Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Setup Steps R12.1.2

Caricato da

Uma Shankar MedamCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax Setup Steps R12.1.2

Caricato da

Uma Shankar MedamCopyright:

Formati disponibili

SETUPTAXCODESINR12.1.

May26,2010

How to Setup Taxes in R12.1.2

Prerequisite:

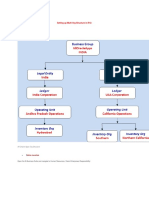

Go To: Tax Manager > Tax Configuration > Tax Regime>Home> Create First Party Legal Entity and

Establishment

1:1.1ChecktheCreateFirstParty:LegalEntity&Establishment

ClickonGotTask:

Enterthecountrynameandclickgo

1 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Step 1: Create the Tax Regime

The tax regime is the highest/ultimate level that taxes are rolled up to, typically, a specific country. In this step,

the Controls and Defaults must be set. The Control section outlines 4 options. Once the tax is made live, the

control options cannot be changed.

The Defaults section will default as applicable to the tax, status, jurisdictions, and tax rate levels, but they can

be changed at each level.

Go To: Tax Manager > Tax Configuration > Tax Regime

1.1: Press On create

2 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

1.2:

- Enter Tax regime Code & Name the same

- Entry Regime level: Country

- Entry Effective date: old date EX: 1-Jan-2000

- Check Boxes: Allow Tax Recovery - Allow Tax Exemptions - Allow Override and Entry of Inclusive Tax

Lines

- Allow tax inclusion: standard inclusive handling

- Default recovery rate: immediate

3 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

1.3:

- ClickContinueButtontoAssignPartyNamewhichistheLegalEntityName

4 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

1.4:

- Go To: Create Tax Authorities Party Tax Profile from (Parties TAB)

-- Choose party type: First party Legal Entity

5 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

May26,2010

- Click Update Tax Profile Yellow Pencil to assign the Tax Regime Code through Configuration Option tab

Button Note you will find it already Assigned and that step for confirmation only

6 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

1.5:

- Go To: Create Tax Authorities Party Tax Profile in Home page

- Choose party type: Operating Unit Owing Tax Content

- Choose Party name: As shown

7 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

8 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

May26,2010

ClickonCreateTaxProfileLink

- Go to Configuration Option Button to assign the Tax Regime code with the Operating Unit Name

9 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

GotoChecktheTaxRegimeCodetoverifytheConfigurationOptiontoviewtheassignmentoftheLegalEntityName

&theOperatingUnitNametotheTaxRegimeCode

10 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Step 2: Create the Tax

One Tax Regime can have multiple taxes defined under it. The tax type, e.g. sales, VAT, use, is determined

when the tax is set up. Taxes can be set up by geography type, which allows for taxes at different levels... For

example, in the US, there is can be a tax levied at the State level, one at the County level, and one at the City

level.

Go To: Tax Manager > Tax Configuration > Taxes

2.1:

- Enter the required fields:

Tax Regime - Configuration Owner - Tax Source etc

In configeration owner : choose Globale Configeration Owner to make the tax aviliable on both of legel

entity & Operating Unit

11 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

NOTE: DOES NOT MARK ON Check Box (Make Tax Available for Transaction) till you complete the

remaining setup steps as We Going To DO

NOTE: Important Do Choose the check box ALLOW PRIMERY RECOVERY RATE determination

rules that will make duplicate tax rule and will give you error in calculation tax

12 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

NOTE: THAT THE DEFAULT RECOVERY RATE CODE WILL BE DEFIEDN LATER SO YOU

WILL CHOOSE IT WHEN YOU ARE GOING TO FINISH AND MAKE THE TAX AVAILIABLE

Then click on TAX ACCOUNT: To determine the liability account of the tax

Choose TAX code regime

Choose TAX name

Choose your ledger then press on create

13 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

Choose the liability account its mandatory

14 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

May26,2010

Step 3: Create the Tax Status

This is used primarily in the UK to define reduced rate, zero rate, etc. taxes. All taxes must have at least one tax

status defined, and one of those must have the "Set as Default Status" option checked.

Go To: Tax Manager > Tax Configuration > Tax Regime

Complete the data and press apply

15 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Step 4: Create the Tax Jurisdiction

A tax jurisdiction is a geographic area for which a tax is levied, e.g. Colorado, California, Florida, El Paso

County, and Los Angeles.

There must be at least one Tax Jurisdiction for each Tax Status with the "Set as default Tax Jurisdiction"

selected and the "Default Effective Date" supplied.

Go To: Tax Manager > Tax Configuration > Tax Regime

Complete the data as shown

16 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Associated Juristification tax rulesConfiger it after you difine tax rate and you have to

define ti to every tax rate you will define

Click on Apply

Click on Tax Accounts : Choose the ledger you created and enter the liability account

Click on Apply

Step 5: Create the Tax Rate & Recovery Rate

Create specific tax rates to be applied for geography. There must be at least one default tax rate. The tax

accounts are also set up in this step.

5.1: Go To: Tax Manager > Tax Configuration > Tax Recovery Rate

For the Non Recovery tax recovery rate to make it available in tax accounts for the non recovery rate

after u define it put the AP ACCRUAL ACCOUNT

- Complete Data As Shown

- Check on tax accounts that its right from (TAX ACCOUNTS)

17 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

- After Finish Click On Apply

5.2: Go To: Tax Manager > Tax Configuration > Tax Rate

For the Non Recovery rate to make it available in tax accounts for the non recovery rate after u define it

put the AP ACCRUAL ACCOUNT

- Complete the data

- Define the tax accounts

- After Finish Click On Apply

18 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Step 6: Define Tax Rules

Prerequisite:

1- Enter a Tax Determining Factor Set and Name and Click Create to Assign it later to the rules (

And this will Be done to each Regime Code you will Made ( If you Make more than one Regime )

but if you are going to make more than one regime ( You have to check on the check box named :

Allow Cross Regime Compounding )

2- DO this proceed to every rate you will define

A) Go To : Tax Manager > Advanced Setup Options > Determine Factor Set

19 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

InsertDeterminingFactorClass:'TransactionInputFactor'(DataEntryFromYourChoose)

InsertDeterminingFactorName:'TaxClassificationCode'(DataEntryFromYourChoose)

ChooseYourTaxRegime

ChooseYourLedger

SetUsageChoose:TaxRules

InDeterminingFactorClassChoose:TransactionInputFactor

InDeterminingFactorNameChoose:TaxClassificationCode

AfterFinishClickOnApply

B) Go To : Tax Manager > Advanced Setup Options > Tax Condition Set

Enter You Tax Condition Name ( It refers To The Percentage of the Tax )

Enter Name

20 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Choose The Determine Factor that you Made

Choose Ledger

Choose Country

Click On Continue

ChoosetheOperator:EqualTo

ChoosetheValue/FromRange:NameofyourregimeAnditcanbeOverride

ThenClickOnFinish

3- Make This Step to Assign the Rules To Every Tax Regime you Made

Select Your Legal Entity

Select Tax Regime Code

Select Tax

21 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

Click On GO to show the rules set

22 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

May26,2010

Make all the rules for each application are you going to use from event class

Set defaults for the following rule types:

Some definitions needed to know it before going to tax rules:

For every application AP & AR & PURCHASING choose: Event Class and then choose application and

then choose the event that you the tax to effect on but for SALES ORDER in the EVENT CLASS

CATEGORY CHOSSE : TAX EVENT CLASSE & EVENT CLASSE : SALES TRANSACTIONS

23 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

Direct tax rate determination:

For Example :

Choose Event Class Category :Event Class

Choose Application: Purchasing

Choose Event: Purchase Order Agreement

Complete Data As shown

24 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

Place of Supply ( Use to assign the tax to the supply place )

Complete the data as Shown

And click Save

25 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

Determine Tax Apllicabiltiy

26 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

Determine tax Registration

27 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

Taxable Basis

28 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

May26,2010

Countinue the same for the all rules

Step 7: Make the Tax Live for Transactions

Return back to the Tax created in step 2, and select the Make Tax Available for Transactions option. If it is not

available to be checked, the tax is not set up correctly. Any missed setups will need to be completed before this

can be setup.

MakeitAvailablefortransactions

29 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

Choosetherecoveryrate

30 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

TheLaststeptoaftermakingthetaxavaliablefortransactionsyouDefault

andcontrolswindowtomakethetaxyoudefiendavaliableonapplication

andtheapplicationscanusethistaxinthetransactions

Makethedefinationsonetimeforlegelentityandsecondetimeoperating

unit

Dothisstepforeveryappliactionyouentendtousetaxonit

GOTO:DefaultandControls>ConfigrationTAXoptions

31 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

AfterFinishthis:GOto:Defaultandcontrols>ApplicationTaxOptions

Toarrangethedefaulthierarchyforthetax

32 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

AfterFinishthis:GOto:Defaultandcontrols>ApplicationTaxOptions

TomaketheTaxAvailableforthecountryDefault

33 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

AfterAllThat

Youreadytousetaxonapplication

34 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

May26,2010

AndhereisSomeProfileoptionsyoumayneedtocontroltax:

eBTax: Allow Ad Hoc Tax Changes

TheeBTax:AllowAdHocTaxChangesprofileoptioncontrolswhichuserscanmake

Adhoctaxchangesonthetransactionline,suchasselectingadifferenttaxstatusortax

rate.Thechangesthatausercanmakealsodependuponthedetailsoftheapplicable

taxsetups.

IfthetaxrateassociatedwithataxhastheAllowAdHocRateoptionenabled,then

userscanoverridethecalculatedtaxrateonthetransactionline.

eBTax: Allow Manual Tax Lines

TheeBTax:AllowManualTaxLinesprofileoptioncontrolswhichuserscanenter

Manualtaxlinesonthetransactionforthetaxsetupsthatallowthisupdate.

Ifthetaxconfigurationhastherelatedoptionsenabled,thenuserscanentermanualtax

Linesonthetransactionfortheapplicabletax.

Therelatedtaxsetupsare:

Taxes: AllowEntryofManualTaxLines

Configuration Owner Tax Options:

AllowEntryofManualTaxLines

AllowManualTaxOnlyLines

eBTax: Allow Override of Customer Exemptions

TheeBTax:AllowOverrideofCustomerExemptionsprofileoptioncontrolsthedisplay

OftheTaxHandlingfieldonthetransactionline.YouusetheTaxHandlingfieldto

Applyandupdatecustomertaxexemptionstotransactions.

IfyousettheeBTax:AllowOverrideofCustomerExemptionsprofileoptiontoYes,you

Mustalsocompletetherelatedsetupsfortaxexemptions.

eBTax: Allow Override of Tax Classification Code

TheeBTax:AllowOverrideofTaxClassificationCodeprofileoptioncontrolswhether

Userscanupdatethetaxclassificationcodethatisdefaultedtothetransactionline.

EBusinessTaxdefaultsthetaxclassificationcodetothetransactionlineaccordingto

Thedefaultinghierarchydefinedfortheoperatingunitandapplication.

eBTax: Allow Override of Tax Recovery Rate

TheeBTax:AllowOverrideofTaxRecoveryRateprofileoptioncontrolswhichusers

Canenterorupdatethecalculatedtaxrecoveryratesonthetransactionforthetax

Recoveryratesetupsthatallowthisupdate.

IfthetaxrecoveryrateassociatedwithataxhastheAllowAdHocRateoptionenabled,

Thenuserscanoverridethecalculatedtaxrecoveryrateonthetransaction.

Themeaningofadhocentryoftaxrecoveryratesdiffersaccordingtothesource

Applicationforthetransaction:

Payables Theusercanonlyselectanotherpreviouslydefinedrecoveryrateforthe

Tax.

Procurement Theusercaneitherselectanotherpreviouslydefinedrecoveryrate

Forthetaxorenteranewrecoveryrate.

35 MadeBy:MohamedElhamy|TaxCodes

SETUPTAXCODESINR12.1.2

eBTax: Inventory Item for Freight (Oracle Order Management only)

TheeBTax:InventoryItemforFreightprofileoptionletsOrderManagementusean

InventoryitemdefinedasFreight onReceivablestransactionlines.Youcanusethe

FreightInventoryitemtocontrolthetaxrateontaxablefreightamounts.

Thevaluesforthisprofileoptionare:

Freight Charge ThefreightInventoryitemappliestoexternalReceivables

Transactions.

Freight for Intercompany ThefreightInventoryitemappliestointernalReceivables

Transactionsonly.

YoumustalsosettheeBTax:InvoiceFreightasRevenueprofileoptiontoYes.

eBTax: Invoice Freight as Revenue (Oracle Order Management only)

TheeBTax:InvoiceFreightasRevenueprofileoptioncontrolswhethertoconsider

Freightamountsastaxablelineitems.

SettheeBTax:InvoiceFreightasRevenueprofileoptiontoyes,ifyouarerequiredto

Taxfreightamounts.ThefreightamountsenteredintheOrderManagementShip

ConfirmwindowarethenpassedtoReceivablestransactionsastaxablelineitems.

IfyousettheeBTax:InvoiceFreightasRevenueprofileoptiontoYes,youmustalsoset

TheeBTax:InventoryItemforFreightprofileoption.

eBTax: Read/Write Access to GCO Data

TheeBTax:Read/WriteAccesstoGCODataprofileoptioncontrolswhetheruserscan

Setuptaxconfigurationdatafortheglobalconfigurationowner.

IfyousettheeBTax:Read/WriteAccesstoGCODataprofileoptiontoYes,thenthe

Setting Up Applications for Oracle E-Business Tax 2-7

Applicableuserscansetuptaxesandrelatedconfigurationdatafortheglobal

Configurationowner.Legalentitiesandoperatingunitscanthensharetheglobal

Configurationownertaxsetups.

See:ConfigurationOptionsinOracleEBusinessTax,Oracle E-Business Tax User Guide

Formoreinformation.

eBTax Taxware: Service Indicator

TheeBTaxTaxware:ServiceIndicatorprofileoptionindicateswhethertaxesare

Calculatedonserviceorarentaltransactions.

TheTaxwareAPIparameterthatacceptsthisprofileoptionvalueisJurLink.ServInd.

Thevaluesforthisprofileoptionare:

Service Servicetransaction.

Rental Rentaltransaction.

Space Nonservicetransaction.

eBTax Taxware: Tax Selection

TheeBTaxTaxware:TaxSelectionprofileoptionindicateswhetherTaxwareuses

Jurisdictionleveljurisdictioncodestocalculatetaxes.

TheTaxwareAPIparameterthatacceptsthisvalueisTaxSelParmofTaxfn_Tax010.

Thevaluesforthisprofileoptionare:

Tax only Taxwarecalculatestaxbasedontheshiptoaddressonly.

Jurisdiction and Tax Taxwarecalculatestaxbasedonalljurisdictioninformation,

Includingshipto,shipfrom,pointoforderorigin(POO),andpointoforder

36 MadeBy:MohamedElhamy|TaxCodes

May26,2010

SETUPTAXCODESINR12.1.2

acceptance(POA).

eBTax Taxware: Use Nexpro

TheeBTaxTaxware:UseNexproprofileoptionindicateswhetherTaxwareusesthe

Nexprofunctionality.Ifyouenablethisoption,additionalconfigurationisrequiredon

TheTaxwaresideoftheintegrationtoachievenexusbasedtaxation.

TheTaxwareAPIparameterthatacceptsthisvalueisTaxLink.UseNexproInd.

eBTax Vertex: Case Sensitive

TheeBTaxVertex:CaseSensitiveprofileoptionenablescasesensitivesearchesofVertex

Taxcalculationdata.Thedefaultvalueisyes.

37 MadeBy:MohamedElhamy|TaxCodes

May26,2010

Potrebbero piacerti anche

- Oracle HRMS Setup For SingaporeDocumento33 pagineOracle HRMS Setup For SingaporeShmagsi11Nessuna valutazione finora

- WFM Ter Compare WRKR Holiday To Reported Hours ApDocumento5 pagineWFM Ter Compare WRKR Holiday To Reported Hours ApYonny Isidro RendonNessuna valutazione finora

- Password Protect Excel Outputs in BI PublisherDocumento2 paginePassword Protect Excel Outputs in BI PublisherAyman BadrNessuna valutazione finora

- Oracle® Advanced Global Intercompany System: User's Guide Release 12Documento60 pagineOracle® Advanced Global Intercompany System: User's Guide Release 12Srinivas SriniNessuna valutazione finora

- Oracle® Advanced Global Intercompany System: User's Guide Release 12Documento60 pagineOracle® Advanced Global Intercompany System: User's Guide Release 12Srinivas SriniNessuna valutazione finora

- List of MBA HR ProjectsDocumento6 pagineList of MBA HR ProjectsUma Shankar MedamNessuna valutazione finora

- List of MBA HR ProjectsDocumento6 pagineList of MBA HR ProjectsUma Shankar MedamNessuna valutazione finora

- List of MBA HR ProjectsDocumento6 pagineList of MBA HR ProjectsUma Shankar MedamNessuna valutazione finora

- Kathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Documento236 pagineKathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Csongor KicsiNessuna valutazione finora

- Setup and user guide for online payslip (SSHRDocumento8 pagineSetup and user guide for online payslip (SSHRMohamed Hosny ElwakilNessuna valutazione finora

- Configure Descriptive Flexfields and Generate OTBI Reports With DFFsDocumento4 pagineConfigure Descriptive Flexfields and Generate OTBI Reports With DFFsMohmed BadawyNessuna valutazione finora

- Webadi GuideDocumento20 pagineWebadi GuidedampursNessuna valutazione finora

- Absence CalculationDocumento12 pagineAbsence CalculationIkramNessuna valutazione finora

- Security Rules in R12Documento6 pagineSecurity Rules in R12devender143Nessuna valutazione finora

- Oracle Approvals Management Payables Invoice Approval ProcessDocumento85 pagineOracle Approvals Management Payables Invoice Approval ProcessJuNAiDSuAlEhNessuna valutazione finora

- EBS Create A New Address Style For Location Addresses.Documento2 pagineEBS Create A New Address Style For Location Addresses.dbaahsumonbdNessuna valutazione finora

- Case Study On How Payables Open Interface Works With EbtaxDocumento13 pagineCase Study On How Payables Open Interface Works With EbtaxsidfreestylerNessuna valutazione finora

- Create and Modify Fast Formulas in Oracle Fusion PayrollDocumento8 pagineCreate and Modify Fast Formulas in Oracle Fusion PayrollKiran NambariNessuna valutazione finora

- Master Note: Payables Open Interface Import Functional OverviewDocumento5 pagineMaster Note: Payables Open Interface Import Functional OverviewHeriNessuna valutazione finora

- Payroll Balance DefinitionsDocumento6 paginePayroll Balance DefinitionsNaresh As RishiNessuna valutazione finora

- 18.3-Irecruit User Manual-External ApplicantsDocumento23 pagine18.3-Irecruit User Manual-External ApplicantsAbdulmonaem AlbaqlawiNessuna valutazione finora

- Bursting File BTW BIP and SFTP ServerDocumento9 pagineBursting File BTW BIP and SFTP Servermegs85ci7039Nessuna valutazione finora

- How To Create A Manual Transaction and Pay Commission in Oracle Incentive Compensation Release 12 (ID 1248974.1)Documento6 pagineHow To Create A Manual Transaction and Pay Commission in Oracle Incentive Compensation Release 12 (ID 1248974.1)Tarun JainNessuna valutazione finora

- Applies To:: Apr 10, 2015 HowtoDocumento8 pagineApplies To:: Apr 10, 2015 HowtokottamramreddyNessuna valutazione finora

- Oraclei Setup Setup DocumentationDocumento8 pagineOraclei Setup Setup DocumentationmanukleoNessuna valutazione finora

- Oracle HRMS TablesDocumento3 pagineOracle HRMS TablesbalasukNessuna valutazione finora

- 07.EBS R12.1 HCM 7 Oracle PayrollDocumento76 pagine07.EBS R12.1 HCM 7 Oracle PayrollUzair Arain0% (1)

- This Article Is Going To Cover The Steps Required To Make Changes To OTL Timecard LayoutsDocumento9 pagineThis Article Is Going To Cover The Steps Required To Make Changes To OTL Timecard LayoutsShyam GanugapatiNessuna valutazione finora

- End Date or Purge Element Entry After Payroll ProcessingDocumento3 pagineEnd Date or Purge Element Entry After Payroll Processinghamdy20017121Nessuna valutazione finora

- Using A Custom Payroll Flow Pattern To Submit A Parameterized Report in Oracle Cloud ApplicationDocumento9 pagineUsing A Custom Payroll Flow Pattern To Submit A Parameterized Report in Oracle Cloud ApplicationBala SubramanyamNessuna valutazione finora

- How To Keep Journal Entry Approval HistoryDocumento8 pagineHow To Keep Journal Entry Approval HistoryKriez NamuhujaNessuna valutazione finora

- Oracle Receivables Question BankDocumento16 pagineOracle Receivables Question BankbalajinaiduvenkiNessuna valutazione finora

- International HR and Payroll White Paper Explains Setup and ConfigurationDocumento20 pagineInternational HR and Payroll White Paper Explains Setup and ConfigurationSridhar YerramNessuna valutazione finora

- Setup and run retro pay processesDocumento3 pagineSetup and run retro pay processesImtiazALiNessuna valutazione finora

- Time Card Configuration GuideDocumento136 pagineTime Card Configuration GuideKiran NambariNessuna valutazione finora

- OracleFastFormulaToSupportBusiness PPTDocumento25 pagineOracleFastFormulaToSupportBusiness PPTmahendhirangNessuna valutazione finora

- Oracle Concepts For You How To Create Special Information Type (SIT) in Oracle HRMSDocumento8 pagineOracle Concepts For You How To Create Special Information Type (SIT) in Oracle HRMSnasr aldein sameh nasr mohamedNessuna valutazione finora

- Setting Up Multi Org Structure in R12Documento80 pagineSetting Up Multi Org Structure in R12Mohamed IbrahimNessuna valutazione finora

- AME SetupDocumento7 pagineAME SetupSivasekar NarayananNessuna valutazione finora

- Create Custom WebADI Integrator in 12c with Desktop Integration ManagerDocumento6 pagineCreate Custom WebADI Integrator in 12c with Desktop Integration ManagerrhrashelNessuna valutazione finora

- AME OverviewDocumento30 pagineAME Overviewakhil reddyNessuna valutazione finora

- Customize Oracle Iexpenses WorkflowsDocumento6 pagineCustomize Oracle Iexpenses Workflowsjogil7730Nessuna valutazione finora

- VAT QuestionnaireDocumento20 pagineVAT QuestionnaireSanjib PandaNessuna valutazione finora

- Oracleapps TDS IssuesDocumento2 pagineOracleapps TDS IssuesSrinivasa KirankumarNessuna valutazione finora

- HRMS Payroll in Oracle AppsDocumento71 pagineHRMS Payroll in Oracle AppsSumit KNessuna valutazione finora

- Oracle Recruiting Cloud Setup GuideDocumento11 pagineOracle Recruiting Cloud Setup GuideManish RanjanNessuna valutazione finora

- Count number of Element entries in Input Value Validation Fast FormulaDocumento7 pagineCount number of Element entries in Input Value Validation Fast Formulahamdy20017121Nessuna valutazione finora

- rECRUITMENT PDFDocumento30 paginerECRUITMENT PDFYogeshNessuna valutazione finora

- Bind Variables Work For SQL Statements That Are Exactly The Same, Where TheDocumento1 paginaBind Variables Work For SQL Statements That Are Exactly The Same, Where TheAnjali PatelNessuna valutazione finora

- AutoInvoice-in-Oracle-Apps-R12 Faqs PDFDocumento3 pagineAutoInvoice-in-Oracle-Apps-R12 Faqs PDFshameem_ficsNessuna valutazione finora

- GL Interface: GL - Je - Source - TL - Unique 6) Jecategoryname - Unique GL - Code - CombinationsDocumento11 pagineGL Interface: GL - Je - Source - TL - Unique 6) Jecategoryname - Unique GL - Code - CombinationsPhanendra KumarNessuna valutazione finora

- Conquering The Challenges - Costing PRDocumento8 pagineConquering The Challenges - Costing PRSoorav MlicNessuna valutazione finora

- HCM Data Loader in FusionDocumento35 pagineHCM Data Loader in FusionmurliramNessuna valutazione finora

- Transaction Design Studio: What It Is and How It WorksDocumento16 pagineTransaction Design Studio: What It Is and How It WorksBarış Ergün100% (1)

- Oracle XML Publisher-Font FileDocumento6 pagineOracle XML Publisher-Font FileSachin GhadmodeNessuna valutazione finora

- Create Cross Validation RulesDocumento12 pagineCreate Cross Validation Rulesskshiva100% (1)

- Oracle Payroll India User ManualDocumento100 pagineOracle Payroll India User Manualnikhilburbure100% (1)

- AME For Iprocurement Based RequisitionsDocumento8 pagineAME For Iprocurement Based Requisitionssenigma13Nessuna valutazione finora

- Intracompany Accounting SetupDocumento9 pagineIntracompany Accounting SetupcanjiatpNessuna valutazione finora

- MileageDocumento12 pagineMileageranjeetdonNessuna valutazione finora

- Optimize iExpense Guide and FAQsDocumento12 pagineOptimize iExpense Guide and FAQsRavi BirhmanNessuna valutazione finora

- Form Personalization by A.PassiDocumento11 pagineForm Personalization by A.PassiTatyana RossiNessuna valutazione finora

- Oracle E-Business Suite The Ultimate Step-By-Step GuideDa EverandOracle E-Business Suite The Ultimate Step-By-Step GuideNessuna valutazione finora

- r12 e Business TaxDocumento70 paginer12 e Business TaxUma Shankar Medam100% (1)

- AP AR Netting WhitepaperDocumento18 pagineAP AR Netting WhitepaperSandip GhoshNessuna valutazione finora

- Oracle Apps Technical ManualDocumento81 pagineOracle Apps Technical ManualPJ190289% (9)

- Multi Org StructureDocumento44 pagineMulti Org StructureUma Shankar MedamNessuna valutazione finora

- Interview ERP - A To ZDocumento305 pagineInterview ERP - A To ZUma Shankar MedamNessuna valutazione finora

- Webadi Setup Excel2007 Setup For IE7&8Documento8 pagineWebadi Setup Excel2007 Setup For IE7&8Vemula DurgaprasadNessuna valutazione finora

- Revised KarnatakaDocumento14 pagineRevised KarnatakaUma Shankar MedamNessuna valutazione finora

- AdvertisementDocumento3 pagineAdvertisementSankalp KumarNessuna valutazione finora

- Oracle AIM DocumentDocumento42 pagineOracle AIM DocumentUma Shankar MedamNessuna valutazione finora

- Latest MBA HR Projects Latest MBA HR ProjectsDocumento39 pagineLatest MBA HR Projects Latest MBA HR ProjectsUma Shankar Medam67% (3)

- Latest MBA HR Projects Latest MBA HR ProjectsDocumento39 pagineLatest MBA HR Projects Latest MBA HR ProjectsUma Shankar Medam67% (3)

- Dermatology Study Guide 2023-IvDocumento7 pagineDermatology Study Guide 2023-IvUnknown ManNessuna valutazione finora

- Kate Elizabeth Bokan-Smith ThesisDocumento262 pagineKate Elizabeth Bokan-Smith ThesisOlyaGumenNessuna valutazione finora

- EC GATE 2017 Set I Key SolutionDocumento21 pagineEC GATE 2017 Set I Key SolutionJeevan Sai MaddiNessuna valutazione finora

- WWW - Commonsensemedia - OrgDocumento3 pagineWWW - Commonsensemedia - Orgkbeik001Nessuna valutazione finora

- Money Laundering in Online Trading RegulationDocumento8 pagineMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohNessuna valutazione finora

- Vector 4114NS Sis TDSDocumento2 pagineVector 4114NS Sis TDSCaio OliveiraNessuna valutazione finora

- Bio310 Summary 1-5Documento22 pagineBio310 Summary 1-5Syafiqah ArdillaNessuna valutazione finora

- Allan S. Cu v. Small Business Guarantee and FinanceDocumento2 pagineAllan S. Cu v. Small Business Guarantee and FinanceFrancis Coronel Jr.Nessuna valutazione finora

- MQC Lab Manual 2021-2022-AutonomyDocumento39 pagineMQC Lab Manual 2021-2022-AutonomyAniket YadavNessuna valutazione finora

- Why Choose Medicine As A CareerDocumento25 pagineWhy Choose Medicine As A CareerVinod KumarNessuna valutazione finora

- Qad Quick StartDocumento534 pagineQad Quick StartMahadev Subramani100% (1)

- Mobile ApplicationDocumento2 pagineMobile Applicationdarebusi1Nessuna valutazione finora

- Guide To Raising Capital From Angel Investors Ebook From The Startup Garage PDFDocumento20 pagineGuide To Raising Capital From Angel Investors Ebook From The Startup Garage PDFLars VonTurboNessuna valutazione finora

- PHY210 Mechanism Ii and Thermal Physics Lab Report: Faculty of Applied Sciences Uitm Pahang (Jengka Campus)Documento13 paginePHY210 Mechanism Ii and Thermal Physics Lab Report: Faculty of Applied Sciences Uitm Pahang (Jengka Campus)Arissa SyaminaNessuna valutazione finora

- Steps To Christ AW November 2016 Page Spreaad PDFDocumento2 pagineSteps To Christ AW November 2016 Page Spreaad PDFHampson MalekanoNessuna valutazione finora

- LSMW With Rfbibl00Documento14 pagineLSMW With Rfbibl00abbasx0% (1)

- Shopping Mall: Computer Application - IiiDocumento15 pagineShopping Mall: Computer Application - IiiShadowdare VirkNessuna valutazione finora

- Mpu 2312Documento15 pagineMpu 2312Sherly TanNessuna valutazione finora

- Basic Features of The Microcredit Regulatory Authority Act, 2006Documento10 pagineBasic Features of The Microcredit Regulatory Authority Act, 2006Asif Hasan DhimanNessuna valutazione finora

- Service Manual: Precision SeriesDocumento32 pagineService Manual: Precision SeriesMoises ShenteNessuna valutazione finora

- October 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterDocumento8 pagineOctober 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterRoyal Forest and Bird Protecton SocietyNessuna valutazione finora

- Analyze and Design Sewer and Stormwater Systems with SewerGEMSDocumento18 pagineAnalyze and Design Sewer and Stormwater Systems with SewerGEMSBoni ClydeNessuna valutazione finora

- Eye Bags ReliefDocumento27 pagineEye Bags ReliefNatsu DragneelNessuna valutazione finora

- Final Year Project (Product Recommendation)Documento33 pagineFinal Year Project (Product Recommendation)Anurag ChakrabortyNessuna valutazione finora

- Nokia CaseDocumento28 pagineNokia CaseErykah Faith PerezNessuna valutazione finora

- Consumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaDocumento16 pagineConsumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaSundaravel ElangovanNessuna valutazione finora

- Technical Specification of Heat Pumps ElectroluxDocumento9 pagineTechnical Specification of Heat Pumps ElectroluxAnonymous LDJnXeNessuna valutazione finora

- Cell Organelles ColoringDocumento2 pagineCell Organelles ColoringThomas Neace-FranklinNessuna valutazione finora

- 02 Slide Pengenalan Dasar MapinfoDocumento24 pagine02 Slide Pengenalan Dasar MapinfoRizky 'manda' AmaliaNessuna valutazione finora