Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Rugby World Cup - The Macquarie Quant Guide MAC

Caricato da

MentalCrumbleCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Rugby World Cup - The Macquarie Quant Guide MAC

Caricato da

MentalCrumbleCopyright:

Formati disponibili

Rugby World Cup

GLOBAL

The Macquarie Quant Guide

Always bet on black: New Zealand to go back-to-back

The attention of the Rugby loving world will shift to the United Kingdom over the

next 6 weeks as the 20 best teams in the world fight it out in the 8th official Rugby

World Cup. We warm up for this years Melbourne Cup by building a Quant

model to forecast the outcome.

New Zealand is impossible to go past this year and is our favoured team to

take out the title. This will be a history making effort for the All Blacks as no team

has won back-to back World Cups before.

Inside

A Quant guide to the Rugby World Cup

A prediction for every match

Building the model

Model Results: Country by country

The match schedule and forecasts

The odds for New Zealand to take out the crown are already narrow therefore

we run a full simulation of the tournament allowing our model to pick the

outcome of each match.

Group standings and the finals

Final thoughts

The final sees New Zealand plotted against England on the 31st of October at

Twickenham, London. The home ground advantage just isnt quite enough to get

England over the line.

Australia finish 3rd on the numbers and are unfortunately drawn in the same

pool as England. This means they finish second in the pool which results in a

showdown with the All Blacks in the semi-finals. A potential bogey game for the

Kiwis and wed be happy for our model to get this one wrong!

South Africa appears to be the biggest disappointment driven by their form

over the last 12 months. They finished last in the recent Rugby Championship.

They are welcoming back a wealth of experience for the World Cup but are

facing an uphill battle to be serious competitors in 2015.

France and Ireland should win their fare share of games in the tournament and

will benefit from playing close to home. Wales will provide stiff competition but

are in a very difficult group with England and Australia more likely to advance.

Getting Quanty with William Web Ellis

In similar vein to our prior work on the Melbourne Cup and the Football World

Cup in Brazil we transform traditional stats from the sport (in this case rugby) into

Quant factors to create a model for the Web Ellis trophy. The pillars of our

model are:

Value:

World Ranking, World Cup Matches

Momentum:

Change in Ranking, Win % (Last 12m)

Sentiment:

Odds, Change in Odds

Quality:

Best Result, Point Differential (12m), World Cup Points

Other:

Home Ground Advantage

We must stress that the purpose of this model is for fun. Our equity models

incorporate years of research internally and from external sources such as

academia. The world cup model has been put together by a lone team member

in their spare time. Enjoy the rugby!

16 September 2015

Please refer to page 9 for important disclosures and analyst certification, or on our website

www.macquarie.com/research/disclosures.

Macquarie Wealth Management

Rugby World Cup

A Quant guide to the Rugby World Cup

Building models for Macquarie Style

We transform Rugby

stats to build a

model for the World

Cup

This is not the first time weve taken a quant approach to sport see for example our

catalogue of reports forecasting Australias famous Melbourne Cup horse race: (2014, 2013,

2012 and more) and last years Football World Cup in Brazil. These forecasts do not come

without pedigree; Macquaries Melbourne Cup model has generated some good

performances and the Football World Cup model successfully picked Germany to win last

year.

We follow in these footsteps and take the same approach here: we use quantitative investing

principles to build a model to rank each countrys World Cup chances, and then use that

model to forecast tournament results.

Focussing on William Web Ellis

With Australia having a proud Rugby tradition, we thought this years World Cup (Web Ellis

Trophy) would be a good warm up for the Melbourne cup. There are clear favourites in this

competition and we will tend to prefer these teams as our model is data driven. Many would

argue a lot of the teams are simply making up the numbers. The players in these teams

would strongly disagree and will be focussed on causing an upset. With this in mind, we

highlight 10 interesting rugby facts before getting into the nuts and bolts of the model.

Some interesting

facts for the

upcoming

tournament

1.

World Cup upsets do occur.... some of the more infamous include Ireland upsetting

Australia 15 to 6 in the 2011 group stage. Or who could forget Frances upset of

New Zealand in the semi-final in 1999. They were given no hope and trailed 24-10

only to turn it on for 20 minutes and score 33 points. They followed it up again in

2007 beating the Kiwis 20-18 in the quarter final.

2.

Can the Kiwis overcome their Northern Hemisphere blues? New Zealand has never

reached a Rugby World Cup Final in the Northern Hemisphere.

3.

On the other hand, the Australians seem to enjoy getting above the equator having

won two World Cups in the Northern Hemisphere.

4.

The only nations to host and win a tournament are New Zealand (1987, 2011) and

South Africa (1995).

5.

A defending champion has never won the World Cup. Can New Zealand create

history and be the first team to win two in a row?

6.

145 is the most points that have ever been scored against a team at a World Cup.

New Zealand gave a rugby lesson to Japan in 1995. The widest winning margin in a

World Cup match is 142, achieved by Australia against Namibia in 2003.

7.

The first international rugby match was between Scotland and England in 1871 at

Raeburn Park in Edinburgh. Scotland won 1-0 by converting a try.

8.

The reigning rugby Olympic champion is the USA! 1924 was the last time rugby was

played at the Olympics in Paris. The United States is the most successful nation

winning gold in 1920 and 1924 as well as being the current Olympic champion.

Rugby sevens will make an appearance in the 2016 Rio Olympics.

9.

The same whistle, the Gil Evans whistle, is used to kick off the opening game of

every Rugby World Cup tournament. It was first used by Gil Evans, a Welsh referee

in 1905 and was also used at the kick off of the final rugby match at the 1924 Paris

Olympics.

10. A try was originally worth no points! Under the initial rules the only way to score was

by kicking a goal. A try simply gave the team the right to do a place kick for points.

Hence, it gave them a try for goal.

16 September 2015

Macquarie Wealth Management

Rugby World Cup

Building the model

The pillars of quant

We use our

traditional pillars of

building models for

equities

Quant factors are the building blocks of quant styles, and styles are combined into models.

For example, our Macquarie Alpha Model has over 120 factors that are grouped into 10 styles

which are then weighted to form a single model rank (see the report). For our World Cup

model we will take a similar approach, using the 5 most important quant styles:

1.

Value cheapness, what you get for the price

2.

Momentum what is working, what is getting better

3.

Sentiment what everyone is looking for right now, what people like

4.

Quality what is the best, the most reliable

5.

Other/Innovative Data what no-one else using, what I know that others dont

Altogether we have 10 factors across these 5 styles with no factor making up more than 20%

of the model weight providing diversification.

Value

1.

The World Rugby Rankings provides a quantitative measure to rank international

teams across the globe. The system ranks teams on their recent performances and

weights the results depending on the significance of the game and quality of the

opposition.

2.

World Cup matches: We look through the history of the prior World Cups and find

which countries have had the most matches.

Momentum

1.

Change in world ranking: We look at what the world ranking (described above) was

6 months ago and compare it to today. Those nations moving up the rankings will be

in better form and more dangerous.

2.

Similar to above, we simply take a nations winning percentage over the last 12

months. This does not account for the quality of the opposition but is still quite

indicative of the form.

Sentiment

1.

Betting odds. The bookmakers are the best guide to what the consensus views the

chances of each nation are. We incorporate up-to-date odds from Bet 365.

2.

Change in odds: In our quant models, we look at changes in sentiment as there is

often persistence in these changes. Here we focus on those teams where the

sentiment is shifting over the last 6 months.

Quality

1.

Winning a World Cup is a huge achievement and requires incredible focus and

calmness under pressure. We look at each countrys history at the World Cup and

give a higher score to those who have performed on the big stage before.

2.

Winning and losing does not tell the entire story. By looking at the for-and-against

record for the last 12 months, we determine how convincingly the teams have been

winning or losing.

3.

World Cup Points: A teams ability to score enough points can be rewarded in this

tournament with bonus points available in the group stages. We look at the history of

total points scored in World Cups for each country.

Other Data

1.

16 September 2015

Home ground advantage can make a big difference, especially in the Northern

Hemisphere with parochial crowds lifting the home team to another level. We think

this will benefit European teams over teams from other regions in the world.

Macquarie Wealth Management

Rugby World Cup

Factor and style weighting

Diversification is a

key to Quant

investing so we

spread the weights

across the model

Diversification is key to quant, and with a distinct lack of historical data we go very close to

the simplest (but also sometimes the best) weighting scheme for our styles: equal weighted.

We allocate 25% each to Value, Momentum, Sentiment, with Quality and Other Data making

up the remaining 25%. The underlying factors making up the styles are weighted based on

their anticipated impact. We delved deep into the quant teams knowledge base to find an

expert in this space and came up empty. Thankfully there were many diehard fans in the

broader group to provide some qualitative advice as to which factors are more impactful to

the outcome of a match.

The weightings are shown at the top of the table on the next page. Once the model is built

we can then plug and play and see how we think the tournament will pan out.

16 September 2015

Macquarie Wealth Management

Rugby World Cup

Model Results: Country by country

New Zealand scores top marks in the model and are deserved favourites going into the

tournament. Their form and the fact that this tournament will mark the end of careers of some

of their finest ever players means they will be up to the challenge.

Model rankings

are shown

below!

The home ground advantage sees England slot firmly into second place. The pressure will

be on! We see the home ground advantage as a benefit but some may argue they will choke

under the pressure.

New Zealand

leads the way

Australia is ranked third and was building nicely until their recent match with New Zealand.

Consistency and their ability to execute under pressure will be the key for Wallabies.

Of the Europeans France, Wales and Ireland all look like they can make some noise this

year too.

South Africa is the surprise disappointment in the model following their form slump in 2015.

They are welcoming back a number of key players to the team for the tournament but lack of

match time makes them a risky proposition.

Fig 1 Team rankings and the model inputs

Value

25%

Quant Factor

Weight

Momentum

25%

Sentiment

25%

Quality

20%

Other Data

5%

World

Ranking

World Cup

Matches

Change in

Ranking

Win %

(last 12m )

Odds

Change in

Odds (6m )

Best Result

in WC

For and

Against (12m )

World Cup

Points

Hom e Region

(Europe)

Factor within Style

75%

25%

50%

50%

75%

25%

50%

20%

30%

100%

Model Weight (factor wt * style wt)

19%

6%

13%

13%

19%

6%

10%

4%

6%

5%

100%

100%

45%

100%

100%

80%

100%

100%

100%

0%

85%

85%

55%

85%

95%

35%

100%

75%

85%

100%

95%

90%

95%

40%

85%

75%

100%

45%

95%

0%

70%

100%

80%

60%

75%

85%

75%

60%

90%

100%

80%

75%

75%

85%

70%

15%

50%

65%

70%

100%

75%

70%

35%

95%

80%

90%

10%

90%

65%

100%

90%

60%

10%

35%

90%

5%

100%

30%

80%

0%

55%

80%

65%

20%

60%

100%

50%

35%

75%

100%

65%

70%

60%

45%

65%

70%

50%

40%

60%

0%

60%

50%

85%

70%

50%

70%

10%

60%

50%

0%

50%

25%

70%

95%

50%

70%

0%

70%

30%

0%

40%

50%

5%

85%

35%

95%

0%

95%

35%

0%

45%

50%

50%

30%

60%

10%

10%

25%

55%

0%

20%

50%

40%

65%

15%

70%

0%

80%

25%

100%

0%

Input for Factor

New Zealand

England

Australia

France

Wales

Ireland

South Africa

Scotland

Argentina

Fiji

Tonga

Japan

Samoa

Romania

Namibia

USA

Italy

Georgia

Canada

Uruguay

5%

15%

100%

60%

15%

70%

0%

85%

15%

30%

25%

90%

25%

30%

70%

0%

10%

20%

0%

35%

50%

15%

5%

50%

20%

0%

5%

40%

100%

25%

10%

20%

50%

30%

30%

0%

50%

15%

100%

15%

55%

25%

10%

30%

30%

10%

15%

45%

0%

10%

5%

30%

15%

15%

70%

0%

20%

5%

0%

Final

Ranking

87%

82%

78%

77%

71%

69%

59%

59%

56%

54%

50%

40%

39%

37%

33%

33%

30%

29%

22%

16%

Each column for each country shows their total possible score out of 100%

Source: Macquarie Research, bet365.com.au, September 2015.

Now that we have the model, the next step is to apply it to the tournament!!

16 September 2015

Macquarie Wealth Management

Rugby World Cup

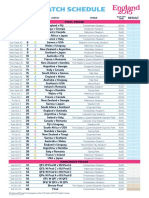

The match schedule and forecasts

We can forecast the

winner of each

match scheduled for

the tournament

We apply our model simply and equally to all matches:

The team with the highest rank wins (4 points).

If the team model scores are within 15% then a bonus point is added to the loser as we

expect a close match (1 point).

If the team model scores are greater than 25% than a bonus point is added to the winner

as they are more likely to score more than 4 tries (1 point).

Fig 2 The Pool matches and the model results

Date

18-Sep-15

19-Sep-15

19-Sep-15

19-Sep-15

19-Sep-15

20-Sep-15

20-Sep-15

20-Sep-15

23-Sep-15

23-Sep-15

23-Sep-15

24-Sep-15

25-Sep-15

26-Sep-15

26-Sep-15

26-Sep-15

27-Sep-15

27-Sep-15

27-Sep-15

29-Sep-15

1-Oct-15

1-Oct-15

2-Oct-15

3-Oct-15

3-Oct-15

3-Oct-15

4-Oct-15

4-Oct-15

6-Oct-15

6-Oct-15

7-Oct-15

7-Oct-15

9-Oct-15

10-Oct-15

10-Oct-15

10-Oct-15

11-Oct-15

11-Oct-15

11-Oct-15

11-Oct-15

Match Pool

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

A

C

D

B

D

B

A

C

B

A

D

C

C

D

B

A

A

B

B

C

A

D

C

B

B

A

C

B

D

A

B

C

C

B

A

A

C

D

D

B

Team A

England

Tonga

Ireland

South Africa

France

Samoa

Wales

New Zealand

Scotland

Australia

France

New Zealand

Argentina

Italy

South Africa

England

Australia

Scotland

Ireland

Tonga

Wales

France

New Zealand

Samoa

South Africa

England

Argentina

Ireland

Canada

Fiji

South Africa

Namibia

New Zealand

Samoa

Australia

England

Argentina

Italy

France

USA

Model Rating

82%

50%

69%

59%

77%

39%

71%

87%

59%

78%

77%

87%

56%

30%

59%

82%

78%

59%

69%

50%

71%

77%

87%

39%

59%

82%

56%

69%

22%

54%

59%

33%

87%

39%

78%

82%

56%

30%

77%

33%

Model Rating

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

v

54%

29%

22%

40%

30%

33%

16%

56%

40%

54%

37%

33%

29%

22%

39%

71%

16%

33%

37%

33%

54%

22%

29%

40%

59%

78%

50%

30%

37%

16%

33%

29%

50%

59%

71%

16%

33%

37%

69%

40%

Team B Location

Time

Winner?

Fiji

Georgia

Canada

Japan

Italy

USA

Uruguay

Argentina

Japan

Fiji

Romania

Namibia

Georgia

Canada

Samoa

Wales

Uruguay

USA

Romania

Namibia

Fiji

Canada

Georgia

Japan

Scotland

Australia

Tonga

Italy

Romania

Uruguay

USA

Georgia

Tonga

Scotland

Wales

Uruguay

Namibia

Romania

Ireland

Japan

21:00

13:00

15:30

17:45

21:00

13:00

15:30

17:45

15:30

17:45

21:00

21:00

17:45

15:30

17:45

21:00

13:00

15:30

17:45

17:45

17:45

21:00

21:00

15:30

17:45

21:00

15:30

17:45

17:45

21:00

17:45

21:00

21:00

15:30

17:45

21:00

13:00

15:30

17:45

21:00

England

Tonga

Ireland

South Africa

France

Samoa

Wales

New Zealand

Scotland

Australia

France

New Zealand

Argentina

Italy

South Africa

England

Australia

Scotland

Ireland

Tonga

Wales

France

New Zealand

Japan

South Africa

England

Argentina

Ireland

Romania

Fiji

South Africa

Namibia

New Zealand

Scotland

Australia

England

Argentina

Romania

France

Japan

Twickenham, London

Kingsholm Stadium, Gloucester

Millennium Stadium, Cardiff

Brighton Community Centre, Brighton

Twickenham, London

Brighton Community Centre, Brighton

Millennium Stadium, Cardiff

Wembley Stadium, London

Kingsholm Stadium, Gloucester

Millennium Stadium, Cardiff

Olympic Stadium, London

Olympic Stadium, London

Kingsholm Stadium, Gloucester

Elland Road, Leeds

Villa Park, Birmingham

Twickenham, London

Villa Park, Birmingham

Elland Road, Leeds

Wembley Stadium, London

Sandy Park, Exeter

Millennium Stadium, Cardiff

Stadium MK, Milton Keynes

Millennium Stadium, Cardiff

Stadium MK, Milton Keynes

St James' Park, Newcastle

Twickenham, London

Leicester City Stadium, Leicester

Olympic Stadium, London

Leicester City Stadium, Leicester

Stadium MK, Milton Keynes

Olympic Stadium, London

Sandy Park, Exeter

St James' Park, Newcastle

St James' Park, Newcastle

Twickenham, London

Manchester City Stadium

Leicester City Stadium, Leicester

Sandy Park, Exeter

Millennium Stadium, Cardiff

Kingsholm Stadium, Gloucester

Bonus Point Bonus Point

Lose < 7 Score > 4 tries

England

Ireland

France

USA

Wales

New Zealand

France

New Zealand

Argentina

Canada

Wales

Australia

Scotland

Ireland

France

New Zealand

Japan

Scotland

Australia

Tonga

Ireland

Romania

Fiji

South Africa

Georgia

New Zealand

Wales

England

Romania

Ireland

Japan

Source: Macquarie Research, September 2015.

16 September 2015

Macquarie Wealth Management

Rugby World Cup

Group standings and the finals

Final group standings

The result of the

pool matches is

shown below

Our simulation results in the following standings after all of the pool matches. England tops

Group A with a close win over Australia. This proves critical for them being able to advance

past the semi-finals as they avoid a clash with New Zealand earlier than the final.

If the results go the way we anticipate South Africa, New Zealand and Australia will be in the

top bracket. England appears to have the friendlier run into the finals if they can top Group A.

The winner of Group D (we have France pipping Ireland) should have a much easier path to

the semi finals.

Fig 3 Final standings of the Pools

Group A

England

Australia

Wales

Fiji

Uruguay

Group B

South Africa

Scotland

Japan

Samoa

USA

Group C

New Zealand

Argentina

Tonga

Namibia

Georgia

Group D

France

Ireland

Romania

Italy

Canada

Played

4

4

4

4

4

Win

4

3

2

1

0

Loss

0

1

2

3

4

Draw

0

0

0

0

0

Bonus PointsFinal Points

2

18

2

14

3

11

1

5

0

0

Played

4

4

4

4

4

Win

4

3

2

1

0

Loss

0

1

2

3

4

Draw

0

0

0

0

0

Bonus PointsFinal Points

1

17

2

14

2

10

0

4

1

1

Played

4

4

4

4

4

Win

4

3

2

1

0

Loss

0

1

2

3

4

Draw

0

0

0

0

0

Bonus PointsFinal Points

4

20

1

13

1

9

0

4

1

1

Played

4

4

4

4

4

Win

4

3

2

1

0

Loss

0

1

2

3

4

Draw

0

0

0

0

0

Bonus PointsFinal Points

3

19

4

16

2

10

0

4

1

1

Source: Macquarie Quantitative Research, September 2015

And the winner is.... New Zealand

We can now

simulate the finals

bracket

We map out the finals bracket below continuing to use our ranking system. New Zealand

comes out on top

Fig 4 The Pool matches and the model results

Saturday, 17 October 2015

Quarter Final 1

South Africa

41

Australia

Quarter Final 2

New Zealand

42

Ireland

Sunday, 18 October 2015

Quarter Final 3

France

43

Argentina

Quarter Final 4

England

44

Scotland

59%

78%

Saturday, 24 October 2015

Semi Final 1

Australia

45

New Zealand

78%

87%

87%

69%

Saturday, 31 October 2015

Rugby World Cup Final

New Zealand

England

87%

82%

Friday, 30 October 2015

3rd and 4th playoff

Australia

47

France

78%

77%

48

77%

56%

82%

59%

Sunday, 25 October 2015

Semi Final 2

France

46

England

77%

82%

Source: Macquarie Research, September 2015.

16 September 2015

Macquarie Wealth Management

Rugby World Cup

Final thoughts

So that its for the 2015 World Cup. We cant go past the favourites for this tournament but

England look well placed to give the Kiwis a run for their money.

As we stated on the front page, the purpose of this model is mostly fun. We are trying our

best to pick the winner but this is definitely not our area of expertise. Our equity models

incorporate years of research internally and from external sources such as academia. The

World Cup model has been put together by a lone team member in their spare time.

Enjoy the rugby!

16 September 2015

Macquarie Wealth Management

Important disclosures:

Rugby World Cup

Recommendation definitions

Volatility index definition*

Financial definitions

Macquarie - Australia/New Zealand

Outperform return >3% in excess of benchmark return

Neutral return within 3% of benchmark return

Underperform return >3% below benchmark return

This is calculated from the volatility of historical

price movements.

All "Adjusted" data items have had the following

adjustments made:

Added back: goodwill amortisation, provision for

catastrophe reserves, IFRS derivatives & hedging,

IFRS impairments & IFRS interest expense

Excluded: non recurring items, asset revals, property

revals, appraisal value uplift, preference dividends &

minority interests

Benchmark return is determined by long term nominal

GDP growth plus 12 month forward market dividend

yield

Macquarie Asia/Europe

Outperform expected return >+10%

Neutral expected return from -10% to +10%

Underperform expected return <-10%

Macquarie First South - South Africa

Outperform expected return >+10%

Neutral expected return from -10% to +10%

Underperform expected return <-10%

Macquarie - Canada

Outperform return >5% in excess of benchmark return

Neutral return within 5% of benchmark return

Underperform return >5% below benchmark return

Macquarie - USA

Outperform (Buy) return >5% in excess of Russell

3000 index return

Neutral (Hold) return within 5% of Russell 3000 index

return

Underperform (Sell) return >5% below Russell 3000

index return

Very highhighest risk Stock should be

expected to move up or down 60100% in a year

investors should be aware this stock is highly

speculative.

High stock should be expected to move up or

down at least 4060% in a year investors should

be aware this stock could be speculative.

Medium stock should be expected to move up

or down at least 3040% in a year.

Lowmedium stock should be expected to

move up or down at least 2530% in a year.

Low stock should be expected to move up or

down at least 1525% in a year.

* Applicable to Asia/Australian/NZ/Canada stocks

only

EPS = adjusted net profit / efpowa*

ROA = adjusted ebit / average total assets

ROA Banks/Insurance = adjusted net profit /average

total assets

ROE = adjusted net profit / average shareholders funds

Gross cashflow = adjusted net profit + depreciation

*equivalent fully paid ordinary weighted average

number of shares

All Reported numbers for Australian/NZ listed stocks

are modelled under IFRS (International Financial

Reporting Standards).

Recommendations 12 months

Note: Quant recommendations may differ from

Fundamental Analyst recommendations

Recommendation proportions For quarter ending 30 June 2015

Outperform

Neutral

Underperform

AU/NZ

46.23%

37.67%

16.10%

Asia

58.36%

25.65%

15.99%

RSA

47.27%

29.09%

23.64%

USA

44.20%

49.29%

6.52%

CA

60.65%

34.19%

5.16%

EUR

43.01% (for US coverage by MCUSA, 9.68% of stocks followed are investment banking clients)

40.93% (for US coverage by MCUSA, 5.53% of stocks followed are investment banking clients)

16.06% (for US coverage by MCUSA, 1.38% of stocks followed are investment banking clients)

Company-specific disclosures:

Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/disclosures.

Analyst certification: The views expressed in this research reflect the personal views of the analyst(s) about the subject securities or issuers and no

part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this

research. The analyst principally responsible for the preparation of this research receives compensation based on overall revenues of Macquarie Group

Ltd (ABN 94 122 169 279, AFSL No. 318062) (MGL) and its related entities (the Macquarie Group) and has taken reasonable care to achieve and

maintain independence and objectivity in making any recommendations.

General disclosure: This research has been issued by Macquarie Securities (Australia) Limited (ABN 58 002 832 126, AFSL No. 238947) a Participant

of the Australian Securities Exchange (ASX) and Chi-X Australia Pty Limited. This research is distributed in Australia by Macquarie Equities Limited

(ABN 41 002 574 923, AFSL No. 237504) ("MEL"), a Participant of the ASX, and in New Zealand by Macquarie Equities New Zealand Limited (MENZ)

an NZX Firm. Macquarie Private Wealths services in New Zealand are provided by MENZ. Macquarie Bank Limited (ABN 46 008 583 542, AFSL No.

237502) (MBL) is a company incorporated in Australia and authorised under the Banking Act 1959 (Australia) to conduct banking business in Australia.

None of MBL, MGL or MENZ is registered as a bank in New Zealand by the Reserve Bank of New Zealand under the Reserve Bank of New Zealand Act

1989. Any MGL subsidiary noted in this research, apart from MBL, is not an authorised deposit-taking institution for the purposes of the Banking Act

1959 (Australia) and that subsidiarys obligations do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide

assurance in respect of the obligations of that subsidiary, unless noted otherwise.

This research is general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice, you

should consider the appropriateness of the advice having regard to your situation. We recommend you obtain financial, legal and taxation advice before

making any financial investment decision. This research has been prepared for the use of the clients of the Macquarie Group and must not be copied,

either in whole or in part, or distributed to any other person. If you are not the intended recipient, you must not use or disclose this research in any way.

If you received it in error, please tell us immediately by return e-mail and delete the document. We do not guarantee the integrity of any e-mails or

attached files and are not responsible for any changes made to them by any other person. Nothing in this research shall be construed as a solicitation to

buy or sell any security or product, or to engage in or refrain from engaging in any transaction. This research is based on information obtained from

sources believed to be reliable, but the Macquarie Group does not make any representation or warranty that it is accurate, complete or up to date. We

accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. The Macquarie

Group accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this research and/or further

communication in relation to this research. The Macquarie Group produces a variety of research products, recommendations contained in one type of

research product may differ from recommendations contained in other types of research. The Macquarie Group has established and implemented a

conflicts policy at group level, which may be revised and updated from time to time, pursuant to regulatory requirements; which sets out how we must

seek to identify and manage all material conflicts of interest. The Macquarie Group, its officers and employees may have conflicting roles in the financial

products referred to in this research and, as such, may effect transactions which are not consistent with the recommendations (if any) in this research.

The Macquarie Group may receive fees, brokerage or commissions for acting in those capacities and the reader should assume that this is the case.

The Macquarie Groups employees or officers may provide oral or written opinions to its clients which are contrary to the opinions expressed in this

research.

Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/disclosures.

Macquarie Group

16 September 2015

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- RWC 2023 Draw Media Guide ENG - 230904 - 100004Documento18 pagineRWC 2023 Draw Media Guide ENG - 230904 - 100004TavyNessuna valutazione finora

- RWC Official Media Guide 2023 ENGDocumento124 pagineRWC Official Media Guide 2023 ENGFacu Rojas PoetaNessuna valutazione finora

- Berenberg - Apple+Tesla - Open Letter - 131025 PDFDocumento2 pagineBerenberg - Apple+Tesla - Open Letter - 131025 PDFMentalCrumbleNessuna valutazione finora

- Economic Insights Playing ChickenDocumento2 pagineEconomic Insights Playing ChickenMentalCrumbleNessuna valutazione finora

- Rosenblum How Bad Was ItDocumento24 pagineRosenblum How Bad Was ItcaitlynharveyNessuna valutazione finora

- HMMM September 3Documento37 pagineHMMM September 3richardck61Nessuna valutazione finora

- Blue Bulls 2001Documento4 pagineBlue Bulls 2001Fab IanNessuna valutazione finora

- Superrugby Saturday-Pacific RacingDocumento1 paginaSuperrugby Saturday-Pacific RacingjoanalcarazNessuna valutazione finora

- SuperRugby RESULTDocumento1 paginaSuperRugby RESULTjoanalcarazNessuna valutazione finora

- Superrugby Aoteaora r4 Friday Pacific RacingDocumento1 paginaSuperrugby Aoteaora r4 Friday Pacific RacingjoanalcarazNessuna valutazione finora

- Warringah Rugby Club - WikipediaDocumento3 pagineWarringah Rugby Club - WikipediaAjay BharadvajNessuna valutazione finora

- R WC 2015 Match Schedule With Ko FullDocumento1 paginaR WC 2015 Match Schedule With Ko FullignaciochansNessuna valutazione finora

- New Zealand Vs South Africa Rugby Championship Live Stream 08 October 2016Documento6 pagineNew Zealand Vs South Africa Rugby Championship Live Stream 08 October 2016rugbyliveNessuna valutazione finora

- Rugby World Cup FixturesDocumento3 pagineRugby World Cup FixturesDumitru StircuNessuna valutazione finora

- 2015 Rugby World Cup Welcome BookletDocumento8 pagine2015 Rugby World Cup Welcome BookletglosafNessuna valutazione finora

- Mitre 10cup Wednesday Pacific RacingDocumento1 paginaMitre 10cup Wednesday Pacific RacingjoanalcarazNessuna valutazione finora

- Rugby World Cup Match ScheduleDocumento5 pagineRugby World Cup Match ScheduleDavid GomezNessuna valutazione finora

- German Rugby World Cup Television ScheduleDocumento5 pagineGerman Rugby World Cup Television ScheduleJames MacleanNessuna valutazione finora

- Match Schedule White BackgroundDocumento1 paginaMatch Schedule White BackgroundDiego ParisiNessuna valutazione finora

- 2011 Rugby World CupDocumento1 pagina2011 Rugby World CupBliksimpieNessuna valutazione finora

- All Blacks: New ZealandDocumento25 pagineAll Blacks: New Zealandnicolem6495Nessuna valutazione finora

- Rugby World Cup Office SweepstakeDocumento19 pagineRugby World Cup Office SweepstakeCasey BanksNessuna valutazione finora

- Six Nations 2021Documento19 pagineSix Nations 2021schmidtNessuna valutazione finora

- Stuttgarter RC: Jump To Navigation Jump To SearchDocumento8 pagineStuttgarter RC: Jump To Navigation Jump To SearchsakuraleeshaoranNessuna valutazione finora

- Springbok Miscellany: From The Earliest Days To The Modern EraDocumento36 pagineSpringbok Miscellany: From The Earliest Days To The Modern EraLittleWhiteBakkieNessuna valutazione finora

- Next Senior National Representative Team June 2012Documento1 paginaNext Senior National Representative Team June 201243AJF43Nessuna valutazione finora

- t2 T 078 Rugby World Cup Reading Comprehension Pack - Ver - 1Documento4 paginet2 T 078 Rugby World Cup Reading Comprehension Pack - Ver - 1English Panda100% (1)

- Rugby World Cup 2015 WallchartDocumento1 paginaRugby World Cup 2015 WallchartbunaciuneNessuna valutazione finora

- Rugby World Cup 2011Documento3 pagineRugby World Cup 2011Jaly ZenNessuna valutazione finora

- TSV Victoria LindenDocumento6 pagineTSV Victoria LindensakuraleeshaoranNessuna valutazione finora

- French Rugby World Cup Television ScheduleDocumento4 pagineFrench Rugby World Cup Television ScheduleJames MacleanNessuna valutazione finora

- Early History of Rugby UnionDocumento13 pagineEarly History of Rugby UnionJL GalaxyNessuna valutazione finora

- PostCodes 2008Documento43 paginePostCodes 2008Theepana JeyaramNessuna valutazione finora

- Mitre 10cup Result-Wednesday-Pacific RacingDocumento1 paginaMitre 10cup Result-Wednesday-Pacific RacingjoanalcarazNessuna valutazione finora