Fall 2008Xavier HernándezNessuna valutazione finora

- Exercise701 2 3Documento1 paginaExercise701 2 3Bes GaoNessuna valutazione finora

- Assignment 2Documento2 pagineAssignment 2Hamza KoliaNessuna valutazione finora

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsDa EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNessuna valutazione finora

- Ejercicios 1 y 2 MiercolesDocumento83 pagineEjercicios 1 y 2 MiercolesDamian EmilioNessuna valutazione finora

- Risk Averse Agent: Class 3Documento28 pagineRisk Averse Agent: Class 3Damian EmilioNessuna valutazione finora

- 01Documento6 pagine01Damian EmilioNessuna valutazione finora

- Cursodublin PDFDocumento89 pagineCursodublin PDFrafdanNessuna valutazione finora

- Differential EquationsDocumento128 pagineDifferential EquationsKarelia LevineNessuna valutazione finora

- How To Apply ForDocumento16 pagineHow To Apply ForDamian EmilioNessuna valutazione finora

- ABSTRACTS Núm 74 Nueva AntropologíaDocumento3 pagineABSTRACTS Núm 74 Nueva AntropologíaDamian EmilioNessuna valutazione finora

- 3a Normal Form ContinuedDocumento25 pagine3a Normal Form ContinuedDamian EmilioNessuna valutazione finora

- Macroeconomics Study GuideDocumento60 pagineMacroeconomics Study Guidewilder_hart100% (1)

- Allocative Efficiency Vs X EfficiencyDocumento25 pagineAllocative Efficiency Vs X EfficiencyaasdNessuna valutazione finora

- MBA Syllabus 2010Documento60 pagineMBA Syllabus 2010a_r786Nessuna valutazione finora

- Micro Midterm May 2015ADocumento7 pagineMicro Midterm May 2015ATriet TruongNessuna valutazione finora

- CT7Documento8 pagineCT7Vishy BhatiaNessuna valutazione finora

- Lecture 1 Economic Growth Potential OutputDocumento25 pagineLecture 1 Economic Growth Potential Outputshajea aliNessuna valutazione finora

- The Production Theory PDFDocumento2 pagineThe Production Theory PDFASIF khan0% (1)

- Importance of Studying Production & Operation ManagementDocumento2 pagineImportance of Studying Production & Operation ManagementBalaji Lakshminarayanan100% (1)

- Macroeconomics Mankiw 8th Edition Solutions ManualDocumento27 pagineMacroeconomics Mankiw 8th Edition Solutions ManualEricaGatespxje100% (36)

- In Escorts Operation ManagementDocumento100 pagineIn Escorts Operation Managementlalsingh0% (1)

- The Economic Implications of Learning by Doing - ArrowDocumento20 pagineThe Economic Implications of Learning by Doing - ArrowjosecaceresNessuna valutazione finora

- Production FunctionDocumento51 pagineProduction FunctionzafrinmemonNessuna valutazione finora

- Paper 29Documento36 paginePaper 29Chatrine Isabella SaragihNessuna valutazione finora

- Module 2Documento26 pagineModule 2golu tripathiNessuna valutazione finora

- Nicholson Microeconomics 7.3 7.7 SolutionsDocumento4 pagineNicholson Microeconomics 7.3 7.7 SolutionsMaxim Pecionchin50% (2)

- 1 BEFA-Handout PDFDocumento58 pagine1 BEFA-Handout PDFSiva Venkata RamanaNessuna valutazione finora

- Unit 6 Production With One Variable Input: 6.0 ObjectivesDocumento13 pagineUnit 6 Production With One Variable Input: 6.0 ObjectivesSaima JanNessuna valutazione finora

- 0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics IDocumento44 pagine0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics I18651 SYEDA AFSHANNessuna valutazione finora

- R&D Measurement Methods and ModelsDocumento32 pagineR&D Measurement Methods and ModelsBianca DíazNessuna valutazione finora

- 11 Economic Cours 3&4Documento41 pagine11 Economic Cours 3&4tegegn mehademNessuna valutazione finora

- Agricultural ProductivityDocumento144 pagineAgricultural ProductivityNamagua LeeNessuna valutazione finora

- Isha Garg Test 01Documento60 pagineIsha Garg Test 01AVINASHNessuna valutazione finora

- Economics:: According To Prof. Joel Dean "The Purpose of Managerial Economics Is ToDocumento12 pagineEconomics:: According To Prof. Joel Dean "The Purpose of Managerial Economics Is Toravi.youNessuna valutazione finora

- EC611 - (CH 06) Production Theory & EstimationDocumento33 pagineEC611 - (CH 06) Production Theory & Estimationsilverster_123Nessuna valutazione finora

- Economy Analysis of Broiler ProductionDocumento6 pagineEconomy Analysis of Broiler Productioncklim123Nessuna valutazione finora

- Befa 5 Units-NotesDocumento280 pagineBefa 5 Units-Notesravi tejaNessuna valutazione finora

- Romer Model SlidesDocumento36 pagineRomer Model Slidesranuv8030Nessuna valutazione finora

- Excel Shortcut ListDocumento157 pagineExcel Shortcut ListNisha VermaNessuna valutazione finora

- Two Marks Question and AnswersDocumento71 pagineTwo Marks Question and AnswersBoopathy KarthikeyanNessuna valutazione finora