Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Seminar Week 2

Caricato da

JaquinDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Seminar Week 2

Caricato da

JaquinCopyright:

Formati disponibili

Problem 1

Mr Blair the manager of L department had just received his monthly operating statement, and

the line for computing costs had upset him. ‘I can’t believe it. We just went through a study

showing how my department could save money by using the central computing department.

The first month using this department shows that my costs are up more than 20%’.

Before converting to the in house department the L department had used an outside firm to

provide computing support at a cost of £15000 per month. The company internal audit

department had recently reported that it was inefficient to use an outside firm for services

where needs could be handled internally. At present, computer services had unused capacity,

and the additional services required by L would cost an incremental £10000. After an

assurance that his requirements could really be supplied at this lower incremental cost, Blair

agreed to convert to internal supply of computing support.

After seeing the line on his monthly report showing that the 200 hours of work that his

department needed had produced computing costs of over £18000, Blair demanded an

explanation.

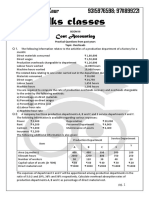

The manager of computing services department provided the following two tables of data for

computer service costs;

Table 1 – apportionment of computing costs to the other three divisions – prior to handling L’s

requirement

Department Computing services Percent Apportioned cost

hours

A 600 50% £60000

B 400 33.3% £40000

C 200 16.7% £20000

Total 1200 100% £120000

Table 2 – apportionment of computing department costs after L’s requirement is included

(+the £10000)

Department Computing services Percent Apportioned cost

hours

A 600 42.9% £55700

B 400 28.6% £37100

C 200 14.3% £18600

L 200 14.3% £18600

Total 1400 100% £130000

It was explained that costs had to be charged out in an equitable manner, and hours of work

done by computing services for all the departments seemed fairest.

1 Why had the apportioned cost been more than Blair had thought?

2 What was Blair expecting?

3 What do you think is fair?

Problem 2

Fullcost Ltd. manufactures a range of office equipment in three separate production

departments. Materials are first shaped in the Cutting Department, then machined ready for

the various fixings before final assembly.

The following budgeted and statistical information exists concerning Fullcost Ltd. for the year

ended 30 June.

Departments Cutting Machining Assembly Material Maintenance Total

stores

Costs £ £ £ £ £ £

Depreciation 18600 23050 10500 5000 10500 67650

Consumables 3150 4200 5000 0 11500 23850

Indirect wages 15750 14000 15000 12500 18250 75500

Electricity 120000

Rent 160000

Insurance 12000

Technical

data

Floor area (sq 250 150 250 100 50 800

metres)

% usage of 50 20 20 5 5 100

electricity

Number of 600 100 50 0 150 900

material issues

Number of 150 300 50 0 0 500

maintenance

jobs

Labour hours 8000 6000 10000 24000

Machine hours 8000 14000 4000 26000

Calculate appropriate overhead absorption rates for each production department. Justify your

choice of absorption base.

Potrebbero piacerti anche

- British Commercial Computer Digest: Pergamon Computer Data SeriesDa EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNessuna valutazione finora

- These Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowDocumento13 pagineThese Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowKos PaviliunNessuna valutazione finora

- Costing - PracticalDocumento8 pagineCosting - Practicaldenish gandhiNessuna valutazione finora

- Overheads - CW - Sums - Part 1Documento6 pagineOverheads - CW - Sums - Part 1kushgarg627Nessuna valutazione finora

- Example Overheards Allocation 1Documento4 pagineExample Overheards Allocation 1Phomolo StoffelNessuna valutazione finora

- 03 Overhead CostingDocumento9 pagine03 Overhead CostingPappu LalNessuna valutazione finora

- Q1. Cadila Co. Has Three Production Departments A, B and C and Two ServiceDocumento5 pagineQ1. Cadila Co. Has Three Production Departments A, B and C and Two Servicemedha surNessuna valutazione finora

- G2 Gestão de Financeira IF 2016 1rtfDocumento4 pagineG2 Gestão de Financeira IF 2016 1rtfAdrielle RodriguesNessuna valutazione finora

- Chapter 4 Overhead ProblemsDocumento5 pagineChapter 4 Overhead Problemsthiluvnddi100% (1)

- Chapter # 10Documento2 pagineChapter # 10kqandeelNessuna valutazione finora

- Chapter 5 ExercisesDocumento12 pagineChapter 5 ExercisesIsaiah BatucanNessuna valutazione finora

- TYBCOM - Cost - OverheadsDocumento8 pagineTYBCOM - Cost - Overheadsmkbooks4uNessuna valutazione finora

- Overheads PracticalDocumento37 pagineOverheads PracticalSushant Maskey100% (1)

- Chapter 6 OverheadsDocumento3 pagineChapter 6 OverheadsDevender SinghNessuna valutazione finora

- KEDGE BS-IBB4 - Management Control & Operations: The French Cost Accounting Method CorrectionDocumento2 pagineKEDGE BS-IBB4 - Management Control & Operations: The French Cost Accounting Method CorrectionArnaud DelacourNessuna valutazione finora

- Task: Assignment Two Date Given: 14TH MAY 2020 Due Date: 26TH MAY 2020Documento7 pagineTask: Assignment Two Date Given: 14TH MAY 2020 Due Date: 26TH MAY 2020Joseph Mwezi MunukayumbwaNessuna valutazione finora

- Budgetary ControlDocumento14 pagineBudgetary ControlCool BuddyNessuna valutazione finora

- ACMA Unit 6 Problems - Overheads PDFDocumento4 pagineACMA Unit 6 Problems - Overheads PDFPrabhat SinghNessuna valutazione finora

- AE 22 - MOH - DepartmentalizationDocumento4 pagineAE 22 - MOH - DepartmentalizationJake BorinagaNessuna valutazione finora

- Hand-Out 4 - ABC and Support Cost AllocationDocumento2 pagineHand-Out 4 - ABC and Support Cost AllocationJerric CristobalNessuna valutazione finora

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - V (UNIT-V)Documento9 pagineSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - V (UNIT-V)Jaya BharneNessuna valutazione finora

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocumento7 pagineCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaNessuna valutazione finora

- Overhead Q 9Documento1 paginaOverhead Q 9LOLNessuna valutazione finora

- Tutorial OverheadDocumento6 pagineTutorial OverheadImran FarhanNessuna valutazione finora

- Solutions Manual Instructors Physics by Resnick Halliday Krane 5th Ed Vol 2Documento6 pagineSolutions Manual Instructors Physics by Resnick Halliday Krane 5th Ed Vol 2onyejekwe100% (1)

- 21st - OCTOBER - 2022-TODAY CLASS - DotDocumento23 pagine21st - OCTOBER - 2022-TODAY CLASS - DotPalesaNessuna valutazione finora

- Responsibility Accounting Exercise ProblemsDocumento2 pagineResponsibility Accounting Exercise ProblemsJessa Mae LavadoNessuna valutazione finora

- NirmalaDocumento3 pagineNirmalaswamilpatniNessuna valutazione finora

- Module 2 Capital Budgeting Handout For LMS 2020Documento11 pagineModule 2 Capital Budgeting Handout For LMS 2020sandeshNessuna valutazione finora

- OverheadsDocumento7 pagineOverheadsshobhit chaturvediNessuna valutazione finora

- Activity 1 PDFDocumento2 pagineActivity 1 PDFnimeshaNessuna valutazione finora

- Manufacturing AccountsDocumento2 pagineManufacturing AccountsMohamed IrshaNessuna valutazione finora

- Farid Financial PlanDocumento40 pagineFarid Financial PlanAnonymous p6NIzY5zjNessuna valutazione finora

- UM22060Documento4 pagineUM22060saksham bavejaNessuna valutazione finora

- MA1 - De thi giua ky - HK2 - 21-22 - send-đã chuyển đổiDocumento4 pagineMA1 - De thi giua ky - HK2 - 21-22 - send-đã chuyển đổiThu ThanhNessuna valutazione finora

- OverheadsDocumento11 pagineOverheadsCool BuddyNessuna valutazione finora

- Notes and Activities - Departmentalization (Service Cost Allocation)Documento6 pagineNotes and Activities - Departmentalization (Service Cost Allocation)itsBlessedNessuna valutazione finora

- PROBLEM 2-45:: Particulars Case A Case B Case CDocumento6 paginePROBLEM 2-45:: Particulars Case A Case B Case CSrihari KumarNessuna valutazione finora

- 03 Overhead CostingDocumento16 pagine03 Overhead CostingBharatbhusan RoutNessuna valutazione finora

- Bag Financial 1Documento3 pagineBag Financial 1mehrunisa ramzanNessuna valutazione finora

- Quarter 1: Net ProfitDocumento20 pagineQuarter 1: Net ProfitAzmain MugdhoNessuna valutazione finora

- Characteristics Cost Accounting Financial Accouting: D) Creative Stationary Cost Statement For The Month September 2018Documento3 pagineCharacteristics Cost Accounting Financial Accouting: D) Creative Stationary Cost Statement For The Month September 2018vomawew647Nessuna valutazione finora

- Adv Excel Session-3 Styles Cells EditingDocumento23 pagineAdv Excel Session-3 Styles Cells EditingRitik TaranNessuna valutazione finora

- Arcadia and Enterprise Co. Worked ExamplesDocumento22 pagineArcadia and Enterprise Co. Worked ExamplesIvy TulesiNessuna valutazione finora

- Day 4Documento8 pagineDay 4um23328Nessuna valutazione finora

- AccountingDocumento8 pagineAccountingayangarmyNessuna valutazione finora

- Accounts - FIFO and WA For FinalDocumento11 pagineAccounts - FIFO and WA For FinalRohan SinghNessuna valutazione finora

- 13 OhDocumento12 pagine13 OhLakshay SharmaNessuna valutazione finora

- Acc Final 2Documento15 pagineAcc Final 2Tanvir OnifNessuna valutazione finora

- Absorption Costing Question 1Documento5 pagineAbsorption Costing Question 1phamdungmc512Nessuna valutazione finora

- Homework For ABCDocumento6 pagineHomework For ABCLikey CruzNessuna valutazione finora

- Financial Feasibility: 4.1 Total Start Up Cash NeededDocumento5 pagineFinancial Feasibility: 4.1 Total Start Up Cash NeededAmna Arif100% (1)

- Latihan Soal Akuntansi BiayaDocumento5 pagineLatihan Soal Akuntansi Biayaaufa alfayedhaNessuna valutazione finora

- Management Acc. Assign.2 KashifDocumento2 pagineManagement Acc. Assign.2 Kashifusman faisalNessuna valutazione finora

- Overhead ApportionmentDocumento3 pagineOverhead ApportionmentHassanAbsarQaimkhaniNessuna valutazione finora

- Cost Sheet AnalysisDocumento7 pagineCost Sheet AnalysisShambhawi SinhaNessuna valutazione finora

- Financial Plan OkDocumento7 pagineFinancial Plan OkSYED ARSALANNessuna valutazione finora

- 03 Tazoah Francis Exercise 03 CostDocumento4 pagine03 Tazoah Francis Exercise 03 Costrita tamohNessuna valutazione finora

- Srinath SirDocumento19 pagineSrinath Sirmy Vinay100% (1)

- Over Heads Additional Sums PDFDocumento40 pagineOver Heads Additional Sums PDFShiva AP100% (1)

- w3 Workshop SolutionDocumento7 paginew3 Workshop SolutionJaquinNessuna valutazione finora

- Lecture 2 - Cost AssignmentDocumento10 pagineLecture 2 - Cost AssignmentJaquin0% (1)

- Workshop Week 2Documento2 pagineWorkshop Week 2JaquinNessuna valutazione finora

- Joes Cafe SolutionDocumento2 pagineJoes Cafe SolutionJaquin100% (1)

- Chapter 6 Supply Chain ManagementDocumento25 pagineChapter 6 Supply Chain ManagementMỹ DuyênNessuna valutazione finora

- BuisinessmanDocumento57 pagineBuisinessmanLourencoNessuna valutazione finora

- Contractor or EmployeeDocumento9 pagineContractor or EmployeeGreg BlasiakNessuna valutazione finora

- The Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Documento23 pagineThe Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Sanjay ParekhNessuna valutazione finora

- MBA Report Final 2 PDFDocumento36 pagineMBA Report Final 2 PDFpalNessuna valutazione finora

- Cost Leadership and Differentiation An Investigation of The Fundamental Trade-OffDocumento38 pagineCost Leadership and Differentiation An Investigation of The Fundamental Trade-Offjulie100% (3)

- S cabaleryFlexiblePipeSolutionsDocumento23 pagineS cabaleryFlexiblePipeSolutionsprateekchopra1Nessuna valutazione finora

- Horlicks NoodlesDocumento9 pagineHorlicks NoodlesdhawalearchanaNessuna valutazione finora

- Introducción A Las MicrofinanzasDocumento21 pagineIntroducción A Las MicrofinanzasNitzia VazquezNessuna valutazione finora

- HedgingDocumento3 pagineHedgingMrzeeshanNessuna valutazione finora

- Excel Crop Care LTD Bhavnager Report Sem - 2Documento39 pagineExcel Crop Care LTD Bhavnager Report Sem - 2jagrutisolanki01Nessuna valutazione finora

- FBC - Outgoing Exchange FormDocumento1 paginaFBC - Outgoing Exchange FormScott Dauenhauer, CFP, MSFP, AIFNessuna valutazione finora

- PR2 Group 1Documento3 paginePR2 Group 1Deborah BandahalaNessuna valutazione finora

- Ronan Livingston: 4752 Red Coat RD Virginia Beach, VA 23456 Phone: (757) 793-1016 E-Mail: Ronanlivingston327@gmai - Co MDocumento2 pagineRonan Livingston: 4752 Red Coat RD Virginia Beach, VA 23456 Phone: (757) 793-1016 E-Mail: Ronanlivingston327@gmai - Co Mapi-400357926Nessuna valutazione finora

- Entrepreneurship Development ProgrammeDocumento10 pagineEntrepreneurship Development ProgrammeJitendra KoliNessuna valutazione finora

- Berjaya Land Berhad - Annual Report 2016Documento50 pagineBerjaya Land Berhad - Annual Report 2016Yee Sook YingNessuna valutazione finora

- AC 506 Midterm ExamDocumento10 pagineAC 506 Midterm ExamJaniña NatividadNessuna valutazione finora

- Ez Payment 2 UDocumento12 pagineEz Payment 2 USophy Sufian SulaimanNessuna valutazione finora

- Omer FarooqDocumento3 pagineOmer FarooqomerfarooqscribdNessuna valutazione finora

- Provisional Ominibus Karnataka List1Documento93 pagineProvisional Ominibus Karnataka List1Jeeva JpNessuna valutazione finora

- 02kertas Keja BB FixDocumento23 pagine02kertas Keja BB FixFanjili Gratia MamontoNessuna valutazione finora

- Corporate IdentityDocumento64 pagineCorporate IdentityGeetanshi Agarwal100% (1)

- SWOT Analysis of Meezan BankDocumento10 pagineSWOT Analysis of Meezan Banksufyanbutt007Nessuna valutazione finora

- Introduction To FranchisingDocumento45 pagineIntroduction To FranchisingAmber Liaqat100% (2)

- 32 San Jose VS NLRCDocumento14 pagine32 San Jose VS NLRCJan Niño JugadoraNessuna valutazione finora

- Home OfficeDocumento4 pagineHome OfficeVenessa Lei Tricia G. JimenezNessuna valutazione finora

- Parking Garage Case PaperDocumento10 pagineParking Garage Case Papernisarg_Nessuna valutazione finora

- Foss, Patricia ResumeDocumento2 pagineFoss, Patricia Resumepattifoss626Nessuna valutazione finora

- Vendor Agreement SampleDocumento7 pagineVendor Agreement Samplebaibhavjauhari100% (1)

- Purchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousDocumento2 paginePurchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousJosephSousNessuna valutazione finora