Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bad Bank Definition

Caricato da

Prateek LoganiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bad Bank Definition

Caricato da

Prateek LoganiCopyright:

Formati disponibili

9/13/2015

BadBankDefinition|Investopedia

Free Annual Reports | Register

Search Investopedia

DICTIONARY

Active Trading

INVESTING

Forex

TRADING

Technical Analysis

MARKETS

Brokers

Options

PERSONAL

FINANCE

Futures

WEALTH

MANAGEMENT

Personal Finance

Retirement

FINANCIAL

ADVISORS

Acronyms

EXAM PREP

Accounting

TUTORIALS

Banking

VIDEO

Bonds

Top10MutualFunds

BuyMutualfundsonline.Selectfrom5000+schemes.OpenFreeA/cnow.

Bad Bank

AA

You may also like: Does Warren Buffett own the same stock as you?

DEFINITION OF 'BAD BANK'

A bank set up to buy the bad loans of a bank with significant nonperforming assets at market

price. By transferring the bad assets of an institution to the bad bank, the banks clear their

balance sheet of toxic assets but would be forced to take write downs. Shareholders and

bondholders stand to lose money from this solution (but not depositors). Banks that become

insolvent as a result of the process can be recapitalized, nationalized or liquidated.

BREAKING DOWN 'BAD BANK'

A well-known example of a bad bank was Grant Street National Bank, which was created in

1988 to house the bad assets of Mellon Bank. The financial crisis of 2008 revived interest in

the bad bank solution, as managers at some of the world's largest institutions contemplated

segregating their nonperforming assets into bad banks.

Federal Reserve Bank Chairman Ben Bernanke proposed the idea of using a government-run

bad bank in the recession following the subprime mortgage meltdown in order to clean up

private banks with high levels of problematic assets and allow them to start lending again. An

alternate strategy considered was a guaranteed insurance plan that would keep the toxic

assets on the banks' books but eliminate the banks' risk and pass the risk on to taxpayers.

Refine Your Financial Vocabulary

Gain the Financial Knowledge You Need to Succeed. Investopedias FREE Term of the Day

helps you gain a better understanding of all things financial with technical and easy-tounderstand explanations. Click here to begin developing your financial language with this

daily newsletter.

RELATED TERMS

Investment Bank - IB

A financial intermediary that performs a

variety of services. ...

Bank Credit

The amount of credit available to a company

or individual from ...

Chapter 11

Nonperforming Asset

Bank

Technical Bankruptcy

Named after the U.S. bankruptcy code 11,

Chapter 11 is a form ...

A financial institution licensed as a receiver

of deposits. There ...

Subscribe to our Free Newsletters!

Sign Up

Enter e-mail address

Learn More

A debt obligation where the borrower has

not paid any previously ...

The state of a company or person who has

defaulted on a financial ...

Marketplace

How to Turn $50 into $1,000, Every Day, as Long as the

Stock Market is Open

Exclusive: Learn the "House Odds" of Investing

RELATED ARTICLES

Are you interested in generating income?

BONDS & FIXED INCOME

5 Signs Of A Credit Crisis

These indicators can illuminate the depth and severity of problems in the credit markets.

HOT DEFINITIONS

Endowment Effect

http://www.investopedia.com/terms/badbank.asp

1/4

9/13/2015

BadBankDefinition|Investopedia

Halo Effect

J-Curve Effect

Wal-Mart Effect

Fisher Effect

OPTIONS & FUTURES

Draghi Effect

Dialing In On The Credit Crisis

Would a similar crisis have occurred if iPhone investors were offered the

same loan options as homeowners?

OPTIONS & FUTURES

Mark-To-Market Mayhem

Did this accounting convention contribute to the credit crisis of 2008? Find

out here.

Trading Center

Best Mutual Funds for

SIP

Compare & Invest in Best

SIP Mutual Funds & get

Maximum Returns

INSURANCE

Fannie Mae, Freddie Mac And The Credit Crisis Of 2008

Is the U.S. Congress' failure to rein in these mortgage giants to blame for the

financial fallout?

INVESTING BASICS

Understanding the Inverted Yield Curve

An inverted yield curve occurs during the rare times when short-term

interest rates are higher than long-term interest rates.

ECONOMICS

What is a Loan Loss Provision?

BestMutual

FundsforSIP

Compare&Investin

BestSIPMutualFunds

&getMaximumReturns

Banks set aside loan loss provisions to cover losses from bad loans.

MUTUAL FUNDS & ETFS

ETF Analysis: SPDR S&P Regional Banking

Learn about the SPDR S&P Regional Banking Fund, an exchange-traded

fund (ETF) that invests in equities of regional banks located in the United

States.

MUTUAL FUNDS & ETFS

ETF Analysis: SPDR S&P Bank

Explore analysis of the SPDR S&P Bank ETF, and learn how the ETF tracks

the banking sector and how investors can benefit from this ETF.

STOCK ANALYSIS

Who Are Wells Fargos Main Competitors?

Explore information on the main competitors of Wells Fargo, the other

three of the "big four" U.S. banks of Citigroup, JPMorgan Chase and Bank of

America.

STOCK ANALYSIS

Who Are Bank of Americas Main Competitors?

Explore information and analysis on JPMorgan Chase, Wells Fargo and

Citigroup, the three banks considered the main competitors to Bank of

America.

RELATED FAQS

Q: Who decides when to print money in India?

A: The Reserve Bank of India, or RBI, manages currency in India. The bank's additional responsibilities

include regulating the ... Read Full Answer >>

http://www.investopedia.com/terms/badbank.asp

2/4

9/13/2015

BadBankDefinition|Investopedia

Q: What is the difference between a Debit Order and a Standard Order in a bank reconciliation?

A: While both debit orders and standard orders represent recurring transactions that must be considered

in bank reconciliations, ... Read Full Answer >>

Q: How can I cancel a bank draft that I have purchased?

A: It is not commonly possible to cancel or stop payment on a bank draft since it, in effect, represents a

transaction that ... Read Full Answer >>

Q: How does investment banking differ from commercial banking?

A: Investment banking and commercial banking are two primary segments of the banking industry.

Investment banks facilitate the ... Read Full Answer >>

Q: Who generally structures a syndicated loan?

A: Typically, either an investment bank or a commercial bank structures a syndicated loan. A syndicated

loan is provided by ... Read Full Answer >>

Q: What role does a correspondent bank play in an international transaction?

A: A correspondent bank is most typically used in international buy, sell or money transfer transactions to

facilitate foreign ... Read Full Answer >>

Ads

Best SIP Investment Plans

www.myuniverse.co.in/ZipSip

Invest in best top funds & avail higher returns. Invest in 2 Mins.

IBPS GK PDF Free Download

www.talentsprint.com/Bank

Last 6 Months Topics Covered, Download IBPS Current Affairs PDF

HDFC Life Click2Invest

hdfclife.com/ULIP

Invest Rs 1000/Month & Get more Returns on Maturity. Tax Benefits.

BROWSE BY TOPIC:

Banking Industry

Ben Bernanke

Powerful Leader

Recession

Special Purpose Entity

YOU MAY ALSO LIKE

Top Cities that treat

women travellers like

queens

Has China Moved From

Competitor to

Adversary? Topic A:

Whats Better?

Investing in Equity

Mutual Funds or

Outbrain | Using Heat

Maps to Increase

Content Performance

Skyscanner

Roll Call

scripbox

Outbrain

SIP can make investors

rich in 35 years

He Was the Next

Michael Jordan

MyUniverse

OZY

Top 10 places you can't

miss when you visit

Hong Kong

Getting Started with

the Intel Edison Board

on Windows*

Discover Hong Kong

Intel

Recommendedby

Search Investopedia

http://www.investopedia.com/terms/badbank.asp

Symbol

3/4

9/13/2015

BadBankDefinition|Investopedia

DICTIONARY:

CONTENT LIBRARY

Articles

Terms

CONNECT WITH INVESTOPED

Videos

Free Annual Reports

Tutorials

Slideshows

Stock Simulator

FXtrader

FAQs

Calculators

Exam Prep Quizzer

Chart Advisor

Stock Analysis

Net Worth Calculator

WORK WITH INVESTOPEDIA

License Content

Advertise With Us

Write For Us

Email Deployment

Contact Us

Careers

Sign Up for Our Free Newsletters!

2015, Investopedia, LLC. All Rights Reserved Terms Of Use Privacy Policy

http://www.investopedia.com/terms/badbank.asp

4/4

Potrebbero piacerti anche

- Instructor Led DiscussionDocumento2 pagineInstructor Led DiscussionPrateek LoganiNessuna valutazione finora

- Case Analysis: Service Design For Mobile BankingDocumento6 pagineCase Analysis: Service Design For Mobile BankingPrateek LoganiNessuna valutazione finora

- Diversity Discussion StartersDocumento24 pagineDiversity Discussion StartersPrateek LoganiNessuna valutazione finora

- Reflective Discussion GuidanceDocumento4 pagineReflective Discussion GuidancePrateek LoganiNessuna valutazione finora

- Edutopia Onlinelearning Mastering Online Discussion Board Facilitation PDFDocumento15 pagineEdutopia Onlinelearning Mastering Online Discussion Board Facilitation PDFPrateek LoganiNessuna valutazione finora

- LP Quantitative TechniquesDocumento29 pagineLP Quantitative TechniquesPrateek LoganiNessuna valutazione finora

- Survey On Marketing of BantaDocumento4 pagineSurvey On Marketing of BantaPrateek LoganiNessuna valutazione finora

- Merger of Snapdeal With Free ChargeDocumento11 pagineMerger of Snapdeal With Free ChargePrateek LoganiNessuna valutazione finora

- Sun's Acquisition of Ranbaxy PharmaDocumento15 pagineSun's Acquisition of Ranbaxy PharmaPrateek LoganiNessuna valutazione finora

- Zomato Buys UrbanspoonDocumento12 pagineZomato Buys UrbanspoonPrateek LoganiNessuna valutazione finora

- TCSDocumento42 pagineTCSsharma_love7589% (9)

- Swim Lane TemplateDocumento6 pagineSwim Lane TemplatePrateek Logani100% (1)

- Tata Consultancy ServicesDocumento21 pagineTata Consultancy ServicesPrateek LoganiNessuna valutazione finora

- Summer Training Report On HDFC LifeDocumento90 pagineSummer Training Report On HDFC LifePrateek LoganiNessuna valutazione finora

- Tata Consultancy ServicesDocumento21 pagineTata Consultancy ServicesPrateek LoganiNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PAS 26 Accounting and Reporting by Retirement Benefit PlansDocumento25 paginePAS 26 Accounting and Reporting by Retirement Benefit Plansrena chavezNessuna valutazione finora

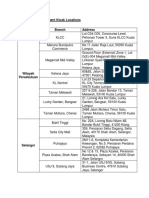

- Debit Card Replacement Kiosk Locations v2Documento3 pagineDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Personal LoanDocumento49 paginePersonal Loantodkarvijay50% (6)

- The Power of GodDocumento100 pagineThe Power of GodMathew CookNessuna valutazione finora

- Egyptian Gods and GoddessesDocumento5 pagineEgyptian Gods and GoddessesJessie May BonillaNessuna valutazione finora

- Lecture 1Documento15 pagineLecture 1Skyy I'mNessuna valutazione finora

- CrackJPSC Mains Paper III Module A HistoryDocumento172 pagineCrackJPSC Mains Paper III Module A HistoryL S KalundiaNessuna valutazione finora

- Reflection (The Boy Who Harnessed The Wind)Documento1 paginaReflection (The Boy Who Harnessed The Wind)knightapollo16Nessuna valutazione finora

- A Term Paper On The Application of Tort Law in BangladeshDocumento7 pagineA Term Paper On The Application of Tort Law in BangladeshRakib UL IslamNessuna valutazione finora

- Creating A Carwash Business PlanDocumento7 pagineCreating A Carwash Business PlanChai Yeng LerNessuna valutazione finora

- Ch13 (Man)Documento44 pagineCh13 (Man)kevin echiverriNessuna valutazione finora

- Workplace Wellness Survey Report - FinalDocumento43 pagineWorkplace Wellness Survey Report - FinalMeeraNessuna valutazione finora

- The Kurdistan Worker's Party (PKK) in London-Countering Overseas Terrorist Financing andDocumento28 pagineThe Kurdistan Worker's Party (PKK) in London-Countering Overseas Terrorist Financing andrıdvan bahadırNessuna valutazione finora

- MBA621-SYSTEM ANALYSIS and DESIGN PROPOSAL-Bryon-Gaskin-CO - 1Documento3 pagineMBA621-SYSTEM ANALYSIS and DESIGN PROPOSAL-Bryon-Gaskin-CO - 1Zvisina BasaNessuna valutazione finora

- Sources of Criminal LawDocumento7 pagineSources of Criminal LawDavid Lemayian SalatonNessuna valutazione finora

- Washington D.C. Healthcare Systems, Inc. and Jeffrey Thompson v. District of ColumbiaDocumento94 pagineWashington D.C. Healthcare Systems, Inc. and Jeffrey Thompson v. District of ColumbiaDonnie KnappNessuna valutazione finora

- Cmvli DigestsDocumento7 pagineCmvli Digestsbeth_afanNessuna valutazione finora

- Education Rules 2012Documento237 pagineEducation Rules 2012Veimer ChanNessuna valutazione finora

- The Ery Systems of South India: BY T.M.MukundanDocumento32 pagineThe Ery Systems of South India: BY T.M.MukundanDharaniSKarthikNessuna valutazione finora

- Art10 PDFDocumento10 pagineArt10 PDFandreea_zgrNessuna valutazione finora

- A Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippinesDocumento42 pagineA Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippineschaynagirlNessuna valutazione finora

- Solutions-Debraj-Ray-1 Dev EcoDocumento62 pagineSolutions-Debraj-Ray-1 Dev EcoDiksha89% (9)

- John Carroll University Magazine Winter 2008Documento69 pagineJohn Carroll University Magazine Winter 2008johncarrolluniversityNessuna valutazione finora

- How To Cite Legal Materials PDFDocumento2 pagineHow To Cite Legal Materials PDFNadine AbenojaNessuna valutazione finora

- Politics of BelgiumDocumento19 paginePolitics of BelgiumSaksham AroraNessuna valutazione finora

- Music in Chishti SufismDocumento17 pagineMusic in Chishti SufismkhadijaNessuna valutazione finora

- Chapter 18Documento24 pagineChapter 18Baby KhorNessuna valutazione finora

- LWB Manual PDFDocumento1 paginaLWB Manual PDFKhalid ZgheirNessuna valutazione finora

- Marxism and Brontë - Revenge As IdeologyDocumento8 pagineMarxism and Brontë - Revenge As IdeologyJonas SaldanhaNessuna valutazione finora

- Learning Module Theories of Crime CausationDocumento13 pagineLearning Module Theories of Crime CausationVictor PlazaNessuna valutazione finora